How to delete trading account on jp markets

Length of use: over 1 year CLICK HERE to verify.

JP markets review

Today forex bonuses

JP markets offers the metatrader 4 and mobile forex trading top platform. Jpmarkets.Co.Za offers over 25 forex currency pairs, cfds, stocks, gold, silver, oil, bitcoin and other cryptocurrencies for your personal investment and trading options.

2020-06-19: the south african FSCA has privisionally suspended the license of JP markets. This was done because "there is reasonable belief that substantial prejudice to clients or the general public may occur if they continue rendering financial services."

CLICK HERE to verify.

Broker details

Live discussion

Join live discussion of jpmarkets.Co.Za on our forum

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Not able to withdraw

Length of use: 6-12 months

Due to the numerous complaints from clients failing to withdraw their funds, the FSCA (financial sector conduct authority) has provisionally suspended JP market's license pending a full investigation. As from the 19th of june 2020 they are no longer allowed to take any new business or clients. I'm not surprised coz when i used them back in 2016 i couldn't even make a deposit to fund my account. Had to do an EFT and then call their office to let them know so they could check with the bank. Very poor service indeed. Anyway you can read the story of their suspension below:

Length of use: over 1 year

Length of use: over 1 year

This is the worst broker in the world, I made withdrawals amounting to R1.5 million in a he past weeks and they started asking me to submit my fica and bank cards of which I did. Only today they told me I won’t be getting my withdrawals since their system says I used different accounts to fund my account of which I didn’t. I don’t even know the people they talked about.

Stay away from this broker. I just can’t wait for this lock down to be over so I can visit their offices

Length of use: over 1 year

Jp markets should be challenged and charged for market and accounts manipulation. This is wrong and we will expose them.

Our funds and pending orders just disappeared and when we tried to contact someone no one answered.

This broker will not last long with the kind of service it provides.

Frequently asked questions

What is the minimum deposit for JP markets?

JP markets does not have a strict minimum deposit. Traders can invest whatever they are comfortable with. However JP markets recommends starting with around ZAR3,000.

Is JP markets a good broker?

Unbiased traders reviews on forexpeacearmy is the best way to answer if JP markets is a good broker. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we'd recommend to check recent JP markets community discussions: https://www.Forexpeacearmy.Com/community/tags/jpmarkets/

Is JP markets safe?

To define whether a company is safe or not, you'd better get to know about this company, the unbiased traders reviews on forexpeacearmy is the best resources to grant you such knowledge. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

JP markets at least is regulated with south africa financial services board under license 46855. Being regulated gives you a chance to complain to the authority if it comes down to it.

What is JP markets?

JP markets is an online forex retail broker. JP markets offers a number of assets to be traded on metatrader 4 and JP mobile app.

- Forex currency pairs

- Cryptocurrencies

- Stock indices

- Precious metals

- Commodities

How to delete trading account on jp markets

JP markets does not have a strict minimum deposit – our clients are welcome to invest whatever they are comfortable with. We do however recommend starting with around R3 000, particularly if you require training.

How much does JP markets charge for training?

Our clients enjoy complimentary access to some of the best forex training and mentorship at no charge, provided they have live, funded accounts with JP markets – there are different levels of access available depending on the value of your investment. We offer classes at selected offices across south africa, or online and video courses should you prefer to learn at your own pace.

Have a look at our training calendar on our website or email learn@jpmarkets.Co.Za to book, or to enquire about our self-study options.

What documents are required to open an account?

As a licensed financial services provider, we are obligated to comply with the financial intelligence centre act (also known as FICA). This act is the government’s response to the global fight against money laundering and fraud. To comply with the act, we must identify, verify and update clients’ information, which includes their proof of residence or proof of address. In short – these efforts ensure a safer financial system for all of us. As most of our business is conducted online and we do not transact with our clients face-to-face, we are subject to stricter laws than other entities. We therefore require the following in order to validate your account:

- A certified copy of your ID.

- Confirmation of residential address. Examples include the following:

- A utility bill reflecting the name and residential address of the person;

- A recent lease or rental agreement reflecting the name and residential address of the person;

- Municipal rates and taxes invoice reflecting the name and residential address of the person;

- Mortgage statement from another institution reflecting the name and residential address of the person;

- Fixed -line telephone account reflecting the name and residential address of the person;

- Valid television licence reflecting the name and residential address of the person;

- A statement of account issued by a retail store that reflects the residential address of the person.

- We will also require confirmation of your bank details in order to process any withdrawals.

I don’t receive any mail in my name – what can I submit as proof of address?

You can request a cohabitation form from us, and ask the homeowner to complete and submit along with their supporting documentation. Alternatively you could approach your ward councilor or local police station for an affidavit confirming your residential address.

I just tried to login and it says invalid login/password/no connection.

Open your MT4 client terminal.

Click on open an account.

Click on scan and let the whole scanning of the servers finish.

Once scanning finishes, click on jpmarkets-live (for live) or jpmarkets-practice (for demo).

Input login and password and you should be able to connect.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

How do I fund my trading account?

JP markets differs from its competitors because we are authorized and licensed to accept local deposits from clients. We have bank accounts with absa, FNB, standard bank and nedbank, as well as multiple payment gateways. It’s as easy as doing an EFT or cash deposit, or a simple card transaction on our website with your preferred intermediary. Please click here for more details: jpmarkets.Co.Za/bank-details.

Can I fund my account using bitcoins?

Yes you can, but only via skrill – fund your skrill wallet using bitcoin and use this intermediary to fund your JP markets trading account.

What reference must I use when I make a deposit?

Please use your MT4 account number as reference number when making a deposit. Should your MT4 number not be active, please use your full name and surname. You can also forward your proof of payment to finance@jpmarkets.Co.Za with your MT4 number in the subject line.

What is the turnaround time for my deposit to be allocated and reflect in my account?

Deposits are allocated almost instantaneously but because this is done manually, we try to adhere to a maximum TAT of 1 hour during business hours. Please be aware that this window may be slightly longer around news events etc.

My deposit has not reflected on my account – what is the problem?

Please ensure that you have used the correct reference, and that your proof of payment contains the following:

- Sending bank, and recipient bank, details.

- Date of transaction.

- Amount.

- Beneficiary reference.

Kindly note that due to high incidences of fraud, we cannot allocate bigger amounts until they have reflected in our bank account. It is for this reason also that all cheques deposits are subject to a 10-day clearance period.

I just downloaded MT4, why can’t I place any trades?

Sometimes upon downloading, not all symbols are displayed automatically. To enable this, you need to do the following:

– right click on your ‘market watch’ list. – select ‘show all’

Please make sure that you trade the instruments that has a dash (-) next to it.

I forgot my password for the client portal.

To reset your password, go to JP markets home.

– enter your email address and select ‘reset’

You will receive email instructions to reset your password.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

I forgot my password for my trading platform.

Log into your client portal via our website and click ‘my accounts’ then click on the account number (in blue) to access your trading account.

Click on ‘change password’

Enter the new password in both blocks and submit – you should now be able to access your trading account with your new password.

How do I request a withdrawal?

Withdrawing funds from your JP markets account is easy and quick. Withdrawal are processed monday to friday from 9am to 5pm, GMT +2 (south african standard time), with all others being acted on within 24 hours.

For security reasons, we will call you to verify the request- if you are expecting a withdrawal, please answer any 087 / 010 / 021 calls to avoid further delays.

Please log in to your member area at secure.Jpmarkets.Co.Za and do an internal transfer from your trading account to your landing account.

Click on ‘transfers’ on the top grey bar and select ‘internal transfers’ from the bar on the right hand side.

The ‘from’ account is your trading account and the ‘to’ account is your landing account.

Enter the amount (in your trading currency) that you would like to withdraw. We will process the conversion on our side and click on submit, and it will go to our finance department for verification.

Ensure all documentation is in order before submitting your request, or it will be declined. We require clear, scanned copies of the following in order to process a withdrawal – ID, proof of address and bank statement confirming your INDIVIDUAL bank details – we are not allowed to process third party payments as per FSB regulations.

More information relating to withdrawals is available on our website.

What is the turnaround time for a withdrawal?

Withdrawals are processed immediately and paid within 4 hours provided that all documentation is in order and you have spoken with our withdrawals department to verify your banking details.

How long does it take for a withdrawal to reflect?

Withdrawals are paid from our bank accounts to yours within 4hrs after approval, usually from the same bank. The notable exception is capitec as they do not offer business bank accounts. These withdrawals are therefore regrettably delayed by the banking system which is unfortunately outside of our control.

Can I withdraw a bonus?

Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

How much is a spread?

Spreads are variable based on market conditions. However, JP markets offers some of the most competitive spreads in the market. On average you can get EUR/USD for about 2 pips, under normal market conditions.

Does JP markets have control over the spread/platform?

No, JP markets has no control over the platform, spreads or clients’ accounts. Unlike some other brokers, our liquidity comes directly from the biggest banks in the world such as JP morgan. UBS and morgan stanley to mention just a few. As a result, the spread is determined by the market conditions. The platform is a 3rd party company – we basically connect our best pricing into MT4. As a result, clients receive market pricing and the most stable and fair pricing.

How much is a swap?

Swaps are dependent on the pairs but can be checked by right clicking in your market watch, and selecting ‘symbols and properties’.

Pending order expiration

When setting a pending order(buy/sell limit OR buy/sell stop), you specify price and can also specify expiry.

In the MT4 platform you can either uncheck or check the expiry box. When unchecked, the pending order will be GTC (good till cancelled), thus the pending order will not expire unless you close it manually. If the expiry box is checked, you will be prompted for a time, take note that the default time is to expire at the close of the next hour.

In the mobile MT4 platform, you will also be asked for expiration either GTC or an expiry time/date. The default is also to expire at the close of the next hour.

Even if you specify a stop loss, the price specified as stop loss is not guaranteed as you may get a worst price due to market conditions as stop orders are always executed as market orders.

Also, it is imperative to clarify that orders may get closed before it reaches the TP or SL levels due to account reaching a stop out level.

Does JP markets give signals to clients?

JP markets does not give signals to clients. However, we do provide world class information and education around specific pairs and symbols and what is happening in the markets. These are sometimes received up to 3 times a day via SMS and email to ensure you get the best available information to make the most informed trading decision. Remember, your success is our success.

Does JP markets buy mandela coins?

JP markets does not accept mandela coins as a preferred method of payment as it is not authorized by the FSB. Clients can cash this in at their bank and then fund their account via the usual channels.

How do I become an introducing broker (IB)?

You can sign up directly on our website under our partners tab. You can also call on at our head office on 021 276 0230 or email support@jpmarkets.Co.Za.

We pay the best commissions in the industry and you can withdraw your rebates at any time. You can also track your rebates on your MT4 account which you can trade with or withdraw at any time. We also have a dedicated team of IB professionals that help you with your business from building a website, hosting seminars, online marketing, designing banners to mention a few. These individuals are focused to take all these tasks away from you to ensure you can focus on sales.

Our goal for all our partners is to help them grow so that one day they too can open their own brokerage, if that is their aim. Our sister company, JP technology, can assist with all the requirements to start your own brokerage.

We can also tailor make a structure to suit your individual requirements. Your success is our success!

What different account types does JP markets offer?

We understand that traders are different, and therefore their requirements are different, based on their trading style. As a result, we offer different types of accounts structured to suit you as a trader. We have ZAR, USD and GBP based accounts, as well as accounts which charge you commission or an account which charge you spread as a cost. All these accounts have direct market access and your order flows directly into the market, thereby ensuring you receive the best possible market price from the forex market with no manipulation of prices, slippages or lagging of any sort. We do not differentiate between micro or mini accounts – you are free to trade all available pairs without restriction.

What is the difference between ECN and standard accounts?

An ECN account stands for electronic communication network. It means that your orders are executed directly in the market. The difference between the two is that on an ECN account, you will see a commission charged per transaction whereas on a standard account you will be charged on spread. Both accounts work out to similar in cost so it is all dependent on what you as a trader prefer.

How much is the commission on an ECN account?

The commission charged is $ 10 per lot. We do offer a lower commission on our VIP accounts.

Why was my stop loss / take profit not hit?

System brief the way pending orders work in financial markets is as follows:

If a client has placed a buy limit or a buy stop order, the orders will get executed if the ask price reaches the specified level.

If a client has placed a sell limit or a sell stop order, the orders will get executed if the bid price reaches the specified level.

If a client has placed a buy order, both SL (stop loss) and TP (take profit) levels will be executed if the bid price reaches the specified levels.

If a client has placed a sell order, both SL (stop loss) and TP (take profit) levels will be executed if the ask price reaches the specified levels.

- By default, MT4 platform only displays bid price line. Enable the ask price line on the charts.

- All the highs and lows of all symbols are made from the bid prices.

Clients make their trading decisions based only on the bid price line which is what they see ontheir charts and then think that their stop loss and take profit levels were wrongly executed.

Clients place trades only using the pricing information on the charts which is not the right way asthe charts are made not from the tradable prices but from pricing library.

Clients should place trades using the prices displayed on the market watch as those are theprices JP markets is willing to buy and sell.

How a chart looks with only bid price line

How chart looks with both bid and ask price lines

How does JP markets make money if you are offering free courses and your clients are “profitable”?

JP markets makes revenue when clients trade. Therefore the more that clients trade, the more revenue that is made. It is for this reason we ensure that our clients receive all the knowledge and tools available to be able to make their own educated trading decisions.

Who regulates JP markets?

JP markets is an authorized FSP 46855. We are regulated by the financial services board and the responsible acts such as FIC act, SARB and FICA act.

How much money can I make if I deposit X amount?

Your profits all depend on the type of trader you are. There are no limitations or restrictions on what you can make in the forex market. Some people have managed to make 10 000 % in one day but what is important is to manage your risk.

I want to start trading but I don’t know how?

We can teach you through our online courses, PDF forex book or any of our free classes we host. Contact us at learn@jpmarkets.Co.Za to find out more.

Do I have to pay JP markets for their services other than my investment?

No, there are no fees you have to pay.

Can JP markets trade on my behalf?

No, we do not trade clients’ funds on their behalf, and we do not recommend that you give your login credentials to anyone to trade on your behalf. We can however teach you how to trade the markets on your own. Alternatively you could link your account to that of a master trader – check out our social trading facility here copytrader.Jpmarkets.Co.Za. You can compare the trading history of the available traders and pick the one whose trading strategy is most closely aligned with your investment goals.

Does JP markets make any deductions for taxes on the money I make/withdraw?

No, we do not make any deductions – your tax considerations are completely between you and SARS. However, it should be noted that any profit that you make from trading forex will be classed as contributing to your gross income in the income tax act, and thus would be taxed as income, based on the income tax tables for an individual. Consequently, any expense that you incur in the production of the income can be deducted. Please speak to your tax consultant to be completely clear about the tax implications.

Is my money safe?

Your funds are completely safe. Funds are kept in client to client segregated accounts which gets monitored and audited daily by a third party registered auditor every single day. Therefore, your funds are separate and completely safe and secured. In addition, we also have fidelity and professional indemnity insurance to give our clients that extra piece of mind.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

Connect to an account

To start working with a trading account, you need to connect to it using a login (account number) and password. Two types of account access are available in the trading platform: master and investor. Logging in using the master password gives full rights for working with the account. Investor authorization allows you to see the account status, analyze prices, and work with your own expert advisors, but not trade. The investor access is a convenient tool for demonstrating the trading process on the account.

The trading platform provides the option of extended authentication using SSL certificates.

Click " login to trade account" in the file menu or in the navigator.

Specify the following data in this window:

- Login — the number of the account used for connection.

- Password — the master or investor password for the account.

- Server — server to connect to. Also you can indicate a server manually. Enter its IP address and port number as [server number]:[port number], for example, 192.168.0.1:443.

Enable the "save password" option, and the next time you start the platform, the last used account will be automatically connected to the server. Option "keep personal settings and data at startup" in the platform settings performs the same action.

After specifying all the details, click "OK" to connect.

Forced change of password #

Upon authorization, you may be requested to change the master password of the account. Forced password change can be enabled by the trade server administrator. The mechanism of forced change of the master password, when you first connect or on a regular basis, increases safety.

Enter the new password, and then enter it again to confirm. The password must meet the following requirements:

- It cannot be shorter than the length required in the password change dialog.

- Must contain at least two of three types of characters: lower case, upper case and digits.

- Must not be the same as the previous password.

If the master password is changed forcedly, the investor password of the account is also reset. A new investor password can be set in the platform settings.

Deposit and withdrawal #

The trading platform allows quickly switching to deposit/withdrawal operations on the broker website. You do not need to search for these functions in the trader's room, while fast navigation commands are available directly in terminals: in the accounts menu in navigator and in toolbox:

MT4 trading platform

Metatrader 4 covers all brokerage and trading activities for all markets

Fill the form and get your demo account now!

MT4 features

Multi account manager – MAM software

MAM plugin is a simple, fast, effective and reliable addition to the metatrader4 system.

Copier

Just plug in our software trade and copy the same trades to your clients’ accounts.

Drawdown controller

Our draw down tool allows the trader to determine a maximum loss established

My fxbook autotrade - social trading

Build the ultimate trading portfolio built from the best live trading accounts and easily copy trades to your MT4 account at JP holdings!

Metatrader expert advisor

An automatic trading system (MTS, forex robot, eas) written in metaquotes language 4 (mql4)

Mobile trading

One of the most popular forex trading platforms, metatrader 4, is now available on your android, ipad or iphone absolutely free of charge.

Trading platform

Forex, gold, oil, stocks, indices

BTCUSD (bitcoin / US dollar)*

ETHUSD (ethereum / US dollar)*

LTCUSD (litecoin / US dollar)*

Covers all brokerage and trading activities of forex and CFD markets.

Day traders, swing traders and position traders can all take advantage of our wholesale rates when selecting our variable spread option.

Forex and exchange markets

Metatrader 4 (MT4) has been created for our self-traders to provide trade operations and technical analysis in real-time mode. The platform provides a wide range of features for our traders, including various execution technologies, unlimited charting quantity, large number of technical indicators and line studies, custom indicators and scripts and more.

Introducing brokers and traders find out JP holding's to be very convenient and effective.

Engaging with your clients simplified.

Consolidated everything an IB needs into a single experience

Ultra low

spreads

250+ trading

instruments

$10 minimum

deposit

Leverage

1:500

Immediate deposits

and withdrawals

24/5 email

support

Instruments

250+ instruments in the platform.

Desktop, tablet, mobile

Desktop, tablet, mobile and web based trading with metatrader 4 and metatrader 5

Automated trading platforms

A range of automated trading platforms and EA compatibility

Spreads offering

Competitive spreads offering

Client funds security

Client funds are held in segregated accounts for increased security

Multilingual languages

Trading website in more than 20 languages

Customer support

Connect through whatsapp

Whatsapp contact to reach customer support

Why trade with veracity markets?

Veracity markets is continuously working hard to become a major player in the online financial field, with a proven track record of positive customer satisfaction. Our key responsibility is to offer top-notch services to all our traders.

Trade anywhere

any time

Successful online trading depends on efficient and powerful trading technology. Veracity markets offers you the best trading platforms to get you into the market quicker and easier. You can access quality information and trading tools to help ensure you make educated trading decisions.

Choose your account type

| standard account |

|---|

| initial deposit : $250 |

| spreads : floating from 1.6 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| pro account |

|---|

| initial deposit : $250 |

| spreads : floating from 2 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisors : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| ECN account |

|---|

| initial deposit : $250 |

| spreads : floating from 0.00 pips |

| commission : $7 lot only FX & metals* |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: not available |

| read full account terms & description here |

| open account |

Access the world's top tradable assets

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum cursus sit amet metus id ultricies.

Become a

just perfect trader

today and receive 100%

on your first deposit

Trade a broad range of markets

Discover hundreds of markets available to trade, with more to be added soon

Forex trading

Over 38 major, minor & exotic pairs

Cryptocurrencies

Trade a broad range of cryptocurrencies

Indices

9 globel indices available

Metals

Trade gold, silver, platinum & copper

Commodities

Oil, gas & agricultural commodities

Shares

Over 150 shares to choose from

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Start your trading with veracity markets in 4 simple steps:

Register

Verify

Trade

Trade

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

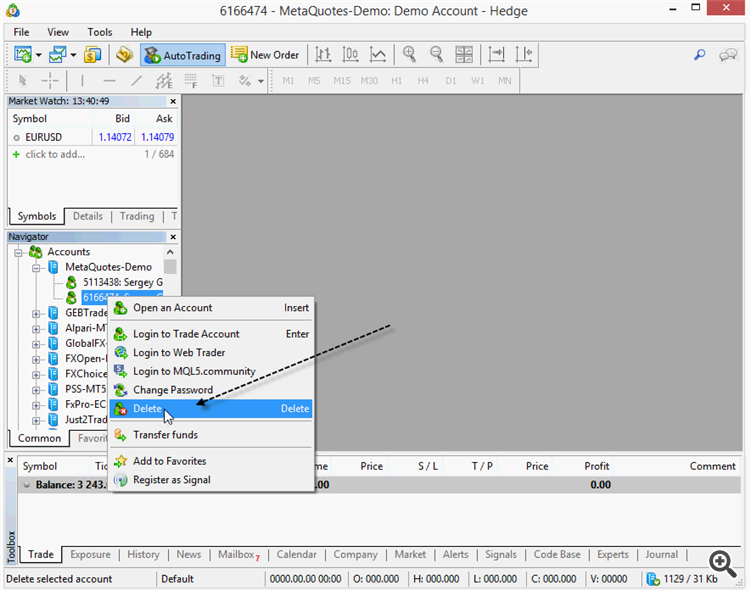

No delete option for demo account on terminal or right-click mouse

I downloaded a demo version through a broker.

Performing some functions and to conclude I need to delete my logged-in demo account .

Delete key on keyboard does not delete demo account; right-click mouse does not display a delete option.

Right-click has the following: "open an account; login trade account; login web trader; login to mql5 community; change password; add to favourites; register as signal; register as virtual server"

I downloaded a demo version through a broker.

Performing some functions and to conclude I need to delete my logged-in demo account .

Delete key on keyboard does not delete demo account; right-click mouse does not display a delete option.

Right-click has the following: "open an account; login trade account; login web trader; login to mql5 community; change password; add to favourites; register as signal; register as virtual server"

You cannot delete your only (logged in) account in MT. You have to create a new account or log into another one, in order to be able to delete it.

Thanks sergey, however the delete option does not exist.

Right-click options are: " open an account; login trade account; login web trader; login to mql5 community; change password; add to favourites ; register as signal; register as virtual server"

I am definitely logged in the demo-account and can see it in the navigator window.

I doubt this is the issue, I am using MT4 platform through windows 10 installed on mac OS bootcamp.

Jerrajerra :

Thanks sergey, however the delete option does not exist.

Right-click options are: " open an account; login trade account; login web trader; login to mql5 community; change password; add to favourites ; register as signal; register as virtual server"

I am definitely logged in the demo-account and can see it in the navigator window.

I doubt this is the issue, I am using MT4 platform through windows 10 installed on mac OS bootcamp.

I do not have MT4 on mac so I can not check it.

Anyway - you can use the suggestion of eleni: open metaquotes demo on same MT4, logn into it, and delete your first demo account from the second one.

Eleni anna branou :

You cannot delete your only (logged in) account in MT. You have to create a new account or log into another one, in order to be able to delete it.

That did cross my mind, however the video from the broker demonstrates him deleting his demo account successfully and he had no other accounts available.

In navigator, broker name / accounts / no "+" to expand as no accounts existed after he deleted his demo.

Learn how to trade the market in 5 steps

Want to trade but don't know where to start?

Millions of neophytes try their hand at the market casino each year, but most walk away a little poorer and a lot wiser, having never reached their full potential. The majority of those who fail have one thing in common: they haven't mastered the basic skills needed to tilt the odds in their favor. However, if one takes adequate time to learn them, it's possible to be on the way to increasing one's odds of success.

World markets attract speculative capital like moths to a flame; most people throw money at securities without understanding why prices move higher or lower. Instead, they chase hot tips, make binary bets, and sit at the feet of gurus, letting them make buy-and-sell decisions that make no sense. A better path is to learn how to trade the markets with skill and authority.

Start with a self-examination that takes a close look at your relationship with money. Do you view life as a struggle, with a hard effort required to earn each dollar? Do you believe personal magnetism will attract market wealth to you in the same way it does in other life pursuits? More ominously, have you lost money on a regular basis through other activities and hope the financial markets will treat you more kindly?

Whatever your belief system, the market is likely to reinforce that internal view again through profits and losses. Hard work and charisma both support financial success, but losers in other walks of life are likely to turn into losers in the trading game. Don't panic if this sounds like you. Instead, take the self-help route and learn about the relationship between money and self-worth.

Key takeaways

- Learning how to trade the financial markets begins with educating oneself on reading the financial markets via charts and price action.

- Use technical analysis, in conjunction with fundamental analysis, to decipher price action.

- Practice makes perfect or, at the very least, it allows the neophyte to test out theories before committing real funds.

Once you get your head on straight, you can embark on learning trading and start with these five basic steps.

1. Open a trading account

Sorry if it seems we're stating the obvious, but you never know! (remember the person who did everything to set up his new computer—except to plug it in?) find a good online stock broker and open a stock brokerage account. Even if you already have a personal account, it's not a bad idea to keep a professional trading account separate. Become familiar with the account interface and take advantage of the free trading tools and research offered exclusively to clients. A number of brokers offer virtual trading. Some sites, including investopedia, also offer online broker reviews to help you find the right broker.

2. Learn to read: A market crash course

Financial articles, stock market books, website tutorials, etc. There's a wealth of information out there and much of it inexpensive to tap. It's important not to focus too narrowly on one single aspect of the trading game. Instead, study everything market-wise, including ideas and concepts you don't feel are particularly relevant at this time. Trading launches a journey that often winds up at a destination not anticipated at the starting line. Your broad and detailed market background will come in handy over and over again, even if you think you know exactly where you’re going right now.

Here are five must-read books for every new trader:

- Stock market wizards by jack D. Schwager

- Trading for a living by dr. Alexander elder

- Technical analysis of the financial markets by john murphy

- Winning on wall street by martin zweig

- The nature of risk by justin mamus

Start to follow the market every day in your spare time. Get up early and read about overnight price action on foreign markets. (U.S. Traders didn't have to monitor global markets a couple of decades ago, but that’s all changed due to the rapid growth of electronic trading and derivative instruments that link equity, forex and bond markets around the world.)

News sites such as yahoo finance, google finance, and CBS moneywatch serve as a great resource for new investors. For more sophisticated coverage, you need to look no further than the wall street journal and bloomberg.

3. Learn to analyze

Study the basics of technical analysis and look at price charts—thousands of them—in all time frames. You may think fundamental analysis offers a better path to profits because it tracks growth curves and revenue streams, but traders live and die by price action that diverges sharply from underlying fundamentals. Do not stop reading company spreadsheets because they offer a trading edge over those who ignore them. However, they won’t help you survive your first year as a trader.

Your experience with charts and technical analysis now brings you into the magical realm of price prediction. Theoretically, securities can only go higher or lower, encouraging a long-side trade or a short sale. In reality, prices can do many other things, including chopping sideways for weeks at a time or whipsawing violently in both directions, shaking out buyers and sellers.

The time horizon becomes extremely important at this juncture. Financial markets grind out trends and trading ranges with fractal properties that generate independent price movements at short-term, intermediate-term, and long-term intervals. This means a security or index can carve out a long-term uptrend, intermediate downtrend, and a short-term trading range, all at the same time. Rather than complicate prediction, most trading opportunities will unfold through interactions between these time intervals.

Buying the dip offers a classic example, with traders jumping into a strong uptrend when it sells off in a lower period. The best way to examine this three-dimensional playing field is to look at each security in three time frames, starting with 60-minute, daily and weekly charts.

4. Practice trading

It’s now time to get your feet wet without giving up your trading stake. Paper trading, or virtual trading, offers a perfect solution, allowing the neophyte to follow real-time market actions, making buying and selling decisions that form the outline of a theoretical performance record. It usually involves the use of a stock market simulator that has the look and feel of an actual stock exchange's performance. Make lots of trades, using different holding periods and strategies, and then analyze the results for obvious flaws.

Investopedia has a free stock market game, and many brokers let clients engage in paper trading with their real money entry systems, too. This has the added benefit of teaching the software so you don’t hit the wrong buttons when you are playing with family funds.

So, when do you make the switch and start trading with real money? There’s no perfect answer because simulated trading carries a flaw that’s likely to show up whenever you start to trade for real, even if your paper results look perfect.

Traders need to co-exist peacefully with the twin emotions of greed and fear. Paper trading doesn’t engage these emotions, which can only be experienced by actual profit and loss. In fact, this psychological aspect forces more first-year players out of the game than bad decision-making. Your baby steps forward as a new trader needs to recognize this challenge and address remaining issues with money and self-worth.

5. Other ways to learn and practice trading

While experience is a fine teacher, don't forget about additional education as you proceed on your trading career. Whether online or in-person, classes can be beneficial, and you can find them at levels ranging from novice (with advice on how to analyze the aforementioned analytic charts, for example) to pro. More specialized seminars—often conducted by a professional trader—can provide valuable insight into the overall market and specific investment strategies. Most focus on a specific type of asset, a particular aspect of the market, or a trading technique. Some may be academic, and others more like workshops in which you actively take positions, test out entry and exit strategies, and other exercises (often with a simulator).

Paying for research and analysis can be both educational and useful. Some investors may find watching or observing market professionals to be more beneficial than trying to apply newly learned lessons themselves. There are a slew of paid subscription sites available across the web: two well-respected services include investors.Com and morningstar.

It's also useful to get yourself a mentor—a hands-on coach to guide you, critique your technique, and offer advice. If you don't know one, you can buy one. Many online trading schools offer mentoring as part of their continuing ed programs.

Manage and prosper

Once up and running with real money, you need to address position and risk management. Each position carries a holding period and technical parameters that favor profit and loss targets, requiring your timely exit when reached. Now consider the mental and logistical demands when you're holding three to five positions at a time, with some moving in your favor while others charge in the opposite direction. Fortunately, there’s plenty of time to learn all aspects of trade management, as long as you don’t overwhelm yourself with too much information.

If you haven't done so already, now is the time to start a daily journal that documents all of your trades, including the reasons for taking risk, as well as the holding periods and final profit or loss numbers. This diary of events and observations sets the foundation for a trading edge that will end your novice status and let you take money out of the market on a consistent basis.

The bottom line

Start your trading journey with a deep education on the financial markets, and then read charts and watch price actions, building strategies based on your observations. Test these strategies with paper trading, while analyzing results and making continuous adjustments. Then complete the first leg of your journey with monetary risk that forces you to address trade management and market psychology issues.

How to delete trading account on jp markets

To keep spreads as narrow as possible, we aim to get optimal prices from all our liquidity providers. Real time prices are aggregated from liquidity providers in order to offer best bid and ask prices to clients. Our electronic pricing engine allows us price updating on every currency pair three times per second, and thanks to this our prices reflect the current global forex market levels.

Just perfect markets MT4 features

over 700 instruments including forex, cfds and futures 1 single login access spreads as low as 0.01 pips full EA (expert advisor) functionality VPS functionality built-in help guides handles a vast number of orders creates various custom indicators and different time periods

1 click trading technical analysis tools with 50 indicators and charting tools 3 chart types hedging allowed history database management, and historic data export/import full data back-up and security internal mailing system

MT4 IOS/ANDROID:

The just perfect markets MT4 mobile trader allows you to access your account on your phone native application with the same login and password you use to access your account on your PC or mac.

Just perfect markets MT4 mobile trader features:

30 technical indicators full trading history journal built in news functionality with push notifications

MT5 PC/MAC

The just perfect markets MT5 offers all the pioneering features that the just perfect markets MT4 has to offer, with the addition of 300 stocks (shares) cfds, making it the ideal multi-asset platform. Trade forex, stocks, gold, oil, equity indices and cryptocurrencies from 1 platform with no rejections, no re-quotes and flexible leverage from 1:1 to 3000:1.

Just perfect markets MT5 features

over 700 instruments, including stock cfds, stock indices cfds, forex, cfds on precious metals, cfds on cryptocurrencies, and cfds on energies 1 single login access spreads as low as 0 pips full EA functionality

one click trading all order types supported over 80 technical analysis objects market depth of latest price quotes hedging allowed

MT5 IOS/ANDROID

Trade on the go with one of the most powerful trading platform.

Never miss an opportunity again by downloading and installing one of the most technologically advanced

platform on your IOS and android devices.

Download the MT5 native application today and access the worlds markets from your mobile phone or tablet.

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

So, let's see, what was the most valuable thing of this article: is jpmarkets a good forex broker? Read real reviews, by traders, for traders™ add your rating to the largest forex review database by forex peace army™ >> at how to delete trading account on jp markets

Contents of the article

- JP markets review

- Today forex bonuses

- Broker details

- Live discussion

- Video

- Traders reviews

- Not able to withdraw

- Frequently asked questions

- What is the minimum deposit for JP markets?

- Is JP markets a good broker?

- Is JP markets safe?

- What is JP markets?

- How to delete trading account on jp markets

- How much does JP markets charge for training?

- What documents are required to open an account?

- I don’t receive any mail in my name – what can I...

- I just tried to login and it says invalid...

- How do I fund my trading account?

- Can I fund my account using bitcoins?

- What reference must I use when I make a deposit?

- What is the turnaround time for my deposit to be...

- My deposit has not reflected on my account – what...

- I just downloaded MT4, why can’t I place any...

- I forgot my password for the client portal.

- I forgot my password for my trading platform.

- How do I request a withdrawal?

- What is the turnaround time for a withdrawal?

- How long does it take for a withdrawal to reflect?

- Can I withdraw a bonus?

- How much is a spread?

- Does JP markets have control over the...

- How much is a swap?

- Pending order expiration

- Does JP markets give signals to clients?

- Does JP markets buy mandela coins?

- How do I become an introducing broker (IB)?

- What different account types does JP markets...

- What is the difference between ECN and standard...

- How much is the commission on an ECN account?

- Why was my stop loss / take profit not hit?

- How does JP markets make money if you are...

- Who regulates JP markets?

- How much money can I make if I deposit X amount?

- I want to start trading but I don’t know how?

- Do I have to pay JP markets for their services...

- Can JP markets trade on my behalf?

- Does JP markets make any deductions for taxes on...

- Is my money safe?

- Forex brokers lab

- What is JP markets?

- JP markets account types, spreads and leverage

- What is the difference between ECN and STP JP...

- Trading platforms

- Trading products

- What are JP markets fees?

- What is the minimum deposit for JP markets?

- JP markets bonuses and promotions

- JP markets deposit and withdrawal methods

- Is JP markets suspended?

- Customer services

- Conclusion

- Connect to an account

- Forced change of password #

- Deposit and withdrawal #

- MT4 trading platform

- MT4 features

- Multi account manager – MAM software

- Copier

- Drawdown controller

- My fxbook autotrade - social trading

- Metatrader expert advisor

- Mobile trading

- Trading platform

- Forex and exchange markets

- Engaging with your clients simplified.

- Consolidated everything an IB needs into a single...

- Ultra low spreads

- 250+ trading instruments

- $10 minimum deposit

- Leverage 1:500

- Immediate deposits and withdrawals

- 24/5 email support

- Instruments

- Desktop, tablet, mobile

- Automated trading platforms

- Spreads offering

- Client funds security

- Multilingual languages

- Customer support

- Connect through whatsapp

- Why trade with veracity markets?

- Trade anywhere any time

- Choose your account type

- Access the world's top tradable assets

- Become a just perfect trader today...

- Trade a broad range of markets

- Forex trading

- Cryptocurrencies

- Indices

- Metals

- Commodities

- Shares

- Start your trading with veracity markets in 4...

- Register

- Verify

- Trade

- Trade

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

- No delete option for demo account on terminal or...

- Learn how to trade the market in 5 steps

- Want to trade but don't know where to start?

- 1. Open a trading account

- 2. Learn to read: A market crash course

- 3. Learn to analyze

- 4. Practice trading

- 5. Other ways to learn and practice trading

- Manage and prosper

- The bottom line

- How to delete trading account on jp markets

- MT4 IOS/ANDROID:

- MT5 PC/MAC

- MT5 IOS/ANDROID

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

No comments:

Post a Comment