Open demo account tickmill

- Free

- Unlimited

- Change the leverage

- Trade without risk

- Immitate real money trading

Today forex bonuses

Also, you can use the web trader. You just have to log in with your account details now.

How to use the tickmill demo account

You want to start trading with tickmill? – then you should start with the free demo account first. On this page, we will show you how to open the free demo account and how to use it. Furthermore, as experienced traders for 7 years, we will show you tips and tricks and why you should use the demo account before you start trading live.

Open the tickmill demo account

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Facts about the tickmill demo account:

Tickmill offers you a free demo account to practise or test the trading platform. When you register you can choose the leverage on the account and the virtual deposit. The demo account means that you are trading with virtual money and no risk. Beginners can try out their first trades and advanced traders can practice new strategies or learn how to trade new assets. The demo account is multi-functional.

Virtual deposit:

Choose the deposit amount you want. It can be any number. We recommend using the investment amount of your real deposit later. Use the demo account like it would be real money.

Tickmill offers leveraged financial products like forex and cfds you can choose the leverage of the demo account. It can be up to 1:500.

The account balance is available in USD, GBP, EUR, PLN.

Advantages of the tickmill demo account:

- Free

- Unlimited

- Choose the deposit amount

- Choose the leverage

How to open the free demo account:

In the following steps, we will show you exactly how to open the free demo account with tickmill. From our experience, it is very easy and fast for traders to get access to the financial markets.

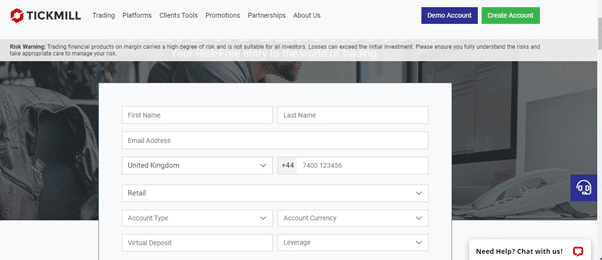

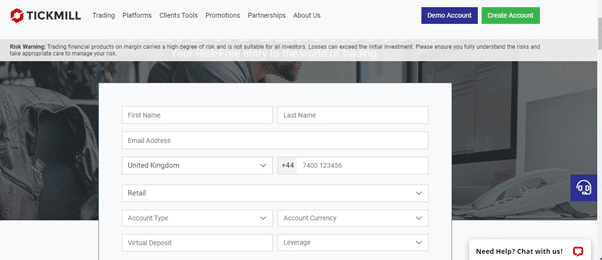

1. Fill your personal data into the form

As you see in the picture above you have to insert your personal data into the form the request the demo account. Make sure your data is correct otherwise you may have problems later if you want to start real money trading. Read also our article about how to deposit on tickmill.

Then you have to choose the account type, deposit amount, and leverage of the account.

2. Confirm your email address and receive the login details

Tickmill will send you an email with the login details for your trading account.

3. Download the trading platform

Download the trading platform metatrader 4 to your mobile or desktop device. Also, you can use the web trader. You just have to log in with your account details now.

Metatrader 4 is one of the most popular software worldwide for retail traders. You get access to the financial markets within a few clicks. Customize the charts as you want. There are many tools and indicators for your personal analysis.

On the webpage of tickmill, you will also find trading tutorials on how to use the platform. If you got questions about the software you can reach multi-language support. Forex trading is made by opening an order on the market (picture below). You buy or sell currency pairs that are traded against each other. If one currency increases in value you can earn or lose money.

Note: it is important to right-click on the markets and choose “view all” to see all assets and markets.

Tickmill demo account trading

4. Start trading

To invest in a market you should open the new order window to open the trade. Insert the trading volume (1 volume/lot is 100.000 units of the base currency) of your position and the risk management (stop loss and take profit). For beginners, it is difficult to calculate the positions. That is why they should the demo account first. But tickmill offers helpful forex calculator tools, so you can learn it easily.

Why you should use the tickmill demo account:

The demo account is an account with a virtual balance. Traders can invest without risk like it is real money.

Beginners should start using the demo account first. If you are new to trading you need to practice strategies, the software, and market behavior. Forex trading is very risky and without knowledge, you can burn a lot of money. If you feel comfortable you can start to trade with a small amount of real money.

Advanced traders.

For advanced traders, the tickmill demo account is perfect to learn more about the conditions of the broker. Also, you can test new strategies and markets to trade.

Conclusion: the tickmill demo account is perfect for everyone

On this page we gave you detailed information about the tickmill demo account. It is a virtual money account for practicing. The account is unlimited and free to use. You can imitate real money trading. The biggest advantages are that you can choose the account balance and trading leverage.

The account opening is also easy and fast. There are no restrictions for you and you can start trading with a trusted forex broker for free. For all traders, we recommend to try out the free demo account before investing real money because you can earn important experience with the demo account.

Advantages:

- Free

- Unlimited

- Change the leverage

- Trade without risk

- Immitate real money trading

We recommend to trader with the trusted broker tickmill. The best way to test the platform by yourself is the demo account. (5 / 5)

Tutorial – open a demo account on tickmill

In this article about the forex broker tickmill, we will talk about all the necessary steps for opening a demo account with this company. Demo accounts have virtual funds that can be used by the trader to invest in the markets without any risk. They also present exactly the same information and market prices in real-time as in real accounts.

The benefits of opening a practice demo account before a live account are significant (if used properly). Among these advantages we can highlight the following:

- Know the broker’s trading platform and services.

- Virtual funds for simulated trades.

- Know the assets, their prices and the spreads offered by the broker

- The novice trader can practice constantly and without restrictions to gain more experience without risking real money.

Tickmill is a broker that offers various types of forex trading accounts for clients of different profiles.

- Classical

- Pro

- VIP

- Islamic account (no swap)

Each of these accounts has characteristics designed for various types of traders. They are trading accounts that adjust to various types of needs.

You can get more information about the company tickmill and its brokerage services in the following guide about this broker: review of tickmill broker

Demo account opening process

The first thing to do is visit the official tickmill page , there you can see the corresponding button to open a demo account.

When we click on the “ demo account ” button we are immediately redirected to the registration process, where we must fill out the corresponding form in order to open a tickmill practice demo account.

Here, we must indicate the following data:

-account type (these accounts emulate tickmill’s real trading accounts.).

– desired account leverage (1: 1 to 1: 500).

In addition, we must check the boxes that indicate that we agree to receive the tickmill newsletter and information about special offers and the one that indicates that we understand the broker’s privacy policy.

Once we complete the data in the demo account form, we must click on the “ open demo account ” button.

Immediately, tickmill opens the demo account, sends the information to the customer’s email, with the account access data. At the same time, it displays the following message:

The message we receive in our email is as follows:

In this message, tickmill indicates the account details, including the number and password. In addition, the message includes a link to download the platform (metatrader 4) and the server to connect to this software and start trading.

If you think you have gained enough experience practicing on a demo account, you can open a live account with tickmill. For this, you can click on the “ apply for a live account ” link at the end of the message.

This brings us to the following page on the broker’s website:

Here we can enter our secure client area if we already have a real account with tickmill. Otherwise, we can register and open a real account with this broker by clicking on the “open account” tab, which leads us to the following form where we can start the registration process.

In another article, we will explain how to complete this process.

Tickmill demo account features

Virtual deposit

It is the amount of virtual funds required to start the demo account. These funds are necessary to be able to place simulated orders. For example, we can trade with a simulated deposit of $10000. It is recommended to use a number of virtual funds similar to the amount of real funds that we are going to deposit.

Account type

In the tickmill demo account, we can test the characteristics of the types of real accounts available in the broker. For this purpose, we must indicate the type of trading account that we want to simulate.

Account currencies

The type of currency with which we are going to trade in the demo account. We can choose between a large number of currencies, including the main currencies, such as the USD, EUR, GBP, and AUD, among others.

Leverage

In this section, we can choose the amount of leverage that we want or with which we feel more comfortable, something that regularly cannot be done in other brokers.

It should be noted that high leverages carry greater risks since the greater the leverage the greater the margin required to trade safely.

In general terms, greater leverage implies greater profits as well as can cause greater losses, and in summary, implies greater trading risk.

Trading platform

Tickmill uses metatrader 4 as its default trading platform in its downloadable versions for PC, as well as in its web version. Below is the webtrader version of metatrader4:

You can get more information about the tickmill broker and open a practice demo account at no cost, through the following link:

Tickmill broker review

Reviewer : justin freeman

Published: 23rd december, 2020.

Broker information

- Company name: tickmill ltd

- Founded: 2014

- Country: seychelles

- Phone: +442036086100

Platform info

- Platform: metatrader 4, webtrader

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA, cysec, FSA SC

- Bonus: $30 welcome account

- Minimum deposit: $100

- Leverage: 1:500

- US clients: no

- Funding methods: bank transfer, visa, mastercard, skrill, neteller, fasapay, unionpay, dotpay, nganluong.Vn, qiwi wallet, thai online bank transfer, globepay, vietnam instant online bank transfer, paysafe

- Pairs offered: 62+

Open free

demo account

Bonus offer for forexfraud visitors

Expert’s viewpoint

This review of the broker tickmill reaffirms its position as a top-quality platform, built by traders, for traders. This approach results in a trading experience that just has to be tried out – a fact confirmed by the firm’s continued growth and increasing popularity with traders.

A record number of new clients have taken the decision to sign up to the platform. It now has more than 350,000 registered accounts. It also keeps adding to its impressive collection of industry awards.

The ‘best trading experience’ award from forex brokers in 2020 is just one example of how tickmill continues to get things right.

A quick scan of online feedback from the trading community also gives a glimpse of the strength of tickmill’s fan base. The firm has built a reputation for providing traders with all the tools they need to be successful.

This is backed up by review site trustpilot recording that 82% of reviews mark tickmill as ‘excellent’ or ‘good’.

The forex fraud tickmill review team found the broker to be ‘safe to use’. The tickmill experience is all about great trading, but behind the scenes, the firm has also gained a reputation for being trustworthy. Tickmill complies with regulations to a degree that is well above market average, and it’s a profitable and viable company.

Free demo account

The tickmill trading experience

The tickmill trading platform is set up to provide reliable, low-cost, super-fast trading, in all the popular markets. There are a lot of behind-the-scenes features that go to make tickmill trustworthy, but trying out the actual trading platform using a tickmill demo account (by clicking here) is a hands-on way to find out what a great platform feels like.

The range of extra tickmill support services complements, rather than overwhelms, the trading experience.

Research and learning materials are set at beginner, intermediate and advanced levels. Some are tailored to explaining the basics and preparing clients for trading. When you are ready to enter into the markets, there is a collection of up-to-date research notes that focus on identifying trade entry and exit points.

It takes a few seconds to sign up to a tickmill demo account, and doing so is highly recommended. Whether you’re looking for a new, safe broker or trying trading for the first time, using a tickmill demo offers a risk-free opportunity to see just how good the trading experience can be.

$30 welcome bonus

Broker summary

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group’s companies include tickmill UK ltd, tickmill europe ltd, and tickmill ltd. One other subsidiary is the 100%-owned procard global ltd, a UK-registered firm.

Tickmill currently operates in more than 200 countries, and has more than 350,000 registered customers and 150 employees. Reports show that it has executed more than 273m trades and records average monthly trading volume well above $123bn.

There is a focus on quality as well as quantity. With the average trade execution speed at 0.2 seconds, lots of trading tools and a variety of educational materials, the award-winning ECN broker meets most of the requirements of traders, beginners and professionals alike.

Broker introduction

The best way to find out more and explore the reasons for the firm’s popularity is to try out a risk-free tickmill demo account.

Once you have completed the brief registration process, you will be able to use your tickmill sign in at any time. The only requirement is that you supply your email address and phone number, and then you are ready to step into the markets and develop your trading skills.

You can set your balance of virtual funds and leverage terms at a level that suits you. Although you will be ‘paper trading’, you will benefit from all the high-tech mechanisms of the actual tickmill MT4 platform.

Spreads & leverage

Making a consistent profit from the markets isn’t easy. Part of the recipe for success is setting up with a broker that helps you tilt the balance in your favour. One way to improve your trading bottom line is by selecting a platform that offers low-cost access to the markets.

Tickmill fees are low. Bid-offer spreads start from as low as 0.0 pips, and there are also near-zero commissions. Numbers such as these are just hard to beat, and tickmill unsurprising scores highly in this category.

If you’re looking to take advantage of such welcoming T&cs, it’s also possible to apply leverage to your trading. This isn’t for everyone as it comes with additional risks. Tickmill account types score additional bonus points by allowing clients to choose their own leverage terms instead of setting them at a riskier default position.

In line with standard practice, the maximum tickmill leverage terms on offer to clients will be determined by the regulatory body of the country in which you live. UK and EU clients will find leverage capped at 1:30, which is still a considerable level, but some in other domiciles might be able to scale up to 1:500.

Platform & tools

The tickmill MT4 platform gives access to the most popular retail forex platform in the world. It’s been used by millions of traders for many years and is very much the benchmark by which other platforms are measured.

It is available in desktop, web trader and app format for android and ios mobile devices. MT4 is the gold standard in online trading. It is a fully customisable trading environment that provides traders with the tools to create their own technical indicators, custom scripts and expert advisors (eas).

Whichever approach you take, you will have access to analytical tools and trade indicators that are considered to be among the best in the industry. To add a cherry on top of the cake, tickmill clients also gain access to the myfxbook copy trading platform and autochartist.

Hedging and scalping strategies are allowed, which demonstrates that the platform is based on a high-quality IT infrastructure. The operator allows the use of all eas and trading algos – this is the green light for expert users of MT4, who can take full advantage of the power of the best trading platform in the world.

Despite its relative youth, tickmill has already picked up a number of prestigious forex awards. In 2016, it won the ‘most trusted forex broker’ at the best ECN/STP broker awards. That trend continues, and the broker won the ‘best trading award’ at the forex broker awards in 2020.

Commissions & fees

The brokerage offers a free-to-use, risk-free demo account, which gives traders a taste of what’s on offer. The demo account offers full access to MT4, as well as to the full array of tradable assets, not to mention real-life volatility and prices.

There are five varieties of live account. Each is accessed through the same tickmill login portal but offers different T&cs.

- Classic account – this is the most accessible account. It is an entry-level account aimed at those looking to get into the game cheaply, and without having to pay commissions. The tickmill minimum deposit for this account is 100 base currency (EUR, USD, GBP and PLN are all accepted). The maximum available leverage is 1:500 and the spreads start from 1.6 pips. Trade execution is of the NDD variety.

- Pro account – this is quite an improvement in regard to spreads. While it does feature a commission of 2 per side per lot, its spreads start from 0 pips. The maximum available leverage is 1:500 on this account.

- VIP account – the minimum balance for this account is 50,000 base currency, which means that this option is not for everyone. The spreads start from 0 pips on this account and the maximum available leverage is 1:500. Commissions are ultra-low and start from just 1 per side, per lot.

- Professional clients – there are improved T&cs for those putting through high trading volumes. Criteria to qualify include a minimum portfolio size of EUR 500,000; trading volume of at least 10 trades per quarter, over the previous four quarters; and you are required to have worked in the financial sector for at least a year, in a relevant position.

- Islamic account – this is a swap-free option that is fully sharia law-compliant. Those who want to set up such an account have to open a regular account, as described above, after which they have to request the conversion of this account into an islamic one.

Trading conditions offered by the islamic account are the same as those available through the above-mentioned regular accounts.

The required margin for hedging positions on the classic, pro and VIP accounts is 0. Scalping is allowed and there are no time limitations for keeping the positions open.

There are three base currencies to choose from and negative balance protection rules apply. Deposits can be made through an impressive range of accepted methods, such as bank wire, visa, mastercard, neteller, skrill, fasapay, paysafecard, qiwi, unionpay, dotpay and globepay.

There are no commissions charged on most deposits and withdrawals. One exception is bank wire, where charges are applied to small transactions but can be avoided if you make a deposit larger than US$5,000.

Education

Tickmill offers a great range of materials to help traders build up their knowledge and therefore trade safely. There are webinars, tutorials, seminars, ebooks, infographics, glossaries, articles and insights.

There are also dedicated sections to technical and fundamental analysis. All of this ‘how-to’-style material is backed up by other services, such as autochartist, which helps identify actual trading opportunities.

Customer service

Tickmill support is available during business hours, monday to friday. This coverage is not as extensive as it could be, but our review team found the staff to be professional, informed and client-focused.

Final thoughts

Asset prices go up and asset prices go down. No matter how experienced a trader you are, ‘market risk’ is unavoidable.

The important thing is that traders exploit those things that they can control, and broker selection is high up on that list.

Choosing a safe, reliable broker that is well regulated and has been operating for many years is a good first step. Tickmill is firmly in that category, and also offers a lot of other neat and innovative features. It even intermittently offers a $30 bonus scheme to help novice traders try trading with real funds, but in small size, and that are given to them by the broker.

As the regulatory framework that tickmill has put in place is well above average, it’s worth concluding this review with confirmation that the behind-the-scenes infrastructure makes it a safe and reliable broker.

The online broker sector is a competitive one and tickmill stands out for giving traders everything they need, and nothing they don’t.

Broker details

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group companies include tickmill UK ltd, regulated by the financial conduct authority (FCA); tickmill europe ltd, regulated by the cyprus securities and exchange commission (cysec); and tickmill ltd, regulated by the seychelles financial services authority (FSA).

Coming under the legislative framework of mifid II, the broker is authorised to provide services across countries in the european economic area (EEA) and beyond. If you are a retail client residing in europe or the UK, you automatically come under the protection of the investor compensation fund (ICF) or the financial services compensation scheme (FSCS).

Open your tickmill account

How can I open a demo account with tickmill?

Demo accounts, in desktop and mobile app format, are free to use and downloadable here.

Is tickmill a regulated broker?

Yes. As tickmill is a global broker, the regulatory protection that applies to clients will depend on where they live. Regulators that tickmill are authorised by include the financial conduct authority (FCA), the cyprus securities and exchange commission (cysec), the seychelles financial services authority (FSA) and the labuan financial services authority (labuan FSA).

What bonus terms does tickmill offer?

These change from time to time, but one offer that regularly pops up is the $30 welcome account, where the broker credits your account with $30 and lets you keep any profits.

How do I withdraw money from tickmill?

To comply with regulations, tickmill requests clients to return funds to the account that made the initial deposit. The good news is that unlike a lot of other brokers, tickmill does not apply charges on these transactions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

Open demo account tickmill

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Open demo account tickmill

Link your live tickmill account with autotrade :

Please note you will have to supply your master password below so autotrade can copy trades to your live account. Passwords are transferred and saved in an encrypted format in our servers for maximum security.

Please read the terms and conditions of this agreement carefully before continuing with the use of the autotrade service. If you continue to browse and use this website you are agreeing to comply with and be bound by the following terms and conditions of use, which together with our privacy policy govern autotrade's relationship with you in relation to this website.

Each time you use the website, the current version of the terms and conditions will apply.

Autotrade is an automated platform to copy trades from one account to another based on the client's settings.

The term autotrade or "us" or "we" refers to the owner of the website. The term "you", "client" refers to the user or viewer of our website.

The use of this website is subject to the following terms of use:

The section headings contained in this agreement are for reference purposes only and shall not affect the meaning or interpretation of this agreement.

(a) all performance claims found on autotrade about trading systems or strategies must be regarded as hypothetical. Use of autotrade to offer or subscribe to a trading system or strategy indicates you agree to our terms and conditions. Before using any systems or strategies listed on autotrade you should be aware that there is often a vast difference between hypothetical results and real-life trading results achievable in a real brokerage account, and real-live results are almost always vastly worse than hypothetical results. Performance results for systems and strategies listed on autotrade do not take into account fees, spreads and/or trading commissions that may be charged by your broker. Please consult with your broker for information on these costs. Additional information on how autotrade calculates performance data can be found on the autotrade help page.

(b) HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

(c) trading is never without risk and you are urged to carefully read and consider the following before utilizing any or all of our services:

(1) no aspect of the site is intended to provide, or should be construed as providing, any investment, tax or other financial related advice of any kind. You should not consider any content on the site to be a substitute for professional financial advice. While individual participants may offer investment advice or opinions and/or effect a transaction which may be subsequently copied by another trader, such advice, opinions, or trades amount to nothing more than exchanges between persons who may be anonymous or unidentifiable or simply the execution of a trade by such traders. Autotrade does not provide investment advice directly, indirectly, implicitly, or in any manner whatsoever by making such information and/or features available to you. You should use any information gathered from here and/or utilize the autotrade features only as a starting point for your own independent research.

(2) the site, services, and autotrade features are provided by autotrade solely for informational purposes. Autotrade and/or any on its behalf, including its affiliates and their employees and agents are not investment or financial advisers. ANY INVESTMENT DECISIONS YOU MAY MAKE IN RELIANCE ON INFORMATION WHICH IS AVAILABLE ON OUR WEBSITE OR AS A RESULT OF THE USE OF THE autotrade TRADING FEATURES, ARE AT YOUR OWN RISK AND autotrade, AND ITS PARTNERS, AFFILIATES, EMPLOYEES AND AGENTS WILL NOT BE LIABLE FOR ANY LOSSES THAT YOU MAY SUSTAIN. YOU ARE SOLELY AND EXCLUSIVELY RESPONSIBLE FOR DETERMINING WHETHER ANY INVESTMENT, OR STRATEGY, OR ANY OTHER PRODUCT OR SERVICE IS APPROPRIATE OR SUITABLE FOR YOU BASED ON YOUR INVESTMENT OBJECTIVES AND PERSONAL AND FINANCIAL SITUATION.

(3) if you choose to copy specific traders and/or trades and/or to engage in transactions based on content on the site, then such decision and transactions and any consequences flowing there-from are your sole responsibility.

(5) you may achieve a materially different result than the autotrade system that you followed, especially if you place additional trades in your account or you modify or cancel an order generated by the autotrade system.

(6) any past performance indicated on this site is not indicative of future results. Anyone investing should be able and prepared to bear a loss of his or her entire investment. You are fully responsible for any losses you may sustain as a result of our automatic execution of instructions generated as a result of the utilization of any of the autotrade trading features.

2. No advice or solicitation

(a) any comments/opinions or market advice found on the website are not necessarily the opinions of autotrade or its affiliates and should not be construed as a solicitation or recommendation. The comments/opinions posted are of traders who may or may not be experienced. The comments/opinions are not reviewed or researched by autotrade or its affiliates. If you chose to make decisions or place trades based upon the comments, you are doing so at your own risk. Autotrade and its affiliates are not responsible for any losses incurred due to the use of the content on autotrade.

(b) autotrade is not providing exchange, investment, tax or legal advice, acting as a fiduciary or endorsing any company, property, product, service, exchange, security, instrument, or any other matter by posting any participant submitted information on the website.

(c) autotrade is not disposing analysis, exchange, trading, brokers, or investment advisory services on this website. We do not purport to tell people, or suggest to people what they should buy or sell for themselves or who can guide them so. Neither autotrade nor anyone affiliated with autotrade is responsible for any exchange, trading, or investment decision made by participants on the basis of using this website. Participants should always read the corresponding prospectus and other relevant material, check with their licensed financial advisor and their tax advisor to determine the suitability of any exchange or investment.

(a) you acknowledge that there is a risk that the website may knowingly contain incomplete, incorrect, inaccurate, misleading and/or false information.

(b) the information on this website is not verified in any way.

(c) the content of the pages of the website is for your general information only with no responsibility or liability regarding this information or resulting from it. The content is subject to change without notice.

(d) neither we nor any third parties provide any warranty or guarantee regarding the information on the website, including, but not limited to, the accuracy, timeliness, performance, completeness or suitability of the information and materials found or offered on the website for any purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law.

(e) your use of any information or materials on the website is entirely at your own risk, for which we shall not be liable. It shall be your own responsibility to ensure that any products, services or information available through the website meet your specific requirements.

(f) the information posted on the website should not be used by others in connection with any sale, offer for sale or solicitation of an offer to sale or buy foreign currency, securities or any other investments, and is not a recommendation or opinion for you to participate in any transaction.

(g) this website contains material which is owned by or licensed to us. This material includes, but is not limited to, the design, layout, look, appearance, graphics and any information or materials, includes, but is not limited to any information or materials provided by you. We shall be free to use, for any purpose, any and all ideas, concepts, know-how, techniques or other information provided by you to the website. Reproduction is prohibited by law.

(h) all trademarks reproduced in this website, which are not the property of, or licensed to the operator, are acknowledged on the website.

4. Fees

autotrade is compensated for the service through the spread (1 pip) which is also used to pay out the system providers of autotrade. System providers are compensated with 0.5 pip (or $5/lot depending on the broker) per each profitable trade in the follower account which was initiated by their system.

Some brokers can pay us from their exising spread and some require markup to match it. You should check with your broker to understand the markup amount, if any.

You are responsible for all taxes (if any) associated with the service. All payments to you in relation to the service will be treated as inclusive of tax (if applicable) and will not be adjusted.

(a) autotrade shall have no duty of confidentiality regarding personal or other information submitted on the website. We shall act as provided in an applicable privacy policy, or as otherwise required by law, with respect to the disclosure of personal information, includes, but is not limited to names, address, or email address submitted to us. If you would like to protect any information submitted by you, please submit it to us under the bolded statement that the following information is personal and confidential and do not submit it to us as all or part of a web posting. We expressly disclaim any responsibility for reviewing or evaluating any information submitted to us as part of a web posting.

(b) you agree and understand that you are responsible for maintaining the confidentiality of your password which, together with your login e-mail address, allows you to access certain portions of the website.

(c) by providing us with your e-mail address, you agree to receive all required notices electronically, to that e-mail address. It is your responsibility to update or change that address, as appropriate.

(d) you hereby waive any rights or requirements under the laws or regulations of any jurisdiction which require an original non-electronic signature or delivery or retention of non-electronic records, to the extent permitted by applicable mandatory law.

(a) you must be 18 years of age or older to use the website. You represent and warrant that you are 18 years of age or older and are fully able and competent to enter into, and abide by, the contract created by the terms and conditions.

(b) you represent that only your own proprietary capital is being used to fund your account. If this is not the case, you represent that you are properly registered or licensed in the jurisdiction where you are located, or exempt from such registration or licensure. You agree to immediately inform us in the event that the foregoing representation is no longer accurate.

(c) you may open a free demo account which simulates a live autotrade account. Such an account will expire after 30 days.

Although a demo account will have the same functionality as a live account, it will never perform identically to a live account with the same settings due to the inherent differences (slippage,spread,etc').

(d) unauthorized use of this website may lead to a claim for damages and/or be a criminal offence.

(e) if you become aware of any unauthorized use of your registration information, you agree to notify autotrade immediately.

(f) from time to time this website may also include links to other websites. These links may be provided by us or 3rd parties for your convenience to provide further information. They do not signify that we endorse the website(s). We have no responsibility for the content of the linked website(s).

(g) any material downloaded or otherwise obtained through the use of the website is done at your own discretion and risk and you are solely responsible for any damage to your computer system or loss of any data that results from the download of any such material.

(h) in order to make use of the autotrade service, a client must apply and maintain an account balance of $1000 or its equivalent. In case the balance decreases below $500 (or its equivalent), autotrade may terminate access to the service with a notification to the client, so the account can be funded again and reapplied for the service.

(i) autotrade reserves the right to, and may, terminate or temporarily suspend your access to all or any part of the website, without notice, for conduct that autotrade believes violates these terms and conditions or any of its policies or guidelines, or for any other reason in its sole discretion. Autotrade will bear no responsibility or liability from such action.

(j) when using the website, you must comply with all applicable laws, any applicable foreign or domestic regulatory body, national or other securities exchanges, including rules against making false or misleading statements to manipulate the price of a foreign currency or any security.

(k) in the event that any provision of these terms and conditions is held unenforceable, the validity or enforceability of the remaining provisions will not be affected, and the unenforceable provision will be replaced with an enforceable provision that comes closest to the intention underlying the unenforceable provision.

7. Autotrade refund policy

(a) autotrade will issue a refund to a client for losses caused by platform errors (covering only the erroneous part of the loss), limited to the total rebates autotrade recieved from the client's broker for the client's account for the past 3 months prior to the error, if the client provides timely notice of the error to autotrade as described below. A platform error occurs if a trading signal that should have been rejected according to the client's account settings is accepted by autotrade and submitted to the client's broker, or if a trading signal that should have been accepted according to the client's account settings is rejected by autotrade and not submitted to the client's broker. Autotrade shall not be responsible for refunding lost profits resulting from platform errors under any circumstances.

(b) errors of third party signal providers or brokers shall not be considered platform errors, and autotrade shall not be responsible for refunding losses or lost profits resulting from such errors under any circumstances.

(c) in order to receive a refund of losses caused by platform errors, you must notify autotrade in writing of your potential claim. You must deliver the written notice to autotrade as soon as you knew, or should have known, of the platform error, but in any event, no later than 24 hours after the platform error occurred. If autotrade does not receive such notice from you within 24 hours after the platform error occurred, it will not be liable for any losses resulting from the platform error.

(d) if autotrade confirms that a platform error occurred with respect to your account, and you provided the required notice to autotrade within 24 hours, you will receive a refund of your losses caused by the platform error (not including lost profits).

(e) you are required to review your account statements and monitor your account status at least daily to ensure that the trades you ordered were placed, and that all trades that were made on your account were authorized by you. You are also required to check your account after disconnecting from the autotrade service and manually manage any trades opened by autotrade which were left open, if any.

(f) except as expressly provided by this refund policy, neither autotrade, nor our officers, principals, employees or agents shall be liable to any person for any losses, damages, costs or expenses (including, but not limited to, loss of profits, loss of use, direct, indirect, incidental or consequential damages) resulting from any errors in the autotrade platform.

8. Limitation of liability

(a) to the maximum extent permitted by applicable law, in no event shall autotrade, its affiliates, or their respective officers, directors, shareholders, employees and agents be liable for any damages, liability, claims, expenses and costs, incurred by you as a result of your use of the site or the information. Without limitation, they shall not be liable for any lost profits, lost savings or any consequential, incidental, direct, indirect, special, punitive or other damages whatsoever, including, without limitation, damages for loss of business profits, business interruption, loss of business information, costs associated with recreating lost data, the cost of any substitute program or other pecuniary loss, arising out of this agreement or the use of or inability to use the site or the information, whether resulting from impaired or lost data, or any other cause, even if autotrade has been advised of the possibility of such damages.

(b) no warranties. You agree that autotrade has made no express warranties regarding the autotrade service which is being provided "as is" without warranty of any kind; autotrade hereby disclaims all warranties, conditions or representations with respect to autotrade whether express, implied or statutory, including, but not limited to, any warranties or conditions of quality, performance, non-infringement, merchantability or of fitness for a particular purpose. Autotrade further does not represent or warrant that its service will always be available and accessible, that its operation will be uninterrupted, timely, secure and error-free or that any communication will be complete and accurate. Nor does autotrade warrant any connection to or transmission of data from the internet, made through autotrade.

You agree to protect and fully compensate autotrade and their affiliates from any and all third party claims, liability, damages, expenses and costs, including, but not limited to, reasonable attorneys fees, caused by or arising from your use of the service, your violation of these terms or your infringement, or infringement by any other user of your account, of any intellectual property or other right of anyone.

Autotrade is brand of myfxbook, a company registered in israel, therefore your access to and use of this website, and these terms and conditions, are governed by and will be construed solely in accordance with the laws of the state of israel, without giving effect to any law or rule that would cause the laws of any jurisdiction other than israel to be applied. Any action arising out of these terms and conditions or this website shall be litigated in, and only in, courts located in israel, and you agree to submit to the exclusive jurisdiction of those courts, and further agree that they are a convenient forum for you.

Tutorial – open a demo account on tickmill

In this article about the forex broker tickmill, we will talk about all the necessary steps for opening a demo account with this company. Demo accounts have virtual funds that can be used by the trader to invest in the markets without any risk. They also present exactly the same information and market prices in real-time as in real accounts.

The benefits of opening a practice demo account before a live account are significant (if used properly). Among these advantages we can highlight the following:

- Know the broker’s trading platform and services.

- Virtual funds for simulated trades.

- Know the assets, their prices and the spreads offered by the broker

- The novice trader can practice constantly and without restrictions to gain more experience without risking real money.

Tickmill is a broker that offers various types of forex trading accounts for clients of different profiles.

- Classical

- Pro

- VIP

- Islamic account (no swap)

Each of these accounts has characteristics designed for various types of traders. They are trading accounts that adjust to various types of needs.

You can get more information about the company tickmill and its brokerage services in the following guide about this broker: review of tickmill broker

Demo account opening process

The first thing to do is visit the official tickmill page , there you can see the corresponding button to open a demo account.

When we click on the “ demo account ” button we are immediately redirected to the registration process, where we must fill out the corresponding form in order to open a tickmill practice demo account.

Here, we must indicate the following data:

-account type (these accounts emulate tickmill’s real trading accounts.).

– desired account leverage (1: 1 to 1: 500).

In addition, we must check the boxes that indicate that we agree to receive the tickmill newsletter and information about special offers and the one that indicates that we understand the broker’s privacy policy.

Once we complete the data in the demo account form, we must click on the “ open demo account ” button.

Immediately, tickmill opens the demo account, sends the information to the customer’s email, with the account access data. At the same time, it displays the following message:

The message we receive in our email is as follows:

In this message, tickmill indicates the account details, including the number and password. In addition, the message includes a link to download the platform (metatrader 4) and the server to connect to this software and start trading.

If you think you have gained enough experience practicing on a demo account, you can open a live account with tickmill. For this, you can click on the “ apply for a live account ” link at the end of the message.

This brings us to the following page on the broker’s website:

Here we can enter our secure client area if we already have a real account with tickmill. Otherwise, we can register and open a real account with this broker by clicking on the “open account” tab, which leads us to the following form where we can start the registration process.

In another article, we will explain how to complete this process.

Tickmill demo account features

Virtual deposit

It is the amount of virtual funds required to start the demo account. These funds are necessary to be able to place simulated orders. For example, we can trade with a simulated deposit of $10000. It is recommended to use a number of virtual funds similar to the amount of real funds that we are going to deposit.

Account type

In the tickmill demo account, we can test the characteristics of the types of real accounts available in the broker. For this purpose, we must indicate the type of trading account that we want to simulate.

Account currencies

The type of currency with which we are going to trade in the demo account. We can choose between a large number of currencies, including the main currencies, such as the USD, EUR, GBP, and AUD, among others.

Leverage

In this section, we can choose the amount of leverage that we want or with which we feel more comfortable, something that regularly cannot be done in other brokers.

It should be noted that high leverages carry greater risks since the greater the leverage the greater the margin required to trade safely.

In general terms, greater leverage implies greater profits as well as can cause greater losses, and in summary, implies greater trading risk.

Trading platform

Tickmill uses metatrader 4 as its default trading platform in its downloadable versions for PC, as well as in its web version. Below is the webtrader version of metatrader4:

You can get more information about the tickmill broker and open a practice demo account at no cost, through the following link:

FOREX.Com demo account

Your form is being processed.

The power to conquer the markets

/media/forex/images/global/icons/icon-performance.Svg" alt="trade with precision" />

Trade with precision

/media/forex/images/global/icons/icon-drawing-tools.Svg" alt="drawing tools icon" />

Professional charting

/media/forex/images/global/icons/icon-bulb-actionable-trade-ideas.Svg" alt="integrated news and analysis" />

Actionable insights

/media/forex/images/global/icons/icon-mobile.Svg" alt="mobile solutions" />

Trade on the go

Metatrader 5

- Integrated reuters news and FOREX.Com global market research

- Free EA hosting capabilities

- Web and mobile trading support

*based on active metatrader servers per broker, apr 2019.

The markets are moving. Stop missing out.

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Tickmill broker review

Reviewer : justin freeman

Published: 23rd december, 2020.

Broker information

- Company name: tickmill ltd

- Founded: 2014

- Country: seychelles

- Phone: +442036086100

Platform info

- Platform: metatrader 4, webtrader

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA, cysec, FSA SC

- Bonus: $30 welcome account

- Minimum deposit: $100

- Leverage: 1:500

- US clients: no

- Funding methods: bank transfer, visa, mastercard, skrill, neteller, fasapay, unionpay, dotpay, nganluong.Vn, qiwi wallet, thai online bank transfer, globepay, vietnam instant online bank transfer, paysafe

- Pairs offered: 62+

Open free

demo account

Bonus offer for forexfraud visitors

Expert’s viewpoint

This review of the broker tickmill reaffirms its position as a top-quality platform, built by traders, for traders. This approach results in a trading experience that just has to be tried out – a fact confirmed by the firm’s continued growth and increasing popularity with traders.

A record number of new clients have taken the decision to sign up to the platform. It now has more than 350,000 registered accounts. It also keeps adding to its impressive collection of industry awards.

The ‘best trading experience’ award from forex brokers in 2020 is just one example of how tickmill continues to get things right.

A quick scan of online feedback from the trading community also gives a glimpse of the strength of tickmill’s fan base. The firm has built a reputation for providing traders with all the tools they need to be successful.

This is backed up by review site trustpilot recording that 82% of reviews mark tickmill as ‘excellent’ or ‘good’.

The forex fraud tickmill review team found the broker to be ‘safe to use’. The tickmill experience is all about great trading, but behind the scenes, the firm has also gained a reputation for being trustworthy. Tickmill complies with regulations to a degree that is well above market average, and it’s a profitable and viable company.

Free demo account

The tickmill trading experience

The tickmill trading platform is set up to provide reliable, low-cost, super-fast trading, in all the popular markets. There are a lot of behind-the-scenes features that go to make tickmill trustworthy, but trying out the actual trading platform using a tickmill demo account (by clicking here) is a hands-on way to find out what a great platform feels like.

The range of extra tickmill support services complements, rather than overwhelms, the trading experience.

Research and learning materials are set at beginner, intermediate and advanced levels. Some are tailored to explaining the basics and preparing clients for trading. When you are ready to enter into the markets, there is a collection of up-to-date research notes that focus on identifying trade entry and exit points.

It takes a few seconds to sign up to a tickmill demo account, and doing so is highly recommended. Whether you’re looking for a new, safe broker or trying trading for the first time, using a tickmill demo offers a risk-free opportunity to see just how good the trading experience can be.

$30 welcome bonus

Broker summary

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group’s companies include tickmill UK ltd, tickmill europe ltd, and tickmill ltd. One other subsidiary is the 100%-owned procard global ltd, a UK-registered firm.

Tickmill currently operates in more than 200 countries, and has more than 350,000 registered customers and 150 employees. Reports show that it has executed more than 273m trades and records average monthly trading volume well above $123bn.

There is a focus on quality as well as quantity. With the average trade execution speed at 0.2 seconds, lots of trading tools and a variety of educational materials, the award-winning ECN broker meets most of the requirements of traders, beginners and professionals alike.

Broker introduction

The best way to find out more and explore the reasons for the firm’s popularity is to try out a risk-free tickmill demo account.

Once you have completed the brief registration process, you will be able to use your tickmill sign in at any time. The only requirement is that you supply your email address and phone number, and then you are ready to step into the markets and develop your trading skills.

You can set your balance of virtual funds and leverage terms at a level that suits you. Although you will be ‘paper trading’, you will benefit from all the high-tech mechanisms of the actual tickmill MT4 platform.

Spreads & leverage

Making a consistent profit from the markets isn’t easy. Part of the recipe for success is setting up with a broker that helps you tilt the balance in your favour. One way to improve your trading bottom line is by selecting a platform that offers low-cost access to the markets.

Tickmill fees are low. Bid-offer spreads start from as low as 0.0 pips, and there are also near-zero commissions. Numbers such as these are just hard to beat, and tickmill unsurprising scores highly in this category.

If you’re looking to take advantage of such welcoming T&cs, it’s also possible to apply leverage to your trading. This isn’t for everyone as it comes with additional risks. Tickmill account types score additional bonus points by allowing clients to choose their own leverage terms instead of setting them at a riskier default position.

In line with standard practice, the maximum tickmill leverage terms on offer to clients will be determined by the regulatory body of the country in which you live. UK and EU clients will find leverage capped at 1:30, which is still a considerable level, but some in other domiciles might be able to scale up to 1:500.

Platform & tools

The tickmill MT4 platform gives access to the most popular retail forex platform in the world. It’s been used by millions of traders for many years and is very much the benchmark by which other platforms are measured.

It is available in desktop, web trader and app format for android and ios mobile devices. MT4 is the gold standard in online trading. It is a fully customisable trading environment that provides traders with the tools to create their own technical indicators, custom scripts and expert advisors (eas).

Whichever approach you take, you will have access to analytical tools and trade indicators that are considered to be among the best in the industry. To add a cherry on top of the cake, tickmill clients also gain access to the myfxbook copy trading platform and autochartist.

Hedging and scalping strategies are allowed, which demonstrates that the platform is based on a high-quality IT infrastructure. The operator allows the use of all eas and trading algos – this is the green light for expert users of MT4, who can take full advantage of the power of the best trading platform in the world.

Despite its relative youth, tickmill has already picked up a number of prestigious forex awards. In 2016, it won the ‘most trusted forex broker’ at the best ECN/STP broker awards. That trend continues, and the broker won the ‘best trading award’ at the forex broker awards in 2020.

Commissions & fees

The brokerage offers a free-to-use, risk-free demo account, which gives traders a taste of what’s on offer. The demo account offers full access to MT4, as well as to the full array of tradable assets, not to mention real-life volatility and prices.

There are five varieties of live account. Each is accessed through the same tickmill login portal but offers different T&cs.

- Classic account – this is the most accessible account. It is an entry-level account aimed at those looking to get into the game cheaply, and without having to pay commissions. The tickmill minimum deposit for this account is 100 base currency (EUR, USD, GBP and PLN are all accepted). The maximum available leverage is 1:500 and the spreads start from 1.6 pips. Trade execution is of the NDD variety.

- Pro account – this is quite an improvement in regard to spreads. While it does feature a commission of 2 per side per lot, its spreads start from 0 pips. The maximum available leverage is 1:500 on this account.

- VIP account – the minimum balance for this account is 50,000 base currency, which means that this option is not for everyone. The spreads start from 0 pips on this account and the maximum available leverage is 1:500. Commissions are ultra-low and start from just 1 per side, per lot.

- Professional clients – there are improved T&cs for those putting through high trading volumes. Criteria to qualify include a minimum portfolio size of EUR 500,000; trading volume of at least 10 trades per quarter, over the previous four quarters; and you are required to have worked in the financial sector for at least a year, in a relevant position.

- Islamic account – this is a swap-free option that is fully sharia law-compliant. Those who want to set up such an account have to open a regular account, as described above, after which they have to request the conversion of this account into an islamic one.

Trading conditions offered by the islamic account are the same as those available through the above-mentioned regular accounts.

The required margin for hedging positions on the classic, pro and VIP accounts is 0. Scalping is allowed and there are no time limitations for keeping the positions open.

There are three base currencies to choose from and negative balance protection rules apply. Deposits can be made through an impressive range of accepted methods, such as bank wire, visa, mastercard, neteller, skrill, fasapay, paysafecard, qiwi, unionpay, dotpay and globepay.

There are no commissions charged on most deposits and withdrawals. One exception is bank wire, where charges are applied to small transactions but can be avoided if you make a deposit larger than US$5,000.

Education

Tickmill offers a great range of materials to help traders build up their knowledge and therefore trade safely. There are webinars, tutorials, seminars, ebooks, infographics, glossaries, articles and insights.

There are also dedicated sections to technical and fundamental analysis. All of this ‘how-to’-style material is backed up by other services, such as autochartist, which helps identify actual trading opportunities.

Customer service

Tickmill support is available during business hours, monday to friday. This coverage is not as extensive as it could be, but our review team found the staff to be professional, informed and client-focused.

Final thoughts

Asset prices go up and asset prices go down. No matter how experienced a trader you are, ‘market risk’ is unavoidable.

The important thing is that traders exploit those things that they can control, and broker selection is high up on that list.

Choosing a safe, reliable broker that is well regulated and has been operating for many years is a good first step. Tickmill is firmly in that category, and also offers a lot of other neat and innovative features. It even intermittently offers a $30 bonus scheme to help novice traders try trading with real funds, but in small size, and that are given to them by the broker.

As the regulatory framework that tickmill has put in place is well above average, it’s worth concluding this review with confirmation that the behind-the-scenes infrastructure makes it a safe and reliable broker.

The online broker sector is a competitive one and tickmill stands out for giving traders everything they need, and nothing they don’t.

Broker details

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group companies include tickmill UK ltd, regulated by the financial conduct authority (FCA); tickmill europe ltd, regulated by the cyprus securities and exchange commission (cysec); and tickmill ltd, regulated by the seychelles financial services authority (FSA).

Coming under the legislative framework of mifid II, the broker is authorised to provide services across countries in the european economic area (EEA) and beyond. If you are a retail client residing in europe or the UK, you automatically come under the protection of the investor compensation fund (ICF) or the financial services compensation scheme (FSCS).

Open your tickmill account

How can I open a demo account with tickmill?

Demo accounts, in desktop and mobile app format, are free to use and downloadable here.

Is tickmill a regulated broker?

Yes. As tickmill is a global broker, the regulatory protection that applies to clients will depend on where they live. Regulators that tickmill are authorised by include the financial conduct authority (FCA), the cyprus securities and exchange commission (cysec), the seychelles financial services authority (FSA) and the labuan financial services authority (labuan FSA).

What bonus terms does tickmill offer?

These change from time to time, but one offer that regularly pops up is the $30 welcome account, where the broker credits your account with $30 and lets you keep any profits.

How do I withdraw money from tickmill?

To comply with regulations, tickmill requests clients to return funds to the account that made the initial deposit. The good news is that unlike a lot of other brokers, tickmill does not apply charges on these transactions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

So, let's see, what was the most valuable thing of this article: how to use and open the tickmill demo account in 2021 ✔ tutorial for beginners and new traders ✔ tips and tricks ➜ read more about it now at open demo account tickmill

Contents of the article

- Today forex bonuses

- How to use the tickmill demo account

- Facts about the tickmill demo account:

- How to open the free demo account:

- 1. Fill your personal data into the form

- 2. Confirm your email address and receive the...

- 3. Download the trading platform

- 4. Start trading

- Why you should use the tickmill demo account:

- Conclusion: the tickmill demo account is perfect...

- Tutorial – open a demo account on tickmill

- Demo account opening process

- Tickmill demo account features

- Trading platform

- Tickmill broker review

- Expert’s viewpoint

- The tickmill trading experience

- Broker summary

- Broker introduction

- Spreads & leverage

- Platform & tools

- Commissions & fees

- Education

- Customer service

- Final thoughts

- Broker details

- Open demo account tickmill

- Open demo account tickmill

- Tutorial – open a demo account on tickmill

- Demo account opening process

- Tickmill demo account features

- Trading platform

- FOREX.Com demo account

- The power to conquer the markets

- Metatrader 5

- The markets are moving. Stop missing out.

- Try a demo account

- Tickmill broker review

- Expert’s viewpoint

- The tickmill trading experience

- Broker summary

- Broker introduction

- Spreads & leverage

- Platform & tools

- Commissions & fees

- Education

- Customer service

- Final thoughts

- Broker details

No comments:

Post a Comment