Jp markets deposit methods

• no promotions

• users only trade cryptocurrencies but don’t own them. We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Today forex bonuses

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

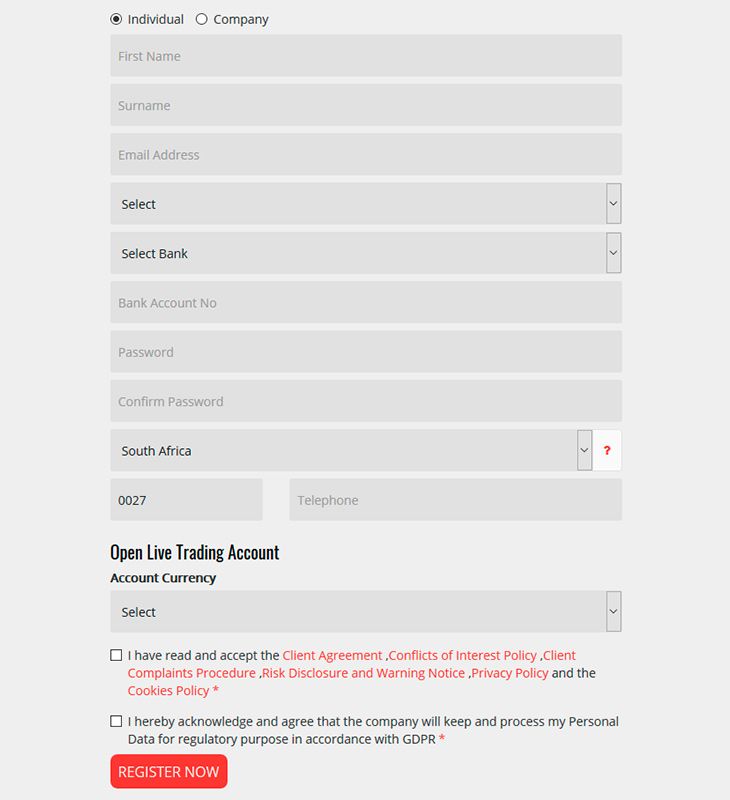

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

JP markets review 2020

JP markets summary

JP markets is a forex broker, that was founded in 2016 and it is currently headquartered in cape town. It aims to create long-lasting trading relationships and trading capability, which will encourage traders from all over the world to reach their trading potential.

- Regulated by the FSCA

- Provides negative balance protection

- Fast deposit process

- No minimum deposit required

- Demo account provided

- Interest on trading account available

- Low non-trading fees

- The trading platform is a very customer-friendly design

- No 24\7 customer support

- Slow withdrawal process

- Inactivity fee required

Safety & regulation

JP markets is a legitimate forex broker that is regulated by the financial services board (FSB) or financial sector conduct authority (FSCA) which is named now, of south africa. This forex trading broker stores client funds in segregated accounts away from corporate funds. JP markets also provides negative balance protection to ensure the protection of the client funds in case your balance in the negatives.

This JP markets review will provide you with the different protective measures that this forex broker takes for clients.

Is JP markets safe?

JP markets is considered a safe forex broker that is registered with the financial services board (FSB) of south africa. JP markets offers negative balance protection to its clients and keeps client funds in segregated accounts.

- Regulated by the financial services board (FSB) of south africa

- Provides negative balance protection

- Stores funds in segregated accounts

- Offersprofessional indemnity insurance

Regulation

JP markets is a legitimate forex broker that is regulated by the financial services board (FSB) of south africa with a license number 46855.

Protection

JP markets is a CFD and forex broker that stores client funds in segregated accounts and provides negative balance protection. In addition, JP markets offers professional indemnity insurance.

Awards

In 2019, JP markets was awarded as the most transparent broker of 2019 by the european and south africa’s best broker of 2019 by the global business outlook magazine.

JP markets fees

JP markets offers low non-trading fees and relatively low trading fees. You will not have to consider being charged with a deposit or withdrawal fee, but the ECN trading account does charge commission.

This JP markets review will inform you of the different trading and non-trading fees you have to consider.

- Low non-trading fees

- No deposit or withdrawal fee

- Tight spreads provided

- Commission charged for ECN trading account

- Inactivity fee required

Trading fees

Trading fees with JP markets are relatively low, but you have to consider that you will be charged with a 10USD commission per lot. In addition, most of the spreads are variable that could start from 0.7 pips. On average, the EUR\USD spread is about 2 pips for the STP trading account, which shows how competitive the spreads are.

Non-trading fees

As for the non-trading fees of JP markets, you will not be charged with a deposit or withdrawal fee. You will be charged with an inactivity fee and an account maintenance fee of 50USD every three months.

Leverage

For regular clients, you will find that the maximum leverage level is up to 1:500. As for professional clients, you will find that the maximum leverage level is up to 1:200.

| Deposit fees and withdrawal fees | ||||

|---|---|---|---|---|

| deposit fees | 0USD | |||

| withdrawal fees | 0USD | |||

| JP markets fees compared to competitors | |||

|---|---|---|---|

| JP markets | hugosway | plus500 | |

| account fee | yes | no | no |

| inactivity fee | yes | no | yes |

| deposit fee | 0USD | 0USD | 0USD |

| withdrawal fee | 0USD | 0USD | 0USD |

Account opening

JP markets offers two different types of trading accounts, depending on the client’s preference. You can choose between the STP trading account and the ECN trading account. Fortunately, you are not required a minimum deposit to open a JP markets account.

This JP markets review will give you a step-by-step guide on how to open a JP markets live account.

- No minimum deposit required

- Flexible leverage levels

- Copy trading account available

- Interest on available balance provided

Minimum deposit

There is no minimum deposit required to trade with JP markets

Account types

JP markets accounts

Both trading accounts of JP markets, the ECN account, and the STP account, are quite similar to one another. The main difference is that the ECN account, or electronic communication network account, trades straight to the market. You will find that you are charged a commission of 10USD with the ECN account while the commission of the STP account is integrated into the spreads provided.

How to open a JP markets trading account

Follow these steps and you will be able to open your very own JP markets live account!

Follow these steps and you will be able to open your very own JP markets live account!

Deposit & withdrawal

The deposits and withdrawals of JP markets are fairly simple. You will not be required to pay a deposit or withdrawal fee. In addition, there are three different forms of payment methods you can fund your trading account with.

This JP markets review will demonstrate the different payment methods offered.

Account base currencies

There is only one account base currency offered by JP markets, which is the USD.

Deposits

With JP markets, you will find that they do not require a deposit fee, which means you will not be charged every time you make a deposit. There are different ways to deposit funds into your trading account, from bank transfers to the electronic wallet. You will find that the deposit process is fast and can be processed up to 24 hours.

- Various methods of deposit

- No deposit fee

- Fast deposit process

- The low minimum withdrawal amount

JP markets deposit options

- Bank transfer

- Credit\debit card

- Electronic payment

Withdrawal

With JP markets, you will not have to pay a withdrawal fee either. You can withdraw funds from your accounts in the same methods of deposits, but the account has to be corresponding to your account information. However, you will find that the withdrawal process can be slow.

- No withdrawal fee

- Various withdrawal options

- The low minimum withdrawal amount

JP markets withdrawal options

- Bank transfer

- Credit\debit card

- Electronic payment

Trading platforms

JP markets provides two types of trading platforms: metatrader4 and an in-house mobile application for JP markets. Metatrader4 is one of the most well-known trading platforms that are used by traders all over the world.

This JP markets review will use metatrader4 as a model to analyze the features available for clients with JP markets.

- Metatrader4

- JP markets mobile application

Web trading platform

The metatrader4 web trading platform that is provided by JP markets is available for use in many languages, and you will find the platform easy to navigate through. There are more than 30 indicators that can be customized to your trading needs, on whatever operating system you own. Additionally, you will have access to five different pending order types, which are: market, limit, stop, good till cancelled (GTC), and good till time (GTT). These order types are considered the order types needed in basic trading. You have the option of viewing your full portfolio and any past transactions that you have made, to keep updated on your performance. On the other hand, the MT4 web trading platform does not provide price alerts or notifications, and you will have to rely on the initial login process since there is no two-step verification process.

- Available in several languages

- Customizable indicators

- Easy to navigate

- Able to view the portfolio and past transactions

- Available on all operating systems

- No price alerts or notifications

- No two-step login process for verification

Desktop trading platform

The metatrader4 desktop trading platform is similar to the web trading platform in many ways. With the desktop platform, you can customize more than 30 indicators any way you choose, in any language you want. You can download the MT4 desktop trading platform on any operating system and you can activate price alerts in the form of push notifications on your desktop. There are five pending order types that you can use to trade, which are: market, limit, stop, good till cancelled (GTC), good till time (GTT). Additionally, you can view your past transactions and your full portfolio, so you can keep track on all your past performances. However, you will find the JP markets MT4 desktop trading platform to be very outdated in design and it does not provide a two-step login process as a form of verification.

- Available in different languages

- Indicators can be customized

- Access to your portfolio and past transactions

- Downloadable on mac and windows

- Price alerts and notifications are available

Mobile trading platform

The JP markets MT4 mobile trading platform is also similar to both the web trading platform and the desktop trading platform. However, this platform is better for users who prefer to trade on the go. You can use the five basic pending order types of market, limit, stop, good till canceled (GTC), and good till time (GTT). As a mobile device user, you can download it on your ios or android device; the mobile application is compatible with both operating systems. There are over 30 indicators that be customized to your liking, and you will find that the design of the trading platform is very user friendly. You can activate price alerts as a push notification on your device, but you cannot use facial recognition or fingerprint recognition as a form of identification for logging in.

- A wide selection of languages available

- Customizable indicators provided

- Price alerts and notifications are available

- Downloadable on ios and android

- User-friendly design

Markets & financial instruments

JP markets offers five different financial markets, including currency pairs and indices. You will be able to trade through five different financial asset classes and more than 50 financial instruments.

This JP markets review will list the different financial markets that you will have access to trade.

| What JP markets offers | ||||

|---|---|---|---|---|

| forex | metals | |||

| indices | shares | |||

| futures | ||||

Markets research & trading tools

Trading tools

JP markets allows two different trading tools that will enable you to improve your trading strategies. You can use the social trading tool that will provide the option of interacting with other traders. Additionally, copy trading is a trading tool to copy trading solutions of other traders and apply it as your own.

This JP markets review will provide you with the different trading tools available with JP markets.

| JP markets tools | ||||

|---|---|---|---|---|

| social trading | copy trading | |||

- Social trading allows interaction with other traders

- Copy-trading enhances the different trading strategies

Cons

Market research

JP markets provides clients with different research materials that will enhance your trading knowledge. You will be able to look through the economic calendar for future and past economic events. In addition, you can use market outlooks and fundamental analysis for more in-depth technical data on the different financial markets.

- Economic calendar updated daily

- Market outlook updated weekly

- Research materials available

- Fundamental analysis provides technical data

Customer service

JP markets provides very helpful customer service methods that have a fast response and relevant answers to your questions. You can reach them via phone, live chat, whatsapp, or email. However, they are not available 24\7 and do not operate during the weekend.

This JP markets review will list the different means of communication that will allow you to reach the customer service team.

- Different types of customer service

- Fast response

- Accurate and relevant answers

- Available in multiple languages

Means of communication

- Phone support

- Live chat

- Email support

Client education

JP markets offers a variety of different educational resources with different educational tools. You will be able to read through how-to documents and online trading courses. Additionally, you will be able to watch video tutorials and look up trading definitions with the trading glossary. If you are more affiliated with a hands-on approach, the demo account is available for you to use without facing any financial exposure.

This JP markets review will demonstrate how to open a demo account through a step-by-step guide.

Client education resources

- Online trading courses

- Research materials

- Video tutorials

- Demo account

- How-to documents

- Glossary

How to open a demo account

You will first need to go into the dashboard of the JP markets website and select the option of “open account”. Once you choose the button of “open a new trading account”, you can select your base currency and type of trading account for the demo account. Finally, enter your login credentials and get started with JP markets.

Conclusion

JP markets is a CFD and forex trading broker that was established in 2016 and it was headquartered in cape town. There are also operations of JP markets in swaziland, kenya, pakistan, and bangladesh. JP markets is currently regulated by the financial services board of south africa.

JP markets is a legitimate forex trading broker that is regulated by the financial services board (FSB) of south africa. This forex trading broker stores client funds in segregated accounts away from corporate funds. JP markets also provides negative balance protection to ensure the protection of the client funds in case of your balance in the negatives.

Overall, JP markets is a safe and regulated forex trading broker that is worth joining.

Jp markets deposit methods

Please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. Also, payment allocations can take up to 24 hours from mondays to fridays. For faster allocation please email all proof of payments to finance@jpmarkets.Co.Za.

Account name: JP markets SA (pty) ltd

Account number: 408 902 1536

Account type: current account

Currency type: south african rand account (ZAR)

Bank identifier code (BIC): ABSAZAJJ

Your ref: MT4 number: (e.G. 554472).

Nedbank

Nedbank details:

Account name: JP markets SA (pty) ltd

Account number: 113 6899 766

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Standard bank

Standard bank details:

Account name: JP markets SA (pty) ltd

Account number: 271 294 531

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

First national bank

FNB bank details:

Account name: JP markets SA (pty) ltd

Account number: 62638202432

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Snapscan

Step 1. Snap

Open snapscan and use your phone’s camera to scan the snapcode displayed at the checkout or on your bill.

Step 2. Pay

Enter the amount you want to pay and confirm payment with your 4-digit PIN.

That’s it. You’re done! Make sure the merchant has received proof of payment – email to finance@jpmarkets.Co.Za with the MT4 number in the subject line

Online gateways

We accept payment through several online gateways. This is done through you client portal, the process is quick and easy, with an added benefit of being much faster than a bank deposit.

Please note: when paying with skrill any amount below R200 may result in your deposit not being allocated due to associated fees.

Mpesa

Make use of mpesa to pay in the greater african area. (south africa currently unavailable)

Please follow this link and complete the regular checkout process.

On checkout be sure to choose the i-pay africa option and complete your payment using mpesa.

Please note: that all international payments and other currencies will be converted to the rate that of the SARB (south african reserve bank).

Risk warning: trading on margin products involves a high level of risk.

It is investors’ responsibility to maintain a prudent level of margin, pay their margin and also meet margin call payments on time and in cleared funds. Please keep in mind the possibility of delays in the banking and payments systems. If your payment is not credited by the time you are required to have the necessary margin or meet the margin call, you could lose some, or all of your positions.

IC markets minimum deposit guide (2021)

Trading with IC markets there is every chance that you have already taken a look at our IC markets review.

This will provide you with much of the information you need in order to get started.

Here we are going to get our feet wet a little more with information around the specific areas of IC markets minimum deposit amounts, and IC markets funding methods.

This should present you with all the options you need when depositing and beginning to trade with the broker.

Table of contents

74-89 % of retail CFD accounts lose money

IC markets base currency

As a major broker, IC markets makes a variety of base currencies available for you to trade with. These base currencies do not change regardless of which regulatory authority you are under, or where you are based. This can be something of a positive for many traders who like to choose their base currency.

The options available include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and canadian dollar. If you choose to use a different currency to deposit then you may well be liable to incur a conversion fee.

IC markets funding and deposit methods

As you would expect, there are a range of common funding methods to be found as a trader with IC markets. Here we will take a closer look at the conditions surrounding each method.

Wire transfer

Like almost all top forex brokers, wire transfer deposits and withdrawals are made available by IC markets. These deposits accept all of the base currencies mentioned above with the only exception being if you are located within europe. If this is the case, then you can choose between deposits in euro, GBP, or USD only.

There are no fees from the broker side for wire transfers, though you will want to check with your bank to verify their policy as fees could apply from that side. There is a typical processing time of between 2-5 days for wire transfer deposits.

No IC markets minimum deposit amount applies here.

Credit/debit card

Both credit and debit card deposits are available around the world with IC markets. Mastercard and visa, in particular, are always available. Every base currency is facilitated with the exception of HKD and if you are located again in europe, you must choose between a deposit in euro, GBP, or USD.

With the credit and debit card deposits, again there are no fees attached from the broker end and the deposit is instant so you can trade with your funds right away. Once again, no specific minimum deposit applies here.

Ewallets

Ewallets are an increasingly popular deposit method among top forex brokers. With IC markets these methods are available around the world with the exception of within europe. Even so, UK traders can still use ewallets although only neteller is available to UK traders.

Traders in other places can avail of paypal, neteller, neteller VIP (not available in the UK), and skrill. When it comes to base currencies, all are supported by paypal deposits, all except HKD, CHF, and NZD are supported by neteller, and neteller VIP supports AUD, GBP, EUR, CAD, SGD, and JPY. Skrill as a funding method supports 6 currencies in AUD, USD, JPY, EUR, GBP, and SGD.

There are no fees to be concerned about with these deposit methods and the funds are usually available right away. Again, there is no minimum deposit from IC markets to be concerned about.

Cryptocurrencies

The next IC markets deposit method you may be wondering about is cryptocurrency.

The only crypto which you can use in funding your account is bitcoin, but there are no fees attached to this other than the minimal fees from your own BTC wallet which can be directly used to deposit.

The processing time for this method depends on the crypto network traffic but usually completes within 2-hours.

Other methods

Naturally, there are other methods available for you to deposit with IC markets.

These are largely fee-free and depending on your location. The exception here is when you use china unionpay cards. This facilitates a CNY deposit, but there is a 3.5% fee attached.

Other deposit methods from within europe include klarna and rapidpay which both allow for EUR or USD deposit.

Outside europe, bpay and poli can be used for AUD deposits, fasapay for USD deposits, and if you are located in thailand or vietnam, you can avail of their online internet banking services to deposit USD within 30-minutes.

IC markets minimum deposits

Having had a look at all of the funding methods available, we can see that no minimum deposit particularly applies to any funding method you wish to use.

Now let us take a closer look at whether any minimum deposit in IC markets is needed based on the IC market account types.

In fact we can see that no minimum is required, although a 200 USD deposit is recommended so that you can get the most out of the services offered by the broker. This does not change regardless of where you are based.

So, IC markets minimum deposit is officially 0$. In fact, IC markets is one of our forex trading no minimum deposit option.

Metatrader standard account

The IC markets standard account type makes the well-known and respected MT4 and MT5 trading platforms available for you. This account type features no commission and low spreads which start from 1 pip.

This account type also features micro lot trading if you require it. The IC markets standard account minimum deposit is 0$.

Metatrader true ECN account

The IC markets metatrader true ECN account as referred to in the name makes ECN execution of trades available through both metatrader platforms. This account has spreads that begin from 0 pips although a commission is charged within trading on this account type. That commission amounts to $7 per round trade on a lot.

Again, the IC markets true ENC minimum deposit requirement is 0$.

Ctrader true ECN account

The final account type we will examine is the ctrader true ECN account. This account type has many similarities with the metatrader ECN account and again facilitates ECN-executed trades with a spread starting from 0 pips and commission applied. The commission here is slightly lower at $6 per round turn on a currency lot.

Again micro-trading is catered for and no minimum deposit applies.

Related guides:

IC markets deposit bonus

When it comes to IC markets bonus types that are offered, unfortunately, the broker does not offer any type of trading or no deposit bonus.

This may change in the future with the possibilities open outside the strict european regulations, but at the moment this is not the case.

74-89 % of retail CFD accounts lose money

IC markets minimum deposit

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

IC markets minimum deposit amount

The minimum deposit at IC markets is $200.

Check the following comparison table to see how IC markets stacks up against similar brokers when it comes to minimum deposits:

| IC markets | pepperstone | fusion markets | |

|---|---|---|---|

| minimum deposit | $200 | $0 | $0 |

The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at IC markets. Here are the main pros and cons when it comes to depositing at IC markets:

| Pros | cons |

|---|---|

| • credit/debit card deposit | none |

| • no deposit fee | |

| • several account base currencies |

Open account

74.25% of retail CFD accounts lose money

Why does IC markets require a minimum deposit?

Online brokers sometimes require a minimum deposit in order to cover their initial costs associated with creating a new account and to ensure their profitability. The higher the amount you deposited, the higher the chance for you to trade more and generate bigger profits for the broker.

In some cases, the very high minimum deposit (like the £1 million amount at the VIP account of saxo bank) is there to differentiate the level of services they offer you.

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

IC markets minimum deposit

IC markets deposit fees and deposit methods

IC markets does not charge a deposit fee. This is great because the broker won't deduct anything from your deposits and you only have to calculate with the costs charged by the bank / third-party you send the money with. If you want to know more about IC markets fees, check out the fee chapter of our IC markets review.

While there is no deposit fee at IC markets, the available deposit methods are also important for you. See how IC markets deposit methods compare with similar online brokers:

| IC markets | pepperstone | fusion markets | |

|---|---|---|---|

| bank transfer | yes | yes | yes |

| credit/debit card | yes | yes | yes |

| electronic wallets | yes | yes | yes |

The average transfer times for the different methods are:

- Wire transfer: 2-3 days

- Credit / debit card and online wallets: instant or a few hours

A minor issue with depositing money to IC markets is that based on our experience it's not user-friendly compared to similar brokers. This means either that the interface is not user-friendly or that figuring out where and how you have to make the transfer is a bit complicated.

Find out more about depositing to IC markets on their official website:

Open account

74.25% of retail CFD accounts lose money

IC markets minimum deposit

deposit currencies

Each trading account has a base currency, which means that the broker will hold your deposited money in that currency. At some brokers, you can also have more trading accounts with different base currencies. For example, at IG, it is possible to have both EUR and USD-based accounts.

Why does this matter? A currency conversion fee will be charged if you deposit in a different currency than the base currency of the target trading account. It's likely not a big deal but something you should be aware of.

Some online brokers offer trading accounts only in the major currencies (i.E. USD, GBP, EUR and sometimes JPY) and some support a lot more than that.

| IC markets | pepperstone | fusion markets | |

|---|---|---|---|

| number of base currencies | 10 | 9 | 6 |

Luckily, IC markets stands out from the majority of online brokers by supporting not only the main currencies but some smaller ones as well. The benefit of this for you is that IC markets is very likely to support the currency you want to deposit in and won't have to convert it. The conversion would mean extra costs, as a conversion fee is charged.

A convenient way to save on the currency conversion fee if you wish to fund your brokerage account from a currency different from your existing bank account can be to open a multi-currency digital bank account. At revolut or transferwise the account opening only takes a few minutes after which you can upload your existing currency into your new account, exchange it in-app at great rates, then deposit it into your brokerage account for free or cheap.

Want to stay in the loop?

Sign up to get notifications about new brokerchooser articles right into your mailbox.

IC markets minimum deposit

steps of sending the minimum deposit

The specific process of sending your minimum deposit to IC markets might vary slightly from the following, but generally the process involves the following steps:

Step 1: open your broker account

At most brokers, you can open your trading account online. To open an account, you have to provide your personal details, like your date of birth or employment status, and there is also usually a test about your financial knowledge. The last step of the account opening is the verification of your identity and residency. For this verification you usually have to upload a copy of your ID card and a document that validates your proof of residence, for example, a bank statement.

If you don't know which broker is suitable for you, use our broker selector tool.

Step 2: make the deposit

First you have to sign in to your already opened trading account and find the depositing interface. After this, you select one of the deposit methods the broker supports, enter the deposit amount and make the deposit.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you'll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it's required to use a card that's in your name. In some cases, like with IC markets, you'll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.

- Online wallets like paypal, skrill, neteller, etc.: it works just like any other online purchase. The interface of the wallet will pop up where you'll have to enter your credentials (username and password) and carry out your transaction.

Step 3: review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

Open account

74.25% of retail CFD accounts lose money

so, let's see, what was the most valuable thing of this article: is JP markets reliable forex broker? Is JP regulated in south africa and other african countries? Complete guide & review with screenshots, videos & testimonials. Updated. At jp markets deposit methods

Contents of the article

- Today forex bonuses

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- Forex brokers lab

- What is JP markets?

- JP markets account types, spreads and leverage

- What is the difference between ECN and STP JP...

- Trading platforms

- Trading products

- What are JP markets fees?

- What is the minimum deposit for JP markets?

- JP markets bonuses and promotions

- JP markets deposit and withdrawal methods

- Is JP markets suspended?

- Customer services

- Conclusion

- JP markets review 2020

- JP markets summary

- Safety & regulation

- JP markets fees

- Account opening

- Deposit & withdrawal

- Trading platforms

- Markets & financial instruments

- Markets research & trading tools

- Customer service

- Client education

- Conclusion

- Jp markets deposit methods

- IC markets minimum deposit guide (2021)

- IC markets base currency

- IC markets funding and deposit methods

- IC markets minimum deposits

- IC markets deposit bonus

- IC markets minimum deposit

- IC markets minimum deposit amount

- IC markets minimum deposit IC markets...

- IC markets minimum deposit deposit...

- IC markets minimum deposit steps of sending...

No comments:

Post a Comment