Tickmill broker

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

Today forex bonuses

CFD fees are average.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

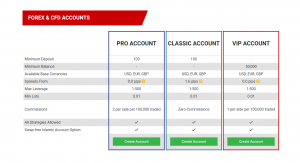

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tickmill broker

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

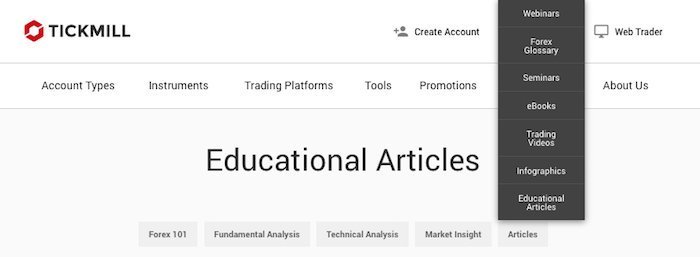

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

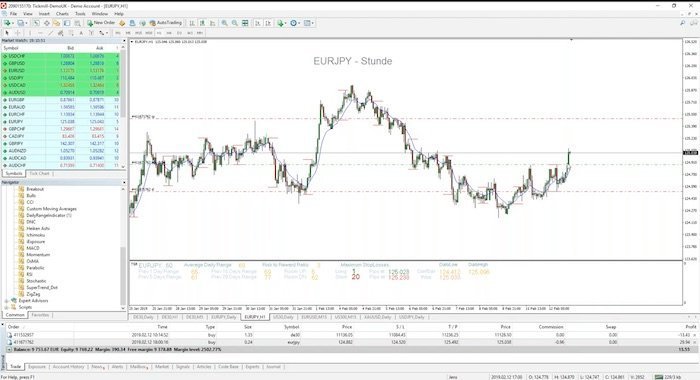

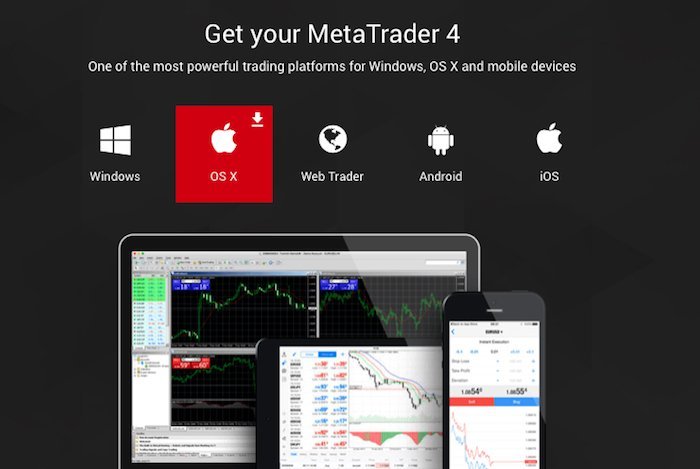

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

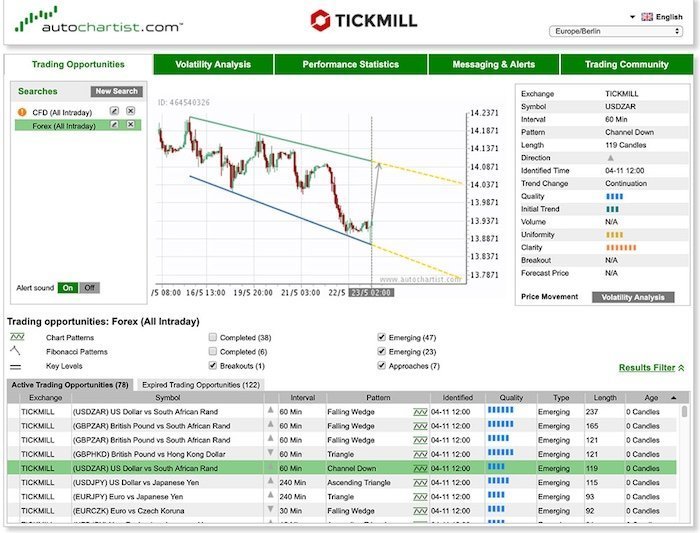

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

Onesto tickmill forex broker recensione – truffa o no?

| Recensione: | regolamento: | minimo. Deposito: | coppie forex: | si diffonde: |

|---|---|---|---|---|

| (5 / 5) | FCA (regno unito), cysec (UE), FSA (SE) | più di 100 anni | 50+ | 0,0 pips – commissione di 1o per 1 lotto |

Siete alla ricerca di esperienze reali e un test critico per il broker tickmill? – allora sei esattamente su questa pagina. Come trader con più di 7 anni di esperienza nei mercati finanziari, abbiamo testato il fornitore in dettaglio per te con denaro reale. Scopri di più sulle condizioni e la serietà del broker. Vale davvero la pena investire in forex broker tickmill denaro o no? – informatevi nei dettagli ora.

Sito ufficiale di tickmill

Che cos’è tickmill? – L’azienda ha presentato

Tickmill è un broker internazionale per il trading di derivati finanziari forex e CFD. La sede principale si trova a londra: 1 fore street, londra EC2Y 9DT, regno unito. Per molti anni, l’azienda si è dimostrata di offrire trading professionale ai migliori rapporti commerciali. Inoltre, ci sono filiali a cipro e seychelles.

Secondo il sito web, tickmill dovrebbe fornire un’eccellente esperienza di trading con gli spread e le commissioni più economici, che daremo uno sguardo più da vicino nel seguente test. Inoltre, il broker brilla con molti premi diversi nel settore e permette ai suoi trader di perseguire qualsiasi strategia di trading.

Fatti su tickmill:

- Forex broker – gran bretagna (londra)

- Realizzato dai commercianti per i commercianti

- Specializzato nel trading forex con condizioni speciali e spread più bassi

- Filiali in tutto il mondo in diversi paesi

- 114 miliardi di volume medio di trading al mese

(nota: ottieni 5 sconti spread con i codici: IBU13836682 (UE) e IB60353132 (internazionale))

Tickmill è un broker forex regolamentato?

Le normative e le licenze sono importanti per i commercianti e i broker in modo da poter creare un rapporto di fiducia. Quando un broker richiede una licenza, devono essere soddisfatti determinati criteri e requisiti. Una violazione della politica significa nella maggior parte dei casi una perdita diretta della licenza.

Tickmill è anche regolato più volte. Il broker ha licenze da FCA (regno unito), cysec (cipro) e FSA (seychelles). Ci dà un’impressione diretta positiva. I trader europei devono fare trading con la licenza inglese (FCA) o cysec, il che porta ulteriori vantaggi. D’altra parte, i commercianti internazionali devono scegliere la licenza FSA.

Attività del gruppo tickmill

La sicurezza dei fondi dei clienti

La sicurezza dei fondi dei clienti dovrebbe essere data a un broker di fiducia. Negli investimenti online, la fiducia in un broker è molto importante. Molti broker più piccoli senza licenza ed esperienza a volte gestiscono il denaro in modo non corretto. Al fine di evitare una tale frode, si dovrebbe prestare attenzione a determinati criteri nella selezione broker.

Tickmill assicura i fondi dei clienti separatamente dai fondi aziendali da gestire. A tale scopo, viene utilizzata la barclays bank, che opera a livello internazionale ed è sempre liquido. Inoltre, i fondi dei clienti saranno protetti nell’improbabile caso di un fallimento o di un dilemma finanziario di tickmill con il financial services compensation scheme (FSCS) fino a 75.000 dollari. Questo è un valore molto alto rispetto ad altri broker, che di solito non hanno alcuna garanzia di deposito o uno più piccolo.

Regolamentazione e sicurezza:

- Regolamentato da FCA, cysece FSA

- I fondi dei clienti sono gestiti da barclays bank

- Garanzia di deposito elevata di 75.000 GBP (licenza FCA)

- Comunicazione sicura del sito web

Revisione delle condizioni di tickmill per i commercianti

Tickmill è un vero broker NDD (non-dealing desk) con noti fornitori di liquidità. E ‘qui scambiatocon conflitto di interessi escluso tra broker e cliente. Questo è un grande vantaggio in quanto non è un market maker.

Ci sono più di 84 strumenti disponibili sul mercato. Il broker è costantemente cercando di espandere la sua offerta e, per esempio, integrare nuovi asset come bitcoin. L’offerta è abbastanza gestibile e il tickmill cerca di specializzarsi con la sua offerta sulle valute (forex). I CFD (contracts for difference) sono disponibili anche per materie prime, titoli di stato o indici azionari. Le azioni individuali non possono essere negoziate su questo broker, quindi ecco un piccolo striscio nella valutazione che deve essere fatta.

Tickmill è caratterizzato dai suoi spread estremamente stretti e da basse commissioni. Noi hanno confrontato molti fornitori negli ultimi anni e tickmill è e rimane il più economico. Lo spread tipico nell’EUR / USD è solo 0,00 – 0,01 pips piccolo e la commissione è un massimo di 2 dollari per scambiato 100.000 dollari (1 lotto) nel conto pro. I commercianti con depositi più elevati possono anche beneficiare di commissioni ancora più piccole (1).

Inoltre, non ci sono requotes, in quanto è un vero forex broker. Ciò significa che sarai sempre in grado di aprire e chiudere una posizione per il prossimo miglior prezzo sul mercato. La liquidità è sempre data dai vari fornitori di liquidità e lo slittamento è anche molto basso sulle notizie commerciali.

Le migliori condizioni:

- Spread molto bassi a partire da 0,0 pip

- La commissione estremamente bassa nell’account pro e VIP è un enorme vantaggio

- Pagare solo 2 s (pro) o 1s (VIP) commissione per 1 lotto scambiato

- Esecuzione rapida e elevata liquidità

- Più di 50 coppie forex

- Max. Leva di 1:500

(nota: ottieni 5 sconti spread con i codici: IBU13836682 (UE) e IB60353132 (internazionale))

Test della piattaforma di trading tickmill

Come piattaforma di trading, il metatrader 4 è offerto a voi. Si tratta di una piattaforma di trading collaudata e mondiale per i commercianti privati e professionali. La piattaforma è disponibile per il browser (web), desktop (download), android (app) e ios (app). Con il metatrader, puoi accedere facilmente e in modo flessibile ai mercati di tickmill da qualsiasi parte del mondo.

Il metatrader è perfetto per qualsiasi trader che vuole guadagnare denaro sostenibile nei mercati. Anche con piccoli capitali possono essere scambiati, perché ci sono micro lotti disponibili. Inoltre, c’è sempre un’esecuzione garantita a tickmill e nessuna esecuzione parziale.

Piattaforma metatrader 4

Grafici e analisi professionali

Una piattaforma di trading dovrebbe essere user-friendly e flessibile. Questo può offrire il metatrader. Diverse impostazioni del grafico per l’analisi tecnica sono regolabili. Utilizzare i famosi candelieri per un’analisi ancora migliore dei mercati. Tickmill fornisce anche tutorial educativi per i principianti.

Inoltre, utilizzare indicatori gratuiti, che sono regolabili per la vostra strategia personale. Il metatrader viene fornito con un sacco di strumenti dopo l’installazione. Se non ne hai abbastanza, puoi aggiungere altri strumenti a metatrader 4. Utilizzare indicatori autoprogrammati per ogni grafico.

Fatti sulla piattaforma:

- Piattaforma di trading flessibile e user-friendly

- Disponibile per ogni dispositivo

- Indicatori gratuiti

- Molti strumenti di analisi diversi

- Possibilità di trading automatizzato

Disponibile per qualsiasi dispositivo

Inoltre, tickmill offre materiale didattico e webinar per i suoi clienti.

Tutorial di trading: come funzionano forex e CFD trading?

Forex è il più grande mercato al mondo. Ogni giorno diversi trilioni di dollari sono in fase di transazione in questo mercato. Ecco perché è anche altamente liquido e interessante per i principianti e commercianti esperti. Tickmill offre oltre 60 diverse coppie di valute. Comprese molte valute dei mercati emergenti. Questo è un enorme vantaggio per coloro che sono alla ricerca di una coppia di valute esotiche per il trading. Per le valute, puoi scommettere su prezzi in calo o in aumento. Acquista una valuta e vendi l’altra valuta dalla coppia di valute. La differenza nel prezzo è ben scritto come profitto.

Sono inoltre offerti CFD. Sono derivati con leva finanziaria che possono essere negoziati su una varietà di valori. Per l’apertura di un trade CFD, non si acquista direttamente l’attività sottostante, ma solo il contratto a tale valore. Questo ha diversi vantaggi perché si può agire con un alto livello di leva finanziaria e molto facilmente posizionare mestieri brevi. Il broker completa l’offerta con CFD su indici azionari, materie prime, metalli preziosi e obbligazioni.

Investire in calo o aumento dei prezzi e garantire la posizione con uno stop loss e prendere profitto. Si tratta di limiti che chiudono automaticamente la tua posizione. Dal momento che il calcolo è a volte confuso, tickmill offre un calcolatore forex. Con questa calcolatrice, è possibile determinare il rischio e la dimensione della posizione in pochi secondi.

Tickmill offre un’esecuzione rapida degli ordini e un’elevata liquidità

Tickmill dispone di diversi data center e data center in tutto il mondo. In metatrader 4 puoi scegliere il miglior accesso (server) per te. Il broker è anche caratterizzato dalla sua bassa latenza. Con la connessione al server live a londra ho una latenza inferiore a 30 ms. Se questo è ancora troppo lento, è possibile noleggiare un server VPS.

Personalmente, non abbiamo avuto problemi con l’esecuzione dell’ordine. Il sito sottolinea anche che non ci sono requotes. Anche con grandi posizioni di dimensioni 30 lotto – può essere scambiato facilmente. Si ottiene sempre un’esecuzione diretta e immediata ai migliori prezzi.

Tickmill è un broker non-dealing desk, che ha una somiglianza con un broker ECN. La differenza tra NDD e ECN è che il broker si trova ancora tra il mercato e i clienti. Si può escludere l’obbligo di pagare fondi aggiuntivi.

Utilizzare un VPS-server per una connessione ottimale

Il fornitore consente qualsiasi strategia e programmi automatici. Gli expert advisor (EA) possono essere eseguiti automaticamente 24 ore al giorno tramite un server VPS presso tickmill. La latenza è molto bassa e il prezzo da 22 dollari al mese troppo.

- La scelta migliore per i programmi automatici

- Bassa latenza

- Tariffe economiche (22 al mese)

Il trading automatizzato tickmill è possibile

Tickmill permette ogni strategia e anche programmi automatizzati. Come accennato in precedenza è possibile noleggiare un server VPS molto economico. In connessione con il metatrader 4 funziona senza problemi e la configurazione è molto semplice. Programmare programmi automatici per il vostro trading o utilizzare i sistemi di trading forniti. Oggi, più di 50 esecuzioni di ordini vengono eseguite automaticamente nel mercato forex.

Qui si può vedere di nuovo che tickmill è un broker NDD serio. Broker dubbi proibiscono strategie o programmi automatici. Inoltre, tickmill non ha limiti per i marchi stop-loss e take-profit. Così può essere scambiato movimenti molto piccoli. A causa delle tasse basse, vale la pena di scalping e day trading.

VPS-server ti permette di fare trading 24 ore su 24, 7 giorni su tickmill.

Come aprire il tuo account tickmill gratuito:

Un altro punto positivo per tickmill è la semplice apertura del deposito. Secondo il sito web, hai bisogno di un massimo di 3 minuti per questo e possiamo confermarlo personalmente. Compila il modulo con i tuoi dati personali. Quindi si ottiene l’accesso diretto al portale clienti di tickmill. Inoltre, la tua email deve essere confermata.

Apri il tuo account gratuito

Dopo di che, l’account deve essere verificato. Grazie alle forti normative, i broker non sono autorizzati a pagare a clienti non verificati. Anche dopo il primo deposito, il conto deve essere verificato con urgenza. Dal momento che il nostro conto è un po ‘più vecchio, non possiamo dirvi se un deposito senza verifica è possibile.

Per la verifica, è sufficiente caricare l’ID e la prova dell’indirizzo. Il broker conferma i documenti entro 24 ore (giorni feriali). Per una verifica ancora più rapida, contatta il supporto e di’ che i tuoi documenti sono stati caricati. Quindi hai accesso a tutte le funzioni del conto di trading.

Unlimited demo account per i principianti presso tickmill

Il conto demo gratuito di tickmill è perfetto per i principianti o commercianti esperti. È illimitato e senza scadenza. I commercianti possono negoziare i mercati con attività virtuali e simulare il trading reale. I trader esperti imparano nuove strategie o testano nuovi mercati. Per il conto demo, non è necessario alcun deposito o verifica.

(nota: ottieni 5 sconti spread con i codici: IBU13836682 (UE) e IB60353132 (internazionale))

3 diversi tipi di account – quale scegliere?

Tickmill offre 3 tipi di account per i commercianti. Interessante per noi è solo l’account pro e VIP. Dalla nostra esperienza, non vale la pena il conto classico per aprire, perché le tasse sono di conseguenza superiori a quello nel conto pro. Nel testo seguente, ti informeremo sui termini di ogni account.

Come descritto sopra, le tasse sono sensazionalmente basse. Leggi la tabella qui sotto per maggiori dettagli. La commissione per i conti pro è di soli 2 dollari. Così si paga solo una tassa di 4 dollari per il commercio completato. Quando apri un account VIP, salvi altri 50, perché paghi solo 2 dollari per ogni operazione completata. Anche con il nostro codice (sotto il pulsante di registrazione) può salvare un altro 5.

Tickmill ti dà gli spread interbancari esatti da 0,0 pip. Il trading è fluido e l’elaborazione veloce è fornita dai server europei. Su richiesta, è possibile creare un conto islamico senza swap (interesse).

| Classico | pro e i contro | vip | |

|---|---|---|---|

| minimo. Deposito: | più di 100 anni | più di 100 anni | 50.000 euro |

| si diffonde: | 1.6 pips (pip) | 0,0 pips | 0,0 pips |

| influenza: | max. 1:500 | max. 1:500 | max. 1:500 |

| incarico: | 0s | 2 x per 1 lotto scambiato | più 1 per 1 lotto scambiato |

Info: tickmill offre anche ai suoi clienti europei di iscriversi come trader professionista e mantenere l’elevata leva di 1: 500.

L’account VIP è la scelta migliore per i trader forex ad alto volume

I trader o le aziende con volumi elevati possono aprire un account VIP. Da un deposito di 50.000 dollari, hai commissioni ancora più economiche. Si paga quindi solo 1 dollari per lotto scambiato. Questo rende 2 dollari per trader completato. Questi bassi costi possono generare un aumento del profitto. Inoltre, gli ordini di arresto e gli ordini limite sono consentiti vicino ai prezzi di mercato. Questa è un’ottima offerta in confronto.

In sintesi, i tipi di account tickmill offrono una grande opportunità per ogni trader. I termini sono molto buoni e molto meglio di altri broker forex. Non importa se si desidera negoziare i mercati con piccolo o grande capitale, tickmill è la decisione giusta per i principianti o commercianti avanzati.

Confronta tu i termini tra tickmill e altri broker. Tickmill è sempre il più economico e ha, quindi, fatto il primo posto nel mio confronto broker forex. Senza altri broker, si ottiene così a buon mercato commissioni di trading senza conflitto di interessi.

Revisione del deposito e ritiro di tickmill

In tickmill è possibile depositare e prelevare utilizzando gli stessi metodi. Sono disponibili bonifici bancari, carte di credito, skrill e neteller. Sul pagamento e deposito, non ci sono tasse.

I miei test e le mie esperienze hanno dimostrato che i pagamenti sono molto veloci e il denaro viene inviato durante il viaggio entro 24 ore. Riceverai un’e-mail di conferma dopo il pagamento quando il pagamento è stato effettuato.

Quanto è alto il deposito minimo? – trading con una piccola somma di denaro

Il deposito minimo è regolarmente di 100 gradi. È possibile il commercio nella piattaforma di trading a partire da 0.01 lotto. Si tratta di una posizione molto piccola e il rischio è nella maggior parte dei casi alto solo pochi centesimi. Il fornitore è quindi ampiamente posizionato perché anche gli investitori più grandi possono commerciare senza problemi a questo broker.

Metodi di deposito e prelievo tickmill

Domande e suggerimenti per le tue transazioni:

- Apri il tuo account gratuito su tickmill. Completa i tuoi dati e verifica l’account. Dopo la verifica, tutte le funzioni del broker sono disponibili per voi.

- Quanti soldi si dovrebbe depositare? – questo è interamente all’ora per gli obiettivi e gli ideali del commerciante. Alcune strategie di trading, ad esempio, non sono fattibili con una piccola somma di 100 dollari. Assicurati di testare il conto demo prima di effettuare il tuo primo deposito.

- Le mie transazioni con tickmill sono sicure? – sì, tickmill funziona solo con le migliori banche e fornitori di pagamenti verificati. È possibile controllare tutte le transazioni nel portale clienti.

- Inoltre, aprire diversi conti di trading nel portale clienti. È quindi possibile utilizzare diversi account per strategie diverse. Un trasferimento interno richiede solo pochi minuti.

Nuovo: ora usa sofort-berweisung (klarna) o paysafecard per capitalizzare il tuo account ancora più velocemente.

C’è una protezione del saldo negativo?

Il saldo negativo di un conto è molto temuto da molti commercianti. E questo è anche molto giustificato. Per alcuni broker, gli operatori in passato sono stati in grado di accumulare debito o saldo negativo attraverso condizioni di mercato estreme, che dovevano essere bilanciate.

A tickmill non ci sono finanziamenti aggiuntivi e si è quindi protetti contro un equilibrio negativo.

Con tickmill non puoi perdere più denaro del tuo deposito.

Servizio tickmill e supporto per i commercianti

Uno degli ultimi punti importanti di questa recensione è il supporto e il servizio dei trader. Tickmill offre supporto in più di 10 lingue diverse (anche africa, asia, india, clienti tailandesi). Dalla nostra esperienza, il broker impiega dipendenti internazionali che si occupano esclusivamente di ogni cliente.

Il supporto è disponibile per i clienti 24 ore su 24, 7 giorni su 7. Il supporto è fornito da chat, telefono o e-mail. Un commerciante non dovrebbe mancare nulla qui. I miei test hanno dimostrato che il supporto è sempre veloce e affidabile!

Tickmill si è presentato in diversi paesi, ad esempio al world of trading di francoforte. Il broker aveva il suo stand lì e ha cercato il contatto diretto con i suoi clienti. Il servizio è una delle cose più importanti per i commercianti e tickmill mostra fiducia e serietà.

Per migliorare ulteriormente il suo servizio, i commercianti ben noti e professionali sono invitati a tenere webinar o altre sessioni di informazione. Nomi noti sono giovanni cicivelli o mike seidel. Il detto “da parte dei commercianti per i commercianti” si applica anche qui. Tickmill cerca di dare ai suoi clienti le migliori prestazioni combinate con un buon servizio.

In sintesi, il supporto da tickmill è molto buono e professionale. Le nostre preoccupazioni personali sono sempre state risolte molto rapidamente e possiamo fare una raccomandazione chiara qui. Nel complesso, il pacchetto complessivo è completato con un ottimo servizio.

| Appoggiare: | disponibile: | numero di telefono: | speciale: |

|---|---|---|---|

| telefono, chat, E-mail | 24/5 | +44 (0)20 3608 6100 | webinar, supporto da 1 a 1, eventi |

Conclusione della mia recensione: tickmill è uno dei migliori broker forex

La mia esperienza e test mostrano su questa pagina che tickmill è un ottimo broker. Egli ottiene da noi una valutazione di 5 stelle. Consigliamo questo broker forex con la coscienza pulita. Tickmill offre un’offerta per ogni tipo di trading.

Con le tasse più economiche del mondo, il broker è attualmente in cima a qualsiasi concorrente. L’esperienza di trading è unica con questo broker e si risparmia un sacco di soldi sull’esecuzione dell’ordine. Per ogni trader che commercia forex, questo è il fornitore giusto.

Se hai altre domande, contatta il supporto per telefono o chat. I dipendenti internazionali sono pronti ad aiutarvi.

- Regolamento del regno unito e elevata sicurezza dei clienti

- Il broker forex più economico del mondo

- Nessunre e alta liquidità

- La migliore esecuzione

- Buon servizio e supporto

- Le migliori condizioni per I trader forex

- Commissioni di trading molto basse

- Nessuna azione per il trading

Tickmill è il miglior broker forex al mondo a causa delle commissioni di trading a buon mercato e buona esecuzione. (5 / 5)

Leggi i nostri altri articoli su tickmill:

Tickmill review

Tickmill is a global forex CFD broker, that has been regulated by the FCA in the united kingdom since 2016.

Headquarters are located at: 1 fore street, london EC2Y 9DT united kingdom. Contact phone number is: +44 203 608 6100. Customer support email address is: [email protected] . Official website is at: https://www.Tickmill.Co.Uk.

Tickmill broker review

A review of the forex brokers tickmill shows, that this broker is offering day traders and investors the classic metatrader4 (MT4) trading platform. There is available both the desktop standalone version, along with the web based and mobile versions. They offer hundreds of underlying assets for trading CFD’s including all the popular major & minor forex pairs, market indexes, individuals shares, and commodities like brent, crude oil, platinum, coffee, sugar etc..

Leverage on all forex pairs is set at 1:30, and can go as high as 1:500 for professional investors. Their spreads are either 0 pips, with commissions or 1.6 pips with no commissions. Depending on your trading style, you will either choose a classic or pro account.

There are three different trading account types offered, with the main difference being commissions and spreads. The minimum deposit requirement for a new trading account is $100. Accounts can be denominated in either USD, EUR, PLN or GBP. Deposits can be done with either bank transfer, credit card or skrill. Withdrawals are processed within one working day.

Tickmill review broker account types

Is tickmill a licensed broker?

Yes, they are a licensed and regulated broker by three different financial regulators.

- United kingdom: tickmill UK ltd is authorised and regulated by the financial conduct authority, license number: 717270. An FCA is one of the most prestigious licenses a forex broker can obtain.

- European union: tickmill europe ltd is licensed cysec (cyprus securities and exchange commission) with license number: 278/15. With mifid, the cyprus license is recognized by all EU member countries.

- South africa: tickmill south africa (pty) ltd, is licensed and regulated by the FSCA with FSP # 49464.

- Global: tickmill ltd is licensed as a securities dealer by the seychelles FSA, with license number: SD008

Scam broker investigator has reviews of hundreds of forex brokers, see here. The best way you can know if a broker is a scam or a legitimate broker, is by verifying that they are licensed by your countries financial regulator. The reason why smart people only use a licensed broker, is so that you can be assured your money is safe in a segregated bank account.

Tickmill trading app review

Compare licensed brokers

You should be aware that there are currently a lot of forex and crypto investment scams circulating online, read more. A smart person will always compare a few different brokers, before making a final choice.

Fortrade is a fast growing english broker, that is licensed in canada, united kingdom and australia, learn more.

They offers MT4 and a unique web based trading app, with free signals, signup here.

We ask current tickmill clients to please share your experience with this broker, in the comments section below.

Tickmill erfahrungen 2021 – der top broker im testbericht

Zuletzt aktualisiert & geprüft: 29.01.2021

- Über 60 währungspaare handelbar

- Cysec reguliert & bei der bafin registriert

- Spreads ab 0.0 pips

Die gesellschaft tickmill europa hat ihren sitz auf zypern und wird somit von der cysec reguliert und außerdem ist der broker in deutschland bei der bafin registriert. Den broker tickmill gibt es schon sehr lange, er wurde ursprünglich unter dem namen armada markets in estland gegründet und siedelte 2015 auf die seychellen um. Mit dem sitz auf zypern wird tickmill europa unter der strengen regulierung der cysec betrieben und gilt somit als sehr sicher. Denn bei dieser regulierungsbehörde handelt es sich um eine der strengsten der welt und es werden umfassende bedingungen an die broker gestellt. Wir haben den broker in unseren tickmill erfahrungen getestet!

Das angebot von tickmill ist auch auf deutsch verfügbar. Das beinhaltet nicht nur die website und den der tickmill kontakt, sondern auch das ausbildungsprogramm mit video-tutorials, artikeln und webinaren.

Jetzt sicher mit tickmill traden investitionen bergen das risiko von verlusten

Die vor- und nachteile des brokers tickmill

- 62 handelbare währungspaare

- Regulierung durch cysec, UK FCA, SFSA, LFSA, FSCA

- STP-broker

- Metatrader 4 kann kostenlos genutzt werden

- Webtrader für direkten handel ohne download

- Mindesteinzahlung nur 100 euro

- Kostenloses tickmill demokonto

- Deutschsprachige website und kundenservice

- Nur geringe auswahl bei den cfds

Trader bei tickmill können entweder direkt online über den webtrader des brokers handeln. Oder auch über die beliebte plattform metatrader 4, welche tickmill kostenlos zur verfügung stellt. Wir haben für unsere leser das angebot des ECN-brokers getestet und im folgenden erfahrungsbericht zusammengefasst.

Beim broker haben die kunden die auswahl zwischen drei verschiedenen kontomodellen, die alle durch sehr niedrige handelsgebühren überzeugen. Tickmill arbeitet als STP-broker und tritt somit nicht als direkter gegenpart zum kunden beim handel auf. So ist ein tickmill betrug durch kursmanipulation nahezu ausgeschlossen. Jede order der kunden wird direkt an einen großen liquiditätspool aus vielen verschiedenen teilnehmern weitergeleitet. Dabei werden die orders zu den bestmöglichen verfügbaren konditionen durchgeführt. So ist gewährleistet, dass die trader immer den besten preis erhalten.

Tickmill EU erfahrungen & testbericht

Bei unserem tickmill test konnten wir schnell viele vorteile entdecken, mit denen sich der anbieter von anderen brokern abhebt. So ist es beispielsweise ein großer vorteil, dass es sich bei tickmill um einen ECN-broker handelt. Anders als die deutlich häufiger vertretenen market maker stellt dieser die handelskurse nicht selbst, sondern leitet die order der kunden direkt an den markt weiter. Dort werden sie innerhalb weniger millisekunden zum bestmöglichen preis ausgeführt. Dabei kommt es nicht zu interessenskonflikten zwischen broker und kunden. Für den broker ist es nämlich im prinzip egal, ob der kunde gewinn oder verlust macht, sein verdienst bleibt immer gleich. Bei diesem broker merkt man tatsächlich, dass der erfolg der kunden ein wichtiges anliegen des unternehmens ist.

Konditionen überblick

- 62 handelbare währungspaare

- Mindesteinzahlung nur 100 euro

- 3 handelsplattformen zur auswahl

- Minimale transaktionsgröße: 0,01 lot

- Maximaler hebel von 1:30 (professionelle kunden mehr)

- Mindestmargin: 3,33% (professionelle kunden weniger)

- Spreads ab 0 pips

- Mobiles trading möglich

- 15 cfds auf indizes, zusätzlich gold und silber

- Kontoführung in EUR, USD, GBP und PLN möglich

bei tickmill mit besten konditionen handeln investitionen bergen das risiko von verlusten

Tickmill im schnell-check

Die regulierung durch die cysec, UK FCA, SFSA, LFSA, FSCA ist ebenfalls ein großer vorteil. Denn diese gelten als strenge kontrollorgane und bietet somit eine besonders hohe sicherheit. Außerdem ist der broker tickmill europe bei der bafin registriert. Kundengelder verwahrt der broker auf separaten konten. Dadurch kann das kapital ausschließlich als margin für den handel des kunden verwendet werden. Eine verwendung für einen anderen zweck durch den broker ist laut lizenzbestimmungen untersagt. So bleiben die kundengelder stets eigentum des traders und sind unabhängig von der liquidität des brokers jederzeit auszahlbar.

Mit dem kostenlosen demokonto können interessierte potentielle kunden das trading bei tickmill kostenlos testen. Eine umfangreiche tickmill anmeldung ist dabei nicht notwendig. Das tickmill demokonto beinhaltet alle funktionen eines echten handelskontos. Bei bedarf füllt der tickmill support das konto erneut kostenlos mit virtuellem kapital auf. Auch der einstieg in den realen handel ist bei tickmill ohne große investitionen möglich. Die tickmill mindesteinlage beträgt nur 100 euro und ist damit deutlich niedriger, als bei den meisten anderen brokern. Durch das geringe mindestordervolumen von nur 0,01 lot können anleger auch schon mit kleinen beträgen handeln.

In sachen währungspaaren gibt es eine gute auswahl. Hier können händler nicht nur alle majors, sondern auch zahlreiche minors und exoten traden. Deutlich geringer fällt dagegen das angebot bei den cfds aus. Hier hoffen wir, dass tickmill die auswahl demnächst noch deutlich erhöht.

Einlagensicherung und regulierung

Für ein entspanntes trading sind die einlagensicherung und die regulierung von großer bedeutung. Denn anleger sollten nur bei einem vertrauenswürdigen und gut regulierten broker forex und cfds handeln. Daher haben wir uns die tickmill regulierung genau angeschaut.

Die regulierung von tickmill EU erfolgt durch die regulierungsbehörde cysec und tickmill UK ltd. Wird außerdem noch von der UK FCA reguliert, weitere regulierungsbehörden von tickmill sind die SFSA, LFSA und die FSCA. Noch dazu ist tickmill europa in deutschland bei der bafin registriert. Dadurch muss der broker sich an zahlreiche strenge auflagen halten. Unter anderem ist die streng separate verwaltung der kundengelder zwingend vorgeschrieben. So können diese nicht durch den broker zu eigenen zwecken verwendet werden. Bei einer möglichen insolvenz des brokers fällt das geld nicht den gläubigern zu, sondern bleibt weiter im eigentum des kunden.

Alle gelder auf den kundenkonten sind außerdem durch die mitgliedschaft des brokers beim financial services compensation scheme (FSCS) bis zu einem betrag von 85.000 GBP abgesichert. Somit ist das trading beim londoner broker tickmill UK ltd. Vertrauenswürdig.

Unsere tickmill erfahrungen im detail

In unserem tickmill test konnten wir erfahrungen mit den beiden angebotenen handelsplattformen dieses brokers machen. Mit dem webtrader wird eine eigene plattform für die kunden bereitgehalten. Sie muss nicht heruntergeladen werden , sondern ist direkt im browser einsatzbereit. Das hat den vorteil, dass sich die trader auch an verschiedenen computern schnell in ihr handelskonto einloggen können. Der webtrader bietet viele praktische funktionen und ist auch für einsteiger leicht zu bedienen.

Als zweite möglichkeit können die kunden den handel über den tickmill MT4 durchführen. Diese weltweit bekannte und bei erfahrenen tradern äußerst beliebte handelsplattform bietet eine vielzahl an unterschiedlichen möglichkeiten zur chatanalyse und ist durch verschiedene zusatzfeatures erweiterbar. Metatrader ist trotz seiner vielen funktionen durchaus auch für anfänger geeignet. Die plattform ist sehr übersichtlich aufgebaut und es stehen mehrere tutorials zur verfügung, welche die bedienung und die verschiedenen funktionen des programms erklären. Sogar der automatisierte handel ist über metatrader möglich, was bei tickmill auch ausdrücklich erlaubt ist.

Auch unterwegs müssen die tickmill kunden nicht auf das trading verzichten. Der broker bietet eine praktische app für android und ios geräte. So bleiben die kunden auch unterwegs auf dem neuesten stand und können marktbewegungen immer zum optimalen zeitpunkt ausnutzen. Der handel am handy oder tablet ist, genau wie am computer, unter professionellen bedingungen möglich. Auch mobil können anleger viele analysen mit unterschiedlichen tools durchgeführen.

Tickmill erfahrungen – die handelskonditionen im review

Unser fazit zu den handelskonditionen fällt sehr positiv aus. Der tickmill erfahrungsbericht hat gezeigt, dass die mindesteinzahlung mit 100 euro erfreulich niedrig ist, so dass auch die kunden hier gut aufgehoben sind, die nicht viel geld in das trading investieren möchten. Mit einer mindesttransaktionsgröße von grade einmal 0,01 lot können einsteiger hier bereits mit kleinen beträgen am handel teilnehmen.

Durch die drei unterschiedlichen tickmill kontotypen kann hier jeder trader die konditionen auswählen, die für seine ganz persönlichen bedürfnisse am besten passen. Beim classic konto werden die tickmill gebühren ausschließlich durch spreads berechnet. Zusätzliche kosten wie beispielsweise kommissionen fallen hier nicht an. Der kontotyp „pro konto“ bietet ein handelskonto mit geringen kommissionen, bei welchem keine oder nur sehr geringe spreads berechnet werden. Händler mit besonders großem volumen können über das VIP konto besondere konditionen erhalten.

Mit 1:30 ist der maximale hebel so hoch wie bei jedem anderen anbietern auch. Das liegt daran, dass broker in der EU für private anleger keinen höhere hebel zulassen dürfen. Professionelle kunden erhalten natürlich andere tickmill hebel. Tickmill arbeitet als STP-broker und leitet die anfragen seiner kunden direkt an den markt weiter. Dort erfolgt dann die ausführung zu bestmöglichen konditionen. Dadurch ist der broker in der lage, immer den niedrigsten preis zu bieten, was die vielen zufriedenen kunden zu schätzen wissen. In unserem tickmill testbericht stießen wir auf durchweg gute konditionen, so dass der broker auch auf grund der geringen kosten empfohlen werden kann.

- 3 verschiedene kontotypen

- Mindesteinzahlung nur 100 euro

- Maximaler hebel für private anleger 1:30

- Keine kommissionen oder provisionen im classic konto

mit den eigenen konditionen traden investitionen bergen das risiko von verlusten

Leistungen, extras und tickmill bonus

Zusätzlich zum regulären trading-angebot bietet tickmill viele weitere leistungen, die es so nicht bei jedem anderen broker gibt. Der mobile handel gehört heutzutage schon zum standard. Selbstverständlich gibt es daher auch eine tickmill app. Eine weitere zusätzlich leistung ist das kostenlose demokonto. Dieses dient zum einen dazu, dass sich interessierte trader das angebot genau anschauen können. Damit können sie alles selber ausprobieren, bevor sie sich für oder gegen eine registrierung bei diesem broker entscheiden. Darüber hinaus wird die tickmill demo aber auch von vielen aktiven tradern immer wieder zwischendurch genutzt. Zum beispiel um neu erworbenes wissen zu vertiefen oder strategien auszuprobieren und zu optimieren. Da die kunden das demokonto für einen unbegrenzten zeitraum nutzen können, sind den möglichkeiten hier keine grenzen gesetzt.

Das schulungsangebot setzt sich aus artikeln zu verschiedenen themen, video-tutorials und regelmäßig angebotenen webinaren zusammen. Hier können anfänger das trading von grund auf erlernen, aber auch für fortgeschrittene wird viel material bereitgestellt. Tickmill ist stets daran interessiert, dass die trader erfolgreich sind und bietet daher eine umfangreiche unterstützung. Mit dem wirtschaftskalender sehen die kunden auf einen blick, welche wichtigen ereignisse anstehen.

- Kostenfreies demokonto

- Trading akademie

- Video-tutorials

- Ausbildungsinhalte auch für fortgeschrittene trader

Tickmill erfahrungen, testberichte & auszeichnungen

Tickmill hat in den letzten jahren sein angebot beachtlich erweitert. Das ist auch der fachpresse nicht verborgen geblieben und der broker wurde in mehreren artikeln sehr positiv erwähnt. Auch die auszeichnungen, welche der broker in jüngster zeit erhalten hat, bestätigen unsere eigenen tickmill erfahrungen. Zum beispiel erhielt tickmill den forex brokers award 2020 als bester handelserfahrungsbroker und auch eine auszeichnung als „bester forex-ausbildungsanbieter“ im jahr 2020 durch das global brands magazine. Auch im jahr 2021 gilt tickmill immer noch als hervorragender broker.

Mit den großen entwicklungen und dem starken wachstum im vergangenen jahr konnte tickmill die finanzwelt nachhaltig beeindrucken. Der broker kündigt auf seiner website an, die kommenden jahre sogar noch produktiver zu gestalten. Wir dürfen also gespannt sein. Außerdem rechnen wir stark damit, auch in zukunft in der fachpresse von tickmill zu lesen.

Beim ausgezeichneten broker tickmill handeln investitionen bergen das risiko von verlusten

Fragen und antworten zum broker

Kann bei tickmill ein demokonto genutzt werden?

Ja. Damit neue kunden das angebot und die vielen leistungen des brokers unverbindlich kennenlernen können, stellt tickmill ein demokonto bereit. Hierfür ist keine vollständige registrierung notwendig, sondern es werden nur wenige angaben wie beispielsweise die E-mail-adresse benötigt. Mit dem tickmill demokonto können die kunden das komplette angebot des brokers zu realistischen bedingungen nutzen. Es wird mit virtuellem geld, aber zu echten kursen gehandelt. Lediglich slippage findet beim demokonto nicht statt. Da die nutzungsdauer für das demokonto nicht begrenzt ist, wird es auch von professionellen tradern zu verschiedenen zwecken immer wieder gerne genutzt.

Welcher maximale gewinn ist möglich?

Die höhe des gewinns ist von der höhe des einsatzes und der kursentwicklung abhängig. Es ist keine pauschale aussage über die maximale gewinnhöhe möglich, denn nach oben sind keine grenzen gesetzt. Allerdings sollte immer auch beachtet werden, dass der handel mit spekulativen finanzprodukten ein hohes risiko mit sich bringt und auch verluste einkalkuliert werden müssen. Der maximale hebel liegt bei 1:30. Dadurch müssen trader bei tickmill nur ein 30tel der investition als margin hinterlegen.

Wie wird der broker reguliert?

Die regulierung von tickmill europa erfolgt durch die cysec. Die auflagen dieser behörde gelten als besonders streng. Das gibt tradern ein hohes maß an sicherheit. Die gelder der handelskonten werden getrennt vom firmenvermögen verwaltet und der broker ist verpflichtet, separat über diese gelder buch zu führen. Somit ist das guthaben der kunden sogar bei einer insolvenz geschützt.

Kann der metatrader 4 genutzt werden?

Ja, neben der eigenen online-handelsplattform ermöglicht tickmill seinen kunden auch den handel mit metatrader 4. Die beliebte handelsplattform ist für alle kontotypen, inklusive dem demokonto, verfügbar. Kunden können die plattform auf der website von tickmill kostenlos herunterladen. Metatrader4 ist mit vielen tools erweiterbar und bietet alle wichtigen möglichkeiten für eine umfangreiche technische analyse. Daher wird die handelsplattform auch von professionellen tradern gerne verwendet.

Wie hoch ist die mindesteinzahlung bei tickmill?

Die mindesteinzahlung für die kontotypen „classic konto“ und „pro konto“ beträgt 100 euro. Damit sind beide konten bestens für einsteiger geeignet. Denn diese müssen dadurch nicht viel geld investieren, um erste tickmill erfahrungen beim realen trading sammeln zu können. Für professionelle trader und kunden mit einem hohen handelsvolumen steht als dritte möglichkeit noch ein VIP konto zur verfügung. Hier werden besonders günstige konditionen geboten, allerdings beträgt die mindesteinzahlung für dieses konto 50.000 euro.

Fazit unserer tickmill erfahrungen

Die auswahl an cfds ist bei tickmill noch ausbaufähig. Doch der broker bietet 62 handelbare währungspaare. Die tickmill regulierung erfolgt durch die cysec, sodass die rechtlichen rahmenbedingungen positiv erfüllt sind. Tradern steht der beliebte metatrader 4 bei dem STP-broker kostenlos zur verfügung. Alternativ ist der handel jedoch auch über den webtrader möglich – und das ohne vorherigen download. Wer erste erfahrungen mit tickmill sammeln möchte, kann ein kostenloses demokonto nutzen. Von diesem angebot profitieren auch erfahrene trader, die neue strategien zunächst risikofrei ausprobieren möchten. Der broker tickmill überzeugt außerdem mit einer geringen mindesteinzahlung von 100 euro. Der deutschsprachige kundenservice rundet das insgesamt positive bild unserer tickmill erfahrungen ab.

Eigene tickmill erfahrungen zum angebot

Mit unserem review bieten wir eine überblick über das angebot von tickmill und teilen unseren lesern unseren eindruck von diesem broker mit. Darüber hinaus finden wir es aber auch sehr wichtig, dass die trader selber uns ihre meinung zu den unterschiedlichen brokern mitteilen. Denn nur so ist es möglich, einen umfassenden überblick über die aktuellen möglichkeiten beim handel von forex und cfds zusammenzustellen. Fall sie bereits tickmill erfahrungen sammeln konnten und bereits über diesen broker gehandelt haben, teilen sie ihre meinung gerne uns und den anderen tradern mit. Werfen sie auch einen blick auf unsere übersicht der besten CFD broker.

Die wichtigsten fakten nochmal im überblick:

| �� kosten ab: | 0,00 euro |

| �� sicherheit / regulierung: | cysec |

| �� mindesteinzahlung: | 100 euro |

| �� demokonto: | ja |

| �� app: | ja, für ios und android |

| �� handelsangebot: | aktien, anleihen, forex |

Fragen & antworten zu tickmill

Wo hat der broker seinen hauptsitz?

Tickmill europa hat seinen sitz auf zypern.

So, let's see, what was the most valuable thing of this article: tickmill review written by investing professionals. Updated for 2021. Everything in one place: pros and cons of fees, trading platform, and investor protection. At tickmill broker

Contents of the article

- Today forex bonuses

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Tickmill broker

- Tickmill review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

- Onesto tickmill forex broker recensione – truffa...

- Che cos’è tickmill? – L’azienda ha presentato

- Tickmill è un broker forex regolamentato?

- La sicurezza dei fondi dei clienti

- Revisione delle condizioni di tickmill per i...

- Test della piattaforma di trading tickmill

- Grafici e analisi professionali

- Tutorial di trading: come funzionano forex e CFD...

- Tickmill offre un’esecuzione rapida degli ordini...

- Utilizzare un VPS-server per una connessione...

- Il trading automatizzato tickmill è possibile

- Come aprire il tuo account tickmill gratuito:

- Unlimited demo account per i principianti presso...

- 3 diversi tipi di account – quale scegliere?

- L’account VIP è la scelta migliore per i trader...

- Revisione del deposito e ritiro di tickmill

- Quanto è alto il deposito minimo? – trading con...

- C’è una protezione del saldo negativo?

- Servizio tickmill e supporto per i commercianti

- Conclusione della mia recensione: tickmill è uno...

- Tickmill review

- Tickmill broker review

- Is tickmill a licensed broker?

- Compare licensed brokers

- Tickmill erfahrungen 2021 – der top broker im...

- Die vor- und nachteile des brokers tickmill

- Tickmill EU erfahrungen & testbericht

- Konditionen überblick

- Einlagensicherung und regulierung

- Unsere tickmill erfahrungen im detail

- Tickmill erfahrungen – die handelskonditionen im...

- Leistungen, extras und tickmill bonus

- Tickmill erfahrungen, testberichte &...

- Fragen und antworten zum broker

- Kann bei tickmill ein demokonto genutzt werden?

- Welcher maximale gewinn ist möglich?

- Wie wird der broker reguliert?

- Kann der metatrader 4 genutzt werden?

- Wie hoch ist die mindesteinzahlung bei tickmill?

- Fazit unserer tickmill erfahrungen

- Eigene tickmill erfahrungen zum angebot

- Fragen & antworten zu tickmill

No comments:

Post a Comment