Open account forex trading

Paxforex offers a full range of services for international trading in the forex market and provides an opportunity to enter into contracts with instruments such as stocks, precious metals, and commodities.

Today forex bonuses

One of the fundamental factors of successful trading is the choice of forex broker through whom you conduct transactions. We want to draw your attention to some advantages of forex trading with paxforex, which will allow you to trade in financial markets with more comfort, more convenience, efficiency, and ease. One of the main priorities of our company is continuous improvement of trading conditions!

Open forex trading account with paxforex

Paxforex offers a full range of services for international trading in the forex market and provides an opportunity to enter into contracts with instruments such as stocks, precious metals, and commodities. One of the fundamental factors of successful trading is the choice of forex broker through whom you conduct transactions. We want to draw your attention to some advantages of forex trading with paxforex, which will allow you to trade in financial markets with more comfort, more convenience, efficiency, and ease.

Free trading account opening benefits

- Quick and easy forex trading account opening. To open an account, you do not need to spend time filling out numerous contracts and provide a large set of documents. You can open a trading account in minutes by simply filling out a short form online and send us scanned copies of your documents.

- A wide range of forex trading platforms. Desktop client terminal (windows), mobile version for pdas and smartphones (iphone, ipod, ipad, android, windows mobile)

- Easy forex trading account replenishment (funding). Make a deposit anytime online by using our electronic payment system. Your funds will be quickly transferred to the trading account, and be immediately available for trading.

- Five types of forex accounts. Forex trading conditions will allow you to feel confident in the market with any initial deposit. For this purpose we have developed three types of trading accounts: cent account, mini account, fix spread account, standard account, and VIP account. Each of these trading accounts is focused on different levels of trader’s experience so you can choose best forex trading account for you.

- Wide range of trading instruments. Paxforex offers over 60 currency pairs on forex, and CFD's on stocks, futures, and precious metals. Such a set of financial instruments significantly expands trade opportunities and allows you to create an optimal investment portfolio and to better respond to world economic events.

- One account for all the trading tools. In order to trade currencies, shares (CFD-contracts) or precious metals with paxforex, no need to open multiple accounts. Just open a forex trading account online and all tools will be available to you in the trading terminal.

- Expert advisers. Paxforex company allows you to use expert advisers in your trading accounts.

- Favorable terms of trade. Leverage allows you to define the optimal forex trading strategy for you: a small leverage can reduce potential losses in the event of an unfavorable market situation; the high leverage increases the risk and, therefore, profits.

One of the main priorities of our company is continuous improvement of trading conditions!

Open account

At tradeview forex opening a live account can be completed in minutes.

We provide security and privacy when your personal information is transmitted online, using the most up to date encryption methods, authentication procedures, network level security practices and periodic application security reviews when you open a new trading account.

IMPORTANT NOTE: if you are located in the greater china region please apply for a live account through the www.Tradeviewasia.Com website OR click HERE to be redirected automatically.

Trade forex: things you should know

Trading foreign currencies is a challenging and potentially profitable opportunity for educated and experienced investors; however, before deciding to trade forex, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money you cannot afford to lose.

There is considerable exposure to risk when trading foreign currencies. Any transaction with currencies involves risks including, but not limited to, the potential for changing political and/or economic conditions that may substantially affect the price or liquidity of a currency.

Moreover, the leveraged nature of forex trading means that any market movement will have an equally proportional effect on your deposited funds. This may work against you as well as for you. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. If you fail to meet any margin call within the time prescribed, your position will be liquidated and you will be responsible for any resulting losses.

IMPORTANT NOTICE TO CLIENTS REGARDING CRYPTO CURRENCY PROHIBITION

We use cookies which are necessary to provide the functionality and services of the website.

Learn more about our privacy policy here.

I consent to the use of the cookies on this website

How to open an account

You can start trading across our range of award-winning platforms in three simple steps: complete our application form, verify your identity and deposit funds. You are now ready to place your first live trade with OANDA. It is as easy as that.

Step 1: apply for an account

To apply, you must be over 18 years old, and a legal resident of the united states. We only ask questions that are relevant to your application and for regulatory purposes. Be prepared to upload proof of identity and address, such as your drivers license.

Step 2: verify your identity and proof of address

We may need you to send some documentation to verify your identity. You can scan the below documents or use your smartphone to take a picture of the documents and submit them through our secure portal.

Driver’s license (proof of identity and address)

You can use your driver's license to validate your identity and address. Scan or take a photo of the front of your license. Please ensure that the full page of the document is visible, all written details are legible and the face in the photo is clear/identifiable.

Don’t have a driver’s license? You can also verify your identity and proof of address using the below documents:

Government-issued passport or ID card (proof of identity)

Scan or take a photo. The scan should show your photo, name and date of birth. The document should be valid as of today (not expired).

Utility bill, bank statement or other document with your name and address on it (proof of address)

The document should show your current residential address and must match the address on your OANDA account application. It should be mailed or dated within the last three months and should be issued in your name. We cannot accept documents addressed as ‘c/o' or ‘care of’ unfortunately.

Step 3: fund and trade

To deposit funds, log in to ‘manage funds’ using your OANDA account details and click on the ‘deposit’ button. You can fund your trading account using a number of methods, including debit cards, bank wire transfer, check (USD) and automated clearing house (ACH). There is no minimum deposit amount. Note: you can only deposit up to 50% of your net worth.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Depositing and withdrawing funds

It is simple and straightforward to deposit and withdraw funds to and from your OANDA account.

Transparent trading costs

We are upfront about our fees so you know how much you are paying when you trade with us.

Trade forex with OANDA

We are a globally-recognized broker with 23 years' experience in foreign exchange trading.

© 1996 - 2021 OANDA corporation. All rights reserved. "OANDA", "fxtrade" and OANDA's "fx" family of trademarks are owned by OANDA corporation. All other trademarks appearing on this website are the property of their respective owners.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Refer to our legal section.

OANDA corporation is a registered futures commission merchant and retail foreign exchange dealer with the commodity futures trading commission and is a member of the national futures association. No: 0325821. More information is available using the NFA basic resource.

Trading FX on margin is high risk and not suitable for everyone. Losses can exceed investment.

Forex trading account – how to open trading account

“disclosure: some of the links in this post are “affiliate links.” this means if you click on the link and purchase the item, I will receive an affiliate commission. This does not cost you anything extra on the usual cost of the product, and may sometimes cost less as I have some affiliate discounts in place I can offer you”

One of the first steps in forex trading is opening a forex trading account. Account gives you entrance into trading world where you will be one of the traders on the biggest market.

" data-medium-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" data-large-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" loading="lazy" width="259" height="244" src="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" alt="forex trading account" />

I will show you what you need to do to open account with broker.

How to open trading account

In order to continue you need to have broker. If you do not have broker even then you can continue to inform yourself about opening an account. It is not bad to know more if you want.

To open trading account, demo or real, necessary steps are:

- Selecting trading account type

- Registration

- Activating trading account

This is global overview but I will get into more details further in this text. Be sure to open first demo account and then after demo trading, real account.

Choosing trading account type

This post is about opening real account. If you are looking how to open demo account check this:

Step by step guide: admiral markets demo account

When opening account, real account, you need to decide which type you want to open. Brokers offers a lot options for any trader and before deciding please read as much as you can so you do not get scammed.

Broker can offer you few account types:

- Business

- Personal

- Managed

- Managed

- Spot

- Futures

- Forwards

Managed account

Some brokers have account where you can deposit money and then let broker to trade for you. These kind of accounts are known as managed account. If you want to trade on forex market by yourself then do not choose this account type.

By the way they charge fees through profit they make on your account and there is minimum amount on deposit which can be different by brokers. Deposit amount is mostly several thousands dollars which can be to high for individual investor.

Be sure that you open forex spot account and not one of the other accounts like futures and forwards.

Trading account size

Between account sizes you will need to choose small or large accounts. Small account is for trader with small amount of invested money. Large account is for trader with high amount of invested money.

Small accounts with every pip move will bring you smaller profit but also small loss if market moves against you. At start it is best to have small loss if you make a bad trade. In time how your progress through forex market you can deposit more money and have large account. With large account every pip move will bring you more money on your account.

For beginners it is recommended to use small account until they master trading and afterwards they can continue on the larger accounts. This way they will protect heavily earned money from fast losing on forex market.

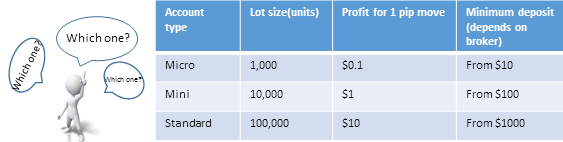

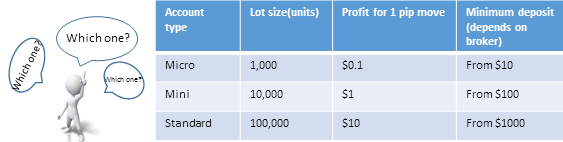

During account opening process sometimes you will encounter three types of account that broker offers you. They are:

- Mini account

- Micro account

- Standard account

There is difference between them as their name suggest it but in general there is no to much complicated differences.

What is micro account

Micro account is account mostly intended for novice traders but it is not mandatory that he is novice.

This account requires smaller amount of deposit and that is between $10 – $250. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $1,000 on the market. Every pip move gives $0.1 difference on trading account. If trade goes in your favor you will earn $0.1 and if trade goes against you then you lose $0.1.

As you can see 1 pip move does not bring a lot profit or loss. If you open a trade and wait until market moves in one direction for 100 pips then this amount will be $10. $10 can be a lot if you have invested $50 on your trading account.

If you are able to invest more money on you account it is best to do it because this way you will avoid possible margin call. With higher amount on the account you will have wide space to trade if trade becomes a bad trade.

Margin call happens when you have bad trade active and without enough money to sustain further loss. When critical level is reached broker automatically close your trade.

What is mini account

Similar to micro account mini account is for traders who wants to invest money in range from $100 – $500. It is a little bit higher then micro account but it gives you possibility to earn $1 with every pip move.

Every trade/contract that you open you control $10,000. Every pip move gives $1 difference on trading account.

It is 10 times more than micro account and for new traders this is more then enough. Same as for micro account here is better to have larger amount of money on account.

What is standard account

Standard account is account mostly intended for experienced traders but it is not mandatory. Novice traders sometimes use standard account for trading.

This account requires larger amount of deposit and that is from $1000 and above. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $100,000. Every pip move gives $10 difference on trading account.

Which account to open

Micro, mini or standard account depends on you and your preferences. Do you want to earn more money with 1 pip move or less money with 1 pip move.

Forex account – micro, mini and standard

Those who have more money and know how to trade they will go for standard account. For novice it is the best to go with mini account. With every pip move novice will earn $1 which is a good profit.

Advantage that you can have with mini account over standard account is when you have high amount invested on trading account you can open several trades. If you have 10 orders on mini account it is same as you have 1 order open on standard account.

On mini account each trade gives you $1 for pip move. If something goes wrong and your margin starts to become red you can close one of orders and rest of them leave open. This way your margin will not be overloaded and you will stay in the game with other orders. If market moves in your direction open orders will bring you profit.

As a conclusion mini account gives you more flexibility in trading over standard account but enough profit for 1 pip move. Choose wisely which account is best for you and your trading preferences.

Leverage

Another thing to watch out when choosing account is leverage on that account. Leverage is ability to control large sum of money using small amount of your invested money.

You can choose different leverage like from 1:50 up to 1:500. This is different from broker to broker. 1:50 means that with one 1$ you can control $50 on the market. Broker lends you rest of the money so you can trade on the market and make more money. But also lose more money if market goes against you.

After you have decided which account you want to have, personal/business or small/large you need to decide to open

- Live or

- Demo account

As said earlier, for beginners it is best to open demo to test and later on to open live account. On demo account you should at least learn how to open and close a trade.

From my experience I can tell you that I have started immediately with live account because demo account could not give me what I wanted and that is – live experience.

Registration

When registering real/live account you will need to do some paper work in order to open it. Those papers could be

- Your ID number

- Utility bill not older than 3 months with your personal address on it, so they can verify that it is really you and data you have provided are accurate

They need this information to comply with the law. Regulatory agencies wants to protect you so they have set requirements for broker to open an account for you. If you are not required to give them these information’s you should be suspicious because that is minimum what they should ask you to provide.

During registration broker could ask you several information about your trading experience, your trading intentions or how much you will invest. They like to get know you(KYC – know your customer) and your trading intentions.

Please read all what is written in their documents so you are familiar with all costs that can arise, if there is any. Also, pay attention when depositing money over wire transfer how much does bank charge for their services.

Trading account activation

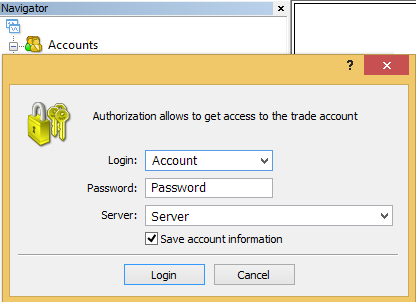

When registration of your live account is done you will receive confirmation mail with account details. Information that trader receives in e-mail can be different because not all forex broker sends same e-mail.

- Account number

- Password for trading platform

- Server on which to connect

In order to activate trading account open your trading platform and follow further steps.

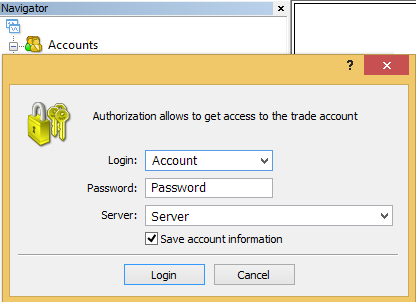

In the MT4 platform right click on the “accounts” menu which is located under “navigator” menu. After right click you will select “login to trade account“.

Use those information’s and enter them into new window that appears, like the picture below this text.

If everything is fine with data entered your trading platform will start to show you real information about trading pair price. If not, you will hear sound that indicates you have entered incorrect data.

Possible cause you did not connect to trading platform with information from broker is:

- Wrong login data – check information from broker

- Wrong trading platform – use platform from your broker

- No internet access – check can you open some other website in your browser in order to verify is internet connection ok

If you have entered all data as shown above and you have tested possible source of the problem and even then you are not connected then please call broker support.

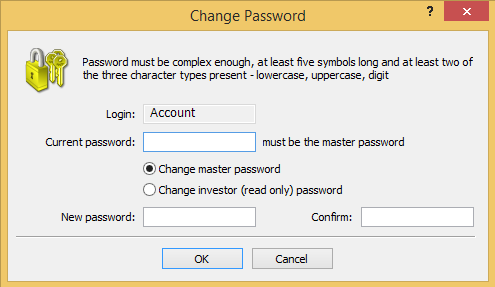

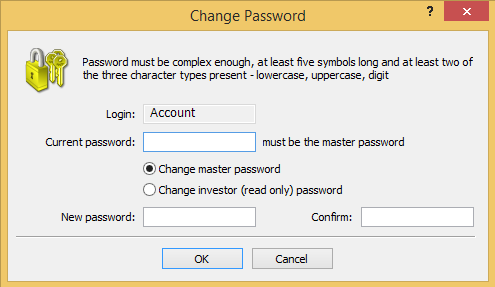

Password change

Password is possible to change immediately after you login into trading account. You are not obligated to leave same password you have received from your broker. You can change it to your desired password where you need to fulfill certain requirements.

Go into MT4 menu “tools” and select “options” with which you will open new window.

“tools” menu for trading account password change

In “options” window under tab “server” you will see option to change password. All other parameters you can leave as they are.

Change trading password under tab “server”

Select “change” and window “change password” will appear where you need to enter new password details. Enter your current password you have received from broker and enter new password. There is 2 places where you need to enter password, “new password” and “confirm“.

Trading account password change

Please pay attention to fulfill all necessary conditions for new password.

- At least five symbols

- At least two of the three character lowercase, uppercase and digit

After all above is done you will have account on MT4 platform ready for trading. If you are using real account then you will need to fund it with real money.

Transfer of real money on the trader account is done in trader room. I cannot show you steps because trader room is different on each broker. But mostly they have instructions how to transfer money from your credit card or bank account or any other possible channel.

FREE 5 day email course

Email course is for beginners who do not know to much about forex trading but wants to know

- What is forex

- What is trading and where to start

- What is metatrader 4

- How to setup charts on metatrader 4

- How to open and close order in metatrader 4

After you are done you will know how to use FREE trading platform to activate order by selecting currency pair on the forex market and make money.

- Trading platform?

- Activate order?

- Select currency pair?

- Make money?

To much strange words? Get them clear and start trading!

Frano grgić

A forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the first choice for traders and beginners. Market analysis is featured by forex factory next to large publications like dailyfx, bloomberg. Getknowtrading is becoming recognized among traders as a website with simple and effective market analysis.

BETA TESTERS WANTED

This is opportunity to be one of the first people to:

On online course about how to start trading

Join if you want to be part of and learn while testing

Categories

Forex signals

FREE PDF's

What is leverage?

How to calculate pip value?

What is margin?

What is lot?

How long demo trade?

0 comments

Disclaimer: any advice or information on this website is general advice only – it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by get know trading, it’s employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, CFD’s, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

How to open a forex trading account

So after demo trading on at least three broker platforms, you’ve narrowed down your choice to a single forex broker?

After finding the right broker for you, you can open a forex trading account in three simple steps:

- Selecting an account type

- Registration

- Activating your account

Why not? It’s all FREE! Make sure to try out and “kick the tires” of several different brokers to get a feel for the right one for you.

Choosing an account type

When you’re ready to open a live account, you have to choose which type of forex trading account you want: a personal account or a business (aka corporate) account.

In the past, when opening a forex trading account, you’d also have to choose whether you wanted to open a “standard” account, a “mini” account, or a “micro” account.

This is great for newbie and inexperienced traders who only have a small account of capital.

This provides you great flexibility, as you won’t have to trade bigger than you’re comfortable with.

Also, always, always, always remember: always read the fine print.

Some brokers have a “managed account” option in their application forms. If you want the broker to trade your account for you, you can pick this.

But is this what you really want? After all, you didn’t read through the whole school of pipsology just to have someone else trade for you!

Besides, opening a managed account requires a pretty big minimum deposit, normally $25,000 or higher. Also, the manager will also take a cut out of any profits.

Lastly, make sure you open a forex spot account and not a forwards or futures account.

Registration

You will have to submit paperwork in order to open an account and the forms will vary from broker to broker.

They are usually provided in PDF format and can be viewed and printed using adobe acrobat reader program.

Also, make sure you know all the associated costs, like how much your bank charges for a bank wire transfer. You’d be surprised how much these actually cost, and they may actually take up a significant portion of your trading capital.

Account activation

Once the broker has received all the necessary paperwork, you should receive an email with instructions on completing your account activation.

So all that’s left is for you to log in and start trading. Pretty easy huh?

Time to log in, pop open those charts, and start trading!

But wait just one minute!

We strongly advise you DEMO trade first.

There’s no shame in demo trading. Everyone has to start somewhere.

If you have been demo trading for at LEAST a month, then maybe you can dip your feet into live trading. Even then, we suggest you go in the shallow end and consider how much you want to risk.

Trading live is a different beast altogether. It’s like the difference between sparring against your kid brother (or sister) and fighting manny pacquiao.

If you start trading live without any demo trading experience, this is what usually happens:

But no matter how successful you were in demo trading, nothing can replace the feeling of having real money on the line.

And once you’ve started trading on a live account, never get too comfortable. Always remain vigilant and use proper risk management.

Otherwise, this might happen:

Roboforex trading accounts

Note: server time = eastern european time (EET), standard time = UTC+2 (summer time = UTC+3).

How to start trading on financial markets with roboforex?

We offer fast order execution, optimal trading conditions, and a convenient members are for managing your accounts. To start trading, you have to register a members area and open a trading account. Choose one of the account types and trading platforms (metatrader 4, metatrader 5 or ctrader), which most closely correspond to your requirements. Moreover, you have an opportunity to perform trading operation through our proprietary terminals, R mobiletrader for ios and android, R webtrader and R trader, which will allow you to trade even at places where there is no access to your PC.

If you find it difficult to make a choice, you can read detailed instructions on "how to open a trading account" page.

Useful links:

Answers to the most frequently asked questions.

How to start trading on forex?

Experts share their experience with beginners.

Download center

Choose and download the most suitable trading platform.

Analytics center

All analytical data and trading instruments in one window.

In case you still have questions, you can ask our live support specialists in any way that is convenient for you.

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

Question: how to open a forex account with deriv?

How to open deriv’s FX trading account?

Deriv - what's now?

Note that the website hercules.Finance does not promote or introduce the service of binary options.

Deriv does not provide the service to residents in USA, canada, and hong kong, or to persons below 18.

How to open a forex account of deriv MT5?

To open a FX account of deriv MT5, follow the simple steps below.

- Go to deriv official website

- Click on “signup” or “create free demo account” button

- Enter your email address and “submit”

- Check “inbox” of your email and click on the registration link

- Complete the online registration with deriv

- Receive account information and login credentials

- Login to deriv official website

The account opening is free and may only take a few minutes to complete.

Go to deriv official website and start your online registration today.

Invest in spot forex and cfds on deriv MT5

On deriv MT5, you can invest in forex currency pairs, cryptocurrency, stock indices, commodities (precious metals and oils) and synthetic indices.

There are over 100 financial markets that you can invest in with deriv.

Deriv MT5 adopts “market execution” with STP (straight through processing) model.

With the STP execution, deriv MT5 provides you fair and fast trading environment, where there is no conflict of interest between deriv and its investors.

For more information about deriv MT5’s trading conditions, visit deriv official website.

Deriv

Post tags

Deriv is an online forex and CFD broker with 1:1000 leverage on MT5 platforms. Deriv has been in the financial industry since 1999.

Deriv does not provide the service to residents in USA, canada, and hong kong, or to persons below 18.

Related

Related faqs

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

How to open an account

You can start trading across our range of award-winning platforms in three simple steps: complete our application form, verify your identity and deposit funds. You are now ready to place your first live trade with OANDA. It is as easy as that.

Step 1: apply for an account

To apply, you must be over 18 years old, and a legal resident of the united states. We only ask questions that are relevant to your application and for regulatory purposes. Be prepared to upload proof of identity and address, such as your drivers license.

Step 2: verify your identity and proof of address

We may need you to send some documentation to verify your identity. You can scan the below documents or use your smartphone to take a picture of the documents and submit them through our secure portal.

Driver’s license (proof of identity and address)

You can use your driver's license to validate your identity and address. Scan or take a photo of the front of your license. Please ensure that the full page of the document is visible, all written details are legible and the face in the photo is clear/identifiable.

Don’t have a driver’s license? You can also verify your identity and proof of address using the below documents:

Government-issued passport or ID card (proof of identity)

Scan or take a photo. The scan should show your photo, name and date of birth. The document should be valid as of today (not expired).

Utility bill, bank statement or other document with your name and address on it (proof of address)

The document should show your current residential address and must match the address on your OANDA account application. It should be mailed or dated within the last three months and should be issued in your name. We cannot accept documents addressed as ‘c/o' or ‘care of’ unfortunately.

Step 3: fund and trade

To deposit funds, log in to ‘manage funds’ using your OANDA account details and click on the ‘deposit’ button. You can fund your trading account using a number of methods, including debit cards, bank wire transfer, check (USD) and automated clearing house (ACH). There is no minimum deposit amount. Note: you can only deposit up to 50% of your net worth.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Depositing and withdrawing funds

It is simple and straightforward to deposit and withdraw funds to and from your OANDA account.

Transparent trading costs

We are upfront about our fees so you know how much you are paying when you trade with us.

Trade forex with OANDA

We are a globally-recognized broker with 23 years' experience in foreign exchange trading.

© 1996 - 2021 OANDA corporation. All rights reserved. "OANDA", "fxtrade" and OANDA's "fx" family of trademarks are owned by OANDA corporation. All other trademarks appearing on this website are the property of their respective owners.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Refer to our legal section.

OANDA corporation is a registered futures commission merchant and retail foreign exchange dealer with the commodity futures trading commission and is a member of the national futures association. No: 0325821. More information is available using the NFA basic resource.

Trading FX on margin is high risk and not suitable for everyone. Losses can exceed investment.

Forex trading account – how to open trading account

“disclosure: some of the links in this post are “affiliate links.” this means if you click on the link and purchase the item, I will receive an affiliate commission. This does not cost you anything extra on the usual cost of the product, and may sometimes cost less as I have some affiliate discounts in place I can offer you”

One of the first steps in forex trading is opening a forex trading account. Account gives you entrance into trading world where you will be one of the traders on the biggest market.

" data-medium-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" data-large-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" loading="lazy" width="259" height="244" src="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" alt="forex trading account" />

I will show you what you need to do to open account with broker.

How to open trading account

In order to continue you need to have broker. If you do not have broker even then you can continue to inform yourself about opening an account. It is not bad to know more if you want.

To open trading account, demo or real, necessary steps are:

- Selecting trading account type

- Registration

- Activating trading account

This is global overview but I will get into more details further in this text. Be sure to open first demo account and then after demo trading, real account.

Choosing trading account type

This post is about opening real account. If you are looking how to open demo account check this:

Step by step guide: admiral markets demo account

When opening account, real account, you need to decide which type you want to open. Brokers offers a lot options for any trader and before deciding please read as much as you can so you do not get scammed.

Broker can offer you few account types:

- Business

- Personal

- Managed

- Managed

- Spot

- Futures

- Forwards

Managed account

Some brokers have account where you can deposit money and then let broker to trade for you. These kind of accounts are known as managed account. If you want to trade on forex market by yourself then do not choose this account type.

By the way they charge fees through profit they make on your account and there is minimum amount on deposit which can be different by brokers. Deposit amount is mostly several thousands dollars which can be to high for individual investor.

Be sure that you open forex spot account and not one of the other accounts like futures and forwards.

Trading account size

Between account sizes you will need to choose small or large accounts. Small account is for trader with small amount of invested money. Large account is for trader with high amount of invested money.

Small accounts with every pip move will bring you smaller profit but also small loss if market moves against you. At start it is best to have small loss if you make a bad trade. In time how your progress through forex market you can deposit more money and have large account. With large account every pip move will bring you more money on your account.

For beginners it is recommended to use small account until they master trading and afterwards they can continue on the larger accounts. This way they will protect heavily earned money from fast losing on forex market.

During account opening process sometimes you will encounter three types of account that broker offers you. They are:

- Mini account

- Micro account

- Standard account

There is difference between them as their name suggest it but in general there is no to much complicated differences.

What is micro account

Micro account is account mostly intended for novice traders but it is not mandatory that he is novice.

This account requires smaller amount of deposit and that is between $10 – $250. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $1,000 on the market. Every pip move gives $0.1 difference on trading account. If trade goes in your favor you will earn $0.1 and if trade goes against you then you lose $0.1.

As you can see 1 pip move does not bring a lot profit or loss. If you open a trade and wait until market moves in one direction for 100 pips then this amount will be $10. $10 can be a lot if you have invested $50 on your trading account.

If you are able to invest more money on you account it is best to do it because this way you will avoid possible margin call. With higher amount on the account you will have wide space to trade if trade becomes a bad trade.

Margin call happens when you have bad trade active and without enough money to sustain further loss. When critical level is reached broker automatically close your trade.

What is mini account

Similar to micro account mini account is for traders who wants to invest money in range from $100 – $500. It is a little bit higher then micro account but it gives you possibility to earn $1 with every pip move.

Every trade/contract that you open you control $10,000. Every pip move gives $1 difference on trading account.

It is 10 times more than micro account and for new traders this is more then enough. Same as for micro account here is better to have larger amount of money on account.

What is standard account

Standard account is account mostly intended for experienced traders but it is not mandatory. Novice traders sometimes use standard account for trading.

This account requires larger amount of deposit and that is from $1000 and above. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $100,000. Every pip move gives $10 difference on trading account.

Which account to open

Micro, mini or standard account depends on you and your preferences. Do you want to earn more money with 1 pip move or less money with 1 pip move.

Forex account – micro, mini and standard

Those who have more money and know how to trade they will go for standard account. For novice it is the best to go with mini account. With every pip move novice will earn $1 which is a good profit.

Advantage that you can have with mini account over standard account is when you have high amount invested on trading account you can open several trades. If you have 10 orders on mini account it is same as you have 1 order open on standard account.

On mini account each trade gives you $1 for pip move. If something goes wrong and your margin starts to become red you can close one of orders and rest of them leave open. This way your margin will not be overloaded and you will stay in the game with other orders. If market moves in your direction open orders will bring you profit.

As a conclusion mini account gives you more flexibility in trading over standard account but enough profit for 1 pip move. Choose wisely which account is best for you and your trading preferences.

Leverage

Another thing to watch out when choosing account is leverage on that account. Leverage is ability to control large sum of money using small amount of your invested money.

You can choose different leverage like from 1:50 up to 1:500. This is different from broker to broker. 1:50 means that with one 1$ you can control $50 on the market. Broker lends you rest of the money so you can trade on the market and make more money. But also lose more money if market goes against you.

After you have decided which account you want to have, personal/business or small/large you need to decide to open

- Live or

- Demo account

As said earlier, for beginners it is best to open demo to test and later on to open live account. On demo account you should at least learn how to open and close a trade.

From my experience I can tell you that I have started immediately with live account because demo account could not give me what I wanted and that is – live experience.

Registration

When registering real/live account you will need to do some paper work in order to open it. Those papers could be

- Your ID number

- Utility bill not older than 3 months with your personal address on it, so they can verify that it is really you and data you have provided are accurate

They need this information to comply with the law. Regulatory agencies wants to protect you so they have set requirements for broker to open an account for you. If you are not required to give them these information’s you should be suspicious because that is minimum what they should ask you to provide.

During registration broker could ask you several information about your trading experience, your trading intentions or how much you will invest. They like to get know you(KYC – know your customer) and your trading intentions.

Please read all what is written in their documents so you are familiar with all costs that can arise, if there is any. Also, pay attention when depositing money over wire transfer how much does bank charge for their services.

Trading account activation

When registration of your live account is done you will receive confirmation mail with account details. Information that trader receives in e-mail can be different because not all forex broker sends same e-mail.

- Account number

- Password for trading platform

- Server on which to connect

In order to activate trading account open your trading platform and follow further steps.

In the MT4 platform right click on the “accounts” menu which is located under “navigator” menu. After right click you will select “login to trade account“.

Use those information’s and enter them into new window that appears, like the picture below this text.

If everything is fine with data entered your trading platform will start to show you real information about trading pair price. If not, you will hear sound that indicates you have entered incorrect data.

Possible cause you did not connect to trading platform with information from broker is:

- Wrong login data – check information from broker

- Wrong trading platform – use platform from your broker

- No internet access – check can you open some other website in your browser in order to verify is internet connection ok

If you have entered all data as shown above and you have tested possible source of the problem and even then you are not connected then please call broker support.

Password change

Password is possible to change immediately after you login into trading account. You are not obligated to leave same password you have received from your broker. You can change it to your desired password where you need to fulfill certain requirements.

Go into MT4 menu “tools” and select “options” with which you will open new window.

“tools” menu for trading account password change

In “options” window under tab “server” you will see option to change password. All other parameters you can leave as they are.

Change trading password under tab “server”

Select “change” and window “change password” will appear where you need to enter new password details. Enter your current password you have received from broker and enter new password. There is 2 places where you need to enter password, “new password” and “confirm“.

Trading account password change

Please pay attention to fulfill all necessary conditions for new password.

- At least five symbols

- At least two of the three character lowercase, uppercase and digit

After all above is done you will have account on MT4 platform ready for trading. If you are using real account then you will need to fund it with real money.

Transfer of real money on the trader account is done in trader room. I cannot show you steps because trader room is different on each broker. But mostly they have instructions how to transfer money from your credit card or bank account or any other possible channel.

FREE 5 day email course

Email course is for beginners who do not know to much about forex trading but wants to know

- What is forex

- What is trading and where to start

- What is metatrader 4

- How to setup charts on metatrader 4

- How to open and close order in metatrader 4

After you are done you will know how to use FREE trading platform to activate order by selecting currency pair on the forex market and make money.

- Trading platform?

- Activate order?

- Select currency pair?

- Make money?

To much strange words? Get them clear and start trading!

Frano grgić

A forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the first choice for traders and beginners. Market analysis is featured by forex factory next to large publications like dailyfx, bloomberg. Getknowtrading is becoming recognized among traders as a website with simple and effective market analysis.

BETA TESTERS WANTED

This is opportunity to be one of the first people to:

On online course about how to start trading

Join if you want to be part of and learn while testing

Categories

Forex signals

FREE PDF's

What is leverage?

How to calculate pip value?

What is margin?

What is lot?

How long demo trade?

0 comments

Disclaimer: any advice or information on this website is general advice only – it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by get know trading, it’s employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, CFD’s, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

So, let's see, what was the most valuable thing of this article: free trading account opening to start trading forex, gold, and silver via paxforex metarader 4 platform. Find out what is a trading account to improve your trading skills on forex market with paxforex. At open account forex trading

Contents of the article

- Today forex bonuses

- Open forex trading account with paxforex

- Free trading account opening benefits

- Open account

- How to open an account

- Step 1: apply for an account

- Step 2: verify your identity and proof of address

- Driver’s license (proof of identity and address)

- Government-issued passport or ID card (proof of...

- Utility bill, bank statement or other document...

- Step 3: fund and trade

- Ready to start trading? Open an account in minutes

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

- How to open a forex trading account

- Choosing an account type

- Registration

- Account activation

- Roboforex trading accounts

- How to start trading on financial markets with...

- Useful links:

- How to start trading on forex?

- Download center

- Analytics center

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- Useful links:

- Question: how to open a forex account with deriv?

- How to open a forex account of deriv MT5?

- Invest in spot forex and cfds on deriv MT5

- Deriv

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- How to open an account

- Step 1: apply for an account

- Step 2: verify your identity and proof of address

- Driver’s license (proof of identity and address)

- Government-issued passport or ID card (proof of...

- Utility bill, bank statement or other document...

- Step 3: fund and trade

- Ready to start trading? Open an account in minutes

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

No comments:

Post a Comment