Litecoin rsi

Image source: shutterstock litecoin is on the verge of turning neutral again if it falls beneath the support at $67.

Today forex bonuses

It would need to fall further beneath $60 before turning bearish.

Litecoin takes 10% hit after RSI drops beneath 50 – where to next?

Litecoin takes 10% hit after RSI drops beneath 50 – where to next?

- Litecoin witnessed a sharp 10% price fall over the past 24-hours, bringing the price for the cryptocurrency down to $70.

- The cryptocurrency ran into resistance at $83.05 and was unable to overcome it, causing prices to drop.

Litecoin dropped by 10% today, to push the price down to $70. It has been surging all year and climbed by a total of 114% to reach a high of around $83.05. Unfortunately, it was unable to overcome this resistance which caused it to roll over and fall by a total of 16% to reach the current price of around $70.

Litecoin is now ranked in the 7th position as it now holds a $4.52 billion market cap value.

Litecoin price analysis

LTC/USD – daily CHART – SHORT TERM

LTC/USD – DAILY CHART – source: tradingview

Market overview

Since my last litecoin analysis , the cryptocurrency was able to climb above the previous resistance at $78.44 as it continued higher to break above $80. However, when it reached $83.05, it was unable to go higher which caused it to roll over and fall to the current $70 support.

Short term prediction: BULLISH/NEUTRAL

Litecoin is on the verge of turning neutral again if it falls beneath the support at $67. It would need to fall further beneath $60 before turning bearish.

If the sellers do push litecoin beneath the support at $67.74, provided by a short term .5 fib retracement, we can expect additional support at $65 and $63.60 (.618 fib retracement). This is then followed with added support at $62.30 (200-days EMA) and $60 (100-days EMA).

On the other hand, toward the upside, resistance lies at $73.45, $76.72 (bearish .382 fib retracement), $78.44, and $80. Above $80, higher resistance lies at $83.05, $86.04, and $89.29 (bearish .5 fibonacci retracement level).

The RSI has dipped beneath the 50 level which is very bad news as it shows that the sellers have started to take control over the market momentum. It would need to climb back above 50 for the bulls to take control again.

Key levels

Support: $73, $70, $67.74, $64.59, $61.33, $60

resistance: $78.44, $80, $83, $86, $89.28, $90

To keep track of defi updates in real time, check out our defi news feed here.

Litecoin trade using RSI S/R levels

I have not talked much about litecoin. Litecoin is one of the major 3 of the cryptocurrency sphere; the other two being bitcoin and ethereum. Traders and investors of litecoin have experienced some significant upside momentum every since the release of the futures contract for bitcoin on sunday, december 10th.

I’ve created several vertical lines on the chart that are placed on both the price and RSI zones. There are also two horizontal lines on the RSI (thick black lines).

One of the first things that traders learn to apply to a chart is a support/resistance line. These are often drawn on the price chart to determine historical highs and lows and to find possible reversal areas or strong continuations. We can apply the same principles to the RSI.

The RSI has two extreme levels, overbought and oversold. The RSI considers overbought conditions when it is 70 and greater. And it is considered oversold when it is 30 and lower. However, each instrument can form its own dynamic strength and resistance zones on an RSI. What I mean is that the default oversold and overbought levels of 30 and 70 are not static and are just suggested.

When we look at litecoin’s RSI and look at the bottoms that the RSI makes, notice how often price will make a move up. Now, not every single move up is as drastic or powerful, they don’t need to be. The most important thing to take away from this is to analyze and identify repeating tops and bottoms in the RSI of any instrument.

It is also important to make sure that the highs and lows in the RSI that you draw coincide with a top and bottom in price. Essentially, for oversold conditions, we want to have price at a historic support area and the RSI being oversold and at a historic RSI support level. Just those two tools can help you find an entry into a countertrade and improve your trade entries.

RSI price analysis: litecoin (LTC), cardano (ADA), yearn.Finance (YFI), binance coin (BNB).

As the current bitcoin bull market intensifies, there have been several switches in position among the top-ten largest assets in capitalization. We review some of them in today’s analysis and also look at what defi-brainchild, yearn.Finance (YFI) is up to in recent days.

Litecoin

Although today may not have turned out too well for litecoin fans, the ‘silver’ coin has made a recent resurge. Earlier in the year, LTC kept relinquishing its position on the top ten for emerging projects. At this time, though, litecoin is now the sixth largest coin by market cap climbing from the number 9 spot in the last couple of days.

Will litecoin compensate for the losses? At the time of writing, an LTC is worth $73.8.

The current RSI is usual, so traders can expect to see prices steady for now. If there is going to be any drop or rise, it will be steady or gradual. We can see much volatility, as the historical volatility is active with ups and downs.

Cardano

ADA is not living up to traders’ expectations as the digital currency is trading less than twenty cents. ADA traders expect to see it close to the all-time high if not above the all-time high. But things are playing out in quite a different way.

Cardano is on the rise, and traders wonder when it will break the $0.1 resistance and hit the $0.2. Various indicators are indicating a price rise, but prices may not get as high as $0.2. Different resistance may shatter as a result of the increase. The $0.11 resistance may break, and possibly the $0.12 may flip.

Yearn.Finance

Yearn.Finance is the most expensive cryptocurrency. At the time of writing, a yearn.Finance is worth $20,285. The relatively young cryptocurrency has an all-time high of $43,678 and an all-time low of $31.65. YFI is currently ranked the 40th coin by market cap.

With all the bullish market unfolding, traders can expect to see prices break the $20,500 resistance level provided traders can keep the current bullish momentum. With the current RSI dropping, prices may fall to the $19k region.

Binance coin

BNB has come a long way. From traders trading the coin in october 2017 at less than a dollar, $0.03 to be exact, the current all-time low of the coin. BNB had an all-time high of $39.6 in july 2019.

At the time of writing, traders are trading binance coin at $28.4. The current RSI is on the drop, and BNB prices may drop to as low as the $27 region. But if traders can rally the market, it will be a massive boost for the prices of BNB as traders can expect to see the coin in the $29 region.

Affiliate: deposit 0.02 BTC, and get a 100% bonus to trade futures on bexplus.

Follow us on twitter, facebook, and telegram to receive timely updates. Subscribe to our weekly newsletter.

Litecoin price analysis: RSI points to increased selling pressure

Litecoin (LTC) is changing hands at $72.69, down 2.3% on a day-to-day basis. The coin takes the 6th place in the global cryptocurrency rating with the current market value of $4.7 billion and an average daily trading volume of $4.9 billion.

Litecoin foundation partners with crypto lending platform

Litecoin foundation announced partnership deal with cred that will allow providing financial services to litecoin holders. Cred is a licensed lender based in california and a popular lending platform based on cryptocurrencies. The platform works in 190 countries.

According to the press-release, litecoin (LTC) holders will be able earn up to 10% on their digital assets through any of cred’s partners including litecoin foundation, bitcoin.Com, uphold, and bitbuy.

We’re thrilled to be working with cred as our financial services partner, offering among the most competitive interest rates on litecoin, charlie lee, creator of litecoin and managing director of litecoin foundation commented in the press-release.

Litecoin holders will be able to receive monthly interest payments for six-months commitment, with the option to roll over the assets for additional periods.

LTC/USD: technical picture implies more sell-off

From the technical point of view, LTC/USD is hovering around a pivotal point. The current support created by psychological $73.00 served as a strong resistance in the beginning of february, thus, a sustainable move below this area may trigger sharp sell-off towards $70.00 and potentially $66.50 ( the middle line of the daily bollinger band, which coincides with the lower level of the previous consolidation channel).

On the upside, we will need to see a sustainable move above $75.00 for the upside to gain traction. This resistance is created by a combination of SMA50 and SMA100 on 1-hour chart. Once it is out of the way, the upside is likely to gain traction with the next focus on the recent high of $78.45 and psychological $80.00.

Meanwhile, the rsis both on daily and hourly charts point downwards, signalling that the bearish sentiments are getting stronger.

LTC/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Latest crypto news

Latest crypto news & analysis

Editors’ picks

XRP pumps towards $1, as the bitcoin rally cools off

In the last 48 hours, ripple has led the rally in the cryptocurrency market, hitting highs of $0.822 for the first time in 2021. The upswing took plac

ADA looks primed for a 30% move

Cardano price saw a meteoric surge of 200% from late-december 2020 to mid-january 2021. However, the smart contracts token has been stagnant over the past two weeks showing an ambiguous outlook.

Stellar at risk of a massive 20% correction

On january 7, XLM price peaked at $0.411 but had a major correction down to $0.21 in the next week. On january 28, the digital asset tried to climb above $0.34 unsuccessfully, closing below there. XLM attempted to crack this resistance level in the following days, again, failing to do so.

XRP price goes under extreme manipulation by new telegram group

XRP price shows a substantial uptick per a telegram group's plan to pump the cryptocurrency on february 1. Although the pump is planned at 13:30 GMT, the price has already surged a whopping 30% today.

BEST CRYPTO BROKERS/EXCHANGES

Bitcoin weekly forecast: elon musk endorses bitcoin while the ECB says investors may “lose all their money”

In the past 24 hours, a lot has happened in the cryptocurrency market. First, the wallstreetbets reddit group announced an upcoming pump on dogecoin which rallied by more than 1,000%. Shortly after, elon musk changed his twitter bio to #bitcoin and followed up with the next tweet.

Crypto partners in your location

Note: all information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Litecoin rsi

LTCUSD H4: 20/25% gains best level TO BUY/HOLD(SHORT-TERM)(NEW) IMPORTANT NOTE: speculative setup. Do your own due dill. Use STOP LOSS. Don't overleverage. Previously recommended buying low. �� summary and potential trade setup . LTCUSD H4 chart review . Expecting reversal/bounce soon . Near 115 USD BEST reload BULLS . Focus on buying pullback/dips .

We haven't even scratched the surface of this run on $LTCUSD yet. I believe we can see a 10x the value against BTC (as the value of bitcoin hovers / declines, we will see huge moves here in LTC in comparison) if you look at the LTCBTC chart, we have truly put in a floor.

Hello friends! Happy new week to you! May this week bring you a lot of profit! As we can see, the past follows the direction of the arrow, there is very little left and the price will reach the level. As we can see, from january 29, the price began its movement in the channel. Note that the.

I think LTC will pull off a run similar to ETH.

When market conditions are bullish across one asset class, it's natural for certain assets in that class to outperform others. If the semiconductor class was doing well, you wouldn't expect NVIDIA to be up exactly the same percentage gain as INTEL. When one outperforms the other, the market usually tends to find value in the under performer with the logic being.

Waiting for a breakout to happen on the daily timeframe ------------------------- please don't forget to FOLLOW, LIKE, and COMMENT . If you like my analysis:) trade safe - trade well regards, michael harding �� chief technical strategist @ LEFTURN inc. RISK DISCLAIMER information and opinions contained with this post are for educational purposes and do not.

Hello guys.SO this is my opinion.There are two consequences if the prices succesfully break a support level around 121.74. 1.This level would be swap zone to push prices lower. 2.The price will go for new support and rally. Any thought?Feel free to share with us.

Weekly short according to feb 2020 bearish pattern which can repeat again for a 50 usd retest.

TP OF LTCUSD IS MENTIONED ����

Hello traders investors and community, welcome to this analysis about litecoin, we are looking at the 4-hour timeframe perspective, the recent events, the established structure, and what we can expect in the upcoming times. Litecoin these times is showing up with some interesting price-actions since it established its strong bullishness to the upside and pulled.

Litecoin the silver crypto currency good luck rank #8 coin on 239,487 watchlists litecoin price (LTC) $132.91 1.35% 0.003918 BTC 0.09740 ETH

RSI price analysis: litecoin (LTC), cardano (ADA), yearn.Finance (YFI), binance coin (BNB).

As the current bitcoin bull market intensifies, there have been several switches in position among the top-ten largest assets in capitalization. We review some of them in today’s analysis and also look at what defi-brainchild, yearn.Finance (YFI) is up to in recent days.

Litecoin

Although today may not have turned out too well for litecoin fans, the ‘silver’ coin has made a recent resurge. Earlier in the year, LTC kept relinquishing its position on the top ten for emerging projects. At this time, though, litecoin is now the sixth largest coin by market cap climbing from the number 9 spot in the last couple of days.

Will litecoin compensate for the losses? At the time of writing, an LTC is worth $73.8.

The current RSI is usual, so traders can expect to see prices steady for now. If there is going to be any drop or rise, it will be steady or gradual. We can see much volatility, as the historical volatility is active with ups and downs.

Cardano

ADA is not living up to traders’ expectations as the digital currency is trading less than twenty cents. ADA traders expect to see it close to the all-time high if not above the all-time high. But things are playing out in quite a different way.

Cardano is on the rise, and traders wonder when it will break the $0.1 resistance and hit the $0.2. Various indicators are indicating a price rise, but prices may not get as high as $0.2. Different resistance may shatter as a result of the increase. The $0.11 resistance may break, and possibly the $0.12 may flip.

Yearn.Finance

Yearn.Finance is the most expensive cryptocurrency. At the time of writing, a yearn.Finance is worth $20,285. The relatively young cryptocurrency has an all-time high of $43,678 and an all-time low of $31.65. YFI is currently ranked the 40th coin by market cap.

With all the bullish market unfolding, traders can expect to see prices break the $20,500 resistance level provided traders can keep the current bullish momentum. With the current RSI dropping, prices may fall to the $19k region.

Binance coin

BNB has come a long way. From traders trading the coin in october 2017 at less than a dollar, $0.03 to be exact, the current all-time low of the coin. BNB had an all-time high of $39.6 in july 2019.

At the time of writing, traders are trading binance coin at $28.4. The current RSI is on the drop, and BNB prices may drop to as low as the $27 region. But if traders can rally the market, it will be a massive boost for the prices of BNB as traders can expect to see the coin in the $29 region.

Affiliate: deposit 0.02 BTC, and get a 100% bonus to trade futures on bexplus.

Follow us on twitter, facebook, and telegram to receive timely updates. Subscribe to our weekly newsletter.

Litecoin trade using RSI S/R levels

I have not talked much about litecoin. Litecoin is one of the major 3 of the cryptocurrency sphere; the other two being bitcoin and ethereum. Traders and investors of litecoin have experienced some significant upside momentum every since the release of the futures contract for bitcoin on sunday, december 10th.

I’ve created several vertical lines on the chart that are placed on both the price and RSI zones. There are also two horizontal lines on the RSI (thick black lines).

One of the first things that traders learn to apply to a chart is a support/resistance line. These are often drawn on the price chart to determine historical highs and lows and to find possible reversal areas or strong continuations. We can apply the same principles to the RSI.

The RSI has two extreme levels, overbought and oversold. The RSI considers overbought conditions when it is 70 and greater. And it is considered oversold when it is 30 and lower. However, each instrument can form its own dynamic strength and resistance zones on an RSI. What I mean is that the default oversold and overbought levels of 30 and 70 are not static and are just suggested.

When we look at litecoin’s RSI and look at the bottoms that the RSI makes, notice how often price will make a move up. Now, not every single move up is as drastic or powerful, they don’t need to be. The most important thing to take away from this is to analyze and identify repeating tops and bottoms in the RSI of any instrument.

It is also important to make sure that the highs and lows in the RSI that you draw coincide with a top and bottom in price. Essentially, for oversold conditions, we want to have price at a historic support area and the RSI being oversold and at a historic RSI support level. Just those two tools can help you find an entry into a countertrade and improve your trade entries.

Litecoin takes 10% hit after RSI drops beneath 50 – where to next?

Litecoin takes 10% hit after RSI drops beneath 50 – where to next?

- Litecoin witnessed a sharp 10% price fall over the past 24-hours, bringing the price for the cryptocurrency down to $70.

- The cryptocurrency ran into resistance at $83.05 and was unable to overcome it, causing prices to drop.

Litecoin dropped by 10% today, to push the price down to $70. It has been surging all year and climbed by a total of 114% to reach a high of around $83.05. Unfortunately, it was unable to overcome this resistance which caused it to roll over and fall by a total of 16% to reach the current price of around $70.

Litecoin is now ranked in the 7th position as it now holds a $4.52 billion market cap value.

Litecoin price analysis

LTC/USD – daily CHART – SHORT TERM

LTC/USD – DAILY CHART – source: tradingview

Market overview

Since my last litecoin analysis , the cryptocurrency was able to climb above the previous resistance at $78.44 as it continued higher to break above $80. However, when it reached $83.05, it was unable to go higher which caused it to roll over and fall to the current $70 support.

Short term prediction: BULLISH/NEUTRAL

Litecoin is on the verge of turning neutral again if it falls beneath the support at $67. It would need to fall further beneath $60 before turning bearish.

If the sellers do push litecoin beneath the support at $67.74, provided by a short term .5 fib retracement, we can expect additional support at $65 and $63.60 (.618 fib retracement). This is then followed with added support at $62.30 (200-days EMA) and $60 (100-days EMA).

On the other hand, toward the upside, resistance lies at $73.45, $76.72 (bearish .382 fib retracement), $78.44, and $80. Above $80, higher resistance lies at $83.05, $86.04, and $89.29 (bearish .5 fibonacci retracement level).

The RSI has dipped beneath the 50 level which is very bad news as it shows that the sellers have started to take control over the market momentum. It would need to climb back above 50 for the bulls to take control again.

Key levels

Support: $73, $70, $67.74, $64.59, $61.33, $60

resistance: $78.44, $80, $83, $86, $89.28, $90

To keep track of defi updates in real time, check out our defi news feed here.

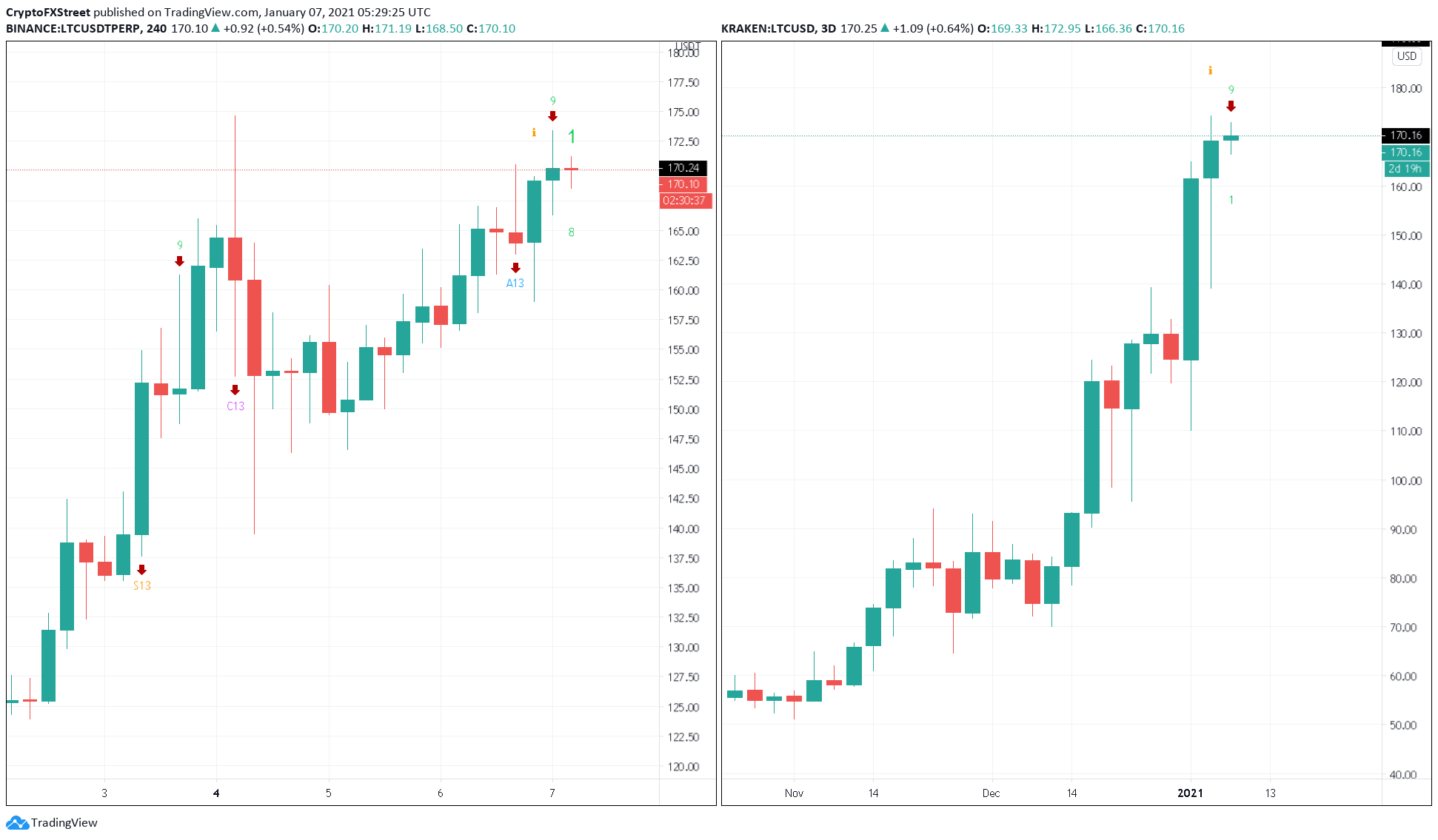

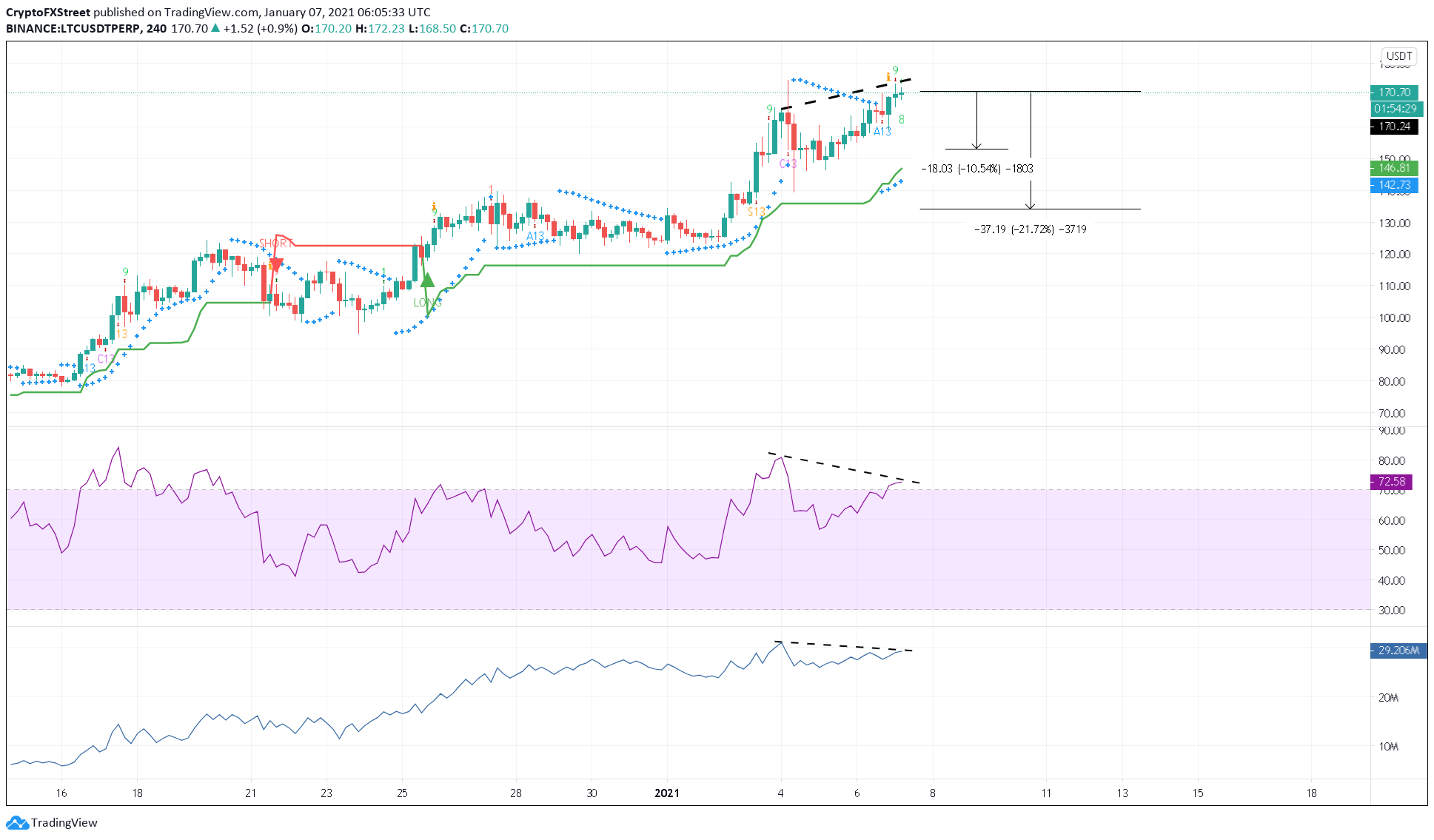

Litecoin price analysis: LTC technicals spell trouble while on-chain metrics forecast upswing towards $370

- Litecoin price faces a potential roadblock since the TD sequential indicator presented a sell signal on both the 4-hour and the 3-day chart.

- LTC is at crossroads as on-chain metrics hint at an upswing contradicting the near-term bearish signals.

Boasting over 270% returns in the last quarter of 2020, litecoin is one of the best performing cryptocurrencies. With most altcoins rallying to new highs, LTC bulls might need to take a break as the TD sequential indicator flashed sell signals across multiple time frames.

Litecoin price may pullback before rising to higher highs

Litecoin price shows signs of weakness after an uninterrupted bull run since early december. The bearish formations presented by the TD sequential indicator could provide LTC with a much-needed retracement.

If sell orders begin to pile up, the fifth-largest digital asset may take a nosedive towards the nearest support barriers at $150 and $120.

LTC/USD 4-hour and 3-day chart

Adding credence to the TD setup’s pessimistic outlook, a bearish divergence seems to have developed between litecoin price and the RSI. A similar behavior can be seen against the OBV, which is making a series of lower lows while prices have been surging.

If a spike in downward pressure was to validate these bearish signals, there are two fundamental levels to keep an eye out for. The $155 support represents a 10% downswing from LTC’s current market value.

Further selling pressure at this level could cause litecoin price to slide to $135.

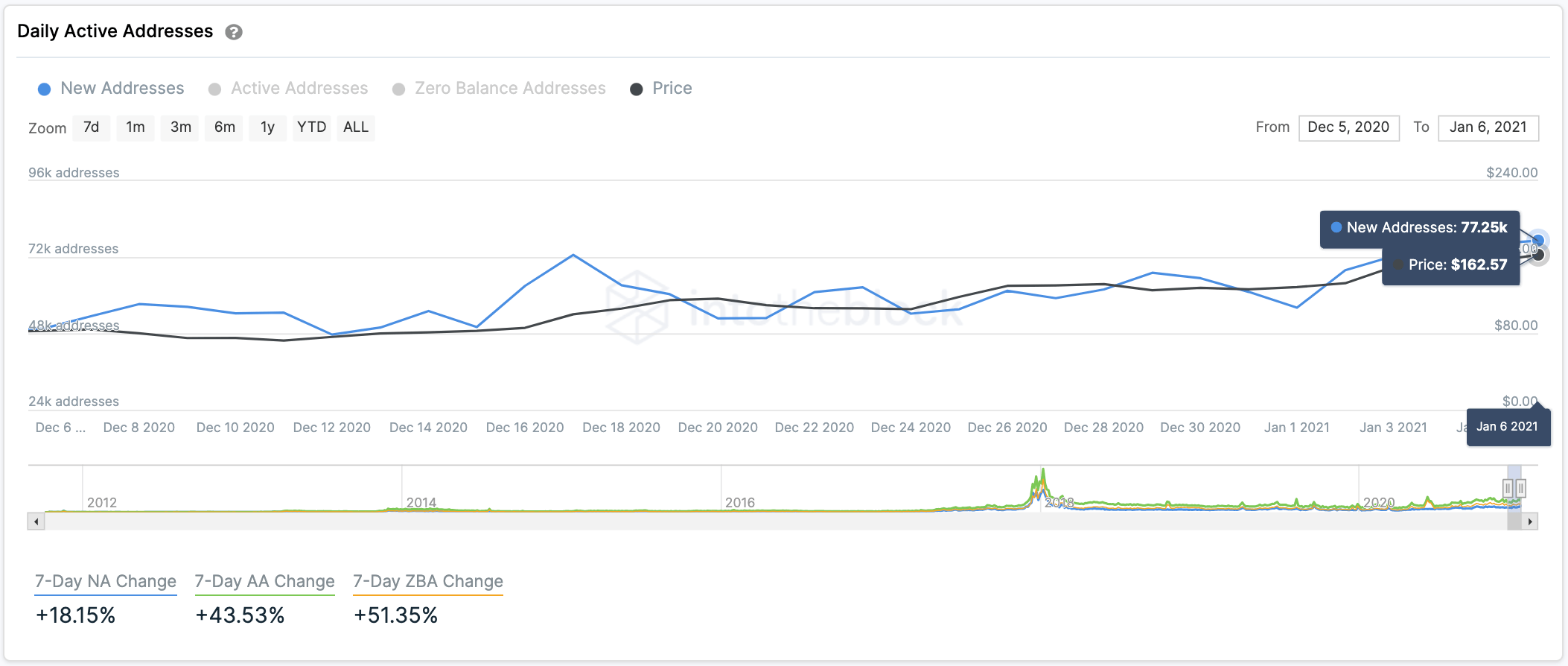

On-chain metrics remain bullish

Despite the multiple sell signals that litecoin price presents from a technical perspective, its on-chain activity suggests that the bull rally may prolong. The number of new addresses joining LTC’s network rose by more than 57% in the last month.

Usually, when the network expands for a prolonged period, prices tend to follow.

Litecoin’s daily active addresses

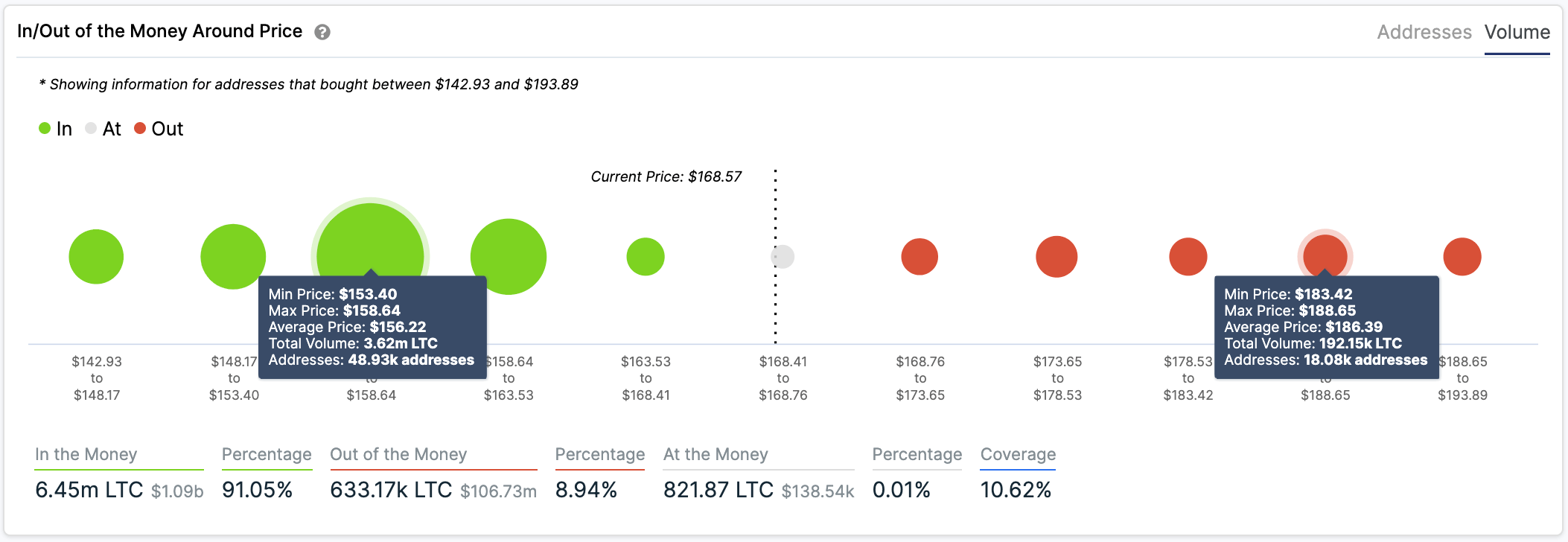

Moreover, the in/out of the money around price (IOMAP) metric from intotheblock shows little to no resistance ahead of litecoin price. The only significant supply wall that may pose a threat to this altcoin’s uptrend lies around $190.

An upswing beyond the overhead resistance would invalidate the bearish signals and lead to further gains.

Nonetheless, litecoin seems to sit on top of stable support that may keep falling prices at bay in the event of a sell-off. The demand barrier at $150 will be the first line of defense since 131,000 addresses have previously accumulated 5.48 million LTC around this price level.

Holders within this range will likely try to prevent seeing their investments go into the red. They may even buy more tokens to allow prices to rebound quickly towards new all-time highs.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Latest crypto news

Latest crypto news & analysis

Editors’ picks

XRP pumps towards $1, as the bitcoin rally cools off

In the last 48 hours, ripple has led the rally in the cryptocurrency market, hitting highs of $0.822 for the first time in 2021. The upswing took plac

ADA looks primed for a 30% move

Cardano price saw a meteoric surge of 200% from late-december 2020 to mid-january 2021. However, the smart contracts token has been stagnant over the past two weeks showing an ambiguous outlook.

Stellar at risk of a massive 20% correction

On january 7, XLM price peaked at $0.411 but had a major correction down to $0.21 in the next week. On january 28, the digital asset tried to climb above $0.34 unsuccessfully, closing below there. XLM attempted to crack this resistance level in the following days, again, failing to do so.

XRP price goes under extreme manipulation by new telegram group

XRP price shows a substantial uptick per a telegram group's plan to pump the cryptocurrency on february 1. Although the pump is planned at 13:30 GMT, the price has already surged a whopping 30% today.

BEST CRYPTO BROKERS/EXCHANGES

Bitcoin weekly forecast: elon musk endorses bitcoin while the ECB says investors may “lose all their money”

In the past 24 hours, a lot has happened in the cryptocurrency market. First, the wallstreetbets reddit group announced an upcoming pump on dogecoin which rallied by more than 1,000%. Shortly after, elon musk changed his twitter bio to #bitcoin and followed up with the next tweet.

Crypto partners in your location

Note: all information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

So, let's see, what was the most valuable thing of this article: litecoin witnessed a sharp 10% price fall over the past 24-hours, bringing the price for the cryptocurrency down to $70. The cryptocurrency ran into resist at litecoin rsi

Contents of the article

- Today forex bonuses

- Litecoin takes 10% hit after RSI drops beneath 50...

- Litecoin takes 10% hit after RSI drops beneath 50...

- Litecoin price analysis

- Market overview

- Short term prediction: BULLISH/NEUTRAL

- Key levels

- Litecoin trade using RSI S/R levels

- RSI price analysis: litecoin (LTC), cardano...

- Litecoin

- Cardano

- Yearn.Finance

- Binance coin

- Litecoin price analysis: RSI points to increased...

- Litecoin foundation partners with crypto lending...

- LTC/USD: technical picture implies more sell-off

- LTC/USD daily chart

- Latest crypto news

- Latest crypto news & analysis

- Editors’ picks

- XRP pumps towards $1, as the bitcoin rally cools...

- ADA looks primed for a 30% move

- Stellar at risk of a massive 20% correction

- XRP price goes under extreme manipulation by new...

- BEST CRYPTO BROKERS/EXCHANGES

- Bitcoin weekly forecast: elon musk endorses...

- Crypto partners in your location

- Litecoin rsi

- RSI price analysis: litecoin (LTC), cardano...

- Litecoin

- Cardano

- Yearn.Finance

- Binance coin

- Litecoin trade using RSI S/R levels

- Litecoin takes 10% hit after RSI drops beneath 50...

- Litecoin takes 10% hit after RSI drops beneath 50...

- Litecoin price analysis

- Market overview

- Short term prediction: BULLISH/NEUTRAL

- Key levels

- Litecoin price analysis: LTC technicals spell...

- Litecoin price may pullback before rising to...

- On-chain metrics remain bullish

- Latest crypto news

- Latest crypto news & analysis

- Editors’ picks

- XRP pumps towards $1, as the bitcoin rally cools...

- ADA looks primed for a 30% move

- Stellar at risk of a massive 20% correction

- XRP price goes under extreme manipulation by new...

- BEST CRYPTO BROKERS/EXCHANGES

- Bitcoin weekly forecast: elon musk endorses...

- Crypto partners in your location

No comments:

Post a Comment