Fbs nigeria

At this moment our best forex broker in nigeria is: hot forex. If you are browsing for an alternative to FBS you should start there.

Today forex bonuses

To each of the top brokers available for you, see our list: forex trading nigeria. If you wish to visit FBS anyway, www.Fbs.Com is their website. Copyright В©2020 forexagentreviews.Com all rights reserved

FBS nigeria

At this moment our best forex broker in nigeria is: hot forex. If you are browsing for an alternative to FBS you should start there. To each of the top brokers available for you, see our list: forex trading nigeria. If you wish to visit FBS anyway, www.Fbs.Com is their website.

#1 alternative in nigeria for FBS

- Over 350,000 accounts open since 2010, 140 employees globally

- Winner of 18 industry awards

- Free monthly contests to enter and win cash prizes

- 4-tier loyalty program

#2 rated best nigeria broker

- Your funds will be safe and secure

- You can deposit or withdraw your funds stress-free

- The trading software is powerful and well designed

- Brokers and staff are friendly and helpful

#3 rated best nigeria broker

- Start with 20 free trades (zero commissions)

- Over 150 trading instruments available

- Extremely fast execution speed at under 30ms

- Trade with up to 500:1 leverage

Is forex trading in nigeria legal?

Are you in the right place?

Copyright В©2020 forexagentreviews.Com all rights reserved

Disclaimer: reproduction in whole or in part in any form or medium without express written permission of is prohibited. This website is a promotional feature and the site has been paid for to host the following positive review about these trading platforms - these reviews are not provided by an independent consumer. This comparison site is supported by payment from operators who are ranked on the site and the payment impacts the ranking of the sites listed. General risk warning: the financial services reviewed here carry a high level of risk and can result in the loss of all your funds.

Trading

Upgrade your profit, trade with the best conditions!

Account comparsion

- Floating spread from 1 pip

- Fixed spread from 3 pips

- Floating spread from 0,5 pip

- Fixed spread 0 pip

- Floating spread from -1 pip

- Up to 1:1000

- Up to 1:3000

- Up to 1:3000

- Up to 1:3000

- Up to 1:500

Maximum open positions and pending orders

- From 0,01 to 1 000 cent lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,1 to 500 lots

(with 0,1 step)

- From 0,3 sec, STP

- From 0,3 sec, STP

- From 0,3 sec, STP

- From 0,3 sec, STP

- ECN

Account types, except ECN account, support the following trading instruments: 35 currency pairs, 4 metals, 6 CFD.

Frequently asked questions

What trading account should I choose?

FBS offers various account types designed to meet your needs, including cent , micro , standard , zero spread , and ECN accounts with unique trading conditions. For newbies who have no trading experience, we recommend opening a demo account first, and only after that a micro or cent account. For those who are not the first day in trading, we advise opening a standard account – a classic one. And for real professionals, we suggest a zero spread account or ECN account.

What is a trading account?

To start trading on forex, you must open an account. The primary purpose of trading accounts is to make transactions (open and close orders) with various financial instruments. The trading account is similar to the bank one – you use it to store, deposit, and withdraw money. However, deposits and withdrawals are available only after you verify your account.

What is forex trading?

Forex, also known as the foreign exchange market or FX market, is the world's most traded market, with a $5.1 trillion turnover per day. In simple words, forex trading is the process of converting one country's currency into the currency of another country, aiming to make a profit from the changes in its value.

Why is FBS the best broker for online trading?

FBS is a legitimate forex broker regulated by the international financial services commission, license IFSC/000102/124 , which makes it trustworthy and reliable. We offer our clients the best trading conditions on the market, including different bonuses, convenient trading tools such as CFD trading and stock trading among trading classic currency pairs , regular promotions , the most transparent affiliate commission up to $80 per lot, 24/7 customer support, and more.

How do I start trading?

First, it's really important to remember that becoming a successful trader isn't an overnight process. It takes time to become familiar with the markets, and there's a whole new vocabulary to learn. For this reason, legitimate brokers like FBS offer demo accounts. To open a demo account, you need to register first. After that, download trading software to open and close your first order.

Download trading platform

Metatrader 4

- Download for windows

- Download for ios in appstore

- Download for android in googleplay

- Start trading online

- Download multiterminal

- Download for mac os

Metatrader 5

- Download for windows

- Download for ios in appstore

- Download for android in googleplay

- Start trading online

- Download for mac os

Deposit with your local payment systems

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Your request is accepted

Manager will call your number

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!

Beginner forex book

Beginner forex book will guide you through the world of trading.

Thank you!

We've emailed a special link to your e-mail.

Click the link to confirm your address and get beginner forex book for free.

You are using an older version of your browser.

Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

FSB scholarship past questions for FSB scholarship exam | download

Below you will find FSB scholarship past questions for nigerian students who have applied for the federal government FSB scholarship. It is important to note that these are simply FSB past questions and therefore, should be studied as what they are, which is simply past questions.

The federal scholarship board (FSB) is an arm of the federal ministry of education – nigeria and FSB is responsible for coordinating the disbursement of scholarship to nigerians home and abroad.

Federal government scholarship board, FSB scholarship past questions

Here are FSB scholarship past questions from past federal scholarship board (FSB) examination exercises. A downloadable PDF document of the FSB scholarship past questions is available below.

FSB sample questions

The following are 10 FSB examination sample questions to give you a quick idea about what the exam is like. You will find that the questions are quite simple.

1) the average ages of three persons is 27 years. Their ages are in the proportion of 1:3:5.What is the age in years of the youngest one among them.

2) an aeroplane covers a certain distance at a speed of 240 kmph in 5 hours. To cover the same distance in 1 2 /3 hours, it must travel at a speed of:

3) the 2006 world cup football tournament held in

4) for which of the following disciplines is nobel prize awarded?

B. Physiology or medicine

C. Literature, peace and economics

5) entomology is the science that studies

A. Behavior of human beings

C. The origin and history of technical and scientific terms

D. The formation of rocks

6) marathon is to race as hibernation is to

7) which of the following numbers is divisible by 3, 4, 5, and 6?

8) which of the following completes the missing series? SCD TEF UGH … WKL

9) look at this series: 8, 6, 9, 23, 87 , … what number should come next?

10) look carefully for the pattern, and then choose which pair of numbers comes next. 42 40 38 35 33 31 28

These questions were set in previous federal government scholarship board (FSB) examinations.

The FSB exam is organized by JAMB and their questions always include analogy, arithmetic, current affair, IT, verbal and quantitative reasoning and english language.

Also note that it is not JAMB UTME but JAMB aptitude test or recruitment exam.

FSB scholarship past questions PDF download

FSB interview requirements

All eligible applicants are to report for interview at the venues scheduled for their respective zones of origin for proper identification. Two sets of the printed, completed application forms are usually submitted at the various interview centres with the following attachments:

- Two sets of photocopies of educational certificates and testimonials of previous schools attended with the originals for sighting;

- Only ONE certificate is accepted i.E WAEC of may/june only for undergraduate applicants;

- Two copies of birth certificate from national population commission;

- State of origin/LGA certificate duly signed, stamped and dated;

- Four (4) passport sized coloured photographs on white background;

- Academic transcripts and NYSC discharge or exemption certificates will be required from applicants for postgraduate studies.

About FSB scholarships

The federal government of nigeria through the federal ministry of education through the federal scholarship board offers the bilateral educational agreement (BEA) oversea scholarships to nigerian undergraduate, masters and doctoral students.

The BEA awards are scholarship awards made to eligible nigerian youths after due process by development partners who have entered into bilateral educational agreement with nigeria. Nigeria equally offers reciprocal awards to citizens of the following bilateral education agreement countries: china, romania, and cuba.

The honourable minister of education (HME) usually annually invites interested and qualified nigerians to participate in the nomination interview for the bilateral educational agreement (BEA) scholarship award tenable in russia, china, morocco, turkey, algeria, romania, serbia, japan, ukraine, cuba, greece, czech republic, syria, macedonia, mexico, egypt, tunisia etc. Federal ministry of education overseas scholarships is for undergraduate, masters and phd nigerian students.

Scholarship value

The total scholarship value is scheduled as follows:

- Any of the above countries are responsible for the tuition and accommodation.

- While nigeria government takes care of the following:

– $500 monthly for supplementation.

– $250 yearly for warm clothing.

– $200 yearly for health insurance.

– $500 yearly for medical scholars only.

– $1000 for PG research grant yearly were applicable.

– ₦100,000 – take off for PG scholars were applicable

– ₦60,000 – take off for UG scholars were applicable

The federal government of nigeria through the federal ministry of education through the federal scholarship board offers local scholarships to nigerian undergraduate, masters and doctoral students who are studying in one institution or the other within nigeria.

Our work

CONCEPT

SSAB works along the cocoa value chain and value chains of different food crops. Its work is based on the value links approach. The emphasis is on primary production, up and down stream business linkages and services.

Valuelinks 2.0 is the title of a generic methodology for value chain development that is used by government administrations, private companies and development agencies alike. The idea is to promote the transformation of value chains towards a greener and more inclusive economy. Valuelinks also is a network of experts and a set of training courses. The methodology is known and used in a growing number of development programmes. Over the past 10 years, more than 3,000 experts have been trained.

Programs have access to the principles and tools via the website www.Valuelinks.Org that also provides information on the valuelinks training courses and presents the new “valuelinks 2.0 manual on sustainable value chain development” (2017). It has two volumes: the first covering value chain analysis, strategy and implementation, and the second a series of value chain solutions, from improved business models, linkages, financing and services to sustainability standards and regulatory change.

FARMER BUSINESS SCHOOL (FBS)

Farmer business school (FBS) strengthens smallholders’ business attitudes and management skills for better and diversified incomes and nutrition. With co-funding from the federal ministry for economic cooperation and development and the world cocoa foundation, the sustainable smallholder agri-business programme (SSAB) and partners developed the first curriculum for african cocoa smallholders in 2010. In five sessions, smallholders learn about:

- Principles of farming as business

- Basics of human nutrition and farm management for a balanced diet

- Investment strategies based on cost-benefit analysis of production techniques

- Financial management, savings and credit

- Benefits from quality produce and from membership in producer organizations

- Investments in replanting of tree crops

FBS complements training on good agricultural practices (GAP), financial and technical services that smallholders demand. To date, 1,400,000 smallholders graduated from FBS.

Since 2012, 30 development programmes have adopted FBS to train smallholders in 25 african countries. With the support of SSAB, the programmes adapted FBS training materials for 39 production systems other than cocoa. In total, SSAB and its partner programmes developed over 85 curricula. Together with the 480.679 cocoa farmers trained in the frame of SSAB, over 1,4 million smallholders are now FBS trained.

Essential success factors are:

- Focus on the business skills most needed by smallholders

- Thorough qualification in theory and practice of trainers with good social skills

- Combination of basic standard modules with product specific modules

- Participatory group work approach.

The demand for support in developing and up-scaling FBS is growing. This led to the creation of the FBS advisory facility under SSAB end of 2016. It provides assistance to rural development programmes and organizations as well as private companies interested in adaption and implementation of the FBS approach.

For information on FBS in côte d'ivoire also see our video below (which is unfortunately only available in french).

The next video shows how FBS is implemented in nigeria. Furthermore, it discusses the sustainability strategy of FBS and takes up the plan to institutionalize the approach through extension service agencies in nigeria.

Another example of our FBS trainings from cameroon can be seen in the video below. In this video, FBS related topics such as the formation of cooperatives and access to finance are addressed:

Another visual example comes from ghana. The video exemplifies the transformation from smallholders to agri-preneurs, triggered by FBS training. It also emphasizes on the success factor to have both, public and private partners, involved in the implementation of FBS. This success factor of a diversified partern structure follows the objective to empower farmers for a strong and sustainable cocoa value chain.

For more videos visit our SSAB FBS youtube channel.

FBS ADVISORY FACILITY

The objective of the FBS advisory facility is to institutionalize spreading of the approach of the farmer business school (FBS) and to further scale-up the approach beyond the cocoa regions of west- and central-africa for other value chains.

- Exchange and networking among FBS practitioners and newcomers

- Support interested institutions, companies or development programmes in african countries to adapt FBS to production systems other than cocoa

- Support actors to carry out FBS autonomously for new production systems in line with quality standards

- Provide a handbook for introduction and management of FBS

- Organize qualification of new FBS master trainers

- Advise on embedding FBS trainings in agricultural training programmes and other service models

- Support the establishment of an international FBS association

- Identify and build capacities of organizations to host and operate the FBS advisory facility after 2019

If you are interested in the services provided by the FBS advisory facility, please contact: fbs-facility@giz.De .

FBS SUCESS STORIES

Toua bibiane ndzana

cameroon

“after FBS in 2012, I do my cropping calendar and my operating account for my farms regularly. I apply the good agricultural practice and plan my expenditure. I save and I am qualified for loans. I diversified production including groundnut.

I increased my profit from 1,200 EUR from 4 hectares in 2013, to 7,900 EUR from 8,8 hectares in 2017. I pay my children's school fees easily now. My son will take over.”

Peter sipalo lubinda

zambia (2016)

“through FBS I learnt to think like a businessman so that I make money from my farming activities. Last season, I was able to produce more than 1,000 kg per hectare of cotton compared to my initial results of 450 kg -600 kg per hectare.

In addition to cotton, I diversify my production, and now I grow maize, groundnut and vegetables to improve my family’s health and wellbeing. From the money I earned I was able to build a nice house for my family with roofing sheets. We also purchased cows, goats and chickens, which we didn‘t have before. I am a lead farmer in my community, so I help others by demonstrating the good agricultural practices.”

COOPERATIVE BUSINESS SCHOOL (CBS)

SSAB constantly analyses and improves the farmer business school (FBS) approach and results. After FBS trainings many cocoa smallholders established and ran farmer-based organizations (FBO). There is still potential to improve fbos’ capacities to provide business services to their members. To this effect, market orientation, entrepreneurship, knowledge of value chains, good governance of farmer organizations, technical and economic viability of fbos have to be strengthened. Beyond institutional development, managing teams of FBO need technical, economic and organizational skills on one side and the buy-in of members to succeed business services on the other.

SSAB compared different FBO training manuals and found that they emphasise institutional development (registrations, statutory aspects, accountability) whilst the area of commercial operations and services of fbos are insufficiently tackled, an issue long neglected both by fbos and development partners.

To strengthen fbos' capacity, together with partners we have finalized the cooperative business school (CBS). CBS targets managers of FBO’s. In the training curriculum, following issues are tackled:

- Business services (including procurement, marketing, internal and external financial services and trainings), related business model and business plan development

- Understanding markets, the value chain and related logistics

- Financial and strategic management of FBO's.

So far, SSAB has trained 613 different cooperatives in cameroon, côte d´ivoire, ghana, nigeria and togo. In total, 3,854 managers and members of farmer-based organizations (FBO’s) have participated in CBS (20% women). With both managers and group members joining the training, the whole cooperative is gaining from the training and with that, thousands more farmers can benefit from improved business services.

The handbook is for managing teams of smallholder fbos and thus written in simple language. It contains a lot of examples and practical tools to make it indeed relevant for them and members. The contents are relevant for all types of FBO in west- and central africa beyond cocoa and can easily be adapted to the context of other countries. The manual is accompanied by a trainers’ guide that contains short modules (max. 100 minutes long) that can be used either for subsequent trainings or also separately, according to the needs and interests of the fbos.

GOOD AGRICULTURAL PRACTICES (GAP)

We support our partners in delivering cost-effective extension to intensify production of cocoa and food. Diversification of smallholders’ livelihoods is key to lower the dependency from income from cocoa production, provide a stable and higher income throughout the year and to improve the nutrition of the family.

We use rather traditional face-to-face extension materials, such as technical-economic producer references or image blocks, as well as innovative media such as 3D-animation. To promote food production, together with our partners we have selected specific livelihoods for each partner country. These are based on profitability, availability of technology for smallholders, nutritional value and access to markets. The recommended GAP are research-based and have been cross-checked against their applicability in the rural areas.

A technical-economic producer reference is a short document for extension workers and farmers. It provides illustrated key messages on good agricultural practices as well as harvest and post-harvest techniques developed by agricultural research. Significant work is needed to ensure the concise, correct and compelling documentation and illustration of GAP as well as harvest and post-harvest techniques. The technical recommendations are completed by profitability analysis and management issues to succeed adoption and increase productivity and income. On the one hand this ensures well-structured and conducive extension sessions along the production cycle, and helps, on the other hand, farmers to apply good agricultural practices between and after extension sessions. Each smallholder, man or woman, participating in extension sessions receives his or her producer reference. Producer references are also used to develop additional extension material such as image blocks, 3D animation and radio broadcasts.

Since start of the programme, 196,279 smallholders (31% women) have received the training on GAP and good harvest and post-harvest practices for cocoa and for food products of their choice. With our partners we have developed 42 producer references for 10 food products and 3 for cocoa production (re-planting of cocoa, nursery management and mature cocoa). They are adapted to the specificities of our partner countries.

ICT SOLUTIONS FOR DEVELOPMENT: 3D ANIMATION AS A POWERFUL EXTENSION TOOL

Digital extension material in the form of 3D animations support the face-to-face extension services of partners and adapt them to the fast-growing digital environment in africa.

SSAB used well-proven and research-based analog training material to develop 3D animated training videos. The videos are produced with a modular principle, making it easy to adapt to different languages and recent developments of innovative strategies to bring the message to the farmer. We produced five 3D animation films: GAP for cocoa, cassava and maize, one on good practices for a healthy diet and one on safe pesticide use and management. All videos are available in english and french.

Whatsapp for what’s GAP - whatsapp is the most widely used messenger worldwide. To spread the videos and extension messages whatsapp is one method of distribution. Our programme partners use their network and spread the news of SSAB ICT-based extension materials to farmers.

Cinema on the go - the programme purchased 100 hand projectors, which partners’ trainers will use in the cocoa farming communities to broadcast our videos.

Diffusion via online channels - SSAB identified a variety of online channels: from the GIZ youtube channel to partner websites and online extension platforms to further distribute its 3D animated extension materials.

Our digital principles - producing its ICT training material, SSAB followed the most important digital principle: designing the video with the user. We involved farmer in the production process to ensure identification with the material. The wide reach of the videos in four west and central african countries, as well as a modular design, that enables easy adaptation, speaks to the principle of build for scale. By working with local production studios, SSAB considered the existing ecosystem as much as possible.

The use of digital extension, educational videos and agricultural 3D animations is very limited in africa. Pictures of farmers were caricatural and distorted. An intense capacity development for production studios was necessary. Until now, we trained 708 extension agents and trainers in 4 countries. It is planned that at least 50 of them organize 8 whatsapp groups each with 20 farmers reaching 50,000 farmers via whatsapp. With 100 hand-projectors up to 30,000 farmers, per year and country shall be reached.

- We cooperate with partners to utilize the digital extension material

- We make use of existing solutions (i.E. Whatsapp) instead of reinventing the wheel.

- Animations are no comics! We are very careful with the picture we paint and present farmers as active change agents.

BUSINESS SERVICES

To ensure access to quality inputs, markets, financial services and information SSAB has collaborated with (A) cooperatives, (B) input dealers and (C) financial institutions to develop business service centers based on the core business that is already offered to their clients. We support the host institutions in strengthening their core business and in adding complementary services to this. Farmers profit from a variety of business services at proximity that help them to increase their productivity and income and save to invest in future.

Depending on their core business and set-up, they offer (i) supply of agro-chemical inputs, (ii) financial services or link up and (iii) technical services. The scope of technical business services provided ranges from advice/ training on GAP/GPHP to GPS measurement, pruning and spraying of pesticides. The service providers work as individuals or as employees and by preference they are young men and women that stay in the cocoa communities. Financial services include access to current and savings accounts, risk-reduced loan packages for inputs and in some cases cashless payment of inputs.

The core piece of our monitoring system (M&E) is mdata capture system for the monitoring of FBS training data. It was piloted in all project countries and is currently being rolled out. The data on GAP training for cocoa and food products is collected in an excel dashboard. To monitor business services we are developing an android-based mobile application to allow data collection of the different input dealers across the cocoa regions in ghana.

Objective of mdata capture

- Ensure cost-effective monitoring approach to large scale training programme

- Providing for a virtual flow of information to reduce cost and time lag between planning, implementation and reporting

- Enhance control and accountability of field data for reporting at a central location

- Create knowledge platform for dissemination of information

Development of the system

initially we developed a mobile app for basic phones without android capabilities for planning and reporting on FBS and GAP training.Going with the trend of smartphone availability in our partner countries we further developed mdata capture into an android-SMS hybrid technology, which makes it possible to run an android application on SMS basis.

Data analysis: the web portal

for data analysis and publication, the system has three components:

- Public section with country and regional reports, information on approach and impacts

- Section reserved for partners and grantors to view specific reports on FBS and GAP training performance

- Admin panel for data validation by project staff

The architecture:

trainers enter information on trainings held into the WIB application or the android app which sends the data to a central database where it is aggregated. From this central database graphic presentation of the data are generated once SSAB staff validated the data. It can then be accessed on the SSAB website. From the other end, SSAB staff or training coordinators can enter data on training schedules which is communicated to trainers via the system.

Forex trading in nigeria

The ultimate guide for beginners

For nigerian investors, forex trading can be a way to earn wealth.

It involves speculating on the rise and fall of a currency's fluctuations. It has become really popular in nigeria with an estimated daily trading volume of ₦300-450 million. You may be attracted to forex trading because it offers opportunities/potential to make good profits in less time (minutes & hours instead of months) with your investment.

But is trading in the forex market really profitable for small or retail individual investors? How much income can you earn from trading forex part time or full time? What are the risks?

There are so many other questions that may come to your mind if you are a beginner forex trader. We will try to answer all these questions and more with this guide.

Busy right now? Don't worry. Click the button below & we will send you a copy of this guide in less than 5 seconds. Just let us know where you want receive it & we will deliver it to you!

Contents

What is forex trading?

Forex trading is the buying & selling of currencies with an aim to make a profit. Traders can place their trades in the forex market, which is an over-the-counter market that allows investors to trade currencies. This is a platform for investors, institutions, banks, and retail traders.

Foreign exchange market is the largest trading markets and has an average turnover of US$6.5 trillion on a daily basis around the world. This is larger than all the stock markets in the world combined together. Trading activities are conducted through the “interbank market” which allows you to execute trades 24 hours in a day, for 5 days a week from monday through friday.

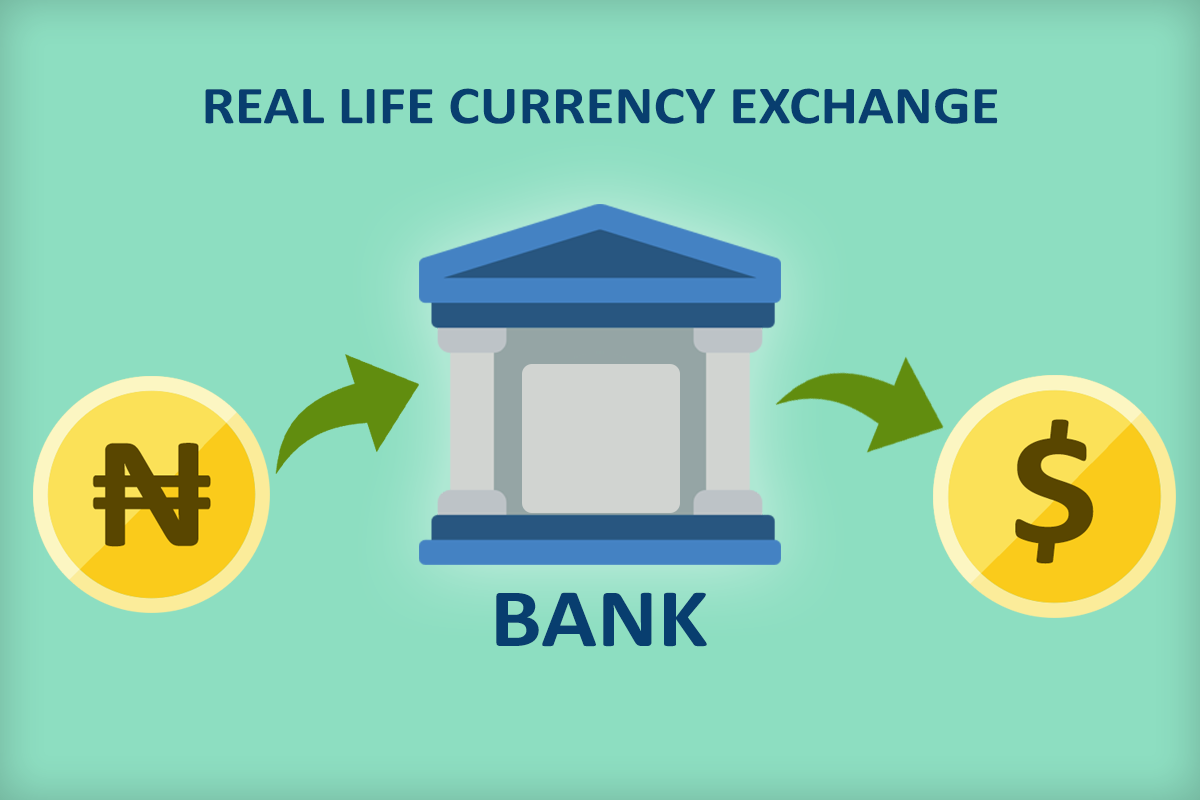

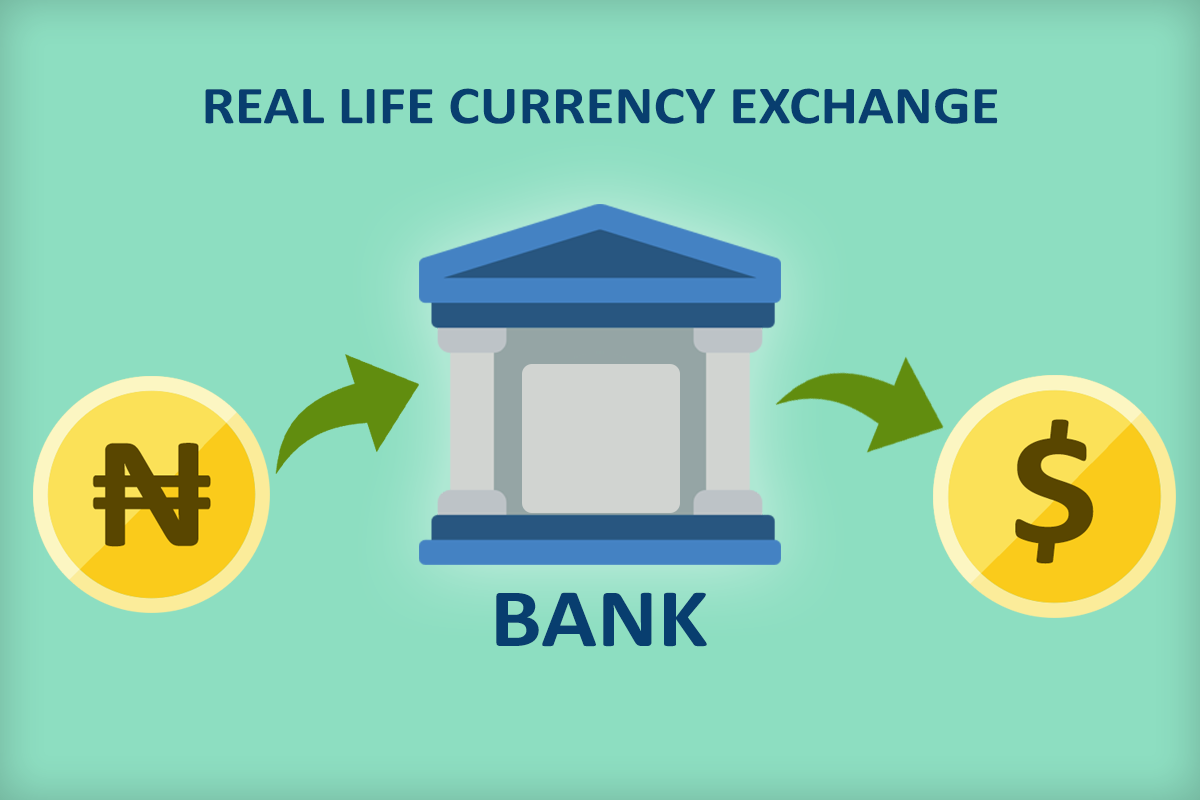

Real life example of forex trading

Have you traveled overseas? If you have then the chances are that you have already traded currencies before. This is because you need to acquire the currency of the country you are visiting by exchange the currency of your home country.

Let’s say that you change ₦380,000 to US dollars for travelling, and you get 1000 USD from the exchanger. In this example you are physically buying USD by exchanging your nairas. When you change your naira into a different currency to spend money on your trip, you are actually making a forex transaction.

The rate that you get from your exchanger is decided on the basis of the real time exchange rates plus the profit margin of the money changer. If the current market rate is NGN380 per USD, then you would probably get around ₦390 rate from your changer. The difference of ₦10 (390 – 380) for each USD is your changer’s profit margin.

In theory, this is what online forex trading on the internet is all about, but still a bit more than exchanging currencies through a money changer.

Understanding currency pairs

All transactions in the forex market are based on the purchase of one currency for the sale of another currency. So you are trading or exchanging the 2 currencies simultaneously for one another, hence known as ‘currency pairs’.

For example: EUR/USD (euro & the US dollar), NGN/USD (nigerian nairas & the US dollar) etc.

There are 100s of currency pairs, including the so called majors, minors & exotic. It is really important to understand what currency pairs, and how they work before you can start trading forex.

In this chapter, you will learn everything you need to know about currency pairs. Let's start!

Types of currency pairs

Currency pairs are mainly classified into 3 types:

1) major currency pairs: these are the currency pairs that include US dollar as one of currency in the pair. Almost 85% of the global trading volume is traded in the majors.

Majors include 7 currency pairs: EUR/USD (euro/US dollar), GBP/USD (pound/US dollar), USD/JPY (US dollar/japanese yen), AUD/USD (australian dollar/US dollar), USD/CHF (US dollar/swiss franc), NZD/USD (new zealand dollar/ US dollar) and USD/CAD (US dollar/canadian dollar).

Since most of the trading is done in majors, so they are highly liquid & it is easier to get in & out of trades. The opportunities to make profits are higher.

2) minor currency pairs: minors, also called the cross curreny pairs, contain all the currencies in the major pairs except for US dollar. These include EUR (euro), GBP (pound), JPY (japanese yen) etc.

Examples: EUR/GBP, EUR/JPY, GBP/JPY etc. As you may have noticed that these are the crosses of all the major currencies excluding US dollar.

The liquidity & volume are lower than majors, so trading opportunities may be lower than with majors.

3) exotic currency pairs: exotic currency pairs are made from one of the currency from major pairs and other one from the emerging economies like: brazil, south africa, mexico, russia etc. Examples of such pairs include: USD/BRL (united states dollar/brazilian real), USD/HKD (united states dollar/hong kong dollar), USD/ZAR (US dollar/south african rand), USD/RUB (US dollar/russian ruble) etc.

Exotic pairs usually don't have high liquidity & trading volume but they have high volatility plus they have high spreads as compared to major & minor pairs.

As a beginner forex trader, you need to stick to major pairs only as it offers high liquidity and predictable market movements.

Currency pairs lingo

While trading forex, you would come across these common terms. We will be explaining all the important terms here.

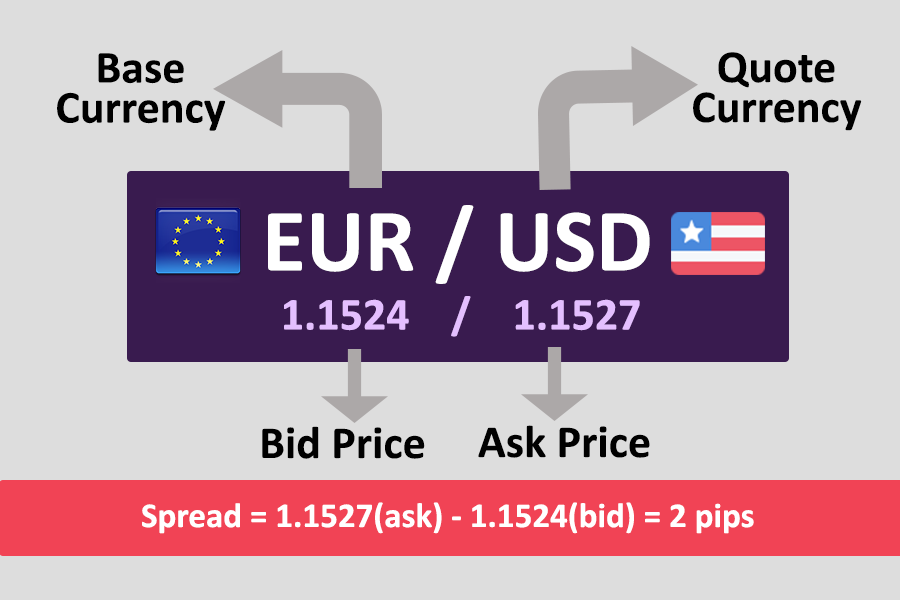

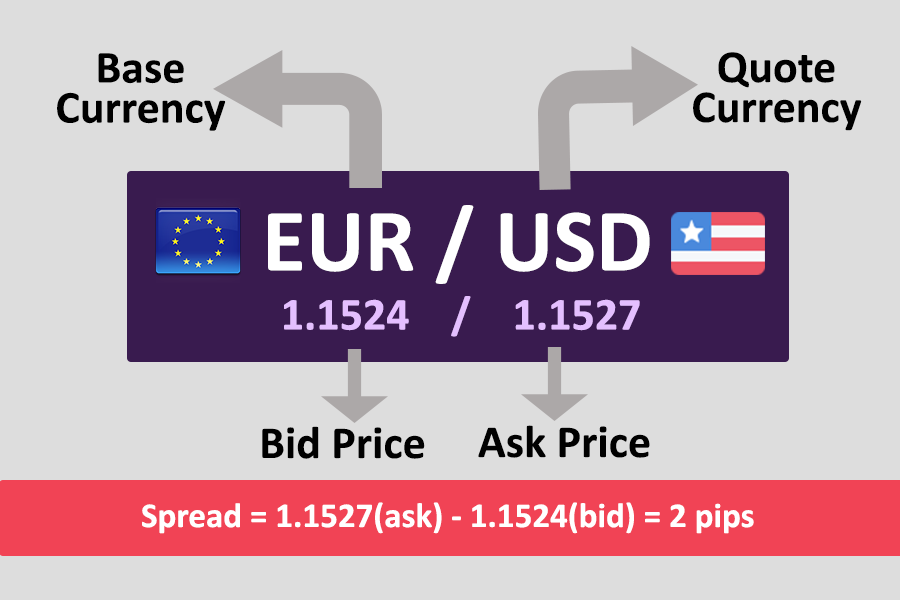

1) quote by the broker: when you open a trading account with a forex broker, they tell you the bid/ask price to buy & sell the currency. It will be quoted like this example: EUR/USD 1.2812/15. This price is the quote by the broker.

2) pip: pip is the smallest unit in the currency quote (given by the broker). It is the last decimal in the price. For example: in the quote 1.2811 moves to 1.2812, the movement in the last decimal is 1 pip.

3) bid price: bid price is the price at which the broker is willing to buy a currency pair from you. At this price, you can sell base currency in the pair. This price is shown on the left side in the quote ticker by the broker.

For example: if you see the quote as EUR/USD 1.2812/15, then 1.2812 is the quote price, and it means that you can sell 1 euro for 1.2812 US dollars.

4) ask price: ask price is the price, at which the broker is willing to sell a currency pair to you. At this price, you can buy the base currency mentioned in the pair. It is shown on the right side of the quote ticker by the broker.

For example: when you see the same quote as above it had 2 values in it: EUR/USD 1.2812/15, the second value tells you about the ask price, it means you can buy 1 EUR for 1.2815 dollars.

5) spread: spread is the difference between the bid & ask price quoted to you by the broker. So in above example: in which quote is EUR/USD 1.2812/15, the difference between 1.2815 minus 1.2812 i.E. 0.0003 or 3 pips, is the spread.

How to start forex trading?

Forex trading can now be done by anyone in nigeria, anytime, from home or anywhere through the internet. All you need to trade forex online is a laptop, good internet connection, good trading strategy tested on demo & starting capital which we recommend to be atleast ₦50,000.

You need to signup with a forex broker. There are many 'good' & 'scam' brokers. We will tell you exactly who to choose.

Finally, once you have a trading account we will show you the forex orders that you can place, and the profit/loss calculation.

1) open account with a forex broker

In order to trade forex, you need to find a broker. There are numerous forex brokers available for nigerian traders such as hotforex, exness, XM forex, FXTM, forex.Com, fxpro, oanda etc.

We have compiled the list of best forex brokers for nigerian traders. All of the brokers that we recommend on our website have proven track record of honest dealing with traders, and are authorized/regulated by top-tier global regulatory bodies (FCA, FSCA, cysec & ASIC) for the safety of your funds.

Forextime is the best broker for forex trading in nigeria.

- Competitive spread on majors (and zero fees on deposits & withdrawals)

- Free demo trading account

- Easy to use (mobile-friendly) MT4 & MT5 platforms

- 56 currency pairs, 4 cryptocurrencies, 100s of cfds

- Fast withdrawals in nigeria & good support

- Your funds are safe – regulated with UK's FCA (financial conduct authority), cysec (cyprus securities exchange commission) and FSCA (financial sector conduct authority in south africa)

Start trading at FXTM important: forex trading is risky, so have a working strategy before trading live.

Start with demo accounts: never start trading directly on a live account if you are a beginner as your real money will be at risk. We advise you to first create a demo account with the broker of your choice and then learn to trade by building & testing out a trading strategy that works for you. Only once you are confident about your trading style & strategy, only then you should decide to trade with real money on a live account.

Once you have found the forex broker of your choice, you can then open an account with that broker to start trading (or demo account to learn). This account will enable you to place your trades in the interbank market at the live currency prices.

If you are creating a live account: all reputed brokers have some sort of KYC (ID & address proof verification) & you cannot start trading in the market without verifying your account with any of the regulated broker. Once the verification is complete, you will need to make a deposit to fund your live account. These funds will be used to place live trades at the real market prices.

2) place your first trade

After you have created your live account & funded it with your forex broker, you can then open your first trade. The two positions that you can take in the forex market are either the “long position” or the “short position”.

You need to study and analyse the trading charts or the market news & then decide whether you want to place a buy order or a sell order.

The long position implies that you are buying a currency pair and are betting on it to rise in value in the future. For ex. If you currenny market price of EUR/USD is 1.1000 & you believe that it would reach 1.25 in the near future then you can place a buy order, hence you would be buying euros & selling US dollars.

See the example below for a profitable long/buy order in forex.

Buy order in forex is similar to buying an equity stock. You buy the currency at a low price, and once it reaches a higher value, you can then sell off the currency, thus making your profit.

The short position can be taken when you believe the price of the currency will fall in the upcoming period. If the present price of EUR/USD is 1.10 & you think that it would fall to 1.0 in the near future then you can place a sell order in the marker.

Below is an illustration of how you can make profit with a sell order in forex.

You can place a sell order when the currency is at a higher price and then when the value falls significantly, you can buy it back at lower price, thus realizing your profit.

3. Close the trade

To realize your proft (or loss), you need to close the trade that you opened.

Profit or loss? Depending on the movement of the currency pair that you were trading, you will either be profitable or make a loss once you close the trade.

Example: if you have placed a buy/long order on EUR/USD, and the price of the pair goes up by 100 pips, and you decide to close the trade. You would have made a profit of around $100 (minus spread) if you are trading 1 mini lot.

But if the EUR/USD goes down 100 pips, and you decide to close the trade. You will make a loss in this case.

Also read: our detailed guide on how to trade forex in nigeria

FSB scholarship past questions for FSB scholarship exam | download

Below you will find FSB scholarship past questions for nigerian students who have applied for the federal government FSB scholarship. It is important to note that these are simply FSB past questions and therefore, should be studied as what they are, which is simply past questions.

The federal scholarship board (FSB) is an arm of the federal ministry of education – nigeria and FSB is responsible for coordinating the disbursement of scholarship to nigerians home and abroad.

Federal government scholarship board, FSB scholarship past questions

Here are FSB scholarship past questions from past federal scholarship board (FSB) examination exercises. A downloadable PDF document of the FSB scholarship past questions is available below.

FSB sample questions

The following are 10 FSB examination sample questions to give you a quick idea about what the exam is like. You will find that the questions are quite simple.

1) the average ages of three persons is 27 years. Their ages are in the proportion of 1:3:5.What is the age in years of the youngest one among them.

2) an aeroplane covers a certain distance at a speed of 240 kmph in 5 hours. To cover the same distance in 1 2 /3 hours, it must travel at a speed of:

3) the 2006 world cup football tournament held in

4) for which of the following disciplines is nobel prize awarded?

B. Physiology or medicine

C. Literature, peace and economics

5) entomology is the science that studies

A. Behavior of human beings

C. The origin and history of technical and scientific terms

D. The formation of rocks

6) marathon is to race as hibernation is to

7) which of the following numbers is divisible by 3, 4, 5, and 6?

8) which of the following completes the missing series? SCD TEF UGH … WKL

9) look at this series: 8, 6, 9, 23, 87 , … what number should come next?

10) look carefully for the pattern, and then choose which pair of numbers comes next. 42 40 38 35 33 31 28

These questions were set in previous federal government scholarship board (FSB) examinations.

The FSB exam is organized by JAMB and their questions always include analogy, arithmetic, current affair, IT, verbal and quantitative reasoning and english language.

Also note that it is not JAMB UTME but JAMB aptitude test or recruitment exam.

FSB scholarship past questions PDF download

FSB interview requirements

All eligible applicants are to report for interview at the venues scheduled for their respective zones of origin for proper identification. Two sets of the printed, completed application forms are usually submitted at the various interview centres with the following attachments:

- Two sets of photocopies of educational certificates and testimonials of previous schools attended with the originals for sighting;

- Only ONE certificate is accepted i.E WAEC of may/june only for undergraduate applicants;

- Two copies of birth certificate from national population commission;

- State of origin/LGA certificate duly signed, stamped and dated;

- Four (4) passport sized coloured photographs on white background;

- Academic transcripts and NYSC discharge or exemption certificates will be required from applicants for postgraduate studies.

About FSB scholarships

The federal government of nigeria through the federal ministry of education through the federal scholarship board offers the bilateral educational agreement (BEA) oversea scholarships to nigerian undergraduate, masters and doctoral students.

The BEA awards are scholarship awards made to eligible nigerian youths after due process by development partners who have entered into bilateral educational agreement with nigeria. Nigeria equally offers reciprocal awards to citizens of the following bilateral education agreement countries: china, romania, and cuba.

The honourable minister of education (HME) usually annually invites interested and qualified nigerians to participate in the nomination interview for the bilateral educational agreement (BEA) scholarship award tenable in russia, china, morocco, turkey, algeria, romania, serbia, japan, ukraine, cuba, greece, czech republic, syria, macedonia, mexico, egypt, tunisia etc. Federal ministry of education overseas scholarships is for undergraduate, masters and phd nigerian students.

Scholarship value

The total scholarship value is scheduled as follows:

- Any of the above countries are responsible for the tuition and accommodation.

- While nigeria government takes care of the following:

– $500 monthly for supplementation.

– $250 yearly for warm clothing.

– $200 yearly for health insurance.

– $500 yearly for medical scholars only.

– $1000 for PG research grant yearly were applicable.

– ₦100,000 – take off for PG scholars were applicable

– ₦60,000 – take off for UG scholars were applicable

The federal government of nigeria through the federal ministry of education through the federal scholarship board offers local scholarships to nigerian undergraduate, masters and doctoral students who are studying in one institution or the other within nigeria.

Best forex brokers in nigeria

We compared the best forex brokers in nigeria. If you are a trader from nigeria and want to start forex trading, be smart to avoid financial scams prevalent on african continent and consider trading with CBN regulated forex brokers. Nigerian forex traders should make sure if depositing in nigerian NAIRA currency is allowed by your chosen nigerian forex trading platform! Doing so, can save you future exchange rate fees between USD and NAIRA.

Check the forex brokers nigeria comparison.

�� 5 best forex broker in nigeria

Our handpicked list of regulated forex brokers operating in nigeria.

- CM trading – best nigerian forex broker

- XM.COM – no deposit bonus & high leverage

- Hotforex– best for high leverage & bonuses

- Pepperstone – best forex trading platforms

- IQ option – best high leverage forex broker

The brokers below represent the best forex brokers for trading in nigeria.

#1 – CM trading ⇒ the best nigerian forex broker

CM trading caters to both beginners and intermediate traders, it is the best all-round forex company ever. Established in 2009 and regulated by FSCA this is one of the go-to brands for “both beginner and also profi FX traders.

Cmtrading.Com is truly one of the top forex brokers in nigeria !

- Welcome bonuses for new clients

- No requotes & no slippages policy

- Variable spreads from 0.9 pips

- Maximum leverage up to 1:500

- Metatrader 4 (MT4)

- Minimum first deposit $200

#2 – XM ⇒ the best forex trading platform

One of the best and most trusted forex brokers in nigeria. Fully regulated. XM is 100% safe and with a robust and stable trading platform that naturally comes with metatrader 4.

- Welcome BONUS for new forex traders from nigeria

- Zero re-quotes, zero rejections policy

- Local depositing methods available for nigerians

- Minimum deposit required is just $15

- Maximum leverage is 1:888

- Metatrader 4

- Scalping and hedging is allowed

#3 – IQ option – broker with high leverage

The largest trading platform with intuitive and easy to learn interface is great for all newcomers to trading! Fully regulated by cysec.

Fully regulated, with safe bank accounts, negative balance protection and wide variety of assets is the best option for starting out in the world of online trading.

- High leverage 1:1000

- Local depositing methods available for nigerians

- 48 currency pairs

- Large range of stocks

- 15 crypto currencies

- Minimum first deposit $5

Is forex trading legal in nigeria ?

Yes forex trading is legal in nigeria. With the rapidly growing nigerian economy, it was no wonder that the nigerian forex market has witnessed rapid growth during the past decade, as more and more middle class nigerians have been joining the fx market. This boom has led to many scams and fraud taking place. The national watchdog has been therefore cracking down on unregulated scam forex brokers who promise riches to newbies since the past few years. The fx industry in nigeria now tries hard to regain its good reputation.

History of forex trading in nigeria

The boom in forex currency trading has begun in mid 2000’s and by now there are around 300 thousand retail forex traders in nigeria according to financemagnates.Com resource. Thanks to low barriers of entry (low minimum deposits + high leverage trading + free trading platforms) more and more middle class people can now afford to invest this way.

We strongly urge you to start trading only with regulated fx brokers! You may choose either some of our world renowned brokers with regulation in UK, cyprus OR go with some local nigerian CBN regulated forex broker.

Nigeria forex trading regulation

Central bank of nigeria (www.Cbn.Gov.Ng) shortly just CBN is the main regulatory body which controls the capital markets including forex companies.

How to choose the right fx broker as a nigerian trader

African continent, especially nigeria is well known for a widespread forex scam. It is therefore important to protect your hard earned cash from fake forex gurus, crypto scam, ponzi schemes, get rich quick schemes and various con artists. Do yourself a favor and deposit your hard earned money only into the safe forex trading platform! Don’t trust anyone who’s telling you they will share with you forex secrets!

Forex trading in nigeria

The ultimate guide for beginners

For nigerian investors, forex trading can be a way to earn wealth.

It involves speculating on the rise and fall of a currency's fluctuations. It has become really popular in nigeria with an estimated daily trading volume of ₦300-450 million. You may be attracted to forex trading because it offers opportunities/potential to make good profits in less time (minutes & hours instead of months) with your investment.

But is trading in the forex market really profitable for small or retail individual investors? How much income can you earn from trading forex part time or full time? What are the risks?

There are so many other questions that may come to your mind if you are a beginner forex trader. We will try to answer all these questions and more with this guide.

Busy right now? Don't worry. Click the button below & we will send you a copy of this guide in less than 5 seconds. Just let us know where you want receive it & we will deliver it to you!

Contents

What is forex trading?

Forex trading is the buying & selling of currencies with an aim to make a profit. Traders can place their trades in the forex market, which is an over-the-counter market that allows investors to trade currencies. This is a platform for investors, institutions, banks, and retail traders.

Foreign exchange market is the largest trading markets and has an average turnover of US$6.5 trillion on a daily basis around the world. This is larger than all the stock markets in the world combined together. Trading activities are conducted through the “interbank market” which allows you to execute trades 24 hours in a day, for 5 days a week from monday through friday.

Real life example of forex trading

Have you traveled overseas? If you have then the chances are that you have already traded currencies before. This is because you need to acquire the currency of the country you are visiting by exchange the currency of your home country.

Let’s say that you change ₦380,000 to US dollars for travelling, and you get 1000 USD from the exchanger. In this example you are physically buying USD by exchanging your nairas. When you change your naira into a different currency to spend money on your trip, you are actually making a forex transaction.

The rate that you get from your exchanger is decided on the basis of the real time exchange rates plus the profit margin of the money changer. If the current market rate is NGN380 per USD, then you would probably get around ₦390 rate from your changer. The difference of ₦10 (390 – 380) for each USD is your changer’s profit margin.

In theory, this is what online forex trading on the internet is all about, but still a bit more than exchanging currencies through a money changer.

Understanding currency pairs

All transactions in the forex market are based on the purchase of one currency for the sale of another currency. So you are trading or exchanging the 2 currencies simultaneously for one another, hence known as ‘currency pairs’.

For example: EUR/USD (euro & the US dollar), NGN/USD (nigerian nairas & the US dollar) etc.

There are 100s of currency pairs, including the so called majors, minors & exotic. It is really important to understand what currency pairs, and how they work before you can start trading forex.

In this chapter, you will learn everything you need to know about currency pairs. Let's start!

Types of currency pairs

Currency pairs are mainly classified into 3 types:

1) major currency pairs: these are the currency pairs that include US dollar as one of currency in the pair. Almost 85% of the global trading volume is traded in the majors.

Majors include 7 currency pairs: EUR/USD (euro/US dollar), GBP/USD (pound/US dollar), USD/JPY (US dollar/japanese yen), AUD/USD (australian dollar/US dollar), USD/CHF (US dollar/swiss franc), NZD/USD (new zealand dollar/ US dollar) and USD/CAD (US dollar/canadian dollar).

Since most of the trading is done in majors, so they are highly liquid & it is easier to get in & out of trades. The opportunities to make profits are higher.

2) minor currency pairs: minors, also called the cross curreny pairs, contain all the currencies in the major pairs except for US dollar. These include EUR (euro), GBP (pound), JPY (japanese yen) etc.

Examples: EUR/GBP, EUR/JPY, GBP/JPY etc. As you may have noticed that these are the crosses of all the major currencies excluding US dollar.

The liquidity & volume are lower than majors, so trading opportunities may be lower than with majors.

3) exotic currency pairs: exotic currency pairs are made from one of the currency from major pairs and other one from the emerging economies like: brazil, south africa, mexico, russia etc. Examples of such pairs include: USD/BRL (united states dollar/brazilian real), USD/HKD (united states dollar/hong kong dollar), USD/ZAR (US dollar/south african rand), USD/RUB (US dollar/russian ruble) etc.

Exotic pairs usually don't have high liquidity & trading volume but they have high volatility plus they have high spreads as compared to major & minor pairs.

As a beginner forex trader, you need to stick to major pairs only as it offers high liquidity and predictable market movements.

Currency pairs lingo

While trading forex, you would come across these common terms. We will be explaining all the important terms here.

1) quote by the broker: when you open a trading account with a forex broker, they tell you the bid/ask price to buy & sell the currency. It will be quoted like this example: EUR/USD 1.2812/15. This price is the quote by the broker.

2) pip: pip is the smallest unit in the currency quote (given by the broker). It is the last decimal in the price. For example: in the quote 1.2811 moves to 1.2812, the movement in the last decimal is 1 pip.

3) bid price: bid price is the price at which the broker is willing to buy a currency pair from you. At this price, you can sell base currency in the pair. This price is shown on the left side in the quote ticker by the broker.

For example: if you see the quote as EUR/USD 1.2812/15, then 1.2812 is the quote price, and it means that you can sell 1 euro for 1.2812 US dollars.

4) ask price: ask price is the price, at which the broker is willing to sell a currency pair to you. At this price, you can buy the base currency mentioned in the pair. It is shown on the right side of the quote ticker by the broker.

For example: when you see the same quote as above it had 2 values in it: EUR/USD 1.2812/15, the second value tells you about the ask price, it means you can buy 1 EUR for 1.2815 dollars.

5) spread: spread is the difference between the bid & ask price quoted to you by the broker. So in above example: in which quote is EUR/USD 1.2812/15, the difference between 1.2815 minus 1.2812 i.E. 0.0003 or 3 pips, is the spread.

How to start forex trading?

Forex trading can now be done by anyone in nigeria, anytime, from home or anywhere through the internet. All you need to trade forex online is a laptop, good internet connection, good trading strategy tested on demo & starting capital which we recommend to be atleast ₦50,000.

You need to signup with a forex broker. There are many 'good' & 'scam' brokers. We will tell you exactly who to choose.

Finally, once you have a trading account we will show you the forex orders that you can place, and the profit/loss calculation.

1) open account with a forex broker

In order to trade forex, you need to find a broker. There are numerous forex brokers available for nigerian traders such as hotforex, exness, XM forex, FXTM, forex.Com, fxpro, oanda etc.

We have compiled the list of best forex brokers for nigerian traders. All of the brokers that we recommend on our website have proven track record of honest dealing with traders, and are authorized/regulated by top-tier global regulatory bodies (FCA, FSCA, cysec & ASIC) for the safety of your funds.

Forextime is the best broker for forex trading in nigeria.

- Competitive spread on majors (and zero fees on deposits & withdrawals)

- Free demo trading account

- Easy to use (mobile-friendly) MT4 & MT5 platforms

- 56 currency pairs, 4 cryptocurrencies, 100s of cfds

- Fast withdrawals in nigeria & good support

- Your funds are safe – regulated with UK's FCA (financial conduct authority), cysec (cyprus securities exchange commission) and FSCA (financial sector conduct authority in south africa)

Start trading at FXTM important: forex trading is risky, so have a working strategy before trading live.

Start with demo accounts: never start trading directly on a live account if you are a beginner as your real money will be at risk. We advise you to first create a demo account with the broker of your choice and then learn to trade by building & testing out a trading strategy that works for you. Only once you are confident about your trading style & strategy, only then you should decide to trade with real money on a live account.

Once you have found the forex broker of your choice, you can then open an account with that broker to start trading (or demo account to learn). This account will enable you to place your trades in the interbank market at the live currency prices.

If you are creating a live account: all reputed brokers have some sort of KYC (ID & address proof verification) & you cannot start trading in the market without verifying your account with any of the regulated broker. Once the verification is complete, you will need to make a deposit to fund your live account. These funds will be used to place live trades at the real market prices.

2) place your first trade

After you have created your live account & funded it with your forex broker, you can then open your first trade. The two positions that you can take in the forex market are either the “long position” or the “short position”.

You need to study and analyse the trading charts or the market news & then decide whether you want to place a buy order or a sell order.

The long position implies that you are buying a currency pair and are betting on it to rise in value in the future. For ex. If you currenny market price of EUR/USD is 1.1000 & you believe that it would reach 1.25 in the near future then you can place a buy order, hence you would be buying euros & selling US dollars.

See the example below for a profitable long/buy order in forex.

Buy order in forex is similar to buying an equity stock. You buy the currency at a low price, and once it reaches a higher value, you can then sell off the currency, thus making your profit.

The short position can be taken when you believe the price of the currency will fall in the upcoming period. If the present price of EUR/USD is 1.10 & you think that it would fall to 1.0 in the near future then you can place a sell order in the marker.

Below is an illustration of how you can make profit with a sell order in forex.

You can place a sell order when the currency is at a higher price and then when the value falls significantly, you can buy it back at lower price, thus realizing your profit.

3. Close the trade

To realize your proft (or loss), you need to close the trade that you opened.

Profit or loss? Depending on the movement of the currency pair that you were trading, you will either be profitable or make a loss once you close the trade.

Example: if you have placed a buy/long order on EUR/USD, and the price of the pair goes up by 100 pips, and you decide to close the trade. You would have made a profit of around $100 (minus spread) if you are trading 1 mini lot.

But if the EUR/USD goes down 100 pips, and you decide to close the trade. You will make a loss in this case.

Also read: our detailed guide on how to trade forex in nigeria

so, let's see, what was the most valuable thing of this article: is trading legal with FBS in nigeria? Might you be better investing with an alternative broker instead? Find a FBS review, promotions, and bonuses for nigeria. At fbs nigeria

Contents of the article

- Today forex bonuses

- FBS nigeria

- #1 alternative in nigeria for FBS

- #2 rated best nigeria broker

- #3 rated best nigeria broker

- Is forex trading in nigeria legal?

- Are you in the right place?

- Trading

- Account comparsion

- Frequently asked questions

- What trading account should I choose?

- What is a trading account?

- What is forex trading?

- Why is FBS the best broker for online trading?

- How do I start trading?

- Download trading platform

- Deposit with your local payment systems

- Data collection notice

- Beginner forex book

- Thank you!

- FSB scholarship past questions for FSB...

- Federal government scholarship board, FSB...

- FSB scholarship past questions PDF download

- FSB interview requirements

- About FSB scholarships

- Our work

- CONCEPT

- FARMER BUSINESS SCHOOL (FBS)

- FBS ADVISORY FACILITY

- FBS SUCESS STORIES

- COOPERATIVE BUSINESS SCHOOL (CBS)

- GOOD AGRICULTURAL PRACTICES (GAP)

- ICT SOLUTIONS FOR DEVELOPMENT: 3D ANIMATION AS A...

- BUSINESS SERVICES

- Forex trading in nigeria

- What is forex trading?

- Understanding currency pairs

- How to start forex trading?

- FSB scholarship past questions for FSB...

- Federal government scholarship board, FSB...

- FSB scholarship past questions PDF download

- FSB interview requirements

- About FSB scholarships

- Best forex brokers in nigeria

- �� 5 best forex broker in nigeria

- #1 – CM trading ⇒ the best nigerian forex broker

- #2 – XM ⇒ the best forex trading platform

- #3 – IQ option – broker with high leverage

- Is forex trading legal in nigeria ?

- History of forex trading in nigeria

- Nigeria forex trading regulation

- How to choose the right fx broker as a nigerian...

- Forex trading in nigeria

- What is forex trading?

- Understanding currency pairs

- How to start forex trading?

No comments:

Post a Comment