How to get a forex account

Account privacy:

our associates work with jurisdictions that aren't part of the CRS/AEOI, which are reporting standards that demand member countries to exchange tax information with foreign tax authorities.

Today forex bonuses

Also, if you're not only trading in forex but also with bonds, stocks, and similar financial instruments, this account can be your trading one-stop-shop.

How to get A bank account for forex trading

Our associates can help you with your forex friendly bank account process. Contact us and we will help you with the process.

Offshore banking is not the same as it was years ago. Options are limited for medium-sized investors, and this is especially true if you are a forex trader.

If you've earned money doing forex trading, it's particularly difficult to open a forex friendly bank account which offers multi-currency options, and allows you to handle your main operations easily.

However, there are still a few good options to get a multi-currency trading account that will allow you to handle your operations simply with the added options of tax optimization and confidentiality.

Non-CRS jurisdictions/small minimum opening deposit

we work with banks in non-CRS jurisdictions, which means they don’t immediately report your financial information to the tax authorities of other countries.

Likewise, these jurisdictions also boast tax credits and exemptions for foreigners and investors that can lower their income tax rate to less than 10 %.

Moreover, you can open your account with a low minimum deposit (usually around $2,500), and our partner banks offer reliable, top-notch financial services.

In fact, such a bank account isn’t ideal just for well-established traders, but it can also be a fantastic addition if you’re only starting in the forex world.

Its focus on protecting wealth has developed in response to society’s need, and right, to have wealth protected from those who attempt to take it by force, litigation or legislation – whether through illegal, unethical or immoral means.

Also, if you're not only trading in forex but also with bonds, stocks, and similar financial instruments, this account can be your trading one-stop-shop.

Five reasons to open A forex-friendly bank account

low minimum deposit and account balance:

most banks require a minimum deposit of around $2,500. This is significantly lower than in many other jurisdictions. Moreover, the minimum balance you should keep is generally low.

That's fantastic, especially when considering that most jurisdictions that will let you open a bank account remotely usually require high amounts for the minimum deposit and minimum balance. That's not the case here, generally.

Low fees with full transparency:

one of the issues which prevent many investors from getting into forex trading is transparency issues.

However, that's not the case with all banks. Some banks provide a wholly transparent pricing structure that offers competitive fees and commissions.

This will give you the certainty that you're not being overcharged, allowing you to keep almost all of your earnings.

Friendly tax regime:

our associates work with jurisdictions that generally don't have dividends tax or capital gains tax.

They also have a territorial base for their tax rate, which means they only tax nationally-sourced income.

Furthermore, they have plenty of tax credits and exemptions that can lower your income tax rate to less than 10 % in some cases.

Account privacy:

our associates work with jurisdictions that aren't part of the CRS/AEOI, which are reporting standards that demand member countries to exchange tax information with foreign tax authorities.

That means these jurisdictions are perfect for forex traders that want to protect their assets with as much confidentiality as possible and with ideal tax planning.

One-stop shop:

the banks don't just offer forex friendly accounts, but also regular multi-currency accounts and precious metals accounts fully backed by actual gold and silver.

This means that you can receive a multitude of financial services at one bank, which gives you great flexibility.

In fact, with the trading account, you can also invest in stocks, futures, options, bonds, and many other financial instruments.

How to open A forex friendly account

pre-approval:

the pre-approval means your profile is viewed by banks to see if they may be interested in having you as a potential client.

If their answer is affirmative, that doesn’t necessarily mean you’ll be accepted, but it significantly increases your chances.

You will need the following:

- Bank form, filled and signed

- Notarized passport copy

- Certified copy of proof of residence

- Banking reference and/or six-month bank statements

if you pass the pre-approval, your application will be processed by the bank. It usually takes at least 20 days for most banks to approve the account.

During this process, the bank may ask for some additional documents.

The process is incredibly simple:

- Provide documents and forms

- Have a short phone call with a bank representative to finalize the pre-approval process

- Submit the application to the bank

- If everything goes right, you'll have your forex-friendly trading bank account

our associates can help you with your forex friendly bank account process. Contact us and we will help you with the process.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

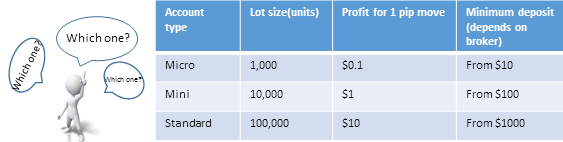

You will be required to select your preferred forex trading account. There are 3 major types of forex trading accounts-the mini, standard, and managed accounts. Each has its pros and cons. You will need to choose your account type depending on such factors as your tolerance risk, how much time you will have to trade daily, and your size of starting investment, etc.

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

How to start your own forex managed account

So you’re thinking about starting your own forex managed account?

You’ve come to the right place!

I consider myself the pre-eminent expert within the industry of forex MAM’s, PAMM’s and managed accounts.

Here’s why you should listen to what I have to say:

– I’m the managing director of both think huge and think huge investments

– I oversee $10mil+ of investor capital across MAM’s and PAMM’s at 5 different brokers

– we have 6 years experience running trade copying, regulated and unregulated structures.

This is me presenting in shanghai to a group of investors.

First thing– what is a forex managed account?

A forex managed account, a MAM or a PAMM is essentially the same thing. An investor allocates money for you to trade on their behalf and agrees to pay you a fee.

FYI – the difference between a MAM and a PAMM is in the way trade sizes are apportioned to investors. PAMM’s give more flexibility whereas MAM’s give more transparency to investors.

The process of trading for your investors under this model varies slightly from broker to broker, but it normally looks something like this:

- Your investor signs an LPOA (limited power of attorney) allowing you to trade their account for them, and agrees a fee structure.

- They fund their account with the broker allocating the capital to your master account (sometimes called a MAM master).

- You’ll see money drop in and out of the master account when clients deposit and withdraw.

- You trade the master account and (hopefully) make both your clients, and yourself, lost of money

- Each month the broker will transfer your agreed fee, ready for withdrawal to your bank account.

There are 3 different ways for you to earn income from your managed account.

Paid when you make your clients money (equity gains, remember that your balance is fugazi. All we care about as traders are equity gains)

This is the best kind of fee because it aligns your interests with those of your investors. It’s how we structure all our managed accounts. Under a performance fee model, you’re only making money if the clients are also making money. Like a perfect marriage, your goals are aligned.

You earn a slice of the spread every time you open and close a trade.

I hate traders who charge their investors rebates.

I’m surprised it’s still a thing if I’m honest.

It’s actually a disincentive to trade responsibly, because it encourages overtrading and excessive risk-taking in favour of long-term performance.

I’ve seen several situations where investors have made substantial losses, while the trader walks away with a huge rebate cheque. Where’s the justice in that!

An ongoing fixed percentage fee for managing client money.

If you’re running a business with fixed overheads, how will you keep the lights on during periods of negative performance? This is the role of the management fee.

Most genuine clients are willing to accept a fee 1-2% of funds under management per year.

In fact, I’ve even spoken to clients will ONLY invest in a managed account if there is a management fee in place because it shows a sense of maturity from the traders perspective.

When times are tough investors don’t want traders taking unnecessary risks to keep their business afloat.

Do you need to be a license to offer a forex managed account?

Now, listen very carefully, because I’m probably the only person in the world that will give you a straight answer to this question.

Your broker will dictate whether they’re willing to set up a managed account on your behalf and accept clients. In my experience, they WILL allow you to trade investor money without a license provided you’re attracting clients from offshore.

As an example, if you’re in australia, you can’t trade for aussies. If you’re in the UK, you can’t trade for brits.

Does this make you liable if a client decides to sue you?

I’m not 100% sure, but I would assume so.

However, I’ve never seen this happen despite the hundreds of dodgy MAM’s that have dusted millions of dollars from clients over the years.

I assume the reason is two-fold.

- The amount most investors allocate to managed accounts isn’t worth pursuing.

- When pursuing a trader on another part of the world, it’s just too hard.

Does this sound too sketchy for you and you’d like to be a fully regulated, licensed and legitimate money manager?

It’s the reason we set up think huge investments. A regulated corporate authorised representative under ASIC’s jurisdiction.

However I will say, the costs and ball ache are substantial and probably not worth it for the average trader.

Here’s some stuff to take into consideration based on my experience.

– prospective clients need to undertake a detailed questionnaire assessing their risk appetite and current financial situation.

– accepted clients must have a net worth of $100k+ and not be investing more than 15% of their overall asset base.

– there are approx. 4 detailed forms to sign covering the risks involved (clients hate forms).

– it costs up to $100 to onboard a new client, then $50 per year in running admin costs

– the monthly cost to maintain regulation as a corporate authorised representative (which basically means you rent someone else’s license and they do all the compliance bullshit) is $5,000+

For you to make money as a trader under a regulated structure, you’ll need to be managing a substantial sum, and maintain your profitability.

If you’re struggling to make money trading, you’ll bleed out from your fixed costs quite quickly.

It’s a tough game, and the reason you don’t see many regulated forex managed account providers in the market.

If you seriously want to become a professional trader managing client money, don’t start with a managed account.

First, begin by trading for clients using one for the many trade copier communities out there. Simpletrader, MQL5 or myfxbook autotrade are some of the biggest and most respected.

You won’t make a fortune, but you’ll learn what it’s like to trade for other people and manage the emotional rollercoaster that follows.

If you have extended success with that, money will start to find you after about 12 months.

My advice to aspiring traders is to protect and preserve your track record. Once you’re able to string together a continuous, consistent trading statement of 3+ years it will change your life forever.

Money, opportunity and pressure will follow.

Only then will you live the life of your trading dreams.

It’s not easy, but it is possible

Try live forex trading room now for just 7 days free and gain access to:

- Daily live streams

- FX trading academy

- Tradeable forex signals

- Live chat with all members

- And much, much more!

How to open a forex trading account

So after demo trading on at least three broker platforms, you’ve narrowed down your choice to a single forex broker?

After finding the right broker for you, you can open a forex trading account in three simple steps:

- Selecting an account type

- Registration

- Activating your account

Why not? It’s all FREE! Make sure to try out and “kick the tires” of several different brokers to get a feel for the right one for you.

Choosing an account type

When you’re ready to open a live account, you have to choose which type of forex trading account you want: a personal account or a business (aka corporate) account.

In the past, when opening a forex trading account, you’d also have to choose whether you wanted to open a “standard” account, a “mini” account, or a “micro” account.

This is great for newbie and inexperienced traders who only have a small account of capital.

This provides you great flexibility, as you won’t have to trade bigger than you’re comfortable with.

Also, always, always, always remember: always read the fine print.

Some brokers have a “managed account” option in their application forms. If you want the broker to trade your account for you, you can pick this.

But is this what you really want? After all, you didn’t read through the whole school of pipsology just to have someone else trade for you!

Besides, opening a managed account requires a pretty big minimum deposit, normally $25,000 or higher. Also, the manager will also take a cut out of any profits.

Lastly, make sure you open a forex spot account and not a forwards or futures account.

Registration

You will have to submit paperwork in order to open an account and the forms will vary from broker to broker.

They are usually provided in PDF format and can be viewed and printed using adobe acrobat reader program.

Also, make sure you know all the associated costs, like how much your bank charges for a bank wire transfer. You’d be surprised how much these actually cost, and they may actually take up a significant portion of your trading capital.

Account activation

Once the broker has received all the necessary paperwork, you should receive an email with instructions on completing your account activation.

So all that’s left is for you to log in and start trading. Pretty easy huh?

Time to log in, pop open those charts, and start trading!

But wait just one minute!

We strongly advise you DEMO trade first.

There’s no shame in demo trading. Everyone has to start somewhere.

If you have been demo trading for at LEAST a month, then maybe you can dip your feet into live trading. Even then, we suggest you go in the shallow end and consider how much you want to risk.

Trading live is a different beast altogether. It’s like the difference between sparring against your kid brother (or sister) and fighting manny pacquiao.

If you start trading live without any demo trading experience, this is what usually happens:

But no matter how successful you were in demo trading, nothing can replace the feeling of having real money on the line.

And once you’ve started trading on a live account, never get too comfortable. Always remain vigilant and use proper risk management.

Otherwise, this might happen:

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

You will be required to select your preferred forex trading account. There are 3 major types of forex trading accounts-the mini, standard, and managed accounts. Each has its pros and cons. You will need to choose your account type depending on such factors as your tolerance risk, how much time you will have to trade daily, and your size of starting investment, etc.

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

How to get A bank account for forex trading

Our associates can help you with your forex friendly bank account process. Contact us and we will help you with the process.

Offshore banking is not the same as it was years ago. Options are limited for medium-sized investors, and this is especially true if you are a forex trader.

If you've earned money doing forex trading, it's particularly difficult to open a forex friendly bank account which offers multi-currency options, and allows you to handle your main operations easily.

However, there are still a few good options to get a multi-currency trading account that will allow you to handle your operations simply with the added options of tax optimization and confidentiality.

Non-CRS jurisdictions/small minimum opening deposit

we work with banks in non-CRS jurisdictions, which means they don’t immediately report your financial information to the tax authorities of other countries.

Likewise, these jurisdictions also boast tax credits and exemptions for foreigners and investors that can lower their income tax rate to less than 10 %.

Moreover, you can open your account with a low minimum deposit (usually around $2,500), and our partner banks offer reliable, top-notch financial services.

In fact, such a bank account isn’t ideal just for well-established traders, but it can also be a fantastic addition if you’re only starting in the forex world.

Its focus on protecting wealth has developed in response to society’s need, and right, to have wealth protected from those who attempt to take it by force, litigation or legislation – whether through illegal, unethical or immoral means.

Also, if you're not only trading in forex but also with bonds, stocks, and similar financial instruments, this account can be your trading one-stop-shop.

Five reasons to open A forex-friendly bank account

low minimum deposit and account balance:

most banks require a minimum deposit of around $2,500. This is significantly lower than in many other jurisdictions. Moreover, the minimum balance you should keep is generally low.

That's fantastic, especially when considering that most jurisdictions that will let you open a bank account remotely usually require high amounts for the minimum deposit and minimum balance. That's not the case here, generally.

Low fees with full transparency:

one of the issues which prevent many investors from getting into forex trading is transparency issues.

However, that's not the case with all banks. Some banks provide a wholly transparent pricing structure that offers competitive fees and commissions.

This will give you the certainty that you're not being overcharged, allowing you to keep almost all of your earnings.

Friendly tax regime:

our associates work with jurisdictions that generally don't have dividends tax or capital gains tax.

They also have a territorial base for their tax rate, which means they only tax nationally-sourced income.

Furthermore, they have plenty of tax credits and exemptions that can lower your income tax rate to less than 10 % in some cases.

Account privacy:

our associates work with jurisdictions that aren't part of the CRS/AEOI, which are reporting standards that demand member countries to exchange tax information with foreign tax authorities.

That means these jurisdictions are perfect for forex traders that want to protect their assets with as much confidentiality as possible and with ideal tax planning.

One-stop shop:

the banks don't just offer forex friendly accounts, but also regular multi-currency accounts and precious metals accounts fully backed by actual gold and silver.

This means that you can receive a multitude of financial services at one bank, which gives you great flexibility.

In fact, with the trading account, you can also invest in stocks, futures, options, bonds, and many other financial instruments.

How to open A forex friendly account

pre-approval:

the pre-approval means your profile is viewed by banks to see if they may be interested in having you as a potential client.

If their answer is affirmative, that doesn’t necessarily mean you’ll be accepted, but it significantly increases your chances.

You will need the following:

- Bank form, filled and signed

- Notarized passport copy

- Certified copy of proof of residence

- Banking reference and/or six-month bank statements

if you pass the pre-approval, your application will be processed by the bank. It usually takes at least 20 days for most banks to approve the account.

During this process, the bank may ask for some additional documents.

The process is incredibly simple:

- Provide documents and forms

- Have a short phone call with a bank representative to finalize the pre-approval process

- Submit the application to the bank

- If everything goes right, you'll have your forex-friendly trading bank account

our associates can help you with your forex friendly bank account process. Contact us and we will help you with the process.

Forex trading account – how to open trading account

“disclosure: some of the links in this post are “affiliate links.” this means if you click on the link and purchase the item, I will receive an affiliate commission. This does not cost you anything extra on the usual cost of the product, and may sometimes cost less as I have some affiliate discounts in place I can offer you”

One of the first steps in forex trading is opening a forex trading account. Account gives you entrance into trading world where you will be one of the traders on the biggest market.

" data-medium-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" data-large-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" loading="lazy" width="259" height="244" src="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" alt="forex trading account" />

I will show you what you need to do to open account with broker.

How to open trading account

In order to continue you need to have broker. If you do not have broker even then you can continue to inform yourself about opening an account. It is not bad to know more if you want.

To open trading account, demo or real, necessary steps are:

- Selecting trading account type

- Registration

- Activating trading account

This is global overview but I will get into more details further in this text. Be sure to open first demo account and then after demo trading, real account.

Choosing trading account type

This post is about opening real account. If you are looking how to open demo account check this:

Step by step guide: admiral markets demo account

When opening account, real account, you need to decide which type you want to open. Brokers offers a lot options for any trader and before deciding please read as much as you can so you do not get scammed.

Broker can offer you few account types:

- Business

- Personal

- Managed

- Managed

- Spot

- Futures

- Forwards

Managed account

Some brokers have account where you can deposit money and then let broker to trade for you. These kind of accounts are known as managed account. If you want to trade on forex market by yourself then do not choose this account type.

By the way they charge fees through profit they make on your account and there is minimum amount on deposit which can be different by brokers. Deposit amount is mostly several thousands dollars which can be to high for individual investor.

Be sure that you open forex spot account and not one of the other accounts like futures and forwards.

Trading account size

Between account sizes you will need to choose small or large accounts. Small account is for trader with small amount of invested money. Large account is for trader with high amount of invested money.

Small accounts with every pip move will bring you smaller profit but also small loss if market moves against you. At start it is best to have small loss if you make a bad trade. In time how your progress through forex market you can deposit more money and have large account. With large account every pip move will bring you more money on your account.

For beginners it is recommended to use small account until they master trading and afterwards they can continue on the larger accounts. This way they will protect heavily earned money from fast losing on forex market.

During account opening process sometimes you will encounter three types of account that broker offers you. They are:

- Mini account

- Micro account

- Standard account

There is difference between them as their name suggest it but in general there is no to much complicated differences.

What is micro account

Micro account is account mostly intended for novice traders but it is not mandatory that he is novice.

This account requires smaller amount of deposit and that is between $10 – $250. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $1,000 on the market. Every pip move gives $0.1 difference on trading account. If trade goes in your favor you will earn $0.1 and if trade goes against you then you lose $0.1.

As you can see 1 pip move does not bring a lot profit or loss. If you open a trade and wait until market moves in one direction for 100 pips then this amount will be $10. $10 can be a lot if you have invested $50 on your trading account.

If you are able to invest more money on you account it is best to do it because this way you will avoid possible margin call. With higher amount on the account you will have wide space to trade if trade becomes a bad trade.

Margin call happens when you have bad trade active and without enough money to sustain further loss. When critical level is reached broker automatically close your trade.

What is mini account

Similar to micro account mini account is for traders who wants to invest money in range from $100 – $500. It is a little bit higher then micro account but it gives you possibility to earn $1 with every pip move.

Every trade/contract that you open you control $10,000. Every pip move gives $1 difference on trading account.

It is 10 times more than micro account and for new traders this is more then enough. Same as for micro account here is better to have larger amount of money on account.

What is standard account

Standard account is account mostly intended for experienced traders but it is not mandatory. Novice traders sometimes use standard account for trading.

This account requires larger amount of deposit and that is from $1000 and above. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $100,000. Every pip move gives $10 difference on trading account.

Which account to open

Micro, mini or standard account depends on you and your preferences. Do you want to earn more money with 1 pip move or less money with 1 pip move.

Forex account – micro, mini and standard

Those who have more money and know how to trade they will go for standard account. For novice it is the best to go with mini account. With every pip move novice will earn $1 which is a good profit.

Advantage that you can have with mini account over standard account is when you have high amount invested on trading account you can open several trades. If you have 10 orders on mini account it is same as you have 1 order open on standard account.

On mini account each trade gives you $1 for pip move. If something goes wrong and your margin starts to become red you can close one of orders and rest of them leave open. This way your margin will not be overloaded and you will stay in the game with other orders. If market moves in your direction open orders will bring you profit.

As a conclusion mini account gives you more flexibility in trading over standard account but enough profit for 1 pip move. Choose wisely which account is best for you and your trading preferences.

Leverage

Another thing to watch out when choosing account is leverage on that account. Leverage is ability to control large sum of money using small amount of your invested money.

You can choose different leverage like from 1:50 up to 1:500. This is different from broker to broker. 1:50 means that with one 1$ you can control $50 on the market. Broker lends you rest of the money so you can trade on the market and make more money. But also lose more money if market goes against you.

After you have decided which account you want to have, personal/business or small/large you need to decide to open

- Live or

- Demo account

As said earlier, for beginners it is best to open demo to test and later on to open live account. On demo account you should at least learn how to open and close a trade.

From my experience I can tell you that I have started immediately with live account because demo account could not give me what I wanted and that is – live experience.

Registration

When registering real/live account you will need to do some paper work in order to open it. Those papers could be

- Your ID number

- Utility bill not older than 3 months with your personal address on it, so they can verify that it is really you and data you have provided are accurate

They need this information to comply with the law. Regulatory agencies wants to protect you so they have set requirements for broker to open an account for you. If you are not required to give them these information’s you should be suspicious because that is minimum what they should ask you to provide.

During registration broker could ask you several information about your trading experience, your trading intentions or how much you will invest. They like to get know you(KYC – know your customer) and your trading intentions.

Please read all what is written in their documents so you are familiar with all costs that can arise, if there is any. Also, pay attention when depositing money over wire transfer how much does bank charge for their services.

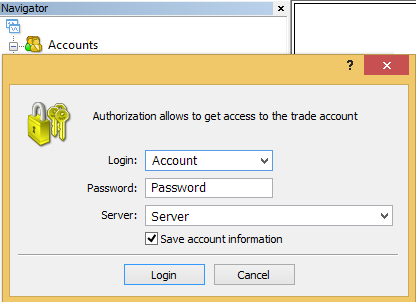

Trading account activation

When registration of your live account is done you will receive confirmation mail with account details. Information that trader receives in e-mail can be different because not all forex broker sends same e-mail.

- Account number

- Password for trading platform

- Server on which to connect

In order to activate trading account open your trading platform and follow further steps.

In the MT4 platform right click on the “accounts” menu which is located under “navigator” menu. After right click you will select “login to trade account“.

Use those information’s and enter them into new window that appears, like the picture below this text.

If everything is fine with data entered your trading platform will start to show you real information about trading pair price. If not, you will hear sound that indicates you have entered incorrect data.

Possible cause you did not connect to trading platform with information from broker is:

- Wrong login data – check information from broker

- Wrong trading platform – use platform from your broker

- No internet access – check can you open some other website in your browser in order to verify is internet connection ok

If you have entered all data as shown above and you have tested possible source of the problem and even then you are not connected then please call broker support.

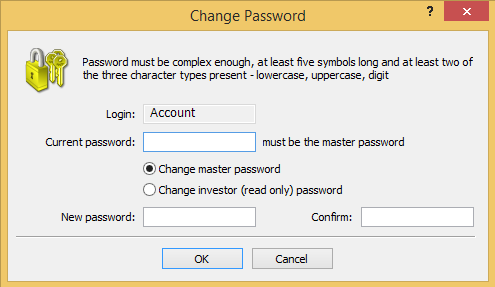

Password change

Password is possible to change immediately after you login into trading account. You are not obligated to leave same password you have received from your broker. You can change it to your desired password where you need to fulfill certain requirements.

Go into MT4 menu “tools” and select “options” with which you will open new window.

“tools” menu for trading account password change

In “options” window under tab “server” you will see option to change password. All other parameters you can leave as they are.

Change trading password under tab “server”

Select “change” and window “change password” will appear where you need to enter new password details. Enter your current password you have received from broker and enter new password. There is 2 places where you need to enter password, “new password” and “confirm“.

Trading account password change

Please pay attention to fulfill all necessary conditions for new password.

- At least five symbols

- At least two of the three character lowercase, uppercase and digit

After all above is done you will have account on MT4 platform ready for trading. If you are using real account then you will need to fund it with real money.

Transfer of real money on the trader account is done in trader room. I cannot show you steps because trader room is different on each broker. But mostly they have instructions how to transfer money from your credit card or bank account or any other possible channel.

FREE 5 day email course

Email course is for beginners who do not know to much about forex trading but wants to know

- What is forex

- What is trading and where to start

- What is metatrader 4

- How to setup charts on metatrader 4

- How to open and close order in metatrader 4

After you are done you will know how to use FREE trading platform to activate order by selecting currency pair on the forex market and make money.

- Trading platform?

- Activate order?

- Select currency pair?

- Make money?

To much strange words? Get them clear and start trading!

Frano grgić

A forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the first choice for traders and beginners. Market analysis is featured by forex factory next to large publications like dailyfx, bloomberg. Getknowtrading is becoming recognized among traders as a website with simple and effective market analysis.

BETA TESTERS WANTED

This is opportunity to be one of the first people to:

On online course about how to start trading

Join if you want to be part of and learn while testing

Categories

Forex signals

FREE PDF's

What is leverage?

How to calculate pip value?

What is margin?

What is lot?

How long demo trade?

0 comments

Disclaimer: any advice or information on this website is general advice only – it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by get know trading, it’s employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, CFD’s, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

Getting started in forex

The forex (FX) market has many similarities to the equity markets; however, there are some key differences. This article will show you those differences and help you get started in forex trading.

If you've decided to take a stab at forex trading, access to currency markets has never been easier with a wide range of online brokerage platforms offering everything from spot trading to futures and cfds.

Key takeaways

- Before you settle on a forex broker, carry out your due diligence and make sure you are choosing the best option for yourself.

- Look for low spreads and fees from a provider in a well-regulated jurisdiction that offers a suite of tools and access to leverage, among other factors.

- Once you've chosen your broker, study up on basic forex strategies and how to properly analyze currency markets.

- You may want to start with a demo account to try your strategy out and backtest before risking real money in the market.

Choosing a forex broker

There are many forex brokers to choose from, just as in any other market. Here are some things to look for:

Lower spreads save you money!

- Low spreads. The spread, calculated in "pips," is the difference between the price at which a currency can be purchased and the price at which it can be sold at any given point in time. Forex brokers don't charge a commission, so this difference is how they make money. In comparing brokers, you will find that the difference in spreads in forex is as great as the difference in commissions in the stock arena.

Make sure your broker is backed by regulatory agencies and a reliable institution!

- Quality institution.Unlike equity brokers, forex brokers are usually tied to large banks or lending institutions because of the large amounts of capital required (leverage they need to provide). Also, forex brokers should be registered with the futures commission merchant (FCM) and regulated by the commodity futures trading commission (CFTC). You can find this and other financial information and statistics about a forex brokerage on its website, the website of its parent company or through the financial industry regulatory authority's brokercheck website.

Get the tools you need to succeed!

- Extensive tools and research. Forex brokers offer many different trading platforms for their clients – just like brokers in other markets. These trading platforms often feature real-time charts, technical analysis tools, real-time news and data and even support for trading systems. Before committing to any broker, be sure to request free trials to test different trading platforms. Brokers usually also provide technical and fundamental information, economic calendars and other research.

Leverage your bets!

- Wide range of leverage options.Leverage is necessary in forex because the price deviations (the sources of profit) are merely fractions of a cent. Leverage, expressed as a ratio between total capital available to actual capital, is the amount of money a broker will lend you for trading. For example, a ratio of 100:1 means your broker would lend you $100 for every $1 of actual capital. Many brokerages offer as much as 250:1. Remember, lower leverage means lower risk of a margin call, but also lower bang for your buck (and vice-versa).

If you have limited capital, make sure your broker offers high leverage through a margin account. If capital is not a problem, any broker with a wide variety of leverage options should do. A variety of options lets you vary the amount of risk you are willing to take. For example, less leverage (and therefore less risk) may be preferable for highly volatile (exotic) currency pairs.

Make sure your broker uses the proper leverage, tools, and services relative to your amount of capital.

- Account types. Many brokers offer two or more types of accounts. The smallest account is known as a mini account and requires you to trade with a minimum of, say, $250, offering a high amount of leverage (which you need in order to make money with this size of initial capital). The standard account lets you trade at a variety of different leverages, but it requires a minimum of $2,000. Finally, premium accounts, which often require significantly higher amounts of capital, let you use different amounts of leverage and often offer additional tools and services.

Broker actions to avoid in forex trading

- Sniping or hunting. Sniping and hunting – defined as prematurely buying or selling near preset points – are inappropriate acts committed by brokers to increase profits. Unfortunately, the only way to determine the brokers that do this and those that do not is to talk to fellow traders. There is no blacklist or organization that reports such activity.

- Strict margin rules. When you are trading with borrowed money, your broker has a say in how much risk you take. As such, your broker can buy or sell at their discretion, which can be a bad thing for you. Let's say you have a margin account, and your position takes a dive before rebounding to all-time highs. Even if you have enough cash to cover, some brokers will liquidate your position on a margin call at that low. This action on their part can cost you a significant amount of capital.

Be sure to conduct thorough due diligence prior to selecting a broker! Once you've decided, signing up for a forex account is similar to getting an equity account. The only major difference is that for forex accounts, you are required to sign a margin agreement. This agreement states that you are trading with borrowed money, and, as such, the brokerage has the right to intervene in your trades to protect its interests. That said, once you sign up and fund your account, you'll be ready to trade.

Defining a basic forex trading strategy

Technical analysis and fundamental analysis are two of the oft-used strategies in the forex market. Technical analysis is by far the most common strategy used by individual forex traders, which we'll explain in further detail below.

Fundamental analysis

If you think it's difficult to value one company, try valuing a whole country! Fundamental analysis in the forex market is very complex, and is often used only to predict long-term trends; however, some traders do trade short term strictly on news releases. There are many fundamental indicators of currency values released at many different times such as:

These reports are not the only fundamental factors to watch. There are also several meetings where quotes and commentary can affect markets just as much as any report. These meetings are often called to discuss interest rates, inflation, and other issues that affect currency valuations. Even changes in wording when addressing certain issues—the federal reserve chairman's comments on interest rates, for example—can cause market volatility. Therefore, two important meetings for forex traders to watch are the federal open market committee and humphrey hawkins hearings.

Simply reading the reports and examining the commentary can help forex fundamental analysts gain a better understanding of long-term market trends and allow short-term traders to profit from extraordinary events. If you choose to follow a fundamental strategy, be sure to keep an economic calendar handy at all times so you know when these reports are released. Your broker may also provide real-time access to this type of information.

Technical analysis

Technical analysts of the forex analyze price trends, similar to their counterparts in the equity markets. The only key difference between technical analysis in forex and technical analysis in equities is the timeframe, as forex markets are open 24 hours a day. As a result, some forms of technical analysis that factor in time must be modified to factor in the 24-hour forex market. These are some of the most common forms of technical analysis used in forex:

Many technical analysts combine these studies to make more accurate predictions. (i.E., the common practice of combining the fibonacci studies with elliott waves.) others create trading systems to repeatedly locate similar buying and selling conditions.

Finding your forex trading strategy

Most successful traders develop a strategy and perfect it over time. Some focus on one particular study or calculation, while others use broad spectrum analysis to determine their trades.

Most experts suggest trying a combination of both fundamental and technical analysis in order to make long-term projections and determine entry and exit points. That said, it is the individual trader who needs to decide what works best for him or her (most often through trial and error) in the end.

Forex trading considerations to remember

- Open a demo account and paper trade until you can make a consistent profit. Many people jump into the forex market and quickly lose a lot of money due to taking on too much leverage. It is important to take your time and learn to trade properly before committing capital.

- Trade without emotion. Don't keep "mental" stop-loss points if you don't have the ability to execute them on time. Always set your stop-loss and take-profit points to execute automatically, and don't change them unless absolutely necessary.

- The trend can be your friend. If you go against the trend, make sure you have a good reason. That's because you have a higher chance of success in trading with the trend because the forex market tends to move in that direction than the other.

The bottom line

The forex market is the largest market in the world, and individuals are becoming increasingly interested in plying their trade in FX. However, there are multiple considerations to take into account before you begin trading, such as being sure your broker meets certain criteria and understanding a trading strategy that works best for you. One way to learn to trade forex is to open up a demo account and try it out.

Best forex managed accounts 2021

A managed forex account is where a money manager handles the investments and trading of the client’s account on their behalf. They manage the client’s account by seeking trading opportunities, adjusting the risk, implementing their own strategies, or even taking input from the client on what they would like to trade on and how.

The world’s most popular FX platforms, the MT4 and the MT5 both feature the possibility of having a money manager manage accounts through them. This is often called a MAMM account.

The brokers below represent the best forex managed accounts brokers.

82% of retail CFD accounts lose money

82% of retail CFD accounts lose money

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

ECN, market maker, no dealing desk

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

Here’s a list of the best forex managed accounts brokers.

Regulated by: cysec, FCA, FSC

Headquarters : 30 churchill place, london, E14 5EU, UK

82% of retail CFD accounts lose money

FXTM is also known as forextime, and commenced operations in 2011 from its de facto headquarters in limassol, cyprus. Since then, FXTM has achieved rapid global expansion, driven primarily by its desire to serve specific local markets with strong FX demand.

The MT4 and MT5 are the platforms provided by FXTM. These platforms, however, come in various versions built for the web, for desktops and for mobile devices. The FXTM MT5 is an improvement on the MT4 and can be downloaded from the myfxtm members’ area.

Activtrades

Headquarters : 1 thomas more square london E1W 1YN united kingdom

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

Activtrades was founded in 2001 and was recognised by the sunday times fast track 100 as the 90th fastest growing company in the UK for 2017. The company is regulated by the UK financial conduct authority (FCA), as well as the securities commission of the bahamas and offers CFD and spread betting trading accounts with direct execution (non-dealing desk).

FP markets

.png)

Headquarters : level 5, exchange house 10 bridge st sydney NSW 2000, australia

This brokerage offers a massive range of tradable assets through forex, CFD, and share trading accounts. FP markets supports the MT4, MT5, and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spread or commission pricing.

FP markets was founded in 2005 and is headquartered in sydney, australia. It is regulated by the ASIC in australia. Demo accounts are available. While it is suitable for beginners, education resources are limited.

What is a forex managed accounts?

A managed forex account is where a professional trader/money manager manages the trading on the clients’ behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs.

An investor may advise the money manager on strategies and signals to look for while trading on his behalf. An investor may do this to take themselves out of the equation and trade without the psychology and emotions that come with wins and losses. On the other hand, some clients simply choose to let the brokerage/money manager trade the account based on their own systems and strategies.

Forex managed accounts can be compared to traditional investment accounts of equities and bonds, in the way that an investment manager handles the trading logistics. In no instance can a money manager withdraw or add funds to the account, they are granted trade only access to the account, and the investor has full control over their account. Money managers charge a fee or commission for managed accounts, so it is important to research a variety of options, as their prices can vary greatly.

How does a managed forex account work?

For an investor to have a managed trading account, they must first open a trading account at a reputable brokerage firm of their choice. Then allocate the necessary amount of funds for a managed account. The money manager has limited access to the account and operates on a trade only basis. The investor remains in full control of the account and its deposits and withdrawal processes.

Now, if a money manager does not have any control over the investors money, how can they conduct trades? Well, upon setting up a managed account, both the investor and money manager must sign a document called a limited power of attorney agreement (LPOA). This is an agreement for both parties, allowing the trader to trade on an investors account on their behalf, without needing to transfer the investors funds to the traders account. This agreement provides a high level of security, control, and transparency that’s comfortable for the investor.

With the signing of this agreement, the managed account gets placed in what’s called a “master block”, and as stated before, the investor continues to have full control of their account. They can check the balance, deposit or withdraw funds, monitor trade activity, and even revoke the LPOA agreement at any time if they are not happy with the money manager. One thing they can not do is conduct their own trading on the account, unless they revoke the LPOA agreement.

Regarding the money managers aspect of managed forex accounts. They may trade for many investors all from a single master account using PAMM, LAMM, or MAM software and technology. These technical procedures are integrated into most reputable brokerages and various online trading platforms, making it possible for traders to manage investor accounts.

Account types

Investing through a managed account has been around for a long time. In fact, it’s been around for as long as investing. With that in mind, there have generally been 3 types of managed forex accounts that prevail- individual, pooled, and more recently; varieties of PAMM accounts.

Individual account

This type of account is the most simple and standard type of account when you think of a managed account. The account managed is a segregated account where the money manager makes all the trades on your behalf. The traders’ decisions are based solely on your instruction or desire, he/she is trading for you and only you.

Their decisions will be based on your risk level and whether you provide any specific strategy or guidance. Since there are no additional traders’ funds involved in this account, the minimum deposit may be quite high- exceeding $10,000. For this reason, and the fact the manager is trading this account individually for you, you will want to ensure a professional and competent money manager is chosen. A great deal of research and client testimonials will be beneficial when going this route.

Pooled account

This type of account is very similar too mutual funds, in where many investors pool their money together in a separate account and share the profits after fees and expenses. With pooled accounts, there are often a variety of pools to choose from. Each may be offering different risk levels, minimum deposits, investment strategies, currencies traded, and fees and expenses. These types of accounts are managed for a variety of investors, requiring you to choose or be advised on which pool suits your needs.

Unlike individual accounts, the manager is trading for numerous investor desires. To help determine an account for you, each fund will have years of past performance for review. A main benefit of pooled accounts is the lower minimum deposit required to enter, being as low as $2000. Although, there are often minimum participation requirements upon entering a pool fund. These are all factors you need to consider before diving in.

PAMM, LAMM, & MAMM accounts

These types of accounts use sophisticated technology to distribute profits, losses, and fees based on percentages of funds each investor has involved in the master account used for trading. These account methods are relatively new in comparison with the other two listed here, and offer the satisfaction of dealing directly with the broker of your choice in a secure and transparent way.

It’s similar to the mirror and copy trading features some brokers offer, because of the automation and technicality. Although, it still has more similarities to a managed account. All these types of accounts are basically pool accounts, in the sense that numerous investors pool their money together and reap the profits or losses of the money manager.

What should you look for in a managed forex account?

There are numerous things to consider when opening a managed forex account and you must always be careful when selecting a money manager. You need to use due diligence ensuring the money manager is reputable and trustworthy. The forex industry is known to have some notable scammers in the past, so extra precautions must be made to guarantee safe and secure management.

Not only do you need to take precaution when choosing your money manager, but also in the type of account that’s suitable for your needs. Below are some things to look for when choosing a managed forex account.

- The risk level of an account or manager is something to consider. When trading with an individual account, you want to choose a money manager who’s trading style and history is at the level of risk you’re comfortable with. You can advise your money manager on how to trade, but by choosing one that trades with your level of risk already can make all the difference. As well, with trading accounts, you want to choose a pool with your appropriate risk level and trading method.

- Another important factor are the fees, expenses, and minimum deposits involved with a trading account. Many firms will charge performance fees to your account. These fees can vary greatly based on the account type, and risk level of such an account. These rates can range from anywhere between 10%-35% and some cases even higher. These rates are in accordance to a principle called the “high water mark”. This protocol is applied to your account if at the end of each month your net balance is higher than a certain percentage. If this is the case, your account will be deducted the performance fee which is a certain percentage. Some brokerages may also charge an account management fee on top of the other fees for following a specific formula. Also in some cases, there can be a fee for the termination of account in the event of transferring all funds.

- An important factor when choosing a reputable managed forex account is the availability of past performance history. Past performance may not be an indicative factor of future results, but at least the history shows experience of the forex account. There should be published history of at least a few years for a reputable brokerage managed account.

How to open a managed forex account?

Opening a managed forex account is more complicated than you might think. That is why we’ve created a detailed list pertaining to the necessary steps involved. Discover the intricate process in great detail below;

- Before you make the necessary steps to opening an account, you must first determine your risk tolerance. You need to know this so you know who to look for in a money manager, you can view their track record and overall risk score. Another point that goes along with this are your goals. If you want to make higher profits in a short amount of time, high risk managed account might be the option for you.

- Spend time networking and searching for the right forex trader. There are lots of options out there, but not everyone is right for you. Use your due diligence and research, reach out, and network to find the best possible forex brokerage.

- Once you have narrowed down your list of forex traders, you need to go over each contract. Make sure you feel comfortable with everything and understand the max drawdowns, liability coverage, fees and expenses, and so on. Your due diligence is key in obtaining a successfully managed forex account.

- Again, ensure everything is up to spec with the trader your interested in. View past performance reports, client testimonials, reviews, and anything you can dig up on the internet.

- Once you have completed the steps above you are ready to select a forex trader to manage your account. You’ll need to complete and sign the necessary documents, and contracts including the signing of a limited power of attorney agreement (LPOA).

- The next step is to receive your account number and transfer funds into the account. The account number is tied to your name, information, and your segregated trading account. Once everything is in order you can go ahead and transfer the funds, knowing you’re with a trusted and secure forex trader by following the steps above.

- Finally, you wait for the money to be transferred, and it’s complete. It really is a simple process. You can have a managed forex account up and running within a few days. Now, you can analyze your account and even learn from the trades that are being made.

So, let's see, what was the most valuable thing of this article: how to get A bank account for forex trading our associates can help you with your forex friendly bank account process. Contact us and we will help you with the process. Offshore banking at how to get a forex account

Contents of the article

- Today forex bonuses

- How to get A bank account for forex trading

- Fxdailyreport.Com

- How to start your own forex managed account

- How to open a forex trading account

- Choosing an account type

- Registration

- Account activation

- Fxdailyreport.Com

- How to get A bank account for forex trading

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

- Getting started in forex

- Choosing a forex broker

- Lower spreads save you money!

- Make sure your broker is backed by regulatory...

- Get the tools you need to succeed!

- Leverage your bets!

- Make sure your broker uses the proper leverage,...

- Broker actions to avoid in forex trading

- Defining a basic forex trading strategy

- Finding your forex trading strategy

- Forex trading considerations to remember

- The bottom line

- Best forex managed accounts 2021

- Activtrades

- FP markets

- What is a forex managed accounts?

- How does a managed forex account work?

- Account types

- What should you look for in a managed forex...

- How to open a managed forex account?

No comments:

Post a Comment