Can you trade forex with $100

Now we can calculate the required margin: the notional value is $6,000.

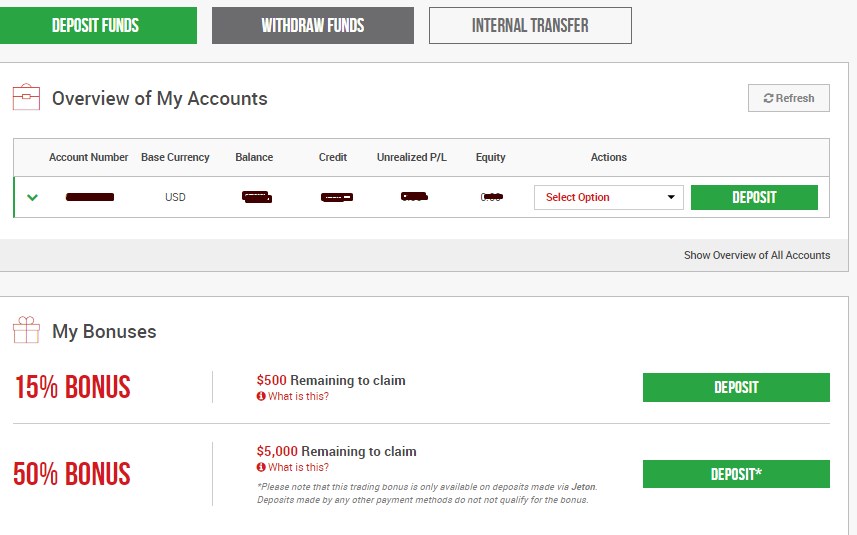

Today forex bonuses

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

Since you’re a big baller shot caller, you deposit $100 into your trading account.

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Aside from the trade we just entered, there aren’t any other trades open.

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%. At this point, this is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

How to trade forex with $100

→ click here to start trading forex with $100 .

How to trade forex with just $100 as a starting point?

How to start trading with small initial capital?

How much money do I need to start trading forex?

How long do I have to wait before I start making a decent amount of money from initially trading forex with $100?

Perhaps these are just some of the questions strolling through your mind if you’re to consider trading forex as a newbie. Especially if you want to trade forex with $100!

Can you trade forex with $100?

While there is nothing certain in the world of forex trading, there are many trading possibilities to help you become a pro. One of them is to start trading forex with $100.

Trading forex with a small amount of capital is great if you’re not familiar with the forex market. The truth is that you should trade forex with $100 only when this $100 is not the only money you have to put food on the table. Because to trade forex, you have to be prepared to lose before you win!

That said, there are many other factors to consider before you start trading forex with $100. After all, there’s so much more to forex than earning money!

Invest in forex trading education , practice trading to build up some confidence and develop a consistent forex trading strategy, and always explore your emotions while trading forex.

Should you trade forex with $100?

Too many people believe that trading in the foreign exchange market requires you to start with a considerable initial amount of money at your disposal or to be already pretty wealthy.

Well, to trade forex, you should be financially stable and able to lose. Experts claim that any money you invest in forex trading should be disposable ; in other words, financial losses shouldn’t affect your daily life.

If you are new to the forex market, in particular, you can expect at least a dozen sources to bombard you with recommendations and suggestions on how to get rich trading forex and build considerable forex wealth at a rapid pace and with a low amount of money.

One of the most popular and controversial theories in the field of forex trading suggests that you can initially invest just $100 in entering the forex market, which can quickly grow to as much as $10,000 or even a million in a short period of time. Whether or not forex beginners can stand a chance of a great return is a subject of an endless list of factors. But it’s unlikely.

How to trade forex with $100

Although many people believe that a large amount of money at your disposal is much needed for starting trading forex, there are also many forex beginners coming into the forex market with relatively small trading accounts of just $100, £100 or similar amounts.

Here we should note that there are different forex trading accounts you can consider. Forex brokers often offer four types: standard, mini, micro, and nano accounts. While standard accounts require initial capital, mini accounts allow people to trade forex using mini lots.

However, one of the main fundamentals in the foreign exchange market is that the size of your account is not the most important thing in this initial stage.

Learning is what matters the most in order to benefit from the potential chance to earn money by trading forex. Hands down, you will soon find out that it is easier said than done as it takes a lot of patience and discipline to be able to witness the progress of your account.

If you’re looking for some great options for a forex trading education, make sure you check out trading education’s free forex trading course . With the right educational background and a lot of practice, you will be able to learn the art of forex trading.

On top of that, to trade forex, one should be consistent . Never trade forex out of greed or revenge! Discipline, patience, and emotional control, along with other characteristics and skills valued in the forex realm, are just a few of the fundaments that you should master.

How do you trade forex with $100 and potentially make a profit?

Let’s continue on. As mentioned above, the point of the size of your forex trading account is not that important. Even if you decide to trade forex with $100, you can definitely do so!

The size of your account just provides you with different possibilities, which makes it a function to achieving success… but also experiencing failure. Both success and failure can happen to accounts worth millions of pounds or dollars too.

But let’s assume that we all live in a perfect world and all the flashy forex trading advertisements are without a doubt going to change your life. You want to start your “home business”, you want to trade forex with $100 at first and make a decent monthly profit, you want to be this regular person succeeding on the road to the riches fast and easily.

Speaking hypothetically, all this can eventually happen with the help of forex trading. Thanks to the high leverage in the forex market , you can truly pursue paths that are not available with other sorts of investment endeavours . A quick return is something that in reality does and has happened to some people in forex trading. It is also a truth that some people tend to be treated kindly by the market and have managed to learn from their failures to make more successful forex trades.

How do you really trade forex with $100?

However, this is not the mentality you should enter the forex market with. Simply because all these hypothetical cases are just hypothetical - not something that happens on a day-to-day basis to the regular trader.

At the same time, there is no doubt that compared to other investment opportunities, forex won’t break the bank in order for you to enter the market. You can start trading forex with just $100 . Here are some tips to help you make money with $100.

1. Learn more about forex trading and its complexities

Forex is considered the biggest and most liquid financial market in the world, and some of the advantages of forex trading include:

- You can trade from home and you don’t need to rent an office.

- All you need is a computer and internet connection.

- You don’t need any employees or special inventory.

- You don’t need marketing and advertising.

- Forex operates 24 hours a day, so you can trade forex as a side job.

- You don’t need a university degree. However, a good education is highly recommended. Here’s the link to the free forex course in case you missed it.

It sounds like forex trading offers some really good opportunities, right? Well, you can explore the advantages of forex trading even if you decide to trade forex with $100.

2. Understand leverage in forex

Here we should mention that one of the main factors which attracts traders to forex trading is high leverage. That said, the primary reason why so many people fail and leave the forex market is high leverage, too.

Normally, a minimum of 50:1 leverage ratio is what the majority of all the reliable brokers out there offer . Though leverage in forex can be limited and controlled by government regulations, in some countries forex brokers may offer you a leverage ratio of 500:1 or even 1000:1!

Though all this sounds like a good way to make some quick money, be aware that the higher the leverage, the higher the possibility of losing money. So you may want to keep the risk and the leverage low.

3. Focus on the trading process, not on the money

Do not focus solely on making money. Forex trading is not a get-rich-quick scheme. To trade forex you need to invest a lot of time, resources, and patience.

Of course, we all know that the main motivation in forex trading is making a living. Making money can be a pretty powerful moving force, indeed.

But such motivation can pressure you into making rushed decisions. That’s why do not enter the forex market with the one and only goal of making quick money. Better think of forex trading as constant progress and growth instead of an easy way to monetise everything you do and plan to do.

There is a lot of truth in the saying that making money in forex is simply a result of trading it successfully. When you develop a consistent trading strategy and style , you will soon understand the wise meaning behind these words.

4. Balance life, realistic expectations & forex trading

When it comes to making money, one of the main problems that many newbies face is the way they treat forex trading. Some beginners who want to trade forex with $100 may quit their day jobs in hopes of making forex the main source of income in their lives. Some hope to become millionaires before the age of 40.

When you focus all your mental energy on monetising every step you take, though, you lose your focus of more important things, such as creating a risk management technique , mastering an effective strategy, being consistent, and having a healthy lifestyle.

5. Treat your small account the same you would treat a big one

Even if you trade forex with $100, you need to treat your account as if it is a big one . You better focus on how to be a good trader first.

From then on, it is all a step-by-step learning process, which will help you to trade with a larger account. Once you learn how to trade forex successfully, your money is more likely to follow.

6. Learn to control your emotions when trading forex with $100

No matter if you trade forex with $100 or a large amount, emotional self-control is one of the main keys to success in forex trading. A slow, calculated approach, as well as a lot of patience and discipline, is something that many good forex traders mention when asked about their success.

Interestingly enough, forex traders with smaller accounts tend to be more emotional when trading forex because they want to make their accounts grow fast. Don’t allow this urgent “need” of growing your account to lead you to over-trading, over-leveraging, over-risking, and most probably losing money consistently.

Additionally, do not forget that large accounts are not built overnight; it takes a lot of consistency and a long-term approach rather than taking big risks. Even the “big fish” in forex trading have a trading win rate of between 55% and 70% which is, as you can see, definitely not a perfect and smooth day-to-day trading experience.

In fact, when it comes to forex trading, the path to success is definitely not paved with taking a lot of high risks. Only risk 1% of your trading account . You wouldn’t risk the shirt on your back, right?

7. Build a consistent track record to improve your forex trading performance

Last but not least, having a very small forex trading account means that you need to focus on keeping a consistent track record.

In fact, good track records will help you boost your confidence as a forex trader slowly and surely - even when you trade forex with $100. Once you start making progress - and your track record progresses too - you can then consider proceeding with further developing your forex account and trading larger sums.

This step-by-step approach in forex trading is a very important one. You may have already built your own forex trading strategy and an efficient trading routine . So stick to them and don’t fall into the rabbit hole of over-analysing every piece of data and every headline you have access to.

It is also highly recommended to have a forex trading journal as it will help you stay more disciplined and organised while also providing you with valuable self-reflection insights.

How to manage a small forex trading account?

The basic principles of managing a small and a large forex account are all the same.

However, when you manage a small account you will be obviously trading smaller position sizes per trade, which can lead to dissatisfaction and impatience. In this case, keep greed and emotions out of the equation and avoid over-leveraging and trading too large. This is a common mistake many forex trading beginners tend to make, which can destroy your account faster than you can spell your name.

Focus on trading only the most obvious and confluent price action setups, adopt a more relaxed forex trading style, don’t be aggressive. This will help you manage your money and increase your chances of making a profit.

Also, every time you enter a trade, make sure that you are prepared to lose as you could potentially lose any forex trade. After all, there is a theoretical pattern of loss and gain in life, and forex trading is no exception.

Trading forex with $100: conclusion

With nano and micro forex trading accounts gaining more and more popularity these days, opening an account with $100 is definitely possible. In fact, many brokers work with an initial deposit as low as $10. Some even accept the extreme $5 or $1!

But there is a significant difference between whether you can start to trade forex with $100 and whether you should do it. Just because it is allowed and possible, does not mean that you should start with this amount. Then again, just because someone tells you $100 is too low does not mean that you should not try at all.

The leitmotif in all cases, however, is that you have to be realistic in your expectations and focus on working on a consistent and efficient forex trading strategy . Do not take high risks, do not get emotional, and do not enter obsessed with the idea of earning money overnight; simply try to define the meaning of forex trading “success” beforehand.

Key points

- As there are different forex accounts that traders can consider, trading forex with $100 is possible and potentially profitable.

- The size of your account is not the most important factor in forex trading, so treat your small account the same way you would treat a larger one.

- Education, emotional self-control, consistency, and patience are crucial to success.

- Whether you trade forex with $100,000 or $100, you should be realistic, persistent and ready to lose before you win.

Trade with the largest forex broker

Now you know how to trade forex with just $100

Whether you’re just getting started or ready to take your trading to the next level, forex.Com can help. As the global market leader, forex.Com offers tight spreads on over 90 pairs and access to 300+ markets. Learn more about what it’s like to trade with the largest forex broker and open an account with $100.

Best forex trading platform in the USA

Sign up for forex.Com and start trading forex with $100. There are no management fees or other hidden costs involved.

Forex.Com have proven themselves trustworthy within the industry over many years – we recommend you try them out.

Remember: forex trading involves significant risk of loss and is not suitable for all investors

Can you trade forex with $100; the plain and hard truth

Beginners venturing into forex trading often have high expectations. Well, forex trading can be extremely profitable, as seen from the numerous success stories of people who have built fortunes trading. However, it has its fair share of risks, and it is essential to be wary of them when scaling up your investment. The inflation in recent years has reduced the value of $100, and many people might be wondering whether they can start with this in their forex investment career. The sad truth is that it all depends on the path you take. If you are patient and have a desire to learn, you can successfully trade forex with $100 and build a huge capital base. On the flip side, you can lose this amount in a single trade and probably never log in to your investment account ever again.

Research is key

Before you try to trade forex with $100, understand that knowledge is power. Try and know as much as you can in the market.

Find out about markets and trading in general, as this will help you make decisions that will increase your chances of making profits.

If you want to make a quick gamble with your money, then you do not have to learn much more than how to enter orders in your brokerage platform.

Research and knowledge will give you consistency and shape you up for the long haul in forex trading. You will need to understand more about certain currencies and the factors that affect their valuation.

Good brokers will offer resources such as ebooks, articles, and videos that will help you understand what you are signing up for.

How can you trade forex with $100 profitably?

Here, we are going to assume that we live in an ideal world and all the flashy advertisements telling you how much money you can make are valid. You are looking to start a steady, forex investment career that will yield a healthy monthly return.

In reality, you can achieve this thanks to the high leverage in the market that allows you to pursue paths that are not offered by other investment opportunities. While we discourage you from pursuing quick returns in forex trading, this is something that does and continues to happen to some people.

Some people are lucky to get some TLC from the market, and they make more successful trades that overshadow their failures. However, this is the wrong mentality to hold when entering the market as the chances of being disappointed are high.

The leverage levels offer you an opportunity to trade vast amounts of money with your mere $100. Well, most brokers will provide a minimum for 50:1 leverage, which means that you can trade $5000 worth of equity at only $100.

Country regulations control these leverage levels, but you can still find brokers offering you leverage in the region of $1000:1.

While all this sounds good to you, note the higher the leverage, the higher the probability of losing a lot of money. This way, it is better to approach investing safely by keeping risk and leverage low.

Focus on trade and not money

This might appear a bit strange since your primary motivation behind forex trading is to make money. However, focusing on trade can be a huge asset for the long haul.

It inhibits you from making rash decisions and thus protects you from constant failure. Look at success in terms of the progress and growth as opposed to how much you make when you trade forex with $100.

If you do this, the money will come as a side effect, and before you know it, trading will be easy. If you want to monetize all the steps you make and strive to make the most returns out of $100, you tend to forget about critical things such as maintaining a strategy and risk management.

The idea is to become a good trader, and the $100 you invest should help you do this.

Avoid emotional trades

With a lot of money in your account, a few winning trades a month can result in huge returns. You do not even have to risk a lot.

Try and trade forex with $100 in the same way that you would if you had a $1 million. It is hard to keep calm as most small traders tend to get more emotional with their accounts due to impatience, and the insatiable need to grow their capital.

The path to profit is defined by taking a lot of high risks. You would not dare do this with your big account, and once you get this mentality, you should be good to go.

A slow and calculated approach is what the best forex traders take on their path to success.

Understand that since something is possible does not mean that it is probable. If it is difficult to get a $5,000 account to $10,000, what about getting a $100 one to $1000.

Forex trading is that it should not be done with scared money. This way, all the money you use to trade should be disposable, and you should be able to pay your bills and go on with your life normally.

If $100 is the only disposable amount of money you have, it gives the impression that your financial situation might not be as secure as it should be to cushion you from all the risks associated with trading. The hard truth is that you should consider trading forex or any other market once you can afford to lose money.

If you want to win at trading, you cannot be scared of losing money.

In recent years, nano and micro forex accounts have flooded the market, and it is possible to trade forex with $100. Some brokers allow deposits as low as $5.

However, you should understand the difference between whether you can trade forex with $100 or whether you should do it. The key is to be realistic with your expectations, avoid taking risks with huge leverages, and learn the skill of investing rather than rushing into it to make overnight fortunes.

Once you focus on building the right mentality and trading strategy, you will be comfortable trading even $10,000, something that overshadows the urge to become a day trader with $100 quickly.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

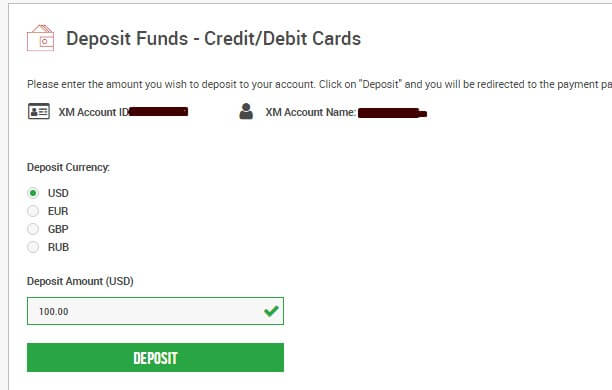

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

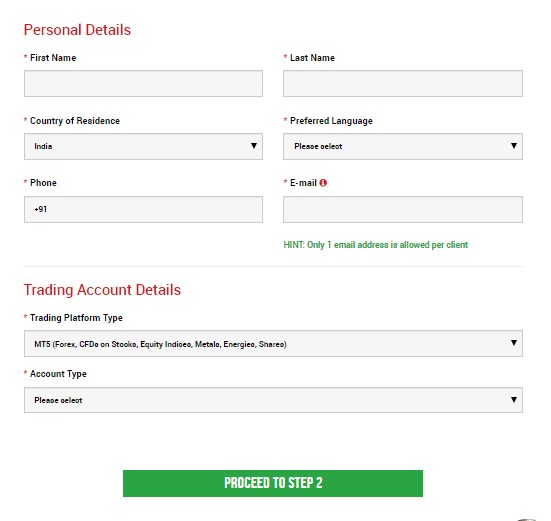

Step 2: filling the personal details

Fill all the box with accurate details

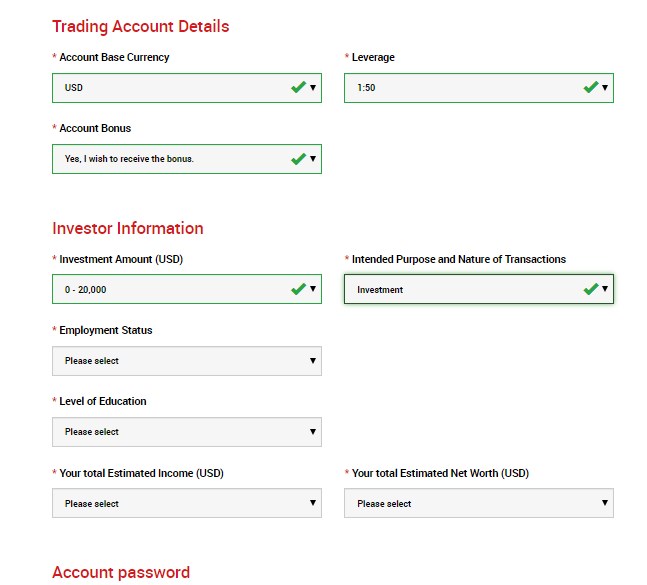

Step 3: investor information & trading account details

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

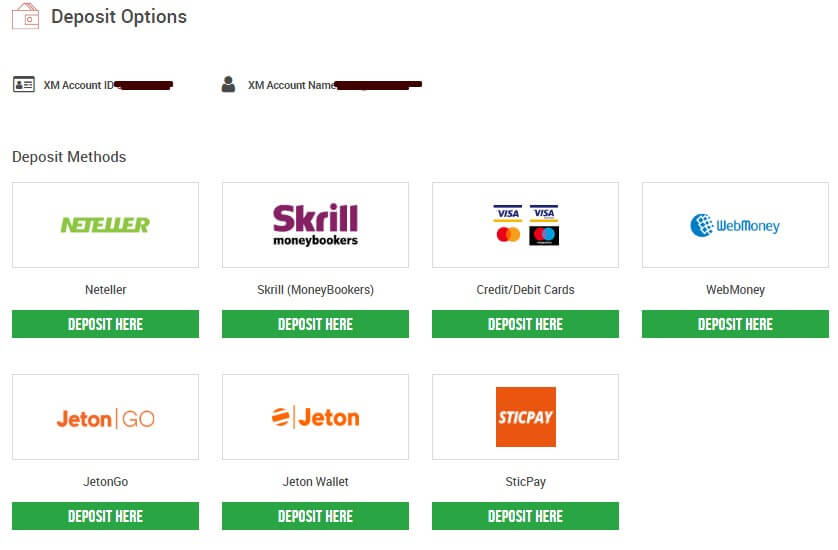

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

How you can trade forex with less than $100

Forex is one of the biggest reliable and excellent online trading strategies. Globally, there are a variety of investors who are actively using this platform to obtain substantial gains through a day of abandonment. However, the specific way to focus on gains is to enter the appropriate system approach.

Before entering the legal machine stage, new immigrants will face a complex task. With a strong education, you can make real-time assessments of the fate-changing style and reliable investment amount.

Therefore, all of these will be on the road to victory without delay. In this case, many shoppers worry about the large number of funds used for foreign exchange trading in places where there are few funds. In this case, we will not tell you by investing more than $ 100 now that you will no longer face any risk factors.

Forex trading

If you understand the leverage walk method, then you can become a successful trader without any problems, which is the most important. If you forget the leverage in some buying and selling techniques, then it will lead to disaster. If you are willing to accept the risk of buying and selling with huge amounts of money, it may also result in cross losses. If the industry benefits you, you can also take advantage of it.

Now, your daily currency duties do not need to intervene with foreign exchange trading funds or capital.

You should no longer invest heavily in foreign exchange trading, because if something goes wrong, it may even bring your survival to a halt.

Please don’t forget to no longer bear any risk restrictions to open a trading or make investment beyond the stage.

This is not to adopt the method of getting rich quickly. You want to realize how smooth it is by turning $ 100 into more than a thousand dollars or more in foreign exchange transactions. This is usually risky and maybe a step. Leverage can be comparable and similar to a double-edged sword, making your income more likely.

It can make you fall and take your risks into the abyss. If you change to a terrible route, you can use leverage to amplify your loss of ability.

The leverage of trading at 100: 1 allows you to choose a trading volume of up to 10,000 USD, and may charge every 100 USD to your account. If this is a 100,000 USD purchase and promotional miles, then you can get 1000 USD in your account. With the help of leverage, you can make a considerable profit without problems, which is equivalent to injecting $ 100,000 into your trading account. In addition, even leverage can cause significant losses to your buying and selling accounts.

$ 100 trading account

Please find out the biggest basic factors in the way that the resident conducts foreign exchange transactions and starts shopping and promotional accounts:

Margin calculation area

The most critical battle in purchase and promotion is the calculation between two economic gadgets, the dollar or the euro. You have to remember to invest cash in US dollars. You need to find out how to use the euro to get the marginal value of the final necessities. Please work hard to deal with your marginal costs and 5 micro-quality to get the final cost (about 60 USD).

Current margin cost calculation – you can place the most convenient buying and selling options to generate excellent value as well as margin calculation.

Find out fairness-you want to study your current position and continue in accordance with its principles. The overall value may be equal to your fairness.

Find your unfixed margin – you can get the calculated equity by subtracting the current margin fee from the available margin rate.

Obtaining margin level – the future trading consequences may depend on the percentage of margin level.

You can effortlessly study the above-mentioned reliable steps to provide reliable transactions for your foreign exchange trading account to generate valuable exchanges.

Procrastination of war:

The most important step in foreign exchange trading, everyone knows that successful traders in the market will never delay. Take full advantage of every opportunity you get, you can benefit from the trading goals without any difficulty.

Never postpone any responsibilities or priorities until the next day, until today it needs to be completed. You can redeem by using a demo account, which will help you cope with procrastination effortlessly.

Keep running in the following directions:

The well-known quote “sport makes us perfect”, you can exercise in a comparable way with the help of a demo account to enjoy. This will be very useful for identifying the operation method of foreign exchange trading structure and knowing its talents. Analyzing foreign exchange transactions will take a lot of effort, trial, and time.

Reputation:

Please maintain self-awareness in foreign exchange advertising and marketing. You need to study the dangers you worry about and get the most benefits in a safe area. For this, you can use useful resources to think about evaluating projects and dreams. This is a crucial step, mainly for novices who like to start buying and promoting foreign exchange.

Funds

Super-modern traders should start foreign exchange trading with minimal capital and gradually increase investment from all profits, without any additional deposits. Can’t earn income, or don’t make money.

You can maximize the quantity by fulfilling the transaction without difficulty. With minimal investment, you can reduce the risk of huge losses caused by large amounts of cash.

Unmarried currency pair

Foreign exchange transactions related to foreign exchange transactions are very complicated due to their personal stubbornness, distinctive characteristics, and unpredictability of the market. In the global economy, there is not much difficulty in becoming a superb dealer. You can start with familiar unmarried foreign exchange pairs. Choose the world’s giant or your US is always a better choice for foreign exchange trading.

How to trade forex with $100

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Many people realize that $100 doesn’t buy much these days, but if you want to trade the forex market, $100 can get you started and could even generate a new source of income you can earn at home. If you manage to develop and implement a successful trading plan, then your first $100 forex account could ultimately change your life for the better.

On the other hand, if you plan to just get into the currency market to make a few practice trades or to gamble a bit, then a loss of $100 usually won’t break the bank for most people.

The key to success as a forex trader consists of having a viable trading plan that you can easily stick to, no matter whether you’re trading with $100 or $1,000,000 in your margin account. Read to learn how to get started trading forex with $100.

Step 1: research the market.

Knowledge is power. These words take on a special meaning when applied to trading in the forex market that holds the top position for trading volume among the world’s financial markets. Knowing more about markets and trading in general increases your chances of succeeding when you trade forex.

Of course, if you just want to take a quick gamble with your $100, then you wouldn’t need to learn much more than how to enter orders in your brokerage account using an online trading platform.

To achieve any level of consistent long-term success, however, you will need to acquire a certain amount of knowledge about currencies and the fundamental factors that influence their relative valuation. Most online brokers provide ample educational resources for new traders that can include articles, ebooks, webinars and tutorial videos. All of these can help you learn more about the forex market before you begin risking money.

You will probably also need to learn how to analyze a market’s behavior to have a better chance of predicting its future direction. The 2 principal analytical market research methods for traders consist of fundamental and technical analysis.

Fundamental analysis

This method analyzes the impact of economic releases and news on the market. Each currency’s relative value generally reflects the state of that particular nation’s economy and its geopolitical situation compared with the currency it is quoted relative to.

Below are the most important news events and indicators watched by fundamental forex analysts:

- Geopolitical shifts and other major news events

- Central bank monetary policy and benchmark interest rate levels

- Gross domestic product (GDP)

- Employment statistics (non-farm payrolls, unemployment rate, weekly initial jobless claims, etc.)

Fundamental analysis gives you an important edge when you trade. Not only can it help predict longer term exchange rate trends, but it can also help explain and predict sharp short-term movements, such as those that coincide with significant economic releases.

Most online forex brokers include a news feed with their trading platform to help you perform fundamental analysis. Another important resource for fundamental trading is the economic calendar that lists all the important upcoming economic releases for various major economies.

Technical analysis

You can study the forex market using technical analysis such as charts and computed technical indicators — a common method to determine the levels of supply and demand in the market that can influence and predict an exchange rate’s future movement.

By looking at exchange rate charts you can identify common patterns with predictive value. You could also use a variety of popular indicators based on market observables to help predict short- and long-term trends in the market.

These indicators can include moving averages, momentum oscillators, overbought or oversold indicators and volume figures. Some important indicators include the moving average convergence divergence indicator (MACD), the relative strength index (RSI) and the 200-day moving average, to name just a few.

Trading volume is another important market observable to give an indication of how much activity accompanies a particular market move. Also, support and resistance levels suggest the degree of supply and demand existing at different exchange rate levels.

The charts themselves can also give important information to use and act upon. For example, a fascinating system of interpreting and trading candlestick charts was originally developed by japanese rice merchants. These informative charts indicate the opening and closing exchange rates, the range of the currency pair and whether the exchange rate increased or decreased for each period displayed on the chart.

Overall, technical analysis provides a relatively objective way to analyze the forex market that can work well for predicting short-term market moves. Many scalpers and day traders use technical analysis to inform their trading activities.

Step 2: open a demo account.

Most online forex brokers provide clients with a fully functional demo account, which reflects market conditions but does not require you to make a deposit.

The forex platforms provided by these brokers generally have comprehensive technical analysis tools such as charting and indicators that incorporate into the chart. If the broker supports the popular metatrader 4 platform developed by metaquotes, then you can automate your trading with expert advisor (EA) software you can buy or develop yourself.

The reason opening a demo account makes sense is so that you can get a feel for the market and learn how to use a broker’s trading platform without committing any funds. You can also use a demo account to begin working out your own trading strategy and putting it into a trade plan.

By learning how to take risk as a forex trader and seeing how disciplined you are when dealing with taking profits and losses, you can also determine if you have the necessary mindset to become successful as a forex trader.

Once you’ve opened your demo account and have begun trading with virtual money, you can start developing a trading plan. If you plan on success, remember that the more you know, the easier developing a trading strategy becomes. Take the time to review as many of the online educational resources on trading that you can, so that your trading plan has a solid foundation in best practices.

Step 3: fund an account and start trading.

Once you’ve traded in your demo account and worked out a trading plan you feel confident with, you can fund a live account and make your first real trade. Although trading in a live account may seem identical to trading in a demo account, you’ll have to deal with the emotional swings that come with winning and losing money, even if you’re only risking $100.

Fortunately, any viable trading plan can be traded with a $100 account since most brokers will let you trade in micro units or 0.01 lots. After you’ve refined your trading plan and have increased your working capital with profitable trading, you can then increase the size of your trading units. Avoid taking larger than expected losses by incorporating a sound money management component into your trading plan.

If you’re a beginning trader, you may want to restrict your trading activities to one particular currency pair before taking positions in multiple pairs in your account. Each currency pair differs in the way it trades because of the underlying fundamentals of the component currencies.

So, let's see, what was the most valuable thing of this article: trading scenario: what happens if you trade with just $100? What happens if you open a trading account with just $100 ? Or €100 ? Or £100 ? Since margin trading allows you to open trades at can you trade forex with $100

Contents of the article

- Today forex bonuses

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- Fxdailyreport.Com

- How to start forex trading with $100

- How to trade forex with $100

- Can you trade forex with $100?

- Should you trade forex with $100?

- How to trade forex with $100

- How do you trade forex with $100 and...

- How do you really trade forex with...

- 1. Learn more about forex trading and its...

- 2. Understand leverage in forex

- 3. Focus on the trading process, not on...

- 4. Balance life, realistic expectations &...

- 5. Treat your small account the same you...

- 6. Learn to control your emotions when...

- 7. Build a consistent track record to...

- How to manage a small forex trading...

- Trading forex with $100:...

- Key points

- Can you trade forex with $100; the plain and hard...

- Research is key

- How can you trade forex with $100 profitably?

- Focus on trade and not money

- Avoid emotional trades

- How to trade forex with $100

- How to trade forex with $100 to earn more...

- Six steps to start forex with 100...

- 1.Start to invest your money

- 2.The margin calculation takes...

- 3.Now, calculate the margin that you have...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin...

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- How to trade forex with $100

- How to trade forex with $100 to earn more...

- Six steps to start forex with 100...

- 1.Start to invest your money

- 2.The margin calculation takes...

- 3.Now, calculate the margin that you have...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin...

- How you can trade forex with less than $100

- Forex trading

- $ 100 trading account

- Margin calculation area

- Procrastination of war:

- Keep running in the following directions:

- Reputation:

- How to trade forex with $100

- Step 1: research the market.

- Step 2: open a demo account.

- Step 3: fund an account and start trading.

No comments:

Post a Comment