Fbs micro account minimum deposit

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers.

Today forex bonuses

While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Better management of risk

Fxdailyreport.Com

Benefits of trading with small amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce commissions

When trading small amounts, you are usually constricted to put the majority of your money into a single trade. This, however, helps you reduce commissions. Traders are usually more likely to be sloppy when you are going to be making 20 trades in a day. But when trading with small amounts forces traders to be more selective about the trades they take.

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better management of risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of forex brokers with a low minimum deposits 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial brokerage services (FBS)

FBS: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

FBS’s responsive and reliable website will surely lure you in as it offers quick and easy links to its informative sub sections. But relying on aesthetics and accessibility alone is not enough to survive in the world of forex. Does FBS have what it takes?

Two companies are operating under the FBS brand name.

The FBS.Eu, or tradestone limited is regulated by cyprus securities and exchange commission (cysec) and is authorized to provide online trading services in all EU countries. As one of the world’s top regulatory bodies, cysec has made a name of itself as a reliable protector of trader’s rights, as well as insuring brokers are operating within the laws that govern their operations. FBS is also a member of the investors compensation fund allowing for client compensations of up to €20 000 if the broker cannot meet its obligations to the trader. This broker is limited to a maximum leverage of up to 1:30, as sanctioned by ESMA.

The FBS.Com or FBS markets inc. Is regulated by the international financial services commission (IFCS) based in belize. The IFSC strives to promote belize as a safe heaven for international brokers, because it offers tight control over investment firms and protects the interest of traders. However, offshore regulatory bodies, like the IFCS, are not bound by the rules and governance of more renowned european institutes such as the FCA, cysec or ESMA. That’s why the maximum leverage available to FBS.Com clients is 1:3000.

FSB.Com allows for the trade of forex pairs, metals, stock cfds, and some crypto currencies, while FBS.Eu comes equipped with a very limited choice of trading assets: forex and metals.

FSB proves its stature as a global broker by giving us a galore of supported languages: german, english, french, italian, spanish, portuguese, arabic, indonesian, malaysian, bengali, chinese, japanese, korean, lao, thai, turkish, urdu and vietnamese.

FSB LOGIN

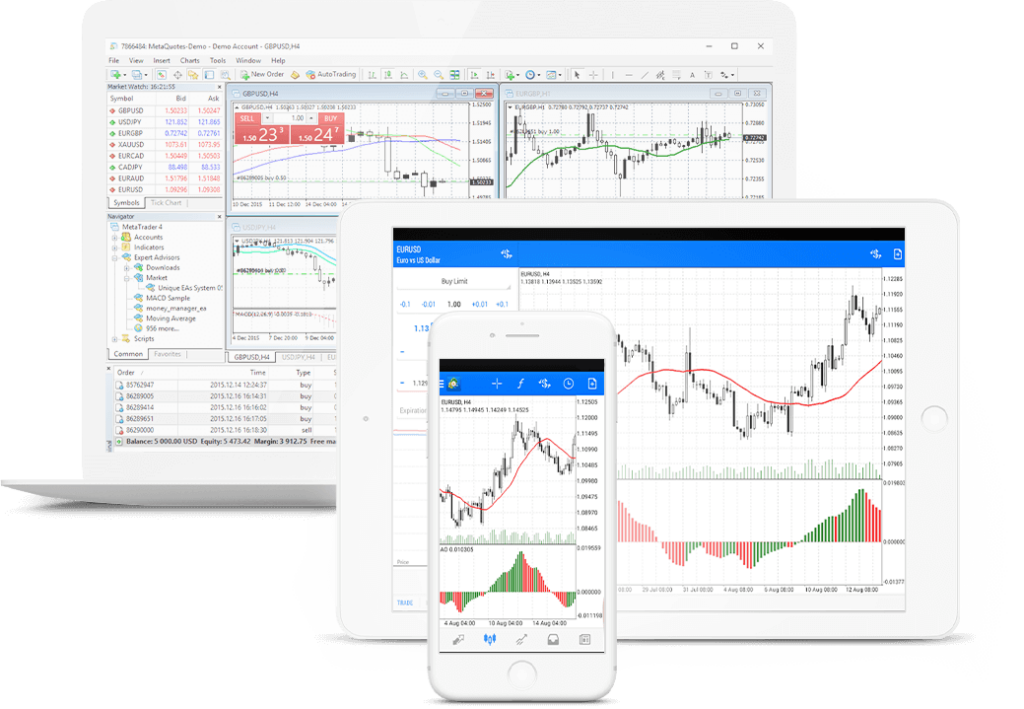

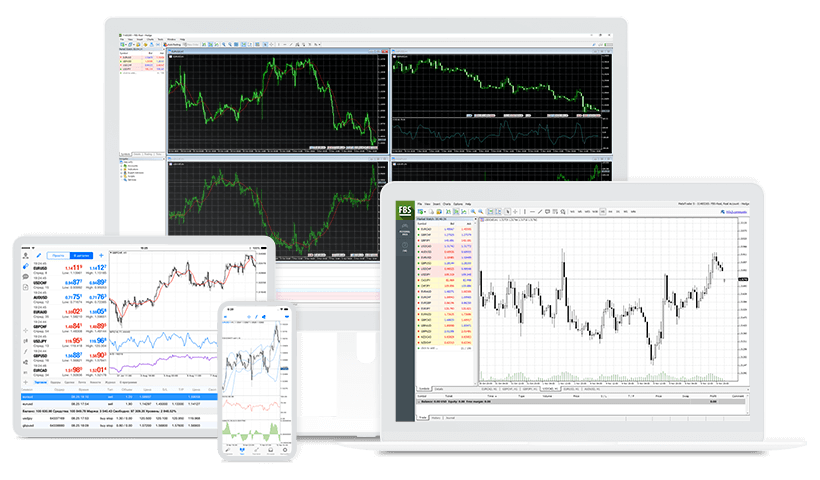

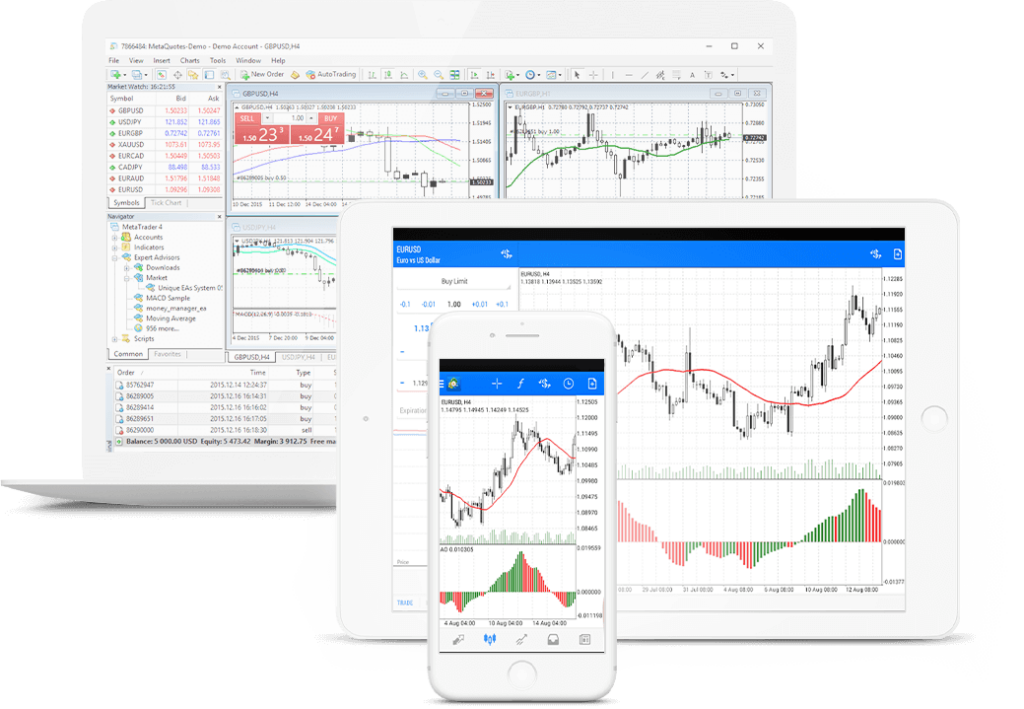

FBS.Com offers 3 platforms in total. It’s unsurprising that MT4 and MT5 are here, but the brokers very own mobile-only FBS trader is a welcome addition.

FBS.Eu clients have access only to MT4.

METATRADER 4

МТ4 is a must. Traders cannot ever go wrong with this platform, as 80% of the entire online trade market revolves around it. And for many reasons. Its expert advisors will allow for automatic trading, leaving you free to do as you please while your account is being traded with. Expect features that will grant you better access and more freedom: real-time charts, advanced charting tools, over 50 customizable trading indicators and much more. VPS is also available.

The spreads begin from 0.0 pips to 3 pips; all depend on the account type the client picks. For the standard account the spread starts from 0.5 pips with no commission whatsoever. The EU and UK are under ESMA directive, and are limited to a leverage of no more than 1:30. Outside this jurisdiction the leverage can reach a staggering 1:3000.

The platform can be accessed on windows, android and apple devices, including mobile and tablet. An MT4 browser version is also accessible (no eas).

METATRADER 5

MT5 strives to replace MT4 but fails to do so, not because it’s inferior but because most brokers nowadays use MT4 as the default terminal. Nevertheless, MT5 comes with new and handy features that traders will surely find useful. There are auto trading bots, plus VPS.

The spreads begin from 0.0 pips to 3 pips; all depend on the account type the client picks. For the standard account the spread starts from 0.5 pips with no commission what so ever. As decreed by ESMA the UK and EU leverage cannot surpass 1:30. Outside these zones it can reach 1:3000.

MT5 is available on all desktop, mobile and tablet devices that support the common operating systems- windows, ios and android. A browser version is also there, in addition to the desktop one.

FBS TRADER

Note that FBS trader is currently available solely to fbs.Com clients.

This mobile-exclusive metatrader substitute is much easier to use, and features all the necessary tools for competent trading. However, as easy as it is, MT4 still offers much more.

Spreads and leverages don’t vary from the ones on MT4/5. Your choice of account has a direct impact on them. This goes for the commission as well.

The expected spread lingers on 1.1 pips, while the leverage can reach 1:3000.

Traders can get access to it on any ios device, with the android version, as of writing this review, is still in development.

FBS MINIMUM DEPOSIT

The minimum deposit for a cent account with FBS.Com is just $1.

The minimum deposit for a trading account with FBS.Eu is $100.

Fund your account using with FBS.Com with one of the following funding methods: bank transfer, VISA, mastercard, neteller, sticpay, skrill, perfect money or bitwallet.

FBS.Eu accepts deposits with VISA, mastercard, wire transfer, skrill and neteller.

Only wire transfer can take up to 4 days to process, while all other methods are instant.

Sticpay method user will be commissioned a 2.5% fee on each deposit, while perfect money may be taxed from the payment system itself. The rest are toll-free.

FBS.Com supports trading accounts in EUR, USD, JPY. Clients of FBS.Eu are limited to EUR and USD accounts.

FSB WITHDRAWAL TIME AND FEES

Those trading under FBS.Eu, as licensed by cysec, are assured that their withdrawals will be as safe and secure as possible.

FBS.Com clients can cash out using VISA, mastercard, neteller, sticpay, skrill, perfect money or bitwallet. FBS.Eu cash out options are limited to VISA, mastercard, wire transfer, skrill and neteller

Bitwallet processes are instant, while all other methods are processed between 1-2 days. Once the money is processed by the broker, it may take some time before it reaches your personal account. Wire transfer time is between 3-7 working days and there may be fees depending on the client’s bank.

No method is spared by fees. With VISA it’s $1, neteller gets 2%, sticpay is 2.5%, skrill charges 1%, perfect money obtains 0.5%. Bitwallet users may also get charged but it is not specified by how much.

FBS BONUSES

FBS.Eu just like all other forex brokers based in EU doesn’t offer any bonuses because of ESMA regulations.

FBS.Com however offers a number of bonuses to its potential clients:

– once in a while users are picked at random for a brand new luxury car.

– you can get $100 as bonus to start trading with your account of choice (demo excluded).

– clients can double their initial deposits by activating the 100% deposit bonus.

– cashback offers you $15 per traded standard lot.

– increase your intake by up to $3000 each month by activating the partner account.

– earn loyalty points by trading, and exchange them for prizes and more.

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

Top 6 best brokers with true micro accounts for 2021

Top rated:

As a forex trader, undoubtedly you want to be dealing with the top forex brokers in the industry. Before you take a deep dive into big money trading though, you may want to explore your options in micro trading.

With choosing the best micro forex broker in mind, here we have listed six of the very best in the industry to select from.

These forex trading brokers will all allow you the chance to trade in micro-lots which are 0.01 of a standard lot. This is a great option if you are looking for an opportunity to trade within a lower risk area.

Although many brokers may claim to offer trading in micro-lots and even smaller in the case of nano lots, though only a few will offer dedicated micro-accounts. These are the micro trading brokers that we will list for your knowledge.

Table of contents

Forex micro vs standard account (micro lots)

Delving deeper into the trading experience to find out exactly what are micro-lots and micro-accounts and what can you as a forex trader get from them, we can see that micro lots allow you to trade for a minimal fraction of a standard lot. As mentioned above, a micro lot is 0.01 of a standard lot size. Which is often offered by forex standard accounts.

Taking this into account, where a standard lot on any of the forex currency pairs would cost $100,000 to trade with 1:1 leverage, a micro lot would cost $1,000 with the same leverage. These types of lots are pretty much offered by every forex broker nowadays. Then you have micro accounts.

Within a micro account for forex trading, you can often trade in smaller lots than even the micro lot, a nano lot, or 0.001 of a standard lot is typically available on these accounts. This would lower your real money trading cost to $10 per nano lot using the same calculation as above.

This low risk is only slightly more than you would experience with a forex demo account and is great for those looking to start out.

Let’s recap briefly the difference between a forex micro account and a forex standard account:

Forex standard accounts usually offer minimum trade sizes as low as 1 micro lot.

Forex micro accounts, on the other hand, offer minimum trade sizes as low as 1 nano lot.

If you are looking for a low risk, no minimum deposit broker, then look no further than our low no minimum deposit broker top 10.

Top 6 micro account forex brokers

Here are what we believe to be some of the best micro account forex brokers for you to choose from:

A factual FBS review for retail forex traders

- Website: www.Fbs.Com

- Myanmar: +951 651135

philippines: +632.632.7634

tunisia: +216 52 925 626 - Office address:

- No. 414, 9th street, thamine (1) ward,

- Mayangone township,

- Yangon

FBS, or financial brokerage services, is predominantly an asian forex broker that has its offices in china, malaysia, philippines, indonesia, jordan, vietnam, and russia. The IFSC in belize is the primary regulatory organization that regulates all the financial components of the company. FBS regulation is not one of the high points for the firm since most trusted brokers are regulated by organizations such as the CFTC, NFA, FCA, ASIC, and cysec. Belize is a tax haven, and the regulatory guidelines of IFSC are still under debate as to whether it can be compared to the more established and highly reputed international regulatory organizations.

FBS was initially based out of russia and started its FX operations in 2009. The broker claims to have more than 700,000 clients from 120 different countries across the world. Although that might be an accurate representation of the reach of the broker by modern standards, the reality lies in the fact that the broker does not have any traders from the US, and the lack of EU regulation also prevents the broker from actively promoting their services in the euro zone. However, despite all the confusion surrounding the regulatory status, the broker has indeed managed to receive numerous awards and recognitions for their services. The broker has also been able to receive positive FBS reviews from existing customers; however, the broker is not entirely free from criticisms either.

FBS trading account features at A glance

- Minimum deposit of $1

- Maximum FBS leverage of 1:3000

- Five different types of accounts

- FBS spreads starting from 0 pip

- ECN account offered with tight spreads and a commission per lot

- Full range of payment options

- Trading instruments include 32 currencies and two metals

- MT4 & MT5 trading platform

One the main reasons why traders choose FBS is due to the very low barrier to enter the markets, as the minimum deposit required for an FBS account is $1. There are two types of accounts available for smaller traders, which include the cent and the micro accounts. The cent account starts at $1 deposit, while the micro account starts at $5 deposit. The cent account also has very tight spreads starting from 1 pip, and the micro account has fixed spreads starting from 3 pips. The maximum leverage offered is different for both accounts, as the cent account has a maximum leverage of 1:1000 and the micro account has a maximum leverage of 1:3000.

The cent account is certainly the more attractive proposition here due to the reduced cost of trading, as on the contrary, the micro account spread of 3 pips is immensely higher than the average micro account. Traders with a higher deposit of $100 can take advantage of a standard account that has all the features of the micro account albeit with tighter spreads of 1 pip.

The ECN account is offered as a zero spread account, which allows traders to enjoy up to 0 pips in spreads at the cost of a commission of $20 per lot. The minimum deposit required for the ECN account is $500, while the leverage is set at a maximum of 1:3000. The final type of trading account is the unlimited account that is usually reserved for institutional and professional traders, which offers a maximum leverage of 1:500 along with floating spreads starting from 0.2 pips. There is no commission for the unlimited account, and the initial deposit starts from $500. The unlimited account is the best type of FBS account due to its favorable trading conditions, lower cost of trading, comparatively lower leverage, and high speed of trade execution.

FBS utilizes the MT4 and MT5 trading platforms for accessing the FX markets on both desktop and mobile devices. The FBS trading platforms are connected to high-speed servers, and the company has tweaked the platform slightly to offer the best trading results. The FBS mobile platforms are available as downloadable MT4 apps on the itunes and google play stores, while traders can also use the MT4 web trader for browser-related trading requirements.

How does FBS treat their clients?

FBS customer support is available in 18 different languages and is designed to offer the most comprehensive support to clients from a majority of asian, european, and middle eastern clients. The live chat feature is an excellent feature to get immediate assistance, and official correspondence can be made through emails or phone calls.

Unlimited account holders also enjoy SWAP-free accounts, which is a great feature for long-term traders who hold on to overnight trades. FBS account can help in reducing the cost of trading to a great extent, which is indeed one of the most significant advantages of FBS.

One of the other perceived benefits of FBS is the availability of a 100% deposit bonus, which is offered for all traders opening a new account making their first deposit. The FBS bonus is certainly not preferred, as a majority of negative FBS reviews are due to the conflicts arising between traders and FBS over withdrawal issues. Brokers only offer a bonus if traders are willing to accept their terms and conditions, and it is often difficult to satisfy these trading conditions before making a withdrawal of the initial invested amount.

The maximum leverage also plays negatively to the company’s strength, the 1:3000 leverage is indeed the highest offered by any broker in the industry. Novice and even experienced traders are susceptible to the risks of higher leverage, as a huge margin of 1:3000 can wipe out the investment with just a 3 pip move. Considering that the starting spread for the micro account is 3 pips, it is easy to understand how a trader can face a margin call for initial deposits as low as $5. The high leverage is also another factor that contributes to the overall negative image of the company.

On the other hand, if used wisely, both leverage, as well as lower spreads, can work remarkably in the trader’s favor. Profitable FX trading is dependent on striking the perfect balance between all the different tools of the trade, and if done carefully, FBS offers the best resources for making consistent profits in the forex markets.

Is FBS regulated?

Yes, our review of FBS found that the broker is regulated and licensed by cysec, which ensures regular reporting, transparency, and fairness for EU clients. For those trading outside the EU, it is regulated by the international financial services commission of belize (IFSC).

Can you withdraw FBS bonus?

Yes, if you are trading from a country that allows a bonus from FBS, it can be withdrawn after two lots are traded and profit reaches $25. To withdraw, proper account registration and verification is required too. This means supplying FBS with proof of identification and address.

What is FBS account?

FBS offers two live trading accounts (standard and cent) and two demo account types (standard and cent). There are zero commissions on trades, leverage of up to 1:30, and spread starting from 1 pip. Standard accounts are available with a €100 initial deposit, whilst cent accounts start from €10. Swap-free accounts are also available.

How long does FBS withdrawal take?

Withdrawal times at FBS depend on which method you are using to receive your funds. All withdrawals are processed by the broker within 48 hours on business days. E-wallet and crypto transfers are processed within minutes, whilst wire transfers can take up to 48 hours.

What is the minimum deposit on FBS?

Minimum deposit limits at FBS depend on the account type you have selected. For international clients, there is a micro account that allows deposits from $1. For european clients, the lowest entry point is the cent account at €10. Standard accounts require a minimum deposit of €100.

Fbs micro account minimum deposit

Low minimum deposit forex brokers

After spending weeks of examining and reviewing many brokers, I found some of the best low minimum deposit forex brokers with micro accounts below $10.

Here’s a list of the best legit and regulated low minimum deposit forex brokers with small micro accounts:

You can find reviews and more brokers with micro accounts in the table at the bottom of this post.

You'll see in this article:

Why forex micro accounts?

There are a few reasons that people look for the forex brokers with low minimum deposit or forex micro accounts but I think the main reason is that you are a new trader and you want to get your feet wet before plunging into the ocean.

Well, that’s a wise thing to do and fortunately, there are several forex brokers offering low minimum deposit accounts so not only do you have a chance to begin with a few bucks but also you have a wide range of brokers that you can pick from.

There are some factors that you can pay heed to when choosing a low minimum deposit account. Some of them might not be as important while picking brokers for a larger size account, like educational material, and some should be treated differently such as leverage.

There might be other reasons for the traders to search for the forex brokers with low minimum deposits like having a strategy, especially a scalping one, with aggressive money management or dividing your capital into several small portions and keeping it out of your account for psychology issues or any other reasons.

Either way, you are probably interested in knowing some information about the brokers in this category so that you can make a more reliable decision.

What to search in low minimum deposit forex brokers?

There are several sections that I’ve designed for the table but some of them are more important especially if you are new to trading so I’ll explain them to some extent.

These are some of the factors that I think are important to consider when searching for low minimum deposit forex brokers.

I looked into these metrics precisely when I was searching for micro accounts brokers so that I can write a fair review and provide useful information for everyone that reads this post.

Ok, now let’s see what you should look at when seeking brokers with small accounts.

Regulation

Brokers’ regulation is always important however it’s crucial when you trade with large size accounts. With a low minimum deposit, you don’t need to scout out for a highly regulated broker with the authorization of several financial bodies in different parts of the world.

On the other hand, choosing a broker with no regulation is not a wise decision either because they have no obligatory conditions that watch their probable wrongdoings and make them accountable if they do something illegal.

Not regulated brokers have tempting conditions in some cases such as lower spreads but you can find those situations, and even better, in some regulated brokers as well — you just need to dig deeper.

Not all unregulated brokers are scam and you may find a good one every now and then but I prefer to look for the best ones among regulated brokers.

I think having one regulation in this case suffices. That’s why I’ve chosen the brokers in this list from the ones that are authorized by one regulatory body at the least.

If you want to know more about the method that I used for scoring them, you can see this post that I explain about that.

Spread

With low minimum deposit accounts, you get the worst spreads of brokers most of the time. This is definitely not the strong suit of micro or mini accounts but if this is your priority, for example if you are a scalper, there are still some brokers in the list that have lower spreads.

You will defiantly have problems if you’re a scalper with a 3 to 4 pip tp/sl unless you have an impressive win rate.

On the other hand, there are plenty of options to pick from if you have something like a 10-pip target or stop loss.

If you are a longer-term trader like a day trader, the condition is better and you can pay attention to the other aspect of the brokers as well.

The spread section of the list is based on the lowest spread (from) you get for EUR/USD, which normally has the lowest spread among all the available currency pairs.

If you trade a specific pair or pairs or even other trading instruments like metals, cfds, cryptocurrencies, and etc; you can find the typical or minimum spreads for them on the website of the brokers.

Another good side of regulated brokers is that they publish some information like their spreads on their websites, however, according to my experience, the information released by high regulated brokers are more reliable.

Leverage

This is probably the most important factor for micro accounts. It makes it possible to trade with a low budget in general. Without that there’s no such a thing as a low minimum deposit account.

As a general rule, the higher leverage in small size accounts the better and the lower in large-size accounts the safer, so it’s kind of a double-edged sword.

It’s very hard to trade with as low as 5 or 10 dollars normally even with high leverage like 1.2000, now imagine you have to trade when you have 1:300 with min lot size of 0.01 — it’s kind of impossible to open more than one trade at a time.

In a nutshell, with a 1:300 leverage and 0.01 lot size and a $10 account, we can have roughly 2 trades at a time so if you have a strategy that generates lots of signals, you should pick the highest leverage or larger lot size or even both.

For example, with a lot size of 0.001, you can have 20 trades with the same leverage (1:300) and even larger tp/sl.

If you just open one trade at a time even 1:200 will be enough. In this case, you can put stress on other aspects of the broker you want to pick.

Min lot size

Minimum lot size is the next crucial factor for minimum deposit accounts. The combination of this and the leverage determines your freedom in trading with micro accounts.

As we saw, the larger leverage the better for micro accounts. It’s the opposite for min lot size, the smaller the better.

One standard size for example for EUR/USD is worth $10. 0.1 lots are worth $1 and 0.01 lots are worth 10 cents.

With a $10 account, considering you use a large leverage like 1:1000, you almost have 100 pips which makes it possible to have lots of small trades with a for example 5-pip tp/sl.

Imagine how many trades you can have with 0.001 or even 0.00001 lot size. It’s very helpful for scalpers with a lot of simultaneous trades.

There are some brokers in the list that provides such lot sizes, so if opening lots of positions at the same time is in your trading style, they would be a great fit for you.

Education

This section is not necessarily important if you are not new to trading but it’s a helpful element to consider if you are a newbie.

You have to be well-equipped before even think of trading a small account, but since micro accounts can be an alternative to the demo accounts, you can start with a few dollars right away instead of fake money.

There are some advantages to that. First of all, there are some differences between demo and live accounts.

For example, you may not see problems like slippage (getting a worse price than the one you order), or at least not as frequent, in demo accounts.

So when you trade with a live account especially if you rip a few number of pips like scalpers, you might get into trouble and stumble upon situations you’ve never seen before.

Another issue that you might come across when trading with live accounts is psychology. You can trade with fake money and win or lose big amounts but nothing changes inside you.

You trade fearlessly and don’t care about your trades so you wouldn’t get back and analyze them to find the flaws. It’s different in real money even if it’s not much.

Anyway, if you’re a complete beginner, choosing a broker with educational material can serve you well in the early stage of your trading career.

You’ll probably need more, especially in terms of experience, but even basics can prevent you from jumping into many unreasonable trades or losing your money soon.

I went through all the educational materials of the brokers listed here so that I can be a better reviewer. I didn’t want to just see the headlines of education sections on the brokers’ websites to figure out if they have any material but I examined each of them thoroughly so that I can give meaningful scores.

The scores are from A+ which includes the educations that have useful articles, videos webinars, seminars with high-standard quality, to B which means the broker only provides some basics.

If you are a rather experienced trader, you can skip this section and pay attention to other parts but if you are a beginner, consider this factor as one of your choosing criteria.

Bonus

I chose this factor for the brokers with low minimum deposit because it can increase your initial money so that you can trade with a chubbier account, however, it might not be beneficial to you if you don’t know these kinds of bonuses well.

First of all, you should know that there’s nothing like free money in this case. It means no broker gives you a bonus with no string attached. You need to trade and redeem the bonus.

In other words, the brokers take back their money when you trade and give them spreads or commission which are the revenue stream of the legit brokers.

For example, for withdrawing a bonus, you need to trade a rather high number of lots compare to the size of your account. It’s even worse when they give you no deposit bonus.

For example, if you get a $50 bonus, you need to trade 50 standard lots so that you can withdraw that $50. In other words, you have to be a hell of a trader with lots of trades in a day because in most cases you have a limited time for redeeming the money too.

It can lead to overtrading and growing other bad trading habits which are fatal to the future of your trading especially if you are a newbie.

If you decide to use these types of bonuses, you can find them on the table or on this post that I wrote about them here.

Just make sure to read the terms and conditions of the bonus so you don’t break the bonus’ rules and waste your time.

There are reviews both on the above link and on the links inside the table that explain the conditions thoroughly.

Support

Since online trading creates an opportunity for people from all over the world, brokers try to provide service in different languages.

It comes in handy for the traders who don’t speak english or english is not their native language because there might be some terms and conditions that people ignore because they don’t understand them correctly.

Brokers’ website is the primary source of the clients to find everything they need to know about their brokers and become more familiar with different parts of them.

Moreover, it’s very helpful for those who want to take advantage of educational materials. If the broker’s website offers their languages, the learning process becomes more productive.

Supporting different languages on a website doesn’t necessarily mean that they have customer service or support in those languages.

Some websites support lots of languages but they only have english customer service agents. On the other hand, there are some brokers in the list that have agents for most of the languages that their site supports.

Hotforex, FXTM, FBS, robo forex are some of them.

You can find whether they speak in your language or not by either having a look at their contact page or asking them via online chat.

FBS: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

FBS’s responsive and reliable website will surely lure you in as it offers quick and easy links to its informative sub sections. But relying on aesthetics and accessibility alone is not enough to survive in the world of forex. Does FBS have what it takes?

Two companies are operating under the FBS brand name.

The FBS.Eu, or tradestone limited is regulated by cyprus securities and exchange commission (cysec) and is authorized to provide online trading services in all EU countries. As one of the world’s top regulatory bodies, cysec has made a name of itself as a reliable protector of trader’s rights, as well as insuring brokers are operating within the laws that govern their operations. FBS is also a member of the investors compensation fund allowing for client compensations of up to €20 000 if the broker cannot meet its obligations to the trader. This broker is limited to a maximum leverage of up to 1:30, as sanctioned by ESMA.

The FBS.Com or FBS markets inc. Is regulated by the international financial services commission (IFCS) based in belize. The IFSC strives to promote belize as a safe heaven for international brokers, because it offers tight control over investment firms and protects the interest of traders. However, offshore regulatory bodies, like the IFCS, are not bound by the rules and governance of more renowned european institutes such as the FCA, cysec or ESMA. That’s why the maximum leverage available to FBS.Com clients is 1:3000.

FSB.Com allows for the trade of forex pairs, metals, stock cfds, and some crypto currencies, while FBS.Eu comes equipped with a very limited choice of trading assets: forex and metals.

FSB proves its stature as a global broker by giving us a galore of supported languages: german, english, french, italian, spanish, portuguese, arabic, indonesian, malaysian, bengali, chinese, japanese, korean, lao, thai, turkish, urdu and vietnamese.

FSB LOGIN

FBS.Com offers 3 platforms in total. It’s unsurprising that MT4 and MT5 are here, but the brokers very own mobile-only FBS trader is a welcome addition.

FBS.Eu clients have access only to MT4.

METATRADER 4

МТ4 is a must. Traders cannot ever go wrong with this platform, as 80% of the entire online trade market revolves around it. And for many reasons. Its expert advisors will allow for automatic trading, leaving you free to do as you please while your account is being traded with. Expect features that will grant you better access and more freedom: real-time charts, advanced charting tools, over 50 customizable trading indicators and much more. VPS is also available.

The spreads begin from 0.0 pips to 3 pips; all depend on the account type the client picks. For the standard account the spread starts from 0.5 pips with no commission whatsoever. The EU and UK are under ESMA directive, and are limited to a leverage of no more than 1:30. Outside this jurisdiction the leverage can reach a staggering 1:3000.

The platform can be accessed on windows, android and apple devices, including mobile and tablet. An MT4 browser version is also accessible (no eas).

METATRADER 5

MT5 strives to replace MT4 but fails to do so, not because it’s inferior but because most brokers nowadays use MT4 as the default terminal. Nevertheless, MT5 comes with new and handy features that traders will surely find useful. There are auto trading bots, plus VPS.

The spreads begin from 0.0 pips to 3 pips; all depend on the account type the client picks. For the standard account the spread starts from 0.5 pips with no commission what so ever. As decreed by ESMA the UK and EU leverage cannot surpass 1:30. Outside these zones it can reach 1:3000.

MT5 is available on all desktop, mobile and tablet devices that support the common operating systems- windows, ios and android. A browser version is also there, in addition to the desktop one.

FBS TRADER

Note that FBS trader is currently available solely to fbs.Com clients.

This mobile-exclusive metatrader substitute is much easier to use, and features all the necessary tools for competent trading. However, as easy as it is, MT4 still offers much more.

Spreads and leverages don’t vary from the ones on MT4/5. Your choice of account has a direct impact on them. This goes for the commission as well.

The expected spread lingers on 1.1 pips, while the leverage can reach 1:3000.

Traders can get access to it on any ios device, with the android version, as of writing this review, is still in development.

FBS MINIMUM DEPOSIT

The minimum deposit for a cent account with FBS.Com is just $1.

The minimum deposit for a trading account with FBS.Eu is $100.

Fund your account using with FBS.Com with one of the following funding methods: bank transfer, VISA, mastercard, neteller, sticpay, skrill, perfect money or bitwallet.

FBS.Eu accepts deposits with VISA, mastercard, wire transfer, skrill and neteller.

Only wire transfer can take up to 4 days to process, while all other methods are instant.

Sticpay method user will be commissioned a 2.5% fee on each deposit, while perfect money may be taxed from the payment system itself. The rest are toll-free.

FBS.Com supports trading accounts in EUR, USD, JPY. Clients of FBS.Eu are limited to EUR and USD accounts.

FSB WITHDRAWAL TIME AND FEES

Those trading under FBS.Eu, as licensed by cysec, are assured that their withdrawals will be as safe and secure as possible.

FBS.Com clients can cash out using VISA, mastercard, neteller, sticpay, skrill, perfect money or bitwallet. FBS.Eu cash out options are limited to VISA, mastercard, wire transfer, skrill and neteller

Bitwallet processes are instant, while all other methods are processed between 1-2 days. Once the money is processed by the broker, it may take some time before it reaches your personal account. Wire transfer time is between 3-7 working days and there may be fees depending on the client’s bank.

No method is spared by fees. With VISA it’s $1, neteller gets 2%, sticpay is 2.5%, skrill charges 1%, perfect money obtains 0.5%. Bitwallet users may also get charged but it is not specified by how much.

FBS BONUSES

FBS.Eu just like all other forex brokers based in EU doesn’t offer any bonuses because of ESMA regulations.

FBS.Com however offers a number of bonuses to its potential clients:

– once in a while users are picked at random for a brand new luxury car.

– you can get $100 as bonus to start trading with your account of choice (demo excluded).

– clients can double their initial deposits by activating the 100% deposit bonus.

– cashback offers you $15 per traded standard lot.

– increase your intake by up to $3000 each month by activating the partner account.

– earn loyalty points by trading, and exchange them for prizes and more.

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

Fxdailyreport.Com

Benefits of trading with small amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce commissions

When trading small amounts, you are usually constricted to put the majority of your money into a single trade. This, however, helps you reduce commissions. Traders are usually more likely to be sloppy when you are going to be making 20 trades in a day. But when trading with small amounts forces traders to be more selective about the trades they take.

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better management of risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of forex brokers with a low minimum deposits 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial brokerage services (FBS)

so, let's see, what was the most valuable thing of this article: here is list of best forex trading brokers with low minimum deposits 1 dollar, $5, or $10 for micro and mini account. At fbs micro account minimum deposit

Contents of the article

- Today forex bonuses

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

- FBS: login, minimum deposit, withdrawal time?

- RECOMMENDED FOREX BROKERS

- FSB LOGIN

- FBS MINIMUM DEPOSIT

- FSB WITHDRAWAL TIME AND FEES

- FBS BONUSES

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- Top 6 best brokers with true micro accounts for...

- Forex micro vs standard account (micro lots)

- Top 6 micro account forex brokers

- A factual FBS review for retail forex traders

- FBS trading account features at A glance

- Fbs micro account minimum deposit

- Low minimum deposit forex brokers

- Why forex micro accounts?

- What to search in low minimum deposit forex...

- FBS: login, minimum deposit, withdrawal time?

- RECOMMENDED FOREX BROKERS

- FSB LOGIN

- FBS MINIMUM DEPOSIT

- FSB WITHDRAWAL TIME AND FEES

- FBS BONUSES

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

No comments:

Post a Comment