Minimum deposit for tickmill

- Free and unlimited

- No deposits are necessary

- Profits can be withdrawn

- No risks

Today forex bonuses

You can use the buttons below to open your account and get a 5% rebate on commission with the broker. In the picture below you see the account form to open your account. Type in your personal detail and check them. They should be correct. Tickmill can only accept real and personal data which will be verified later.

Tickmill minimum deposit | tutorial

You want to know how to deposit on forex broker tickmill? – then you are completely right on this website. In the next sections, we will show you exactly how it works and the deposit methods. Also, we will discuss the no deposit bonus of tickmill. Learn how to open and capitalize on your trading account to invest in different financial markets.

Tickmill deposit methods (depending on your country)

Overview about the tickmill deposit methods

Tickmill offers more than 10 different deposit methods. You can use electronic wallets, credit cards, online banking, or the bank wire to deposit funds to your trading account. The deposit methods are depending on your country of residence and the regulation of tickmill. The broker got 3 different regulators and also the company is using only regulated payment methods.

Overview about all payment methods:

| payment method: | minimum deposit: | minimum withdrawal: |

|---|---|---|

| bank transfer: | € / $ / £ 100 | € / $ / £ 25 |

| credit cards: | € / $ / £ 100 | € / $ / £ 25 |

| skrill: | € / $ / £ 100 | € / $ / £ 25 |

| neteller: | € / $ / £ 100 | € / $ / £ 25 |

| sticpay: | € / $ / £ 100 | € / $ / £ 25 |

| fasapay: | € / $ / £ 100 or 1,500,000 rp | € / $ / £ 25 |

| unionpay: | 700 ¥ or € / $ / £ 100 | € / $ / £ 25 |

| nganluong.Vn: | 2,000,000 VND | € / $ / £ 25 |

| qiwi: | € / $ / £ 100 | € / $ / £ 25 |

| webmoney: | € / $ 100 | € / $ 25 |

Are there fees for the deposit?

Tickmill does not charge any fees for the deposit or withdrawal. But sometimes traders deposit with foreign currencies so there can be a currency exchange fee depending on your deposit method. In addition, if you make a international transfer your bank can charge a fee. In conclusion, tickmill is not charge any fees.

Step by step tutorial to open your account and make the deposit

In the following sections, we will show you step by step how to open the account and make the deposit on tickmill. From our experience, it is very easy to do the process but you should pay attention in order to get fully satisfied.

1. Open your free customer account with tickmill

First of all, you have to open the account on the tickmills website. You can use the buttons below to open your account and get a 5% rebate on commission with the broker. In the picture below you see the account form to open your account. Type in your personal detail and check them. They should be correct. Tickmill can only accept real and personal data which will be verified later.

Furthermore, tickmill got 3 regulators. Traders outside the european union should trade with the FSA of seychelles regulator and european clients should be trade with the FCA of united kingdom regulator. After you registered you can can continue with the next step.

Tickmill account opening

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

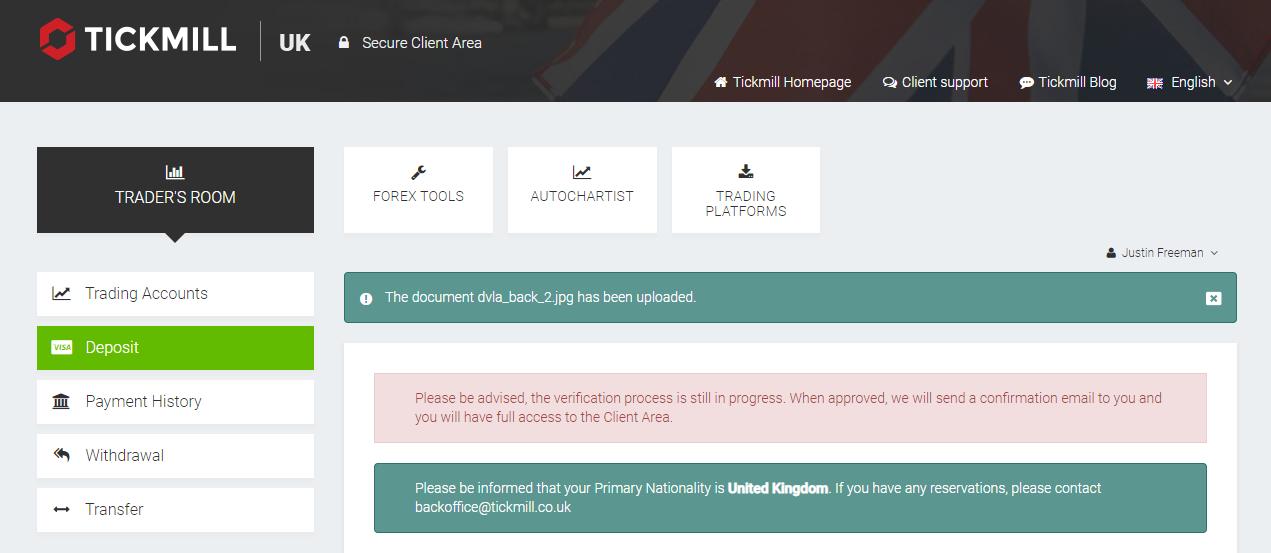

2. Verify you account

In order to start trading with real money, you have to verify the account fully. To trade with the demo account you do not have to verify. We recommend doing this step quickly.

Verify your email address first and then you get access to the customer area. Tickmill will ask you additional questions about your personal data and trading experience. After you finished the question you should verify your personal data. Upload the required documents. Tickmill accepts photos or scans of passports and utility bills. Also, bank statements are accepted. In the customer area, you will see which documents are required and accepted.

Tickmill will verify the documents within a few hours. To get the account even faster verified you can contact the chat support.

- Complete the personal data section

- Upload the required documents

- Tickmill will verify your account in a few hours

3. Open the real trading account in the customer area

Once you logged into the customer area (traders room) you can open new trading accounts by clicking on “+ open new account”. In the picture below you will see the account dashbord with the marked field.

4. Do the deposit on your account

Now you are finished after opening the trading account. Just click on the deposit to fund your account. Also, you can transfer money between different trading account and make a fast withdrawal. With some methods, the money will be instantly credited to your account balance.

Are your funds safe with tickmill?

As mentioned before tickmill is a regulated broker. So a fraud can be excluded. The client’s funds are managed in european tier 1 banks and separated from the company funds. You always have access to your money. Furthermore, tickmill is a member of the financial service compensation scheme (FSCS) for UK regulations. The funds are compensated by £85,000 per client.

Also, tickmill is part of the investor compensation fund (ICF) regulated by the cysec. Overall, your funds are very safe with tickmill. There is no scam or hidden fees for you.

- Multi-regulated forex broker

- Member of the FSCS

- Member of the ICF

- Separated clients funds

Tickmill no deposit bonus – welcome account

Tickmill offers all international traders which are trading with the FSA SC license a free no deposit bonus ($30 welcome account). There are no hidden fees or costs for you. If you registered fully you will get a free $30 bonus to your trading account. Note that you can apply the bonus only once. Existing clients are not allowed to get the $30 bonus.

Tickmill $30 welcome account and bonus

You do not need to deposit any funds in order to get the $30 and there is no risk of losing money. The profits which are made from the bonus can be withdrawn quickly. All in all, tickmill is one of the few brokers who is offering such a special service to its clients. Use the button below to sign up and get the free bonus.

- Free and unlimited

- No deposits are necessary

- Profits can be withdrawn

- No risks

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Conclusion: the deposit on tickmill is quite simple

On this page, we actually showed you how to deposit on the popular forex broker tickmill. It is one of the fastest-growing brands for forex trading because the service and offers of this broker are amazing. You pay very low fees compared to other companies. In addition, there are no fees for your deposit on tickmill.

The deposit is working very fast with different methods. But note that you need a fully verified account in order to use all functions of the broker. Tickmill is regulated and very secure. The funds are managed in big european banks and the company is part of the financial services compensation scheme and investor compensation fund.

What you learned about the tickmill deposit:

- Use more than 10 different methods

- Fast deposits

- No fees

- You need a fully verified account

- You can apply for a $30 bonus

- The regulated and secure company,

- The minimum deposit is $100

Traders are allowed to deposit very fast with more than 10 methods to tickmill. Also, the funds are very safe with this broker. (5 / 5)

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

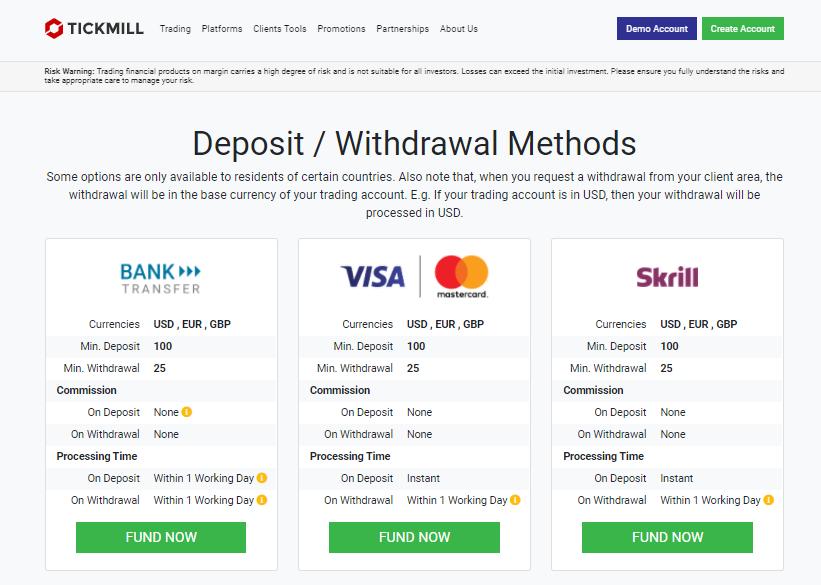

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

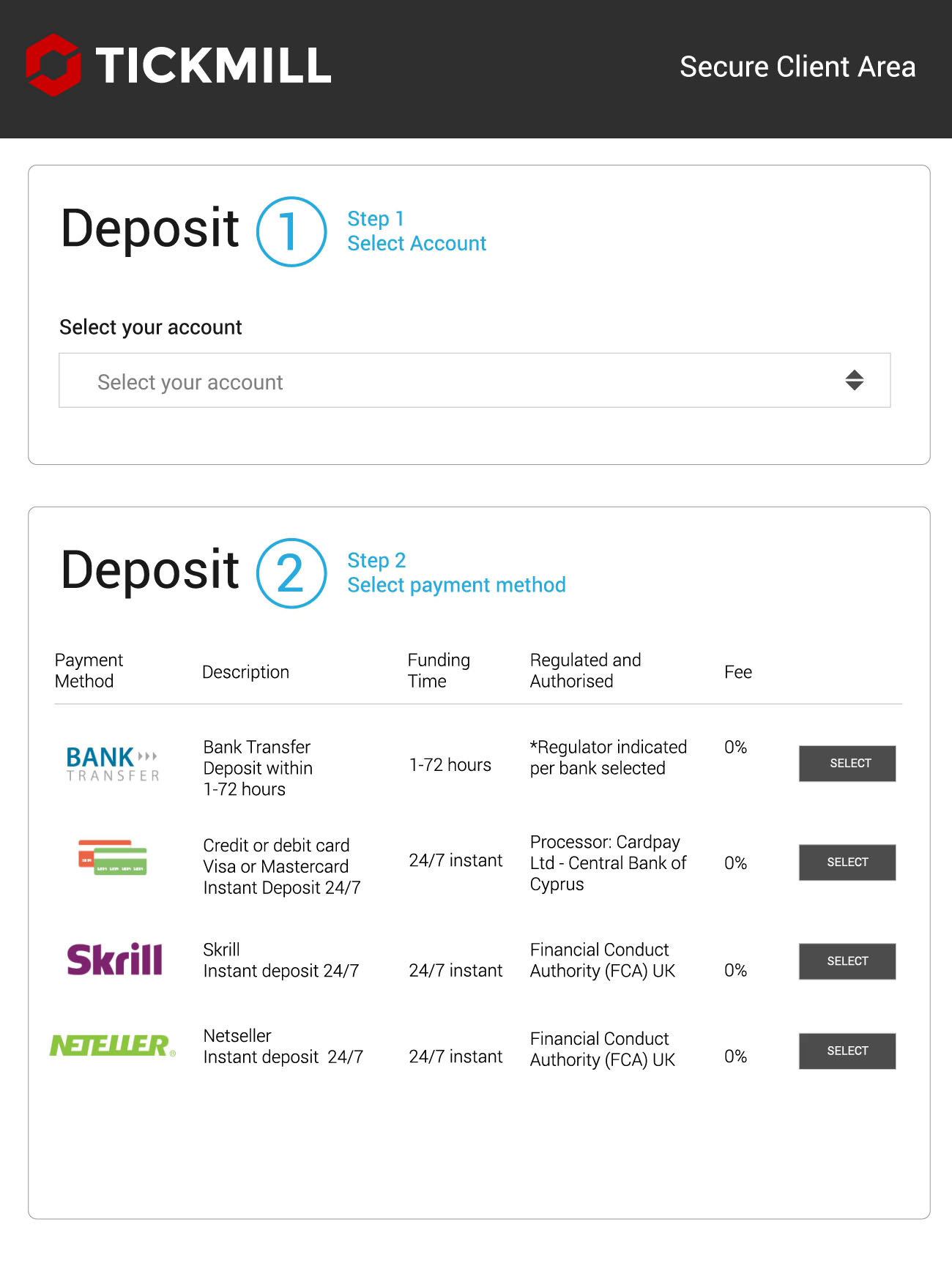

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

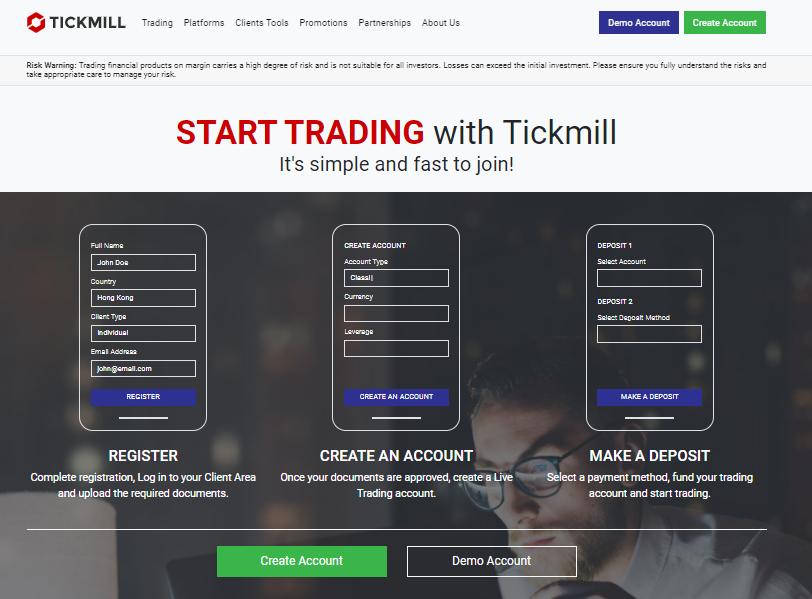

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill minimum deposit and fees overview

If you’re making a short-list of brokers to choose from, there are a lot of factors to consider. Do they cover the markets you want to trade, what are the fees and commissions, is the customer service high-grade?

One feature that sometimes flies below the radar is the minimum deposit requirement. This is the amount of funds you need to wire to a broker to open an account.

It might appear to be low down on the list of priorities, but there are two reasons to keep it in mind. The first is that some potential clients have a limited amount of free funds. The other is that trading in small size can be beneficial to your P&L.

When starting out, having positions that are of an uncomfortable size can be hair-raising. Using small trades and taking the emotion out of trading can actually allow you to stick with your strategy, rather than panic and close out a position early instead of waiting for it to become profitable.

Before we get started, let’s take a look at our other guides:

- An in-depth reviewof tickmill

- The top forex brokersin 2021

- Expert guidesto trading forex

Below is a summary of why tickmill should be top of the short-list of candidate brokers.

- Low minimum deposit

- User-friendly registration process

- Low-cost trading

- Superior trading infrastructure

- No deposit or withdrawal fees

Tickmill minimum deposit

The minimum deposit for all account types is $100. If you want to step up to the VIP account, you have to hold a minimum balance of $50,000.

The tickmill minimum deposit is a realistic amount of cash to facilitate you getting started trading the markets. You need a certain amount of capital to put trades on and hold positions if price goes against you.

Trading with the minimum would require you to trade in small size, but that’s not a bad idea for newbies.

How to make a deposit

First of all, you need to open an account. This process is done online and involves setting up a password — which only you will know. There is also a requirement to submit personal information and proof of address.

Completing this know your client (KYC) process is actually a good sign as regulated brokers ask clients to tick boxes so that compliance with the financial regulator is assured. Tickmill, as a regulated broker, is also required to keep a log of your tax ID details in case you make substantial profits and your local tax authority wants to apply the appropriate charges.

If you have all the information to hand, then the registration process can take as little as a matter of minutes. There is a requirement on tickmill to verify the KYC docs you upload and this part of the process may be the one which takes the longest time.

Once your account is validated, you can pay funds into it using the desktop or mobile app platform.

- Log in to your tickmill account client area

- Click ‘deposit’ in the left-hand sidebar

- Enter the deposit amount and select your base currency

- Select your payment method

- Click ‘submit' to confirm your deposit

When depositing funds into your tickmill account, there are more than 10 different payment providers to choose from. The list includes:

- Bank transfer

- Visa

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Vn

- Qiwi

- Webmoney

All of the above payment methods, apart from bank transfer and unionpay, allow for instant deposits of funds.

You might also notice that tickmill fees are reported with great transparency. The broker does not charge any commissions on deposits or withdrawals.

Part of tickmill’s eagerness to share that information is that this is a big plus point for it. There are a lot of brokers that charge commissions, particularly on withdrawals, and trading is risky enough without surrendering cash to admin charges.

Full disclosure does require mention of the fact that some clients may choose a payment option that incurs charges from a third-party. Giving the subject of which payment processor to use can save money.

If you choose one of the faster payment systems, then the process of depositing funds can take moments to complete.

All deposits starting from $5,000 USD or equivalent and processed in one transaction by bank transfer, are included in the zero fees policy. Smaller bank transfer amounts may be liable to charges.

Tickmill deposit currencies

Currencies that can be wired include:

- USD

- EUR

- GBP

- PLN

Take this quick quiz to help us find the best path for you

User-friendly registration process

One of the positive features of the tickmill platform is the straight-forward onboarding process. The list of questions that has to be worked through is set by the regulator. Tickmill makes the process as painless as possible and its list of drop-down prompts helps guide users.

It’s important to remember that there aren’t any right or wrong answers to some of the questions. Tickmill just needs to know more about you so it can gauge your competency. Answering as accurately as possible is important as the broker will grade the degree of customer care they need to apply.

Low-cost trading

Tickmill fees are some of the lowest in the market. It’s not a no-frills broker. In fact, it provides clients with dedicated a premium-grade trading experience. There are a whole range of additional services such as autochartist, but when it comes to fees, tickmill is market-leading.

This approach might stem from the fact that the founders of tickmill themselves come from a trading background. They have first-hand experience of how hard it can be to make a profit in the markets and giving it up on administrative costs is a painful experience.

The broker operates a variable spread tariff. At times of strong market liquidity, the spreads on 10 major currency pairs, such as EURUSD, can be as tight at 0.0 pips. It’s hard to compete with zero.

The aggressive policy towards trader expenses is long-established and can be expected to remain in place — it’s part of the tickmill brand DNA.

Superior trading infrastructure

The behind-the-scenes infrastructure of a broker is sometimes overlooked. It’s, in some ways, unglamorous, but is incredibly important.

The feeling that tickmill has been built by traders, for traders is demonstrated by the platform operating on state-of-the-art technological infrastructure.

Tickmill’s set up means that not only does it offer low-cost trading, but it is reliable as well.

- It has one of the industry’s fastest execution times — 0.20s on average.

- Its no requotes policy means that when you execute a trade, you can have confidence of it being filled.

- This policy runs across the 80+ markets on offer on the platform.

- Trading strategies such as expert advisors (eas), hedging and scalping, which are not available or permitted at other brokers, can all be conducted on the tickmill platform.

- Virtual private servers (VPS) are available 24/7 and come with a 100% uptime guarantee.

- The VPS servers are located close to the exchanges to ensure lower latency — which means better quality and lower cost trading.

- One-click trading — including ‘go to zero’ functionality so you can close all your positions with just one click.

Tickmill is safe

Everybody wants their trader to be ‘safe’ and tickmill has gone to great lengths to give its clients a sense of security.

Applying for licences at regulators and complying with all the reporting standards costs money and takes time. Tickmill’s approach to take on licences with five different regulators therefore needs applauding.

By operating under license in five distinct regions of the world, tickmill gives its clients coverage from a regulator geographically close to them.

- Tickmill UK ltd is authorised and regulated by the financial conduct authority (FCA). FCA register number: 717270.

- Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA). FSA licence number: SD008.

- Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) as a CIF limited company. Cysec licence number: 278/15.

- Tickmill asia ltd is authorised and regulated by the labuan financial services authority (labuan FSA). Licence number: MB/18/0028.

- Tickmill south africa (pty) ltd is authorised and regulated by the financial sector conduct authority (FSCA). FSCA licence number: FSP 49464.

A client’s location and domicile status will determine which regulator’s protective umbrella they come under. Not all of the below features will apply to all accounts, but some of the protective to look out for includes:

- Negative balance protection — NBP stipulates that you can’t lose more money than you put into an account. If you invest $100 in tickmill and get things horribly wrong then the most you can lose is. $100.

- Segregation of funds — some regulators require brokers to hold client funds at an independent bank. If segregation applies then tickmill’s own accounts, which pay staff wages and other costs, will be separate from client trading accounts. This means that if a broker fails, your funds are safe.

- Anti-money laundering – AML protocols at the FCA and cysec, for example, require any funds paid into a tickmill account to only be returned to the account from which it initially came. This is to prevent cash being laundered through brokers, but adds up to extra security for clients as their cash can’t be forwarded on to a rogue account.

Ease of access

Once you’ve set up your account and wired funds, you want the platform to work for you, not vice versa. The tickmill trading infrastructure may be extremely high-tech, but the user-interface has an intuitive feel.

The desktop version of the trading platform has functionality that has been tested and enhanced for more than 15 years. It’s very much a finished product with the input of millions of individual traders going in to shaping how it works.

The mobile trading experience is also high-quality. Given how powerful some of the metatrader analysis tools are, it’s quite an achievement to have so many available on the smaller screen. The app is free to download and compatible with ios and android devices. Setting it up takes moments, and once completed, you’re in position to trade at your desktop, or on the go.

Further reading:

Is tickmill trustworthy?

Tickmill is a safe broker. One of the ways it’s gone on to establish a reputation for being trustworthy is by gaining regulatory approval from five different regulators. Tickmill holds licenses with the following regulators — FCA in the UK, cysec in cyprus / EU, the FSCA in south africa, and the FSA in seychelles and the labuan financial services authority in asia.

This means tickmill has to comply with the rules and regulations stipulated by those organisations, which means client protection is a priority.

How can I contact tickmill?

Tickmill actually has bricks and mortar offices in a range of global locations. Its customer service team are contactable during business hours via telephone or email.

How to sign up for a tickmill account?

Signing up for a tickmill account is super-easy. The process is all online and takes minutes to work through. Once you’ve funded your account, you’ll be ready to trade the markets.

Be sure to make sure you reach the right place (not a scammer) by following this link to the tickmill website and registration page.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

Tickmill sets the minimum deposit to 100 USD for all MT4 account types

100 USD will be the minimum requirement for all traders to trade FX with tickmill.

Please note that tickmill has changed the minimum required deposit amount for all account types to 100 USD.

The change will take effect from september 3rd.

The change was made in order to provide better trading experience for traders.

You can find the full trading conditions of each MT4 account type in here.

Tickmill

Post tags

FSA regulated forex broker with superior trading conditions.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Hello I need your help about to withdraw my money to on my walet is still pending

my cod 6CK6258GAGE

Thank you tickmill team for the great experience. Great support help and fx condition on mt4. Everything is very smooth thanks to my account manager.

Related

Page navigation

Related posts

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Question: how much do I need to trade FX on tickmill MT4?

The required minimum deposit by tickmill

Tickmill requires 100 USD (or equivalent amount in other currencies) as the minimum required deposit amount to start trading.

For VIP service, you must deposit over $50,000 to open a VIP account with superior trading conditions.

Tickmill accepts funds via various deposit methods including bank wire transfer, credit/debit card, online wallet etc.

You may choose a preferable deposit and withdrawal method after signing up with tickmill

For the calculation of margin requirement, you may want to use tickmill’s calculator or open a demo account to see how numbers are calculated.

Manage your risks with your deposit amount

To minimize the possibility of stop out (liquidation) which causes all positions to be forcefully closed, you are recommended to deposit enough amount to support your open positions.

Practically if you deposit more, your account becomes more stable against market volatility and draw downs.

But it is also a basic knowledge to not deposit more than you can afford to lose, as you would never know when the market turns against your orders.

To protect investors from exceeded losses, tickmill supports NBP (negative balance protection) which works as an insurance fund for all investors.

Tickmill’s NBP will fix all negative balances to zero, thus the maximum loss is always limited to the total deposit amount on tickmill MT4.

With tickmill, your risk management starts from when you make a deposit.

For more information about NBP (negative balance protection), visit the page here.

Get $30 no deposit bonus to get started

Tickmill (seychelles) now offers $30 no deposit bonus which you can get for free.

If you are not ready to invest your own money, or want to see the trading conditions of tickmill MT4 first, you can receive the 30 USD bonus to start trading.

The promotion requires no deposit from you, but the bonus will be credited to your new live trading account for free.

Tickmill’s $30 no deposit bonus is available only for new traders of tickmill.

Tickmill

Post tags

FSA regulated forex broker with superior trading conditions.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Hello I need your help about to withdraw my money to on my walet is still pending

my cod 6CK6258GAGE

Thank you tickmill team for the great experience. Great support help and fx condition on mt4. Everything is very smooth thanks to my account manager.

Related

Related faqs

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Question: how much do I need to trade FX on tickmill MT4?

The required minimum deposit by tickmill

Tickmill requires 100 USD (or equivalent amount in other currencies) as the minimum required deposit amount to start trading.

For VIP service, you must deposit over $50,000 to open a VIP account with superior trading conditions.

Tickmill accepts funds via various deposit methods including bank wire transfer, credit/debit card, online wallet etc.

You may choose a preferable deposit and withdrawal method after signing up with tickmill

For the calculation of margin requirement, you may want to use tickmill’s calculator or open a demo account to see how numbers are calculated.

Manage your risks with your deposit amount

To minimize the possibility of stop out (liquidation) which causes all positions to be forcefully closed, you are recommended to deposit enough amount to support your open positions.

Practically if you deposit more, your account becomes more stable against market volatility and draw downs.

But it is also a basic knowledge to not deposit more than you can afford to lose, as you would never know when the market turns against your orders.

To protect investors from exceeded losses, tickmill supports NBP (negative balance protection) which works as an insurance fund for all investors.

Tickmill’s NBP will fix all negative balances to zero, thus the maximum loss is always limited to the total deposit amount on tickmill MT4.

With tickmill, your risk management starts from when you make a deposit.

For more information about NBP (negative balance protection), visit the page here.

Get $30 no deposit bonus to get started

Tickmill (seychelles) now offers $30 no deposit bonus which you can get for free.

If you are not ready to invest your own money, or want to see the trading conditions of tickmill MT4 first, you can receive the 30 USD bonus to start trading.

The promotion requires no deposit from you, but the bonus will be credited to your new live trading account for free.

Tickmill’s $30 no deposit bonus is available only for new traders of tickmill.

Tickmill

Post tags

FSA regulated forex broker with superior trading conditions.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Hello I need your help about to withdraw my money to on my walet is still pending

my cod 6CK6258GAGE

Thank you tickmill team for the great experience. Great support help and fx condition on mt4. Everything is very smooth thanks to my account manager.

Related

Related faqs

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

So, let's see, what was the most valuable thing of this article: how to deposit on tickmill in 2021 ✅ methods for payments ✔ no deposit bonus explained ✔ minimum deposit ➔ read more at minimum deposit for tickmill

Contents of the article

- Today forex bonuses

- Tickmill minimum deposit | tutorial

- Overview about the tickmill deposit methods

- Are there fees for the deposit?

- Step by step tutorial to open your account and...

- 1. Open your free customer account with tickmill

- 2. Verify you account

- 3. Open the real trading account in the customer...

- 4. Do the deposit on your account

- Are your funds safe with tickmill?

- Tickmill no deposit bonus – welcome account

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill minimum deposit and fees overview

- Tickmill minimum deposit

- How to make a deposit

- Tickmill deposit currencies

- Take this quick quiz to help us find the best...

- User-friendly registration process

- Low-cost trading

- Superior trading infrastructure

- Tickmill is safe

- Ease of access

- Tickmill sets the minimum deposit to 100 USD for...

- Tickmill

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Page navigation

- Related posts

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Question: how much do I need to trade FX on...

- The required minimum deposit by tickmill

- Manage your risks with your deposit amount

- Get $30 no deposit bonus to get started

- Tickmill

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Question: how much do I need to trade FX on...

- The required minimum deposit by tickmill

- Manage your risks with your deposit amount

- Get $30 no deposit bonus to get started

- Tickmill

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

No comments:

Post a Comment