Trading real money

The main benefit of playing trading games is clear – if you’re good enough you’ll have a reasonable chance of building up some nice cash profits.

Today forex bonuses

They can be played without risking large amounts of your own cash in the first place and if you buy and sell cleverly you can compound the growth in share values (plus any dividends earned) and end up with a valuable portfolio. Positioning themselves as a ‘fully regulated esports trading platform’ blinkpool are currently in beta test phase, although are accepting user registrations so you can be ready to trade when it goes live.

Real money share trading games

How and where to play trading games to win cash – trade in standard business shares or a range of global sports

Want to build up a nest egg for the future? Or just fancy your chances at playing the stock market but don’t want to go down the traditional share-buying route?

Well there are alternative solutions, and one that’s becoming increasingly popular is in the new types of share trading platforms.

These are similar to normal share buying, but the twist is they’re more allied to gaming than just pure financial trading. In fact some of the most popular involve trading in the participants of games – on football players or teams, or a range of teams in other sports. Knowledge is everything and they do sit prominently in the list of games of skill.

On this page we’ll take a look at some of these new share trading platforms, how they work, and which types of shares you can trade in the games.

Types of share trading games

Broadly speaking we can break down the different trading games into two main types – financial share trading and sports share trading.

No complicated stuff like forex/currency trading or binary options here!

There’s also an option to trade items or services inside virtual world games, plus a new type of trading on events in esports contests. This looks destined to attract a lot of interest from the video gaming community.

Sports share trading

Probably the most notable from a gaming perspective – trading in sports as an alternative to betting on sporting events is on the increase.

One platform that’s been running for a couple of years and has attracted a lot of fans in the UK is the footballer stock exchange run by footballindex.

The ASM exchange (at allsportsmarket.Com) is a recent operator to enter the market, and focuses on offering share trading in US sports teams across all the four major leagues – baseball, basketball, NFL, and NHL.

Others include playerssx.Com, sportsstocks.Com, and athletexchange.

Financial markets trading

First up here is a platform that really does deserve the tag of ‘innovative’ – it’s the financial trading platform run by bet-on-finance. An alternative is wallstreetsurvivor.Com .

Footballindex

If you and love football, the footballindex footballer share trading platform will be right up your street.

No more betting on soccer matches, now you can invest in the players and earn from share dividends and player value increases.

The platform lets you b uy shares in high (or low) performing players. Use your knowledge to buy the right players. Earn dividends. Sell for a profit.

Allsportsmarket

Perhaps destined to become the leading sports shares trading platform, allsportsmarket label themselves as an ‘an experimental exchange where investors can buy and sell sports teams, just like traditional stocks, and earn dividends when their teams win or appreciate in value’. They make a big point of being a non-betting operation, which will clearly be of interest to US players who cannot of course bet legally in most states.

Athletexchange

Athletexchange present their platform as the ‘ultimate fantasy sports stock market’.

Taking fantasy sports to another level – athletexchange offers the same excitement of owning your favorite players and teams as traditional fantasy offerings, but adds the dimension of a dynamic market where traders just like you buy and sell shares of players and teams. The

Playersx

Billed as a fantasy sports stock market, at players SX you’ll be buying, selling, or trading your favourite sporting athletes in NFL or NHL leagues in a similar way to stocks on the financial stock market.

You’ll be able to play at trading for real money across the whole season or for single days at a time,

You’ll also be picking up a 5% bonus on your first deposit.

Wallstreetsurvivor

Stepping away from sports trading, we now come to the biggest financial share trading game – it’s run by wallstreetsurvivor.

Here you’ll be creating your own contests for your class or club, or competing in one of the monthly contests for a share of $2,000 in prizes.

You can learn how to build and run a portfolio of stocks, and practice investment principles before risking your real money.

Blinkpool esports trading

The ability to place bets on esports is a fairly new phenomenon, and blinkpool are looking to grow their trading solution as an alternative to straight betting on teams.

Positioning themselves as a ‘fully regulated esports trading platform’ blinkpool are currently in beta test phase, although are accepting user registrations so you can be ready to trade when it goes live.

You’ll be able to watch contests and place trades on events during live esports matches, for example on the next ‘success’ in a game.

Pros & cons

The main benefit of playing trading games is clear – if you’re good enough you’ll have a reasonable chance of building up some nice cash profits. They can be played without risking large amounts of your own cash in the first place and if you buy and sell cleverly you can compound the growth in share values (plus any dividends earned) and end up with a valuable portfolio.

On the negative side they don’t offer the same excitement level of other real money games like competitive cash video gaming, more because any profits are not likely to come as quickly as they do in those types of games. Plus of course with share trading you’re exposed to unexpected bad news which can send your portfolio (if it’s not spread wide enough) into a downward spiral.

Resources

You’ll find a good list of real money stock and share trading apps here on this page, so there will be little value in linking to pages with similar lists. Equally you can get to the main share trading operators from the write ups above.

Most likely the best additional resources you’re going to find will be those that focus on understanding the vagaries of share trading and how to do it effectively.

For a beginner this guide to share trading is worth a look. It’s a little old but the principles still hold true.

For practice before getting involved for real cash try out a portfolio and trading simulator or one of the other investment game operators like virtualtrader.

Summary

Trading in stocks and shares is an ages old way of investing to build up a cash reserve, but the gamification of stock trading and more importantly its application to sporting games is just a few years old. We can expect to see innovations in the field over coming years.

For now though there are a handful of apps and operators where you can get involved. You don’t have to risk big amounts, have plenty of opportunities to learn before you do, and with good application of knowledge and skill it’s possible to play these trading games for real money successfully…..

…and who knows! You might pick up some valuable knowledge and end up one day answering a $/€/£10000 stocks and shares question in one of the real money trivia games that have sprung up recently.

Day trading: smart or stupid?

Photo credit: BRYAN R. SMITH/AFP/getty images

Whether it is related to bitcoin or mainstream stocks, day trading is the new “sexy” that gets an inordinate amount of hype. There are lots of sites that claim to; “turn you into an instant day trader” or promise that, “millions of dollars can be made just investing a few hours per day.” not to mention that “anyone can become a day trader, instantly.” if you believe all of this, I have a bridge I would like to sell you.

First, let’s first be clear about a definition of day trading. Investopedia indicates that “day trading is defined as the buying and selling of a security within a single trading day. This can occur in any marketplace, but is most common in the foreign-exchange (forex) market and stock market.”

Ideally, the day trader wants to end the day with no open positions, so they don’t have to risk holding on to a potentially risky position overnight or for a few days. That means that if the market turns against them, they could lose a lot of money. Is this a smart way to invest or is it just another “get rich scam” for the fool-hardy?

Do you have the stomach to day trade?

If you are an amateur, you may be playing with fire. Your odds of success are like those of any other high stakes gambler. The professionals really know their stuff. Typically, they are well-established, disciplined traders who are experts in the markets. The other characteristic is that they invest large sums of money, which they can afford to lose. That seems strange, but in fact, they need a lot of money to capitalize effectively on small price movements. The other factor is that when you trade larger positions, you are faced with reduced commissions compared to what a small stock day trader will face. They have money to risk; it is called “risk capital,” which is the money that they allocate for speculative purposes. This is where the high-risk/high-reward investment strategy comes in to play. They do not bet the whole farm on one trade because they could be on the wrong side of the market.

There are two types of day traders:

Professional day traders

These people work for large financial institutions. I think that this is a great way to start. First, you will be trained by professionals and not by a “do-it-yourself” online course. You may even get a mentor who will watch over you. They have all the latest tools for trading and the information on order flow and “stops” that are placed, so they will have a leg up on the small trader. You will be paid a base salary and then a bonus. Secondly, you are not investing your own money, so you have nothing at risk, except your job and your time.

Tradingsim states that the base salary at a new york financial institution “. May be about 50,000 – 7000 dollars US. This is just enough for you to pay your cable bill, feed yourself and maybe take a taxi or two.” they want you to be hungry and make your bonus because, if you make money, it means that you have made money for them. You should be earning about 10-30% of the profits you bring in, according to tradingsim.

Individual day traders

These people go it alone. Just being familiar with stocks and the market is not enough. They really need to understand technical analysis and have sophisticated tools to understand chart patterns, trading volume and price movements. Investopedia explains that “learning and understanding how these indicators work only scratches the surface of what you’ll need to know to develop a personal trading style.”

It’s important to remember that trading requires enough invested money in taking advantage of relatively small price movements. Without the price movements, you won’t make money. If you are investing small amounts of money, the gains will be minuscule and may not even cover the trading commissions you will have to pay.

Fiction will not cost you real money

If you are convinced that day trading is for you, try it out with fictional trades. The point is that you must develop your techniques of when to get into a position and when to get out. It sounds like advice you would give a gambler, right? Well, it is. Most traders develop a very disciplined process and stick to it and know when to close out a position. You can trade just a few stocks or a basket of stocks. Again, do this for about a month and calculate what you make and lose each day.

“the success rate for day traders is estimated to be around only 10%, so … 90% are losing money.” cory michael at vantage point trading is even more pessimistic (or realistic) when he says, “only 1% of [day] traders really make money.” he says it’s because of the “social mood.” put simply, by definition, if you are buying, someone else must be selling; that is the social part. The markets are a real-time thermometer; buying and selling, action and reaction. If someone is making money, someone else is losing money. You would have to join the crowd as the market is moving up and be smarter than that crowd to get out before they do, if it starts to fall.

Nial fuller at learntotradethemarket.Com quips, ”the reality of a day-trader is a guy who got 2 hours of sleep last night because he was trying to trade the overnight session, now he’s up at 6am trying to day-trade the next session. Many traders get sucked into trying to become a rich day-trader largely because that’s what they think is socially acceptable or “cool.” this scenario gives me a stomach ache, which is exactly the point. I remember walking through the trading floor at chase and hearing the moans and groans from the traders, not to mention seeing the 32 oz. Bottles of pepto-bismol prominently displayed on each of their desks.

You know my advice. Any system of betting is not designed so that the majority of people can beat it. If you are going to dabble in day trading, set aside some money that you can afford to lose, because chances are, you will. You also may want to remember the words of aristotle, (who was not a day trader, by the way), “bring your desires down to your present means. Increase them only when your increased means permit.”

I’m a new york times #1 best selling author of 27 books all empowering families (and their kids) to take charge of their financial lives. I make money lessons fun,…

Which market are you trading?

It is important to decide whether you are trading the indices or trading individual stocks because the approaches are completely different.

Traders were worried about a new strain of covid on monday morning, but stocks bounced back strongly during the day as positive price action created concern about missing out on more upside.

The indices were mixed and breadth was almost 2-to-1 negative, but it was an exceptional day for astute stock pickers. There was a very long list of stocks that were up more than 10% but most of them were not the well-known big-caps that are the main focus of the media. The big-cap technology names were mixed and the FATMAAN stocks were lackluster.

For quite a while, traders have been celebrating pockets of very hot trading. Special purpose acquisition companies (spacs) and bitcoin-related names have been the key momentum sectors, but other groups such as solar energy, biotechnology and electric vehicles have also offered exception action. It is these hot sectors that have offered huge rewards for aggressive investors.

While the indices have done well, they are not where the opportunity in this market has been. There is some positive correlation between the indices and momentum, but it is limited. Monday's action was a particularly good illustration that this is a market of stocks and not just a monolithic stock market.

The trillion-dollar question is, "how much longer does this continue?" many market players are becoming nervous at this overabundance of opportunity. Comparisons to the internet bubble of 1999-2000 are very common and the phrase "this will end badly" is constantly repeated.

Of course, the usual market timers are battling the momentum and telling us how idiotic the buyers are to ignore their carefully crafted negative narratives. The only problem is that the price action and hot sectors just aren't paying any attention to the arguments.

Traders are left with two basic choices: either embrace the skepticism and move to the sidelines right away or keep pushing and try to rack up as many gains as they can, while they can. It should be quite clear that I prefer the latter approach. I'm going to stick with my strong stocks until they weaken. I expect to lose some money in a turn, but after days such as monday I will have a pretty good cushion.

This is a tale of two markets right now. The indices look and act quite differently than the stocks in the strong momentum sectors. It is important to decide which market you are trading because the approaches are completely different.

We have a flat start here on tuesday morning but once again there is some very strong action in SPAC names such as velodyne lidar (VLDR) and quantumscape (QS) .

Real money share trading games

How and where to play trading games to win cash – trade in standard business shares or a range of global sports

Want to build up a nest egg for the future? Or just fancy your chances at playing the stock market but don’t want to go down the traditional share-buying route?

Well there are alternative solutions, and one that’s becoming increasingly popular is in the new types of share trading platforms.

These are similar to normal share buying, but the twist is they’re more allied to gaming than just pure financial trading. In fact some of the most popular involve trading in the participants of games – on football players or teams, or a range of teams in other sports. Knowledge is everything and they do sit prominently in the list of games of skill.

On this page we’ll take a look at some of these new share trading platforms, how they work, and which types of shares you can trade in the games.

Types of share trading games

Broadly speaking we can break down the different trading games into two main types – financial share trading and sports share trading.

No complicated stuff like forex/currency trading or binary options here!

There’s also an option to trade items or services inside virtual world games, plus a new type of trading on events in esports contests. This looks destined to attract a lot of interest from the video gaming community.

Sports share trading

Probably the most notable from a gaming perspective – trading in sports as an alternative to betting on sporting events is on the increase.

One platform that’s been running for a couple of years and has attracted a lot of fans in the UK is the footballer stock exchange run by footballindex.

The ASM exchange (at allsportsmarket.Com) is a recent operator to enter the market, and focuses on offering share trading in US sports teams across all the four major leagues – baseball, basketball, NFL, and NHL.

Others include playerssx.Com, sportsstocks.Com, and athletexchange.

Financial markets trading

First up here is a platform that really does deserve the tag of ‘innovative’ – it’s the financial trading platform run by bet-on-finance. An alternative is wallstreetsurvivor.Com .

Footballindex

If you and love football, the footballindex footballer share trading platform will be right up your street.

No more betting on soccer matches, now you can invest in the players and earn from share dividends and player value increases.

The platform lets you b uy shares in high (or low) performing players. Use your knowledge to buy the right players. Earn dividends. Sell for a profit.

Allsportsmarket

Perhaps destined to become the leading sports shares trading platform, allsportsmarket label themselves as an ‘an experimental exchange where investors can buy and sell sports teams, just like traditional stocks, and earn dividends when their teams win or appreciate in value’. They make a big point of being a non-betting operation, which will clearly be of interest to US players who cannot of course bet legally in most states.

Athletexchange

Athletexchange present their platform as the ‘ultimate fantasy sports stock market’.

Taking fantasy sports to another level – athletexchange offers the same excitement of owning your favorite players and teams as traditional fantasy offerings, but adds the dimension of a dynamic market where traders just like you buy and sell shares of players and teams. The

Playersx

Billed as a fantasy sports stock market, at players SX you’ll be buying, selling, or trading your favourite sporting athletes in NFL or NHL leagues in a similar way to stocks on the financial stock market.

You’ll be able to play at trading for real money across the whole season or for single days at a time,

You’ll also be picking up a 5% bonus on your first deposit.

Wallstreetsurvivor

Stepping away from sports trading, we now come to the biggest financial share trading game – it’s run by wallstreetsurvivor.

Here you’ll be creating your own contests for your class or club, or competing in one of the monthly contests for a share of $2,000 in prizes.

You can learn how to build and run a portfolio of stocks, and practice investment principles before risking your real money.

Blinkpool esports trading

The ability to place bets on esports is a fairly new phenomenon, and blinkpool are looking to grow their trading solution as an alternative to straight betting on teams.

Positioning themselves as a ‘fully regulated esports trading platform’ blinkpool are currently in beta test phase, although are accepting user registrations so you can be ready to trade when it goes live.

You’ll be able to watch contests and place trades on events during live esports matches, for example on the next ‘success’ in a game.

Pros & cons

The main benefit of playing trading games is clear – if you’re good enough you’ll have a reasonable chance of building up some nice cash profits. They can be played without risking large amounts of your own cash in the first place and if you buy and sell cleverly you can compound the growth in share values (plus any dividends earned) and end up with a valuable portfolio.

On the negative side they don’t offer the same excitement level of other real money games like competitive cash video gaming, more because any profits are not likely to come as quickly as they do in those types of games. Plus of course with share trading you’re exposed to unexpected bad news which can send your portfolio (if it’s not spread wide enough) into a downward spiral.

Resources

You’ll find a good list of real money stock and share trading apps here on this page, so there will be little value in linking to pages with similar lists. Equally you can get to the main share trading operators from the write ups above.

Most likely the best additional resources you’re going to find will be those that focus on understanding the vagaries of share trading and how to do it effectively.

For a beginner this guide to share trading is worth a look. It’s a little old but the principles still hold true.

For practice before getting involved for real cash try out a portfolio and trading simulator or one of the other investment game operators like virtualtrader.

Summary

Trading in stocks and shares is an ages old way of investing to build up a cash reserve, but the gamification of stock trading and more importantly its application to sporting games is just a few years old. We can expect to see innovations in the field over coming years.

For now though there are a handful of apps and operators where you can get involved. You don’t have to risk big amounts, have plenty of opportunities to learn before you do, and with good application of knowledge and skill it’s possible to play these trading games for real money successfully…..

…and who knows! You might pick up some valuable knowledge and end up one day answering a $/€/£10000 stocks and shares question in one of the real money trivia games that have sprung up recently.

Day trading: smart or stupid?

Photo credit: BRYAN R. SMITH/AFP/getty images

Whether it is related to bitcoin or mainstream stocks, day trading is the new “sexy” that gets an inordinate amount of hype. There are lots of sites that claim to; “turn you into an instant day trader” or promise that, “millions of dollars can be made just investing a few hours per day.” not to mention that “anyone can become a day trader, instantly.” if you believe all of this, I have a bridge I would like to sell you.

First, let’s first be clear about a definition of day trading. Investopedia indicates that “day trading is defined as the buying and selling of a security within a single trading day. This can occur in any marketplace, but is most common in the foreign-exchange (forex) market and stock market.”

Ideally, the day trader wants to end the day with no open positions, so they don’t have to risk holding on to a potentially risky position overnight or for a few days. That means that if the market turns against them, they could lose a lot of money. Is this a smart way to invest or is it just another “get rich scam” for the fool-hardy?

Do you have the stomach to day trade?

If you are an amateur, you may be playing with fire. Your odds of success are like those of any other high stakes gambler. The professionals really know their stuff. Typically, they are well-established, disciplined traders who are experts in the markets. The other characteristic is that they invest large sums of money, which they can afford to lose. That seems strange, but in fact, they need a lot of money to capitalize effectively on small price movements. The other factor is that when you trade larger positions, you are faced with reduced commissions compared to what a small stock day trader will face. They have money to risk; it is called “risk capital,” which is the money that they allocate for speculative purposes. This is where the high-risk/high-reward investment strategy comes in to play. They do not bet the whole farm on one trade because they could be on the wrong side of the market.

There are two types of day traders:

Professional day traders

These people work for large financial institutions. I think that this is a great way to start. First, you will be trained by professionals and not by a “do-it-yourself” online course. You may even get a mentor who will watch over you. They have all the latest tools for trading and the information on order flow and “stops” that are placed, so they will have a leg up on the small trader. You will be paid a base salary and then a bonus. Secondly, you are not investing your own money, so you have nothing at risk, except your job and your time.

Tradingsim states that the base salary at a new york financial institution “. May be about 50,000 – 7000 dollars US. This is just enough for you to pay your cable bill, feed yourself and maybe take a taxi or two.” they want you to be hungry and make your bonus because, if you make money, it means that you have made money for them. You should be earning about 10-30% of the profits you bring in, according to tradingsim.

Individual day traders

These people go it alone. Just being familiar with stocks and the market is not enough. They really need to understand technical analysis and have sophisticated tools to understand chart patterns, trading volume and price movements. Investopedia explains that “learning and understanding how these indicators work only scratches the surface of what you’ll need to know to develop a personal trading style.”

It’s important to remember that trading requires enough invested money in taking advantage of relatively small price movements. Without the price movements, you won’t make money. If you are investing small amounts of money, the gains will be minuscule and may not even cover the trading commissions you will have to pay.

Fiction will not cost you real money

If you are convinced that day trading is for you, try it out with fictional trades. The point is that you must develop your techniques of when to get into a position and when to get out. It sounds like advice you would give a gambler, right? Well, it is. Most traders develop a very disciplined process and stick to it and know when to close out a position. You can trade just a few stocks or a basket of stocks. Again, do this for about a month and calculate what you make and lose each day.

“the success rate for day traders is estimated to be around only 10%, so … 90% are losing money.” cory michael at vantage point trading is even more pessimistic (or realistic) when he says, “only 1% of [day] traders really make money.” he says it’s because of the “social mood.” put simply, by definition, if you are buying, someone else must be selling; that is the social part. The markets are a real-time thermometer; buying and selling, action and reaction. If someone is making money, someone else is losing money. You would have to join the crowd as the market is moving up and be smarter than that crowd to get out before they do, if it starts to fall.

Nial fuller at learntotradethemarket.Com quips, ”the reality of a day-trader is a guy who got 2 hours of sleep last night because he was trying to trade the overnight session, now he’s up at 6am trying to day-trade the next session. Many traders get sucked into trying to become a rich day-trader largely because that’s what they think is socially acceptable or “cool.” this scenario gives me a stomach ache, which is exactly the point. I remember walking through the trading floor at chase and hearing the moans and groans from the traders, not to mention seeing the 32 oz. Bottles of pepto-bismol prominently displayed on each of their desks.

You know my advice. Any system of betting is not designed so that the majority of people can beat it. If you are going to dabble in day trading, set aside some money that you can afford to lose, because chances are, you will. You also may want to remember the words of aristotle, (who was not a day trader, by the way), “bring your desires down to your present means. Increase them only when your increased means permit.”

I’m a new york times #1 best selling author of 27 books all empowering families (and their kids) to take charge of their financial lives. I make money lessons fun,…

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Real-world trading

Real-world trading (RWT), also called real-world item trading (RWIT), is the act of trading anything outside of runescape (usually real-world money) for runescape items or services, or vice versa. Legally, every item in runescape is the property of jagex, and therefore cannot be considered as personal property of the player. Players who conduct RWT violate rule 12, and risk being permanently banned without warning.

There are two general kinds of real-world traders: personal sellers and companies. Personal sellers are people who exchange virtual items and real money on their own behalf and do it on a more casual basis, while larger groups and companies engaged in this practice via websites and on a more public and formal basis. Both kinds of RWT are considered violations of rule 12 and are treated identically by jagex if evidence is presented or found to suggest an RWT action has occurred or is being arranged.

Contents

- 1 rule breaking

- 2 rationale for being against RWT

- 3 RWT criminal behaviour

- 4 the removal of real-world-traders

- 4.1 jagex's initial response

- 4.2 jagex's actions

- 4.3 players' reactions

- 4.4 jagex's stance

- 4.5 real-world traders' reactions

- 5 controversies

- 5.1 runefest 2010

- 5.2 "exclusive item" membership card promotion

- 5.3 runefest 2011

- 5.4 banned account reinstatement

- 5.5 refer a friend programme

- 5.6 go green for halloween (green skin)

- 5.7 golden scythe

- 5.8 squeal of fortune

- 5.9 removal of real-life ability paragraph in rule

- 6 examples

- 7 references

Rule breaking

Real-world item traders often get money and items in-game through devious means; they use bots to gather money and items, exploit bugs in the game, and scam players of their items and accounts, therefore making them the cause of the majority of rulebreaking in-game.

Because real-world trading is against runescape's rules, some players have tried to find legal loopholes, such as claiming that the real money is paid for the time spent, that the transfers of real and virtual items are independent, or even that they were selling a joke and it came with an account/money. However, jagex still says that these methods are against rules.

Over time, jagex has banned many players for this behaviour and has implemented some updates in-game to stop this, but it has not been without controversy.

Rationale for being against RWT

Some mmorpgs have been known to encourage RWT, and have even provided legal means to engage in trading items for real-world money. For some of these games, there are even stores that allow you to buy in-game currency, or to be able to unlock special features of the game.

In the case of runescape, until recently the only differences that could be achieved by paying additional money had was that you can pay for a membership subscription to provide access to member content and benefits and obtain a special promotion item such as a katana/green skin/turkeyhat/ice man mask/barbed bow/flaming skull through the timing and placement of your subscription payment. However, jagex introduced (on 2 april 2012) the ability to pay real money for spins on the squeal of fortune and runecoins for use in solomon's general store , which can reward the player with a variety of rewards. Other than these four exceptions, all players of runescape are treated identically in terms of what sorts of content is available to them.

Andrew gower, one of the co-founders of jagex and the original developer who created runescape, pointed out that introducing the ability to engage in real-world item trading significantly modifies player behaviour and puts players with access to significant "real-life" financial resources on an unfair footing with other players, distorting many aspects of game play and changing the relationship between the company and players. As a long time multi-player game player himself, mr. Gower saw the impact of real-world item trades and how it changed the behaviour of players who obtained these items in other games. Mr. Gower left the company before the squeal of fortune and solomon's general store were placed into the game. This is one rule that was established at the very beginning when runescape was still being designed and before any players even started to play this game.

An example of how this distorts the game play is in particular with "gold farmers", or resource gatherers that work for the RWT companies. While "macros" or "bots" are sometimes used for automating boring tasks, there are sometimes employees of the RWT companies who also are "playing" runescape with other more normal players. However, their purpose in being in the game is not necessarily to have fun or to try different things out. They are actually getting paid to perform menial tasks like chopping logs, mining ore, or engaging in other resource gathering. Some of these accounts are shared between multiple employees, so it isn't unusual for an account to be used 24 hours per day. Usually for some tasks where a player would eventually get bored with doing the same repetitive actions over and over again, the gold farmers "camp" out in resource gathering areas for more efficient collecting. As these are not programs, but actual live people, anti-macro measures such as the random events cannot prevent this.

By facilitating some sort of exchange to take place between the virtual currencies and real-world currencies, it may open up legal liabilities issues for jagex and the player community for real-world taxation laws, including income taxes, violations of gambling laws in many countries or political jurisdictions, and regulatory oversight by banking institutions and the financial ministries (or executive departments like the US I.R.S.) over in-game content. This sort of complex government regulation is something companies like jagex often try to avoid. By not facilitating RWT or even permitting it at all, jagex is able to avoid having to report to these government regulatory agencies or be licensed as a banking organisation.

RWT criminal behaviour

Upon review of the kinds of individuals involved with RWT, and in particular the corporate entities involved with this trade, discoveries of other sorts of real-life criminal activity has also taken place by these organisations.

Other criminal activities also occur, including money laundering where financial transactions from other criminal activity is included with income from RWT activities to "legitimize" the income, and to help provide capital resources for funding other criminal enterprises.

Perhaps the most significant issue that jagex had to directly face was the use of stolen credit cards being used to pay for membership fees by RWT organisations. Credit card information was obtained from other criminal activities and then used to help pay for the gold farmer accounts on member worlds. Where after a certain period of time it would be reported that the card was stolen. When this happens, the "vendor" (in this case jagex) is required by the credit card agreements to refund the unauthorized spending. This issue very directly impacted jagex from a fiscal standpoint, and represented a significant loss of income for jagex as a company - although of course these amounts did not represent part of the legitimate player base. It is usually up to the vendor (jagex) to recover the money, but issues of jurisdiction evidence and the individually small sums involved make this difficult.

The removal of real-world-traders

Jagex's initial response

As this issue grew, jagex increased efforts to counter real world trading. In early 2007, jagex began performing mass-bans on real world trading accounts, the first of which was made public on 1 may. Jagex also introduced more complicated random events, a new rune essence system, and began recruitment of additional player moderators.

On the 'runescape' december 'behind the scenes', jagex informed everyone that they would be taking EXTREME measures in order to finally be rid of RWT. A quote from the article:

"on a more serious note, many of you will be aware of our efforts to stop real-world trading and how some of our recent updates have been part of that. You may have questions about it: what does it mean? How does it affect the game? How big a problem is it? What are the ways of dealing with it? To answer these questions and more, we'll be releasing a very important development diary on the subject."

Jagex's actions

On 10 december of 2007, jagex released four major updates, all of which were instrumental in their attempt to end real world trading:

They found nearly every way possible to keep RWT from happening, including removing unbalanced trading and making a limit on how much people could stake in the duel arena, changing the way dropped items acted, modifying the party room and getting rid of player killing in the wilderness.

To replace pking thoughout the wilderness, jagex added bounty hunter, clan wars and revenants. Later, they added fist of guthix and pvp worlds.

Players' reactions

Due to these updates, riots broke out all across runescape. There were also many smaller riots going on around, and thousands of players reportedly quit the game. There was a common misconception that players that quit the game would cost jagex money, however, the loss of tens of thousands of member RWT's far outweighed the loss of a few thousand quitting players.

Jagex's stance

Jagex claimed that real-world trading had been much more devastating to runescape. Not only had there been illegal trades of money for items and gold, but it caused many larger problems. Jagex stated that many rwts committed credit card fraud, using stolen credit card numbers to pay for their P2P gold-farming accounts, costing jagex a large amount of money.

Real-world traders' reactions

Since the updates, most of the various real-world trading companies began requesting the customer's account, password, and bank PIN, and then farm the gold on the customer's account, similar to power-levelling, as this is one of the only options left for real-world trading. Another method was transferring the items between accounts via bounty hunter, however bounty hunter was later removed, making this no longer possible. Today, due to the free trade and wilderness update, most companies do not require your password for gold orders and will meet face to face at a certain time to transfer your gold.

Controversies

Runefest 2010

On 28 april 2010, jagex added a new option to the in-game NPC diango, allowing players who had purchased a ticket for runefest 2010 to exchange a code to receive a unique in-game item, the flagstaff of festivities. Those who have bought tickets for the runefest 2010 event will be emailed item codes for each ticket which they have purchased. A great deal of controversy was therefore sparked on the runescape official forums, as players felt that due to the requirement of purchasing a ticket to obtain the item, jagex were participating in 'real-world trading' or microtransactions, therefore going against jagex's apparent stance on real-world trading. The defence jagex used was questionable, arguing that the players were not buying the flagstaff, but tickets to an event, which is exactly the logic that jagex refuted when raised as a defence in certain RWT activities.

"exclusive item" membership card promotion

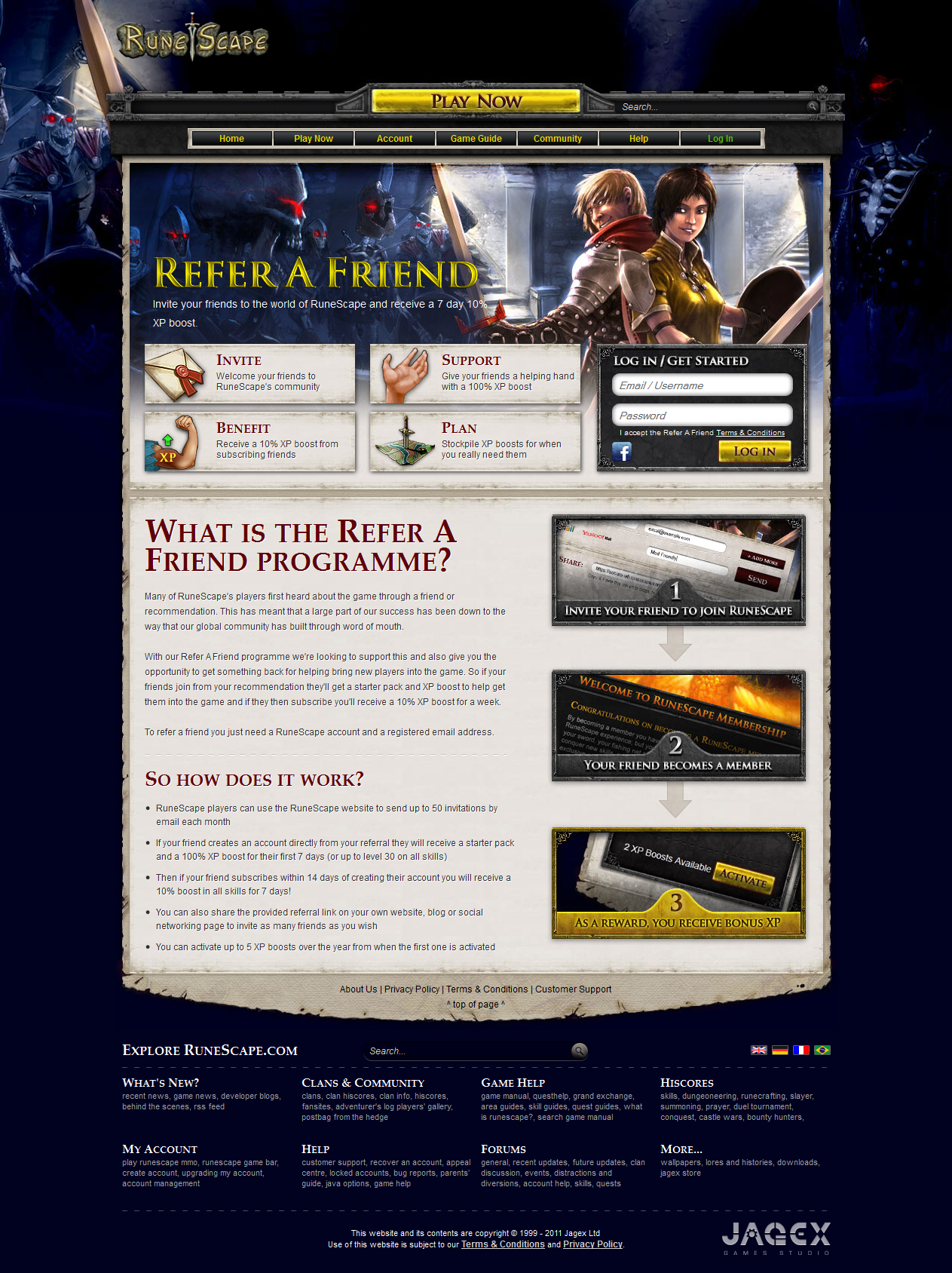

The main page advertisement for the promotion.

On 14 june 2011, jagex started a promotion in which american customers buying membership cards would also receive the exclusive in-game ornate katana. The only way to obtain the katana was by purchasing a 90-day membership card at a gamestop location within the united states between 20 june and 10 july [1] . People who subscribe from other countries, use other methods, buy membership cards from other stores or for different durations, or purchase membership on other days cannot obtain the katana. The controversy was not just because of the selling of an in-game item, but also because the promotion is exclusive to the point that most members either could not obtain the item without great inconvenience or expense. This offer was advertised on the main page but not within an article. Some people in the runescape community felt that jagex was actually performing RWT themselves in this update.

Runefest 2011

The runefest website was updated to announce that yet another item would be given to those who purchase tickets for runefest 2011. In the FAQ, it was announced "flagstaffs are so last year! But don’t worry this year attendees will still get something awesome to show off in-game." similar to the runefest controversy the previous year, many players see this as jagex participating in real-world trading.

Banned account reinstatement

Banned account reinstatement allowed banned players to pay jagex real-world money to get their accounts unbanned, however with a severe rollback to both stats and items on the account. Many players considered it controversial as some players saw it as real-world trading. Whether an account can receive a banned account reinstatement or not is completely at jagex's discretion. Not every banned account could participate in account reinstatement.

Refer a friend programme

This update grants members who refer a prospective user an experience boost of 10% to all their skills for one week. This will only apply should the new player also purchase runescape membership, and following this they too will receive an experience boost in any skill under level 30. The programme sparked much outrage amongst players all across runescape, who staged a large riot on world 66, the most common server for demonstrations and riots. The players accused jagex of real-world trading, due to the fact that by paying real-world money, new members could be given a free experience boost, along with the player that referred them. Many players also felt that granting these boosts would greatly encourage and profit macro accounts, which is an offence that can result in a permanent ban. Hundreds of players took part in a riot in falador square, shouting such things as "ban the bots!", "we pay we say!", and "welcome to botscape!".

RWT companies create the bots, bot the game at the expense of players and keep the cash. Everytime we sell membership we are real-world trading. Runescape wouldn't exist if we didn't do it.

Go green for halloween (green skin)

This update allowed players to change their skin green but to make this option available for good you had to buy and redeem a 30 or 35 day membership card between 20 october 2011 - 4 november 2011.

Golden scythe

This item was given only to 25 select players who attended runefest 2011, and as this event had an entry fee, real money was used to get a chance at winning the item.

Squeal of fortune

On 2 april 2012, jagex introduced the ability to purchase spins on the squeal of fortune. Possible rewards from the squeal of fortune include money and experience. This meant that players could buy experience, rare items, and gold in much the same way as they could from real-world trading companies. On 4 february 2014, the squeal of fortune was replaced by treasure hunter, which allows players to purchase keys for in-game rewards.

Removal of real-life ability paragraph in rule

On 6 april 2012, jagex removed the following paragraph from the RWT rule:

| “ | we don't want players to be able to buy their way to success in runescape. If we let players start doing this, it devalues runescape for others. We feel your status in real-life shouldn't affect your ability to be successful in runescape. | ” |

Many players demanded an explanation from jagex about the removal of the paragraph from the rules, because it was previously used as reasoning when other controversial updates were implemented.

Some players believe the paragraph was removed because of jagex's recent stance on marketing, with the implementation of updates such as the squeal of fortune and refer a friend programme. According to mod moltare, the squeal of fortune and refer a friend programme are not real-world trading because real-world trading is a third party to third party situation.

Subsequently, in october 2013, bonds were introduced, which effectively allow players to purchase in-game wealth from other players via a form of credit bought from jagex.

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Real money share trading games

How and where to play trading games to win cash – trade in standard business shares or a range of global sports

Want to build up a nest egg for the future? Or just fancy your chances at playing the stock market but don’t want to go down the traditional share-buying route?

Well there are alternative solutions, and one that’s becoming increasingly popular is in the new types of share trading platforms.

These are similar to normal share buying, but the twist is they’re more allied to gaming than just pure financial trading. In fact some of the most popular involve trading in the participants of games – on football players or teams, or a range of teams in other sports. Knowledge is everything and they do sit prominently in the list of games of skill.

On this page we’ll take a look at some of these new share trading platforms, how they work, and which types of shares you can trade in the games.

Types of share trading games

Broadly speaking we can break down the different trading games into two main types – financial share trading and sports share trading.

No complicated stuff like forex/currency trading or binary options here!

There’s also an option to trade items or services inside virtual world games, plus a new type of trading on events in esports contests. This looks destined to attract a lot of interest from the video gaming community.

Sports share trading

Probably the most notable from a gaming perspective – trading in sports as an alternative to betting on sporting events is on the increase.

One platform that’s been running for a couple of years and has attracted a lot of fans in the UK is the footballer stock exchange run by footballindex.

The ASM exchange (at allsportsmarket.Com) is a recent operator to enter the market, and focuses on offering share trading in US sports teams across all the four major leagues – baseball, basketball, NFL, and NHL.

Others include playerssx.Com, sportsstocks.Com, and athletexchange.

Financial markets trading

First up here is a platform that really does deserve the tag of ‘innovative’ – it’s the financial trading platform run by bet-on-finance. An alternative is wallstreetsurvivor.Com .

Footballindex

If you and love football, the footballindex footballer share trading platform will be right up your street.

No more betting on soccer matches, now you can invest in the players and earn from share dividends and player value increases.

The platform lets you b uy shares in high (or low) performing players. Use your knowledge to buy the right players. Earn dividends. Sell for a profit.

Allsportsmarket

Perhaps destined to become the leading sports shares trading platform, allsportsmarket label themselves as an ‘an experimental exchange where investors can buy and sell sports teams, just like traditional stocks, and earn dividends when their teams win or appreciate in value’. They make a big point of being a non-betting operation, which will clearly be of interest to US players who cannot of course bet legally in most states.

Athletexchange

Athletexchange present their platform as the ‘ultimate fantasy sports stock market’.

Taking fantasy sports to another level – athletexchange offers the same excitement of owning your favorite players and teams as traditional fantasy offerings, but adds the dimension of a dynamic market where traders just like you buy and sell shares of players and teams. The

Playersx

Billed as a fantasy sports stock market, at players SX you’ll be buying, selling, or trading your favourite sporting athletes in NFL or NHL leagues in a similar way to stocks on the financial stock market.

You’ll be able to play at trading for real money across the whole season or for single days at a time,

You’ll also be picking up a 5% bonus on your first deposit.

Wallstreetsurvivor

Stepping away from sports trading, we now come to the biggest financial share trading game – it’s run by wallstreetsurvivor.

Here you’ll be creating your own contests for your class or club, or competing in one of the monthly contests for a share of $2,000 in prizes.

You can learn how to build and run a portfolio of stocks, and practice investment principles before risking your real money.

Blinkpool esports trading

The ability to place bets on esports is a fairly new phenomenon, and blinkpool are looking to grow their trading solution as an alternative to straight betting on teams.

Positioning themselves as a ‘fully regulated esports trading platform’ blinkpool are currently in beta test phase, although are accepting user registrations so you can be ready to trade when it goes live.

You’ll be able to watch contests and place trades on events during live esports matches, for example on the next ‘success’ in a game.

Pros & cons

The main benefit of playing trading games is clear – if you’re good enough you’ll have a reasonable chance of building up some nice cash profits. They can be played without risking large amounts of your own cash in the first place and if you buy and sell cleverly you can compound the growth in share values (plus any dividends earned) and end up with a valuable portfolio.

On the negative side they don’t offer the same excitement level of other real money games like competitive cash video gaming, more because any profits are not likely to come as quickly as they do in those types of games. Plus of course with share trading you’re exposed to unexpected bad news which can send your portfolio (if it’s not spread wide enough) into a downward spiral.

Resources

You’ll find a good list of real money stock and share trading apps here on this page, so there will be little value in linking to pages with similar lists. Equally you can get to the main share trading operators from the write ups above.

Most likely the best additional resources you’re going to find will be those that focus on understanding the vagaries of share trading and how to do it effectively.

For a beginner this guide to share trading is worth a look. It’s a little old but the principles still hold true.

For practice before getting involved for real cash try out a portfolio and trading simulator or one of the other investment game operators like virtualtrader.

Summary

Trading in stocks and shares is an ages old way of investing to build up a cash reserve, but the gamification of stock trading and more importantly its application to sporting games is just a few years old. We can expect to see innovations in the field over coming years.

For now though there are a handful of apps and operators where you can get involved. You don’t have to risk big amounts, have plenty of opportunities to learn before you do, and with good application of knowledge and skill it’s possible to play these trading games for real money successfully…..

…and who knows! You might pick up some valuable knowledge and end up one day answering a $/€/£10000 stocks and shares question in one of the real money trivia games that have sprung up recently.

So, let's see, what was the most valuable thing of this article: learn how and where to trade stocks and shares for real money. Review of share trading games including sports-related stocks and financial share trading. At trading real money

Contents of the article

- Today forex bonuses

- Real money share trading games

- Types of share trading games

- Footballindex

- Allsportsmarket

- Athletexchange

- Playersx

- Wallstreetsurvivor

- Blinkpool esports trading

- Pros & cons

- Resources

- Summary

- Day trading: smart or stupid?

- Which market are you trading?

- Real money share trading games

- Types of share trading games

- Footballindex

- Allsportsmarket

- Athletexchange

- Playersx

- Wallstreetsurvivor

- Blinkpool esports trading

- Pros & cons

- Resources

- Summary

- Day trading: smart or stupid?

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Real-world trading

- Contents

- Rule breaking

- Rationale for being against RWT

- RWT criminal behaviour

- The removal of real-world-traders

- Jagex's initial response

- Jagex's actions

- Players' reactions

- Jagex's stance

- Real-world traders' reactions

- Controversies

- Runefest 2010

- "exclusive item" membership card promotion

- Runefest 2011

- Banned account reinstatement

- Refer a friend programme

- Go green for halloween (green skin)

- Golden scythe

- Squeal of fortune

- Removal of real-life ability paragraph in rule

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Real money share trading games

- Types of share trading games

- Footballindex

- Allsportsmarket

- Athletexchange

- Playersx

- Wallstreetsurvivor

- Blinkpool esports trading

- Pros & cons

- Resources

- Summary

No comments:

Post a Comment