Does tickmill have nasdaq

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Today forex bonuses

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Tickmill review

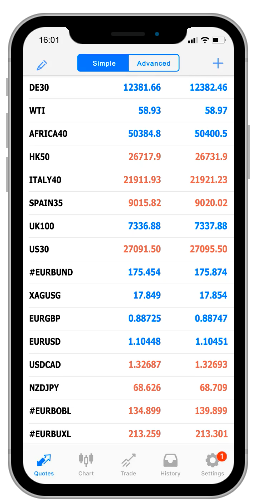

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

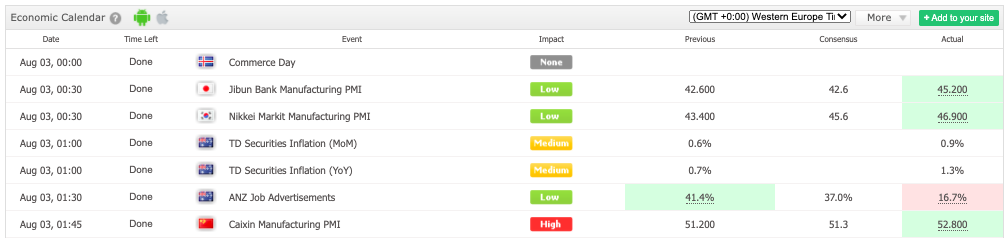

Chart of the day ustec (nasdaq)

Chart of the day USTEC (nasdaq)

USTEC (nasdaq) - probable price paths

The great lockdown recession as the IMF titled it will see the global economy contract by 3% this year, led by the US (-5.9%) and europe (-7.5%) while india (1.9%) and china (1.2%) brought up the rear. US equities still remained buoyant overnight as seven state governors formed a working group to plan for an easing of the lockdown and ahead of kudlow’s suggestion of some “important announcements” by president trump on reopening the US economy.

The S&P500 added 3.1% to a 1-month high, with J&J reporting stronger sales and higher quarterly dividends even though bank earnings from jpmorgan and wells fargo reported a surge in loan-loss provisions to the highest since the GFC. UST bonds gained overnight with the 10-year bond yield at 0.75%, whereas oil prices tanked again, which suggested that risk appetite was still wavering. Meanwhile, the fed kicked off its CP purchase facility, while elsewhere, india extended its lockdown for another 19 days and BI opted to keep its policy rate unchanged at 4.5% but cut its RRR instead by 200bps (50bps for islamic banks).

More cautious market sentiment prevailed in asia, with mixed equity markets ahead of further US earnings announcements later today. China’s central bank cut interest rates and added liquidity into the financial system. President trump said he will share new guidelines in the coming days for states to reopen their economies. In europe, the number of new cases continued to fall or trend lower, as some countries gradually reopen their economy or move closer to doing so. Chancellor merkel is set to discuss easing restrictions with german state premiers today

From a technical and trading perspective, the nasdaq is testing the first pivotal decision point post the rally from the march low as price probes the equality objective at 8720 we have see an initial profit taking move and must now watch for a lose below the near term volume weighted average price at 8320, this would flip the daily chart bearish and suggest at a minimum we will likely retest the 8000 level a failure to find bids here would be a bearish development and set a downside equality objective at 5620. If buyer do emerge at or above 8000 then we cans another leg higher targeting 9100 as the next upside objective

Disclaimer: the material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money .

Trump cancels WHO funding over china claims

Will US/china relations survive COVID-19 crisis?

Market short-squeeze is likely to continue keeping broad market under pressure

Chart of the day nzdusd

Precious metals monday 01-02-2021

The investment bank outlook 01-02-2021

Weekly market outlook 01-02-20

Daily market outlook, february 1, 2021

Brent oil: potential jump ahead!

Key economic events and reports of the week ahead

Elon musk’s tweet initiates fresh buying momentum in btc

Why stock markets can fall further but, not for much longer

POPULAR TAGS

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review and tutorial 2021

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Trade on majors, minors and exotics with up to 1:500 leverage.

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular alternatives to tickmill

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.Com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use tickmill from united states, canada, japan, bangladesh, nigeria, pakistan, kenya.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

Compare brokers for trading NASDAQ 100

For our trading nasdaq 100 comparison, we found 20 brokers that are suitable and accept traders from ukraine.

We found 20 broker accounts (out of 147) that are suitable for trading NASDAQ 100.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

Plus500

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About plus500

Platforms

Funding methods

76.4% of retail CFD accounts lose money

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Axitrader

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About axitrader

Platforms

Funding methods

68.5% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Etoro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About etoro

Platforms

Funding methods

71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

XM group

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XM group

Platforms

Funding methods

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

73% of retail investor accounts lose money when trading cfds with this provider

Easymarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About easymarkets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The NASDAQ-100

The nasdaq is an american stock market owned and operated by nasdaq inc. It is the second largest in the world by market capitalisation, after the new york stock exchange. The nasdaq-100 (NDX) is a modified capitalisation-weighted index composed of 100 of the largest equity securities listed on the nasdaq. It includes companies from a wide spectrum of nonfinancial industries, such as technology, health care, and retail. The nasdaq-100 is the premier large-cap growth index and provides the basis for benchmarking numerous investment products. Around 50 billion etps (exchanged traded products) were benchmarked to the nasdaq-100, according to a study by the nasdaq research team in 2015.

Nasdaq-100 was launched on january 31st, 1985, presenting itself as an alternative to the NYSE indices. It created two separate indices: the nasdaq-100, which consists of stocks from industry, retail, technology, telecommunication, healthcare, biotechnology, transportation, media & services; and the nasdaq financial-100, which consists of insurance firms, banking companies, brokerage, and mortgage companies. Nasdaq expected these to be used as benchmark indices by market participants, anticipating a healthy derivatives market to develop around them. The index was rebalanced to a modified market cap index on december 21st, 1998, followed by special rebalance effective from may 2nd, 2011.

Composition

The index comprises 100 of the largest non-financial organisations, based on market capitalisation, that are listed on the nasdaq stock market. The past three decades have seen nasdaq-100 evolve from being the market’s technological index to a leading indicator of strong growth potential companies, who are leading industry-wide innovation. Companies included in the nasdaq-100 have driven economic growth in the recent years and they represent a shift in the business world in the 21st century. By the end of 2014, 448 stocks had been a member of the nasdaq-100 since its inception. In recent years, somewhere between 7 to 15 stocks have been added or removed each year. The top ten companies who have held the highest weights in the index during the recent years are apple, microsoft, amazon, google, facebook, gilead sciences, intel, cisco & comcast. The main sectors included in nasdaq 100 as at the 30th june 2019 were: technology – 53.48 %; consumer services – 24.63%; health care – 11.10%; consumer goods – 5.49%; industrials – 4.33%; and telecom – 0.97%.

The top ten securities by weight as at 1st may 2019 were as follows:

| TICKER | SECURITY | WEIGHT |

|---|---|---|

| AAPL | APPLE INC. | 10.70% |

| MSFT | MICROSOFT CORP | 10.57% |

| AMZN | AMAZON.COM INC | 10.12% |

| FB | FACEBOOK INC | 5.01% |

| GOOG | ALPHABET CL C CAP | 3.89% |

| GOOGL | ALPHABET CL A CMN | 4.43% |

| CMCSA | COMCAST CORP A | 2.34% |

| INTC | INTEL CORP | 2.73% |

| CSCO | CISCO SYSTEMS INC | 2.93% |

| NFLX | netflex | 1.98% |

Eligibility for nasdaq-100 inclusion

The eligibility criteria for any stock to be included in nasdaq-100 are as follows:

- Listing – the primary listing in the US must be exclusive to the nasdaq global market or the nasdaq global select market. Securities that were dually listed on other US markets prior to jan 1st, 2014 and have continuously maintained such a listing, are the exception to the rule.

- Security types – security types eligible for listing include common stocks, adrs and tracking stocks. Close-ended funds, convertible debentures, etfs, llcs, limited partnership interests, preferred stocks, rights, warrants and derivative securities are not eligible to be included in the index.

- Market capitalisation – there are no qualifying criteria for market capitalisation as such, inclusion is only determined based on the top 100 largest companies in the eligible industries by market capitalisation.

- Liquidity – A minimum of 3 months average daily trading volume (ADTV) of 200,000 shares.

- Security seasoning criteria – the security must have ‘seasoned’ in either the nasdaq, the NYSE or the NYSE amex for at least 3 months, excluding the month of the initial listing

How the value of nasdaq-100 is derived

The nasdaq-100 is a modified market capitalisation-weighted index, which means that its value is derived from the aggregate value of index share weights of each index security, multiplied by the last trading price of the security, which is then divided by the divisor of the index. The divisor serves the purpose of scaling down the obtained aggregate value, which is more desirable for the practical use of the index.

The base value of the index was set at 250, and reset to 125 when it closed at 800 on december 31st, 1993.

The index value is calculated on each trading day, based on the last traded price, once per second for the whole trading window of the day.

How to trade the nasdaq-100

The index can be traded through financial institutions such as brokers and serves as an underlying asset for a variety of products. These include exchange-traded funds (etfs) and derivative instruments such as futures, options, and contracts for difference (cfds).

Etfs are funds whose value reflect the value of an index as they are composed of shares that are present in the index itself. The etfs attempt to track the index as closely as possible. Etfs can be traded on the exchange and can be bought as individual stock, allowing traders to follow the index with just one holding.

Another way of speculating on the movement of the indices without owning the shares is through cfds. As cfds allow users to speculate on the value of the index, traders can go for long contracts when they believe the index will move up and the price will therefore increase; or go short on the CFD when they believe the index is going down and prices will therefore decline. Cfds are usually highly leveraged products, which means that traders can have a large holding for a relatively small margin. Margin refers to the proportion of the trade that is required to be put down as deposit.

CFD products are highly popular for the nasdaq-100 index.

Benefits of CFD trading on nasdaq-100

- Enables access to one of the most popular and growth oriented indices in the market without the requirement of actually owning shares in the underlying companies.

- Maximises the potential of the portfolio by using leverage – although it must be noted that this can also go against the trader when markets move in the opposite direction to which they have speculated.

- Allows traders to take a speculative stance on the overall market movement, whether they believe it will move up, or down.

- Cuts down the cost of a portfolio of companies by trading on the index.

- Availability of a large pool of regulated brokers who provide a platform to trade on NSD-100 cfds, making it convenient for traders.

However, it is necessary to keep in mind that cfds are highly leveraged products and pose a considerable risk of loss of capital. Only experienced traders with the right risk appetite should venture into trading in these instruments.

Authorised and regulated online CFD broker plus500 offers a US-TECH 100 (NQ) CFD which is based on the E-mini nasdaq 100 futures, itself based on the underlying nasdaq 100 index. Trades in the instruments are offered at a spread of 1.7, with a minimum contract size of 1, and an initial margin requirement of 0.33. The intuitive platform calculates the minimum trade sizes and margins required to place a trade automatically. The manual calculation is as follows: CFD margin = V (lots) × contract × market price × margin rate, %.

Current value of nasdaq-100 index

Conclusion

Nasdaq-100 is one of the most comprehensive market indices that captures the overall movement of 100 market mover stocks. The index is well diversified in sectoral allocation and has beaten multiple other indices in its returns. The index serves as the benchmark and underlying value for numerous other instruments such as etfs and multiple derivative products such as cfds. Cfds for the nasdaq-100 are readily available and offered by many regulated brokers, such as plus500 and avatrade. The trading platforms offered by these brokers are user-friendly and compatible on hand held devices as well as desk top computers.

Why choose XTB

for trading NASDAQ 100?

XTB scored best in our review of the top brokers for trading nasdaq 100, which takes into account 120+ factors across eight categories. Here are some areas where XTB scored highly in:

- 16+ years in business

- Offers 1,500+ instruments

- A range of platform inc. MT4, mirror trader, web trader, tablet & mobile apps

XTB offers three ways to tradeforex, cfds, social trading. If you wanted to trade NASDAQ100

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

XTB have a AAA trust score. This is largely down to them being regulated by financial conduct authority, segregating client funds, being segregating client funds, being established for over 16

Trust score comparison

| XTB | IG | plus500 | |

|---|---|---|---|

| trust score | AAA | AAA | AA |

| established in | 2002 | 1974 | 2008 |

| regulated by | financial conduct authority | financial conduct authority and ASIC | financial conduct authority (FRN 509909) and cyprus securities and exchange commission (license no. 250/14). Plus500au pty ltd (ACN 153301681), licensed by: ASIC in australia, AFSL #417727, FMA in new zealand, FSP #486026; authorised financial services provider in south africa, FSP #47546 |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of XTB vs. IG vs. Plus500

Want to see how XTB stacks up against IG and plus500? We’ve compared their spreads, features, and key information below.

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least €25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/02/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Nasdaq trading basics: how to trade nasdaq 100

Trading the nasdaq 100 index: an introduction

The nasdaq 100 is a modified market-capitalization weighted index that consists of the largest 100 non-financial companies that are listed on the nasdaq stock exchange. It should not be confused with the nasdaq composite index.

Nasdaq trading involves using fundamental or technical analysis to determine price levels at which to enter a trade. Traders can take a bet on which way the price will go and then place stop losses and take-profits to manage risk.

This article will cover top nasdaq 100 trading strategies for traders of all levels, as well as an overview of the nasdaq trading hours.

Why trade the nasdaq 100 index?

Trading the nasdaq 100 gives traders a diversified exposure to great number of companies in the non-financial sector. Other reasons to trade the nasdaq 100 index include:

- The nasdaq 100 is one of the world’s most popular and widely followed indexes. There is no shortage of technical and fundamental analysis.

- The clear technical chart patterns which provide distinct entry and exit signals.

- The nasdaq provides traders with a great deal of liquidity which leads to tight spreads that offer inexpensive costs to enter and exit trades.

- Traders can trade the E-mini NASDAQ 100 futures on the CME (chicago mercantile exchange) almost 24/5.

How to trade nasdaq 100: top tips & strategies

Successful nasdaq trading involves similar analysis techniques used to trade a range of financial markets. Before entering a trade, traders should have a reason to enter the trade based on technical or fundamental analysis. Professional traders stick to strategies which contain principles and guidelines that they follow to be successful.

How to T rade the nasdaq 100 using technical A nalysis

Traders use technical analysis to analyze charts, looking for buy or sell signals. Technical analysts can use indicators to help them identify current trends in the market, shifts in sentiment or potential retracement patterns.

In the chart above we show how the MACD (moving average convergence divergence) can be used to filter buy and sell signals when trading nasdaq 100. The MACD consists of a MACD-line (blue line) and signal-line (orange line), when the two cross on the bottom, as shown in the chart above by the green circle, it offers a buy-signal. When the two cross at the top (the red circle) it offers a sell-signal.

There are a variety of different indicators that traders use. It is important that traders use an indicator they understand and feel comfortable. Indicators do not work all the time, so traders must implement proper risk management. Risk management includes using appropriate leverage , a positive risk-reward ratio and limiting the exposure of all open trades to less than 5% of total equity.

Technical indicators are not the only way to look for buy and sell signals when trading the nasdaq 100. Traders also use price patterns like support and resistance, ascending triangles, trend channels, elliot waves and others to find opportunities in the market.

How to trade the nasdaq using fundamental A nalysis

When trading the nasdaq, a range of underlying fundamental variables affect the price of the index. Traders must be aware of these variables and their possible impact on the index. These variables can range from macroeconomic variables to the fundamental composition of the index. Here are some of the main movers of the nasdaq 100 index:

- The largest companies in the nasdaq 100. The nasdaq is a market-capitalization weighted index so the largest companies tend to move it the most, like apple, microsoft and amazon. Some indices are weighted differently, and this can affect their price. It is important to understand the differences between the major indices .

- Changes in the federal reserve’s stance on monetary policy can have adverse effects on all stock markets, including the nasdaq 100 index.

- Economic data like inventory levels, employment, CPI, interest rates and GDP. This data can signal what actions the central bank will take on monetary policy.

- Trade wars and currency wars can impact large companies in the nasdaq by way of tariffs and trade barriers.

Advanced tips for trading the nasdaq 100 index

It is important for nasdaq traders to be patient and disciplined before entering a trade. Before even looking for a trade, a trader should know how much they are willing to risk and have a reasonable expectation of what they are looking to gain through the trade.

Here are some expert tips for trading the nasdaq 100:

- At dailyfx we recommend limiting your exposure to less than 5% on all open trades.

- Before entering a trade, decide on a risk-reward ratio. It is extremely important to have a positive risk-reward ratio. See our guide to traits of successful traders for the statistics on taking trades with a positive risk-reward ratio.

- Entering a trade before major economic data releases should be avoided. Major economic data can cause massive spikes in volatility, it is better to wait for the markets to settle before trading again.

- Record all your trades so that you can preview the trades afterwards. By doing this you can pinpoint and work on your weak spots.

- Do not trade if you are emotional, tired or bored. Only trade when you have done your research and analysis and are confident in the trade.

- Select the correct trading time frame that suites your goal.

Nasdaq trading hours

Nasdaq 100 futures can be traded on the chicago mercantile exchange (CME) from:

Sunday – friday 6:00pm – 5:00pm ET with a trading halt from 4:15pm – 4:30pm ET and a daily maintenance period from monday – thursday 5:00pm – 6:00pm ET.

There are also etfs that track the nasdaq 100 like invesco QQQ trust (QQQ) which trades on the NASDAQ exchange. This has:

- Pre-market trading hours from 4:00 a.M. To 9:30 a.M. ET

- Market hours from 9:30 a.M. To 4:00 p.M. ET

- After-market hours from 4:00 p.M. To 8:00 p.M. ET

Take your nasdaq trading to the next level

To stay ahead of the curve when trading nasdaq 100, traders should follow the nasdaq 100 live chart for price movements. We also recommend downloading our quarterly trading forecast on equities and reading our reputable traits of successful traders guide - where we analyzed over a million live trades and came to a striking conclusion.

Below is a snippet from our expert guide on the differences between dow, nasdaq, and S&P 500 such as how market capitalization and volatility affect them and how they are weighted.

Dailyfx provides forex news and technical analysis on the trends that influence the global currency markets.

Best brokers for trading NASDAQ 100, US-TECH 100

�� > compare CFD brokers > best brokers for trading NASDAQ 100, US-TECH 100

Compare NASDAQ brokers

NASDAQ brokers can offer access the popular US tech 100. Compare NAS100 brokers to choose the broker that offers the cheapest fees and the best trading platform to help you make money. These brokers are authorised and regulated by the FCA.

What is nasdaq 100?

The nasdaq 100 index (ticker: NDX) is the equity index comprised of the 100 largest companies listed on the nasdaq market. For those unfamiliar with the term nasdaq, it stands for National Association of Securities Dealers Automatic Quotations.

Currently, nasdaq is one of the largest stock exchanges in the world. Setup in 1971, nasdaq has a longstanding history of hosting growth company. It gained its popularity because nasdaq was the first exchange to trade stocks electronically. At that time, it was a quantum leap in share trading. (see GMG's guide to nasdaq)

Currently, some of the world's biggest tech companies are components of the nasdaq 100. For example, the five largest stocks of the index are apple, microsoft, amazon, facebook and google (see below):

Nasdaq 100 is capitalisation weighted, this means that companies with higher market capitalization carry a higher weightage in the index.

Can you trade the nasdaq 100 index?

Yes, you can. There are multiple financial products derived from the underlying nasdaq 100 index that you can trade with, including:

- Futures

- Options

- Exchange-traded funds (link)

- Investment funds

- Spread trading

The biggest ETF based on the nasdaq 100 index is the QQQ ETF (ticker: QQQ). For many years, this ETF is one of the most traded instruments in the US market. Investors like to gain exposure to the nasdaq through this ETF.

What is the attraction of nasdaq 100?

Nasdaq indices (100 and composite) are the most-followed equity indices in the world. NDX is attractive to investors and traders alike because:

- Nasdaq 100 is a growth index - you can participate in the best success stories

- Nasdaq 100 offers good liquidity - some of the NDX components were the most valuable in the world at one time or another (apple, microsoft, and amazon)

- Nasdaq 100 offers better relative performance than many other large-cap indices

Moreover, the index is volatile enough to attract traders. Therefore, daily liquidity of the index is good.

What drives the nasdaq 100?

Stock markets are driven by a wide variety of factors, including some of the following:

- Macro factors (e.G. GDP, unemployment, business indicators etc)

- Monetary factors (e.G., quantitative easing, rates movements, yield curve etc)

- Technical factors (e.G., new highs)

For the nasdaq 100, another factor to watch out for is speculative bubble.

During the nineties, for example, nasdaq stocks soared amidst a wave of speculative trading interest. Companies worth only millions only a short while ago attained multi-billion valuation - only to see these valuation figures collapsed to zero when the bubble burst. Easy come, easy go.

Next, if you are trading NDX short term, you will need to pay attention to news flow and data announcements because they can have massive impact on the index over the short term.

Another area to watch out for are federal reserve meetings and the release of FOMC minutes. Any change in interest rates beyond market expectations can cause violent swings in the SPX. For example, if investors were expecting a 0.25% hike but the central bank raised it by 0.5% - this may cause prices swing massively after the announcement.

Studying the reaction of the market to these factors are important.

How to trade the nasdaq 100 using technical indicators?

To trade the nasdaq profitably requires a good trading strategy, of which technical indicators may come in handy. Technical indicators include:

- Trend indicators like moving average

- Price action

- Oscillators

- Support & resistance levels (see GMG guide on support/resistance)

- Patterns like breakout and reversals

For example, you may use the moving averages to judge whether the index is still trending or due for a reaction.

Another favourite indicator is a break of resistance or support levels. Look at the nasdaq 100 ETF (QQQ) below. It was clear that the breakout above the 195 key resistance last month resulted in a persistent rally into 204 (see below). This resistance, now broken, may even convert into resistance.

Bear in mind, however, the different traders will gravitate towards different trading styles. Therefore you must find the technical indicators that best support your trading objectives.

Stock indices & oil

Access global stock indices and oil with exceptional trading conditions.

What are stock indices?

A stock index is a group of stocks that can be bought or sold as a single tradable instrument. Now, some traders speculate on how the price of a single asset changes however, some choose to speculate with stock indices. As a group, stock indices can be used to indicate the health of an industry or even a country.

Classifying stock indices, however, is a little more complex. Some indices, like the DAX 30 for example, is a group of the 30 top-performing companies in germany. Classified as a ‘national stock index’ it gives an indication of the health of the german stock market.

However, stock indices aren’t only comprised of stocks that are grouped together because of their geographical location. Some stock indices represent and track the performance of certain sectors of the market. For example, the nasdaq 100 index, tracks the performance of all the companies listed on the nasdaq exchange. Generally being technology-related firms, the nasdaq gives an indication of the health of the technology sector in the US!

Why TRADE STOCK INDICES OR OIL with tickmill?

Our aim is to help our traders succeed by providing an exceptional trading experience.

Low spreads. Access to 14+ indices.0.20s average execution speed. All trading strategies enabled. Leverage up to 1:100.

Stock indices & oil

| instrument | minimum spread | typical spread | long position | short position |

| DE30 | 0.8 | 0.91 | -1.019 | -1.39 |

| FRANCE40 | 1 | 1 | -1.873 | -3.036 |

| HK50 | 14 | 14 | -2.127 | -1.881 |

| ITALY40 | 10 | 10 | -1.904 | -3.043 |

| JP225 | 5.2 | 6.04 | -1.921 | -1.968 |

| UK100 | 0.9 | 0.9 | -0.557 | -0.539 |

| US30 | 2.2 | 2.52 | -2.709 | -2.451 |

| US500 | 0.39 | 0.39 | -0.337 | -0.305 |

| USTEC | 0.8 | 1.93 | -1.187 | -1.074 |

| WTI | 0.04 | 0.04 | -0.582 | -0.146 |

| BRENT | 0.04 | 0.04 | -0.531 | -0.24 |

| XTIUSD | 0.04 | 0.04 | -0.601 | -0.266 |

HOW-TO

trade stock indices & OIL

As stock indices are made up of groups of firms, there are a number of different factors that affect the price of the index. In very simple terms, if the stocks that make up an index go up in value, then the price of the index will increase, and vice versa.

Traders that speculate with stock indices are able to decide if an index will increase or decrease in value based on market sentiment.

The price movement of an index is likely to be much smoother than other financial instruments, as one individual stock can’t bring about a huge spike in price. However, there is significant volatility in stock indices as they can reflect broad political and economic shifts.

Learn to trade

stock indices & oil

Stock indices & oil trading hours

| INSTRUMENT | TRADING HOURS |

| AUS200 | mon-fri: 00:50-07:30 / 08:10-23:00 |

| DE30 | mon: 01:05-02:00 / 02:15-23:15 / 23:30-24:00 tue-thu: 01:02-02:00 / 02:15-23:15 / 23:30-24:00 fri: 01:02-02:00 / 02:15-23:00 |

| US30 | mon-thu: 01:00-23:15 / 23:30-24:00 fri: 01:00-23:15 / 23:30-23:58 |

| STOXX50 | mon: 01:05-02:00 / 02:15-23:15 / 23:30-24:00 tue-thu: 01:00-02:00 / 02:15-23:15 / 23:30-24:00 fri: 01:00-02:00 / 02:15-23:00 |

| FRANCE40 | mon-fri: 09:00-23:00 |

| AFRICA40 | mon-fri: 08:30-17:30 |

| ITALY40 | mon-fri: 09:00-23:00 |

| UK100 | mon: 01:05-23:15 / 23:30-24:00 tue-thu: 01:00-23:15 / 23:30-24:00 fri: 01:00-23:00 |

| HK50 | mon-fri: 03:15-06:00 / 07:00-10:30 / 11:15-19:00 |

| SPAIN35 | mon-fri: 09:00-21:00 |

| USTEC | mon-thu: 01:00-23:15 / 23:30-24:00 fri: 01:00-23:15 / 23:30-23:58 |

| JP225 | mon-thu: 01:00-24:00 fri: 01:00-23:58 |

| US500 | mon-fri: 01:00-23:15 / 23:30-24:00 fri: 01:00-23:15 / 23:30-23:58 |

| SWISS20 | mon-fri: 09:00-23:00 |

| WTI | mon-thu: 01:00-24:00 fri: 01:00-23:45 |

| BRENT | mon-thu: 03:00-23:59 fri: 03:00-23:58 |

| XTIUSD | mon-thu: 01:00-23:59 fri: 01:00-23:55 |

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

So, let's see, what was the most valuable thing of this article: is tickmill a good forex broker? Read real reviews, by traders, for traders? Add your rating to the largest forex review database by forex peace army? At does tickmill have nasdaq

Contents of the article

- Today forex bonuses

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Chart of the day ustec (nasdaq)

- Chart of the day USTEC (nasdaq)

- Trump cancels WHO funding over china claims

- Will US/china relations survive COVID-19 crisis?

- Market short-squeeze is likely to continue...

- Chart of the day nzdusd

- Precious metals monday 01-02-2021

- The investment bank outlook 01-02-2021

- Weekly market outlook 01-02-20

- Daily market outlook, february 1, 2021

- Brent oil: potential jump ahead!

- Key economic events and reports of the week ahead

- Elon musk’s tweet initiates fresh buying momentum...

- Why stock markets can fall further but, not for...

- POPULAR TAGS

- Tickmill review and tutorial 2021

- Tickmill company summary

- Trading platforms

- Popular alternatives to tickmill

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

- Compare brokers for trading NASDAQ 100

- We found 20 broker accounts (out of 147)...

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Plus500

- Avatrade

- Forex.Com

- Axitrader

- Etoro

- XM group

- City index

- Easymarkets

- The NASDAQ-100

- Composition

- Eligibility for nasdaq-100 inclusion

- How the value of nasdaq-100 is derived

- How to trade the nasdaq-100

- Benefits of CFD trading on nasdaq-100

- Current value of nasdaq-100 index

- Conclusion

- Why choose XTB for trading NASDAQ 100?

- A comparison of XTB vs. IG vs. Plus500

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Nasdaq trading basics: how to trade nasdaq 100

- Trading the nasdaq 100 index: an introduction

- Why trade the nasdaq 100 index?

- How to trade nasdaq 100: top tips & strategies

- Advanced tips for trading the nasdaq 100 index

- Nasdaq trading hours

- Take your nasdaq trading to the next level

- Best brokers for trading NASDAQ 100, US-TECH 100

- Compare NASDAQ brokers

- What is nasdaq 100?

- Can you trade the nasdaq 100 index?

- What is the attraction of nasdaq 100?

- What drives the nasdaq 100?

- How to trade the nasdaq 100 using technical...

- Stock indices & oil

- What are stock indices?

- Why TRADE STOCK INDICES OR OIL...

- Stock indices & oil

- HOW-TO trade stock indices...

- Learn to tradestock indices &...

- Stock indices & oil trading hours

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

No comments:

Post a Comment