How to upload money to standard securities account

You can also deposit a cheque in HDFC bank addressed to RKSV SECURITIES INDIA PVT.LTD.

Today forex bonuses

For securities and RKSV COMMODITIES INDIA PVT.LTD. For commodities and send us a scan copy or photo of the cheque. The bank details for NEFT transfer are as follows:

Add money to my trading account

There are three ways to add funds to your account:

NEFT/RTGS transfer

You can transfer funds using the regular NEFT/RTGS process. You can add the the below mentioned bank account to your payee list in your registered bank account. Once you make the NEFT transfer to our bank account you need to email the reference number of the transaction to support@upstox.Com. Your funds will be credited to your account within one working day.

The bank details for NEFT transfer are as follows:

For securities

bank name - HDFC bank

account name - RKSV SECURITIES INDIA PVT.LTD.

Account number -00600340067574

account type - current account

IFSC code- HDFC0000060

For commodities

bank name - HDFC bank

account name - RKSV COMMODITIES INDIA PVT.LTD.

Account number -15770340022236

account type - current account

IFSC code- HDFC0000060

Please note that you should be using your registered bank for the NEFT transaction.

Direct transfer

You can transfer funds in real-time directly from the upstox-pro platform powered by ATOM. On the platform you can go to transfer funds section in the top right corner. You can further choose whether you wish to transfer funds for securities or commodities. Your registered bank accounts will be displayed on the same screen. You can choose the account you wish to use for funds transfer. You will be directed to your bank website’s internet banking portal. When you enter your security credentials with your bank account the transfer will automatically be credited to your account.

Cheque

You can also deposit a cheque in HDFC bank addressed to RKSV SECURITIES INDIA PVT.LTD. For securities and RKSV COMMODITIES INDIA PVT.LTD. For commodities and send us a scan copy or photo of the cheque.

Please note that the cheque should be of your registered bank account.

How to upload money to standard securities account

SBG securities proprietary limited (“SBG sec”) is pleased to offer you an alternative to holding cash in your trading account (held with the JSE trustees proprietary limited otherwise known as “JSET”). You can open a money market account through SBG sec, subject to the minimum net balance being maintained and as further detailed in clause 8 of the standard online share trading mandate.

The minimum net balance is currently R50 000.00 (fifty thousand rand).

Interest earned on cash held in your trading account is calculated on the average daily call rate obtained by the JSET. The net rate earned for july 2019 is 5.87% after deducting SBG sec fees of 1.00% plus VAT.

However, for a money market account, SBG sec has a call account with the standard bank of south africa limited (“standard bank”) into which it places your funds. The table below illustrates the comparative returns on offer:

| deposit ranges - R | std bank interest rate | SBG sec fee | money market account net rate | difference vs JSET | effective yearly rate |

|---|---|---|---|---|---|

| 50 000 - 100 000 | 3.310% | 0.912% | 2.398% | 0.26% | 2.42% |

| 100 001 - 250 000 | 3.310% | 0.798% | 2.512% | 0.15% | 2.54% |

| 250 001 - 500 000 | 3.310% | 0.684% | 2.626% | 0.03% | 2.66% |

| 500 001 - 1 000 000 | 3.310% | 0.570% | 2.740% | 0.08% | 2.77% |

| 1 000 001 - 5 000 000 | 3.310% | 0.513% | 2.797% | 0.14% | 2.83% |

| 5 000 001 - 10 000 000 | 3.310% | 0.456% | 2.854% | 0.19% | 2.89% |

| 10 000 001 > | 3.310% | 0.399% | 2.911% | 0.25% | 2.95% |

Note that the rate obtained on a money market account is a daily call rate provided by standard bank which may change without any notification.)

Money market account holders will receive comprehensive details of all movements of funds, interest earned, rates obtained and fees deducted on their monthly SBG sec statement.

The JSE requires all clients to maintain an account with JSET to ensure settlement of trades within specified times. SBG sec will automatically transfer funds from your money market account into your JSET account to meet settlement obligations i.E. You will notice no difference to your trading account other than the fact that you may earn higher interest from standard bank on your cash balance.

There is a R4.56 payment fee (including VAT) for withdrawals made from either a money market account or a JSET account to your bank account.

There are no extra fees or charges above the standard fee for a trading account (other than those noted in the table above) for a money market account.

To open a money market account please ensure that you select money account when registering for standard online share trading, or alternately review your account preferences if you have already opened an account. However, it will always be subject to the minimum net balance being maintained and subject to the conditions contained in clause 8 of the standard online share trading mandate.

Gross interest earned on the account will be reflected in IT12 returns, however the fees paid may or may not be deductible for tax purposes depending on individual circumstances. Investors are encouraged to seek their own independent tax advice in this regard.

For more information on a money market account, please contact SBG sec on phone calls will be suspended during the COVID-19 lock-down. Please contact us via email. Or email us at [email protected] .

Frequently asked questions

We're here to help

We want to help you get the most out of our products and services. Below you’ll find answers to popular questions about pension options, savings products and much more.

Want to talk to us?

You can find the contact details for our various products and services here.

Contact & help

If you need more help with something, you can contact us directly to talk about your needs. This page has all of our contact options to help you find the one you need.

Make a complaint

We’re here to help. If you need to raise a complaint or speak with us about a concern, you can contact us directly. Find out the best way to contact us here.

Helpful guides and articles

Find out more about pensions and your retirement options with our range of helpful guides.

Pensions guides

Retirement guides

Moneyplus

There's a lot to look forward to

What we offer

Help & support

Online services

Connect with us

This website describes products and services provided by standard life assurance limited (part of the phoenix group) and subsidiaries of the standard life aberdeen group. The standard life aberdeen group and the phoenix group are in a strategic partnership – learn more about the products and services provided by each company.

Standard life assurance limited continues to use the standard life brand, but products and services under this brand are provided by different companies:

All the pension products on this website are provided by standard life assurance limited, which is part of the phoenix group.

Standard life assurance limited is registered in scotland (SC286833) at standard life house, 30 lothian road, edinburgh, EH1 2DH. Standard life assurance limited is authorised by the prudential regulation authority and regulated by the financial conduct authority and the prudential regulation authority.

Where we mention financial advice from standard life on this website, the advice services are provided by the standard life aberdeen group.

Our retirement advice service is provided by standard life client management limited. Standard life client management limited is registered in scotland (SC193444) at 1 george street, edinburgh, EH2 2LL. Standard life client management limited is authorised and regulated by the financial conduct authority.

We also refer to advice from 1825 on this website. '1825' is a trading name used by 1825 financial planning and advice ltd, which is part of the standard life aberdeen group. 1825 financial planning and advice ltd is registered in england (01447544) at 14th floor 30 st. Mary axe, london, england, EC3A 8BF and is authorised and regulated by the financial conduct authority.

The standard life stocks & shares ISA and personal portfolio are provided by standard life savings limited, which is part of the standard life aberdeen group.

Standard life savings limited is registered in scotland (SC180203) at 1 george street, edinburgh, united kingdom, EH2 2LL. Standard life savings limited is authorised and regulated by the financial conduct authority.

The standard life self investor ISA and trading account are provided by elevate portfolio services limited, which is part of the standard life aberdeen group.

Elevate portfolio services limited is registered in england (01128611) at bow bells house, 1 bread street, london, EC4M 9HH. Elevate portfolio services limited is authorised and regulated by the financial conduct authority.

Our onshore bond products are also provided by standard life assurance limited, which is part of the phoenix group.

Our offshore bond is provided by standard life international dac, which is part of the phoenix group.

Standard life international dac is authorised and regulated by the central bank of ireland and subject to limited regulation in the UK by the financial regulation authority. Details about the extent of our regulation by the financial conduct authority are available from us on request.

Standard life international dac is a designated activity company limited by shares and registered in dublin, ireland (408507) at 90 st stephen’s green, dublin.

Equity release

Standard life equity release is provided by age partnership limited. Standard life client management acts as an introducer and refers customers to age partnership limited.

Age partnership limited (registered in england (5265969) at 2200 century way, thorpe park, leeds, LS15 8ZB). Age partnership is authorised and regulated by the financial conduct authority. Their FCA register number is 425432.

With-profits investments

The with-profits investments on this site are provided by standard life assurance limited, which is part of the phoenix group.

For more information please read our service and provider information page.

Transferring shares online with the big four

To transfer your shares to one of the big four banks online, take a look at the following methods.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

If you want to transfer shares to another person, company or bank account, you can do this through an off-market or online transfer. Here you can find information on different types of shares, what you need for online share transfers, and how to transfer shares with each of the big four banks.

To transfer your shares to another trading platform, you need to complete a clearing house electronic subregister system (CHESS) sponsorship form that will allow you to transfer your existing holdings from a certain issuer or broker to another sponsoring participant.

CHESS is the computer system used by the ASX to record shareholdings and manage share transaction settlements.

Share trading account offer

Etoro share trading (US stocks)

Standard brokerage - US shares

Share trading account offer

Get $0 brokerage on US stocks with trades as little as $50 when you join the world's biggest social trading network.

- $0 brokerage for US stocks

- Trades starting from $50

- Fractional shares

- Copy top traders

go to site

Important: share trading carries risk of capital loss.

Disclaimer: trading cfds and forex on leverage is high-risk and losses could exceed your deposits.

Compare share trading accounts

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Important: share trading can be financially risky and the value of your investment can go down as well as up. “standard brokerage” fee is the cost to trade $1,000 or less of ASX-listed shares and etfs without any qualifications or special eligibility. If ASX shares aren’t available, the fee shown is for US shares. Where both CHESS sponsored and custodian shares are offered, we display the cheapest option.

What are sponsored shares?

Essentially, your share transfer will depend on how your shares are sponsored, that is either through the issuer or broker.

Issuer-sponsored holdings are those that you may have purchased as a new issue, earned through a demutualisation, been allocated by your company, inherited from a family member or transformed from broker sponsorship. Broker-sponsored holdings, on the other hand, are those registered with a stock broker and are usually given an HIN (holder identification number) by the broker.

How to transfer shares online: the big four

Skip ahead

Westpac

Online

- Download a CHESS sponsorship and broker to broker transfer form from westpac’s website.

- Fill out your details and the old and new brokers’ details – make sure that these details are correct and match the ones in the old broker. Then sign the declaration & sign/s section. Note: for broker-sponsored shares, you will have an HIN instead of a securityholder reference number (SRN) allocated to your shares, which starts with an "X".

- Print out the form and complete any outstanding information.

- Email it to online@wespac.Com.Au.

You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

- Download a CHESS sponsorship and broker-to-broker transfer form from westpac’s website.

- Fill out your details and the old and new brokers’ details – make sure that these details are correct and match the ones in the old broker. Then sign the declaration & sign/s section. Note: for broker-sponsored shares, you will have an HIN instead of a securityholder reference number (SRN) allocated to your shares, which starts with an "X".

- Print out the form and complete any outstanding information.

- Fax the form on 1300 130 493.

This type of transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post the completed CHESS form to:

Westpac securities

reply paid 85157

AUSTRALIA SQUARE NSW 1214

Otherwise, you can transfer shares through an off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to a your shares to a westpac securities CHESS sponsored account.

- Complete the standard transfer form from westpac’s website.

- Fill out all required details. You can refer to the second page of the form for guidelines.

- Send the completed form to westpac securities:

westpac securities

reply paid 85157

australia square NSW 1214

This post transfer costs $50 per transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Case study: commbank

If you want to transfer shares held with a stockbroker firm to commbank for business purposes, you will need to fill out a broker-to-broker transfer form. To do this, you must first ensure that the firm you have chosen to stock your shares is eligible for share transfer.

Here are the steps to follow to transfer shares to commonwealth bank:

- Log into your commsec account.

- Navigate to support > forms & brochures: shares > CHESS sponsorship and broker-to-broker request form.

- Download the CHESS sponsorship form from the bank’s website.

- Complete the form and make sure that all the registration details of your old firm match the ones of the new firm.

- Choose whether you need your HIN or some of your holdings to be transferred to commsec.

- After agreeing with the terms and conditions on the form, sign and post the form to the bank’s postal address:

commsec - conversions

locked bag 22

australia square

NSW 1215

Normally you would wait two to three days after the form is received until the shares you nominated are transferred successfully.

Commbank

Online

- Create or sign in to your commsec account.

- Download the CHESS sponsorship form from commonwealth bank’s website.

- Nominate whether you would like your HIN or some of your nominated shares to be transferred to commsec then sign the “agreement” section.

- Email the completed form to shares@commsec.Com.Au.

You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post the completed CHESS form to:

Commsec

locked bag 22

australian square NSW 1215

Otherwise, you can transfer shares through off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to transfer your shares to a commsec CHESS sponsored account.

- Complete the off market transfer form from commsec’s website.

- Fill out all required details. You can refer to the first two pages of the form for guidelines.

- Send the completed form to:

commsec

locked bag 22

australian square NSW 1215

This post transfer costs $54 per transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Online

- Download the broker to broker transfer form from ANZ securities.

- Fill out your details as well as the holdings details, then complete and sign the declaration section.

- Email the form to requests@anzshareinvesting.Com

This type of transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

- Download the broker-to-broker transfer form from ANZ securities.

- Fill out and complete the form before signing the declaration section.

- Fax the form on 1300 553 589.

This type of transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post

Post the completed fbroker to broker transfer form to:

ANZ share investing

reply paid 1346

royal exchange NSW 1224

Otherwise, you can transfer shares through an off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to transfer shares to an ANZ securities CHESS sponsored account.

- Complete the off market transfer form from ANZ securities or download the form.

- Fill out all required details in the form.

- Send the completed form to westpac securities:

ANZ share investing

reply paid 1346

royal exchange NSW 1224

There is a post transfer fee of $55 for each transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Online

- Log into nabtrade.

- Navigate to admin > permissions > broker sponsored > apply > submit to download the broker to broker transfer request form.

- Complete all information on the form.

- Send the form to enquiries@nabtrade.Com.Au

This transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

- Log into nabtrade.

- Navigate to admin > permissions > broker sponsored > apply > submit to download the pdf form of broker to broker transfer request.

- Complete all information on the form.

- Fax the completed form on 1300 368 758.

This transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post the completed broker to broker transfer request to:

Nabtrade

GPO box 4545

melbourne VIC 3001

Otherwise, you can transfer shares through an off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to transfer shares to a nabtrade CHESS sponsored account.

- Complete the off market transfer form from nabtrade’s website or download.

- Fill out all required details. You can refer to the third page of the form for guidelines.

- Send the completed form to:

nabtrade

GPO box 4545

melbourne VIC 3001

There is a post transfer fee of $55 for each transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Track all your accounts in one place!

See your savings, super, shares and loans side-by-side in the finder app. We'll also track your spending and hunt down better ways for you to save. Pop in your phone number below to get your download link.

By submitting your phone number, you agree to the finder privacy policy and terms of use

The latest in share trading

Andrew munro

Andrew munro is the cryptocurrency editor at finder. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a bachelor of arts from the university of new south wales, and has written guides about everything from industrial pigments to cosmetic surgery.

More guides on finder

You can't access robinhood in australia, so here are five low-cost alternatives to trade US stocks.

The broker is offering US shares for a flat $9.50 fee. So how does it stack up to commsec or CMC markets?

Here is the essential info you need to know about investing in the stock market for your children.

How to transfer shares to a company or person with a transfer form.

Trade ASX shares and etfs with commissions starting at $8.

Winner, finalists and methodology for finder awards 2020 best australian share trading account.

Winner, finalists and methodology for finder awards 2020 best international share trading account.

Australia's newest trading app offers flat $5 brokerage with a $100 minimum investment.

Xinja is set to be australia’s first bank to offer $0 brokerage share trading. Here’s how it compares to the rest.

Giving shares to a loved one is a great idea, but how do you actually do it?

Ask an expert

Share

Level 10, 99 york st, sydney , NSW , australia 2000

- About us

- Careers

- Media room

- Contact us

- Partner with us

- How we make money

- Terms of use

- Privacy & cookies policy

- Editorial guidelines

- Sitemap

- © 2021 finder.Com.Au

How likely would you be to recommend finder to a friend or colleague?

Thank you for your feedback.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Finder.Com.Au is one of australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

Finder.Com.Au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Products marked as 'promoted' or 'advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

How to load money in esewa?

Technological advancement has taken the way we do business to a whole new level. Keeping an eye on technological development, esewa has been serving as an online payment gateway. With various internal and external reviews and updates, loading fund in esewa wallet has now been made easier. There are different ways you can transfer money to your esewa wallet, namely:

- Mobile banking

- Internet banking

- Counter deposit

- Cash points

- Send money

Mobile banking:

– mobile banking is an online service offered by banks through which you can conduct inter-bank fund transfers. We have several partner banks, and using their mobile banking you can transfer funds to esewa. To load fund through mobile banking, follow these simple steps:

Step 1: log in to your mobile banking account (mobile number, password).

Step 2: tap on the esewa icon. (check “payment” section if you can’t find the option in mobile app’s home screen)

Step 3: enter your data (amount, esewa id, and purpose) and tap on “submit”.

Step 4: check the details and tap on “confirm”.

Step 5: enter your MPIN/fingerprint to complete the load process.

For the list of banks available to load esewa: banks

Internet banking:

– internet banking is similar to mobile banking as it also assists users to conduct inter-bank fund transfers. But, the difference is, instead of using a mobile application, users use web browsers. To load fund through internet banking, follow the following steps:

- Select load fund in esewa app.

- Select internet banking and your bank from which you want to load esewa.

- Log in with your credentials (provided by the bank)

- Load your esewa wallet.

For the list of banks available to load esewa: banks

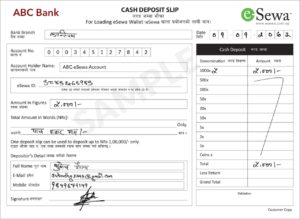

Counter deposit

Counter deposit is the same as when you deposit your cash in bank. Visit any of our counter deposit partner banks, there, you will find a separate esewa voucher. Fill in the details and deposit the amount to your esewa wallet. Esewa counter deposit voucher will look something like this:

Note: you do not need to have bank account in the particular bank to make a counter deposit in your esewa account.

For the list of banks available to load esewa: banks

Cash points

Cash points are the authorized agents of esewa. There are 5000+ cash points all over the nation. To load funds from cash points, you need to be physically present at the agent’s stores. You can identify cash points with the “cash point” hoarding boards of esewa.

Also, you can find cash points near you using the map inside esewa application. Else, you can make a call to our toll-free number (1660-01-02121) to get the details of the cash points nearby.

- Select on load fund.

- Tap on esewa cash points.

- Search your nearest cash point based upon your location.

- Visit your cash point.

- Load your esewa wallet.

- Select “send money”

- Enter the esewa ID you want to transfer funds to.

- Enter amount, purpose of transfer and remarks.

- “proceed” and “confirm” transaction after checking the details.

- Fund is loaded to recipient’s esewa wallet.

- Start the process by filling out a transfer initiation form with your new broker. This form should be available online, but you can call your new broker if you need help.

- Your new broker communicates with your old broker to set up the transfer.

- Your old broker must validate the transfer information, reject it, or amend it within three business days.

- Assuming your old broker validates the transfer and there are no issues, the transfer should be completed within six business days.

- $0 brokerage for US stocks

- Trades starting from $50

- Fractional shares

- Copy top traders

- Download a CHESS sponsorship and broker to broker transfer form from westpac’s website.

- Fill out your details and the old and new brokers’ details – make sure that these details are correct and match the ones in the old broker. Then sign the declaration & sign/s section. Note: for broker-sponsored shares, you will have an HIN instead of a securityholder reference number (SRN) allocated to your shares, which starts with an "X".

- Print out the form and complete any outstanding information.

- Email it to online@wespac.Com.Au.

- Download a CHESS sponsorship and broker-to-broker transfer form from westpac’s website.

- Fill out your details and the old and new brokers’ details – make sure that these details are correct and match the ones in the old broker. Then sign the declaration & sign/s section. Note: for broker-sponsored shares, you will have an HIN instead of a securityholder reference number (SRN) allocated to your shares, which starts with an "X".

- Print out the form and complete any outstanding information.

- Fax the form on 1300 130 493.

- Complete the standard transfer form from westpac’s website.

- Fill out all required details. You can refer to the second page of the form for guidelines.

- Send the completed form to westpac securities:

westpac securities

reply paid 85157

australia square NSW 1214 - Log into your commsec account.

- Navigate to support > forms & brochures: shares > CHESS sponsorship and broker-to-broker request form.

- Download the CHESS sponsorship form from the bank’s website.

- Complete the form and make sure that all the registration details of your old firm match the ones of the new firm.

- Choose whether you need your HIN or some of your holdings to be transferred to commsec.

- After agreeing with the terms and conditions on the form, sign and post the form to the bank’s postal address:

commsec - conversions

locked bag 22

australia square

NSW 1215 - Create or sign in to your commsec account.

- Download the CHESS sponsorship form from commonwealth bank’s website.

- Nominate whether you would like your HIN or some of your nominated shares to be transferred to commsec then sign the “agreement” section.

- Email the completed form to shares@commsec.Com.Au.

- Complete the off market transfer form from commsec’s website.

- Fill out all required details. You can refer to the first two pages of the form for guidelines.

- Send the completed form to:

commsec

locked bag 22

australian square NSW 1215 - Download the broker to broker transfer form from ANZ securities.

- Fill out your details as well as the holdings details, then complete and sign the declaration section.

- Email the form to requests@anzshareinvesting.Com

- Download the broker-to-broker transfer form from ANZ securities.

- Fill out and complete the form before signing the declaration section.

- Fax the form on 1300 553 589.

- Complete the off market transfer form from ANZ securities or download the form.

- Fill out all required details in the form.

- Send the completed form to westpac securities:

ANZ share investing

reply paid 1346

royal exchange NSW 1224 - Log into nabtrade.

- Navigate to admin > permissions > broker sponsored > apply > submit to download the broker to broker transfer request form.

- Complete all information on the form.

- Send the form to enquiries@nabtrade.Com.Au

- Log into nabtrade.

- Navigate to admin > permissions > broker sponsored > apply > submit to download the pdf form of broker to broker transfer request.

- Complete all information on the form.

- Fax the completed form on 1300 368 758.

- Complete the off market transfer form from nabtrade’s website or download.

- Fill out all required details. You can refer to the third page of the form for guidelines.

- Send the completed form to:

nabtrade

GPO box 4545

melbourne VIC 3001 - About us

- Careers

- Media room

- Contact us

- Partner with us

- How we make money

- Terms of use

- Privacy & cookies policy

- Editorial guidelines

- Sitemap

- © 2021 finder.Com.Au

- Today forex bonuses

- Add money to my trading account

- How to upload money to standard securities account

- Frequently asked questions

- We're here to help

- Want to talk to us?

- Helpful guides and articles

- Pensions guides

- Retirement guides

- Moneyplus

- Transferring shares online with the big four

- To transfer your shares to one of the big four...

- Share trading account offer

- Share trading account offer

- Compare share trading accounts

- What are sponsored shares?

- How to transfer shares online: the big four

- Skip ahead

- Westpac

- Case study: commbank

- Commbank

- Online

- Transfer shares from another broker’s CHESS...

- Online

- Post

- Transfer shares from another broker’s CHESS...

- Online

- Transfer shares from another broker’s CHESS...

- Track all your accounts in one place!

- The latest in share trading

- Andrew munro

- Share trading account offer

- Ask an expert

- How to load money in esewa?

- Mobile banking:

- Internet banking:

- Counter deposit

- Cash points

- Send money

- 2 comments

- JOIN OUR NEWSLETTER

- How to upload money to standard securities account

- How to transfer stocks from one brokerage account...

- How to transfer stock between brokers

- Why you shouldn't sell your investments

- Frequently asked questions

- We're here to help

- Want to talk to us?

- Helpful guides and articles

- Pensions guides

- Retirement guides

- Moneyplus

- Transferring shares online with the big four

- To transfer your shares to one of the big four...

- Share trading account offer

- Share trading account offer

- Compare share trading accounts

- What are sponsored shares?

- How to transfer shares online: the big four

- Skip ahead

- Westpac

- Case study: commbank

- Commbank

- Online

- Transfer shares from another broker’s CHESS...

- Online

- Post

- Transfer shares from another broker’s CHESS...

- Online

- Transfer shares from another broker’s CHESS...

- Track all your accounts in one place!

- The latest in share trading

- Andrew munro

- Share trading account offer

- Ask an expert

Send money

Send money is one of the easiest way of loading your esewa wallet. Anytime you are short of funds, just ask your friends to transfer funds to your esewa wallet. The next time one of your friend asks you to transfer money to their esewa wallet, just follow the following steps:

As explained above, there are various ways to load your esewa wallet. Make use of these methods, and enjoy cashless payments through esewa any time, anywhere.

If you have any more confusions on how to load fund, please contact our toll-free number 1660-01-02121, or viber us at +9779868842121.

In case if you don’t have an esewa account? Sign up here: esewa

2 comments

That was helpful.

But most of the times, we need to return back from your cash points as they say loading fund is not possible ( or available). I didn’t mention the cash point here but I request esewa to work upon it.

Hello sir,

kindly inbox us the name and address of the cash point in our facebook messenger, viber (+9779868842121) or inform us at our toll free number 1660-010-2121.

It would be a lot of help for us as well as other esewa customers.

Thank you.

JOIN OUR NEWSLETTER

Get weekly content delivered straight to your inbox.

How to upload money to standard securities account

SBG securities proprietary limited (“SBG sec”) is pleased to offer you an alternative to holding cash in your trading account (held with the JSE trustees proprietary limited otherwise known as “JSET”). You can open a money market account through SBG sec, subject to the minimum net balance being maintained and as further detailed in clause 8 of the standard online share trading mandate.

The minimum net balance is currently R50 000.00 (fifty thousand rand).

Interest earned on cash held in your trading account is calculated on the average daily call rate obtained by the JSET. The net rate earned for july 2019 is 5.87% after deducting SBG sec fees of 1.00% plus VAT.

However, for a money market account, SBG sec has a call account with the standard bank of south africa limited (“standard bank”) into which it places your funds. The table below illustrates the comparative returns on offer:

| deposit ranges - R | std bank interest rate | SBG sec fee | money market account net rate | difference vs JSET | effective yearly rate |

|---|---|---|---|---|---|

| 50 000 - 100 000 | 3.310% | 0.912% | 2.398% | 0.26% | 2.42% |

| 100 001 - 250 000 | 3.310% | 0.798% | 2.512% | 0.15% | 2.54% |

| 250 001 - 500 000 | 3.310% | 0.684% | 2.626% | 0.03% | 2.66% |

| 500 001 - 1 000 000 | 3.310% | 0.570% | 2.740% | 0.08% | 2.77% |

| 1 000 001 - 5 000 000 | 3.310% | 0.513% | 2.797% | 0.14% | 2.83% |

| 5 000 001 - 10 000 000 | 3.310% | 0.456% | 2.854% | 0.19% | 2.89% |

| 10 000 001 > | 3.310% | 0.399% | 2.911% | 0.25% | 2.95% |

Note that the rate obtained on a money market account is a daily call rate provided by standard bank which may change without any notification.)

Money market account holders will receive comprehensive details of all movements of funds, interest earned, rates obtained and fees deducted on their monthly SBG sec statement.

The JSE requires all clients to maintain an account with JSET to ensure settlement of trades within specified times. SBG sec will automatically transfer funds from your money market account into your JSET account to meet settlement obligations i.E. You will notice no difference to your trading account other than the fact that you may earn higher interest from standard bank on your cash balance.

There is a R4.56 payment fee (including VAT) for withdrawals made from either a money market account or a JSET account to your bank account.

There are no extra fees or charges above the standard fee for a trading account (other than those noted in the table above) for a money market account.

To open a money market account please ensure that you select money account when registering for standard online share trading, or alternately review your account preferences if you have already opened an account. However, it will always be subject to the minimum net balance being maintained and subject to the conditions contained in clause 8 of the standard online share trading mandate.

Gross interest earned on the account will be reflected in IT12 returns, however the fees paid may or may not be deductible for tax purposes depending on individual circumstances. Investors are encouraged to seek their own independent tax advice in this regard.

For more information on a money market account, please contact SBG sec on phone calls will be suspended during the COVID-19 lock-down. Please contact us via email. Or email us at [email protected] .

How to transfer stocks from one brokerage account to another

The ascent is reader-supported: we may earn a commission from offers on this page. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

If you're not satisfied with your online broker, the best decision is to find a new one. The right brokerage account is critical to get the most out of your investments. Once you're ready to switch over, you can transfer stocks between brokers so that you still have your previous investments.

Transferring stocks isn't hard, but if you don't do it correctly, you could cost yourself money. To avoid that, you need to know the right and the wrong way to transfer stock between brokers.

How to transfer stock between brokers

The most common way to transfer stock between brokers is the direct transfer method. Most brokers use the automated customer account transfer service (ACATS) to move investments this way.

Here's how an ACATS transfer works:

Your old brokerage firm may charge a transfer fee. Fortunately, the best online brokers frequently offer deals in which they pay any transfer fees the old broker charges. Before you start your transfer, check if there will be a fee and if your new brokerage firm will cover it.

Note that some brokers sell proprietary investments, such as their own mutual fund, that they won't allow you to transfer to a new broker. Your new broker will notify you of any assets that can't be transferred.

Even small discrepancies can delay the process when you transfer stock between brokers. For example, if your new broker has your middle name on file and your old broker only has your middle initial, it can take additional time to validate the transfer. Your old broker will also need to resolve any outstanding margin loans if you have a margin account.

Despite the time it takes to transfer stock between brokers, it's by far the most cost-effective option. To explain why, we need to go over the alternative method that can be very expensive.

Buying your first stocks: do it the smart way

Once you’ve chosen one of our top-rated brokers, you need to make sure you’re buying the right stocks. We think there’s no better place to start than with stock advisor, the flagship stock-picking service of our company, the motley fool. You’ll get two new stock picks every month from legendary investors and motley fool co-founders tom and david gardner, plus 10 starter stocks and best buys now. Over the past 17 years, stock advisor’s average stock pick has seen a 569% return — more than 4.5x that of the S&P 500! (as of 1/15/2021). Learn more and get started today with a special new member discount.

Why you shouldn't sell your investments

For convenience's sake, it's tempting to just sell all of your investments and withdraw the proceeds from your brokerage account. Then, you can take that money, deposit it into your new brokerage account, and purchase the same investments you had in the original account.

That strategy may be simpler, but it comes with a big drawback in the form of capital gains taxes. If you're transferring a standard taxable brokerage account (as opposed to a retirement account like an IRA) and you sell off your assets, you'll generate taxable capital gains on any profits you've earned. And that's true even if you turn around and buy back the exact same investments with your new broker.

You could also end up paying fees when selling your investments and buying them again. This is less likely now that so many popular brokers offer zero-commission trading, but it's an unnecessary extra cost if your old broker doesn't offer that.

If you're not happy with your broker, it doesn't make sense to stay in a bad financial relationship. It's better to transfer stocks between brokers so you can use a brokerage account you like.

Frequently asked questions

We're here to help

We want to help you get the most out of our products and services. Below you’ll find answers to popular questions about pension options, savings products and much more.

Want to talk to us?

You can find the contact details for our various products and services here.

Contact & help

If you need more help with something, you can contact us directly to talk about your needs. This page has all of our contact options to help you find the one you need.

Make a complaint

We’re here to help. If you need to raise a complaint or speak with us about a concern, you can contact us directly. Find out the best way to contact us here.

Helpful guides and articles

Find out more about pensions and your retirement options with our range of helpful guides.

Pensions guides

Retirement guides

Moneyplus

There's a lot to look forward to

What we offer

Help & support

Online services

Connect with us

This website describes products and services provided by standard life assurance limited (part of the phoenix group) and subsidiaries of the standard life aberdeen group. The standard life aberdeen group and the phoenix group are in a strategic partnership – learn more about the products and services provided by each company.

Standard life assurance limited continues to use the standard life brand, but products and services under this brand are provided by different companies:

All the pension products on this website are provided by standard life assurance limited, which is part of the phoenix group.

Standard life assurance limited is registered in scotland (SC286833) at standard life house, 30 lothian road, edinburgh, EH1 2DH. Standard life assurance limited is authorised by the prudential regulation authority and regulated by the financial conduct authority and the prudential regulation authority.

Where we mention financial advice from standard life on this website, the advice services are provided by the standard life aberdeen group.

Our retirement advice service is provided by standard life client management limited. Standard life client management limited is registered in scotland (SC193444) at 1 george street, edinburgh, EH2 2LL. Standard life client management limited is authorised and regulated by the financial conduct authority.

We also refer to advice from 1825 on this website. '1825' is a trading name used by 1825 financial planning and advice ltd, which is part of the standard life aberdeen group. 1825 financial planning and advice ltd is registered in england (01447544) at 14th floor 30 st. Mary axe, london, england, EC3A 8BF and is authorised and regulated by the financial conduct authority.

The standard life stocks & shares ISA and personal portfolio are provided by standard life savings limited, which is part of the standard life aberdeen group.

Standard life savings limited is registered in scotland (SC180203) at 1 george street, edinburgh, united kingdom, EH2 2LL. Standard life savings limited is authorised and regulated by the financial conduct authority.

The standard life self investor ISA and trading account are provided by elevate portfolio services limited, which is part of the standard life aberdeen group.

Elevate portfolio services limited is registered in england (01128611) at bow bells house, 1 bread street, london, EC4M 9HH. Elevate portfolio services limited is authorised and regulated by the financial conduct authority.

Our onshore bond products are also provided by standard life assurance limited, which is part of the phoenix group.

Our offshore bond is provided by standard life international dac, which is part of the phoenix group.

Standard life international dac is authorised and regulated by the central bank of ireland and subject to limited regulation in the UK by the financial regulation authority. Details about the extent of our regulation by the financial conduct authority are available from us on request.

Standard life international dac is a designated activity company limited by shares and registered in dublin, ireland (408507) at 90 st stephen’s green, dublin.

Equity release

Standard life equity release is provided by age partnership limited. Standard life client management acts as an introducer and refers customers to age partnership limited.

Age partnership limited (registered in england (5265969) at 2200 century way, thorpe park, leeds, LS15 8ZB). Age partnership is authorised and regulated by the financial conduct authority. Their FCA register number is 425432.

With-profits investments

The with-profits investments on this site are provided by standard life assurance limited, which is part of the phoenix group.

For more information please read our service and provider information page.

Transferring shares online with the big four

To transfer your shares to one of the big four banks online, take a look at the following methods.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

If you want to transfer shares to another person, company or bank account, you can do this through an off-market or online transfer. Here you can find information on different types of shares, what you need for online share transfers, and how to transfer shares with each of the big four banks.

To transfer your shares to another trading platform, you need to complete a clearing house electronic subregister system (CHESS) sponsorship form that will allow you to transfer your existing holdings from a certain issuer or broker to another sponsoring participant.

CHESS is the computer system used by the ASX to record shareholdings and manage share transaction settlements.

Share trading account offer

Etoro share trading (US stocks)

Standard brokerage - US shares

Share trading account offer

Get $0 brokerage on US stocks with trades as little as $50 when you join the world's biggest social trading network.

go to site

Important: share trading carries risk of capital loss.

Disclaimer: trading cfds and forex on leverage is high-risk and losses could exceed your deposits.

Compare share trading accounts

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Important: share trading can be financially risky and the value of your investment can go down as well as up. “standard brokerage” fee is the cost to trade $1,000 or less of ASX-listed shares and etfs without any qualifications or special eligibility. If ASX shares aren’t available, the fee shown is for US shares. Where both CHESS sponsored and custodian shares are offered, we display the cheapest option.

What are sponsored shares?

Essentially, your share transfer will depend on how your shares are sponsored, that is either through the issuer or broker.

Issuer-sponsored holdings are those that you may have purchased as a new issue, earned through a demutualisation, been allocated by your company, inherited from a family member or transformed from broker sponsorship. Broker-sponsored holdings, on the other hand, are those registered with a stock broker and are usually given an HIN (holder identification number) by the broker.

How to transfer shares online: the big four

Skip ahead

Westpac

Online

You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

This type of transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post the completed CHESS form to:

Westpac securities

reply paid 85157

AUSTRALIA SQUARE NSW 1214

Otherwise, you can transfer shares through an off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to a your shares to a westpac securities CHESS sponsored account.

This post transfer costs $50 per transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Case study: commbank

If you want to transfer shares held with a stockbroker firm to commbank for business purposes, you will need to fill out a broker-to-broker transfer form. To do this, you must first ensure that the firm you have chosen to stock your shares is eligible for share transfer.

Here are the steps to follow to transfer shares to commonwealth bank:

Normally you would wait two to three days after the form is received until the shares you nominated are transferred successfully.

Commbank

Online

You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post the completed CHESS form to:

Commsec

locked bag 22

australian square NSW 1215

Otherwise, you can transfer shares through off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to transfer your shares to a commsec CHESS sponsored account.

This post transfer costs $54 per transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Online

This type of transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

This type of transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post

Post the completed fbroker to broker transfer form to:

ANZ share investing

reply paid 1346

royal exchange NSW 1224

Otherwise, you can transfer shares through an off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to transfer shares to an ANZ securities CHESS sponsored account.

There is a post transfer fee of $55 for each transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Online

This transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

This transfer is free of cost. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Post the completed broker to broker transfer request to:

Nabtrade

GPO box 4545

melbourne VIC 3001

Otherwise, you can transfer shares through an off-market transaction. This is also referred to as a standard transfer.

Transfer shares from another broker’s CHESS sponsored account

Here are the steps to transfer shares to a nabtrade CHESS sponsored account.

There is a post transfer fee of $55 for each transfer. You will have to wait two to three days after the form is received until the shares you nominated are transferred successfully.

Track all your accounts in one place!

See your savings, super, shares and loans side-by-side in the finder app. We'll also track your spending and hunt down better ways for you to save. Pop in your phone number below to get your download link.

By submitting your phone number, you agree to the finder privacy policy and terms of use

The latest in share trading

Andrew munro

Andrew munro is the cryptocurrency editor at finder. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a bachelor of arts from the university of new south wales, and has written guides about everything from industrial pigments to cosmetic surgery.

More guides on finder

You can't access robinhood in australia, so here are five low-cost alternatives to trade US stocks.

The broker is offering US shares for a flat $9.50 fee. So how does it stack up to commsec or CMC markets?

Here is the essential info you need to know about investing in the stock market for your children.

How to transfer shares to a company or person with a transfer form.

Trade ASX shares and etfs with commissions starting at $8.

Winner, finalists and methodology for finder awards 2020 best australian share trading account.

Winner, finalists and methodology for finder awards 2020 best international share trading account.

Australia's newest trading app offers flat $5 brokerage with a $100 minimum investment.

Xinja is set to be australia’s first bank to offer $0 brokerage share trading. Here’s how it compares to the rest.

Giving shares to a loved one is a great idea, but how do you actually do it?

Ask an expert

Share

Level 10, 99 york st, sydney , NSW , australia 2000

How likely would you be to recommend finder to a friend or colleague?

Thank you for your feedback.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Finder.Com.Au is one of australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

Finder.Com.Au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Products marked as 'promoted' or 'advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

So, let's see, what was the most valuable thing of this article: add money to my trading account there are three ways to add funds to your account: NEFT/RTGS transfer you can transfer funds using the regular NEFT/RTGS process. You can add the the below at how to upload money to standard securities account

No comments:

Post a Comment