About xm broker

XM clients can trade from metatrader 4, the most popular trading platform in the world of forex.

Today forex bonuses

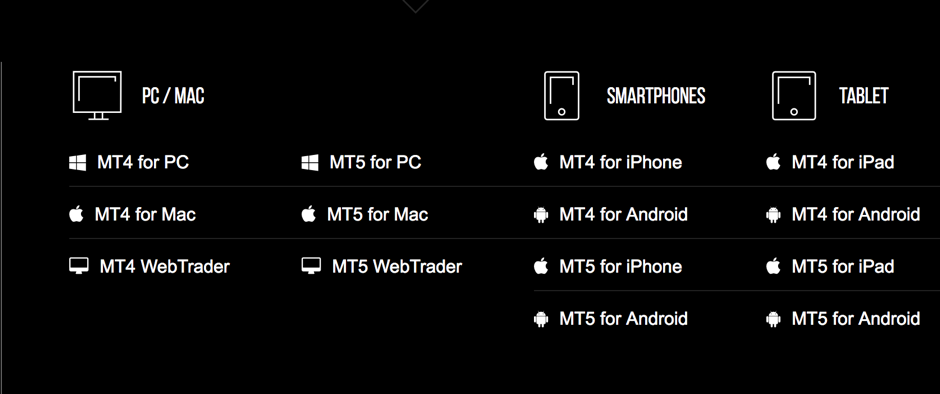

The broker also has a terminal for mac computers (an essential point for fans of products with "i" prefix) - webtrader program, and unique applications for smartphones and tablets. With this choice of trading programs, traders in this company can trade anytime, anywhere and in any way. Those who trade on multiple accounts simultaneously may be interested in platforms such as multi-terminal MT4 and MAM trader. Video with market analysis,

XM forex trading broker

Today I would like to share with you the information that I managed to learn about a rather popular reliable european broker under the short name XM. The research was conducted this week, and in the review, I will state only the facts and no fabulous fantasies or speculations, as sometimes loved to do in reviews about forex brokers.

About XM

Having started its activity in 2009, HM managed to create a reputation of a reliable broker, which provides first-class instruments for trading and the best trading conditions in a relatively short period. The company pays special attention to reliability, narrow spreads and instant execution with a strict policy of no requotes and no order rejection. As far as I know from my experience, these issues are significant when choosing a broker to trade with.

XM clients can trade from metatrader 4, the most popular trading platform in the world of forex. The broker also has a terminal for mac computers (an essential point for fans of products with "i" prefix) - webtrader program, and unique applications for smartphones and tablets. With this choice of trading programs, traders in this company can trade anytime, anywhere and in any way. Those who trade on multiple accounts simultaneously may be interested in platforms such as multi-terminal MT4 and MAM trader.

At xm.Com, you can also easily find exclusive free video tutorials for beginners on how to start trading and a full description of all the trading mentioned above platforms.

Trading tools and functionality of the XM

For its clients, the broker offers maximum access to a wide variety of trading tools and functionality on the leading site and in the final part of the website. Among all this diversity can be distinguished:

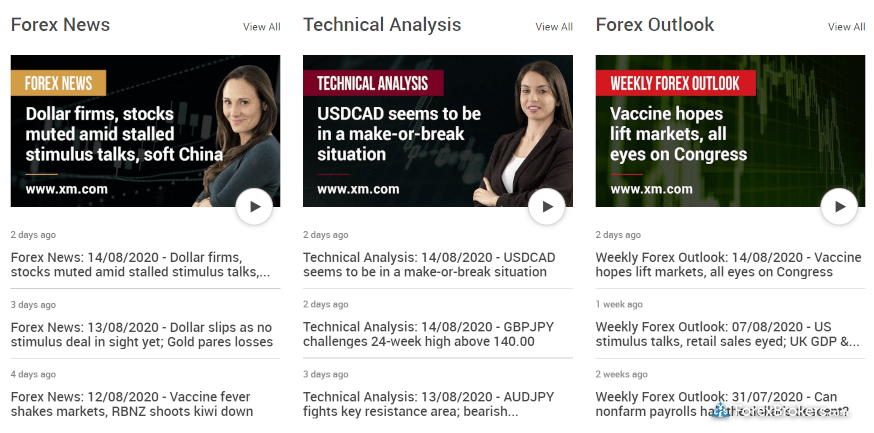

Video with market analysis;

Video with technical analysis;

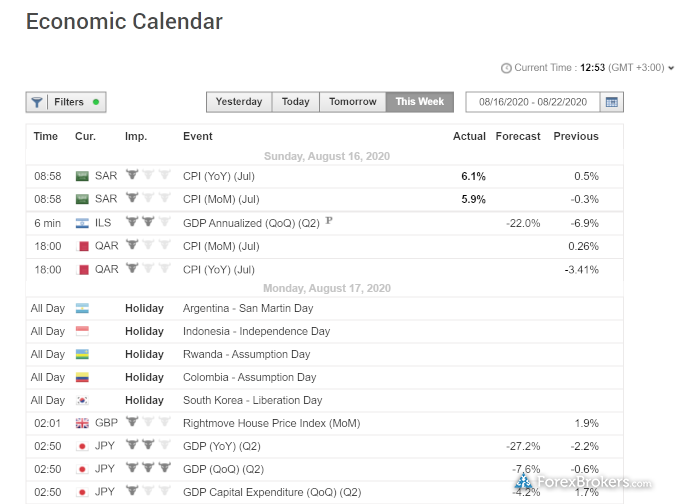

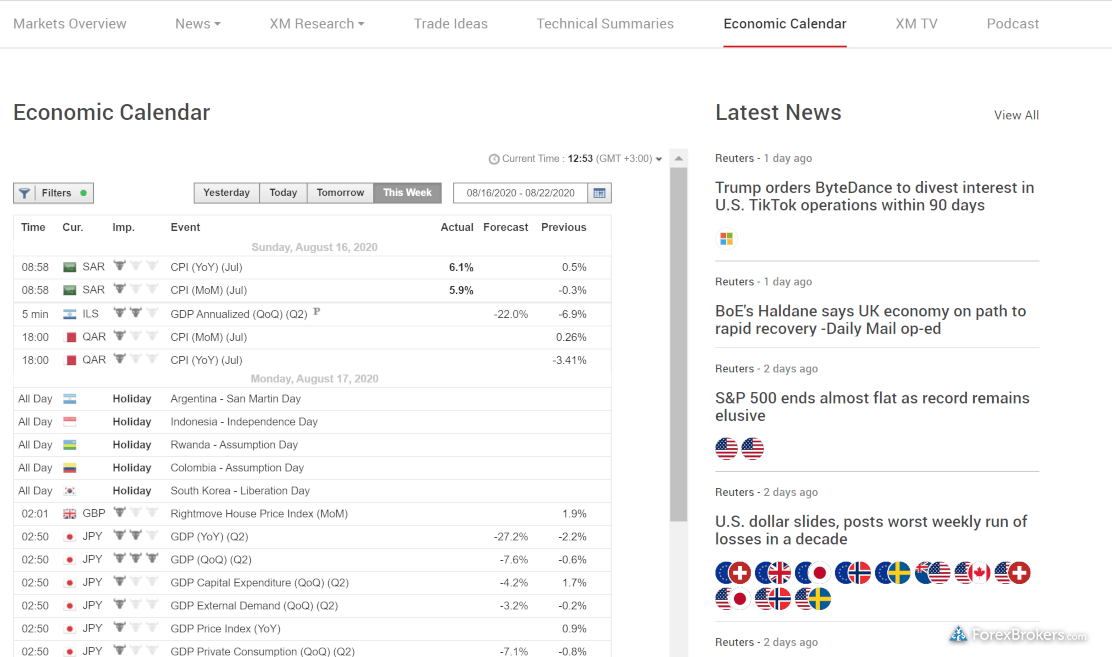

Economic calendar of events;

These tools will be useful for all traders - from beginners to experienced and sophisticated bison who have been trading for years. With the help of this functionality, every trader can improve the results of their trading, if they wish, with little effort. To make a stable profit on forex and cfds, it is necessary to evaluate market movements correctly, and the XM broker provides all the tools to allow its clients to achieve their goals in trading successfully.

In addition to the above, clients of this forex broker get access to several educational services: individual video lessons in many common languages, regular webinars on various topics and periodic seminars held by trading professionals in different parts of the world.

Main advantages of XM in comparison with other brokers

Narrow spreads, from 1 pip, on all major currency pairs;

Flexible shoulder - to 1:888;

Different account base currencies (USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB);

Fully automated account replenishment with instant processing of requests;

Withdrawal of funds on the day the payment request is made;

24-hour support five days a week in more than 20 languages.

If we formulate this review in one phrase, we can say that XM is the broker of the future, available today. It offers its clients from 196 countries a new generation of online services for trading currencies at forex, precious metals and energy.

The HM (XM) is licensed by the world's largest and most influential regulatory bodies, including the australian securities and investment commission and the cyprus securities and exchange commission (cysec). They are also registered with many other regulators around the world, such as FSP's new zealand register of financial services providers and FCA's financial services authority (UK).

The broker is fully compliant with the regulatory requirements as well as the mifid directive. This allows HM to provide its clients and partners with quality services on transparent and understandable terms.

All client funds are kept on segregated accounts with investment-grade banks. This ensures maximum protection of customers' funds. Moreover, all private customer funds up to EUR 20000 are insured in the investor compensation fund, where the broker is a member.

Methods of depositing and withdrawing funds

Depositing of the trading account is fully automatic, i.E. All deposit operations are performed instantly, 24 hours a day, seven days a week. The broker offers its clients maximum convenience and flexibility in working with finances - a vast number of payment methods, all of which are reliable and safe. These methods include:

Credit cards (visa, mastercard, etc.);

Electronic payment systems (skrill, neteller, webmoney, etc.);

Transfers through local banks;

Other ways (moneygram, western union).

Only $5 can be transferred to the account, and the company for its part does not charge any transaction fees, so the entire transfer amount is on the trader's account.

Withdrawal of funds is always made on the same day when the withdrawal request was made. It is also executed with the help of secure but at the same time, convenient enough payment methods. This allows clients to access their funds without delays.

In the company, all clients can get the payment card of XM. The card is directly linked to real accounts of clients. With its help, it is possible to withdraw money through atms and pay for purchases in shops and the internet. Three types of payment cards are available for the clients: mastercard XM in US dollars and euro, and also dollar card XM shanghai (china unionpay).

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Features of trading in XM

Opening a real account with XM takes only a few minutes. Immediately after opening an account, you can trade on the most liquid markets in the world. The company offers 75 tradable instruments, each of which offers narrow spreads and the same trading conditions, regardless of the size of the client's account and its investment level.

In addition to advantageous ranges, there are also fractional exchange rate points. This makes the scales even narrower and the presentation of prices more accurate. With a flexible leverage size of up to 1:888, clients get optimal opportunities to implement their investment plans.

Customer support

The unsurpassed quality of the support service has become the visiting card of this broker. For today the interface of the site is adapted to more than 20 languages, and it concerns not only the site itself but also the work of the customer support service.

Each client gets its account manager. Support at the broker is available 24 hours a day, five days a week. All questions can be addressed by phone, e-mail or via chat directly on the site.

6 asset classes - 16 trading platforms - over 1000 instruments.

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number IFSC/60/354/TS/19).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

XM review and tutorial 2021

XM.Com offer a range of account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service.

XM.Com deliver ultra low spreads across a huge range of forex markets. Flexible lot sizes, and micro and XM zero accounts accommodate every level of trader.

XM review; touted as the next generation broker for online forex and commodity trading, XM global webtrade is suitable for beginner and seasoned traders alike. Traders can get started with the trading software real account, or test the waters with a demo account platform with $100,000USD of virtual currency.

Highlights of this particular broker service include auto trading, no hidden fees or commissions and fast order executions, with 99.35% taking place in under 1 second.

Company details

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

The platform boasts over 1.5 million clients with traders in 196 countries. The XM ethos is all about being big, fair and human. The company prides itself on things like excellent customer service and a personalised approach for every client, no matter their investment goals.

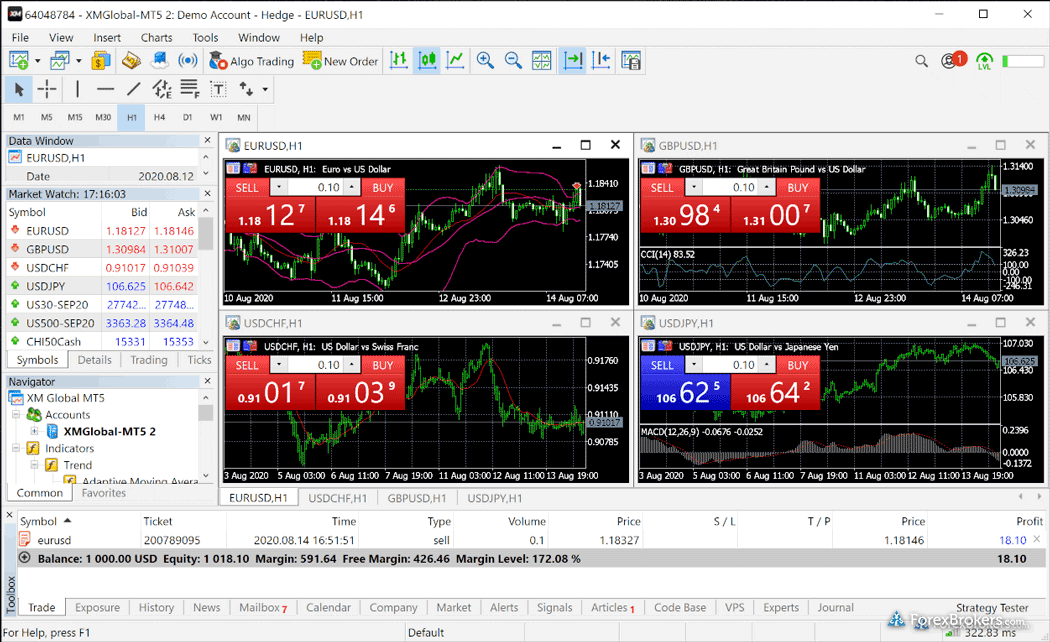

XM trading platform

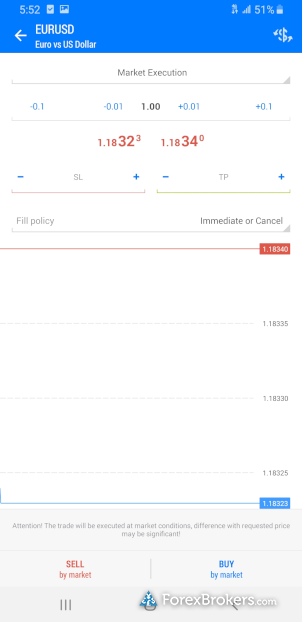

XM offers 2 trading platforms which are accessible from both real and demo accounts. The multi-award winning metatrader 4 is predominantly a forex trading platform that supports stop, limit, market and trailing orders.

The metatrader 5 platform is a multi-asset trading platform which also offers access to stocks, stock indices and precious metals. Both platforms are available on apple and android devices, which makes for a smooth and easy-to-use mobile trading experience.

The trading area offers additional, optional tools, such as economic calendar or trade volume stats.

Assets / markets

This broker has more than 1000 financial instruments which can be traded on the MT4/MT5 platforms and this includes forex trading, stocks cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

Forex trading is available on over 55 pairs, including the major USD, GBP, EUR and JPY pairs.

XM does not offer binary options or futures.

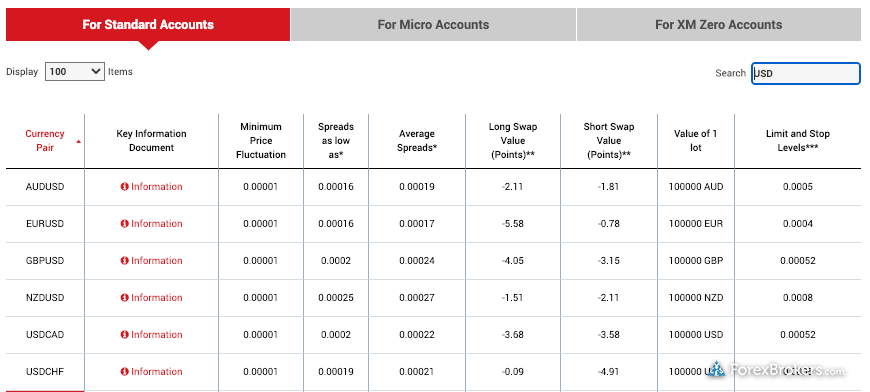

Spreads & commission

Spreads vary depending on the kind of account opened. It’s possible to open a micro account, standard account and XM zero account. The minimum spread across all accounts is 0.1 pips, and the average spread for a major pair such as EUR/USD is 0.1 pips.

XM operates a strict “no hidden fees or commission” policy. As such, commission is only given for XM zero accounts. XM covers all transfer fees and same-day withdrawals are guaranteed.

Leverage

Depending on the instrument, the leverage can range from 2:1 to 30:1. This is completely flexible and XM offers its clients the chance to manage their own leverage risk. Margin requirements remain constant throughout the week and never widen at weekends or at night.

This leverage applies to clients registered under the EU regulated entity of the group.

XM mobile apps

XM is available on a number of android and apple devices, including apple iphone, apple ipad and android tablets and android phones. Login is super-easy and can be done via fingerprint. You can download their apps from the apple app store or the google play store.

They are both fully functional and allow for monitoring and trading on-the-go. The desktop platforms for PC and mac both support one-click trading.

XM global trading platforms

Payment methods

In line with conventional KYC regulations, users need to provide a colour copy of an official identification document such as a passport or a driver’s license. They also need to provide a recent utility bill dated within the last three months as proof of address.

Once registered, the minimum deposit amount is $5 for micro and standard accounts, while zero accounts require a minimum deposit of $100.

Deposits can be made using most major credit cards, electronic payment methods, wire transfer, local bank transfer and more.

Deposits can be made in any currency and it will be automatically converted into the currency you select as your base currency when opening the account.

All withdrawals are processed in 24 hours and there are no fees to take your money out of your ewallet.

Demo account

XM excels in its demo account offering. Users can set up a demo account with just a few details and then get trading with a virtual balance of $100,000USD. The XM demo account is unique in that it offers exactly the same trading conditions as the real thing.

There are no time limits on how long you can use your demo account.

Bonus deals and promotions

XM also offers a free VPS (virtual private server) service to help increase the speed of trades. This VPS is accessible from anywhere and available 24/7. They claim to eliminate downtime and are available across the globe.

XM are also offering commission and fee free withdrawals and deposits.

As an EU regulated brand, XM comply with the ESMA ban on bonuses, and the $30 deposit bonus is no longer available to EU traders.

Regulation and licensing

As noted above, XM group has a range of brands covered by different regulators.

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

Additional features

One of the biggest perks available on the XM platform is the wealth of training and educational materials available. The platform hosts regular webinars aimed at newcomers and seasoned professionals alike.

The platform is inherently social, encouraging users to learn from their team of instructors. The company also published research and technical analysis.

XM MT4 and MT5 forex trading

XM account types

There are four levels of trading account, micro, standard and zero. All accounts allow up to 200 open/pending positions per client.

- Micro accounts: micro accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and can get started with a minimum deposit of $5USD. 1 micro lot is 1,000 units of the base currency.

- Ultra low accounts: XM ultra low accounts, can use EUR, USD, GBP, AUD, ZAR, SGD as the base currency and traders will require a minimum deposit of $50 USD. 1 standard ultra lot is 100,000 units of the chosen base currency, whereas, 1 micro ultra lot is 1,000 units of the base currency. XM ultra low accounts are not applicable to all entities of the group.

- Standard: standard accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and traders can get started with just $5USD. 1 standard lot is 100,000 units of the chosen base currency.

- Zero accounts: zero accounts can use USD, JPY and EUR as the base currency and traders will require a minimum deposit of $10USD. Like the standard account, 1 standard lot is 100,000 units of the chosen base currency.

Benefits

XM offers a full-service education package on forex, ideal for those making their first steps into trading.

However, this isn’t at the expense of the more seasoned professional, who also have access to expert analysis and unparalleled tracking tools. As a company that prides itself on solid customer service, their users are well-served with support available in many different languages.

Drawbacks

While the support may be strong, some users dislike that customer support is only available monday to friday. Another disadvantage is the lack of diversity between the different account types makes for a less personalised feel.

Other brokers offer more a distinct offering in their accounts, but the micro, standard and zero accounts are almost identical. And finally, paypal deposits are not currently supported, which can be problematic for some.

Traders from certain regions are also forbidden to open an account due to licensing laws, these include canada and the united states.

Trading hours

In line with worldwide forex market hours, XM is available 24 hours a day. For phone trading, the XM trading hours are sunday 22:05 GMT through to friday at 21:50 GMT.

Contact details / customer support

The easiest way to contact XM is through their live chat feature found on the contact page of their website.

You can also email support on: support@xm.Com

Safety and security

There are no obvious security concerns with the website. Users are required to confirm their email address in order to open a demo account but signing up for email updates is not a requirement. In order to open a trading account, identification documents are required.

According to the company privacy policy, XM has organisational procedures in place to ensure that personal data is kept secure.

Overall verdict

XM offers a comprehensive broker service to traders of all levels. Whether you are just starting out and learning the ropes, or if you’re a seasoned trader looking for a reliable and efficient platform, XM is a solid choice.

Despite the shortcomings with the different account options, the platform is easy to use and simple to navigate.

Accepted countries

XM accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use XM from united states, canada, israel, iran, portugal, spain.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM broker

XM broker review explained by professional forex trading experts, all you need to know about XM broker login, for more information about XM.Com broker you can also visit XM review by forexsq.Com currency trading website, the top forex broker ratings fx brokers website and the fxstay.Com online investing company and get all information you need to know about XM trading forex broker.

XM broker review

XM broker‘s trading platforms is too diversify, maximum forex brokers offer an industry-leading platform such as MT4 and combine this with a good mobile app. XM,com provides 9 platforms, five of which are keen to desktop computers and 4 that are keen to mobile traders. They really do not leftover any chance to live up to the right of “valuing trading competence” and provide for traders of all levels and necessities. These stages are below defined in brief detail.

XM broker account types

There are 4 types of XM.Com broker trading account types:

XM.Com broker zero account

XM zero accounts provide spreads as little as 0 on 56 currency pairs, silver and gold and the leverage up to 500:1.

XM broker micro trading account

This kind of account is suitable for those who need to accept a low risk approach near investing. This trading account essentials a really low minimum initial deposit of just 5 dollars.

XM.Com broker standard trading account

The standard trading account is more suitable for the expert and more skilled traders. Though the profits are the similar as micro trading accounts, traders with standard trading accounts can trade with greater contract size.

XM.Com broker managed forex accounts

Customers who don’t have the involvements or time to trade for they can also trust on the extra services provided by XM through the method of managed accounts. An expert account manager will help customers’ with their trades and also assistance to manage their assets for them.

XM broker islamic account

Knowing that the forex market is a universal marketplace, it also make payments for those traders who request to trade in accord with their spiritual belief. The islamic trading permits traders to bearing trades based on sharia ideologies.

XM broker demo account

Through the XM forex trading demo account, traders can trial out their trading approaches without having to risk real money. Every demo account is providing with 100,000 dollars in virtual money so traders can attempt to simulate real trading situations.

XM broker deposit and withdrawal methods

They take the most normally used banking approaches today comprising electronic payments, credit cards, local bank transfers, bank wire transfers, western union and moneygram. Their coverage is fairly extensive and enhances more suppleness on adding assets into the account.

XM broker login

To do XM broker login you can visit the broker website and after sign up with the broker you can check your email and do XM broker login.

XM broker review conclusion

However the XM.Com broker is regulated but invest the amount you can afford to lose it as online trading contains risk of losing your money.

By this XM forex review now you know all about XM trading platform, there is other XM broker review on the internet to know about XM MT4, XM login and XM download, if you like this XM forex broker review then share it please and help other currency traders to know about this XM trading review.

XM broker review – an in-depth analysis of this firm

XM broker review

Within the forex industry a good broker is a big deal. XM has become an integral player in the forex market with competitive pricing, load of features, and more. Read our in-depth review to learn more about the broker, XM.

About XM broker

Founded in 2009, XM has become a key player within the forex industry in its decade long history. The broker has grown to offer a substantial range of markets, numbering over 400 in cfds and forex pairs.

They are now widely regulated in a number of highly respected jurisdictions. These include the UK, EU, australia, and in the emerging financial hub of belize. They now possess over 1.5m clients in 196 nations worldwide, having fast become a top broker of choice for many experienced and novice traders alike.

XM account opening

XM offers three distinct account types to trader’s .These are, micro account, standard account, and XM ultra low account. Each account is available in a range of base currencies to suit the needs of traders. The major difference to be noted here is the spread on major currencies. This starts from 1 pip with both the micro and standard account options, but drops to as low as 0.6 pips with the ultra low account.

Minimum deposit

The minimum deposit requirement is highly competitive throughout the range of account offerings. The minimum deposit stands at just $5 for opening a micro, or standard account, and increases to $50 for those seeking to open an XM ultra low account.

Availability and ease of opening

XM offers accounts to some of the widest tanging audiences in the forex industry. This is assisted by their worldwide presence, regulation under a number of financial bodies, and service in multiple languages. Of the nations where service is unavailable, the united states, canada, israel, and iran, stand out as prominent.

Where accounts are available, they are very easy to get started. Opening an XM demo account can be completed by entering just a few simple details. For those wishing to open an XM live account , the process can be completed with similar ease. In fact, many traders can qualify for a no deposit required bonus of up to $30. This is one of several promotions offered by XM to many of their traders.

Product offerings

XM has one of the widest ranges of product offerings in the sector. This is proudly displayed by the broker on their homepage which promotes they offer more than 1000 trading instruments. Much of this is made up of stock cfds of which the broker offers more than 1,100.

They offer a total of 57 forex currency pairs. This includes major, minor, and exotic pairings. CFD markets are also available in commodities, indices, metals, energies, a five major cryptocurrency pairings with the US dollar.

This is indeed a very broad offering, with some form of market available to suit the needs of every trader.

XM commissions and fees

XM offer commission-free trading to all of their account holders. The fees are already incorporated with the competitive spread the broker offers. These spreads start as low as 0.6 pips depending on your account type. The average spread when trading major currency pairs through XM is 1.5-1.7 pips.

Non-trading fees

When it comes to non-trading fees, the broker is also quite competitive. There are no deposit or withdrawal fees on XM aside from the fees levied by your financial institution. The broker does charge variable rollover rates, more details on which are available here . Swap-free accounts are also available for islamic customers after contact with XM customer support.

XM platforms and tools

XM is a metatrader only broker. This means they offer both MT4 and MT5 in their various forms encompassing desktop, webtraders, or mobile trading platforms.

Desktop platform

Both MT4 and MT5 platforms area available on desktop through XM. These third-party platforms are highly-regarded in the industry, and as such, vary little in terms of layout and functionality from broker to broker.

The desktop platforms, while being very functional form an image standpoint, do incorporate all of the latest news, positions, and economic calendar along the bottom taskbar. All the while, the central windows are occupied by your chosen chart. This can be selected from the left-side taskbar where a search function and indicative marketwatch chart are available, displaying the most popular markets.

A major selling-point of MT4 is the fact there are so many professional tools and indicators available. These are more than any other platform in the industry, and charts can be easily and completely customized.

More advanced trading features such as metatrader EA which helps to automate the most effective and customized trading strategies, are also available.

The webtrading counterpart of both platforms, while being more visually appealing, and slightly more accessible due to its in-browser location, provide much of the same rugged effectiveness and convenient ordering which has made the platform popular with so many through years in the industry.

Mobile trading platform

The widely used mobile trading platforms of metatrader are again implemented by XM. These are once again basic in appearance, but extremely easy to access, with one application covering every broker who utilizes the platform. Accounts can be switched on the settings menu within seconds.

These mobile platforms again stand out for their technical charting capabilities which is well-beyond many other platforms in the industry. The platform also incorporates a high-degree of flexibility to customize the trading experience, and the fundamentals are easy for novice and experienced traders alike to deal with.

Education and research

Much of the research carried out through XM which is made available to traders is carried out by its own in-house team. This includes regular market reposts, analysis, and video reporting of both fundamental and technical market issues. Blog style news and research articles are also provided by a number of XM broker analysts.

In terms of educational infrastructure, XM is strong. They offer a range of professionally produced video content and webinars through their learning center hub. These chart all the necessary skills and requirements, guiding new traders into the sector. For more advanced traders, there are also a wide range of live seminars conducted periodically by industry experts and scheduled through XM. These take place worldwide, and in a variety of languages which exemplifies the reach of XM as a global broker.

XM differentiators

A primary differentiating factor with XM is the wide-range of markets it provides to its traders. This provide ample choice for every level and style of investor who wishes to engage in trader through the broker. The very low minimum deposit requirements for every account type is also something which is bound to be attractive, particularly to new traders. This is something which was recently implemented by the broker which show their willingness to adapt to the needs of the industry and make their offerings accessible to all.

Finally, the fact that XM is regulated around the world is a positive differentiator from many brokers. This undoubtedly provides an increased sense of transparency within their operations.

Customer service

XM customer support is available in three primary forms on a 24/5 basis during market hours. These forms are telephone, email, and web-based live chat. When tested, all methods were fully responsive and quick to answer questions in a relevant and helpful manner.

The XM broker website also provides an extensive selection of faqs to answer fundamental queries without the trader requiring to engage with the customer service team. It should be noted that customer service is also available in as many as 30 languages. They were recently awarded the title of best forex customer service, at the 2018 UK forex awards.

XM trustworthiness

Having been active in the industry for more than a decade, and amassed a global base of traders, it is fair to say XM is representative of a highly trustworthy forex broker. They are among the few that have pursued global regulation from many of the most respected bodies in world finance, as well as in belize.

These factors, together with the variety of industry accolades they have collected and how the company has been progressively shaped throughout their years in the industry to cater for the most efficient and effective customer service, place them at the pinnacle of the industry when it comes to trustworthiness.

Conclusion

Having conducted many top broker reviews , it is clear to note the offerings of XM are widespread. From their regulation in various respected jurisdictions, to the widespread catalogue of trading products available, it is clear to see how the broker established a positive reputation throughout the industry and become a major broker within a relatively short period of time.

Undoubtedly, XM are in a very positive position in the sector, and providing excellent service to all levels of trader across the board. As this continues, so too will the strong position and growth of XM as an industry leader.

XM group review

While XM group struggles to stack up against industry leaders, in terms of its platform offering, range of markets, and pricing, XM group provides an outstanding offering of quality educational content and market research.

Top takeaways for 2021

Here are our top findings on XM group:

- Founded in 2009, XM group is regulated in two tier-1 jurisdictions and one tier-2 jurisdiction, making it a safe broker (average-risk) for trading forex and cfds.

- XM group is a best in class metatrader broker in 2021, that offers the complete metatrader suite, along with a few notable upgrades to enhance the experience, in addition to custom indicators. Besides social copy trading, where XM group finished best in class (7th place), XM group’s research offering is rich with depth and variety, challenging industry leaders such as IG and saxo bank.

- Pricing at XM group varies by account type. Overall, the broker is not a stand out for low-cost trading when compared to pricing leaders such as CMC markets and IG.

Special offer:

Overall summary

| feature | XM group |

|---|---|

| overall | 4 stars |

| trust score | 84 |

| offering of investments | 4 stars |

| commissions & fees | 4 stars |

| platforms & tools | 4 stars |

| research | 4.5 stars |

| mobile trading | 4 stars |

| education | 4.5 stars |

Is XM group safe?

XM group is considered averge-risk, with an overall trust score of 80 out of 99. XM group is not publicly-traded and does not operate a bank. XM group is authorised by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and one tier-3 regulator (low trust). XM group is authorised by the following tier-1 regulators: australian securities & investment commission (ASIC) and financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | XM group |

|---|---|

| year founded | 2009 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 2 |

| tier-2 licenses | 2 |

| tier-3 licenses | 1 |

| trust score | 84 |

Offering of investments

Through its various brands, XM offers traders a total of 1,230 cfds across multiple asset classes, including forex, along with 100 exchange-traded securities (non-cfds). The following table summarizes the different investment products available to XM group clients.

| Feature | XM group |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 57 |

| cfds - total offered | 1273 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Traders who need instant execution will appreciate no requotes or rejections with XM’s zero account, compared to market execution offered by other agency-only brokers. That said, XM group still trails the best forex brokers when it comes to its pricing for budget and active traders.

Account options: the commissions and fees at XM group depend on the type of account and which global entity you choose. There are three primary accounts. While the commission-free micro and standard accounts are expensive, the commission-based XM zero account is more competitive.

Spreads and commissions: in the commission-based XM zero account, average spreads on the EUR/USD stands at 0.1 pips (according to XM group website data), making the effective spread 0.8 pips after including the $7 per round-trip commission. The standard and micro accounts have average spreads of 1.6 to 1.7 pips for the same pair and are comparably less attractive options at XM group.

Execution method: XM group acts as the sole dealer (principal market-maker) in all trades it executes. This execution method allows XM group to provide execution for up to $50 million worth of currency at a time and permits up to 200 simultaneous open positions which is reasonable compared to peers.

Shares trading: forex and cfds aside, XM group provides a shares account that requires a $10,000 deposit and is for investors who want to trade shares directly (non-CFD) with no leverage. This account is not available at all the entities of the group.

Gallery

| Feature | XM group |

|---|---|

| minimum initial deposit | $5-100 |

| average spread EUR/USD - standard | 1.6 (aug 2020) |

| all-in cost EUR/USD - active | 0.8 (aug 2020) |

| active trader or VIP discounts | no |

Platforms and tools

Offering the full metatrader suite (MT4, MT5) with additional platform add-ons is a crucial distinction among the best metatrader brokers. XM group checks these boxes, offering the full MT suite alongside multiple proprietary indicators, such as the rivers indicator developed by its in-house staff.

Gallery

| Feature | XM group |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | yes |

| ctrader | no |

| duplitrade | no |

| zulutrade | no |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

XM group’s XM TV is a winner, delivering excellent daily in-house market commentary that competes with industry leaders in video including IG, saxo bank, and CMC markets. And, while market research is found primarily outside of MT4, XM group offers a comprehensive and quality package that will satisfy most traders.

XM TV: XM group has done a great job creating daily forex news videos with market analysis explained in a TV interview-style format. The audio from these videos is also uploaded as a podcast to syndicate the content across media formats.

Articles: video aside, the news section on the XM group’s website allows filtering content by asset classes, making it easier to find articles about forex, indices, stocks, and cryptocurrencies. It is easy to appreciate the scope of research content with XM group, thanks to quality daily market recaps alongside technical and fundamental analysis articles.

Trading signals: XM group offers its trade ideas and technical summaries hub to live account holders, with signals streaming from autochartist and analyzzer. The broker also provides trading ideas (shares only) from trading central. In addition to the metatrader signals market, which allows automated trade copying, XM group supports social copy trading from compatible expert advisors developed by analyzzer.

Accessibility: given that the trading platforms are segmented away from the research, XM is at a slight disadvantage when compared to the best forex brokers for research. For comparison, saxo bank, IG, and CMC markets integrate research features into their platforms.

Gallery

| Feature | XM group |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

XM group offers a high quality, diverse selection of educational content. For example, the in-house video collection, tradepedia, is a great collection for beginners to reference. No question, XM group holds its own against education leaders such as FXCM, IG, and saxo bank.

Tradepedia: XM group offers tradepedia, an in-house video course that provides educational forex and CFD content. I found the series useful with 39 videos across seven chapters with good quality coverage for beginner and advanced video content.

For example, the course instructor demonstrates how to use some of the firm’s proprietary indicators, such as the avramis river indicator. The video had multiple examples to help users interpret this particular study in different market conditions.

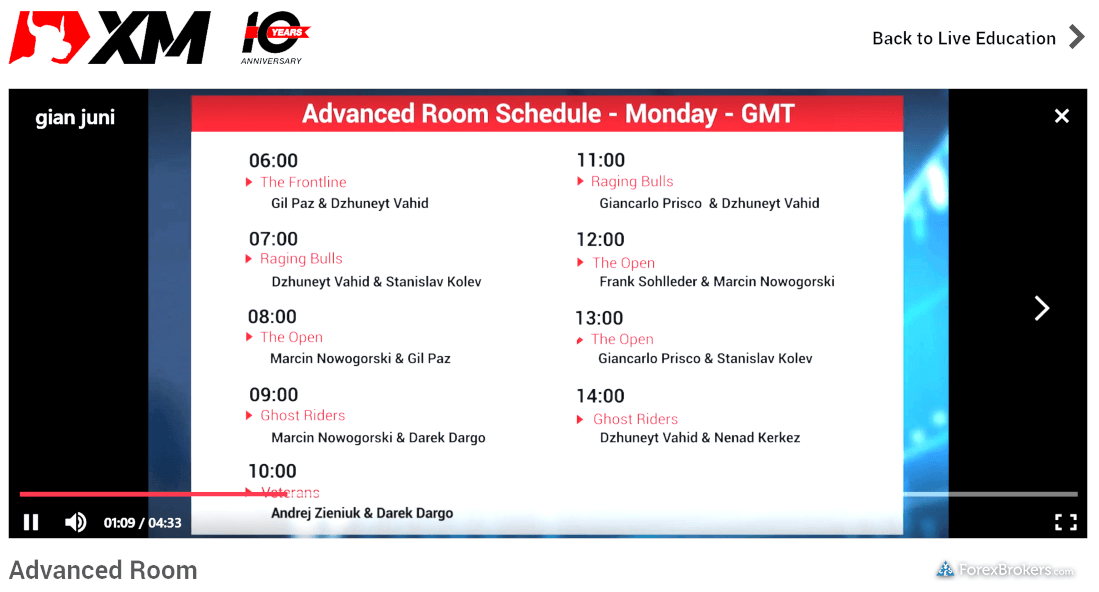

Webinars: with 49 webinar instructors covering 19 languages throughout the week, XM group has extensive coverage of time-zones and a detailed schedule organized by experience level for traders to subscribe.

Articles: there are a series of 53 written articles that are organized in a progressive format across six chapters covering 13 lessons regarding forex, starting with basics, and ending with advanced subjects. Pros aside, XM group should consider adding CFD education for other asset classes to further enhance its educational coverage.

Gallery

| Feature | XM group |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Mobile trading

Since XM group is a metatrader-only broker, the ios and android versions of the MT4 and MT5 mobile apps come standard and are both available for download from the apple itunes store and android play store, respectively. With no proprietary mobile app available, XM group trails the industry leaders in this category, such as IG, and saxo bank.

Gallery

| Feature | XM group |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | yes |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

As a vanilla metatrader broker, XM group offers over 1300 instruments, including 57 currency pairs, yet trails behind the best forex brokers who offer many thousands of tradeable symbols. Meanwhile, while XM group’s pricing on commission-based accounts is close to the industry average, its standard account spreads are expensive.

Drawbacks aside, XM group provides traders excellent research and education, making it a strong choice for beginners and traders who appreciate quality market research.

About XM group

XM group consists of multiple entities that use the XM brand and hold regulatory status in various jurisdictions. The group’s first entity was founded in 2009 in cyprus and is regulated by cysec (license 120/10) under the name trading point of financial instruments ltd.

In 2015, the group established an entity in sydney, australia, regulated by ASIC (license number 443670). In the united kingdom (UK), XM holds regulatory status in london through its FCA-regulated entity (license number 705428), under trading point of financial instruments UK ltd. Finally, in 2017 XM global limited obtained regulatory status in belize, where it is regulated by the IFSC (license number IFSC/60/354/TS/19).

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

XM review

XM is a well-established broker since 2009. XM has headquarters in australia, cyprus, greece and hungary. They are generally well-suited for XM to provide their forex/CFD trading services to global clients.

This broker has also been regulated by ASIC 443670, bafin 124161, CNMV (spain) 2010157773, CONSOB (italy) 3046, cysec 120/10, FCA (UK) 538324 and FSP (new zealand) FSP235905. Simple yet detailed information upon this broker can be seen below.

Company information

Country

australia, cyprus, greece and hungary

Regulation

ASIC 443670

bafin 124161

CNMV (spain) 2010157773

CONSOB (italy) 3046

cysec 120/10

FCA (UK) 538324

FSP (new zealand) FSP235905

Features

Interest rate on funds

Trading by telephone

Islamic accounts available

Requires sending documents via postal mail

Account information

This broker offers micro, standard, islamic and XM ultra low. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by XM is up to 1:888. Meanwhile, you can open an account with a starting capital of $5

If you want to look for further information about this broker's offered account(s), please take a look at the list below.

Minimum position 0.01 lot

Overnight interest rates (swaps)

Instruments traded

Besides lots of currency pair, XM also offers some instruments you would like to trade on, such as forex, gold & silver, CFD and oil for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Minimum position 0.01 lot

Overnight interest rates (swaps)

Instruments traded

Besides lots of currency pair, XM also offers some instruments you would like to trade on, such as forex, gold & silver, CFD, oil and cryptocurrencies for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Cryptocurrencies

1:3

Minimum position 0.01 lot

Instruments traded

Besides lots of currency pair, XM also offers some instruments you would like to trade on, such as forex, gold & silver, CFD and oil for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Minimum position 0.01 lot

Overnight interest rates (swaps)

Instruments traded

Besides lots of currency pair, XM also offers some instruments you would like to trade on, such as forex and cryptocurrencies for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Cryptocurrencies

1:3

Payment methods

Cashu : if you live in the middle east, cashu is one of the most popular online payment services there. Cashu is a digital wallet that allows clients to pay or transfer money online instantly and offer users its own pre-paid mastercard with no absolutely additional fees attached. Introduced in july 2002, cashu has targeted the middle east and north african markets where it serves close to 2.3 million customers. This is the reason why many of the forex brokers that are expanding in the north african and middle east market accept cashu as one of their payment methods.

Fasapay : known as an e-payment for retail forex traders, fasapay does not require a huge amount of fee, giving it a competitive edge among any other e-payments in the forex brokerage industry. Instant process is also featured as one of its advantages.

Neteller : like paypal, neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept neteller as a payment method for their clients' fund deposit and withdrawal. Although the neteller system is available almost all over the world, it remains particularly popular in europe.

QIWI : qiwi is an e-wallet or electronic payment service provider from rusia that is introduced in 2007. The service is mainly used by individuals and businesses in russia, ukraine, kazakhstan, moldova, belarus, romania, the US, and the UAE.

Skrill : mostly, all forex brokers provide skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a skrill e-wallet account.

Webmoney : webmoney is one of the major online wallet services which many people use to send money around the world. For this reason, there is a large number of forex brokers that accept webmoney today. Like other online payment services today, webmoney is supported by mobile applications to make transactions more efficient.

Wire transfer : wire transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don't have credit cards.

XM also provides payment with credit/debit cards, giropay, ideal, moneta.Ru, paysafecard, SOFORT, unionpay and western union

Trading platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitabiliy by placing well-planned trades.

Hereby, XM offers you metatrader 4 and metatrader 5.

Customer support

Do you have any question or find any trouble related to XM? If you do, you should reach XM's support to get the information that you need. Here is the detail of the broker's customer support:

Extensive review

Established in 2009, XM is a member of an online brokerage company called trading point of financial instruments ltd. In providing clients on a global scale, the company has branched into XM australia and XM global, and XM cyprus. Each member has different headquarters and licenses, with XM australia registered under the australian securities and investment commission (reference number: 443670), XM global under the IFSC (60/354/TS/19), and XM cyprus under the cyprus securities and exchange commission (reference number: 120/10).

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the ultra-low account and webinar feature that is accommodated in 19 different languages with 35 native instructors for each language.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from forex, commodities, equity indices in cfds, precious metals, energies, to shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second, strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in ultra-low account, while spreads on other accounts usually start from 1 pip. Instead of providing maximum leverage in the scale of 1:500 or 1:1000 (round numbers), XM chooses to limit their leverage on a 1:888 scale, a unique number that is now widely recognized as XM's trademark.

To protect the client's fund in the event of extreme volatility, XM presents each account type with negative balance protection. The deposit minimum starts from $5 in micro and standard account, while ultra-low account requires a minimum deposit of $50. For trading volume, XM enables a condition similar to a cent account environment, in which the contract size for every lot is only 1,000 units. If it is applied with the smallest lot size in the metatrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their account via wire transfer, credit card, as well as the most favorable e-payment choices like skrill, neteller, and fasapay.

XM also provides islamic account for muslim traders obligated to sharia law that prohibits the use of interest generated by overnight swaps for each currency pairs. To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, mac, multiterminal, webtrader, ipad, iphone, android, and android tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing trading service in more than 15 languages around the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is also open to nearly all types of traders, from small capital traders to the more experienced ones with big deposit at the ready. Traders are even provided with cent trading environment should they choose to register under micro account.

So, let's see, what was the most valuable thing of this article: overview of XM forex broker: general information, features of trading, list of XM trading tools, bonuses, working conditions for traders, deposit and withdrawal of funds. At about xm broker

Contents of the article

- Today forex bonuses

- XM forex trading broker

- About XM

- Trading tools and functionality of the XM

- Main advantages of XM in comparison with other...

- Methods of depositing and withdrawing funds

- Features of trading in XM

- Customer support

- XM review and tutorial 2021

- Company details

- XM trading platform

- Assets / markets

- Spreads & commission

- Leverage

- XM mobile apps

- Payment methods

- Demo account

- Bonus deals and promotions

- Regulation and licensing

- Additional features

- XM account types

- Benefits

- Drawbacks

- Trading hours

- Contact details / customer support

- Safety and security

- Overall verdict

- Accepted countries

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM broker

- XM broker review

- XM broker account types

- XM.Com broker zero account

- XM broker micro trading account

- XM.Com broker standard trading account

- XM.Com broker managed forex accounts

- XM broker islamic account

- XM broker demo account

- XM broker deposit and withdrawal methods

- XM broker login

- XM broker review – an in-depth analysis of this...

- About XM broker

- XM account opening

- Product offerings

- XM commissions and fees

- XM platforms and tools

- Education and research

- XM differentiators

- Customer service

- XM trustworthiness

- Conclusion

- XM group review

- Top takeaways for 2021

- Overall summary

- Is XM group safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About XM group

- 2021 review methodology

- Forex risk disclaimer

- XM review

- Company information

- Features

- Account information

- Instruments traded

- Instruments traded

- Instruments traded

- Instruments traded

- Payment methods

- Trading platforms

- Customer support

- Extensive review

No comments:

Post a Comment