Octafx trading

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992.

Today forex bonuses

Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd. As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

Trade with a regulated broker that adheres to placing clients' asset protection at the forefront.

Octa markets cyprus ltd offers spot forex and contracts for differences (cfds) on assets including equity indices, spot metals and commodities. Octa markets cyprus ltd offers easy-to-use platforms such as metatrader 5 and ctrader.

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) with license №372/18. Octa markets cyprus ltd complies with european securities and market authority's (ESMA) regulatory standards as well as with market in financial instruments directive (mifid II)

Explore our platforms

Trading platforms are designed to enhance your trading experience. Access your trading account via mobile and desktop platforms.

Metatrader 5 and ctrader trading platforms are carefully designed to meet your trading needs.

Mobile and desktop trading on demo accounts

Trade markets with unlimited virtual funds. Test our trading platforms and your trading strategies with no risk involved by opening a demo account.

Octa markets cyprus ltd security

Negative balance protection

Octa markets cyprus ltd notice

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

The website is the property of octa markets cyprus ltd.

Octafx

Predictions and analysis

USDCHF pair still has a huge tendency of continuing in a bearish trend. The price crossover below the 100SMA also gives room for a retest. The intraday time frame(H4, H1) shows an oversold zone in the RSI. I would most likely bet on a profit target of 40 pips away from 0.88253 and a 30 pips stop loss in the buy direction.

Wath took 131 days was achieved in just 77 days with a 20-day correction!! So now with the same speed, we will hit 10,000$ mark soon

Use lot size which you can afford to loss

Buy this pair once the price move above 200 EMA and around 0.61500 $ as after the ranging price is expected to move in an uptrend

After one correction wave price is going to move upwards

Price expected to move upwards

The price will go further down

Wait for the price to reach the sell zone, then go short

The price of AUDUSD is at an important support level if the price takes a turn form here to expect a good long

The price is currently at strong resistance, also a triple top formation so the next wave is expected to be a downside

If the structure formation breaks successfully go for short more than 200 pip price will fall, however target is open

Price is currently sitting on the trend line which was to bottom 5 months back so expecting a push up from here

Ethereum is struggling to recover above the $150.00 resistance level, following last weeks sudden drop towards the $135.00 support zone. ETHUSD bulls need to rally the cryptocurrency above the $170.00 level to change the short-term bearish outlook. Ethereum continues to have a high correlation to bitcoin and could trade sideways until BTCUSD bulls return. • if.

The euro has started to firm test towards the 1.1100 level against the greenback as expected, following another round of weakness in the US dollar index. Buyers now need to rally the EURUSD pair above the 1.1110 resistance level to provoke a major technical breakout. Overall, buying any dips lower in the EURUSD pair appears to be the best option while the US.

The US dollar remains under downside pressure against the japanese yen, following the release of more weak data from the US economy. From a technical perspective, the USDJPY pair is extremely weak while trading below the 108.60 support level. Going forward, a break under the 108.20 level exposes the USDJPY pair to heavy technical selling towards the 107.50 level.

Bitcoin is starting to push lower in early wednesday trade after the buyers failed to gain traction above the $7,300 level earlier this week. A bearish head and shoulders pattern remains valid on the lower time frames while price trades below the $7,800 level. Overall, traders may use any pullbacks in price as a chance to short the BTCUSD pair, with the $6,600.

The british pound has moved to fresh six-week trading high against the US dollar, with the pair moving above the psychological 1.3000 level. Buyers need to hold price above the 1.3000 level to maintain the bullish medium-term range breakout. The GBPUSD pair could easily advance towards the 1.3100 level at this stage, with the 1.3200 level the ultimate upside.

The US dollar has fallen back under the 108.90 level against the japanese yen currency, making the pair technically bearish over the short-term. Continued weakness under this key area could provoke further losses towards the 108.20 level. The USDJPY pair could capitulate to technical selling if the 108.20 support level is broken. • the USDJPY pair is only.

Octafx review and tutorial 2021

Octafx offers multi-asset trading on a range of platforms and mobile solutions.

Octafx offers leveraged trading on currencies.

Trade popular digital currencies at octafx.

Octafx is a forex, CFD and copy trading broker offering the MT4, MT5 and ctrader platforms. In this broker review, we’ll login to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out if octafx is a good forex broker or not.

Octafx details

Octafx was established in 2011. The company’s headquarters are located in saint vincent and the grenadines, with an additional support office in jakarta, indonesia. The broker’s EU entity, octa markets cyprus ltd, is located in limassol, cyprus, and is regulated by the cysec.

With over 1.5 million trading accounts and a long list of forex industry awards, the founder and owner has ensured the company has amassed a global reach.

Trading platforms

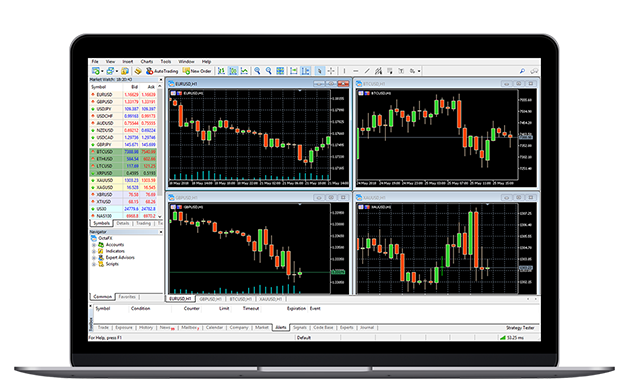

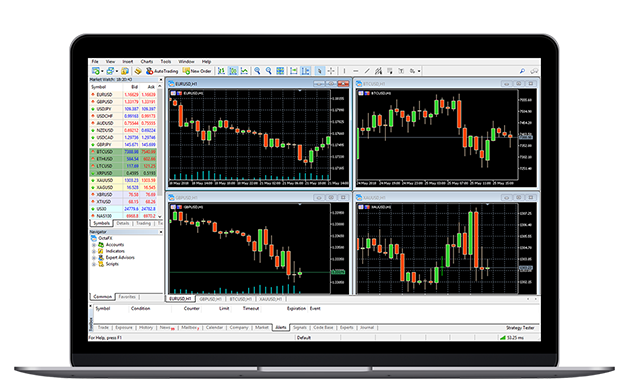

Metatrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.

The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyse price fluctuations and trends in the market, using 3 customisable chart and graph types.

Note that MT4 is currently only available for non-EU clients.

Octafx metatrader 4

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.

Users enjoy 8 types of pending orders, 44 analytical objects including gann and fibonacci retracement, plus additional technical indicators which are unique to MT5, such as trend oscillators and bill williams’ tools. There’s also an economic calendar as well as two major accounting modes for greater flexibility: hedging and netting.

Both platforms come in several languages, including english, arabic and hindi, and are compatible with windows pcs. Octafx provides a useful download guide on the website.

Octafx metatrader 5

Metatrader webtrader

For those using mac pcs, octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser.

The web platforms are highly functional and customisable, boasting the same features found in the desktop versions, including charting tools, market indicators, scripts and expert advisors, plus access to diverse order types and execution modes.

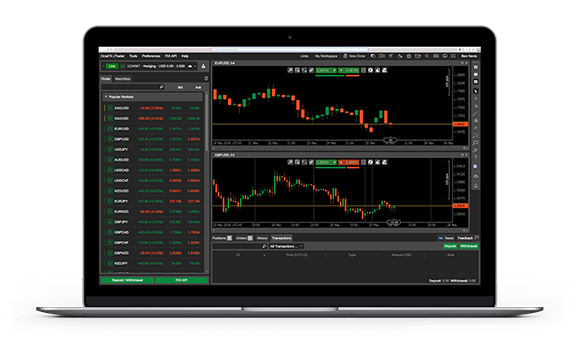

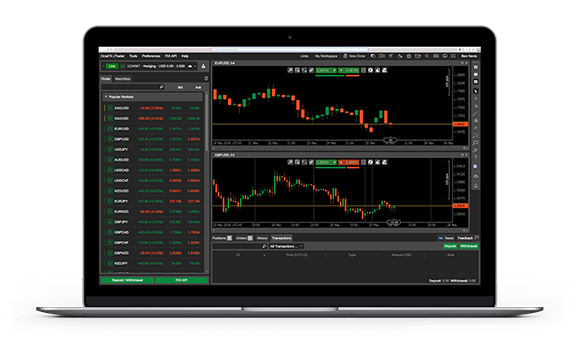

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customisable interface. The platform boasts an impressive suite of 70 technical indicators and 28 chart timeframes, plus advanced level scalping and visual back-testing using cbot. With full market depth, traders can also execute advanced online trading strategies as well as programmable algorithms.

The ctrader platform is ready to download from the website once you have completed the registration process. The ctrader web terminal is also available for macos users.

Octafx ctrader

Markets

Octafx offers some of the most popular products, including:

- Forex – 28 currency pairs including EUR/USD and USD/JPY

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including spot gold and silver contracts, plus brent and crude oil

- Cryptocurrencies – 3 major digital currencies available; bitcoin, ethereum and litecoin

Trading fees

Typical variable spreads for EUR/USD are around 0.7 pips in both the metatrader and ctrader platforms. Gold spreads (XAUUSD) start from around 2 pips and major indices such as NAS100 are around 3.5 points. Bitcoin spreads (BTCUSD) are around 3.1 pips. Fixed spreads are also available for MT4 USD accounts.

Trading commissions are only charged in the ctrader account, at 0.03 USD per 0.01 lots. There are also rollover rates applied on positions held over 3 days. Details of these fees are listed in the product specifications.

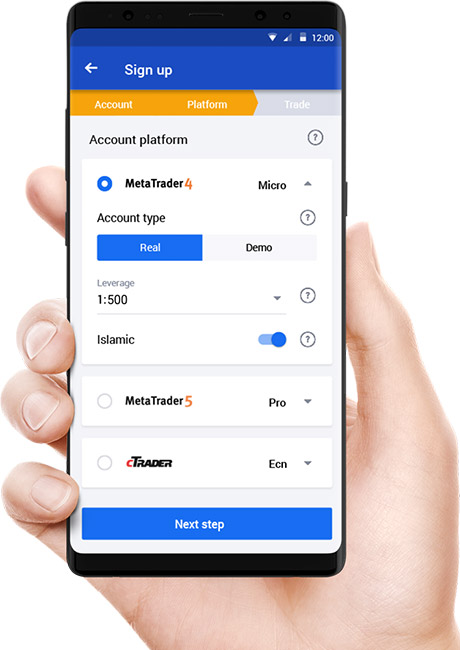

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2.

Note that EU clients can only trade with leverage up to 1:30.

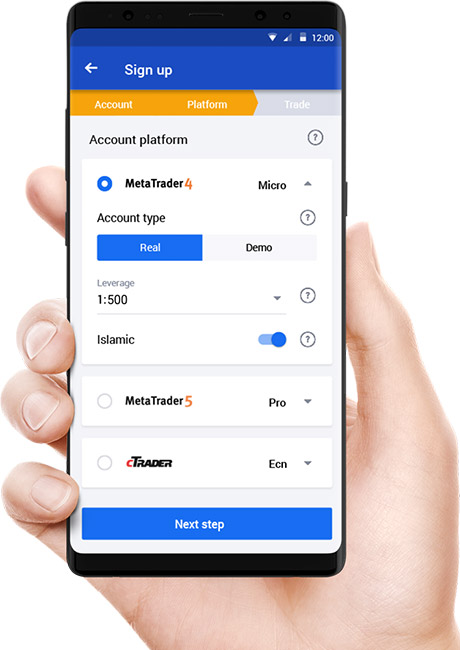

Mobile apps

Octafx delivers mobile app versions of the MT4, MT5 and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications, including a complete set of orders in metatrader and full balance, margin and P&L information in ctrader. All trading apps come with a customisable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts.

Octafx MT4 mobile app

Octafx (non-EU) also offers a downloadable proprietary copy trading mobile app, currently available only on android (APK) devices. The app allows you to manage and keep track of trading accounts whilst on the go. Users can also activate bonuses, access trader tools and deposit into their accounts. The app download process is quick and can be accessed from the google play store.

Octafx mobile app

Payment methods

Octafx offers a few fast funding methods which vary depending on your origin country, including bank cards, perfect money and bitcoin. Local bank transfers are also available for traders from certain countries, including thailand, india and nigeria.

The minimum withdrawal and deposit amounts are 5 USD for perfect money, 0.00096000 for bitcoin and 50 EUR for cards. All deposits methods are generally processed instantly or within a few minutes.

There are no commissions charged on deposits, withdrawals or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings.

Demo account review

Octafx traders can open a demo account which provides the same trading experience as a live account but without risking any real investment. Each demo account is loaded with unlimited demo dollars and opportunities to participate in the broker’s demo contest to be one of the next champions. You can sign up for a free demo account in just a few minutes.

Octafx bonuses & promo codes

Octafx (non-EU) offers several deposit bonus deals, including a 50% bonus and a 100% bonus during special offer periods. In addition, there’s the trade & win promotion where traders can win gifts such as octafx t-shirts or gadgets. There are also contest opportunities, including the octafx 16 cars contest where traders are entered into a car prize draw every 3 months, as well as the champion demo contest 2020 for MT4 users.

Make sure to check all bonus terms and conditions before participating.

Regulation review

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec), under license number 372/18. EU member state residents are therefore protected by strict regulatory standards, including segregated client accounts and protection by the investor compensation fund.

The non-EU entity also claims to provide segregated client accounts to protect trader funds, as well as negative balance protection which ensures that trader account balances never fall below zero.

Additional features

Traders benefit from a range of additional education features and trading tools at octafx, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the autochartist plugin and live quotes.

Octafx also offers a copy trading service, which is available on the desktop terminal and through the android mobile app. The copy trading services allows clients to automatically copy leading traders based on the equity and leverage of both the master trader and the copier’s accounts.

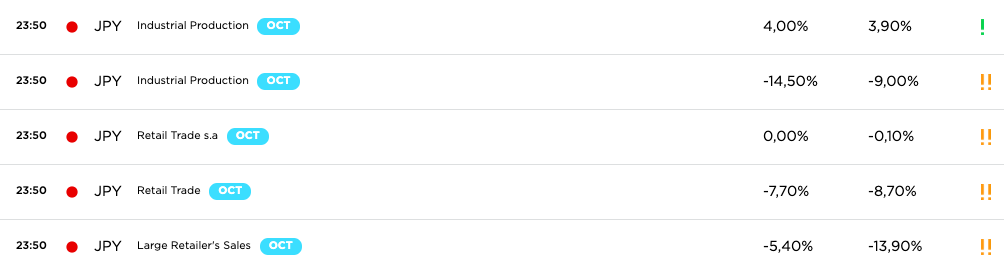

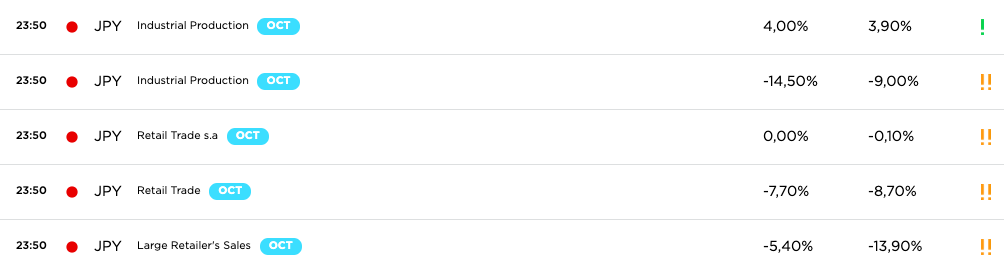

Octafx economic calendar

Account types

There are 3 account types available at octafx, which are determined by the trading platform you are using: micro (MT4), pro (MT5) and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts is the assets available to trade, the spreads and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged in the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

There is also an islamic swap-free account for those worried about whether trading is haram or halal. Note clients from the united states are not accepted at octafx or octa markets cyprus ltd.

Benefits

Traders enjoy several benefits when trading with octafx vs the likes of FBS, IQ option and exness:

- Metatrader and ctrader platforms

- Bonuses and contests (non-EU)

- Commission-free trading

- EU regulation

Drawbacks

Compared to other brokers such as hotforex, XTB and olymptrade, octafx does fall short in some areas:

- Not FCA regulated

- Limited funding methods

- Zero pip spreads unavailable

- No copy trading on ios devices

Trading hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on monday to 23:59 on friday server time (EET/EST). The ctrader server time zone is UTC +0, though you can set other time zones, such as GMT, for charts and trading information.

Customer support

For telephone support, non-EU clients can contact the helpline, +44 20 3322 1059, between 00:00 and 24:00, monday to friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, monday to friday (EET).

There is also an email form, however, the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website. The support team are helpful if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account.

In addition, you can find updates on the broker’s social media pages, as well as the octafx youtube channel.

The broker’s head office addresses are:

- Octafx, suite 305, griffith corporate centre, beachmont, kingstown, st vincent and the grenadines

- Octa markets cyprus ltd, 1 agias zonis and thessalonikis corner, nicolau pentadromos center, block: B’, office: 201, 3026, limassol, cyprus

The broker’s website is available in a number of languages for clients from indonesia, malaysia, pakistan and india.

Security

Octafx uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data. The broker also applies 3D secure visa authorisation when processing credit and debit card transactions.

Octafx verdict

Octafx offers a promising trading service for novices and experienced traders, with a choice of metatrader or ctrader platforms as well as the copytrading app. The broker offers fee-free deposits and withdrawals, plus islamic accounts and a demo solution. The ECN spreads are also decent, though not as competitive as the zero spread accounts offered at other brokers like XM, for example.

Accepted countries

Octafx accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use octafx from united states.

Is octafx a legit company and regulated broker?

Octafx is a legit company registered in saint vincent and the grenadines. The EU entity is registered in limassol, cyprus and regulated by cysec. If you’re unsure whether a broker is a scam or legit company, you can always check out customer reviews online.

Is octafx a market maker?

No, octafx is a no dealing desk (NDD) broker and therefore acts as an intermediary between the trader and the real market. Octafx receives commissions from its liquidity providers for each transaction.

How do I delete my octafx account?

To delete your account, you will need to get in touch with the customer support team. Note accounts are automatically deactivated if you never deposit or sign in to them.

How do I open a copytrading account at octafx?

You can sign up and login to the copytrading account in a few easy steps. Once you login to your personal area, you can set up your copytrading profile and make a deposit to your wallet. You can also sign in to your new account using the android app.

Why was my octafx withdrawal rejected?

If you encounter a withdrawal problem, you will receive a notification in your email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does octafx offer any free bonus deals?

At the time of writing, octafx is not offering any free bonus deals, no deposit bonus deals or promo codes. There are other promotions available for non-EU clients. Make sure to check the bonus conditions before participating.

Is octafx legal in india and pakistan?

Yes, you can legally open an octafx account from 100 countries, including india, pakistan, singapore, ghana and the UAE.

Octafx

Predictions and analysis

USDCHF pair still has a huge tendency of continuing in a bearish trend. The price crossover below the 100SMA also gives room for a retest. The intraday time frame(H4, H1) shows an oversold zone in the RSI. I would most likely bet on a profit target of 40 pips away from 0.88253 and a 30 pips stop loss in the buy direction.

Wath took 131 days was achieved in just 77 days with a 20-day correction!! So now with the same speed, we will hit 10,000$ mark soon

Use lot size which you can afford to loss

Buy this pair once the price move above 200 EMA and around 0.61500 $ as after the ranging price is expected to move in an uptrend

After one correction wave price is going to move upwards

Price expected to move upwards

The price will go further down

Wait for the price to reach the sell zone, then go short

The price of AUDUSD is at an important support level if the price takes a turn form here to expect a good long

The price is currently at strong resistance, also a triple top formation so the next wave is expected to be a downside

If the structure formation breaks successfully go for short more than 200 pip price will fall, however target is open

Price is currently sitting on the trend line which was to bottom 5 months back so expecting a push up from here

Ethereum is struggling to recover above the $150.00 resistance level, following last weeks sudden drop towards the $135.00 support zone. ETHUSD bulls need to rally the cryptocurrency above the $170.00 level to change the short-term bearish outlook. Ethereum continues to have a high correlation to bitcoin and could trade sideways until BTCUSD bulls return. • if.

The euro has started to firm test towards the 1.1100 level against the greenback as expected, following another round of weakness in the US dollar index. Buyers now need to rally the EURUSD pair above the 1.1110 resistance level to provoke a major technical breakout. Overall, buying any dips lower in the EURUSD pair appears to be the best option while the US.

The US dollar remains under downside pressure against the japanese yen, following the release of more weak data from the US economy. From a technical perspective, the USDJPY pair is extremely weak while trading below the 108.60 support level. Going forward, a break under the 108.20 level exposes the USDJPY pair to heavy technical selling towards the 107.50 level.

Bitcoin is starting to push lower in early wednesday trade after the buyers failed to gain traction above the $7,300 level earlier this week. A bearish head and shoulders pattern remains valid on the lower time frames while price trades below the $7,800 level. Overall, traders may use any pullbacks in price as a chance to short the BTCUSD pair, with the $6,600.

The british pound has moved to fresh six-week trading high against the US dollar, with the pair moving above the psychological 1.3000 level. Buyers need to hold price above the 1.3000 level to maintain the bullish medium-term range breakout. The GBPUSD pair could easily advance towards the 1.3100 level at this stage, with the 1.3200 level the ultimate upside.

The US dollar has fallen back under the 108.90 level against the japanese yen currency, making the pair technically bearish over the short-term. Continued weakness under this key area could provoke further losses towards the 108.20 level. The USDJPY pair could capitulate to technical selling if the 108.20 support level is broken. • the USDJPY pair is only.

Octafx review and tutorial 2021

Octafx offers multi-asset trading on a range of platforms and mobile solutions.

Octafx offers leveraged trading on currencies.

Trade popular digital currencies at octafx.

Octafx is a forex, CFD and copy trading broker offering the MT4, MT5 and ctrader platforms. In this broker review, we’ll login to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out if octafx is a good forex broker or not.

Octafx details

Octafx was established in 2011. The company’s headquarters are located in saint vincent and the grenadines, with an additional support office in jakarta, indonesia. The broker’s EU entity, octa markets cyprus ltd, is located in limassol, cyprus, and is regulated by the cysec.

With over 1.5 million trading accounts and a long list of forex industry awards, the founder and owner has ensured the company has amassed a global reach.

Trading platforms

Metatrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.

The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyse price fluctuations and trends in the market, using 3 customisable chart and graph types.

Note that MT4 is currently only available for non-EU clients.

Octafx metatrader 4

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.

Users enjoy 8 types of pending orders, 44 analytical objects including gann and fibonacci retracement, plus additional technical indicators which are unique to MT5, such as trend oscillators and bill williams’ tools. There’s also an economic calendar as well as two major accounting modes for greater flexibility: hedging and netting.

Both platforms come in several languages, including english, arabic and hindi, and are compatible with windows pcs. Octafx provides a useful download guide on the website.

Octafx metatrader 5

Metatrader webtrader

For those using mac pcs, octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser.

The web platforms are highly functional and customisable, boasting the same features found in the desktop versions, including charting tools, market indicators, scripts and expert advisors, plus access to diverse order types and execution modes.

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customisable interface. The platform boasts an impressive suite of 70 technical indicators and 28 chart timeframes, plus advanced level scalping and visual back-testing using cbot. With full market depth, traders can also execute advanced online trading strategies as well as programmable algorithms.

The ctrader platform is ready to download from the website once you have completed the registration process. The ctrader web terminal is also available for macos users.

Octafx ctrader

Markets

Octafx offers some of the most popular products, including:

- Forex – 28 currency pairs including EUR/USD and USD/JPY

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including spot gold and silver contracts, plus brent and crude oil

- Cryptocurrencies – 3 major digital currencies available; bitcoin, ethereum and litecoin

Trading fees

Typical variable spreads for EUR/USD are around 0.7 pips in both the metatrader and ctrader platforms. Gold spreads (XAUUSD) start from around 2 pips and major indices such as NAS100 are around 3.5 points. Bitcoin spreads (BTCUSD) are around 3.1 pips. Fixed spreads are also available for MT4 USD accounts.

Trading commissions are only charged in the ctrader account, at 0.03 USD per 0.01 lots. There are also rollover rates applied on positions held over 3 days. Details of these fees are listed in the product specifications.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2.

Note that EU clients can only trade with leverage up to 1:30.

Mobile apps

Octafx delivers mobile app versions of the MT4, MT5 and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications, including a complete set of orders in metatrader and full balance, margin and P&L information in ctrader. All trading apps come with a customisable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts.

Octafx MT4 mobile app

Octafx (non-EU) also offers a downloadable proprietary copy trading mobile app, currently available only on android (APK) devices. The app allows you to manage and keep track of trading accounts whilst on the go. Users can also activate bonuses, access trader tools and deposit into their accounts. The app download process is quick and can be accessed from the google play store.

Octafx mobile app

Payment methods

Octafx offers a few fast funding methods which vary depending on your origin country, including bank cards, perfect money and bitcoin. Local bank transfers are also available for traders from certain countries, including thailand, india and nigeria.

The minimum withdrawal and deposit amounts are 5 USD for perfect money, 0.00096000 for bitcoin and 50 EUR for cards. All deposits methods are generally processed instantly or within a few minutes.

There are no commissions charged on deposits, withdrawals or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings.

Demo account review

Octafx traders can open a demo account which provides the same trading experience as a live account but without risking any real investment. Each demo account is loaded with unlimited demo dollars and opportunities to participate in the broker’s demo contest to be one of the next champions. You can sign up for a free demo account in just a few minutes.

Octafx bonuses & promo codes

Octafx (non-EU) offers several deposit bonus deals, including a 50% bonus and a 100% bonus during special offer periods. In addition, there’s the trade & win promotion where traders can win gifts such as octafx t-shirts or gadgets. There are also contest opportunities, including the octafx 16 cars contest where traders are entered into a car prize draw every 3 months, as well as the champion demo contest 2020 for MT4 users.

Make sure to check all bonus terms and conditions before participating.

Regulation review

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec), under license number 372/18. EU member state residents are therefore protected by strict regulatory standards, including segregated client accounts and protection by the investor compensation fund.

The non-EU entity also claims to provide segregated client accounts to protect trader funds, as well as negative balance protection which ensures that trader account balances never fall below zero.

Additional features

Traders benefit from a range of additional education features and trading tools at octafx, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the autochartist plugin and live quotes.

Octafx also offers a copy trading service, which is available on the desktop terminal and through the android mobile app. The copy trading services allows clients to automatically copy leading traders based on the equity and leverage of both the master trader and the copier’s accounts.

Octafx economic calendar

Account types

There are 3 account types available at octafx, which are determined by the trading platform you are using: micro (MT4), pro (MT5) and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts is the assets available to trade, the spreads and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged in the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

There is also an islamic swap-free account for those worried about whether trading is haram or halal. Note clients from the united states are not accepted at octafx or octa markets cyprus ltd.

Benefits

Traders enjoy several benefits when trading with octafx vs the likes of FBS, IQ option and exness:

- Metatrader and ctrader platforms

- Bonuses and contests (non-EU)

- Commission-free trading

- EU regulation

Drawbacks

Compared to other brokers such as hotforex, XTB and olymptrade, octafx does fall short in some areas:

- Not FCA regulated

- Limited funding methods

- Zero pip spreads unavailable

- No copy trading on ios devices

Trading hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on monday to 23:59 on friday server time (EET/EST). The ctrader server time zone is UTC +0, though you can set other time zones, such as GMT, for charts and trading information.

Customer support

For telephone support, non-EU clients can contact the helpline, +44 20 3322 1059, between 00:00 and 24:00, monday to friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, monday to friday (EET).

There is also an email form, however, the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website. The support team are helpful if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account.

In addition, you can find updates on the broker’s social media pages, as well as the octafx youtube channel.

The broker’s head office addresses are:

- Octafx, suite 305, griffith corporate centre, beachmont, kingstown, st vincent and the grenadines

- Octa markets cyprus ltd, 1 agias zonis and thessalonikis corner, nicolau pentadromos center, block: B’, office: 201, 3026, limassol, cyprus

The broker’s website is available in a number of languages for clients from indonesia, malaysia, pakistan and india.

Security

Octafx uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data. The broker also applies 3D secure visa authorisation when processing credit and debit card transactions.

Octafx verdict

Octafx offers a promising trading service for novices and experienced traders, with a choice of metatrader or ctrader platforms as well as the copytrading app. The broker offers fee-free deposits and withdrawals, plus islamic accounts and a demo solution. The ECN spreads are also decent, though not as competitive as the zero spread accounts offered at other brokers like XM, for example.

Accepted countries

Octafx accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use octafx from united states.

Is octafx a legit company and regulated broker?

Octafx is a legit company registered in saint vincent and the grenadines. The EU entity is registered in limassol, cyprus and regulated by cysec. If you’re unsure whether a broker is a scam or legit company, you can always check out customer reviews online.

Is octafx a market maker?

No, octafx is a no dealing desk (NDD) broker and therefore acts as an intermediary between the trader and the real market. Octafx receives commissions from its liquidity providers for each transaction.

How do I delete my octafx account?

To delete your account, you will need to get in touch with the customer support team. Note accounts are automatically deactivated if you never deposit or sign in to them.

How do I open a copytrading account at octafx?

You can sign up and login to the copytrading account in a few easy steps. Once you login to your personal area, you can set up your copytrading profile and make a deposit to your wallet. You can also sign in to your new account using the android app.

Why was my octafx withdrawal rejected?

If you encounter a withdrawal problem, you will receive a notification in your email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does octafx offer any free bonus deals?

At the time of writing, octafx is not offering any free bonus deals, no deposit bonus deals or promo codes. There are other promotions available for non-EU clients. Make sure to check the bonus conditions before participating.

Is octafx legal in india and pakistan?

Yes, you can legally open an octafx account from 100 countries, including india, pakistan, singapore, ghana and the UAE.

Trade with a regulated broker that adheres to placing clients' asset protection at the forefront.

Octa markets cyprus ltd offers spot forex and contracts for differences (cfds) on assets including equity indices, spot metals and commodities. Octa markets cyprus ltd offers easy-to-use platforms such as metatrader 5 and ctrader.

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) with license №372/18. Octa markets cyprus ltd complies with european securities and market authority's (ESMA) regulatory standards as well as with market in financial instruments directive (mifid II)

Explore our platforms

Trading platforms are designed to enhance your trading experience. Access your trading account via mobile and desktop platforms.

Metatrader 5 and ctrader trading platforms are carefully designed to meet your trading needs.

Mobile and desktop trading on demo accounts

Trade markets with unlimited virtual funds. Test our trading platforms and your trading strategies with no risk involved by opening a demo account.

Octa markets cyprus ltd security

Negative balance protection

Octa markets cyprus ltd notice

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

The website is the property of octa markets cyprus ltd.

Octafx_official

About me octafx makes forex and CFD trading accessible for everyone. Ultra-low spreads and no commissions allow traders earn more with octafx than with other brokers.

Ethereum is struggling to recover above the $150.00 resistance level, following last weeks sudden drop towards the $135.00 support zone. ETHUSD bulls need to rally the cryptocurrency above the $170.00 level to change the short-term bearish outlook. Ethereum continues to have a high correlation to bitcoin and could trade sideways until BTCUSD bulls return. • if.

The euro has started to firm test towards the 1.1100 level against the greenback as expected, following another round of weakness in the US dollar index. Buyers now need to rally the EURUSD pair above the 1.1110 resistance level to provoke a major technical breakout. Overall, buying any dips lower in the EURUSD pair appears to be the best option while the US.

The US dollar remains under downside pressure against the japanese yen, following the release of more weak data from the US economy. From a technical perspective, the USDJPY pair is extremely weak while trading below the 108.60 support level. Going forward, a break under the 108.20 level exposes the USDJPY pair to heavy technical selling towards the 107.50 level.

Bitcoin is starting to push lower in early wednesday trade after the buyers failed to gain traction above the $7,300 level earlier this week. A bearish head and shoulders pattern remains valid on the lower time frames while price trades below the $7,800 level. Overall, traders may use any pullbacks in price as a chance to short the BTCUSD pair, with the $6,600.

The british pound has moved to fresh six-week trading high against the US dollar, with the pair moving above the psychological 1.3000 level. Buyers need to hold price above the 1.3000 level to maintain the bullish medium-term range breakout. The GBPUSD pair could easily advance towards the 1.3100 level at this stage, with the 1.3200 level the ultimate upside.

The US dollar has fallen back under the 108.90 level against the japanese yen currency, making the pair technically bearish over the short-term. Continued weakness under this key area could provoke further losses towards the 108.20 level. The USDJPY pair could capitulate to technical selling if the 108.20 support level is broken. • the USDJPY pair is only.

The british pound is firming above the 1.2940 level against the US dollar as the greenback comes under a fresh round of selling pressure. A sustained break above the 1.2960 resistance level exposes a potential technical test of the psychological 1.3000 level. Once above the 1.3000 level, the GBPUSD pair could quickly trade higher, with the 1.3200 resistance level.

Litecoin has failed to receive buying interest above the $50.00 resistance level, placing the emphasis on further downside. With the broader cryptocurrency market remaining under pressure, traders should be aware that a quick drop towards the $36.00 level could occur. Overall, only a sustained move above the $57.00 resistance level can change the short-term.

The euro is rising against the US dollar, following comments from US president donald trump surrounding more interest rate cuts from the federal reserve and weak US data. The EURUSD pair needs to hold price above the 1.1045 level to encourage fresh technical buying interest. A daily price close above the 1.1075 resistance level should be considered bullish for the.

The british pound continues to firm above the 1.2900 level against the US dollar, following a bullish weekly and monthly price close. Technical analysis shows that GBPUSD buyers have the upper hand while price closes above the 1.2890 level on a daily basis. Risk-averse traders may await a move above the 1.3000 level in order to confirm a range break and a.

The euro is trading back above the 1.1000 level against the US dollar after the pair bounced fairly sharply from the 1.0980 level on friday. A daily price above the 1.1070 level is now needed to confirm that a major technical bottom is in place for the EURUSD. Looking at the downside potential, a daily price close under the 1.0990 level should encourage bears to.

Bitcoin is under slight downside pressure in early week trade after being technically rejected just before the $8,000 resistance level. The BTCUSD pair was rejected from the top of a large falling wedge pattern on the daily time frame, currently located around the $7,800 level. Going, buyers need to maintain daily price closes above the $7,300 level to encourage.

Litecoin remains vulnerable to further downside on the cryptocurrency market as buyers struggle to reclaim the $50.00 resistance level. The LTCUSD pair still has the potential to fall towards the $36.00 level before medium-term buyers start to move. A sustained rally above the $50.00 level could see the LTCUSD pair testing back towards the technically important.

The euro has once again been rejected from the 1.1020 resistance level against the US dollar, as short-term buyers fail to take back control of the pair. A bullish double-bottom is still in place, although the EURUSD pair could break the november if weakness under the 1.1000 level persists. Going forward, a sustained breakout from the 1.0990 to 1.1020 trading.

The US dollar continues to target towards 110.00 level against the japanese yen as the greenback remains well-supported across the board. The recent high around the 109.60 level provided a signal that the USDJPY intends to push higher over the shor-term. The 110.90 level could be the overall upside objective for medium-term bulls if the 110.00 resistance level is.

The euro currency remains at risk of further losses against the US dollar, with the pair continuing to make bearish daily lower price lows. Going forward, a sustained loss of the 1.0990 support level would be extremely bearish for the EURUSD pair this week. At present, a daily price close above the 1.1070 level is needed to confirm that a new short-term bullish.

The british pound has staged a strong rebound from the 1.2830 level against the US dollar after selles failed to break under the current weekly trading low. Going forward, a series of bullish price close is needed above the 1.2900 level is needed to encourage medium-term buying. A new high above the important 1.2960 level would also be extremely bullish for the.

Bitcoin has staged a strong bounce back from its recent dip under the $7,000 level, with bulls performing a solid breakout above the $7,400 level. Short-term technical analysis shows that a recovery above the $7,400 level could lead to a rally back towards the $8,000 level. Only a sustained decline below the recent swing-low, at $6,850 can negate the possibility.

Octafx_official

About me octafx makes forex and CFD trading accessible for everyone. Ultra-low spreads and no commissions allow traders earn more with octafx than with other brokers.

Ethereum is struggling to recover above the $150.00 resistance level, following last weeks sudden drop towards the $135.00 support zone. ETHUSD bulls need to rally the cryptocurrency above the $170.00 level to change the short-term bearish outlook. Ethereum continues to have a high correlation to bitcoin and could trade sideways until BTCUSD bulls return. • if.

The euro has started to firm test towards the 1.1100 level against the greenback as expected, following another round of weakness in the US dollar index. Buyers now need to rally the EURUSD pair above the 1.1110 resistance level to provoke a major technical breakout. Overall, buying any dips lower in the EURUSD pair appears to be the best option while the US.

The US dollar remains under downside pressure against the japanese yen, following the release of more weak data from the US economy. From a technical perspective, the USDJPY pair is extremely weak while trading below the 108.60 support level. Going forward, a break under the 108.20 level exposes the USDJPY pair to heavy technical selling towards the 107.50 level.

Bitcoin is starting to push lower in early wednesday trade after the buyers failed to gain traction above the $7,300 level earlier this week. A bearish head and shoulders pattern remains valid on the lower time frames while price trades below the $7,800 level. Overall, traders may use any pullbacks in price as a chance to short the BTCUSD pair, with the $6,600.

The british pound has moved to fresh six-week trading high against the US dollar, with the pair moving above the psychological 1.3000 level. Buyers need to hold price above the 1.3000 level to maintain the bullish medium-term range breakout. The GBPUSD pair could easily advance towards the 1.3100 level at this stage, with the 1.3200 level the ultimate upside.

The US dollar has fallen back under the 108.90 level against the japanese yen currency, making the pair technically bearish over the short-term. Continued weakness under this key area could provoke further losses towards the 108.20 level. The USDJPY pair could capitulate to technical selling if the 108.20 support level is broken. • the USDJPY pair is only.

The british pound is firming above the 1.2940 level against the US dollar as the greenback comes under a fresh round of selling pressure. A sustained break above the 1.2960 resistance level exposes a potential technical test of the psychological 1.3000 level. Once above the 1.3000 level, the GBPUSD pair could quickly trade higher, with the 1.3200 resistance level.

Litecoin has failed to receive buying interest above the $50.00 resistance level, placing the emphasis on further downside. With the broader cryptocurrency market remaining under pressure, traders should be aware that a quick drop towards the $36.00 level could occur. Overall, only a sustained move above the $57.00 resistance level can change the short-term.

The euro is rising against the US dollar, following comments from US president donald trump surrounding more interest rate cuts from the federal reserve and weak US data. The EURUSD pair needs to hold price above the 1.1045 level to encourage fresh technical buying interest. A daily price close above the 1.1075 resistance level should be considered bullish for the.

The british pound continues to firm above the 1.2900 level against the US dollar, following a bullish weekly and monthly price close. Technical analysis shows that GBPUSD buyers have the upper hand while price closes above the 1.2890 level on a daily basis. Risk-averse traders may await a move above the 1.3000 level in order to confirm a range break and a.

The euro is trading back above the 1.1000 level against the US dollar after the pair bounced fairly sharply from the 1.0980 level on friday. A daily price above the 1.1070 level is now needed to confirm that a major technical bottom is in place for the EURUSD. Looking at the downside potential, a daily price close under the 1.0990 level should encourage bears to.

Bitcoin is under slight downside pressure in early week trade after being technically rejected just before the $8,000 resistance level. The BTCUSD pair was rejected from the top of a large falling wedge pattern on the daily time frame, currently located around the $7,800 level. Going, buyers need to maintain daily price closes above the $7,300 level to encourage.

Litecoin remains vulnerable to further downside on the cryptocurrency market as buyers struggle to reclaim the $50.00 resistance level. The LTCUSD pair still has the potential to fall towards the $36.00 level before medium-term buyers start to move. A sustained rally above the $50.00 level could see the LTCUSD pair testing back towards the technically important.

The euro has once again been rejected from the 1.1020 resistance level against the US dollar, as short-term buyers fail to take back control of the pair. A bullish double-bottom is still in place, although the EURUSD pair could break the november if weakness under the 1.1000 level persists. Going forward, a sustained breakout from the 1.0990 to 1.1020 trading.

The US dollar continues to target towards 110.00 level against the japanese yen as the greenback remains well-supported across the board. The recent high around the 109.60 level provided a signal that the USDJPY intends to push higher over the shor-term. The 110.90 level could be the overall upside objective for medium-term bulls if the 110.00 resistance level is.

The euro currency remains at risk of further losses against the US dollar, with the pair continuing to make bearish daily lower price lows. Going forward, a sustained loss of the 1.0990 support level would be extremely bearish for the EURUSD pair this week. At present, a daily price close above the 1.1070 level is needed to confirm that a new short-term bullish.

The british pound has staged a strong rebound from the 1.2830 level against the US dollar after selles failed to break under the current weekly trading low. Going forward, a series of bullish price close is needed above the 1.2900 level is needed to encourage medium-term buying. A new high above the important 1.2960 level would also be extremely bullish for the.

Bitcoin has staged a strong bounce back from its recent dip under the $7,000 level, with bulls performing a solid breakout above the $7,400 level. Short-term technical analysis shows that a recovery above the $7,400 level could lead to a rally back towards the $8,000 level. Only a sustained decline below the recent swing-low, at $6,850 can negate the possibility.

Octafx review

Octafx

Leverage: 1:30 | 1:500

Regulation: cysec

Min. Deposit: 100 EUR

HQ: SVG, cyprus

Platforms: MT5, ctrader

Found in: 2011

Octafx licenses

- Octa markets cyprus ltd - authorized by cysec (cyprus) registration no. 372/18

- Octa markets incorporated - authorized by the FSA (SVG)

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

- What is octafx?

- Awards

- Safe or a scam?

- Leverage

- Accounts

- Market instruments

- Fees

- Deposits and withdrawals

- Trading platforms

- Customer support

- Education

- Conclusion

What is octafx?

Octafx is a technology based brokerage company that operates since 2011 and offers industry leading platforms such as metatrader5 and ctrader with numerous investment opportunities and great capabilities.

At the beginning of its establishment octafx walked a path from an offshore brand located in SVG and further on operated in the UK, however since 2017 closed its entity and moved to cyprus.

So, together with the european cysec license broker operates also a global offering from its entity, therefore check on carefully under which regulation you will fall as it may propose different trading conditions.

| Pros | cons |

|---|---|

| forex and cfds offered | phone support not available 24/7 |

| great trading tools | no forex education |

| MT5 and ctrader platforms offered | |

| fast account opening and free demo account | |

| no commission deposits and withdrawal options |

What type of broker is octafx?

Octafx is an STP forex broker also with high standards of secure trading environment, as of the regulation it imposes. The offering to the clients is wide and even comprehensive since proposes the same if not more investment opportunities to the world trading community.

10 points summary

| �� headquarters | broker located in SVG and cyprus |

| ��️ regulation | cysec, FSA SVG |

| �� platforms | MT5, ctrader |

| �� instruments | cfds on commodities, forex, metals, indices and energies |

| �� demo account | available |

| �� minimum deposit | 100$ |

| �� EUR/USD spread | 0.5 pips |

| �� base currencies | USD, EUR |

| �� education | available only through international entity |

| ☎ customer support | 24/5 |

Awards

Octafx already quite known and operates for a while despite a fact that received its european license just recently. So for the years it operates, octafx participates to various exhibitions and received numerous international awards along with the huge number of active traders registered at the company. That all in all confirm its status and reputable position in the industry, which we will also be able to see in detail further in our octafx review.

Is octafx safe or a scam?

The main issue and topic of our octafx review among others if its safe trading environment, which is checked as first due to its regulatory obligation and license under which the broker operated. Octafx launched since 2011 walked a path with various operation licenses including SVG registration, operating the UK branch, yet suspended this entity back in 2017 and target cyprus as its next destination of operation.

| Pros | cons |

|---|---|

| cysec regulated international broker | previously operated only offshore entity |

| global coverage and years of operation | |

| negative balance protection applied |

Is octafx legit?

So, the main gap for these years of operation was the fact that octafx was a brand of the octa markets incorporated company that is registered, regulated and governed by the law of saint-vincent and the grenadines. Which is offshore heaven for its tax-management as well as relative ease to establish a company. Now, since octafx established its legal entity in cyprus and respectively got a license from the local cysec, which also impose regulation according to european ESMA standards.

Therefore, now we can state that octafx and its octa markets cyprus ltd entity shows us a clear state of the compliance to the necessary operation standards.

Since the regulation demands strict follow of forex business operations management, it is considered safe to open an account either with cyprus or international octafx entity.

How are you protected?

The set of regulatory requirements enables protection to the clients and including – funds segregation, application of negative balance protection while the broker is constantly overseen by the authority in terms of its safety compliance. In addition, there is a security of the traders’ accounts applied by the investor protection and compensation schemes in case the broker goes bankrupt.

Leverage

As for the leverage as a known instrument that increases the initial capital you trading with and can be a very useful tool to magnify potential gains is offered by the octafx broker as well. However, along with its great capabilities, leverage increases risks together with its benefits, so you should always learn how to use tools smartly.

Risk level

The risk level is defined also by the leverage level you use since higher leverage dramatically increases your high risk to lose money as well.

For this reason, world authorities and regulators restrict leverage to use to specify, safer levels for retail traders. Therefore, octafx cyprus entity together with its operations established under ESMA rules offers lower leverage levels as defined by the regulator. This means that european traders or those clients that are registered with octafx european entity will fall under ESMA regulation that recently limited leverage.

Yet, if you still prefer to use high leverage international entity of octafx still allows so.

- European traders leverage is maximum 1:30 for major currency pairs, 1:10 for commodities

- International traders can still use leverage until 1:500

Accounts

Another important note within octafx review is a range of account types through which you will access trading. Eventually, the broker offers two account types that also define trading conditions and the platform that is used for trading itself.

| Pros | cons |

|---|---|

| fast digital account opening | none |

| single account for metatrader5 or ctrader platforms | |

| demo account offered | |

| option between trading fee models |

Types of accounts

As the broker defines by itself the MT5 account offered for a conservative trader as it is suitable for the majority of investors also supporting all trading styles and social trading as well. While ctrader will be more suitable for progressive traders or professionals as offers comprehensive trading conditions with commission based fee structure.

Besides, there is an option to submit for a demo practice account and use its unlimited sources to polish strategy or get to know platforms and octafx conditions better.

Yet, the international proposal includes also ECN and PRO account based on the platforms, besides micro account on metatrader4 platform is offered too. It is recommended for novice traders and allows micro lot trading with floating spreads starting at 0.4 pips or fixed spread at 2 pips.

Trading instruments

So what you can trade with octafx? The market range offers you the most demanded instrument while base on the CFD trading model and offering you an opportunity to speculate on the price movement on forex currency pairs, metals, energies and indices.

Another good point at octafx is its pricing strategy or a fee which you will need to pay for the usage of the octafx trading service. There are two options according to the account type you choose and the platform you use, offered by the octa markets.

While an international brand may offer slightly different conditions, which you may check from the site better.

| Pros | cons |

|---|---|

| low forex fees | inactivity fee |

| options between spread only or commission fee basis | |

| 0$ withdrawal fee | |

| micro lot trading available |

Our find on CFD fees

So fee strategy is different according to the platforms while MT5 offers you spread only basis with a minimum spread of EUR USD 0.2 pips, which is a very good offering compared to industry standards.

And ctrader brings you access to raw spread from 0 pip for EUR USD pair plus the commission charge of 3$ pet lot.

Also, see below the comparison table with a typical octafx spread and compare brokers to other CFD brokers with CFD fees, commission or inactivity fee if applicable.

Trading fees of octafx vs similar brokers

| asset/ pair | octafx fees | avatrade fees | etoro fees |

|---|---|---|---|

| EUR USD | 0.5 pips | 1.3 pips | 3 pips |

| crude oil WTI | 2 pips | 3 pips | 5 pips |

| gold | 20 | 40 | 45 |

| inactivity fee | yes | yes | yes |

| fee ranking | low | average | high |

Here is a snapshot of octafx fees

Overnight fee

Also, always consider overnight charge or swap in case you’re holding the position longer than a day. It is always defined by the instrument you trade and may be visible either through a website or platform while trading. See the example on the snap above.

Deposits and withdrawals

Being able to access your funds at any time with ease and convenience is another point with a regulated broker and our octafx review. So together with its strict money management rules, you may fund your account by deposit through a bank account with no complication.

| Pros | cons |

|---|---|

| no deposit fees | limited deposit and withdrawal option for european clients |

| withdrawals free of charge | no credit card supported for cyprus entity |

| wide range of payment methods supported by an international entity |

Deposit fees and options

As a licensed broker that obliges to safety measures, octafx cyprus offers only bank wire transfer for its european clients. While international entity includes also credit cards, e-wallets and other methods which you may check with customer service before any transfer is done.

- Bank wire transfer

What is also great, there is no charges for deposits so you won’t pay any commission, however always define it with your payment provider or bank itself as an international rule vary from jurisdiction to another.

Minimum deposit requirement

By the octafx policy, the minimum deposit set to a EUR100 allowing you to open any account type from the two offered by the broker.

Money withdrawal

Money withdrawal is the same smooth process, while octafx also covers fees so you may access your moany at any time and receive it relatively quickly. Usually, octafx confirms withdrawals within 1-2 business days, but allow extra days for you bank to process the transaction.

Here are the steps to withdraw money from octafx

By a simple follow of instructions, you may access your account and submit a withdrawal. And of course, you may always count on a great help center which is remaining at your assistance.

How do you withdraw money from account?

1. Login to your account. Select on withdraw funds’ at the menu tab

2. Fill in the form and enter the desired withdraw amount

3. Choose the withdrawal method

4. Complete the necessary form requirements

5. Confirm withdrawal details and submit

Trading platforms

Lastly and what we like the most is the octafx platform offering, while you may select either industry leading software also its newer version metatrader5 with all benefits included and not restricted, also with copy trading option. Or to use advanced and very powerful capabilities of ctrader platform.

The choice between the platform is always your and they are indeed very different, also bringing different price model and more suitable trading strategy. Metatrader5 is good for everyone and more trader friendly software, also copy trading available through it.

While ctrader platform is more sophisticated technology also the one that offering ECN direct market access which might be a better option for professionals. Besides, if you open an account with the international brand of octafx there is an option to use metatrader4 and operate through an account with micro lot trading option.

Scores & availability of different platforms

| pros | cons |

|---|---|

| option between metatrader5 and ctrader | no education or video support for european entity, but available through international site |

| user friendly design | |

| price alerts and push notifications | |

| fee report | |

| supporting various languages | |

| web, mobile and desktop versions | |

| MT4 offered only by international entity |

Web trading platform

Both platforms supporting various versions that you may access either just by the load through your browser without any installation which is very useful. Metatrader will bring you all the benefits and powerful capabilities it offers, while ctrader webtrader is also featuring great design and look.

Desktop platform

However, advanced traders would prefer the desktop version as it feature much more customization capabilities and tools to use. So here both platforms also available for download and suitable for any operating system either ios or windows.

Look and feel

Both platforms are with clear look and feel, indeed ctrader is more complex to understand as it is packed with advanced tools yet the design is easy to navigate and customize.

Automated trading

Octafx automated trading capabilities are also useful for either beginning or professional trading through the use of popular eas. You may either create your own once or follow a specified strategy available through the community or in the market place.

Mobile trading platform

The mobile app is also offered for both platforms, while apps are simple to use and offer a wide range of tools at the same time. MT5 mobile offers various charting capabilities also customization which is fantastic for mobile trading along with full management of your account.

Customer service

Also, octafx customer support provides its clients with 24-hour live support available through live chat, email and phone support in various languages. Eventually, avatrade offers some of the greatest quality support with fast and reliable answers and a huge range of free of charge lines all around the world.

Education

Unfortunately, there is no education center or any learning materials about the trading process offered by cyprus entity, either octafx does not provide webinars or analytical research which is not so good for complete beginners.

However, octafx provides education and analysis through its international brand along with unlimited demo platforms allowing to practice strategies and test the offered systems. So if you’re beginning trader maybe you can see competition or participate to the course using other sources.

Yet, we can forgive this missing point to octafx as there are truly many benefits on the trading conditions they provide.

| Pros | cons |

|---|---|

| free unlimited demo account available | no education videos, webinars or learning materials provided by the cyprus entity. All education and analysis tools included in the international offering |

| wide range of trading tools | |

| trading ideas and social trading options | |

| economic indicators and news feed |

Research

In addition to its some of the good quality trading offerings among industry, all clients can enjoy absolutely stunning research tools and trading tools that are accessible directly through the platforms. Along with other user-friendly tools including calculator, fantastic and clear charting with built-in news feed and other essential trading data for your better trading.

Conclusion

Overall, octafx review shows us a broker with a quality trading strategy which offers also flexibility in terms of conditions, platforms and instruments it proposes.

While before we had some concerns due to its operation only through offshore entity now the trust is on a certain good level as octafx is regulated by the european cysec aligned with mifid directive. Therefore means its operation aligned to the necessary protection level through its either entity.

Read more about octafx license through our news by the link.

What we also admit is high-tech access to a range of the instrument and multiple platforms either for manual, algorithmic or social trading. It is definitely a great advantage that octafx offers both industry popular metatrader platform and powerful ctrader which is highly regarded by the professional traders.

Nevertheless, make sure to check the proposal of the particular octafx entity as an international brand and a cyprus one offers slightly different conditions. While obviously, octafx international proposal features more comprehensive tools and conditions along with education and research materials also MT4 availability.

Yet, it is always great to hear your personal opinion about octafx. So you may share your experience or thoughts or discuss them below or ask us for additional information.

So, let's see, what was the most valuable thing of this article: trade with reliable broker and best conditions: low spreads, no swaps, no commissions. Claim and withdraw 50% deposit bonus! At octafx trading

Contents of the article

- Today forex bonuses

- Trade with a regulated broker that adheres to...

- Explore our platforms

- Mobile and desktop trading on demo accounts

- Octafx

- Predictions and analysis

- Octafx review and tutorial 2021

- Octafx details

- Trading platforms

- Markets

- Trading fees

- Leverage

- Mobile apps

- Payment methods

- Demo account review

- Octafx bonuses & promo codes

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Octafx verdict

- Accepted countries

- Is octafx a legit company and regulated broker?

- Is octafx a market maker?

- How do I delete my octafx account?

- How do I open a copytrading account at octafx?

- Why was my octafx withdrawal rejected?

- Does octafx offer any free bonus deals?

- Is octafx legal in india and pakistan?

- Octafx

- Predictions and analysis

- Octafx review and tutorial 2021

- Octafx details

- Trading platforms

- Markets

- Trading fees

- Leverage

- Mobile apps

- Payment methods

- Demo account review

- Octafx bonuses & promo codes

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Octafx verdict

- Accepted countries

- Is octafx a legit company and regulated broker?

- Is octafx a market maker?

- How do I delete my octafx account?

- How do I open a copytrading account at octafx?

- Why was my octafx withdrawal rejected?

- Does octafx offer any free bonus deals?

- Is octafx legal in india and pakistan?

- Trade with a regulated broker that adheres to...

- Explore our platforms

- Mobile and desktop trading on demo accounts

- Octafx_official

- Octafx_official

- Octafx review

- Top 3 forex brokers

- What is octafx?

- Awards

- Is octafx safe or a scam?

- Leverage

- Accounts

- Trading instruments

- Deposits and withdrawals

- Deposit fees and options

- Minimum deposit requirement

- Money withdrawal

- Here are the steps to withdraw money from octafx

- How do you withdraw money from account?

- Trading platforms

- Scores & availability of different platforms

- Web trading platform

- Desktop platform

- Look and feel

- Automated trading

- Mobile trading platform

- Customer service

- Education

- Research

- Conclusion

No comments:

Post a Comment