Free trade money

To level up your trading you need power-ups: besides $100 you get a full set of educational materials the website is operated by FBS markets inc., registration no. 119717, FBS markets inc is regulated by IFSC, license IFSC/000102/124, address: 2118, guava street, belize belama phase 1, belize

Today forex bonuses

TRADE 100 BONUS —

WORK OUT FOR MORE

Bonus information

Get our trade 100 bonus and start your forex career! It works the same way as in sport – first you train and learn, then you earn and get stronger, faster and more efficient. Trade 100 bonus is your personal tool for toning up your brain

What you get with trade 100 bonus

FREE $100 TO TRADE

FBS gives you real money to start your forex journey and trade real

BOOST YOUR SKILLS

To level up your trading you need power-ups: besides $100 you get a full set of educational materials

START WITHOUT DEPOSIT

Learn how to trade and make a real profit out of it – with no need for your own money involved in the process

How can trade 100 bonus help

Trade 100 bonus gives beginner traders a chance to study the basics, get fully involved in the process of real, thorough and effective trading. And the best part is – you don’t need any initial investments for it! Take your time to get to know forex and FBS platform, test your hand, gear up with knowledge – with fewer risks involved

If you are an experienced trader, trade 100 bonus is your chance to get familiar with FBS platform. Trade on major currency pairs, enjoy low spreads and swap free option for your trading and, of course, make some profit out of our welcome gift!

How to get $100 of profit?

Register a bonus account with $100 on it

Use the money to get 30 days of active trading and trade 5 lots

Succeed and get your profit of $100

Bonus conditions

- The bonus is available on metatrader5 platform;

- The order volume is 0.01 lot;

- The sum available for withdrawal is 100 USD;

- The required number of active trading days is 30 (active trading day is a day when the order was opened or closed);

- The maximum number of positions opened at the same time is 5;

- Client should have at least 5 lots traded in the period of 30 active trading days

View the full terms and conditions in the personal area

Share with friends:

Instant opening

Withdraw with your local payment systems

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Your request is accepted

Manager will call your number

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!

Beginner forex book

Beginner forex book will guide you through the world of trading.

Thank you!

We've emailed a special link to your e-mail.

Click the link to confirm your address and get beginner forex book for free.

You are using an older version of your browser.

Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

What is free trade? Definition, theories, pros, and cons

:max_bytes(150000):strip_icc()/collage-of-uncertainty-forecasting-global-currency-688899351-5c05a4c5c9e77c000112292c.jpg)

In the simplest of terms, free trade is the total absence of government policies restricting the import and export of goods and services. While economists have long argued that trade among nations is the key to maintaining a healthy global economy, few efforts to actually implement pure free-trade policies have ever succeeded. What exactly is free trade, and why do economists and the general public view it so differently?

Key takeaways: free trade

- Free trade is the unrestricted importing and exporting of goods and services between countries.

- The opposite of free trade is protectionism—a highly-restrictive trade policy intended to eliminate competition from other countries.

- Today, most industrialized nations take part in hybrid free trade agreements (ftas), negotiated multinational pacts which allow for, but regulate tariffs, quotas, and other trade restrictions.

Free trade definition

Free trade is a largely theoretical policy under which governments impose absolutely no tariffs, taxes, or duties on imports, or quotas on exports. In this sense, free trade is the opposite of protectionism, a defensive trade policy intended to eliminate the possibility of foreign competition.

In reality, however, governments with generally free-trade policies still impose some measures to control imports and exports. Like the united states, most industrialized nations negotiate “free trade agreements,” or ftas with other nations which determine the tariffs, duties, and subsidies the countries can impose on their imports and exports. For example, the north american free trade agreement (NAFTA), between the united states, canada, and mexico is one of the best-known ftas. Now common in international trade, FTA’s rarely result in pure, unrestricted free trade.

In 1948, the united states along with more than 100 other countries agreed to the general agreement on tariffs and trade (GATT), a pact that reduced tariffs and other barriers to trade between the signatory countries. In 1995, GATT was replaced by the world trade organization (WTO). Today, 164 countries, accounting for 98% of all world trade belong to the WTO.

Despite their participation in ftas and global trade organizations like the WTO, most governments still impose some protectionist-like trade restrictions such as tariffs and subsidies to protect local employment. For example, the so-called “chicken tax,” a 25% tariff on certain imported cars, light trucks, and vans imposed by president lyndon johnson in 1963 to protect U.S. Automakers remains in effect today.

Free trade theories

Since the days of the ancient greeks, economists have studied and debated the theories and effects of international trade policy. Do trade restrictions help or hurt the countries that impose them? And which trade policy, from strict protectionism to totally free trade is best for a given country? Through the years of debates over the benefits versus the costs of free trade policies to domestic industries, two predominant theories of free trade have emerged: mercantilism and comparative advantage.

Mercantilism

Mercantilism is the theory of maximizing revenue through exporting goods and services. The goal of mercantilism is a favorable balance of trade, in which the value of the goods a country exports exceeds the value of goods it imports. High tariffs on imported manufactured goods are a common characteristic of mercantilist policy. Advocates argue that mercantilist policy helps governments avoid trade deficits, in which expenditures for imports exceeds revenue from exports. For example, the united states, due to its elimination of mercantilist policies over time, has suffered a trade deficit since 1975.

Dominant in europe from the 16th to the 18th centuries, mercantilism often led to colonial expansion and wars. As a result, it quickly declined in popularity. Today, as multinational organizations such as the WTO work to reduce tariffs globally, free trade agreements and non-tariff trade restrictions are supplanting mercantilist theory.

Comparative advantage

Comparative advantage holds that all countries will always benefit from cooperation and participation in free trade. Popularly attributed to english economist david ricardo and his 1817 book “principles of political economy and taxation,” the law of comparative advantage refers to a country’s ability to produce goods and provide services at a lower cost than other countries. Comparative advantage shares many of the characteristics of globalization, the theory that worldwide openness in trade will improve the standard of living in all countries.

Comparative advantage is the opposite of absolute advantage—a country’s ability to produce more goods at a lower unit cost than other countries. Countries that can charge less for its goods than other countries and still make a profit are said to have an absolute advantage.

Pros and cons of free trade

Would pure global free trade help or hurt the world? Here are a few issues to consider.

5 advantages of free trade

- It stimulates economic growth: even when limited restrictions like tariffs are applied, all countries involved tend to realize greater economic growth. For example, the office of the US trade representative estimates that being a signatory of NAFTA (the north american free trade agreement) increased the united states’ economic growth by 5% annually.

- It helps consumers: trade restrictions like tariffs and quotas are implemented to protect local businesses and industries. When trade restrictions are removed, consumers tend to see lower prices because more products imported from countries with lower labor costs become available at the local level.

- It increases foreign investment: when not faced with trade restrictions, foreign investors tend to pour money into local businesses helping them expand and compete. In addition, many developing and isolated countries benefit from an influx of money from U.S. Investors.

- It reduces government spending: governments often subsidize local industries, like agriculture, for their loss of income due to export quotas. Once the quotas are lifted, the government’s tax revenues can be used for other purposes.

- It encourages technology transfer: in addition to human expertise, domestic businesses gain access to the latest technologies developed by their multinational partners.

5 disadvantages of free trade

- It causes job loss through outsourcing: tariffs tend to prevent job outsourcing by keeping product pricing at competitive levels. Free of tariffs, products imported from foreign countries with lower wages cost less. While this may be seemingly good for consumers, it makes it hard for local companies to compete, forcing them to reduce their workforce. Indeed, one of the main objections to NAFTA was that it outsourced american jobs to mexico.

- It encourages theft of intellectual property: many foreign governments, especially those in developing countries, often fail to take intellectual property rights seriously. Without the protection of patent laws, companies often have their innovations and new technologies stolen, forcing them to compete with lower-priced domestically-made fake products.

- It allows for poor working conditions: similarly, governments in developing countries rarely have laws to regulate and ensure safe and fair working conditions. Because free trade is partially dependent on a lack of government restrictions, women and children are often forced to work in factories doing heavy labor under grueling working conditions.

- It can harm the environment: emerging countries have few, if any environmental protection laws. Since many free trade opportunities involve the exporting of natural resources like lumber or iron ore, clear-cutting of forests and un-reclaimed strip mining often decimate local environments.

- It reduces revenues: due to the high level of competition spurred by unrestricted free trade, the businesses involved ultimately suffer reduced revenues. Smaller businesses in smaller countries are the most vulnerable to this effect.

In the final analysis, the goal of business is to realize a higher profit, while the goal of government is to protect its people. Neither unrestricted free trade nor total protectionism will accomplish both. A mixture of the two, as implemented by multinational free trade agreements, has evolved as the best solution.

Pricing

Compare our general investment account

The comparison to other providers is based on published costs on their websites as of 08 january 2021, for a portfolio size of ВЈ5,000 and trades on shares and etfs within a general investment account.

Вђќ

вђќwhen you invest, your capital is at risk.

Compare our stocks and shares ISA

Your stocks and shares ISA costs a flat fee of ВЈ3/month, and there are no commissions for placing trades. For more information on how freetrade ISA works, you can check our stocks and shares ISA page. Alternatively, if you did your research already and know this is right for you, start an ISA transfer.

Compare our SIPP

Your SIPP costs a flat fee of ВЈ9.99/month, or ВЈ7/month if you are a freetrade plus member, and there are no commissions for placing trades. For more information on how freetrade SIPP works, you can check our SIPP page. Alternatively, if you did your research already and know that SIPP pensions are right for you, you can start a pension transfer.

Disclaimer: comparisons to other providers are based on our understanding of their published costs on their websites as at 08 january 2021, for trading shares and etfs within a SIPP account. They are shown for illustrative purposes only. For confirmation of their up to date charges and product information, you should visit their websites.

Before initiating a pension transfer make sure that you believe, with the help of a financial adviser if required, that this is the right action for you to take. This requires you to read and understand the freetrade SIPP key features document, terms and conditions, charges schedule and SIPP declarations.

Comparison disclosure в“˜

Hargreaves lansdown:

SIPP account charges 0.45% of the value of shares in your account, capped at ВЈ200/year.

Fee per trade reduces to ВЈ8.95 per trade for 10-19 trades, and ВЈ5.95 for 20 or more trades.

FX fee reduces to 0.75% after ВЈ5,000 value of trades, 0.5% for the next ВЈ10,000 and to 0.25% for over ВЈ20,000 value of trades.

Interactive investor:

For ease of comparison, we compared to the investor plan, where you get one free trade per month, then ВЈ7.99 per trade.

SIPP account charges ВЈ10/month, on top of the investor plan fee (ВЈ9.99/month).

FX fee reduces on a tiered scale, based on transaction value: ВЈ25,000 - ВЈ49,999 is 1.25%, ВЈ50,000 - ВЈ99,999.99 is 1%, ВЈ100,000 - ВЈ599,999 is 0.5%, and ВЈ600,000 - ВЈ999,999.99 is 0.25%.

SIPP account charges 0.25% of the value of the shares in your account, capped at ВЈ10/ month.

Fee per trade reduced to ВЈ4.95 when there were ten or more share deals in the previous month.

FX fee reduces on a tiered scale, based on transaction value: for the first ВЈ10,000 is 1.00%, ВЈ10,001 - ВЈ20,000 is 0.75%, ВЈ20,001 - ВЈ30,000 is 0.50% and 0.25% for over ВЈ30,000.

No charge for transfers out in cash to another UK registered pension scheme. ВЈ9.95 per holding (excluding VAT) for in specie transfers to another UK registered pension scheme.В

While youвђ™re on the waitlist, why not download the app and start investing today?

Full pricing

This is our full pricing structure. We have a freemium pricing model, where you can pay for extra features.

Calculator

Find out how much you could save with an account on freetrade in a few easy steps.

Competitor pricings:

Hargreaves lansdown:

monthly fees: ISA charges 0.45% a year on the value of shares in your account, capped at ВЈ45/year. SIPP charges 0.45% a year of the value of shares in your account, capped at ВЈ200/year.

Trading commission: we considered shared dealing charges based on the average number of trades done monthly within a year. Up to 9 deals per month ВЈ11.95/ trade, between 10 and 19 deals per month ВЈ8.95/ trade and ВЈ5.95/ trade for 20 or more deals per month.В

FX fees: depending the value of the trade, FX charges are as follows: first ВЈ5,000 - 1.00%, next ВЈ5,000 - 0.75%, next ВЈ10,000 - 0.50% and over ВЈ20,000 - 0.25%.

ВђќAJ bell:

monthly fees: ISA charges 0.25% of the value of the shares in your account, capped at ВЈ3.5/month. SIPP charges 0.25% of the value of the shares in your account, capped at ВЈ10/month. No charge for cash transfers out of an ISA or SIPP to another UK provider. Transferring out the underlying assets to another provider is ВЈ9.95 per holding.

Trading commission: we considered shared dealing charges based on the average number of trades done monthly within a year. Up to 9 deals per month ВЈ9.95/ trade and ВЈ4.95/ trade for 10 or more deals per month.

Вђќfx fees: depending the value of the trade, FX charges are as follows: first ВЈ10,000 - 1.00%, next ВЈ10,000 - 0.75%, next ВЈ10,000 - 0.50% and over ВЈ30,000 - 0.25%.В

вђќinteractive investor:

monthly fees: we considered all the charges based on their 'investor account', which is ВЈ9.99/ month. SIPP is ВЈ10 a month (inc VAT), payable monthly in addition to your service plan.

Trading commission: one free trade per month, then ВЈ7.99 per trade.

FX fees: depending the value of the trade, FX charges are as follows: ВЈ0 - ВЈ24,999.99 - 1.50%, ВЈ25,000 - ВЈ49,999.99 - 1.25%, ВЈ50,000 - ВЈ99,999.99 - 1%, ВЈ100,000 - ВЈ599,999.99 - 0.50% and ВЈ600,000 or more - 0.25%.

Global financial integrity

OUR TOP ISSUES

Categories

- Anonymous companies

- Corruption

- Gftrade

- Illicit financial flows

- Money laundering

- Natural resources

- Remittances

- Reporting

- Sustainable development goals

- Tax havens/bank secrecy

- Trade misinvoicing

- Transnational crime and terrorist financing

- Uncategorized

Recent posts

Latest tweets

Home blog illicit financial flows free trade zones: a pandora’s box for illicit money

Free trade zones: a pandora’s box for illicit money

Governments around the world are increasingly turning to free trade zones (ftzs) as a means of promoting economic growth and investment: ghana recently signed an agreement with iran to bolster cooperation between their free zones, while the dubai multi commodities centre announced 1,868 new companies have registered in its free zone in 2018 – an all-time record. Further, last year the tiny country of djibouti launched africa’s largest FTZ. Even UK prime minister boris johnson has announced plans to create up to ten free ports in the UK to offset post-brexit tariffs and attract investment. But the risks of ftzs are glaring, with the EU discouraging their existence, labelling ftzs as a “new emerging threat” in the world of financial crime.

Ftzs – also referred to as special economic zones, free ports, or free zones – can be broadly defined as special economic areas that benefit from tax and duties exemptions. While located geographically within a country, they essentially exist outside its borders for tax purposes. Companies operating within ftzs can benefit from deferring the payment of taxes until their products are moved elsewhere, or can avoid them altogether if they bring in goods to store, or manufacture on site before exporting them again. Understandably, governments from emerging markets have tended to support the existence of ftzs as they offer a variety of incentives to attract export businesses, foreign investment and employment.

But ftzs have a darker side, too. Criminals see them as perfect places to manufacture and transport illicit goods, as controls and checks by authorities are often irregular or absent. Illegal transactions can be easily disguised as legal, using trade-based money laundering (TBML) schemes that are notoriously difficult to detect. If an offshore financial center is thought of as a tax haven for illicit finance; think of an FTZ as a haven for illicit trade (and associated crimes): customs authorities have little or no oversight of what actually goes on in an FTZ, goods are rarely ever inspected and companies operating in ftzs tend to benefit from low disclosure and transparency requirements. With the number of ftzs around the globe a continuing mystery – some estimate the number at 4,300 – the opacity inherent in the zones is a massive security, crime and tax challenge.

According to the financial action task force (FATF) – the global standard-setter for anti-money laundering and counter terrorist financing (AML/CTF) regulations – TBML involves the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimize their illicit origins. Indeed, the FATF has classified ftzs as significantly vulnerable to money laundering due to the risk of TBML practices, such as the misrepresentation of the price, quantity or quality of imports or exports, phantom shipments and falsification of invoices. But little guidance or policy recommendations have emerged beyond exploring the nexus between ftzs and illicit trade.

Free trade zones remain one of the weakest links in the fight against dirty money because of how easy it is to engage in the three stages of money laundering: placement, layering and integration. A closer look at some of the largest and well-known ftzs in the world lend testament to these pandora’s boxes of illicit money.

Paraguay

A multibillion-dollar contraband industry thrives in ciudad del este, a paraguayan city located in the tri-border area (TBA) where brazil, paraguay and argentina meet. With a population of just over 300,000 people, ciudad del este is the largest of the cities in the TBA and hosts two ftzs: zona franca S.A. Global and zona franca international. The vast majority of the products arriving in these two ftzs are re-exported to neighboring brazil.

It is difficult to estimate the volume of illegal activity passing through the ftzs in ciudad del este due to the inherent nature of illicit trade and organized crime. In 2017, brazilian prosecutor alexandre collares barbosa of the public prosecutor’s office, claimed that the value of illicit trade moved between ciudad del este and brazil was approximately US$18 billion a year, just over half of paraguay’s GDP. This figure is broadly consistent with more historical figures from the US federal research division, which reported in 2003 that at least US$5 billion – at the time about half of paraguay’s GDP – was allegedly laundered in ciudad del este each year.

Ciudad del este has earned a reputation for being known as the “largest illicit economy in the western hemisphere” for its links to smuggling of drugs, weapons and humans, as well as its reported links to hezbollah.

But the modus operandi to disguise the proceeds of crime tends to follow similar techniques: some high-priced goods will typically be paid for in US dollars. Large sums of US dollars generated from legal and suspected illicit commercial activity are then transported physically from paraguay into neighboring countries. From there, the money makes its way to global banking centers via foreign bank accounts, offshore companies and financial assets.

Investigations into these activities were initiated in 2015 and focused on a criminal group composed of five interdependent nuclei that used bank accounts of several offshore companies to receive large amounts of money from individuals and legal entities interested in purchasing contraband goods, drugs and cigarettes from paraguay. The laundered money was found to be credited to the accounts of companies controlled by a criminal organization and then sent abroad via dollar-cap operations and international payment orders issued by some local brazilian financial institutions, two of which were liquidated by the brazilian central bank in 2017. These payment orders were made on the basis of grossly fraudulent exchange contracts entered into with offshore companies that were not authorized to engage in foreign exchange trading.

Countless other similar cases can be found in ciudad del este, as recently reported by the miami herald. In march 2019, lebanese businessman nader mohammed farhat was extradited to the united states to face charges of money laundering, accused of having run one of the largest illicit currency exchanges in ciudad del este. According to the herald, “’farhat is a known money launderer for narcotics organizations and other illicit organizations,’ new york federal prosecutor charles kelly declared in a court filing.”

United arab emirates

The existence of 45 ftzs and two financial free zones – free zones engaged in financial services – has given the united arab emirates (UAE) a reputation for being one of the most well-transited points for illicit trade in the world. The ftzs permit full foreign ownership of companies, have no import duties or taxation, allow full repatriation of profits and in many cases, have low disclosure rules. There are over 5,000 multinational companies located in the ftzs and thousands more individual trading companies.

While UAE law prohibits the establishment of shell companies and trusts, the operation of financial entities in ftzs that are not identified, regulated, or supervised for financial activity presents a “significant gap in regulatory oversight,” according to the US state department, particularly against criminal activities such as arms trafficking, gold smuggling and counterfeit cigarettes.

According to the organized crime and corruption reporting project, albanian organized crime groups have been known to work out of these zones “through hundreds of cigarette traders who legally buy tax-free cigarettes from airports and other duty-free areas.” using a technique called “sweeping up,” criminal gangs are able to make illicit profits by using trading houses, some of which they control, in order to “buy up the extra cigarettes and combine the surplus into one large shipment to be smuggled into european ports”.

Panama

The main pillar behind panama’s commerce sector is the colón free trade zone (CFTZ). With its proximity to the panama canal – which sees approximately five percent of global trade pass through its locks every year – the CFTZ is the world’s second largest and generated US$620 million in re-exports in 2016.

On occasions, cash couriers have been used in supply chains in order to successfully conduct TBML schemes on behalf of criminal enterprises within the CFTZ. One of the most recent high-profile TBML cases in panama is grupo wisa, a panamanian-colombian conglomerate run by the waked family, who were placed under international sanctions by the US state department in 2018. Using bulk cash smuggling and/or fake commercial invoicing, couriers declared large sums of cash at the duty-free zone of the colón airport, for which the waked family paid US$173 million in 2007 to control. Claiming to bring payments to companies in the CFTZ, the cash was then used for the purchase of goods that were subsequently exported to the money launderers’ jurisdiction, with the proceeds of the sale appearing legitimate.

Where to next?

Ftzs are a well-known problem, but no matching policy solutions or controls are currently in place to cope with the threats they pose. Be it lack of will or want, the international community has turned a blind eye to a glaring gap in efforts to curtail illicit financial flows.

For instance, in 2017 it was estimated that approximately 80 percent of global trade was transacted using open account settlement, meaning that in the majority of cases, banks have no knowledge or visibility to the underlying trade transaction they are processing or settling. Indeed, current trade financing regulations are set up in a way that financial institutions “are limited in both the number of opportunities to interdict illicit flows, as well as the practicality of identifying ‘the bad needle.’” banks are gatekeepers against financial crime, but only insofar as they are required to act in that way. When it comes to facilitating international commercial transactions, they are not.

At a national level, it is crucial that every country with ftzs develops a comprehensive legislation regime in accordance with global standards such as the FATF’s best practices against ftzs and the ‘declaration of intent to stop the maritime transport of counterfeits’ (DOI). The latter was signed in 2016 as a “joint effort between key members of the global shipping industry and brand owners to work together to prevent the transport of counterfeit goods on shipping vessels”, having published in 2018 a set of best practices relating to know-your-customer requirements, due diligence and supply chain integrity in the maritime industry.

While these international efforts are encouraging, implementation is voluntary and non-binding. These global transparency standards need to be enforced by international institutions such as the world trade organization (WTO) and the world customs organization (WCO), and it needs to be ensured that customs authorities transpose best practices into national law.

In many cases, FTZ are not currently bound by national laws or courts, and often rely on common law as a dispute settlement mechanism. Legislation should also address some key issues of concern regarding transparency and trade data collection. Part of the reason granular knowledge of ftzs is lacking is due to the limited amount of information on trade flows reported in ftzs. Making that information available would help quantify the problem and paint a clearer picture of the trading routes and commodities that pose a high risk.

If we are to see any significant improvements in FTZ governance and oversight, the WTO and WCO should, at the very least, enforce some basic requirements. Stricter measures need to be in place when it comes to issuing trading permits in ftzs, the national customs authority must be physically present and inspection of goods should be carried out routinely in warehouses. The cost of engaging in TBML practices in ftzs should always outweigh the benefits reaped from illicit activities, which means that prosecution of such crimes should be more aggressive, sustained and targeted by authorities.

Until these basic requirements are met, free trade zones will continue to be haven for free crime.

Free trade agreements with their pros and cons

Advantages and disadvantages and their possible solutions

:strip_icc()/free-trade-agreement-pros-and-cons-3305845-final-5b71e37f46e0fb002cdbc389.png)

Free trade agreements are treaties that regulate the tariffs, taxes, and duties that countries impose on their imports and exports. The most well-known U.S. Regional trade agreement is the north american free trade agreement.

The advantages and disadvantages of free trade agreements affect jobs, business growth, and living standards:

Key takeaways

- Free trade agreements are contracts between countries to allow access to their markets.

- Ftas can force local industries to become more competitive and rely less on government subsidies.

- They can open new markets, increase GDP, and invite new investments.

- Ftas can open up a country to degradation of natural resources, loss of traditional livelihoods, and local employment issues.

- Countries must balance the domestic benefits of free trade agreements with their consequences.

Six advantages

Free trade agreements are designed to increase trade between two or more countries. Increased international trade has the following six main advantages:

- Increased economic growth: the U.S. International trade commission estimated that NAFTA could increase U.S. Economic growth by 0.1%-0.5% a year.

- More dynamic business climate: without free trade agreements, countries often protected their domestic industries and businesses. This protection often made them stagnant and non-competitive on the global market. With the protection removed, they became motivated to become true global competitors.

- Lower government spending: many governments subsidize local industries. After the trade agreement removes subsidies, those funds can be put to better use.

- Foreign direct investment: investors will flock to the country. This adds capital to expand local industries and boost domestic businesses. It also brings in U.S. Dollars to many formerly isolated countries.

- Expertise: global companies have more expertise than domestic companies to develop local resources. That's especially true in mining, oil drilling, and manufacturing. Free trade agreements allow global firms access to these business opportunities. When the multinationals partner with local firms to develop the resources, they train them on the best practices. That gives local firms access to these new methods.

- Technology transfer: local companies also receive access to the latest technologies from their multinational partners. As local economies grow, so do job opportunities. Multi-national companies provide job training to local employees.

Seven disadvantages

The biggest criticism of free trade agreements is that they are responsible for job outsourcing. There are seven total disadvantages:

- Increased job outsourcing: why does that happen? Reducing tariffs on imports allows companies to expand to other countries. Without tariffs, imports from countries with a low cost of living cost less. It makes it difficult for U.S. Companies in those same industries to compete, so they may reduce their workforce. Many U.S. Manufacturing industries did, in fact, lay off workers as a result of NAFTA. one of the biggest criticisms of NAFTA is that it sent jobs to mexico.

- Theft of intellectual property: many developing countries don't have laws to protect patents, inventions, and new processes. The laws they do have aren't always strictly enforced. As a result, corporations often have their ideas stolen. They must then compete with lower-priced domestic knock-offs.

- Crowd out domestic industries: many emerging markets are traditional economies that rely on farming for most employment. These small family farms can't compete with subsidized agri-businesses in the developed countries. As a result, they lose their farms and must look for work in the cities. This aggravates unemployment, crime, and poverty.

- Poor working conditions: multi-national companies may outsource jobs to emerging market countries without adequate labor protections. As a result, women and children are often subjected to grueling factory jobs in sub-standard conditions.

- Degradation of natural resources: emerging market countries often don’t have many environmental protections. Free trade leads to depletion of timber, minerals, and other natural resources. Deforestation and strip-mining reduce their jungles and fields to wastelands.

- Destruction of native cultures: as development moves into isolated areas, indigenous cultures can be destroyed. Local peoples are uprooted. Many suffer disease and death when their resources are polluted.

- Reduced tax revenue: many smaller countries struggle to replace revenue lost from import tariffs and fees.

Solutions

Trade protectionism is rarely the answer. High tariffs only protect domestic industries in the short term. In the long term, global corporations will hire the cheapest workers wherever they are in the world to make higher profits.

A better solution than protectionism is the inclusion of regulations within trade agreements that protect against the disadvantages.

Environmental safeguards can prevent the destruction of natural resources and cultures. Labor laws prevent poor working conditions. The world trade organization enforces free trade agreement regulations.

Developed economies can reduce their agribusiness subsidies, keeping emerging market farmers in business. They can help local farmers develop sustainable practices. They can then market them as such to consumers who value that.

Countries can insist that foreign companies build local factories as part of the agreement. They can require these companies to share technology and train local workers.

Benefits of free trade

Free trade means that countries can import and export goods without any tariff barriers or other non-tariff barriers to trade.

Essentially, free trade enables lower prices for consumers, increased exports, benefits from economies of scale and a greater choice of goods.

In more detail, the benefits of free trade include:

1. The theory of comparative advantage

This explains that by specialising in goods where countries have a lower opportunity cost, there can be an increase in economic welfare for all countries. Free trade enables countries to specialise in those goods where they have a comparative advantage.

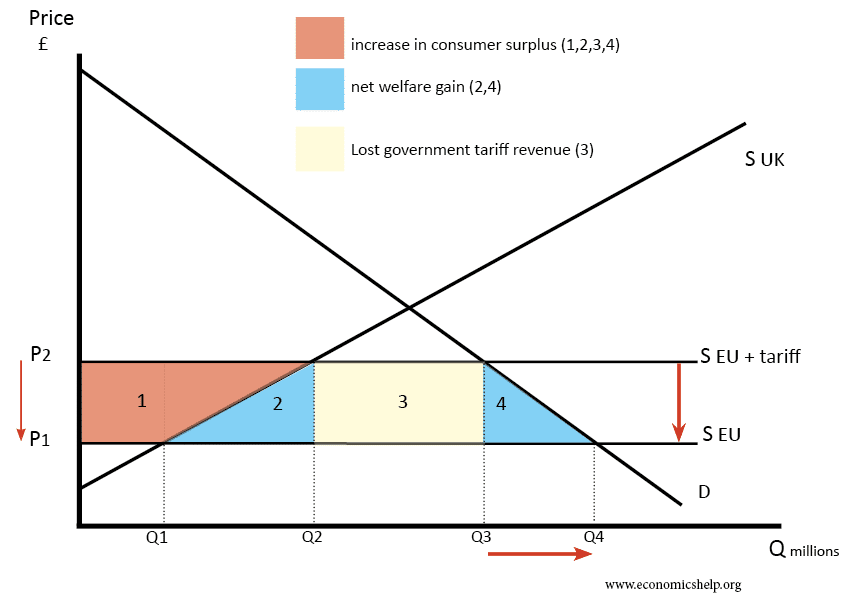

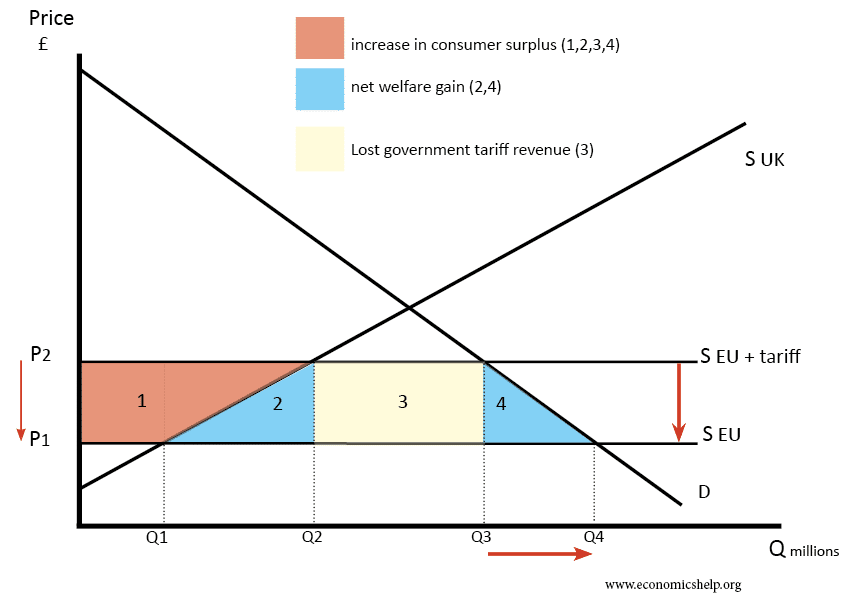

2. Reducing tariff barriers leads to trade creation

Trade creation occurs when consumption switches from high-cost producers to low-cost producers.

- The removal of tariffs leads to lower prices for consumers (prices fall from P1 to P2)

- This fall in prices enables an increase in consumer surplus of areas 1 + 2 + 3 + 4

- Imports will increase from Q3-Q2 to Q4-Q1

- The government will lose tax revenue of area 3. Tax revenue from imports was T (P1-P2) × (Q3-Q2)

- Domestic firms producing this good will sell less and lose producer surplus equal to area 1

- However, overall there will be an increase in economic welfare of 2+4 (1+2+3+4 – (1+3)

- The magnitude of this increase depends upon the elasticity of supply and demand. If demand elastic consumers will have a big increase in welfare

- Essentially, removing tariffs leads to lower prices for consumers – so the price of imported food, clothes and computers will be lower. When the UK joined the EEC – the price of many imports from europe fell.

3. Increased exports

As well as benefits for consumers importing goods, firms exporting goods where the UK has a comparative advantage will also see a significant improvement in economic welfare. Lower tariffs on UK exports will enable a higher quantity of exports boosting UK jobs and economic growth.

4. Economies of scale

If countries can specialise in certain goods they can benefit from economies of scale and lower average costs; this is especially true in industries with high fixed costs or that require high levels of investment. The benefits of economies of scale will ultimately lead to lower prices for consumers and greater efficiency for exporting firms.

5. Increased competition

With more trade, domestic firms will face more competition from abroad. Therefore, there will be more incentives to cut costs and increase efficiency. It may prevent domestic monopolies from charging too high prices.

6. Trade is an engine of growth.

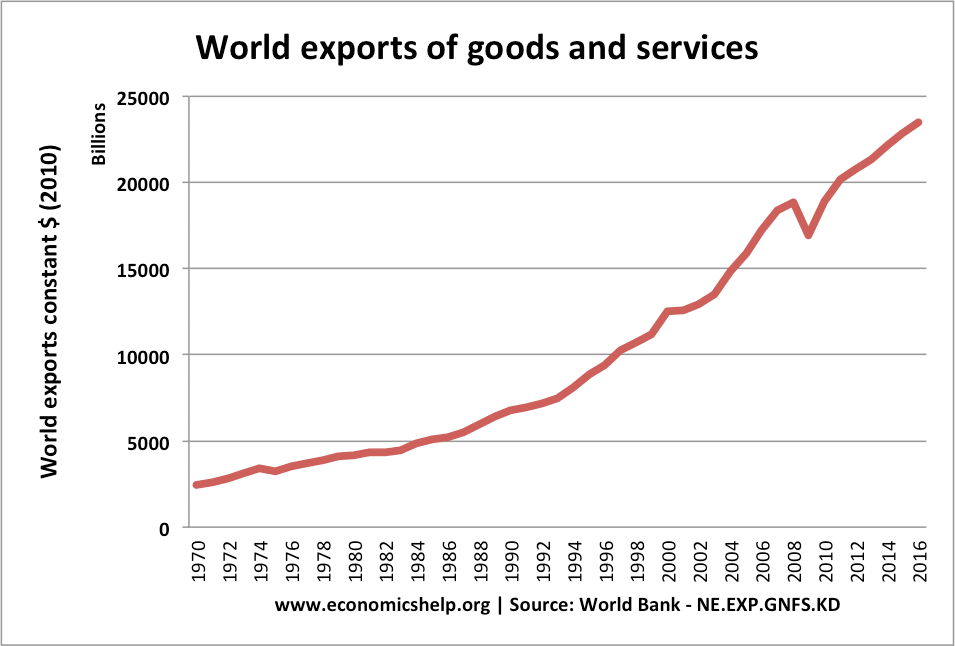

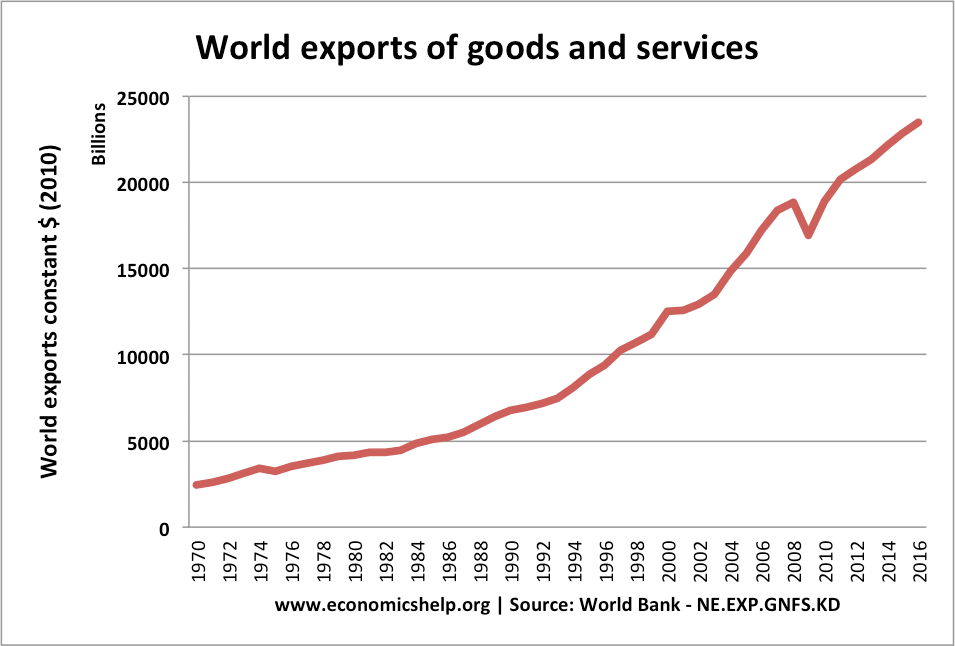

World trade has increased by an average of 7% since 1945, causing this to be one of the significant contributors to economic growth.

World exports of goods and services has increased to $2.2 trillion (2016)

7. Make use of surplus raw materials

Middle eastern countries such as qatar are very rich in reserves of oil, but without trade, there would be not much benefit in having so much oil.

Japan, on the other hand, has very few raw materials; without trade, it would have low GDP.

8. Tariffs may encourage inefficiency

If an economy protects its domestic industry by increasing tariffs industries may not have any incentives to cut costs.

Economists on free trade

Adam smith, the wealth of nations (1776) smith generally supported free trade arguing countries should specialise in their areas of expertise. He made the argument there is no point in protecting the scottish wine industry if it would cost 30 times the price of importing wine from warmer countries. Smith also argued that if our competitors become better off, they will be able to buy more of our exports. Smith saw trade as a way for all countries to become better off. This was in contrast to the zero-sum mercantilist theories popular at the time.

“as a rich man is likely to be a better customer to the industrious people in his neighbourhood than a poor, so is likewise a rich nation. [trade restrictions,] by aiming at the impoverishment of all our neighbours, tend to render that very commerce insignificant and contemptible.”

The wealth of nations, book IV, chapter III, part II, p.495, para. C11.

“if a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry, employed in a way in which we have some advantage.”

The wealth of nations, book IV, chapter II, [link]

David ricardo on the principles of political economy and taxation. (1817) ricardo made case for free trade on the basis of comparative advantage. Ricardo tried to show that removal of tariffs would lead to a net welfare gain – the gain of consumers outweighing the loss of producers

“under a system of perfectly free commerce, each country naturally devotes its capital and labour to such employments as are most beneficial to each. This pursuit of individual advantage is admirably connected with the universal good of the whole.”

David ricardo, on the principles of political economy and taxation (link)

John maynard keynes. Keynes was generally free trade and supported the logic of specialisation

“in a regime of free trade and free economic intercourse it would be of little consequence that iron lay on one side of a political frontier, and labor, coal, and blast furnaces on the other. But as it is, men have devised ways to impoverish themselves and one another; and prefer collective animosities to individual happiness.”

John maynard keynes the economic consequences of the peace (1920) though it worth bearing in mind keynes wavered on free trade in some circumstances

Greg mankiw argues that free trade is one area where economists are united

“few propositions command as much consensus among professional economists as that open world trade increases economic growth and raises living standards.” – greg mankiw [link]

Joseph stiglitz is more circumspect. Stiglitz argues free trade depends on individual circumstances

The economist

ECONOMISTS are usually accused of three sins: an inability to agree among themselves; stating the obvious; and giving bad advice. In the field of international trade, they would be right to plead not guilty to all three. If there is one proposition with which virtually all economists agree, it is that free trade is almost always better than protection. Yet the underlying theory is not readily understood by non-economists. And the advice that follows from it-protection does not pay-is seldom wrong.

Free trade money

The cost of buying and selling shares has fallen steeply since the start of the 2000s thanks to a digital revolution.

In the not too distance past, investors who wanted to buy and sell stocks and shares would have to do this through a stockbroker or a financial adviser who took a sizeable chunk of commission with every deal.

But times changed and online DIY investing platforms give investors the ability to buy and sell at their fingertips, whether from the comfort of their computer or even their phone.

The cost of buying and selling shares has fallen over time, but still remains sizeable at some platforms, with hargreaves lansdown charging £11.95, interactive investor £10 and AJ bell £9.95. Halifax-owned iweb deserves and honorable mention as it charges just £5

The fee-free share dealing firms

Trading 212 and freetrade both have an eye-catching offer designed to pull customers in: neither charges a penny to buy or sell shares.

But why offer this and who are these two firms?

For trading 212, it was a case of adding another string to its bow when contracts for difference (CFD) trading - one of its flagship offerings and main revenue driver -was hit by a regulatory crackdown.

A CFD is a form of derivative trading that allows you to speculate on the rising or falling prices of global financial markets, such as forex, indices, commodities, shares and treasuries. It carries a higher level of risk compared to conventional shares and bonds investments.

Crucially, investors do not buy shares but use derivatives to either simply mimic prices, or magnify moves through the use of leverage, as borrowed money is known.

New european rules, which came into effect in august last year, have reduced the amount CFD traders can leverage, as concern grew that big losses were being incurred by inexperienced investors. Britain's financial watchdog, the FCA is also tightening rules. These measures have trimmed CFD platforms's prospectts.

Trading 212 became the first retail broker in britain to introduced a commission-free share dealing service in 2017.

In the case of freetrade, commission-free share dealing, either through a standard account or isa, is the only service the digital broker currently offers. It plans to expand into new areas in future. It's free to open an isa account until july 2019. The cost will be £3 thereafter.

Both challenger investment platforms have adopted this model as a carrot to tempt customers away from established rivals, such as hargreaves lansdown, interactive investor and AJ bell.

The average commission charged by five of the largest online share-dealing platforms run at £8.31 per trade, with leading brokers such as hargreaves lansdown and interactive investor charging £11.95 and £10 respectively, according to DJB research.

Commission-free sharing dealing looks set to further disrupt a market that is already experiencing a downward pressure on investment fees amid regulatory pressure.

Where can you invest?

It's worth noting that freetrade's and trading 212 respective investment universe is relatively small compared to that of more established rivals.

A total of 335 stocks, etfs and investment trusts sit on the freetrade platform. The selection comprises of 122 US stocks and 136 UK securities - including 33 investment trusts and 44 etfs. The firm expects to increase this figure on an ongoing basis.

Meanwhile, trading 212 hosts more than 1,800 investment opportunities comprising shares in companies based in the UK, the US and in some european markets, as well as etfs.

To put this into perspective, hargreaves lansdown offers 1,643 UK shares, 7,184 overseas shares, 1,170 etfs and 386 investment trusts.

Crucially, neither trading 212 or freetrade allow you to invest in investment funds or individual corporate bonds outside an ETF.

Hargreaves, meanwhile, hosts 470 corporate bonds plus 7,099 funds from the UK and abroad.

Both trading 212 and freetrade offer an isa wrapper, but neither offer a self invested personal pension.

How do these platforms make money?

Ivan ashminov, co-founder of trading 212, told this is money that actual trading costs are less than £1, so waiving trading commission does not have a detrimental effect.

The charges levied on the platform's other services should more than cover a shortfall from these costs, he added.

Things to consider before moving platform

Investors are free to move DIY investing platform and should track down the one that is best for their needs.

However, they need to be aware of fees for moving from their existing platform and from one they sign up to if they don't like it.

Investors should calculate the potential annual saving they would make by switching and a reasonable expectation of investment growth under the new platform against the cost of moving and any exit fees.

Things like customer services offered by the respective platforms may seem like a small detail but can make the world of difference.

Trading 212 adopts a 'freemium' model - like mobile games that are free to download but have in app purchases - in the hope that some customers will shell out for additional services that it develops down the line, such as robo-advice on which stocks to buy.

Customers of newcomer freetrade can only trade shares without incurring a broker charge if transacted outside an isa wrapper through it's 'basic trade' service.

Basic trade means the buys and sells are aggregated and dealt around 4pm every day.

This isn't a huge problem if you plan on holding shares for a long time, but more experienced investors often want to be able to trade instantly at a set price.

Free trades are never quite free

There is no such thing as a free trade. Period.

This is because of a concept called the bid-offer spread, which is essentially the gap between the highest price a buyer is willing to pay you for shares and the lowest price a seller is willing to sell them to you for.

You will pay closer to the higher price to purchase a share and sell nearer the lower price.

The size of the gap depends on how liquid a share is, ie how easy it is to buy and sell, and larger companies therefore tend to have tighter spreads.

These prices are different to the mid-price, which is the one you will generally see quoted in market reports and headline share data.

At the time of publication, shares in tesco were trading at 234.05p, however, the offer was 234.1 and the bid was 234p. The spread here is 0.04 per cent. Another cost in buying shares is stamp duty charged at 0.5 per cent.

When buying a foreign stock, you'll also have factor in the cost of the converting currency. Trading 212 passes on the charge at the spot rate. Whereas freetrade charges spot rate plus 0.45 per cent on these transactions.

Freetrade was founded back in 2015 but officially launched its commission-free share dealing app in september 2018.

Will commission-free trading free trade last?

That's dependent on whether the model can pull enough people for these companies to make money off other things they charge for.

At some point, the platform's respective financial backers will want some return on their investment, and zero commission trading removes a major source of revenue.

Commission-free share trading is novel, but eventually investors might crave a more expansive investment universe, with access to more shares, funds and investment trusts.

So the main challenge for these platforms in future may be to keep hold of the customers they've lured in through the zero-commission share trading service by adding new features that complement their evolution as investors.

Both trading 212 and freetrade are legitimate digital stockbrokers, authorised and regulated by the FCA.

If either platforms ever go under, your investments are covered by up to £85,000 (up from £50,000 as of 1 april) under the financial services compensation scheme safety net.

The saying 'there's no such thing as a free lunch' certainly applies here. While basic share dealing services are free any bells and whistles cost more and there is the spread and tax to take into account.

Also, free trading may tempt you to change your investment style and invest more frequently than necessary. Doing so can increase internal costs and potentially hinder your long-term returns.

When weighing up the right platform to invest for you, it's important to look at the service that it offers, along with administration charges and dealing fees, plus any other extra costs.

| provider | admin charge | charges notes | fund dealing | standard share, investment trusts, ETF dealing | regular investing | dividend reinvestment | |

|---|---|---|---|---|---|---|---|

| trading 212 | n/a | - | n/a | free (investment trust trades unavailable) | n/a | n/a | more details |

| freetrade | n/a | - | n/a | free | n/a | n/a | more details |

| hargreaves lansdown | 0.45% | capped at £45 a year for shares, trusts, etfs | free | £11.95 | £1.50 | 1% (£1 min, £10 max) | more details |

| barclays direct investing* | 0.2% on funds, 0.1% on other investments | min monthly fee £4, max £125 | £3 | £6 | £1 | free | more details |

| share centre | £57.60 | - | 1% £7.50 min | 1% £7.50 min | 0.5%, min £1 | 0.5%, min £1 | more details |

Free share dealing snapshot

Trading 212

Trading 212, which was founded in bulgaria 16 years ago, has operated an online commodities and currency trading platform in the UK for five years. The firm became the first retail broker in britain to introduced a commission-free share dealing service in 2017.

The service, now called, trading 212 invest, provides access to stocks and etfs across the world’s leading stock exchanges and currencies, including cryptocurrencies, like bitcoin, and commodities.

Trading 212 doesn't levy an administration fees on trades, the only costs to be aware of are the bid-ask spread and the foreign exchange spot price when trading shares overseas. Money held in an isa incurs no additional charge.

Freetrade

Freetrade was founded back in 2015 by adam dodds, a former KPMG manager, but officially launched its commission-free share dealing app in september 2018.

In order to offer fee-free trading, freetrade got an FCA licence and joined the london stock exchange in order to processes its own 'basic' orders in bulk each day at 4pm.

The online broker does not levy for trades that are aggregated and dealt around 4pm every day. UK and US shares cost £1 to trade instantly and a foreign exchange charge which comprises of the spot rate (the price quoted for immediate settlement on a commodity, a security or a currency) plus 0.45 per cent.

Isas are currently free until july 2019 but will cost users £3 a month thereafter. Transferring money out of either an isa or general account into a bank account cost £5 a pop. The bid-ask spread costs also apply.

Coming soon? Etoro and revolut

Etoro could be the next the latest investment platform to launch a commission-free share dealing platform.

Users will be able to trade 1,340 shares that sit on the platform without incurring a broker fee. A spokesman for the firm said the service will land before the end of summer and it won't cap users' amount of free trading.

Digital-only bank revolut is also building a commission-free trading platform on its app, its latest bid to use technology to undercut traditional financial services.

Revolut said users will be able to buy and sell listed stocks in seconds, without paying commission. The firm said the product would generate income from premium subscriptions, which will give perks to paying customers, as well as margin trading, securities lending and interest on cash held. No release date has been given.

Benefits of free trade

Free trade means that countries can import and export goods without any tariff barriers or other non-tariff barriers to trade.

Essentially, free trade enables lower prices for consumers, increased exports, benefits from economies of scale and a greater choice of goods.

In more detail, the benefits of free trade include:

1. The theory of comparative advantage

This explains that by specialising in goods where countries have a lower opportunity cost, there can be an increase in economic welfare for all countries. Free trade enables countries to specialise in those goods where they have a comparative advantage.

2. Reducing tariff barriers leads to trade creation

Trade creation occurs when consumption switches from high-cost producers to low-cost producers.

- The removal of tariffs leads to lower prices for consumers (prices fall from P1 to P2)

- This fall in prices enables an increase in consumer surplus of areas 1 + 2 + 3 + 4

- Imports will increase from Q3-Q2 to Q4-Q1

- The government will lose tax revenue of area 3. Tax revenue from imports was T (P1-P2) × (Q3-Q2)

- Domestic firms producing this good will sell less and lose producer surplus equal to area 1

- However, overall there will be an increase in economic welfare of 2+4 (1+2+3+4 – (1+3)

- The magnitude of this increase depends upon the elasticity of supply and demand. If demand elastic consumers will have a big increase in welfare

- Essentially, removing tariffs leads to lower prices for consumers – so the price of imported food, clothes and computers will be lower. When the UK joined the EEC – the price of many imports from europe fell.

3. Increased exports

As well as benefits for consumers importing goods, firms exporting goods where the UK has a comparative advantage will also see a significant improvement in economic welfare. Lower tariffs on UK exports will enable a higher quantity of exports boosting UK jobs and economic growth.

4. Economies of scale

If countries can specialise in certain goods they can benefit from economies of scale and lower average costs; this is especially true in industries with high fixed costs or that require high levels of investment. The benefits of economies of scale will ultimately lead to lower prices for consumers and greater efficiency for exporting firms.

5. Increased competition

With more trade, domestic firms will face more competition from abroad. Therefore, there will be more incentives to cut costs and increase efficiency. It may prevent domestic monopolies from charging too high prices.

6. Trade is an engine of growth.

World trade has increased by an average of 7% since 1945, causing this to be one of the significant contributors to economic growth.

World exports of goods and services has increased to $2.2 trillion (2016)

7. Make use of surplus raw materials

Middle eastern countries such as qatar are very rich in reserves of oil, but without trade, there would be not much benefit in having so much oil.

Japan, on the other hand, has very few raw materials; without trade, it would have low GDP.

8. Tariffs may encourage inefficiency

If an economy protects its domestic industry by increasing tariffs industries may not have any incentives to cut costs.

Economists on free trade

Adam smith, the wealth of nations (1776) smith generally supported free trade arguing countries should specialise in their areas of expertise. He made the argument there is no point in protecting the scottish wine industry if it would cost 30 times the price of importing wine from warmer countries. Smith also argued that if our competitors become better off, they will be able to buy more of our exports. Smith saw trade as a way for all countries to become better off. This was in contrast to the zero-sum mercantilist theories popular at the time.

“as a rich man is likely to be a better customer to the industrious people in his neighbourhood than a poor, so is likewise a rich nation. [trade restrictions,] by aiming at the impoverishment of all our neighbours, tend to render that very commerce insignificant and contemptible.”

The wealth of nations, book IV, chapter III, part II, p.495, para. C11.

“if a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry, employed in a way in which we have some advantage.”

The wealth of nations, book IV, chapter II, [link]

David ricardo on the principles of political economy and taxation. (1817) ricardo made case for free trade on the basis of comparative advantage. Ricardo tried to show that removal of tariffs would lead to a net welfare gain – the gain of consumers outweighing the loss of producers

“under a system of perfectly free commerce, each country naturally devotes its capital and labour to such employments as are most beneficial to each. This pursuit of individual advantage is admirably connected with the universal good of the whole.”

David ricardo, on the principles of political economy and taxation (link)

John maynard keynes. Keynes was generally free trade and supported the logic of specialisation

“in a regime of free trade and free economic intercourse it would be of little consequence that iron lay on one side of a political frontier, and labor, coal, and blast furnaces on the other. But as it is, men have devised ways to impoverish themselves and one another; and prefer collective animosities to individual happiness.”

John maynard keynes the economic consequences of the peace (1920) though it worth bearing in mind keynes wavered on free trade in some circumstances

Greg mankiw argues that free trade is one area where economists are united

“few propositions command as much consensus among professional economists as that open world trade increases economic growth and raises living standards.” – greg mankiw [link]

Joseph stiglitz is more circumspect. Stiglitz argues free trade depends on individual circumstances

The economist

ECONOMISTS are usually accused of three sins: an inability to agree among themselves; stating the obvious; and giving bad advice. In the field of international trade, they would be right to plead not guilty to all three. If there is one proposition with which virtually all economists agree, it is that free trade is almost always better than protection. Yet the underlying theory is not readily understood by non-economists. And the advice that follows from it-protection does not pay-is seldom wrong.

So, let's see, what was the most valuable thing of this article: welcome bonus trade 100 is not a demo account. FBS gives you real money and real account to start your investment career without a deposit. Learn how to trade and make a real profit out of it at free trade money

Contents of the article

- Today forex bonuses

- TRADE 100 BONUS — WORK OUT FOR MORE

- Bonus information

- What you get with trade 100 bonus

- How can trade 100 bonus help

- How to get $100 of profit?

- Bonus conditions

- Share with friends:

- What you get with trade 100 bonus

- Instant opening

- Withdraw with your local payment systems

- Data collection notice

- Beginner forex book

- Thank you!

- What is free trade? Definition, theories, pros,...

- Free trade definition

- Free trade theories

- Pros and cons of free trade

- Pricing

- Compare our general investment account

- Compare our stocks and shares ISA

- Compare our SIPP

- Your SIPP costs a flat fee of ВЈ9.99/month, or...

- Comparison disclosure в“˜

- While youвђ™re on the waitlist, why not download...

- Full pricing

- Calculator

- Global financial integrity

- Free trade zones: a pandora’s box for illicit...

- Free trade agreements with their pros and cons

- Advantages and disadvantages and their possible...

- Six advantages

- Seven disadvantages

- Solutions

- Benefits of free trade

- Economists on free trade

- Free trade money

- The fee-free share dealing firms

- Where can you invest?

- How do these platforms make money?

- Free trades are never quite free

- Will commission-free trading free trade last?

- Trading 212

- Freetrade

- Coming soon? Etoro and revolut

- Benefits of free trade

- Economists on free trade

No comments:

Post a Comment