Octafx payment methods

Unfortunately, however, we have to note that with octafx, the MT4 trading platform is currently only available for clients outside the european union.

Today forex bonuses

Octafx offers a few funding methods which vary depending on the jurisdiction under which you fall. These include bank cards, E-wallets, and crypto coins. Local bank transfers are also available for traders from certain countries, including thailand, india, and nigeria.

Octafx fees and costs – spread comparison

Octafx fees and spreads are those charges for the brokerage services the broker provides to the clients. The quality of services that octafx offers is top-notch. From a stellar trading platform to a wide range of markets, octafx goes the extra mile in serving its traders well.

However, to continue rendering these offers and services, it must be paid well. The only way it can do this is via fees, commissions, and spreads. Here, we detail the octafx fees and spreads so that you can be well informed as to what the broker will charge you for the services it renders.

The following fees can occur if you are an octafx trader:

- Spread

- Commission

- Overnight-free (swap)

- Deposit and withdrawal fee (depending on the payment method, mostly free)

(risk warning: you capital can be at risk)

Octafx fees and spreads

The fees spreads and commission that octafx charges start from US dollar 7 with spreads as low as 0.0 pips. The online broker has a low and incredibly competitive spread when compared to what other brokers offer. It offers a list of spreads which starts from 0.0 pip along with commissions charged from US dollar 0.02 per 0.01 lot for traders using the ECN ctrader account.

Octafx trading fees are according to the type of account that the trader chooses and the options along with the spread list, leverage, and commissions are as follows:

MT4 micro account

Leverage goes up to 1:500 for forex, 1:200 for metals, 1:50 for indices, and 1:2 for cryptocurrencies. The floating spreads start from 0.4 pips, fixed spreads at 2 pips. There are zero commissions charged on trades.

| Asset: | spreads from: | commissions: | swap short (points): | swap long (points): |

|---|---|---|---|---|

| EUR/USD | 0.6 pips | no | -1.90 | -2.10 |

| GBP/USD | 0.9 pips | no | -4.80 | -2.80 |

| USD/JPY | 1.0 pips | no | -3.70 | -1.10 |

| GOLD (XAU/USD) | 1.8 points | no | -2.65 | -5.83 |

| DOW JONES (US30) | 2.5 points | no | -8.00 | -8.00 |

| BITCOIN (BTC/USD) | 2.8 points | no | -2.00 | -2.00 |

MT5 pro account

You have the leverage of up to 1:200 for forex, 1:100 for metals and energies, 1:50 for indices, 1:2 for cryptocurrencies. You floating spreads from 0.2 pips and zero commissions as well.

| Asset: | spreads from: | commissions: | swap: | three days fee: |

|---|---|---|---|---|

| EUR/USD | 0.6 pips | no | no | -0.1 |

| GBP/USD | 0.9 pips | no | no | -0.1 |

| USD/JPY | 1.0 pips | no | no | -0.1 |

| GOLD (XAU/USD) | 1.8 points | no | no | -0.2 |

| DOW JONES (US30) | 2.5 points | no | no | -0.3 |

| BITCOIN (BTC/USD) | 2.8 points | no | no | -0.1 |

Ctrader ECN account

The leverage here might also go up to 1:500 for forex and 1:200 for metals, floating spreads from 0 pips, and commissions from US dollar 0.02 per 0.01 lot.

| Asset: | spreads from: | commissions: | swap: | weekly rollover: |

|---|---|---|---|---|

| EUR/USD | 0.4 pips | $3/1lot | no | -0.2 |

| GBP/USD | 0.4 pips | $3/1lot | no | -0.3 |

| USD/JPY | 0.4 pips | $3/1lot | no | -0.3 |

| GOLD (XAU/USD) | 1.2 points | $3/1lot | no | -0.4 |

Overall, we can say that the trading fees are very cheap with this broker. Compared to other forex brokers, octafx offers professional and suitable trading conditions for any type of trading.

(risk warning: you capital can be at risk)

Introduction to octafx

Octafx is a forex, CFD, and copy trading broker that offers quality trading services via the MT4, MT5, and ctrader platforms. It was established in 2011 with headquarters located in saint vincent and the grenadines. It, however, has an area office in jakarta, indonesia. Because of regulations, the broker has entities covering different jurisdictions.

Octafx’s EU company, octa markets cyprus ltd, is located in cyprus and is regulated by the cyprus securities and exchange commission (cysec). With over 1.5 million trading accounts and a commendable list of forex broker awards, the broker has commanded global attention and continued to grow at an exponential rate. The awards include:

- Best ECN/STP broker 2019 – fxdaily info

- Best forex broker asia 2019 – also by fxdaily info

- Best copy trading platform 2018 – forex-awards.Com

- Best forex broker asia 2018 – global banking & finance review

- Best FX broker 2018 – european CEO magazine

- Best forex ECN broker 2017 – UK finance awards

Octafx trading platforms

Octafx offers quality trading services via a variety of trading platforms. This variety allows traders the ability to choose from enough options. The good thing about octafx trading platforms is that they are synced. So, you can easily switch from one platform to another in real-time. This is because what you do on one platform automatically reflects one another. We will examine each platform below:

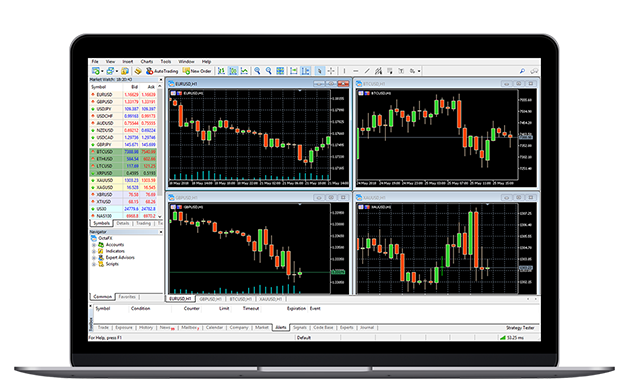

Metatrader 4

The MT4 platform is popular trading software used by both retail and institutional traders, due to its ease of use and flexibility. The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the countless in-built technical indicators, advanced charting tools allow you to analyze price fluctuations and trends in the market.

Unfortunately, however, we have to note that with octafx, the MT4 trading platform is currently only available for clients outside the european union.

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy, and more advanced features. It is a big upgrade to the legacy MT4 that people had used for generations. Users enjoy multiple types of pending orders, several analytical objects, plus additional technical indicators that are unique to MT5. There’s also an economic calendar.

Both the MT4 and MT5 come in several languages, including english, arabic, and hindi, and are compatible with windows and macos pcs. Octafx provides a useful download guide on the website.

Webtrader

Octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser. The web platforms are highly functional and customizable, boasting the same features found in the desktop versions, including charting tools, market indicators, and expert advisors, plus access to diverse order types and execution methods.

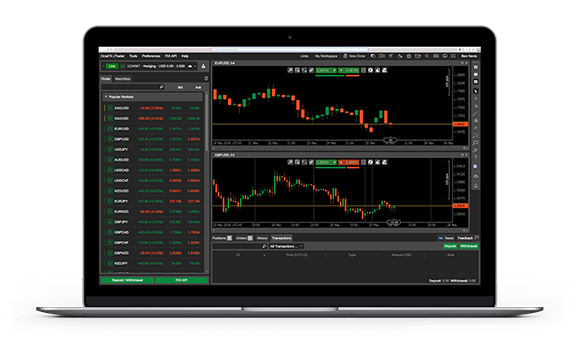

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. It is fast becoming one of the most popular trading platforms. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customizable interface. It boasts an impressive array of 70 technical indicators and a lot of chart timeframes, plus advanced level scalping and visual back-testing by making use of the cbot.

With full market depth, traders can also execute advanced online trading strategies as well as develop their own trading algorithms. The ctrader platform is ready for download from the website once you have completed the registration process. The ctrader web terminal is also available for traders using the macos.

Available assets:

Octafx offers some of the most popular assets, including:

- Forex – 28 currency pairs. However, octafx does not offer a good list of minor and exotic currencies.

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including gold and silver contracts and brent and crude oil

- Cryptocurrencies – 3 major crypto coins including bitcoin, ethereum and litecoin

The fees and commissions are always depending on the asset and account type. We highlighted it in the table above.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2. Note that traders in the EU can only trade with leverage up to 1:30. This is because of the regulation put by EU authorities.

Octafx mobile apps

Octafx delivers mobile app versions of the MT4, MT5, and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications including a complete set of orders in metatrader and full balance, margin, and P&L information in ctrader.

All trading apps come with a customizable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts. Octafx also offers a proprietary copy trading mobile app, currently available only on android (APK) devices. It is also only available for traders residing outside of the EU. The app allows you to manage and keep track of trading accounts of veteran and more experienced traders whilst on the go.

Users can also activate bonuses, access trader tools, and deposit into their accounts. The app can be accessed from the google play store.

Octafx payment methods

Octafx offers a few funding methods which vary depending on the jurisdiction under which you fall. These include bank cards, E-wallets, and crypto coins. Local bank transfers are also available for traders from certain countries, including thailand, india, and nigeria.

There are no commissions charged on deposits, withdrawals, or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings. For withdrawals, it may, however, take some time for the funds to be credited to your account.

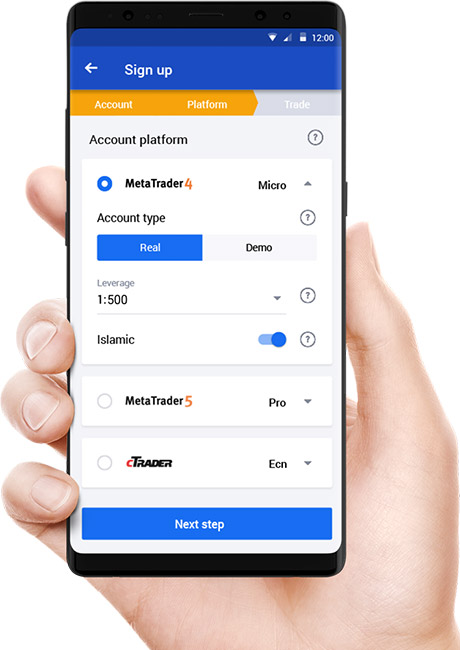

Octafx account types

There are 3 account types available at octafx, determined by the trading platform you use: micro (MT4), pro (MT5), and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts are the assets available to trade, the spreads, and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged on the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

Customer support

Octafx boasts quality customer support services as one of the premium services it offers to its customers. More importantly, you can reach customer service via a myriad of channels. First, there is the telephone support; non-EU clients can contact the helpline, +44 20 3322 1059, while for clients that stay within the EU, the number to call is +357 25 251 973. Traders are, however, limited to calling between mondays and fridays.

Secondly, you can reach out via email. Thirdly and the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website.

Conclusion on the octafx fees and costs

In today’s trading world, we do enjoin traders to go for brokers that charge very low fees – as that has now become the reality. Octafx is one of those brokers that provide you with inexpensive, but high-quality trading service.

All in all, we tested the offers of octafx and we came to the conclusion that it is a very cheap broker to trade with. There are no hidden or expensive fees. So we can clearly recommend this forex broker.

Octafx review and tutorial 2021

Octafx offers multi-asset trading on a range of platforms and mobile solutions.

Octafx offers leveraged trading on currencies.

Trade popular digital currencies at octafx.

Octafx is a forex, CFD and copy trading broker offering the MT4, MT5 and ctrader platforms. In this broker review, we’ll login to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out if octafx is a good forex broker or not.

Octafx details

Octafx was established in 2011. The company’s headquarters are located in saint vincent and the grenadines, with an additional support office in jakarta, indonesia. The broker’s EU entity, octa markets cyprus ltd, is located in limassol, cyprus, and is regulated by the cysec.

With over 1.5 million trading accounts and a long list of forex industry awards, the founder and owner has ensured the company has amassed a global reach.

Trading platforms

Metatrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.

The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyse price fluctuations and trends in the market, using 3 customisable chart and graph types.

Note that MT4 is currently only available for non-EU clients.

Octafx metatrader 4

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.

Users enjoy 8 types of pending orders, 44 analytical objects including gann and fibonacci retracement, plus additional technical indicators which are unique to MT5, such as trend oscillators and bill williams’ tools. There’s also an economic calendar as well as two major accounting modes for greater flexibility: hedging and netting.

Both platforms come in several languages, including english, arabic and hindi, and are compatible with windows pcs. Octafx provides a useful download guide on the website.

Octafx metatrader 5

Metatrader webtrader

For those using mac pcs, octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser.

The web platforms are highly functional and customisable, boasting the same features found in the desktop versions, including charting tools, market indicators, scripts and expert advisors, plus access to diverse order types and execution modes.

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customisable interface. The platform boasts an impressive suite of 70 technical indicators and 28 chart timeframes, plus advanced level scalping and visual back-testing using cbot. With full market depth, traders can also execute advanced online trading strategies as well as programmable algorithms.

The ctrader platform is ready to download from the website once you have completed the registration process. The ctrader web terminal is also available for macos users.

Octafx ctrader

Markets

Octafx offers some of the most popular products, including:

- Forex – 28 currency pairs including EUR/USD and USD/JPY

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including spot gold and silver contracts, plus brent and crude oil

- Cryptocurrencies – 3 major digital currencies available; bitcoin, ethereum and litecoin

Trading fees

Typical variable spreads for EUR/USD are around 0.7 pips in both the metatrader and ctrader platforms. Gold spreads (XAUUSD) start from around 2 pips and major indices such as NAS100 are around 3.5 points. Bitcoin spreads (BTCUSD) are around 3.1 pips. Fixed spreads are also available for MT4 USD accounts.

Trading commissions are only charged in the ctrader account, at 0.03 USD per 0.01 lots. There are also rollover rates applied on positions held over 3 days. Details of these fees are listed in the product specifications.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2.

Note that EU clients can only trade with leverage up to 1:30.

Mobile apps

Octafx delivers mobile app versions of the MT4, MT5 and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications, including a complete set of orders in metatrader and full balance, margin and P&L information in ctrader. All trading apps come with a customisable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts.

Octafx MT4 mobile app

Octafx (non-EU) also offers a downloadable proprietary copy trading mobile app, currently available only on android (APK) devices. The app allows you to manage and keep track of trading accounts whilst on the go. Users can also activate bonuses, access trader tools and deposit into their accounts. The app download process is quick and can be accessed from the google play store.

Octafx mobile app

Payment methods

Octafx offers a few fast funding methods which vary depending on your origin country, including bank cards, perfect money and bitcoin. Local bank transfers are also available for traders from certain countries, including thailand, india and nigeria.

The minimum withdrawal and deposit amounts are 5 USD for perfect money, 0.00096000 for bitcoin and 50 EUR for cards. All deposits methods are generally processed instantly or within a few minutes.

There are no commissions charged on deposits, withdrawals or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings.

Demo account review

Octafx traders can open a demo account which provides the same trading experience as a live account but without risking any real investment. Each demo account is loaded with unlimited demo dollars and opportunities to participate in the broker’s demo contest to be one of the next champions. You can sign up for a free demo account in just a few minutes.

Octafx bonuses & promo codes

Octafx (non-EU) offers several deposit bonus deals, including a 50% bonus and a 100% bonus during special offer periods. In addition, there’s the trade & win promotion where traders can win gifts such as octafx t-shirts or gadgets. There are also contest opportunities, including the octafx 16 cars contest where traders are entered into a car prize draw every 3 months, as well as the champion demo contest 2020 for MT4 users.

Make sure to check all bonus terms and conditions before participating.

Regulation review

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec), under license number 372/18. EU member state residents are therefore protected by strict regulatory standards, including segregated client accounts and protection by the investor compensation fund.

The non-EU entity also claims to provide segregated client accounts to protect trader funds, as well as negative balance protection which ensures that trader account balances never fall below zero.

Additional features

Traders benefit from a range of additional education features and trading tools at octafx, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the autochartist plugin and live quotes.

Octafx also offers a copy trading service, which is available on the desktop terminal and through the android mobile app. The copy trading services allows clients to automatically copy leading traders based on the equity and leverage of both the master trader and the copier’s accounts.

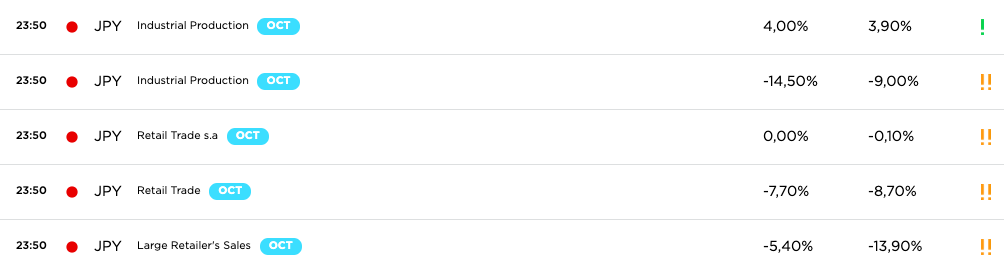

Octafx economic calendar

Account types

There are 3 account types available at octafx, which are determined by the trading platform you are using: micro (MT4), pro (MT5) and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts is the assets available to trade, the spreads and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged in the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

There is also an islamic swap-free account for those worried about whether trading is haram or halal. Note clients from the united states are not accepted at octafx or octa markets cyprus ltd.

Benefits

Traders enjoy several benefits when trading with octafx vs the likes of FBS, IQ option and exness:

- Metatrader and ctrader platforms

- Bonuses and contests (non-EU)

- Commission-free trading

- EU regulation

Drawbacks

Compared to other brokers such as hotforex, XTB and olymptrade, octafx does fall short in some areas:

- Not FCA regulated

- Limited funding methods

- Zero pip spreads unavailable

- No copy trading on ios devices

Trading hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on monday to 23:59 on friday server time (EET/EST). The ctrader server time zone is UTC +0, though you can set other time zones, such as GMT, for charts and trading information.

Customer support

For telephone support, non-EU clients can contact the helpline, +44 20 3322 1059, between 00:00 and 24:00, monday to friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, monday to friday (EET).

There is also an email form, however, the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website. The support team are helpful if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account.

In addition, you can find updates on the broker’s social media pages, as well as the octafx youtube channel.

The broker’s head office addresses are:

- Octafx, suite 305, griffith corporate centre, beachmont, kingstown, st vincent and the grenadines

- Octa markets cyprus ltd, 1 agias zonis and thessalonikis corner, nicolau pentadromos center, block: B’, office: 201, 3026, limassol, cyprus

The broker’s website is available in a number of languages for clients from indonesia, malaysia, pakistan and india.

Security

Octafx uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data. The broker also applies 3D secure visa authorisation when processing credit and debit card transactions.

Octafx verdict

Octafx offers a promising trading service for novices and experienced traders, with a choice of metatrader or ctrader platforms as well as the copytrading app. The broker offers fee-free deposits and withdrawals, plus islamic accounts and a demo solution. The ECN spreads are also decent, though not as competitive as the zero spread accounts offered at other brokers like XM, for example.

Accepted countries

Octafx accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use octafx from united states.

Is octafx a legit company and regulated broker?

Octafx is a legit company registered in saint vincent and the grenadines. The EU entity is registered in limassol, cyprus and regulated by cysec. If you’re unsure whether a broker is a scam or legit company, you can always check out customer reviews online.

Is octafx a market maker?

No, octafx is a no dealing desk (NDD) broker and therefore acts as an intermediary between the trader and the real market. Octafx receives commissions from its liquidity providers for each transaction.

How do I delete my octafx account?

To delete your account, you will need to get in touch with the customer support team. Note accounts are automatically deactivated if you never deposit or sign in to them.

How do I open a copytrading account at octafx?

You can sign up and login to the copytrading account in a few easy steps. Once you login to your personal area, you can set up your copytrading profile and make a deposit to your wallet. You can also sign in to your new account using the android app.

Why was my octafx withdrawal rejected?

If you encounter a withdrawal problem, you will receive a notification in your email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does octafx offer any free bonus deals?

At the time of writing, octafx is not offering any free bonus deals, no deposit bonus deals or promo codes. There are other promotions available for non-EU clients. Make sure to check the bonus conditions before participating.

Is octafx legal in india and pakistan?

Yes, you can legally open an octafx account from 100 countries, including india, pakistan, singapore, ghana and the UAE.

How to make a deposit at octafx forex trading account

In order to start trading on real forex account and earn money you need to make a deposit. Before making a deposit you should know that octafx does not charge commission on deposits or withdrawals. Moreover, octafx covers fees applied by payment systems. We also do not limit the number of deposits per day. Deposits with local banks are processed within 1-3 hours, credit/debit card and e-wallet deposits are instant.

Minimum deposit for pro account on metatrader 5 is $500. Forex traders from indonesia, pakistan, malaysia, thailand, india, vietnam dan nigeria can deposit and withdraw using their local banks. Octafx supports a variety of local banks you can choose from.

As mentioned earlier, for those who can not use local banks we support different payment services and credit cards:

Credit or debit visa cards

How to make a bank deposit

1. Login into account. Find “deposit”

You can find “deposit” buttons in the top or sidebar menu as shown in the picture below.

2. Choose among available local banks.

Local banks availability depends on the region you have filled in during the registration process.

For example, indonesian traders can choose between mandiri, BCA, BNI and BRI. For instance, let’s choose BCA. You can select deposit amount from the offered options or put down the amount you wish.

3. Choose preferred bank deposit method

There are three ways you can make a wire transfer deposit which are ATM, online banking and cash deposit at a bank branch:

If you make a deposit online you need to open your online banking app/website, then make transfer with given credentials and make a screenshot of processed transaction.

Find your nearest ATM and deposit using bank details given on the deposit page.

You can also deposit by cash at your bank branch.

Make sure you use correct data in the process of deposit. Please, double check the deposit amount, as it must be the same you state in the deposit request. Here you can see credentials of the banks we cooperate with.

4. Notify after successful bank transfer

On the next step you need to fill in the deposit form: set the amount, choose bank and type of transfer, put in your bank account number and date of payment. We will process your transaction faster if you upload payment proof (screenshot from online banking or payment slip).

Once you confirm the request it will be pending till it is processed by the bank and our financial department in their working hours (monday-friday 06:00-15:00 EET).

E-wallets and credit card deposits

You can also deposit with a credit/debit card, bitcoin or e-wallets. Such deposits are credited instantly. The process is very simple:

1) you need to choose deposit method

We will choose skrill as an example of e-wallet deposit.

2) fill in the deposit amount

Type the amount you wish to deposit and click ‘continue’.

3) double check and confirm the deposit

Then double check the information and click ‘confirm’. After confirmation you will be redirected to the skrill page. Log into your skrill account and proceed deposit. Once request is processed, funds will be credited to your trading account.

4) log in to your payment system

5) make a transfer

Deposit with a card

Please, notice, that according to our AML policy you will need to verify your credit/debit card as we can not accept transactions from the third parties. To make a deposit you need to enter deposit amount, confirm it and fill your credit/debit card details in the form.

Deposit with bitcoin

You can also deposit with bitcoin. After choosing ‘bitcoin’ in the list of payment methods you will see current exchange rate and address of our wallet. Then you need to open your bitcoin wallet and process transaction.

The last step is to download a trading platform of your choice and you are ready to enter forex market! Please, follow this links to download a software:

We also recommend you to check our education section where we post trading forex strategies, forex tutorials and platform manuals.

Octafx

Octafx review

Author bio.

Updated on: 15 january, 2021

- Awards

- Best CFD broker asia pacific, 2020 - CFI.Co

- Best ECN broker, 2020 - world finance

- Best forex broker asia 2020 - world finance

- Pros

- Trade on metatrader 4, metatrader 5 or ctrader.

- No fees on deposits or withdrawals.

- Negative balance protection.

- Copy trading platform.

- Cons

- You cannot buy shares or cryptocurrency (only cfds).

- No cfds on commodities, stocks or etfs.

- Account base currencies: USD, EUR.

Octafx accounts (2)

Micro account

- Trade forex, crypto-currencies, indices and precious metals on fixed or floating spreads. This account, designed for novice traders, supports metatrader 4.

- $ 100 minimum deposit

- 1:500 leverage (EUR/USD) ?

- 1.1 pips (EUR/USD)

- $ 0 commission / lot

- More ▼

- MT4

- No dealing desk (NDD), STP, market execution

- Fixed and variable spreads

- 25% margin call (%)

- 15% stop out level (%)

- Hedging, scalping, algorithmic trading

- Swap-free account

- Less ▲

- Open account ▷

Pro account

- Trade forex, crypto-currencies, indices, precious metals and energies on tight floating spreads. This account, designed for experienced traders, supports metatrader 5.

- $ 500 minimum deposit

- 1:200 leverage (EUR/USD) ?

- 0.5 pips (EUR/USD)

- $ 0 commission / lot

- More ▼

- MT5

- No dealing desk (NDD), STP, market execution

- Variable spreads

- 45% margin call (%)

- 30% stop out level (%)

- Hedging, scalping, algorithmic trading

- Swap-free account

- Less ▲

- Open account ▷

Octafx markets

Trade cfds on currency pairs or diversify across stocks, indices, precious metals and energies:

- Forex: trade cfds on the price of 28 currency pairs, which include the majors and well as crosses between the AUD, EUR, GBP, USD and JPY. Trade on metatrader 4, metatrader 5 or ctrader with leverage up to 1:500.

- Crypto-currency: trade cfds on the price of 5 crypto-currencies against the US dollar, including bitcoin, ethereum and litecoin. Trade on metatrader 4 or metatrader 5 with leverage up to 1:10.

- Indices: trade cfds on up to 10 stock indices, namely the dow jones 30, the NASDAQ 100, the DAX 30 and ASX SPI 200 index. Trade on metatrader 4 or metatrader 5 with leverage up to 1:50.

- Commodities: trade cfds on the spot price of gold and silver against the US dollar on metatrader 4 or ctrader. In addition, trade cfds on the WTI and brent crude with metrader 5.

- Asset classes

- Forex (CFD)

- Cryptos (CFD)

- Indices (CFD)

- Metals (CFD)

- Energy (CFD)

- Asset classes (#)

- Forex (CFD) 28

- Cryptos (CFD) 5

- Indices (CFD) 10

- Metals (CFD) 2

- Energy (CFD) 2

Octafx trading platforms

Octafx.Com supports the world's three most popular trading platforms: metatrader 4, metatrader 5 and ctrader. Metatrader 5 offers the widest selection of instruments: 28 currency pairs + 4 metals + 2 energies + 10 indices + 3 crypto-currencies. In comparison ctrader offers the most restrictive choice: 28 currency pairs + gold and silver.

When you create an account with octafx, you can choose to open a live or demo account on any of its platforms. You may also trade from several accounts simultaneously if you chose to.

All platforms are available either through a web-based interface, as a download to your desktop computer or as an app for your android or ios devices.

Octafx offers three trading accounts, each associated with a different platform:

- Micro account with metatrader 4: trade with small positions on fixed or floating spreads. This account is designed for novice traders.

- Pro account with metatrader 5: trade on tigher floating spreads without commission. This account is designed for experienced traders.

- ECN account with ctrader: trade on spreads plus commission. Access level II market depth information, namely the number of lots available across different price points. This account will appeal if you are looking to implement scalping or news trading strategies.

Octafx supports all trading styles without restrictions, including trading bots known as expert advisors on metatrader, and cbots on ctrader. In addition, all accounts enjoy negative balance protection: octafx will reset your balance to zero if it becomes negative after an unsuccessful order.

All accounts are available in islamic format for clients of muslim faith. Pay no interest on positions held overnight. Instead, octafx applies a fixed fee that is not interest and depends on the direction of your position.

Octafx minimum deposit

The octafx minimum deposit amount that octafx requires is US dollar 100.

The minimum deposit amount of US dollar 100 when registering a live account is equivalent to ZAR1,766.87 at the current exchange rate between US dollar and south african rand on the day and at the time that this article was written.

Octafx is based in SVG and cyprus and is authorized and regulated by demanding regulating entities namely cysec and FSA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as octafx are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

Octafx does not charge any fees when deposits are made into the trader’s account.

Traders can make use of the following payment methods through which the minimum deposit amount can be paid:

- Credit/debit card

- Bank wire transfer

- Bitcoin

- Skrill, and

- Neteller

Octafx only supports two deposit currencies in which traders can fund their accounts including:

- USD, and

- EUR

Traders should take note that payments made in any other currency apart from the base currencies of the various accounts may be subjected to conversion rates charged by their payment provider. The base currencies are USD and EUR.

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by following these steps:

- Log into the client portal and select ‘deposit’

- Select the deposit method along with the amount.

- After the trader has made their selection, they will be redirected to the payment processor page to confirm their deposit.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. Only a few payment options provided |

| 2. Quick and easy depositing of funds | 2. Only two supported deposit currencies |

What is the minimum deposit for octafx?

How do I make a deposit and withdrawal with octafx?

You can make use of the following payment methods to deposit or withdraw funds:

- Credit/debit card

- Bank wire transfer

- Bitcoin

- Skrill, and

- Neteller

Octafx: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

Octatfx has a highly informative and accessible website that aims to promote their services in layman terms. And it achieves that, yet can it can it practice what it preaches?

The broker website is operated by the following companies:

Octa markets cyprus ltd is tightly regulated by the cyprus securities and exchange commission (cysec), carrying all necessary investigations in order to ensure fraud-free market operations. As regulated by cysec, OCTAFX is part of the ICF allowing for a compensation of up to €20 000 to be attributed to clients, if the broker fails or becomes insolvent.

Octa markets incorporated is regulated by the FSA SVG in st. Vincent and the grenadines. This body’s main duties are to ensure that financial institutions are well supervised and that all threats are acted upon with the appropriate force of action. Unlike cysec, this license issuer has no reimbursement scheme to speak of. Another significant drawback is that there is no regulation dedicated to foreign exchange (forex) trading and cryptocurrency, nor are there licenses issued for these two assets:

Spreads depend on the account the client has chosen. So for the MICRO account the EUR/USD spread is 1.1 pips, for the PRO it’s 0.8-1.1 pips, and for the ECN account it’s typically 0.7-0.8 pips. We would like to remind readers that in the UK and EU the current imposed maximum spread limit is 1:30. For those outside the jurisdiction of ESMA the spread reaches 1:500.

Currently, octatfx offers the following assets to trade with: forex pairs, cryptocurrencies, commodities, stocks. In the bustling, competitive world of forex today, this number of assets is considered low.

The broker is available in the following languages: english, spanish, arabic, indonesian, thai, vietnamese, chinese, german, malay, bengali, portuguese and hindi.

OCTAFX LOGIN

Octatfx offers three platform for trade: MT4, MT5 and ctrader. What’s interesting is that each platform acts also as a separate account.

METATRADER 4

Here we are again with this renowned platform, and for a reason! MT4 stands tall against other trading terminals. Consider using expert advisors to set your automated trading while you do other business, or take full advantage of what MT4 has to offer: multiple chart management, trading directly from the chart, customized trading indicators, huge selection of trading options and much more.

The MT4 acts as the MICRO account type. So, the spread for EUR/USD 1.1 pips, while the leverage for the EU/UK is 1:30 (due to ESMA), and reaches 1:500 for those outside these zones.

There are no commissions attached to this account.

MT4 is available on smartphones (iphone, android), on any browser and as a standalone desktop version.

METATRADER 5

MT5 strives to replace MT4 but fails to do so, not because it’s inferior but because most brokers nowadays use MT4 as the default terminal. Nevertheless, MT5 comes with new and handy features that traders will surely find useful. There are auto trading bots, plus VPS (same as MT4).

The MT5 acts as the PRO account type. So, the spread for EUR/USD 0.8-1.1 pips, while the leverage for the EU/UK is 1:30 (due to ESMA), and reaches to 1:500 for those outside these zones.

The are no commissions attached to this account.

MT5 is available on smartphones, on any browser and as a standalone desktop version.

The functional ctrader has been included by octafx. This platform handles with ease and possesses a much better visual style than both MT4/5. The interface is highly customizable, giving end users a much needed aesthetic touch of their own. One of the main features of ctrader is the ability for traders to access provider’s liquidity making room for better pricing and lower spreads. There is also automated trading, and great back testing facilities.

Ctrader acts as the ECN account type. So, the spread for EUR/USD 0.7-0.8 pips, while the leverage for the EU/UK is 1:30 (due to ESMA), and reaches to 1:500 for those outside these zones.

Ctrader has a commission structure attached to it. For one standard lot a round turnof $6 will be feed. So this changes the EUR/USD spread from 0.7-0.8 pips to 1.3-1.4 pips.

Ctrader is available: for download as a standalone software for desktop, to mobile users, and can be accessed via a browser.

COPYTRADING

The broker offers for the opportunity to copy expert traders, automatically, without spending time on building a strategy or being constantly glued to a screen. This is a superb opportunity for those who do not have the time, or have little of it, to dedicate to online trading. To start, just browse through the many expert traders, set your preferences, invest and voila! Note that, even if the trader dealing for you gets a bonus if your investment turns to profit, this system does not guarantee 100% wins all of the time.

OCTAFX MINIMUM DEPOSIT

The minimum deposit is $50, immediately making room for smaller or casual traders. Typically, a higher minimum deposit limit has the ability to intimidate many novice traders.

The methods for depositing are: neteller, skrill and bitcoin. In this day and age of online currency and cfds trading these options are significantly low than bar. When considering the instruments in circulation by admiral markets and, especially, FX choice, the assortment that this here broker has seems laughable in comparison.

The base currencies are limited to only EUR and USD. The same comment as above can be applied here. A global broker should include more base currencies.

All methods of funding are instant. Here, however, octafx shines, as it falls in the niche of swift deposit methods, a niche that grows ever so tighter.

There are no fees attached. Fees commissioned by thirds parties will be covered by octafx.

OCTAFX WITHDRAWAL TIME AND FEES

Cysec regulation reassures that no harm will come to clients withdrawals.

The withdrawal methods are: neteller, skrill and bitcoin. Again, significantly fewer withdrawal methods that your standard broker.

Withdrawals are instant. This is a rare sight to see in an industry of long process times, and unexpected delays.

There are no fees attached to withdrawal. Fees commissioned by thirds parties will be covered by octafx. This makes us even more agitated at the fact that octafx has not included more payment options.

The minimum withdrawal amount is $5.

BONUSES AND PROMOTIONS

Bonuses are solely offered by octatfx’s offshore entity, due to cysec banning them in europe.

There is a 50% bonus with every deposit.

The most active and successful traders will have the opportunity to win smartphones/smartwatches, as well as a 3 luxury cars at the end of the year.

There is the opportunity to win $500 while trading with your DEMO account.

Trade suing a ctrader DEMO account, and finish with the highest profit at the end of the week to get $150.

BOTTOM LINE

First and foremost, octafx is regulated by one of the best institutes for the job in the world (cysec), as well as one of the shadier ones where many suspicious brokers get their licenses from- FSA SVG, making things rather ambiguous.

Second, there is a very limited number of payment methods, which in this day and age of online trading is unsatisfactory. However, there are no fees attached to said methods, and to top that the broker offers great and detailed trading platforms.

Octafx fees and costs – spread comparison

Octafx fees and spreads are those charges for the brokerage services the broker provides to the clients. The quality of services that octafx offers is top-notch. From a stellar trading platform to a wide range of markets, octafx goes the extra mile in serving its traders well.

However, to continue rendering these offers and services, it must be paid well. The only way it can do this is via fees, commissions, and spreads. Here, we detail the octafx fees and spreads so that you can be well informed as to what the broker will charge you for the services it renders.

The following fees can occur if you are an octafx trader:

- Spread

- Commission

- Overnight-free (swap)

- Deposit and withdrawal fee (depending on the payment method, mostly free)

(risk warning: you capital can be at risk)

Octafx fees and spreads

The fees spreads and commission that octafx charges start from US dollar 7 with spreads as low as 0.0 pips. The online broker has a low and incredibly competitive spread when compared to what other brokers offer. It offers a list of spreads which starts from 0.0 pip along with commissions charged from US dollar 0.02 per 0.01 lot for traders using the ECN ctrader account.

Octafx trading fees are according to the type of account that the trader chooses and the options along with the spread list, leverage, and commissions are as follows:

MT4 micro account

Leverage goes up to 1:500 for forex, 1:200 for metals, 1:50 for indices, and 1:2 for cryptocurrencies. The floating spreads start from 0.4 pips, fixed spreads at 2 pips. There are zero commissions charged on trades.

| Asset: | spreads from: | commissions: | swap short (points): | swap long (points): |

|---|---|---|---|---|

| EUR/USD | 0.6 pips | no | -1.90 | -2.10 |

| GBP/USD | 0.9 pips | no | -4.80 | -2.80 |

| USD/JPY | 1.0 pips | no | -3.70 | -1.10 |

| GOLD (XAU/USD) | 1.8 points | no | -2.65 | -5.83 |

| DOW JONES (US30) | 2.5 points | no | -8.00 | -8.00 |

| BITCOIN (BTC/USD) | 2.8 points | no | -2.00 | -2.00 |

MT5 pro account

You have the leverage of up to 1:200 for forex, 1:100 for metals and energies, 1:50 for indices, 1:2 for cryptocurrencies. You floating spreads from 0.2 pips and zero commissions as well.

| Asset: | spreads from: | commissions: | swap: | three days fee: |

|---|---|---|---|---|

| EUR/USD | 0.6 pips | no | no | -0.1 |

| GBP/USD | 0.9 pips | no | no | -0.1 |

| USD/JPY | 1.0 pips | no | no | -0.1 |

| GOLD (XAU/USD) | 1.8 points | no | no | -0.2 |

| DOW JONES (US30) | 2.5 points | no | no | -0.3 |

| BITCOIN (BTC/USD) | 2.8 points | no | no | -0.1 |

Ctrader ECN account

The leverage here might also go up to 1:500 for forex and 1:200 for metals, floating spreads from 0 pips, and commissions from US dollar 0.02 per 0.01 lot.

| Asset: | spreads from: | commissions: | swap: | weekly rollover: |

|---|---|---|---|---|

| EUR/USD | 0.4 pips | $3/1lot | no | -0.2 |

| GBP/USD | 0.4 pips | $3/1lot | no | -0.3 |

| USD/JPY | 0.4 pips | $3/1lot | no | -0.3 |

| GOLD (XAU/USD) | 1.2 points | $3/1lot | no | -0.4 |

Overall, we can say that the trading fees are very cheap with this broker. Compared to other forex brokers, octafx offers professional and suitable trading conditions for any type of trading.

(risk warning: you capital can be at risk)

Introduction to octafx

Octafx is a forex, CFD, and copy trading broker that offers quality trading services via the MT4, MT5, and ctrader platforms. It was established in 2011 with headquarters located in saint vincent and the grenadines. It, however, has an area office in jakarta, indonesia. Because of regulations, the broker has entities covering different jurisdictions.

Octafx’s EU company, octa markets cyprus ltd, is located in cyprus and is regulated by the cyprus securities and exchange commission (cysec). With over 1.5 million trading accounts and a commendable list of forex broker awards, the broker has commanded global attention and continued to grow at an exponential rate. The awards include:

- Best ECN/STP broker 2019 – fxdaily info

- Best forex broker asia 2019 – also by fxdaily info

- Best copy trading platform 2018 – forex-awards.Com

- Best forex broker asia 2018 – global banking & finance review

- Best FX broker 2018 – european CEO magazine

- Best forex ECN broker 2017 – UK finance awards

Octafx trading platforms

Octafx offers quality trading services via a variety of trading platforms. This variety allows traders the ability to choose from enough options. The good thing about octafx trading platforms is that they are synced. So, you can easily switch from one platform to another in real-time. This is because what you do on one platform automatically reflects one another. We will examine each platform below:

Metatrader 4

The MT4 platform is popular trading software used by both retail and institutional traders, due to its ease of use and flexibility. The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the countless in-built technical indicators, advanced charting tools allow you to analyze price fluctuations and trends in the market.

Unfortunately, however, we have to note that with octafx, the MT4 trading platform is currently only available for clients outside the european union.

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy, and more advanced features. It is a big upgrade to the legacy MT4 that people had used for generations. Users enjoy multiple types of pending orders, several analytical objects, plus additional technical indicators that are unique to MT5. There’s also an economic calendar.

Both the MT4 and MT5 come in several languages, including english, arabic, and hindi, and are compatible with windows and macos pcs. Octafx provides a useful download guide on the website.

Webtrader

Octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser. The web platforms are highly functional and customizable, boasting the same features found in the desktop versions, including charting tools, market indicators, and expert advisors, plus access to diverse order types and execution methods.

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. It is fast becoming one of the most popular trading platforms. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customizable interface. It boasts an impressive array of 70 technical indicators and a lot of chart timeframes, plus advanced level scalping and visual back-testing by making use of the cbot.

With full market depth, traders can also execute advanced online trading strategies as well as develop their own trading algorithms. The ctrader platform is ready for download from the website once you have completed the registration process. The ctrader web terminal is also available for traders using the macos.

Available assets:

Octafx offers some of the most popular assets, including:

- Forex – 28 currency pairs. However, octafx does not offer a good list of minor and exotic currencies.

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including gold and silver contracts and brent and crude oil

- Cryptocurrencies – 3 major crypto coins including bitcoin, ethereum and litecoin

The fees and commissions are always depending on the asset and account type. We highlighted it in the table above.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2. Note that traders in the EU can only trade with leverage up to 1:30. This is because of the regulation put by EU authorities.

Octafx mobile apps

Octafx delivers mobile app versions of the MT4, MT5, and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications including a complete set of orders in metatrader and full balance, margin, and P&L information in ctrader.

All trading apps come with a customizable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts. Octafx also offers a proprietary copy trading mobile app, currently available only on android (APK) devices. It is also only available for traders residing outside of the EU. The app allows you to manage and keep track of trading accounts of veteran and more experienced traders whilst on the go.

Users can also activate bonuses, access trader tools, and deposit into their accounts. The app can be accessed from the google play store.

Octafx payment methods

Octafx offers a few funding methods which vary depending on the jurisdiction under which you fall. These include bank cards, E-wallets, and crypto coins. Local bank transfers are also available for traders from certain countries, including thailand, india, and nigeria.

There are no commissions charged on deposits, withdrawals, or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings. For withdrawals, it may, however, take some time for the funds to be credited to your account.

Octafx account types

There are 3 account types available at octafx, determined by the trading platform you use: micro (MT4), pro (MT5), and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts are the assets available to trade, the spreads, and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged on the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

Customer support

Octafx boasts quality customer support services as one of the premium services it offers to its customers. More importantly, you can reach customer service via a myriad of channels. First, there is the telephone support; non-EU clients can contact the helpline, +44 20 3322 1059, while for clients that stay within the EU, the number to call is +357 25 251 973. Traders are, however, limited to calling between mondays and fridays.

Secondly, you can reach out via email. Thirdly and the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website.

Conclusion on the octafx fees and costs

In today’s trading world, we do enjoin traders to go for brokers that charge very low fees – as that has now become the reality. Octafx is one of those brokers that provide you with inexpensive, but high-quality trading service.

All in all, we tested the offers of octafx and we came to the conclusion that it is a very cheap broker to trade with. There are no hidden or expensive fees. So we can clearly recommend this forex broker.

Octafx review – is octafx a good broker?

RECOMMENDED FOREX BROKERS

Don’t put all your eggs in one basket. Open trading accounts with at least two brokers.

Company information

Octafx is an international award-winning forex brokerage with close to 10 years of experience in the market. It previously acted through a UK brand but has now chosen cyprus for its business destination. Octafx provides clients with very attractive trading conditions, as well as a wide range of trading products which include forex pairs, cfds on commodities, indices, precious metals and energies. Clients have at their disposal two of the most popular trading platforms – the metatrader 5 and ctrader – and many enticing bonuses and promotions.

Regulation & safety

The european brand of octafx operates via the website – octafx.Eu – and abides by the highest regulatory standards. It is owned by the cyprus-based company octa markets cyprus ltd which is regulated by the cyprus securities and exchange commission with a registration number HE359992.

Cysec is among the foremost financial regulators in the world and all brokerages licensed by it have to follow strict rules and are subjected to intensive regulatory oversight. This removes any unwanted risk in trading and guarantees that the client’s funds are safe and their interests protected by the respective laws. Such rules include the segregation of accounts which assures that commingling with the client’s money is not possible. Furthermore, a license by cysec entails participation in a financial mechanism by which clients may be compensated if they suffer losses due to fraud or bankruptcy. The compensation goes up to 20 000 euro per person.

Besides the european brand, octafx group also includes octa markets incorporated which operates via octafx.Com website and is registered in saint vincent and the grenadines. It offers a generous leverage up to 1:500, as well as the option of three account types and three different trading terminals.

Negative balance protection (NBP)

An immense advantage in trading with octafx is the fact that both companies of octafx group provide their clients with negative balance protection. This means that if your balance becomes negative due to stop out, the brokerage will compensate the amount and bring your account balance back to zero. We always recommend that readers invest only with brokers who provide NBP, so that there is assurance they many not lose more money that their initial deposit.

Trading conditions

The trading conditions offered by octafx are very attractive and much more favorable that the standard for the industry. Here are some of the highlights:

- The minimum initial deposit is only $100, more than twice as low as the standard $250;

- Extremely low floating spreads;

- Flexible leverage with maximum levels which vary according to the regulation in each country the broker operates;

- Negative balance protection removes the risk of losses exceeding the initial deposit;

- Low-risk trading in micro lots available on all account types.

Readers have to keep in mind that trading conditions vary a bit according to the broker brand of octafx and the country where it operates. This is, again, a sign of octafx’s commitment to comply with regulatory standards.

Octafx.Eu trading accounts

| Trading account | recommended deposit | max. Leverage* | spread (+ commission) | platform |

| conservative trader | €100 | 1:30 | 0.5 pips | MT5 |

| progressive trader | €100 | 1:30 | 0.3 pips + $6 /lot | ctrader |

Octafx.Com trading accounts

| Account type | minimum deposit | minimum trade size | maximum leverage* | spreads |

| novice | $100 | 0.01 | 1:500 | from 0.4 pip on EUR/USD |

| experienced | $500 | 0.01 | 1:200 | from 0.2 pip on EUR/USD |

| progressive | $100 | 0.01 | 1:500 | from 0 pip pips on EUR/USD |

Trading platforms

Octa FX provides clients with two popular trading terminals that are sure to meet their expectations: metatrader 5 (MT5) and ctrader. The fact that the metatrader 5 trading platform is supported is something we always consider an advantage since the MT5 is among the foremost trading terminals in forex trading at the moment, close to 80 percent of users prefer it. The platform provides an advanced charting package, lots of technical indicators, extensive back-testing environment and a variety of expert advisors (eas).

On the other hand, the multi-asset trading terminal ctrader provides pure ECN execution and a wide selection of advanced tools. Among them are fast order entry and execution speeds, direct order entry via charts and level II pricing which all contribute to render the platform highly valued among the forex trading community.

Another advantage is virtual private server (VPS) which is offered to both new and existing clients for only $15 per month. VPS hosting allows the execution of orders 24 hours, 5 days a week.

The SVG-based company octa markets incorporated which operates via octafx.Com website, besides the MT5 and ctrader, also provides clients with the metatrader 4 so that clients of octafx may have a wider pick of their preferred trading platform, as well as a copytrading app which we always view favorably.

Promotions

By the time of writing this review, octafx provides clients with the following promotions:

- Copytrading app which allows clients to automatically copy leading traders;

- 50 percent bonus on each deposit;

- Free forex trading signals: autochartist which allows clients to follow automated alerts to open and close trades;

- Status program; allows clients access to new benefits such as accelerated transfers, lower spreads, personal manager and many more at every new level

Keep in mind that trading bonus, copytrading app and other promotions may not be eligible for clients of octa markets cyprus ltd.

Methods of payment

Octafx supports the standard payment methods of forex, as well as a popular e-wallet. Clients of the brokerage may deposit or withdraw via visa, mastercard, bankwire, as well as skrill.

Furthermore, the brokerage does not charge any withdrawal or deposit fees which lower the cost of trading and only requires the formal 5 euro minim withdrawal amount for withdrawals via skrill.

Conclusion

Octafx is a reliable award-winning FX and cfds broker that offers pretty good trading conditions and has air-tight regulation. To sum up the above, here are the advantages and drawbacks with regards to this broker:

Solid regulation no significant disadvantages

so, let's see, what was the most valuable thing of this article: how much does it cost to trade with octafx? ✅ fees and costs explained ✔ spread comparison ✔ trading conditions ➔ read more at octafx payment methods

Contents of the article

- Today forex bonuses

- Octafx fees and costs – spread comparison

- Octafx fees and spreads

- Introduction to octafx

- Octafx trading platforms

- Metatrader 4

- Metatrader 5

- Webtrader

- Ctrader

- Available assets:

- Leverage

- Octafx mobile apps

- Octafx payment methods

- Octafx account types

- Customer support

- Conclusion on the octafx fees and costs

- Octafx review and tutorial 2021

- Octafx details

- Trading platforms

- Markets

- Trading fees

- Leverage

- Mobile apps

- Payment methods

- Demo account review

- Octafx bonuses & promo codes

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Octafx verdict

- Accepted countries

- Is octafx a legit company and regulated broker?

- Is octafx a market maker?

- How do I delete my octafx account?

- How do I open a copytrading account at octafx?

- Why was my octafx withdrawal rejected?

- Does octafx offer any free bonus deals?

- Is octafx legal in india and pakistan?

- How to make a deposit at octafx forex trading...

- How to make a bank deposit

- 1. Login into account. Find “deposit”

- 2. Choose among available local banks.

- 3. Choose preferred bank deposit method

- 4. Notify after successful bank transfer

- E-wallets and credit card deposits

- 1) you need to choose deposit method

- 2) fill in the deposit amount

- 3) double check and confirm the deposit

- 4) log in to your payment system

- 5) make a transfer

- Deposit with a card

- Deposit with bitcoin

- Octafx

- Octafx minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- Octafx: login, minimum deposit, withdrawal time?

- RECOMMENDED FOREX BROKERS

- OCTAFX LOGIN

- OCTAFX MINIMUM DEPOSIT

- OCTAFX WITHDRAWAL TIME AND FEES

- BONUSES AND PROMOTIONS

- BOTTOM LINE

- Octafx fees and costs – spread comparison

- Octafx fees and spreads

- Introduction to octafx

- Octafx trading platforms

- Metatrader 4

- Metatrader 5

- Webtrader

- Ctrader

- Available assets:

- Leverage

- Octafx mobile apps

- Octafx payment methods

- Octafx account types

- Customer support

- Conclusion on the octafx fees and costs

- Octafx review – is octafx a good broker?

- RECOMMENDED FOREX BROKERS

- Company information

- Regulation & safety

- Negative balance protection (NBP)

- Trading conditions

- Trading platforms

- Promotions

- Methods of payment

- Conclusion

No comments:

Post a Comment