Proof equals profit forex

In our example, the GBP/USD is quoted in terms of the number of USD per GBP.

Today forex bonuses

GBP is the base currency and USD is the quote currency. At a rate of GBP/USD 1.3147, it costs USD 1.3147 to buy one GBP. So, if the price fluctuates, it will be a change in the dollar value. For a standard lot, each pip will be worth $10, and the profit and loss will be in USD. As a general rule, the P&L will be denominated in the quote currency, so if it's not in USD, you will have to convert it into USD for margin calculations. Assume that you have a 100,000 GBP/USD position currently trading at 1.3147. If the prices move from GBP/USD 1.3147 to 1.3162, then they jumped 15 pips. For a 100,000 GBP/USD position, the 15-pips movement equates to $150 (100,000 x .0015).

Calculating profits and losses of your currency trades

Currency trading offers a challenging and profitable opportunity for well-educated investors. However, it is also a risky market, and traders must always remain alert to their positions—after all, the success or failure is measured in terms of the profits and losses (P&L) on their trades.

It is important for traders to have a clear understanding of their P&L because it directly affects the margin balance they have in their trading account. If prices move against you, your margin balance reduces, and you will have less money available for trading.

Realized and unrealized profit and loss

All your foreign exchange trades will be marked to market in real-time. The mark-to-market calculation shows the unrealized P&L in your trades. The term "unrealized," here, means that the trades are still open and can be closed by you any time.

The mark-to-market value is the value at which you can close your trade at that moment. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. In the case of a short position, it is the price at which you can buy to close the position.

Until a position is closed, the P&L will remain unrealized. The profit or loss is realized (realized P&L) when you close out a trade position. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased.

The total margin balance in your account will always be equal to the sum of the initial margin deposit, realized P&L and unrealized P&L. Since the unrealized P&L is marked to market, it keeps fluctuating, as the prices of your investments change constantly. Due to this, the margin balance also keeps changing constantly.

Calculating profit and loss

The actual calculation of profit and loss in a position is quite straightforward. To calculate the P&L of a position, what you need is the position size and the number of pips the price has moved. The actual profit or loss will be equal to the position size multiplied by the pip movement.

Assume that you have a 100,000 GBP/USD position currently trading at 1.3147. If the prices move from GBP/USD 1.3147 to 1.3162, then they jumped 15 pips. For a 100,000 GBP/USD position, the 15-pips movement equates to $150 (100,000 x .0015).

To determine if it's a profit or loss, we need to know whether we were long or short for each trade.

Long position: in the case of a long position, if the prices move up, it will be a profit, and if the prices move down it will be a loss. In our earlier example, if the position is long GBP/USD, then it would be a $150 profit. Alternatively, if the prices had moved down from GBP/USD 1.3147 to 1.3127, then it will be a $200 loss (100,000 x -0.0020).

Short position: in the case of a short position, if the prices move up, it will be a loss, and if the prices move down it will be a profit. In the same example, if we had a short GBP/USD position and the prices moved up by 15 pips, it would be a loss of $150. If the prices moved down by 20 pips, it would be a $200 profit.

The following table summarizes the calculation of P&L:

| 100,000 GBP/USD | long position | short position |

| prices up 15 pips | profit $150 | loss $150 |

| prices down 20 pips | loss $200 | profit $200 |

Another aspect of the P&L is the currency in which it is denominated. In our example, the P&L was denominated in dollars. However, this may not always be the case.

In our example, the GBP/USD is quoted in terms of the number of USD per GBP. GBP is the base currency and USD is the quote currency. At a rate of GBP/USD 1.3147, it costs USD 1.3147 to buy one GBP. So, if the price fluctuates, it will be a change in the dollar value. For a standard lot, each pip will be worth $10, and the profit and loss will be in USD. As a general rule, the P&L will be denominated in the quote currency, so if it's not in USD, you will have to convert it into USD for margin calculations.

Consider you have a 100,000 short position on USD/CHF. In this case, your P&L will be denominated in swiss francs. The current rate is roughly 0.9970. For a standard lot, each pip will be worth CHF 10. If the price has moved down by 10 pips to 0.9960, it will be a profit of CHF 100. To convert this P&L into USD, you will have to divide the P&L by the USD/CHF rate, i.E., CHF 100 ÷ 0.9960, which will be $100.4016.

Once we have the P&L values, these can easily be used to calculate the margin balance available in the trading account. Margin calculations are typically in USD.

The bottom line

You will not have to perform these calculations manually, because all brokerage accounts automatically calculate the P&L for all your trades. However, it is important that you understand these calculations, as you will have to calculate your P&L and margin requirements while structuring your trade—even before you actually enter the trade.

Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. For example, if you have a leverage of 100:1, you will require a margin of $1,000 to open a standard lot position of 100,000 USD/CHF. Having a clear understanding of how much money is at stake in each trade will help you manage your risk effectively.

The secret to finding profit in pairs trading

"quants" is wall street's name for market researchers who use quantitative analysis to develop profitable trading strategies. In short, a quant combs through price ratios and mathematical relationships between companies or trading vehicles in order to divine profitable trading opportunities. During the 1980s, a group of quants working for morgan stanley struck gold with a strategy called the pairs trade. Institutional investors and proprietary trading desks at major investment banks have been using the technique ever since, and many have made a tidy profit with the strategy.

It is rarely in the best interest of investment bankers and mutual fund managers to share profitable trading strategies with the public, so the pairs trade remained a secret of the pros (and a few deft individuals) until the advent of the internet. Online trading opened the lid on real-time financial information and gave the novice access to all types of investment strategies. It didn't take long for the pairs trade to attract individual investors and small-time traders looking to hedge their risk exposure to the movements of the broader market.

What is pairs trading?

Pairs trading has the potential to achieve profits through simple and relatively low-risk positions. The pairs trade is market-neutral, meaning the direction of the overall market does not affect its win or loss.

The goal is to match two trading vehicles that are highly correlated, trading one long and the other short when the pair's price ratio diverges "x" number of standard deviations - "x" is optimized using historical data. If the pair reverts to its mean trend, a profit is made on one or both of the positions.

An example using stocks

Traders can use either fundamental or technical data to construct a pairs trading style. Our example here is technical in nature, but some traders use a P/E ratio or other fundamental factors to measure correlation and divergence.

The first step in designing a pairs trade is finding two stocks that are highly correlated. Usually that means that the businesses are in the same industry or sub-sector, but not always. For instance, index tracking stocks like the QQQQ (nasdaq 100) or the SPY (S&P 500) can offer excellent pairs trading opportunities. Two indices that generally trade together are the S&P 500 and the dow jones utilities average. This simple price plot of the two indices demonstrates their correlation:

For our example, we will look at two businesses that are highly correlated: GM and ford. Since both are american auto manufacturers, their stocks tend to move together.

Below is a weekly chart of the price ratio between ford and GM (calculated by dividing ford's stock price by GM's stock price). This price ratio is sometimes called "relative performance" (not to be confused with the relative strength index, something completely different). The center white line represents the mean price ratio over the past two years. The yellow and red lines represent one and two standard deviations from the mean ratio, respectively.

In the chart below, the potential for profit can be identified when the price ratio hits its first or second deviation. When these profitable divergences occur it is time to take a long position in the underperformer and a short position in the overachiever. The revenue from the short sale can help cover the cost of the long position, making the pairs trade inexpensive to put on. Position size of the pair should be matched by dollar value rather than number of shares; this way a 5% move in one equals a 5% move in the other. As with all investments, there is a risk that the trades could move into the red, so it is important to determine optimized stop-loss points before implementing the pairs trade.

An example using futures contracts

The pairs trading strategy works not only with stocks but also with currencies, commodities and even options. In the futures market, "mini" contracts - smaller-sized contracts that represent a fraction of the value of the full-size position - enable smaller investors to trade in futures.

A pairs trade in the futures market might involve an arbitrage between the futures contract and the cash position of a given index. When the futures contract gets ahead of the cash position, a trader might try to profit by shorting the future and going long in the index tracking stock, expecting them to come together at some point. Often the moves between an index or commodity and its futures contract are so tight that profits are left only for the fastest of traders - often using computers to automatically execute enormous positions at the blink of an eye.

An example using options

Option traders use calls and puts to hedge risks and exploit volatility (or the lack thereof). A call is a commitment by the writer to sell shares of a stock at a given price sometime in the future. A put is a commitment by the writer to buy shares at a given price sometime in the future. A pairs trade in the options market might involve writing a call for a security that is outperforming its pair (another highly correlated security), and matching the position by writing a put for the pair (the underperforming security). As the two underlying positions revert to their mean again, the options become worthless allowing the trader to pocket the proceeds from one or both of the positions.

Evidence of profitability

In june of 1998, yale school of management released a paper written by even G. Gatev, william goetzmann, and K. Geert rouwenhorst who attempted to prove that pairs trading is profitable. Using data from 1967 to 1997, the trio found that over a six-month trading period, the pairs trade averaged a 12% return. To distinguish profitable results from plain luck, their test included conservative estimates of transaction costs and randomly selected pairs. You can find the full 34-page document here.

Those interested in the pairs trading technique can find more information and instruction in ganapathy vidyamurthy's book pairs trading: quantitative methods and analysis, which you can find here.

The bottom line

The broad market is full of ups and downs that force out weak players and confound even the smartest prognosticators. Fortunately, using market-neutral strategies like the pairs trade, investors and traders can find profits in all market conditions. The beauty of the pairs trade is its simplicity. The long/short relationship of two correlated securities acts as a ballast for a portfolio caught in the choppy waters of the overall market. Good luck with your hunt for profit in pairs trading, and here's to your success in the markets.

How to use a stop-loss and a take-profit in forex trading

This article will provide an explanation of how to use a stop loss and a take profit when trading forex (FX). The article will cover how to place stop-losses in forex, it will provide some examples of placing stop-losses when using certain trading strategies, how to place profit targets, and more!

It is important to know how to set a stop-loss and a take-profit in forex, but what do stop-losses and take-profits actually represent?

These two forms are the most significant elements of trade management. A stop-loss is determined as an order that you send to your broker, instructing them to limit the losses on a particular open position or trade. As for the take-profit or target price, it is an order that you send to your broker, notifying them to close your position or trade when a certain price reaches a specified price level in profit. In this article, we will explore how to use stop-loss and take-profit orders appropriately in FX.

How to place stop-losses in forex

The first thing a trader should consider is that the stop-loss must be placed at a logical level. This means a level that will both inform the trader when their trade signal is no longer valid, and that actually makes sense in the surrounding market structure. There are several tips on how to exit a trade in the right way. The first one is to let the market hit the predefined stop-loss that you placed when you entered the trade. Another method is to exit manually, because the price action has generated a signal against your position.

Knowing how to calculate stop-loss and take-profit in forex is important, but it is crucial to mention that exits can be end up being purely emotion-based. For instance, you could end up manually closing a trade just because you think the market is going to hit your stop-loss. In this case, you feel emotional, as the market is moving against your position, despite no price action based reason to exit manually being present.

The ultimate purpose of the stop-loss is to help a trader stay in a trade until the trade setup, and the original near-term directional bias are no longer valid. The aim of a professional forex trader when placing a stop-loss is to place the stop at a level that grants the trade room to move in the trader's favour.

Essentially, when you are identifying the best place to put your stop-loss, you should think about the closest logical level that the market would have to hit to actually prove your trade signal wrong. Therefore, stop-loss traders want to give the market room to breathe, and to also keep the stop-loss close enough to be able to exit the trade as soon as it is possible, if the market goes against them. This one of the key rules of how to use stop-loss and take-profit in forex trading.

A lot of traders cut themselves short by placing their stop-loss too close to their entry point, merely because they want to trade a bigger position size. But the trap here is that when you place your stop too close, you are actually invalidating your trading edge, as you need to place your stop-loss based on your trading signal and the current market conditions, and not on the basis of how much money you anticipate to make.

Therefore, your assignment is to define your stop-loss placement prior to identifying your position size. In addition, your stop-loss placement should be determined by logic. Do not allow greed to lead you to losses.

Free live trading webinars with admiral markets

Did you know that you can register for FREE to regular trading webinars with admiral markets? Learn directly from professional trading experts and find out how you can find success in the live trading markets. Learn about the best trading indicators, the most popular strategies, the latest news, trends and developments in the markets, and so much more! Click the banner below to register for FREE!

Examples of placing stop-loss strategies

The first strategy is known as the 'pin bar trading strategy stop-loss placement'. The most logical place to put your stop-loss on a pin bar setup is usually beyond the high or low of the pin bar tail.

The second strategy example is the 'inside bar trading strategy stop-loss placement'. Here, the most logical place to put your stop-loss is on an inside bar setup that is solely beyond the mother bar high or low.

The third stop-loss/take-profit strategy example is the 'counter-trend price action trade setup stop-loss placement'. For a counter-trend trade setup, your task is to place the stop-loss just beyond either the high or the low made by the setup that indicates a potential trend change.

The next example strategy is the 'trade range stop placement'. Every trader often sees high-probability price action setups forming at the boundary of a concrete trading range. In such cases, traders may want to place their stop-loss just over the trading range boundary, or on the high or low of the setup being traded.

Consider this when learning how to use stop-loss and take-profit in FX. For instance, if we had a pin bar setup at the top of a trading range that was precisely under the trading range resistance, we would place our stop a little bit higher, just outside the resistance of the trading range, rather than just over the pin bar high.

The next example strategy is 'stop placement in a trending market. When a trending market either pulls back or retraces to a level within the trend, we commonly have two options. The first option is that we can place the stop-loss just over the high or low of the pattern, or we can use the level, and place our stop just under it. Finally, we have come to the 'trending market breakout play stop placement'. This will expand your knowledge about take-profit and stop-loss in forex. In a trending market, we will frequently see the market pause and consolidate in a sideways manner after the trend makes a powerful move.

Such consolidation periods mostly give rise to large breakouts in the direction of the trend, and these breakout trades can potentially be lucrative for traders. There are generally two options for stop placement on a breakout trade with the trend. You can either place your stop-loss near the 50% level of the consolidation range, or on the other side of the price action setup.

How to place profit targets

Frankly speaking, the most feasible approach of how to use stop-loss and take-profit in forex is perhaps the most emotionally and technically complicated aspect of forex trading. The trick is to exit a trade when you have a respectable profit, rather than waiting for the market to come crashing back against you, and then exiting out of fear. The difficulty here is that you will not to want to exit a trade when it is in profit and moving in your favour, as it feels like the trade will continue in that direction.

The irony is that not exiting the moment the trade is significantly in your favour usually means that you will make an emotional exit, as the trade comes crashing back against your current position. Therefore, your focus when using the stop-loss and the take-profit in forex should be to take respectable profits, or a 1:2 risk/reward ratio or greater when they are available - unless you have predefined prior to entering, that you will try to let the trade run further.

What is the general profit target placement theory?

After identifying the most logical placement for our stop-loss, our attention should then shift to finding a logical profit target placement, as well as a risk/reward ratio. It is important to be sure a decent risk to reward ratio is viable on a trade, otherwise it is definitely not worth taking. Therefore, you have to identify the most logical place for your stop-loss, and then proceed to define the most logical place for your take-profit.

If after doing this, there is a decent risk/reward ratio possible on the trade, this trade is probably worth taking.

Nonetheless, you have to be honest with yourself in such a situation - do not ignore key market levels or apparent obstacles that are in your way in terms of reaching a satisfactory risk/reward ratio, simply because you want to enter a trade. Also, don't forget to use the correct stop-loss/take-profit ratio. You have to analyse the general market conditions and structure, resistance and support levels, the main turning points in the market, bar lows and highs, and other important elements.

Try to define whether there is some key level that would make a logical take-profit point, or whether there is some key level obstructing the trade's path to making an adequate profit.

Conclusion

Every trade is basically a business deal. It is essential to weigh the risk and the reward from the deal, and then to decide whether it is worth taking or not. In forex trading, you should consider the risk of the trade, as well as the potential reward, and if it's realistically practical to obtain it according to the surrounding market structure. To trade more profitably, it is a prudent decision to use stop-loss and take-profit in forex.

If you would like to learn more about stop losses in forex, make sure to read the following articles:

Trade with metatrader supreme edition

Admiral markets offers professional traders the ability to significantly enhance their trading experience by boosting the metatrader platform with metatrader supreme edition. Gain access to excellent additional features such as the correlation matrix - which enables you to compare and contrast various currency pairs, together with other fantastic tools, like the mini trader window, which allows you to trade in a smaller window while you continue with your day to day things.Get all of this and much more by clicking the banner below and starting your FREE download!

About admiral markets

admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

What is the most profitable forex strategy?

The templar knights were a group of christian soldiers who, according to legend, searched for the holy grail in the 14th century. The holy grail was a mystical relic said to have miraculous powers that provided eternal youth and happiness to those who drank from it. Like the knights back then, many people today are searching for their own version of the holy grail. They want a secure, fool proof way of gaining, happiness, success or even love, without having to dedicate themselves to working at these things consistently. The same applies to forex. It is just basic science. Humans love an easy reward.

We can observe this in almost every forex trading forum that there is. There are literally hundreds of forum threads with traders, particularly beginners, who all want to find the most profitable forex trading techniques that they think will make them rich in no time if they learn it. They spend hours searching the internet and even hand out large sums of cash to internet forex scammers who convince them that they can sell them the perfect profitable trading strategy that will make them win every trade and make them rich. They quickly find out that this is not the case. In forex, there is not a simple forex strategy, there is no holy grail.

Profitability – profitable forex trading strategies

So, we know that we just said that there is no holy grail in forex trading. This does not mean that there aren’t any profitable forex strategies. The proof is in the pudding, rather, it is seen in the many forex traders in the world who have done so well for themselves that they trade forex as their main source of income. So, what do these traders have that every other struggling trader does not?

Apart from discipline, they have awareness of what their strengths are and they stick to them.

Every forex trader is different. We all have different personalities, different talents, and different goals in life. This means that we all have different thoughts on what profitability means to us. For one person, it may mean a consistent way to earn a few more bucks a month on their day job salary. For another person, it may be a way to save up for retirement. For someone else, they may see it as a way of being financially free from having to work a 9-5 job, meaning that they would become profitable only when they could replace their current salary. For the sake of this article, we will speak of profitability as the ability to consistently make profits over a period of weeks, months or years. This way of measuring profitability does not depend on any dollar amount like the others would have. Rather, it just means that you are making some gain in percentage on your money either every week, month or year and that your overall money increases steadily as time goes by.

Trade with zero fees and VPS!

Start your trading with the spreads from 0 pips on metatrader 4 and metatrader 5!

Every trader must keep in mind though, that his version of what profitability is, is what he should focus on. This will help him to make the right trading decisions, help to measure the amount of risk he is willing to take, and also choose the right trading strategy that suits his needs.

To find out what best forex trading strategies suit a trader’s personal needs and goals, he must consider the following:

- The amount of risk he is willing to expose himself to for the period.

This means that he will need to set a particular risk reward:ratio for himself, for each trade that he takes. People who have more liquid finance available to them or who are more financially capable tend to risk more on their trades than those who do not. This means that they are more likely to take trades which have a lower risk:reward ratio. For an example, the trader who has a well paying 9-5 job, will be more likely to take a trade with a risk reward of 1:1, than a trader who is using this as the main means to save for his retirement. This trader would more likely make trades that have a higher risk reward ratio, where he can make higher profits at a lower risk exposure.

- The amount of stress that he can handle at any one time.

It is easier for high risk adrenaline junkies to trade with the best forex trading strategies for scalping with little problems. For a trader that is less inclined to take high risks or trading highly volatile time frames like the 5 min chart, he may be more comfortable using forex day trading strategies instead. A trader needs to be aware of the amount of stress that he is able to handle, because high stress will encourage traders to engage in behaviours that are bad to his trading. High stress will encourage him to enter his position too early, or too late. It may cause him to exit profitable trades early, and let his losing trades run for too long. A high stress environment may also increase the negative emotions like fear and greed, and affect the ability of a trader to stay disciplined to his strategy.

- The amount of time that he is able and willing to spend looking at price charts each day.

This is usually one of the things that beginner traders do not consider important when they are first learning how to trade forex. They think that following the popular way to trading regardless if they are able to commit to the hours involved is the way to go. It is self-explanatory why this is a foolish way to trade. If you cannot dedicate yourself to sitting diligently at your charts daily for extended periods of time, then short term trading may not be the right option for you. Scalping strategy and day trading strategy requires long periods of focus. If you cannot give it, then you may want to consider trading the longer time frames like the daily, weekly, or monthly charts.

Simple is the way to go – profitable strategy forex

The best forex strategy for consistent profits, for any trader, will be a simple profitable forex strategy. There are many different strategies that forex traders can find on the internet to suit their tastes. The ones that work the best however are the ones that are the simplest to understand and to follow. Because there are different types of trading, it would be difficult to assign one trading strategy as the most profitable forex strategy. As such, we have gathered the most profitable strategies for each major type of forex trading.

Scalping

A very profitable forex strategy in scalping, is one which allows you to have many trade opportunities while offering for some amount of stability. The following strategy is fairly easy to follow and will satisfy the scalper who is looking for multiple trade opportunities during his sessions.

The high low EMA

This scalping strategy is based on the 5 exponential moving averages, on the 5 min chart. To follow this strategy, a trader must first place the 5 EMA high, and the 5 EMA low on his chart. He can choose any currency pair, but it must be noted that this strategy works best on a ranging market.

For this strategy, a trader will be looking for candles that open above and below the 5 EMA lines. If a candle opens above the 5 EMA high (the top EMA), then place a sell. If the candle opens below the 5 EMA low (the bottom EMA), then place a buy.

As you can see, the 5 EMA high is marked in gold, and the 5 EMA low is indicated in magenta. The trade opportunities according to the strategy are indicated by the blue marks. Note that not all the trade opportunities are highlighted, and that a few of the trades would have resulted in a small loss. This is typical of a scalping strategy. This is where trade volume comes into play. The majority of the trades taken on the chart would have been winning trades, and as a result, the scalper would have closed the day with a profit.

Day trading

There are quite a few day trading strategies that many forex traders swear by. They all revolve around the basic three ways of day trading which are trend trading, counter trading and breakout trading, usually being among some of the best forex strategies.

The moving average cross

This profitable forex trading strategy can be seen as a classic go to strategy for day traders. It is usually one of the first strategies and most simple strategies that forex traders learn. For this version of the moving average cross we will be using three moving averages on the hour chart.

To follow this strategy a trader should set three moving averages to the following periods: 20, 60 and 100.

20 MA: fast moving average

60 MA: slow moving average

100 MA: trend line indicator

To produce a buy signal, the fast-moving average (20 MA) has to cross UP over the slow-moving average (60 MA).

To produce a sell signal, the fast-moving average (20 MA) has to cross DOWN below the slow-moving average (60 MA).

In this USDJPY H1 chart, the fast moving 20 MA is the yellow line. The magenta line shows the slow 60 MA. The green line is the trend indicator. As indicated by the area encircled in red, the 20 MA crosses down below the 60 MA indicating a sell signal. The price moves down in a strong bearish movement before tapering off when forming a double bottom pattern, which has been underlined in red. This is the area where it would have been wise to take your profit.

Again, we are looking at the USD/JPY H1 chart. As you can see the market made a sloppy cross over but this formed while the market was moving in a range. Therefore this signal has to be ignored. Using this strategy, any signals formed in a range formation can be dangerous to follow. They are not as reliable as signals formed in trends. The range broke, and the fast 20 MA crossed UP strongly over the slow 60 MA. The strong upward movement that followed is further indicated by the yellow arrow.

Another thing to note is that you can tell that the previous signal that formed in the range was not reliable, because the trend line did not change direction. Moving out of a down trend the green trend line was above both the 20 MA and 60 MA. When the signal was a clear one, the trend line dipped below the two moving averages.

Try the best in-class web platform

Are you looking for a superb trading software? Get your hands on the nicest platform by IQ option!

Swing trading

As the name suggests with this type of trading, you will be looking for areas of weakness in the market, where price is more likely to swing. This means targeting areas of resistance, or areas where you think the price will retrace to, before continuing along the trend. Because swing trading is so highly dependent on the peaks and valleys of the market, knowing if the market is trending and the direction of the trend is essential with this type of trading.

It is therefore essential that any profitable forex strategy tailored to this type of trading be based on the support and resistance levels that price action creates, so that you can determine where the market will probably change trend direction, or retrace.

The 20 SMA swing

Like the above picture suggests this type of swing trading uses the 20 SMA line to determine the trade, and the relative strength index (RSI) is used to measure the strength of the trend. It is noted that this type of system (like most swing trading systems) work best in a trending market. Also, unlike the typical swing trading strategy, it works very well on both the 4H and day charts.

To follow this system, set your 20 SMA (simple moving average) and set your RSI to 5 days. Also put in the 50 RSI level on your indicator as well. There should be three horizontal lines on the RSI. These are the RSI levels. The 50 mark is in the middle, and this is the line we will be using to help relay whether the entries that we observe on our chart are strong enough for us to take.

To determine the direction of the trend we use the 20 SMA line. If the price is above the 20 SMA, then it is in an uptrend. If the price is below the 20 SMA, then it is in a downtrend.

With the RSI, we use it to determine when a rally is actually becoming a retracement. (when price bounces back.) the rules with the RSI are as follows.

- When the RSI peaks over the 50 RSI level and then starts to turn down afterwards, then it is indicating that the bullish trend (uptrend) is weakening and that you should be looking to sell soon.

- When the RSI pushes under the 50 RSI level and then starts to turn upwards after, then it is indicating that the bearish trend (downtrend) is weakening and that you should be looking to buy soon.

- Price must be above the 20 SMA line in an uptrend.

- Wait for price to retrace back down towards the line to touch it.

- When the price has touched the line, or gone very near it, look at your RSI, to see if has peaked down under the 50 RSI level and has started to curve back up. If it has, then this confirms a now weak downward movement.

- Place a buy order (a buy stop) above the high of the candlestick after it closes. The next candlestick should be one that starts to go up. Place your stop loss below the low of the previous candle.

As you can see with this chart, the areas circled in orange are viable buys that we identified with this strategy. Each of them would have rewarded about three times the risk that it took to make the trade, had we placed the buys.

The areas circled in pink, we would not have taken as they barely touched the 50 SMA line before returning up.

- Price must be below the 20 SMA in a downtrend.

- Wait for the price to retrace back up towards the line.

- When price touches the line, then look at your RSI. If it has peaked up over the 50 RSI level before starting to turn down, then we have confirmed weak upward movement.

- Place a sell order below the low of the candle after it closes. Place your stop loss above the high of the candle.

As you can see with this chart (also the AUD/JPY on the daily period), the downtrend began at the area circled in blue. The areas circled in orange were retracements where we would have put our sell orders.

Choose your battle axe

In forex profitable strategy is similar to a weapon of war. You may not have the holy grail to solve all your problems, but you do have a choice of a well-crafted weapon. You have to choose the ‘weapon’ that you are more comfortable with and that is easier for you to handle because it will be better for you in the long run. The same goes for trading. Choose the type of trading that you will be best at, forex trading system that works for you. The profitable forex trading strategy that we highlighted in each type of trading, if mastered, will be one of the greatest tools in your forex knowledge base.

The most powerful and profitable forex strategy

Share this:

XAUUSD has dropped down strongly. First of all I bought it in the dip with a perfect entry point. I waited 20 days in the consolidation. At the end the price retraced back and then it reached my target. Hence this buy trade paid me +5014 pips of realized profit.

Later, the price completed the retracing back spiking up. The price reached my lowest order, but I missed to set the order to the highest entry. I sold and I had only one trade in sell. As a result, that sell trade paid me +9177 pips of realized profit.

Realized profit: XPDUSD +385 pips – XAGUSD +118 pips

XPDUSD converged and then it started a price consolidation. I bought a bit high, not the best entry point. I waited a few days patiently and at the end the buyers pushed up the price to my target. As a result, my buy trade paid me +385 pips of realized profit.

XAGUSD has dropped strongly, just like gold. Then, I bought in the dip with a couple of trades. I closed the highest one with a small profit, letting the lowest one in running for almost 20 days. Then, after the price consolidation the new buyers pushed up the price to my target. As a result, the buy trade paid me +118 pips of realized profit.

Realized profit: USDMXN +7565 pips – EURCAD +458 pips

USDMXN was retracing back and I had my order ready to catch the end of the retracing. My entry point was perfect. The buyers were waiting for it, then my buy trade took an advantage of this, rising strongly. As a result, my buy trade paid me +7565 pips of realized profit. In addition, the buyers continued to push up the price marking a new top in the trading scenario.

EURCAD has dropped and my buy order was waiting there for many days. Finally the price converged filling my order, but unfortunately I bought high, then, it was not a perfect entry. So, the trade followed my trading plan and the strong momentum pushed the price up to my target. As a result, my buy trade paid me +458 pips of realized profit.

Consideration about why people lose money

Some reasons about why a newbie traders lose money:

- Some newbie has still not the right mindset so as the right attitude for a good trading.

- Newbies still have not the necessary skills so as the experience to understand properly the price action.

- Some people consider trading like casino, then their mindset is for gambling but not for trading.

- Some traders are so lazy to base their trading on scammers and trading signals.

How to get the right mindset

Studying with dedication and practicing properly for the long-term everybody can get the right mindset. It is tremendously important because it gives all the necessary to manage the investments in the right way.

Two of the most important things why the right mindset is fundamental are the trade sizing and the risk management. Then, to educate the mind to manage the risk and the emotions a sizing plan is the best way.

Trading is all about discipline, to apply some important rules time by time.

The discipline is what we get having a sizing plan and a growth plan.

Invest $100 for a 5% of price change in reward is different from invest $100.000 for the same reward. Therefore, the mind is not able to manage these 2 investments in the same way. So, there is a training process to go forward to $100.000 of investment education the mind:

- Set your final goals.

- Then, define your intermediary targets.

- Put on your table the trade sizes to invest to reach each target.

- Reach a target and then rinse and repeat.

Conclusion

What is clear now is that the simplicity is the key of every profitable forex trading strategy. In addition, even if it is simple it will be usefulness if the trader don’t understand the price action. Then, success comes from the understanding of price action.

I am not talking about japanese candles so as candlesticks patterns, that are for “babies”. I am talking about what moves the price so as how and why it is moving.

The simplicity in trading pays large rewards.

Simplicity plus a clear comprehension of price action and the right mindset about trading make a successful trader.

It takes time, much as it needs dedication and sacrifice, so as effort and hard work. But at the end, the price action pays for everything. It gives money to pay bills, to put food on the table and to pay the school of children. In the same way, all the extra money is a blessing so as a paycheck for the hard work.

My indelible truth and testimony about trading

When I had nothing, stress and desperation were always with me. Then, I had to find a way to get out of darkness so as move forward leaving behind everything. I started to make trading, but I had no experience so as I had not the right approach. This means that I was uncertain about many things, until I found out my first multimillionaire mentor. Listening him so as studying with dedication his lessons I realized what was not working with my trading. Considering that money attracts money, together with him also other multimillionaires trading mentors gave their contribute to my trading education.

Understanding what they repeated continually, I improved my trading practice. In the same way, I changed my mind about the money.

As a result, my account started to grow. Hence, with dedication and determination I changed my life condition, making a large part of my fortune.

In conclusion, what I tell you is to study with dedication. This is what people do on profiting.Me. There is no other way to reach the financial freedom. Everybody wants the financial freedom so as many of them love the luxury. But never forget to fight for what is really important for your life.

Most of all, my profitable forex strategy is my personal “tool” to build my life. Then, it is the best resource in my hands, so as in my mind, to earn money. It is my skill, so as my ability. “it is my superpower, so as my blessing.”

But alone it is nothing more than this, because my quality trading comes from years of hard work and dedication. Therefore, my life changed.

Probability tools for better forex trading

In order to be successful, forex traders need to know the basic mathematics of probability. After all, it’s difficult to achieve and maintain trading gains without first having the ability to understand the numbers and measure them.

Many traders use a combination of black box indicators to develop and implement trading rules. Yet, the difference between a “good” trader and a great one is his or her understanding of the metrics and methods for calculating performance and gains.

Probability and statistics are the key to developing, testing and profiting from forex trading. By knowing a few probability tools, it’s easier for traders to set trading goals in mathematical terms, create and operate effective trading strategies, and assess results.

It’s helpful to review the most basic concepts of probability and statistics for forex trading. By understanding the math of probability, you’ll know the logic used by mechanical trading systems and expert advisors (EA).

Normal distribution

The most basic tool of probability in forex trading is the concept of normal distribution. Most natural processes are said to be “normally distributed.”

“uniform distribution” implies that the probability of a number being anywhere on a continuum is about equal. This is the sort of distribution that would result from artificially spreading objects as evenly as possible across an area, with a uniform amount of spacing between them.

However, instead of a uniform distribution, a currency-pair’s price will likely be found within a certain area at any given time. This is its “normal distribution,” and probability tools can show an approximation of where that price is likely to be found.

Normal distribution offers forex traders predictive power regarding the likelihood that a currency-pair price will reach a certain level during a certain time frame.

Computers use a random-number generator to calculate the means (averages) of forex prices in order to determine their normal distribution.

If a large number of sample prices are checked, the normal distribution will form the shape of a bell curve when plotted graphically. The greater the number of samples, the smoother the curve will be.

The rules of simple averages are helpful to traders, yet the rules of normal distribution offer more useful predictive power. For example, a trader may calculate that the “average” daily price move of a forex pair is, say, 50 pips.

Yet, the normal distribution can also tell the trader the likelihood that a certain daily price move will fall between 30 and 50 pips, or between 50 and 70 pips.

According to the rules of normal distribution and standard deviation, approximately 68% of the samples will be found within one standard deviation of the mean (average), and about 95% will be found within two standard deviations of the mean. Finally, there is a 99.7% likelihood that the sample will fall within three standard deviations of the mean.

Normal distribution and standard deviation functions in expert advisors (EA) and trading systems help forex traders assess the probability that prices may move a certain amount during a given period of time.

Yet, traders should be cautious when using the concept of normal distribution alone for purposes of risk management. Even though the probability of a rare event (such as a price decrease of 50%) may seem low, unforeseen marketplace factors can make the possibility much higher than it appears during normal distribution calculations.

Reliability of analysis depends on quantity and quality of data

When modelling normal distribution curves, the amount and quality of input price data is very important. The greater the number of samples, the smoother the curve will be. Also, to avoid calculation errors resulting from insufficient data, it’s important that each calculation be based on at least thirty samples.

So, for testing a forex-trading strategy by estimating the results from sample trades, the system developer must analyze at least 30 trades in order to reach statistically-reliable conclusions regarding the parameters being tested. Likewise, the results from a study of 500 trades are more reliable than those from an analysis of only 50 trades.

Dispersion and mathematical expectation to estimate risk

For forex traders, the most important characteristics of a distribution are its mathematical expectation and dispersion. Mathematical expectation for a series of trades is easy to calculate: just add up all the trade results and divide that amount by the number of trades.

If the trading system is profitable, then the mathematical expectation is positive. If the mathematical expectation is negative, the system is losing on average.

The relative steepness or flatness of the distribution curve is shown by measuring the spread or dispersion of price values within the area of mathematical expectation. Typically, the mathematical expectation for any randomly-distributed value is described as M(X).

So, dispersion can be defined as D(X) = M[(X-M(X)] 2 .

And, a dispersion’s square root is called its standard deviation, shown in mathematical shorthand as sigma (σ).

Dispersion and standard deviation are critically important for risk management in forex trading systems. The higher the value of the standard deviation, the higher will be the potential drawdown, and the higher the risk. Likewise, the lower the value for standard deviation, the lower will be the drawdown while trading the system.

For example, below is a sample risk assessment for a test of a forex trading system:

Trade number X (trade gain or loss)

1 -17.08

2 -41.00

3 147.80

4 -159.97

5 216.97

6 98.30

7 -87.75

8 -27.83

9 12.34

10 48.14

11 -60.92

12 10.62

13 -125.43

14 -27.82

15 88.02

16 32.94

17 54.82

18 -160.10

19 -83.37

20 118.40

21 145.65

22 48.43

23 77.39

24 57.49

25 67.75

26 -127.10

27 -70.19

28 -127.60

29 31.31

30 -12.55

In the above example based on the minimum number of thirty trades for an adequate sample, it’s important to note that the mathematical expectation is positive, so the forex trading strategy is indeed profitable.

However, the standard deviation is high, so in order to earn each dollar the trader is risking a much larger amount; this system carries significant risk.

Here’s the rest of the math: to determine the mathematical expectation for this group of trades, add together all the trades’ gains and losses, then divide by 30. This is the mean value M(X) for all the trades. In this case, it equals an average gain of $4.26 per trade. Thus far, the system looks promising.

Next, to calculate the standard deviation of the dispersion, the above average $4.26 is subtracted from the results of each trade, then it’s squared, and the sum of all these squares is added together. The sum is divided by 29, which is the total number of trades minus 1.

By using the formula for dispersion of (X) = M[(X-M(X)] 2 given above, here’s a check of the calculation from the first trade in our example:

Trade 1: -17.08 – 4.26 = -21.34, and (-21.34) 2 = 455.39

The same calculation is performed for each trade in the test series. In this example, the dispersion over the series equals 9,353.62 and by definition its square root equals the standard deviation (σ), which in this case is $96.71.

Thus the forex trader sees that the risk for this particular system is fairly high: the mathematical expectation is indeed positive, with a mean profit of $4.26 per trade, yet the standard deviation is high when compared with that profit.

It can be seen that the trader is risking about $96.71 for each opportunity to earn $4.26 in profit. This risk may be acceptable, or the trader may choose to modify the system in search of lower risk.

Z-score

Beyond the riskiness of a particular trading system, forex traders can also use normal distribution and standard deviation to calculate the Z-score, which indicates how often profitable trades will occur in relation to losing trades.

During the process of developing a winning forex trading system, the trader may wonder how many of the profitable trades seen during testing were “random,” and how many consecutive losing trades must be tolerated in order to achieve winning trades.

For example, let’s assume the average expected profit from a given forex trading system is four times less than the expected loss amount from each stop-loss order triggered while trading this system.

Some traders may assume that the system will win over time, as long as there is an average of at least one profitable trade for each four losing trades. Yet, depending upon the distribution of wins and losses, during real-world trading this system may draw down too deeply to recover in time for the next winner.

Normal distribution can be used to generate a Z-score, sometimes called a standard score, which lets traders estimate not only the ratio of wins to losses, but also how many wins/losses are likely to occur consecutively.

A positive Z-score represents a value above the mean, and a negative Z-score represents a value below the mean. To obtain this value, the trader subtracts the population mean from an individual raw value then divides the difference by the population standard deviation.

The basic standard score calculation for a raw score designated as x is:

Where μ is the population mean and σ is the population standard deviation. It’s important to understand that calculating the Z score requires that the trader know the parameters of the population, not merely the characteristics of a sample taken from that population.

Z represents the distance between the population mean and the raw score, expressed in units of the standard deviation. So, for a forex trading system:

Z = [N x (R – 0.5) – P] / [(P x (P – N)] / (N – 1)]½

N is the total number of trades during a series;

R is the total number of series of winning and losing trades;

P equals 2 x W x L

W is the total number of winning trades during a series

L is the total number of losing trades during a series

Individual series can be represented by a consecutive sequence of pluses or minuses (for example ++++ or —). R counts the number of such series.

Z can offer an assessment of whether a forex trading system is operating on-target, or how far off-target it may be.

Just as importantly, a trader can use Z-score to determine whether a trading system contains fewer or greater series of winners and losers than expected from a random sequence of trades– in other words, whether the outcomes of consecutive trades are dependent upon each other.

If the Z-score is near 0, then the distribution of trade results is near the normal distribution. The score of a sequence of trades may indicate a dependency between the results of those trades.

This is because a normal random value will deviate from the average value by not more than three sigma (3 x σ) with a certainty of 99.7%. Whether the Z value is positive or negative will inform the trader about the type of dependence: A positive Z value indicates that the profitable trade will be followed by a loser.

And, positive Z indicates that the profitable trade will be followed by another profitable one, and a loser will be followed by another loss. This observed dependency lets the forex trader vary the position sizes for individual trades in order to help manage risk.

Sharpe ratio

The sharpe ratio, or reward-to-variability ratio, is one of the most valuable probability tools for forex traders. As with the methods described above, it relies on applying the concepts of normal distribution and standard deviation. It gives traders a method to check the performance of a trading system by adjusting for risk.

The first step is to calculate the holding period returns (HPR). For example, a trade which resulted in a profit of 10% has a HPR calculated as 1 + 0.10 = 1.10 while a trade which loses 10% is calculated as 1 – 0.10 = 0.90.

Likewise, HPR can be calculated by dividing the after-trade balance amount by the before-trade amount. The average holding period returns (AHPR) is then calculated by adding up all individual holding-period returns, then dividing by the number of trades.

AHPR by itself produces an arithmetic average which may not properly estimate the performance of a forex trading system over time. Instead, a trading system’s investment efficiency can be more closely estimated by using the sharpe ratio, which shows how AHPR minus the risk-free rate of long-term investment returns relates to the standard deviation of the trading system.

Sharpe ratio = [AHPR – (1 + RFR)] / SD

When AHPR is the average holding period return, RFR is the risk-free rate of return from “safe” investments such as bank interest rates or long-term T-bond rates, and SD is the standard deviation.

Since more than 99% of all random values will fall within a distance of ±3σ around the mean value of M(X) for a given trading system, the higher the sharpe ratio, the more efficient the trading system.

For example, if the sharpe ratio for normally-distributed trade results is 3, it indicates that the probability of losing is less than 1% per trade, according to the 3-sigma rule.

The concepts of normal distribution, dispersion, Z-score and sharpe ratio are already incorporated into the logarithms of eas and mechanical trading systems, and their usefulness is invisible to most traders.

Yet, by knowing how these basic probability tools work, forex traders can have a deeper understanding of how automated systems perform their functions, and thereby enhance the probability of winning trades.

Are you currently using probability tools to increase your own chance for success?

Comments

Great article. I was looking for exactly this information. Could you clarify how I calculate the R value for a series of winning and losing trades? It’s not quite clear how to do this. You say it’s the total number of series of winning and losing trades. Does that mean I count the consecutive winners and minus the consecutive losers. So if my system have a maximum of 7 consecutive winning trades and 4 consecutative losing trades then that is a total of 3 or 11? Thanks james

I read your blog and want to thank you for giving the trading success key. Which is really helpful for trading mathematical calculation.

Thanks, rechard. I’m glad you found it useful.

How to set take-profit properly?

If it seems to you that price doesn’t hit your take-profit order level intentionally and constantly or you simply don’t know where to set your take-profit, you’re in the right place.

In this article, we’re going to learn at what levels take-profit setting is more effective and highlight certain characteristics of the market «crowd» behavior when setting take-profit.

First, let’s determine what kind of take-profit (TP) can be regarded as properly set.

Theoretically, the take-profit which (in addition to the potential defined in an order) has an additional probability of triggering by various swings, for example, market noise or price false breakouts, can be regarded as properly set.

In other words, TP should be set at the level, which can be randomly touched by price even if you have opened a trade of the wrong direction.

It’s important to understand a number of characteristics of most market participants’ behavior when placing a take-profit order.

Tricks of take-profit setting

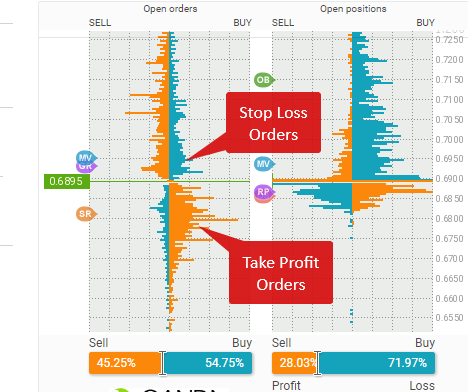

- Unlike stop-losses, take-profits are set by almost all the traders due to a trading psychology. Remember how often you want to forget about stop-losses at all. In the following picture you can see the differecnce between stop loss and take profit orders in amount:

- There is no such a classical idea of where you need to set TP. In most cases, TP is set in accordance with a pattern-based strategy, by an indicator or in a random way at all. If we collect data on the take-profits set by a great number of traders and draw the histogram showing the dependence of a certain price on the volume of take-profit orders opened at the given price, we can see that the volume has been evenly distributed among all the prices on the whole.

Better levels for take-profit setting

We shall take the approach identical to that used in the article on stop-loss in order to identify the right levels for the take-profit setting.

I remind you that we watched for the areas where many stop orders had been accumulated and attempted to avoid the areas so that we could set the right stop-loss. As for TP, we’ll make use of the areas of orders accumulation as an opportunity to improve our chance of making a successful trade.

Let’s look at the levels where stop orders are accumulated (this data were taken from the order-book):

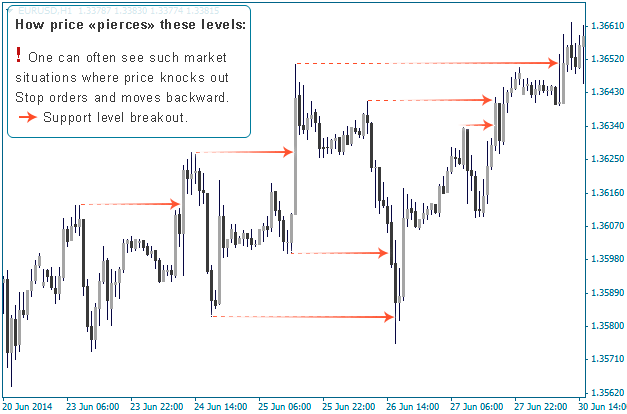

here is a higher probability of price moving through the areas. So as not to speak without proof, let me provide you with an example of how price «pierces» the levels:

Conclusions:

The rule behind a regular knocking out orders is as follows: the majority must lose so that the minority earns a profit. This is why a strategy of placing orders «against the market crowd» justifies itself.

I dare not call a particular take-profit the wrong, so I’m going to highlight a neutral and the right take-profit:

Neutral TP is a TP set randomly or based on a strategy, but regardless of the levels of orders accumulation and round price levels. In this case, the probability of taking profit equals the quality of a trade.

The right TP is a TP set according to your trading strategy but allowing for the levels of orders accumulation and round price levels. It works fine in practice even if you open a trade of the wrong direction.

We have determined what the right take-profit is. Now let’s learn where to set it.

There cannot be the single right take-profit for a particular trade, since there can be a lot of them depending on the long-term character of your strategy. Ways of setting the right take-profit are shown on the picture to the right:

You can set take-profits, for example, on M30 charts where you should watch for previous price highs & lows or round price levels. The basic message which we want to convey to you in this article is that whatever level your profit target is at (it depends on your strategy), take-profit should be moved towards at the support and resistance levels and round price levels.

Forex strategy: 5 ways to bulletproof your entries

Do you have a solid and effective forex strategy? Make sure you aren’t trading in this fast-paced market without one.

Forex traders have many things working against them. One thing in particular stands out. It’s not flattering, but that doesn’t make it less true.

The biggest thing working against most forex traders is… themselves.

Studies show that trader error is a major cause of high forex failure rates. This includes basic mistakes, lack of planning and weak or ineffective strategies.

Forex trading may be hard, but it’s not impossible. In this article, I am going to show you 5 ways to bulletproof your entries. You can use these methods to create a robust forex trading strategy and simplify your path to success.

Forex strategy – bulletproof way #1: choose the right timeframe

Forex time intervals are a personal consideration. But getting to make the choice yourself doesn’t make things any easier. In fact, the paradox of choice can complicate matters.

Many traders default to the first timeframe that grabs their attention, and use that one from then on. Others jump from timeframe to timeframe, trying to find the perfect one. These aren’t the most effective way to chose what timeframe will work best for your trading.

So what is the most effective way to chose the timeframe(s) you will use?

Your choice of timeframe is personal and important.

The answer comes back to you, the trader. It’s important to first understand how you like to trade.

If you’re unsure how you like to trade, don’t worry. Look at the following considerations, and it will become clear to you.

You may be better suited to faster timeframes if you:

- Like to see a trade unfold sooner rather than later, and get impatient waiting for trades that take a long time. More bars equals more attention which translates to less boredom.

- Enjoy paying close attention to your trading screens while a trade is on. A faster time interval means you have to stay more engaged so you don’t miss key setups.

- Struggle to maintain trade discipline over long time periods. Every extra second is a chance to do something impulsive, like move a stop or take profits too early. The faster the timeframe, the less chance for mischief.

You may be better suited to slower timeframes if you:

- Enjoy having time to plan and manage a trade at a less frantic pace. Slower timeframes give you time to think, which can be a great advantage if you like having time to analyze.

- Want to put on more than one trade at the same time. Slower timeframes give you more time to manage trades so you can put more of them on and still perform well.

- Value the ability to get away from your trading screens, even while positions are on. With longer timeframes, you have more time freedom in your day.

Most of us traders will have a little of both of these types in us. I know I sure do. Sometimes certain aspects will even contrast. For example, I enjoy having time freedom (which leads me to the slower timeframes). But at the same time, I like to see things happen fast (which would lead me to the faster timeframes).

The important thing is to figure out which of these considerations are most important to you. Then choose the best-fit timeframe for yourself based on this.

No timeframe will ever be perfect. But if you choose well, it can be a good match to your trading style and personality. And most important, you’ll have taken a step towards bulletproofing your forex strategy.

Forex strategy – bulletproof way #2: keep it strategically simple

K.I.S.S. = keep it simple stupid

Here is an alternative to this famous saying, made more relevant for traders:

“K.I.S.S = keep it strategically simple.”

Complexity is the enemy of great trading. Many traders make the mistake of associating complexity with quality. They think that the more moving parts in a strategy, the greater the chance of profit.

I am here to debunk this myth right now. The best forex strategies are ones that are simple in design and simple to execute.

Think about an entry signal that has a 10 point checklist to trigger. Now imagine applying that in live trading on a minute chart. What are the chances that you (or any trader) can keep track of all 10 checklist criteria?

If a trade does not get identified in real time, that trade will get missed. Missed trades cost money. The more complex a strategy is, the more chances things – important things – will get missed.

Make your forex entries more effective by keeping them simple. This age-old wisdom will go a long way in helping you create a solid forex strategy.

Forex strategy – bulletproof way #3: harness the benefits of sizing

One of the most important aspects of any trade is its size. This is the amount of money that it represents, both in initial size and in total risk.

A great axiom in trading is to keep your risk small and constant. There’s no use winning on 4 trades that make $250 each if the fifth one loses $3,000.

Forex is the market where there is the greatest ability to finesse sizing and dollar risk. You can use this to your advantage, but only if you plan ahead.

Sizing has the power to accelerate your profitability.

If you want to risk $200, make sure you size your position to risk $200. Don’t try to feel your way into a trade. Decide up front the maximum it will cost if it goes against you.

For example, if you identify a trade that has a $20 risk for every $1000 in currency, decide what risk you want to take. If that’s $200 total, then engage in a $10,000 position.

Control over trade sizing is a fantastic feature of the forex market. But this feature is only a benefit if used in the right way. Make sure that you plan ahead to cap your risk at the right level. If you do this right, your forex entries will be more sound.

Forex strategy – bulletproof way #4: start with fixed outcomes in mind

Once you have identified a good entry (see way #2 above), you can combine this with fixed outcomes. A fixed outcome is a pre-set plan for how you will exit a trade. Usually it will come in the form of a stop limit or profit taking order.

Here’s an example:

Let’s take a trade entry where the initial stop is $50 away. The associated profit target is $75 higher. You could put the stop order and profit target on at any time. But if you put them on right from the start, you are in a far better position.

The benefits of putting them on right away are:

- It reduces the risk of changing your mind and moving the stop around to take on more risk.

- Your profit target will already be set, so you can relax without wondering when to take profits.

- It’s good practice in case something pulls you away from your screens. Your trade can function without you right from the start.

A convenient way to bind together the protective stop and profit target is to use an OCO (one cancels all) order. The OCO qualification keeps both orders from executing in the same trade. Either your stop or your profit target will execute, but never both.

“fix your outcomes and you will cut down on chaos in your trading.”

Brokers like interactive brokers and software platforms like ninjatrader can automate this process. They allow you to preset the OCO so everything happens at once when you put a trade on.

Identifying good entries is hard enough work. Keep your post-trade management simple and automate where possible. Bulletproof your forex strategies by setting fixed outcomes right from the start.

Forex strategy – bulletproof way #5: reference economic calendars

Economic releases can have a large impact on the forex pair you are trading. The world is full of uncertainty and unpredictable events. These can create havoc in the forex market.

There is zero reason to add to the volatility in your trading by missing something important. You don’t want to get caught unawares.

Watch a forex calendar or an international economic calendar. Make sure you check it daily before you trade for scheduled economic releases.

You need to cross-reference with economic calendars.

Imagine the damage to your account for missed big news. For example, if you placed a trade minutes before a federal reserve announcement. Or how about right before an ECB rate decision.

I have seen the damage happen to forex traders who missed news, and it is not pretty. I don’t want this to happen to you.

The majority of the forex calendars available are free and are easy to access. Make sure you use one so that you avoid walking towards a potential cliff with a blindfold on. You will improve your forex entries if you keep a close eye on events that matter to your trading.

Conclusion

Forex strategies can be a great deal simpler and more effective than many traders make them. Use the 5 strategies to bulletproof your forex entries to get a head start on the trading outcomes you want.

For more day trading techniques, tools & strategies, check out these articles:

Make sure you bulletproof your forex entries by using these strategies.

Too many traders make forex strategy difficult. It doesn’t need to be. Share this post using the buttons below!

Get our newsletter

We help passionate traders build their profits by focusing on 3 key areas of a successful trading career — market, tools + strategy.

Primary sidebar

Get our newsletter

We help passionate traders build their profits by focusing on 3 key areas of a successful trading career --- market, tools + strategy.

Recent posts

- Day trading for beginners: 7 success shortcuts

- Day trading sites: top 5 forums to visit

- Currency trading strategies: 3 methods that work

- Option trading strategies: 3 characteristics to know

- How to day trade: 7 best methods to learn

- TAS profile scanner plus: software review

- Oil futures: do they affect gas prices?

- Online trading india: #1 strategy for profits

- Day trading software: 4 essential tools

- Stock market day trading: international markets

- Day trading strategies: market profile in focus

- Best stock trading strategy: 5 keys to performance

- Forex strategy: 5 ways to bulletproof your entries

- Interactive brokers: review (why it’s my #1 pick)

- Ninjatrader: software review

Are you looking to boost your trading profits?

Find the best opportunities and leard to trade well.

So, let's see, what was the most valuable thing of this article: the forex is a risky market, and traders must always remain alert to their positions. Learn how to keep on top of your currency trades. At proof equals profit forex

Contents of the article

- Today forex bonuses

- Calculating profits and losses of your currency...

- Realized and unrealized profit and loss

- Calculating profit and loss

- The bottom line

- The secret to finding profit in pairs trading

- How to use a stop-loss and a take-profit in forex...

- How to place stop-losses in forex

- Examples of placing stop-loss strategies

- How to place profit targets

- What is the general profit target placement...

- Conclusion

- What is the most profitable forex strategy?

- Profitability – profitable forex trading...

- Simple is the way to go – profitable strategy...

- Scalping

- Day trading

- Swing trading

- Choose your battle axe

- The most powerful and profitable forex strategy

- Share this:

- Realized profit: XPDUSD +385 pips – XAGUSD +118...

- Realized profit: USDMXN +7565 pips – EURCAD +458...

- Consideration about why people lose money

- How to get the right mindset

- Conclusion

- Probability tools for better forex trading

- Normal distribution

- Reliability of analysis depends on quantity and...

- Dispersion and mathematical expectation to...

- Z-score

- Sharpe ratio

- How to set take-profit properly?

- Tricks of take-profit setting

- Better levels for take-profit setting

- We have determined what the right take-profit is....

- Forex strategy: 5 ways to bulletproof your entries

- Forex strategy – bulletproof way #1: choose the...

- Forex strategy – bulletproof way #2: keep it...

- Forex strategy – bulletproof way #3: harness the...

- Forex strategy – bulletproof way #4: start with...

- Forex strategy – bulletproof way #5: reference...

- Conclusion

- Primary sidebar

No comments:

Post a Comment