Just forex leverage

Низкие плавающие спреды на всех типах счетов, спреды на raw spread от 0 пунктов.

Today forex bonuses

Я торговал с разными брокерами, и justforex – самый честный, как по мне. Проблем с выводом, верификацией и торговлей нет. На все вопросы отвечают и действительно стараются решать проблемы. Хорошие ребята, обратите на них внимание.

6 причин выбрать justforex

Спреды от 0 пунктов

Низкие плавающие спреды на всех типах счетов, спреды на raw spread от 0 пунктов.

Две версии торговой платформы metatrader

Вы можете выбрать платформу MT4 или MT5 в соответствии с вашими потребностями и предпочтениями.

Кредитное плечо до 1:3000

Возможность выбрать удобное кредитное плечо от 1:1 до 1:3000.

170+ торговых инструментов

Мы предлагаем ряд валютных пар, драгоценных металлов для трейдеров, которые хотят зарабатывать на разных рынках.

Все стратегии разрешены

Использование советников, торговля на новостях, хеджирование, скальпинг и т.Д.

Исполнение ордера от 0,01 с

Исполнение ордера при нормальных условиях на рынке происходит за доли секунды.

Я начал работать с этой компанией после того, как получил welcome-бонус в прошлом году. Условия я выполнил, деньги получил. Продолжаю работать и не планирую менять брокера.

Я – новичок в форексе, но мне очень нравится профессионализм этой команды. Поддержка работает круглосуточно и отвечает на все вопросы. Они даже помогли мне найти хорошие статьи по форексу и открыть демо счет. Раздел "аналитика" – просто обязателен, как для новичков, так и для профи. Лично я читаю его каждый день и рекомендую каждому это делать. JF, вы – лучшие!

Я торговал с разными брокерами, и justforex – самый честный, как по мне. Проблем с выводом, верификацией и торговлей нет. На все вопросы отвечают и действительно стараются решать проблемы. Хорошие ребята, обратите на них внимание.

Я торгую с JF уже почти год. И за этот год проблем вообще не было. Мне нравятся их конкурсы и промо-акции – это хорошая возможность испытать себя и подзаработать в процессе. Больше всего мне нравится счет raw spread – нет проскальзываний, быстрое исполнение и очень много пар для торговли. Просто мечта. P.S. Спасибо за вашу работу, народ, мы видим как вы стараетесь!

Эрик из поддержки – молодец! У меня были проблемы с регистрацией карты, но вы во всем разобрались за пару минут. Я вывел уже больше 1 000 USD и продолжаю торговать.

How leverage works in the forex market

Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate. However, leverage is a double-edged sword, meaning it can also magnify losses. It's important that forex traders learn how to manage leverage and employ risk management strategies to mitigate forex losses.

Key takeaways

- Leverage, which is the use of borrowed money to invest, is very common in forex trading.

- By borrowing money from a broker, investors can trade larger positions in a currency.

- However, leverage is a double-edged sword, meaning it can also magnify losses.

- Many brokers require a percentage of a trade to be held in cash as collateral, and that requirement can be higher for certain currencies.

Understanding leverage in the forex market

The forex market is the largest in the world with more than $5 trillion worth of currency exchanges occurring daily. Forex trading involves buying and selling the exchange rates of currencies with the goal that the rate will move in the trader’s favor. Forex currency rates are quoted or shown as bid and ask prices with the broker. If an investor wants to go long or buy a currency, they would be quoted the ask price, and when they want to sell the currency, they would be quoted the bid price.

For example, an investor might buy the euro versus the U.S. Dollar (EUR/USD), with the hope that the exchange rate will rise. The trader would buy the EUR/USD at the ask price of $1.10. Assuming the rate moved favorably, the trader would unwind the position a few hours later by selling the same amount of EUR/USD back to the broker using the bid price. The difference between the buy and sell exchange rates would represent the gain (or loss) on the trade.

Investors use leverage to enhance the profit from forex trading. The forex market offers one of the highest amounts of leverage available to investors. Leverage is essentially a loan that is provided to an investor from the broker. The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire. However, the broker will require a percentage of the trade's notional amount to be held in the account as cash, which is called the initial margin.

Types of leverage ratios

The initial margin required by each broker can vary, depending on the size of the trade. If an investor buys $100,000 worth of EUR/USD, they might be required to hold $1,000 in the account as margin. In other words, the margin requirement would be 1% or ($1,000 / $100,000).

The leverage ratio shows how much the trade size is magnified as a result of the margin held by the broker. Using the initial margin example above, the leverage ratio for the trade would equal 100:1 ($100,000 / $1,000). In other words, for a $1,000 deposit, an investor can trade $100,000 in a particular currency pair.

Below are examples of margin requirements and the corresponding leverage ratios.

| Margin requirements and leverage ratios | |

|---|---|

| margin requirement | leverage ratio |

| 2% | 50:1 |

| 1% | 100:1 |

| .5% | 200:1 |

As we can see from the table above, the lower the margin requirement, the greater amount of leverage can be used on each trade. However, a broker may require higher margin requirements, depending on the particular currency being traded. For example, the exchange rate for the british pound versus japanese yen can be quite volatile, meaning it can fluctuate wildly leading to large swings in the rate. A broker may want more money held as collateral (i.E. 5%) for more volatile currencies and during volatile trading periods.

Forex leverage and trade size

A broker can require different margin requirements for larger trades versus smaller trades. As outlined in the table above, a 100:1 ratio means that the trader is required to have at least 1/100 = 1% of the total value of the trade as collateral in the trading account.

Standard trading is done on 100,000 units of currency, so for a trade of this size, the leverage provided might be 50:1 or 100:1. A higher leverage ratio, such as 200:1, is usually used for positions of $50,000 or less. Many brokers allow investors to execute smaller trades, such as $10,000 to $50,000 in which the margin might be lower. However, a new account probably won't qualify for 200:1 leverage.

It's fairly common for a broker to allow 50:1 leverage for a $50,000 trade. A 50:1 leverage ratio means that the minimum margin requirement for the trader is 1/50 = 2%. So, a $50,000 trade would require $1,000 as collateral. Please bear in mind that the margin requirement is going to fluctuate, depending on the leverage used for that currency and what the broker requires. Some brokers require a 10-15% margin requirement for emerging market currencies such as the mexican peso. However, the leverage allowed might only be 20:1, despite the increased amount of collateral.

Forex brokers have to manage their risk and in doing so, may increase a trader's margin requirement or reduce the leverage ratio and ultimately, the position size.

Leverage in the forex markets tends to be significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market. Although 100:1 leverage may seem extremely risky, the risk is significantly less when you consider that currency prices usually change by less than 1% during intraday trading (trading within one day). If currencies fluctuated as much as equities, brokers would not be able to provide as much leverage.

The risks of leverage

Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. For example, if the currency underlying one of your trades moves in the opposite direction of what you believed would happen, leverage will greatly amplify the potential losses. To avoid a catastrophe, forex traders usually implement a strict trading style that includes the use of stop-loss orders to control potential losses. A stop-loss is a trade order with the broker to exit a position at a certain price level. In this way, a trader can cap the losses on a trade.

What is leverage in forex trading?

If you are a rookie trader, you may find yourself asking questions such as 'what is leverage in forex trading?' and 'how can it be useful?' this article will provide you with answers to these types of questions, together with, a detailed overview of forex leveraging, its advantages and disadvantages, and a list of possible applications and restrictions.

In general, leverage enables you to influence your environment in a way that multiplies the outcome of your efforts without increasing your resources.

In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that traders can be at risk of higher losses. In finance, it is when you borrow money, to invest and make more money due to your increased buying power. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. Let's look at it in more detail for the finance, forex, and trading world.

What is financial leverage?

Leverage in finance pertains to the use of debt to buy assets. This is done in order to avoid using too much equity. The ratio of this debt to equity is the formula for leverage (debt/equity ratio) whereby the greater the proportion of debt, the higher the amount of margin. If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. When this type of debt is used in such a way that the return generated is greater than the interest associated with it, an investor is in a favourable position. However, an excessive amount of margin is risky, given that it is always possible to fail to repay it.

(note that the levels shown in trades 2 and 3 is available for professional clients only. A professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. In order to be considered a professional client, the client must comply with mifid ll 2014/65/EU annex ll requirements.)

Financial and operating margin is quite different from each other, with the latter consisting of a business entity and is calculated as a sum total of the amount of fixed costs it bears, whereby the higher the amount of fixed costs, the higher the operating leverage will be. So, what does leveraging mean for a business? It is the use of external funds for expansion, startup or asset acquisition. Businesses can also use leveraged equity to raise funds from existing investors.

Why use financial leverage?

Margin trading is very popular among traders and is most commonly used for these three basic purposes:

- To expand a firm's or an individual's asset base and generate returns on risk capital. This means that there is an increase in ROE and earnings per share.

- To increase the potential of earnings.

- For favourable tax treatment, since in many countries, the interest expense is tax deductible. So, the net cost to the borrower is reduced.

Leveraged equity

When the cost of capital debt is low, leveraged equity can increase returns for shareholders. When you own stock or shares in a company that has a significant amount of debt, you have leveraged equity. Therefore, the stockholder experiences the same benefits and costs as using debt.

Trading leverage

Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Leveraged trading is also known as margin trading. You can open up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. This allows traders to magnify the amount of profits earned.

Remember, however, that this also magnifies the potential losses. Stock market margin includes trading stocks with only a small amount of trading capital. This is also seen in forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance alone.

It should be remembered that margin does not alter the profit potential of a trade; but instead, reduces the amount of equity that you use. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. Therefore, it is essential to exercise risk management.

What is leverage in forex?

Financial leverage is essentially an account boost for forex traders. With the help of this construction, a trader can open orders as large as 1,000 times greater than their own capital. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade with. More and more traders are deciding to move into the FX (forex, also known as the foreign exchange market) market every day.

Trading currencies online is an exciting experience, and is accessible for many traders, and while each person will have their own reasons for trading in this market, the level of financial margin available remains one of the most popular reasons for traders choosing to trade on the FX market.

When visiting sites that are dedicated to trading, it's possible that you're going to see a lot of flashy banners offering something like ''trade with 0.01 lots, ECN and 500:1 leverage''. While each of these terms may not be immediately clear to a beginner, the request to have forex leverage explained seems to be the most common one.

Although we defined leverage earlier, let's explore it in greater detail:

Many traders define leverage as a credit line that a broker provides to their client. This isn't exactly true, as margin does not have the features that are issued together with credit. First of all, when you are trading with leverage you are not expected to pay any credit back. You are simply obliged to close your position, or keep it open before it is closed by the margin call. In other words, there is no particular deadline for settling your leverage boost provided by the broker.

In addition, there is also no interest on margin, instead, FX swaps are usually what it takes to transfer your position overnight. However, unlike regular loans, the swap payments can also be profitable for a trader. To sum up, margin trading is a tool that increases the size of the maximum position that can be opened by a trader. Now we have a better understanding of forex trading leverage, let's see how it works with an example.

Free trading webinars with admiral markets

If you're just starting out with forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. Click the banner below to register for FREE trading webinars!

How does forex leverage work?

Let's say a trader has 1,000 USD in their trading account. A regular lot of '1' onmetatrader 4 is equal to 100,000 currency units. As it is possible to trade mini and even micro lots with admiral markets, a deposit this size would allow a trader to open micro lots (0.01 of a single lot or 1,000 currency units) with no leverage put in place. However, as a trader would usually be looking for around 2% return per trade, it could only be equal to 20 USD.

This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and profits could be higher. Let's assume a trader with 1,000 USD in their account balance wants to trade big and their broker is supplying a leverage of 1:500. This way a trader can open a position that is as large as 5 lots, when it is denominated in USD. In other words, 1,000 USD * 500 (the leverage), would equal a maximum size of 500,000 USD for the position. The trader can actually request orders of 500 times the size of their deposit.

This way, if 1:500 leverage is used, a trader would be making 500 USD instead of 1 USD. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain them. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is. Admiral markets offers varying leverages which are dependent on client status via admiral markets pro terms.

For retail clients, leverages of up to 1:30 for currency pairs and1:20 for indices are available. For professional clients, a maximum leverage of up to 1:500 is available for currency pairs, indices, energies and precious metals. Users can also participate in futures trading leverage on currency, stock and commodity cfds. Both retail and professional status come with their own unique benefits and trade-offs, so it's a good idea to investigate them fully before trading. Find out today if you're eligible forprofessional terms, so you can maximise your trading potential, and keep your leverage where you want it to be!

Which leverage to use in forex

It is hard to determine the best level one should use, as it mainly depends on the trader's strategy and the actual vision of upcoming market moves. As a rule of thumb, the longer you expect to keep your position open, the smaller the leverage should be. This would be logical, as long positions are usually opened when large market moves are expected. However, when you are looking for a long lasting position, you will want to avoid being 'stopped out' due to market fluctuations.

In contrast, when a trader opens a position that is expected to last for a few minutes or even seconds, they are mainly aiming to extract the maximum amount of profit within a limited time. What is the best forex leveraging in this case? Usually, such a person would be aiming to employ high, or in some cases, the highest possible margin to assure the largest profit is realised, while trading small market fluctuations.

From this we can see that the margin ratio strongly depends on the strategy that is going to be used. To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades. Positional traders often trade with low leverage or none at all. A desired leverage for a positional trader usually starts at 5:1 and goes up to about 20:1.

When scalping, traders tend to employ a leverage that starts at 50:1 and may go as high as 500:1. Knowing the effect of leveraging and the optimal leverage forex trading ratio is vital for a successful trading strategy, as you never want to overtrade, but you always want to be able to squeeze the maximum out of potentially profitable trades. Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one.

To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. Low leverage, watch this free webinar here:

Trading crypto on margin

Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading forex as they do on trading digital currencies. Many brokers now offer margin trading on cryptocurrency cfds. This means traders can speculate on the price direction of a cryptocurrency without owning the underlying asset, storing it and using unregulated crypto exchanges.

Bitcoin leverage trading is also possible. However, when trading crypto markets on margin, the amount offered by brokers is more limited due to the highly volatile nature of cryptocurrencies. With admiral markets, retail clients can trade cryptocurrency cfds like bitcoin with leverage of 1:2.

FX broker offers

Unlike futures and stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. It is hard to indicate the size of the margin that a forex trader should look for, yet most of the forex brokers in the marketplace offer margin based trading that is available from 2:1 on cryptocurrency cfds, all the way up to 1000:1. However, this also depends on whether or not the broker is a regulated entity or not.

Brokers that are regulated by well-known regulators such as the UK financial conduct authority, the cyprus securities and exchange commission and the australian securities and investments commission, offer limited margin to clients categorised as retail. This tends to be an average of 30:1 for clients categorised as 'retail'. There are also many brokers that can supply 1:500 margin.

Also, in very rare cases it is possible to open an account with a broker that supplies 1,000:1, however, there aren't many traders who would actually want to use gearing at this level.

How to change forex leverage

Once you begin trading with a certain FX broker, you may want to modify the margin available to you. This depends on the broker. With admiral markets you can use an industry standardised procedure that includes authenticating to the trader's room, selecting your account, and changing the leverage available. This action takes immediate effect, so be careful if you have open positions when you attempt to reduce your margin level.

Another important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. For example, a broker may offer margin trading of 1:500 on the deposits below 1,000 USD, and margin of 1:200 on the deposits between 1,000 and 5,000 USD.

Once a trader has 950 USD, and opens a 3 lot position on EURUSD, they may decide to deposit a bit more to sustain a required margin, yet when the deposit occurs, the leverage will be changed, and the position might close when the stop out level has been reached.

Conclusion

We hope that this article has been useful to you, and that by now you have clearly understood the nature of gearing, how to calculate forex leverage, and how it can be equally be useful or harmful to your trading strategy. It is important to state that margined forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Do try to avoid any highly leveraged trading when you first start out and before you have gained enough experience.

Trade with admiral markets

If you're feeling inspired to start trading, or this article has provided some extra insight to your existing trading knowledge, you may be pleased to know that admiral markets provides the ability to trade with forex and cfds on up to 80+ currencies, with the latest market updates and technical analysis provided for FREE! Click the banner below to open your live account today!

About admiral markets

Admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

What is leverage in forex

What is leverage

The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain forex broker.

So, forex leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital.

Sounds good?

Nowadays, due to margin trading, each individual has access to foreign exchange market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital (margin) that is required for maintaining trading positions.

But wait – there’s more to know about trading leverage .

How to choose the best leverage level

Which is the best leverage level? - the answer to the question is that it is hard to determine which is the right leverage level.

As it mainly depends on the trader's trading strategy and the actual vision of upcoming market moves. That is, scalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage amount.

So, what leverage to use for forex trading? - just keep in mind that forex traders should choose the level of leverage that makes them most comfortable.

IFC markets offers leverage from 1:1 to 1:400. Usually in forex market 1:100 leverage level is the most optimal leverage for trading. For example, if $1000 is invested and the leverage is equal to 1:100, the total amount available for trading will equal to $100.000. More precisely saying, due to leverage traders are able to trade higher volumes. Investors having small capitals prefer trading on margin (or with leverage), since their deposit is not enough for opening sufficient trading positions.

As it was mentioned above, the most popular leverage in forex is 1:100.

So what’s the problem with high leverage? - well, the high leverage, besides being attractive is very risky too. Leverage in forex may cause really big issues to those traders that are newcomers to online trading and just want to use big leverages, expecting to make large profits, while neglecting the fact that the experienced losses are going to be huge as well.

How to manage leverage risk

So, while leverage can increase the potential profits, it also has the capability to increase potential losses as well, that is why you should choose carefully the amount of leverage on your trading account. But it should be noted that though trading this way require careful risk management, many traders always trade with leverage to increase their potential returns on investment.

It is quite possible to avoid negative effects of forex leverage on trading results. First of all, it is not rational to trade the whole balance, i.E. To open a position with the maximum trading volume.

Apart from that, forex brokers usually provide such key risk management tools as stop-loss orders that can help traders to manage risks more effectively.

Here are the basic points to manage the leverage risks properly:

- Using trailing stops,

- Keeping positions small

- And limiting the amount of capital for each position.

So, forex leverage can be used successfully and profitably with proper management.

Keep in mind that the leverage is totally flexible and customizable to each trader's needs and choices.

Now having a better understanding of forex leverage, find out how trading leverage works with an example.

Best high leverage forex brokers for 2021

Below you will find a list of forex brokers that offer trading accounts with high leverage and, consequently, have low margin requirements. If you’re a scalper and prefer to trade in high volumes or your trading style implies simultaneous position opening, then choosing a high-leverage broker is a good call. Just be careful, as much as the low margin requirement provides an excellent opportunity to quickly make some profits, it also creates a possibility to take heavy losses and even wipe out your trading account in instance. Perform basic risk calculations before engaging in forex trading. Hitting the stop out level is never a fun thing to experience.

Recently, the european securities and markets authority imposed leverage caps on the assets that are traded on brokerage platforms within the EU and the united kingdom. The issue here is that many retail traders cannot afford the large margin requirements needed to support trading under such restricted leverage conditions. If you decide to trade with brokers in the UK and EU, ESMA’s new leverage caps mean that you need to have a margin of 3.33% to trade a major forex pair, as much as 5% to trade a minor forex pair, and as high as 10% to trade stocks cfds. If you love crypto cfds, you have to be prepared to come up with at last 50% of the total capital required to setup a position on BTC/USD or any other crypto pair of your choice. The brokers in those regions have already started to feel the pinch as affected traders pull out of their platforms in large numbers. This is where these high leverage forex companies have come to the rescue and provide alternative trading venues for such traders.

The essence of high leverage trading

To understand the impact of high leverage trading, picture this scenario. If you setup a standard lot position on EUR/USD, you will need $100,000 capital. With a 3.33% margin requirement on a low leverage broker platform, you will need at least $3,333 to setup this position. But if you were to trade with the high leverage brokers in the list below, using a leverage of 1:500 (i.E. 0.2% margin) means that you would only need $200 to effect the same trade. Same position size, and same size of profit or loss. What a world of difference this makes.

Some of the brokers in this list provide leverage of up to 1:3000. However, a clarification at this point would be in order. The leverage you see listed beside each broker is the maximum leverage available to you as a trader. The leverage provided by these brokers falls into a spectrum which starts at 1:2 and terminates at 1:500, or 1:2000 or 1:3000 as the case may be. This gives you the power to choose leverage amounts you are ok with. If you are more comfortable with using a leverage of 1:200 (i.E. Margin of 0.5%) and not the very high leverages (such as 1:3000), by all means work with this. Best high leverage brokerage companies put the power of choice in your hands without having to box you into a corner with very few leverage options.

How to use high leverage correctly

If you take the time to read through the guidelines released by ESMA on the leverage caps, you would notice that the limitation on leverage to 1:30 for forex majors only applies to retail traders. Institutional traders are still allowed to use high leverages; sometimes as high as 1:300. The question is: if high leverage was an entirely bad thing, why was it not scrapped by ESMA entirely? Why are institutional traders allowed to use high leverage whereas retail traders are not?

An explanation for this is that institutional traders usually would have received professional training and proper instruction on position sizing and risk management. The firms they work in also have internal risk control mechanisms that ensure that no trader within the institution goes beyond allowable risk. There is also considerable oversight from team leaders at every level. Furthermore, there is also a great understanding of the concept of volatility, so any leverage used is deployed according to high volatile a market is, with the higher leverages being used to trade low volatility markets.

This goes to show that the real problem here is not leverage in itself, but the propensity of retail traders to abuse leverages and take on too much risk as a result. It is almost a natural thing for traders to want to assume considerable risk, and restricting leverage is not going to cure such innate instincts. Leverage caps will if anything, only serve to push traders to come up with more money to fund such risky trading. Therefore, emphasis on using leverage, whether low or high, should shift totally to ensuring that the traders obey the rules of position sizing and risk management to the letter.

Therefore, in using any of the high leverage brokers listed below, traders must STRICTLY observe the following rules:

- A) high leverage is best left for the low volatility markets. Forex majors tend to have lower trading ranges, lower spreads and have more predictable movements that forex minors or exotic currency pairs. High volatility markets such as stocks and index cfds should be used with lower leverage. The least leverage of all should be used for cryptocurrencies.

- B) position sizing must take into account the 3% exposure rule. That is, the total capital of the trader that should be in open trades should not exceed 3% of the account size. If you are using a leverage of 1:100 (1% margin) and you are trading with a $2,000 account, your position size should not exceed $60. If you set up a trade where you hope to make 90 pips and risk 30 pips as the stop loss, then you should trade micro-lots only. Indeed, you should not trade mini-lots on any account that is less than $5000.

- C) always pay attention to risk-reward ratios. Any trade that involved taking tremendous risk and does not provide a potential profit that is at least three times the risk set as the stop loss should be skipped. In other words, your risk-reward ratio should be at least 1:3.

- D) never take more than 2 trades simultaneously, and you should ensure that they collectively do not exceed 3% of your account size.

- E) do not use high leverage for highly volatile markets such as the cryptocurrency and commodity CFD markets such as gold and crude oil.

- F) remember that using a high leverage broker does not mean you must always use the maximum leverage for all trades. You have to be use leverage responsibly.

- G) before entering any leveraged trade, write down the reasons behind your decision and compare this with your earlier defined parameters for trade entries. If there is significant deviation from your trade strategy parameters (which should all have been derived from previous testing on demo and a small real account), then you should re-evaluate your decision.

High leverage brokers for you

Below is a list of the best high leverage brokers you can work with. A look at the list will reveal that there are some familiar names on it. Some of these brokers have head offices in the UK or in cyprus (EU region). In order to compensate for the exit of traders who cannot meet the steep margin requirements on their EU/UK platforms, these brokers have devised a system of automatically migrating affected clients to their offshore branches. This arrangement works well for broker and trader. The broker retains the client, and the client is able to get the same standard of regulation and service provision from the broker, albeit in a new jurisdiction.

Feel free to look at what each of these brokers has on offer, and start trading with a high leverage brokerage today.

The danger of LEVERAGE in forex trading

Leverage is the biggest reason why so many retail traders are drawn to the forex market in the first place.

We know you heard about this before, but this topic is so important for a newbie, we felt the need to discuss it again.

The forex market has become a bit of a breeding ground for ‘the get rich quick marketeers’ and the so-called gurus out there. And leverage is the main enticement they use.

What is leverage?

Leverage is the ability to control a large amount of money using none or very little of your own money and borrowing the rest. Basically, it’s a loan from the broker that will allow you to have a bigger exposure in the market.

For example, if you deposit $1,000 into your brokerage trading account, he can allow you to trade a $100,000 position. Bigger position and exposure means bigger profits (but also your losses can be greater).

How life would be without leverage? Let’s take a look:

Let’s say that you have $5000 in your trading account and want to buy amazon or apple or facebook stocks. At the time of writing this blog, you’d be able to buy 43 shares for apple, 18 shares on facebook and just 1 share in amazon.

If these companies will have a tremendous 5% rise, this will give you 500$.

Can you imagine? Only $500, but this is life without leverage.

How is life with leverage in the forex market?

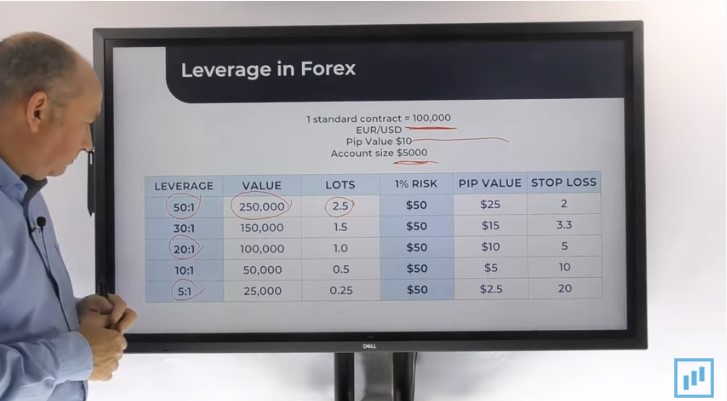

For the same $5000 account, leverage of 50:1 will allow you to control 250.000 units, of the base currency.

The buying or selling of a forex contract is done in terms of lots, and a standard lot represents 100,000 of the base currency.

For example, the EUR/USD has the pip value equal with $10. If you’re using a 50:1 leverage on the $5000 account, you’re controlling 250.000 units of the base, that would equate to two and a half lots. You’ll trade 2.5 lots with a 5,000 account if I’m using 50:1 leverage.

20:1 leverage is basically 100.000 units. That would equate to one standard lot. So if a trader is using one standard lot on a $5,000 account, that’s basically using 20:1 leverage.

How leverage works?

As I always say, when you’re trading the markets, you should always have a predetermined amount that you prepared to risk on each and every trade.

Let’s assume we’re going to risk 1% of the $5000 account on each trade. 1% of $5,000 would equate to 50 bucks. So you’re prepared to risk $50 only by using the 1%.

50:1 leverage:

- Using 50:1 leverage, you’re trading two and a half lots.

- Each lot is worth $10 per pip, that means the pip value is $25.

- You’re allowed just 2 pips wrong then you’re stopped out.

20:1 leverage:

- 20:1 leverage controls 100.000 which is one standard lot.

- 1 lot = $10 per pip. You’re only allowed five pips and you’ll be stopped out and lost your 1% on the account.

5:1 leverage:

- 5:1 leverage controls 25.000 units which are equal to 0.25 lots.

- The pip value will be $2.5, so you’ll be able to lose 20 pips before your stop loss is hit.

The more leverage you use, the more risk you’re taking and it’d be more likely to get stopped out. Risk and leverage go hand in hand, and you need to be certainly aware of that.

Broker’s leverage:

Some of the brokers offer massive leverage in order to entice you in.

100:1, 200:1, 500:1 and even 1000:1.

Imagine that, the $5000 account using 500:1 leverage controls $2,500,000. If the 1% you’re risking moves up or down, you could lose or win $25000 depending on the currency pair. That means 20 pip in wrong and you could blow your $5,000 trading account.

The good news is that recently a lot of the regulations are forcing brokers to offer lower leverage. It started off in japan a few years ago and they’ve reduced their permit to leverage to 20:1 only. In the U.S. Current maximum leverage, you can trade is 50:1. ESMA (european securities markets authority) reduced their permitted leverage to just 30:1 on the major pairs.

It’s definitely a concerted effort in the industry to protect customers such as yourselves. This huge leverage can be great in times when the markets are working for you, but it’ll blow you out of the water when it goes against you.

That is the power and the danger of leverage. It can work for you or against you.

As always if you liked this blog, leave a comment below. Until next time happy trading and good luck! I hope to see you in the trading room .

Try live forex trading room now for just 7 days free and gain access to:

- Daily live streams

- FX trading academy

- Tradeable forex signals

- Live chat with all members

- And much, much more!

What leverage should I use forex? (best leverage advice)

When a lot of people get involved with forex what attracts them originally is leverage and knowing you can leverage other peoples money to make more money on your own faster. Sounds amazing doesn’t it but it is also a double-edged sword that can slice you up badly. These are the things we will cover.

What leverage should I use when starting out in forex? When first starting out in demo go ahead and start with at least 1:200 leverage so you can really get your VOT (volume of trades) in. This way you can focus on multiple trades in one strategy or multiple trades with different strategies until you figure out one which best fits.

When you are first starting out it is generally a good idea to hit the ground running taking as many trades as you can so you can learn what not to do. Test a strategy as it is, do not try to win your way. Either you win with the strategy or you lose. The higher the leverage the more trades you can take.

Once you start narrowing down what strategy you want to use long-term then it may be time to start dialing it down and get to trying to win more trades than you lose. So your leverage won’t be a key factor here if you are at least 100:1. It may also be a good idea to start up another demo account with about the size of the account you will be using when you go live.

For instance, most brokers will just give you a pick of like 1,000 or 5,000 dollar accounts but you can usually also open up sub-accounts underneath that with a particular amount. Something cool to do is to start with like 100 to 1,000 and just try to double it using a conservative risk something like 1-5% (4-5% is aggressive).

Once you have doubled your account it is probably likely time to go live. My advice would be with your first live account to only risk 1% until you are getting the win percentage you had when demoing. This could take time based on where your mindset is.

On a live account you should honestly never have to worry about leverage if you are 1:100 or 1:200. That should give you plenty of trades anything over this means you are over leveraging your account in other words over risking and setting yourself up for a huge loss.

The same thing goes with trading certain currencies. If you are trading GBPJPY and GBPNZD probably not a good idea to trade something like GBPUSD or EURGBP. I say this when you are a beginning trader because if something goes south on GBP with news and you are risking 3% + 3% + 3% that is 9% at one time. You can lose this all based on one currency. As you become more advanced these are called basket trades where you can get more ROI per the movement based on multiple pairs moving similarily. I honestly have dabbled a bit into this but I got away from it too much emotion for me at this time.

What does leverage in forex trading mean?

In case I was getting ahead of myself when you jumped into this article. Leverage simply means you have control over a much bigger dollar amount during a trade then is relative to your deposit. 1:100 means ever $1 you have in your account is worth $100. If you started out with a $1,000 account balance you can actually trade with $100,000 in your control. Sounds great but it is a double-edged sword because you can lose your money just as quick as you profit from it.

For me, I just look at risk percentage and I don’t normally have multiple trades running at a time 2 tops with total risk around 6% b/w those two trades. But I also trade most of the time with a 10 pip stop loss and usually get out at 5 pips manually negative. I know that sounds strange but read my quick write up on trading in the new paradigm.

Forex leverage explained

Leveraging your forex trades can lead to big wins. This guide covers how to balance risk and be smart about your trades.

Tim fries

Tim fries is the cofounder of the tokenist. He has a B. Sc. In mechanical engineering from the university of michigan, and an MBA from the university .

Shane neagle

Meet shane. Shane first starting working with the tokenist in september of 2018 — and has happily stuck around ever since. Originally from maine, .

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Entering the world of forex?

Everyone is crazy about forex nowadays—but many are losing a ton of money because of high leverage. Using leverage to maximize gains seems attractive at first—but there’s a lot more to it.

Before you dive in feet first, it’s important to understand the pros and cons of trading forex to avoid its pitfalls. While using borrowed capital for your investments can lead to big returns, it can lead to equally big losses. ��

Don’t worry – forex leverage can be confusing for all beginners, and we’re here to make the path more clear! As forex trading has increased 300% since the COVID pandemic, you’re certainly not alone in your new studies. This article will help you understand the meanings of leverage and margins, how this affects your trading, and how you can get started trading forex today.

- What exactly is 'leverage'?

- What's trading on 'margin'?

- How much can you leverage?

- Margin requirements

- How leverage affects your trading

- Learning check: quiz

- How much leverage should I use?

- Negative balance protection

- How forex brokers generate revenue

- Terms you need to know

What does leverage mean in forex? ��

If you’re just starting out with forex trading, make sure you understand the essentials of forex trading. Only once you pass the basics will you be able to use leverage to amplify your gains in forex and bring home more of that cheddar.

“leverage” means using a small amount of your own money in order to control a much larger amount of money. Typically, you borrow the remaining amount through your broker.

For example, say you want to control a $50,000 position. Your broker might put aside $500 of your own money and borrow the remainder. You now have control over the $50,000 with just $500 from your own account, so your leverage ratio is 100:1.

Now, let’s say the $50,000 investment rises by $500, so the full position is now worth $50,500. If you were liable for the full $50,000 (representing a 1:1 ratio), this is only a 1% return on your investment. However, since you only put in $500 of your own capital, the $500 increase represents a 100% return on your investment – that’s way more exciting!

Forex trade with a 100:1 leverage ratio

Now, it’s important to understand that this cuts both ways. If you lost $500 instead of gaining $500, you would see a -100% return on your investment. Yikes! If you had a 1:1 ratio and put in the full $50,000 you would only see a -1% return. ��♂️

People like jason maynard have made their careers on leverage trading – but it takes some work and some luck to win big, and there’s always the risk of failure. That’s why understanding the ins and outs of leverage trading is so important!

What is margin trading? ��

Margin trading in the stock market is similar to forex leverage trading, but there are important differences. A margin account is money that you borrow in order to invest in a certain security or currency.

Margin trading uses the practice of leverage in the stock market, while forex trading applies the principle to the forex market. Forex trading does not charge interest on the margin use, and it does not rely on your credit as margin trading does. Both types of trading have the same high risks and high rewards.

How much can you leverage in forex? ��

Before you open an account with a broker, you’ll want to check the maximum leverage ratio that you’ll be able to use. The higher the ratio, the bigger your potential gains or losses. Brokers will usually offer 50:1, 100:1, 200:1, or 400:1 ratios. EFT markets just announced that they will use leverage up to 400:1.

Leverage ratios are often regulated by governments, and there are two agencies responsible in the united states. The main regulator in the EU, the european securities and markets authority passed regulations in 2019 requiring initial margins to be no lower than 20:1, which was likely disappointing news for forex traders in the old continent.

A typical ratio on a standard lot account is 100:1, and a mini lot account will often offer a 200:1 ratio. If you start trading at 400:1, be wary of using small deposits to control large capital, as these can disappear quickly with the volatility of large sums. Lower leverage keeps you safer from mistakes, while higher leverage could bring in higher rewards.

Margin requirements ��

A “margin” refers to the amount of money that you put in to control a given position. In the above example, the margin refers to the $500 of your own money that secures your control over the $50,000 of capital.

A margin will be expressed as a percentage of the full amount you control, and different brokers will require different margins. The above example represents a 1% margin. A broker will pool your margin with margins from other customers in order to create a deposit to place trades.

You can use the margin requirement from a broker to calculate how much leverage you can control. For example, if your broker requires a 5% margin, your maximum leverage will be 20:1. If your broker requires a 0.5% margin, your maximum leverage will be 200:1.

The following table breaks down some common margin requirements and how they correspond to your maximum leverage.

How leverage affects your trading ✅

As we’ve seen, leverage is a powerful tool that can help you win big in the forex market. You can use less capital to control greater positions, giving you flexibility and amplifying your profits. However, it can just as easily amplify your losses.

At very high levels, leverage starts to damage your odds of success. Transaction costs represent a higher percentage of your margin the greater your position is. This means that transaction costs already put you at a disadvantage with excessively high leverage.

- Magnify your gains by controlling significant positions

- Flexibility to control positions without tying up large amounts of capital

- Speculate on the market and benefit from falling markets

- No interest charged on your margins

- Trading 24 hours in the forex market

- Magnify your losses by controlling significant positions

- Margin calls may force you to increase your capital or close a position

- At extremely high leverage positions, transaction costs can eat up most or all of your margin

Pop quiz! ��

Let’s check to make sure you’re following! Don’t stress, we won’t be grading you.

After reading this article, you’ve decided to get started in forex leverage trading. You find a broker that has a $2,000 minimum deposit, which you can make. The broker offers 100:1 leverage.

���� question: how much capital will you be able to control with your $2,000 deposit?

Answer: you’ll be able to control $200,000 of capital with your minimum deposit. Did you get a different answer? Don’t worry – you can review the leverage ratios above, or find a reliable forex trading app that will help you with these calculations. These apps can help users create a plan and have discipline in their trades.

How much leverage should I use? ⚖️

Professional traders often use low leverage in order to protect their capital and ensure consistent returns. These amounts might even be as low as 10:1 or 20:1. This will mean depositing more money and making fewer trades than your broker might allow. Just because your broker allows higher leverage doesn’t mean you can’t trade at these levels.

Especially as you are starting out, or if you are risk-averse, lower leverage ratios will work well for you. As you get a feel for the market, you may decide to use higher leverage in order to take bigger risks. You’ll need to balance your experience and risk tolerance to decide the leverage that is right for you.

As you’re making your picks, stay on top of market trends and predictions for 2021 as the COVID-19 vaccine changes the forex market through 2021. We see a rollout of the COVID-19 vaccine and a potential return to normalcy.

In order to understand how different leverage ratios might affect your losses, let’s imagine two traders: trader 1, and trader 2. Both invest $1,000 of their own capital, but trader 1 uses a high leverage ratio of 100:1, while trader 2 uses a lower leverage ratio of 5:1. The following table breaks down what would happen to each trader in the case of a 100-point loss.

| Potential risks of high leverage | trader 1 | trader 2 |

|---|---|---|

| capital invested | $1,000 | $1,000 |

| leverage ratio | 100:1 | 5:1 |

| value of position controlled | $100,000 | $5,000 |

| result of a 5% loss | -$5,000 | -$250 |

| value of capital remaining | -$4,000 | $750 |

As you can see, the lower leverage safeguarded trader 2 with this relatively low amount of capital invested from a fluctuation in the market.

Negative balance protection ⚠️

Negative balance protection will keep your accounts from being negative even if the market moves quickly against your trade. This is a great feature for beginners who are not used to volatile swings in the market. All of the top forex brokers for beginners provide negative balance protection, as they should since newbies are the most susceptible to making brash, overly leveraged trades.

Negative balance protection will create a margin call if you are quickly losing money on a trade. This is vital as it will keep you from going into debt on your trades. The market volatility is part of what makes forex trading exciting and lucrative – just don’t let it wipe out your funds!

How forex brokers generate revenue ��

There are several types of brokerages, and there are a few ways forex brokers make money. The traditional way brokers make money is by profiting from fluctuations between the bid/ask price of a currency pair, attaching a commission or fee to your trade, or charging for services.

Though less frequent, your broker may also make money from affiliate marketing, partner programs, loan financing, or charging interest or a fee on margin loans. All in all, even though the top forex brokerages of the world have great prices, you should check their fee structure carefully before proceeding.

Leverage-related terms you should know ��

We’ve gone over a lot of terms in this article already, and it’s important to keep them all straight. The following are key terminology you need to understand in order to be a successful forex trader.

- Leverage ratio: this expresses the relationship between the capital you put up versus the position you control.

- Margin: this refers to the capital you put in.

- Margin requirement: expressed as a percentage, this is a number from your broker that will tell you how much capital you can control based on what you put in.

- Used margin: the amount of your capital that your broker has used to control your positions.

- Usable margin: the amount of capital in your account that can still be used for new positions.

- Margin call: this is triggered when the money in your account is less than your potential loss. A broker may close some of your positions to cover this discrepancy.

- Negative balance protection: particularly important for beginners, this will trigger a margin call if you are losing money rapidly to keep you from going into debt.

How to trade forex with $100 ��

You’re almost ready to start trading forex! Let’s say you have just $100 to get started. We’ve seen that different leverage ratios will allow you to control different amounts of capital. If you invest with 10:1 leverage, you’ll be able to control a $1,000 position. If you invest with an extremely high ratio like 400:1, you’ll be able to control a $40,000 position.

Now, with smaller amounts of capital and especially as a beginner, it’s smart to keep your leverage ratio low. This will keep your $100 from being eaten up by transaction fees of a $40,000 position, which could immediately trigger a margin call and give you zero chance of increasing your investment.

If you want to start forex trading and see consistent returns while you get a feel for a market, opt for a low leverage ratio with the capital you have. Some of the best forex brokers in the world, including TD ameritrade’s forex platform, don’t require a minimum deposit.

Forex leverage faqs

How much money do you need to trade forex?

Technically, you can begin using leverage to trade forex with any amount of money! Many brokers can get you started with as little as $100. However, we recommend using very low leverage ratios with small amounts of capital to avoid your entire margin getting eaten up by large transaction fees.

How much can you make trading forex?

Dedicated forex day traders usually aim to increase their portfolios by 5% to 15% per month. However, when using leverage, profits can also be much greater—and lower. An overly-leveraged leveraged forex trade has the potential to wipe out your balance, so the key to making steady growth is by increasing your portfolio by 0.5% to 1% every day through safe trades.

How is forex trading taxed?

Forex futures and options are 1256 contracts. This means they are taxed using the 60/40 rule: 60% of gains or losses are regarded as long-term capital gains, while 40% are treated as short-term capital gains. This often benefits those in higher tax brackets, as short-term capital gains are taxed as ordinary income (up to 37%), and long-term capital gains will be taxed closer to 20%. It’s always a good idea to consider tax implications and consult a professional before you embark on a new financial endeavor.

Do you have to pay back forex leverage?

No, you do not have to pay back the debt that is leveraged along with your margin. However, it is still possible to owe more than you initially put in. This is why we recommend negative balance protection to trigger a margin call if one of your trades is losing money rapidly.

Leverage trading – what is it and how does it work?

Trading on financial leverage can significantly increase your profit margins without having to put down a massive initial capital. But first, you need to know what you’re doing. As warren buffett famously said, “when you combine ignorance and leverage, you get some pretty interesting results.” in this article, we will take a closer look at leverage trading, how it works, and how you can use it as part of your trading strategy.

What is leverage trading?

In physics, leverage provides a mechanical advantage by amplifying a small input force to achieve greater output. Financial leverage follows the same principle. In this case, however, it amplifies an investor’s buying power in the market.

Also known as margin trading, leverage trading refers to the use of borrowed capital to get a much higher potential return on your investment. This allows you to open positions that are significantly larger than what your original capital would otherwise allow.

The idea here is to use that additional capital to buy more contracts of an asset, expecting that the position’s returns will be greater than the cost of borrowing. But just as leverage can increase potential rewards, it also raises risk exposure. Hence it is mainly experienced traders who use it.

Leverage can also refer to the amount of debt a company uses to expand its asset base and finance capital-intensive purchases. For example, instead of issuing new stocks to raise capital, the company can use debt to acquire more assets and improve their business operations.

Terms you should know about when it comes to leverage trading

- Buying power – this is the amount you have available (plus leverage) to buy the securities.

- Coverage – this is the ratio of the net balance in your trading account compared to the leveraged amount.

- Margin – this is the amount required by your broker to cover possible losses should the trade become unfavorable. It is one of the pillars of leverage trading.

- Margin calls – the broker or financial intermediary will issue a margin call if your trading account balance falls below a specified minimum requirement. It’s basically a warning that your position is exposed to a risk level that the broker cannot accept. You’ll then need to add more funds to your account to meet that minimum required amount. Alternatively, you could close off your trading position and face your accrued losses.

- Open position – this means you’ve opened a trade and have not yet closed it out with an opposing trade. Let’s say you own 1,000 shares of amazon stock. This means you have an open position in amazon stocks until you close it out.

- Close position – this just means the value of your investment at the time you closed it. Say you opened a position at $20, and it rose to $25. You close the position at $25 to realize your profit of $5 on the trade.

- Stop-loss – this helps limit risk exposure on a trade by automatically closing a position based on certain parameters. If the trade goes below a specified price level, it triggers the stop-loss, which automatically closes the position in order to limit further losses.

How does leverage trading work?

You can trade on leverage through your broker. Think of it as getting a loan to purchase an asset. You have your initial capital and the broker finances the bulk of the position’s whole purchase price. Any difference between how much you purchased the asset for (opening price) and how much you sold it for (closing price) is settled in your account balance.

If you have significant leverage and the asset appreciated greatly in value, then the amount owed to the broker is taken out of your profits on that trade. However, if the trade went south and you ended up with a loss on your hands, the amount owed is taken out of what is left in your account.

For this reason, leverage trading facilities are not readily available to every trader. The amount that a broker will be willing to finance will depend on a number of factors. These include how much leverage the trader needs and the current regulations covering online trading in that jurisdiction.

Leverage ratio

Financial leverage is always shown as a ratio between the total assets and equity. Total assets refer to the sum of the debt or loan amount and your equity or capital. The equity or capital is basically the cash you deposit into your brokerage account. This is the formula:

Financial leverage = total assets / equity = (equity + debt) / equity

Some brokers allow traders to use a leverage of up to 100:1 or even more. At least in the forex markets. In this instance, this means that you can leverage your trading position up to 100 times.

Let’s say you have $2,000; this is your equity or capital. If your broker allowed leverage of 100:1, you can expose yourself to a position of $200,000 in the market ($2,000 x 100), with just $2,000. Your broker will effectively allow you to borrow $198,000 for the position. Any profit or loss will be magnified by 100 times.

Some brokers offer negative balance protection. This essentially stops you out before your trading account hits negative in the event of a loss. Without this protection feature, you could end up owing money to the broker. This could happen if the position loss turns out greater than the capital you initially invested.

Which assets can have financial leverage?

You can apply leverage trading to several financial instruments including stocks, FOREX, commodities, futures, options, etfs, indices, and even cryptocurrencies. Financial leverage is also used when buying real estate. Your mortgage is the debt in the financial leverage formula. Your downpayment is the equity in the formula.

Each asset class has its maximum leverage limitations in line with market regulations, as well as the broker’s own efforts in promoting leverage trading on their platform.

Examples of trading with leverage

In the leverage ratio example above, we looked at how a 100:1 ratio with an initial $2,000 can allow you to control $200,000 worth of an asset or currency. Let’s take it from the very beginning and see how much profit or loss you make with and without financial leverage.

Let’s assume you decide to buy the asset or currency at a price of $10 per unit. During the day, the price goes up to $10.50 and you close the position. What would be the results of your trade?

- Without leverage — the asset gained $0.50 and for $2,000 you bought 200 shares. Your total profit in this case is $100 ($0.50 x 200).

- With leverage: you applied leverage of 100:1 to your investment, which means bought 20,000 shares. Your total profit on the trade becomes $10,000 ($0.50 x 20,000).

That’s just a glimpse of how much profit you can make from the same $2,000. Of course, this is only a general overview of how leverage trading works. The actual process will differ depending on the market and the type of security being traded. Let’s look at a few specific scenarios.

Trading with leverage in the stock market

Take a look at this snapshot of tesla stock.

As you can see, the trading day opened at just over $440. But then the price went down to $438.58. Let’s say you decide to open a position for 100 shares. You’ll need to have at least $43,858 in your trading account to execute the order.

It turns out that the trading day closed at $442.59, meaning you would have made a profit of (442.59 – 438.58) x 100 = $401. But considering you just put up $43,858, the return does not seem that significant.

If you executed the trade using leverage, you’d need to put up much less to earn that same $401 profit. If the brokerage allowed for 3:1 leverage, you would be able to earn the same amount with only 43,858 / 3 = $14,619.33 of your own capital.

The profit is the same in both cases since you bought the same number of shares. But because of your financial leverage, you were able to get it with much less capital invested.

Leverage trading in futures

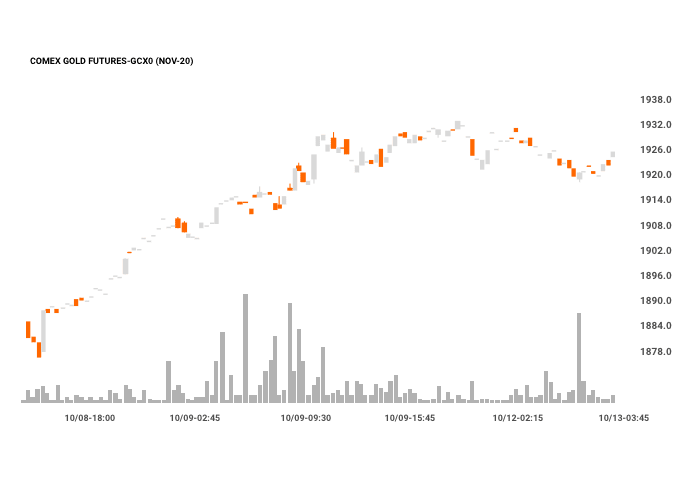

Gold futures contract specs

| contract unit | 100 troy ounces |

| price quotation | USD per troy ounce |

| trading hours | CME globex: sunday – friday 6:00 p.M. – 5:00 p.M. (5:00 p.M. – 4:00 p.M./CT) with a 60 minute break each day from 5:00 pm (4:00 p.M. CT) CME clearport: asia: sunday – friday 6:00 p.M. ET – 3:30 p.M. China london a.M.: sunday – friday 6:00 p.M. ET – 10:32 p.M. London london p.M.: sunday – friday 6:00 p.M. ET – 3:02 p.M. London |

| minimum price fluctiation | outright: 0.10 per troy ounce = $10.00 |

| product code | CME globex: GC CME clearport: GC clearing: GC TAS: GCT TAM: “GCD”,”GC7″ |

| listed contracts | monthly contracts listed for 3 consecutive months, any feb, apr, aug, oct in the nearest 23 months and any jun and dec in the nearest 72 months |

| settlement method | deliverable |

| termination of trading | trading terminates at 12:30 p.M. CT on the third last business day of the contract month. |

| Trade at market or trade at settlement of trading | TAS table |

| settlement procedures | gold settlement procedures |

| position limits | COMEX position limits |

Let’s assume that you are bullish on the value of gold. If your prediction is correct, buying a gold futures contract would allow you to realize a healthy profit.

CME offers a standard gold futures contract with a unit value of 100 troy ounces. Assuming the futures price of gold is $1,925 per ounce, purchasing the contract lets you own 100 ounces of gold for $192,500.

Most investment vehicles would require you to deposit the full amount ($192,500) before taking ownership of the gold. But with leveraged trading, you will only need to put up between 3% to 12% of the contract’s value.

Let’s say the broker allows a 10% margin requirement, then you only need $19,250 to get exposure to $192,500 worth of gold.

Leverage trading in forex

With over $5 trillion worth of currency being traded every day, the forex market is the world’s largest financial market. This extensive liquidity means most brokers are willing to offer leverage ratios as high as 100:1. Some might even offer higher leverage since it’s so much easier to open and close positions.

In forex trading, we measure currency movements in pips. These represent changes in fractions of a cent. For example, if the GBP/USD pair moves 100 pips from 1.8900 to 1.9000, it just means the exchange rate moved by 1 cent.

Because of these tiny movements, forex transactions are usually carried out in huge volumes so that these fractional pip changes can translate to greater profits.

With this, you can already see how leverage trading can impact forex. If you can potentially control an investment worth $100,000 with just $1,000, you have the potential to get phenomenal profit. But remember to also consider what would happen if the trade results in a heavy loss.

What is the difference between leverage and margin?

Although closely interconnected, leverage and margin are not the same. Financial leverage means you’re taking on debt to boost your buying power. You do this because you believe the asset or security you’re buying will bring in more profit than the original cost of the debt.

On the other hand, the margin is the amount of capital you need to create and maintain leverage. Similar to a downpayment before you can access a loan. If your account balance falls below a predetermined level during the trade, you will incur a margin call.

What determines how much leverage you can get with your margin account? The list includes the security you want to trade, your trading account balance, your trading expertise, and the broker’s leverage policy.

Pros and cons of using financial leverage

- Amplified buying power to purchase more units with only a fraction of the actual cost.

- Potential for higher profit on each trade.

- It can reduce nonsystematic risk since you only need a small percentage to control a large position of diversified assets.

- Amplified risk exposure. Even with the ability to set up stop-losses, leveraged trading carries significant risk.

- Losses sustained while trading with financial leverage are usually way more than would have incurred if you didn’t trade on leverage at all.

How to make the most out of trading with leverage

Because of the risks, leverage trading is more suitable for traders with experience. Still, if you’re looking to try it, here are some tips that might help:

Know your financial situation

Work out how much of a loss you’re willing and able to incur on a trade based on your financial situation. Start small and work your way up taking on only leverage ratios that you can firmly manage.

Do a detailed analysis before opening your position

It seems obvious but there is no room for guesswork when it comes to trading with leverage. Use a mix of leading and lagging technical indicators to determine and confirm price movement before opening a position.

Stop-loss is a must

Outside of your trading experience, applying a stop-loss order to your open positions is the first practical measure to minimize the risks associated with leverage trading.

Set up a take profit order

If a stop-loss is your defense, a take-profit order is your attack. This tool automatically closes out your position once it has hit the profit target you set.

Final thoughts

Leverage trading is one of the most powerful tools available to traders and investors who are looking for huge returns. But like any tool, it all depends on the experience and expertise of the one wielding it.

In the right hands, financial leverage can drastically amplify returns; but in the wrong hands, it can wreak havoc and result in a dreaded margin call.

In any case, constantly educating yourself on best practices is the key. Over time, you can start trying out trading with leverage using all sorts of financial instruments, and start developing your own unique trading strategies.

So, let's see, what was the most valuable thing of this article: комфортная форекс торговля: standard cent, standard, pro, raw spread счета без минимального депозита. Рыночное исполнение, узкие спреды, плечо до 1:3000. At just forex leverage

Contents of the article

- Today forex bonuses

- 6 причин выбрать justforex

- Спреды от 0 пунктов

- Две версии торговой платформы metatrader

- Кредитное плечо до 1:3000

- 170+ торговых инструментов

- Все стратегии разрешены

- Исполнение ордера от 0,01 с

- How leverage works in the forex market

- Understanding leverage in the forex market

- Types of leverage ratios

- Forex leverage and trade size

- The risks of leverage

- What is leverage in forex trading?

- What is financial leverage?

- Leveraged equity

- Trading leverage

- What is leverage in forex?

- How does forex leverage work?

- Which leverage to use in forex

- Trading crypto on margin

- FX broker offers

- How to change forex leverage

- Conclusion

- What is leverage in forex

- What is leverage

- How to choose the best leverage level

- How to manage leverage risk

- Best high leverage forex brokers for 2021

- The essence of high leverage trading

- How to use high leverage correctly

- High leverage brokers for you

- The danger of LEVERAGE in forex trading

- What is leverage?

- How leverage works?

- What leverage should I use forex? (best leverage...

- Forex leverage explained

- What does leverage mean in forex? ��

- What is margin trading? ��

- How leverage affects your trading ✅

- How much leverage should I use? ⚖️

- Negative balance protection ⚠️

- How forex brokers generate revenue ��

- Leverage-related terms you should know ��

- How to trade forex with $100 ��

- Forex leverage faqs

- How much money do you need to trade forex?

- How much can you make trading forex?

- How is forex trading taxed?

- Do you have to pay back forex leverage?

- Leverage trading – what is it and how does it...

- What is leverage trading?

- How does leverage trading work?

- Which assets can have financial...

- Examples of trading with leverage

- What is the difference between leverage...

- Pros and cons of using financial...

- How to make the most out of trading with...

- Know your financial situation

- Do a detailed analysis before opening your...

- Stop-loss is a must

- Set up a take profit order

- Final thoughts

No comments:

Post a Comment