Lamm accounts

Whichever type of managed system is chosen, it will be easily accessed via a live-read feed.

Today forex bonuses

This feed will either be via an online report viewer, or through direct access to the trading platform. Everything to do with the account, such as the balance and profit, as well as open and closed trades, will be visible. The downside, if you can call it one, of these types of account is that a trader is unable to use them to place their own trades unless the power of attorney is revoked. Whether this is a downside will really depend on the reason for choosing one of these accounts. If you want an account that is managed by another person, there is unlikely to be an occasion when you will want to place your own trades. LAMM (lot allocation management module) – this is a trading system that allows a trader to allocate different trade lots to individual investors’ accounts. This also means that a trader gets to enjoy the flexibility of being allowed to use different leverages for different types of investor.

Feeling a little confused about brokers with MAM, PAMM, and LAMM accounts? Let’s explain…

Whether you’re new to forex trading or have been enjoying the experience for a length of time, PAMM, LAMM, and MAM are expressions that may sound familiar. But do you understand the difference between them, or even know what they mean? They are all different types of money management systems that are available on the forex market. When it comes to forex trading there are a number of important decisions any type of trader has to make.There are choices about whether to use MT4 or another trading platform, whether to take advantage of any forex bonuses, what trading style to adopt, and a whole load of other options, many of which we will be covering on our other pages. For now, we’ve decided to concentrate on these three money management systems, and give you some pertinent details to help you decide whether you want to pick brokers with MAM, PAMM, and LAMM accounts to help with your trading.

All three types of account are managed accounts with which a fund manager controls multiple accounts from a single one. They involve a fully segregated account that is individually owned by one trader at a brokerage firm. A professional trader or money-maker makes all the trades on the individual account holder’s behalf. This manager is only given access for trading – full control remains with the account holder.

Three different types of money management systems

MAM, PAMM, and LAMM may sound very similar, but there are some significant differences.

MAM (multi-account manager) – this is a combination of LAMM and PAMM. It gives a trader who is managing investor accounts far greater flexibility.

LAMM (lot allocation management module) – this is a trading system that allows a trader to allocate different trade lots to individual investors’ accounts. This also means that a trader gets to enjoy the flexibility of being allowed to use different leverages for different types of investor.

PAMM (percent allocation management module) – this type of system allows a trader to distribute gains, losses, and fees on an equal percentage basis. Each account in the module will have the same percentage of returns as all the others, regardless of the size of the account. In effect, any investors are part of a pool that includes separate accounts and sub-accounts, all of which are traded by one professional trader or money manager who has a limited power of attorney. The money manager will have one master account, the equity of which equals the sum of all the balances held in the sub-accounts.

Whichever type of managed system is chosen, it will be easily accessed via a live-read feed. This feed will either be via an online report viewer, or through direct access to the trading platform. Everything to do with the account, such as the balance and profit, as well as open and closed trades, will be visible. The downside, if you can call it one, of these types of account is that a trader is unable to use them to place their own trades unless the power of attorney is revoked. Whether this is a downside will really depend on the reason for choosing one of these accounts. If you want an account that is managed by another person, there is unlikely to be an occasion when you will want to place your own trades.

Why a trader might choose to open a managed account

There are a number of valid reasons for choosing to open a managed account, and there is a good selection of MAM, PAMM, and LAMM forex brokers to pick from. A managed account provides a trader with maximum security, control, safety, and transparency. The process is really quite simple as well. First, an investor picks a reputable forex broker and opens a trading account, and makes a deposit which only they will have access to. The difference with this type of account is that the money is added to a pool, which is handled by a professional trader or money manager. The account holder is able to see exactly what is going on, and if they aren’t all that happy with the way the money is being managed there is the option of revoking the power of attorney. An account holder isn’t locked in for any particular time, and has the option to opt out should they want to.

But what about the money manager’s point of view? There are good points for a money maker too, as they get to trade all investors’ accounts as if they were one large one, thereby increasing the opportunities for making sizeable profits. The broker handles everything else, which makes it a seamless experience for all involved.

Managed account systems provide traders with a safe and easy way to participate in the forex world.

Choosing a forex broker offering MAMM, PAM, or LAMM accounts will mean you get to keep your finger on the pulse 24/7. When it comes to forex trading, any level of success is going to take a lot of hard work, effort and determination, and a fair amount of trial and error. Managing your own trades can be a full-time job, but not everybody has the time or inclination to walk away from their normal 9-to-5 career and set off down the forex trading road to who knows where. Managed accounts can be the perfect solution for those who don’t want to trade on their own, or for those who want to have a life outside of their forex investment.

Are they the perfect solution? We have to be honest and say there are no guarantees in the forex world. As with any other form of investment, the value of foreign currencies can go up as well as down. There are so many variables and outside influences that can have an effect, but there are ways you can improve your chances and reduce the risk. Brokers with MAM, PAMM, or LAMM accounts are one way, and we’ll be featuring a number of others later.

PAMM, LAMM, MAM….Are you confused?

There are several money-managing systems available on the FX market. PAMM, LAMM, MAM might all sound similar.

There are several money-managing systems available on the FX market. PAMM, LAMM, MAM might all sound similar, however, there are certain differences between the systems that should not pass unnoticed. Before investing in a managed account, setting up an account as a manager, or offering the system to your clients as a broker, you should do your homework first: not only pre-evaluate the specifics of the managed account type, but also – make sure that the system offers suitable conditions for you to do any investment at all in the first place. In order to make the picture clearer, lets have a look at the specifics of the 3 systems and how they differ.

LAMM (lot allocation management module) can be called the predecessor of PAMM, since it does not function according to the size of each individual investors account. Each and every customers account, would automatically increase by one standard lot whenever the manager buys one standard lot of a currency. This system could be beneficial in the case when the customers’ investment is the same as the manager’s, however, there might be more arguments against the system in the case if investors portfolio is much larger than the managers.

MAM (multi-account manager) accounts allow manager to assign a higher leverage to specific subaccounts, if any of the investors have such preferences. This feature makes the MAM accounts particularly suitable for investors with a high-risk tolerance.

PAMM (percent allocation management module)

Is different from other management systems, since the investors’ portfolio is affected depending on the size of the respective deposit. Each managed account has its own ratio in PAMM according to its volume. Typically, PAMM requests financial participation by the manager; therefore the manager is also trading for his/her own interests. The managers’ activity results (trades, profit and loss) are allocated between managed portfolios according to the ratio.

Suggested articles

FP markets launches intuitive and feature-packed mobile trading appgo to article >>

This system is preferred by money managers for the broad options PAMM offers: 1) flexibility in investment conditions (the trader sets the amount of commission and trading period by himself, rollover time can be set at any hour, etc.); 2) TOP manager list, which is created according to performance and publicly available for the investors, works also as a promotion tool for the managers’ skills; 3) trading reporting is available according to the managers’ professional needs.

Investors, however, choose the PAMM system due to the wide range of professional managers available, whose style of trading and results can be examined via the TOP list. Investors have the ability to monitor trades in real time, which gives more certainty and control over the investments. Additionally, an investor can setup the allowed drawdown levels and nominate, or change the traders in the TOP list. On the side, any investor is welcome to participate as an introducing agent to attract more investment.

Soft-FX PAMM saas can be integrated with MT4 via manager API. Due to the simplicity of the system, integration of PAMM saas requires no significant investments, due to its compatibility with MT4 and implemented web interface, which is customizable for each broker.

To sum up, one thing is clear – managed account types differ, but so do the preferences of managers and investors. As a broker, you should first go more into detail of your customer profile and decide which system (MAM, LAMM, PAMM) would fit the individual taste of your clients (managers/investors). Which would be the opportunities that your clients would benefit most from?

If your managers demand flexibility – they’re typically eager to set up their accounts and decide on the details by themselves, your investors demand transparency and are always willing to evaluate the performance of managers beforehand, however, you are not willing to invest a large amount on the setup of the system itself, soft-FX PAMM might be the perfect solution for you. For more details, please visit the following link.

For the LAMM manager

You are a successful trader and want to increase your income? — become a LAMM manager at grand capital and receive fees from your investors! You become a manager and let other traders copy your trades in return for a fee you set yourself. Your account history is displayed in the manager’s rating. Any investor can find your account in the rating and connect to it. The system will then start automatically copying your trades to the investor's account, while you will be receiving a fee.

Advantages of LAMM accounts in grand capital

Investor's funds are not being transferred to the manager's account and remain on the investor's account the whole time.

An investor can manage risks by setting the copying ratio.

An investor can disconnect from the manager's account or cancel a trade at any time.

The manager can choose the desirable type of reward: fixed fee or a certain percentage from the investor's profit.

The manager uses personal funds for trading.

All transactions are copied automatically.

How it works

Creating a managed account

Investor 1 replication ratio: 2

balance: $1 000

Manager commission: 20%

balance: $1 000

Investor 2 replication ratio: 1

balance: $1 000

- The manager deposited $1 000 and asked in his offer the reward of 20% from profit for the period

- The investor 1 with deposit $1 000 joined his/her account

- The investor 2 with deposit $1 000 joined his/her account

- The manager’s transactions are copied to the investor’s 1 account with copy index 2. The manager’s transactions are copied to the investor’s 2 account with copy index 1.

At the end of the investment period

Investor 1 profit $2 000

manager's commission $400

balance $2 600

Manager profit $1 000

commission $600

balance $2 600

Investor 2 profit $1 000

manager's commission $200

balance $1 800

- The investor 1 took profit 200% of the first deposit ($1 000) because transactions had been copied with index 2 and paid the manager 20% from profit ($400). His/her final balance is $2 600.

- The investor 2 took profit 100% of the first deposit ($1 000) and paid the manager 20% from profit ($200). His/her final balance is $1 800

- The manager took profit 100% of the first deposit ($1 000) and got reward 20% from the investor’s 1 profit and the investor’s 2 profit ($600). His/her final balance is $2 600

How to become a manager

- Log into your private office

- If you do not have open accounts then open and deposit a standard or a micro account. Start trading to show your level of proficiency and the results of your trading activity will be shown in the managers rating.

- If you already have an account, log into your private office, choose your standard or micro account and press “become a manager” button. After that your account statistics will be added to the managers’ rating

- In your private office you can see requests from investors and follow your account's forum updates.

Become a LAMM manager

| account | profitability for the last 3 months | age | |

| 1 | trade tanzania:4794816 | 675.38% | 39 days |

| 2 | LO 2.0:4752263 | 233.66% | 121 days |

| 3 | shadow2020:4809613 | 175.22% | 48 days |

| 4 | aisha is'haqu mohammed:4428442 | 169.63% | 793 days |

| 5 | blackrock:532377 | 163.96% | 1442 days |

| 6 | alexander smirnov:4749218 | 162.7% | 188 days |

| 7 | money maker:4810394 | 160.62% | 46 days |

| 8 | rafalk:4461092 | 132.82% | 770 days |

- Grand capital ltd.

- Contacts

- Company news

- Trading

- CFD, futures contracts

- Metatrader 4

- Investment

- Managers' rating

- Analytics

- Economic calendar

- Analytic reviews

- Partnership

- Contests

- Agreements

- FAQ

Risk disclosure: before starting to trade on currency exchange markets, please make sure that you understand the risks connected with trading using leverage and that you have sufficient level of training.

Privacy policy describes in which way the company collects, keeps and protects clients' personal data

- grandcapital ltd. 24598 IBC 2018 (suite 305, griffith corporate centre, P.O. Box 1510, beachmont, kingstown, st. Vincent and the grenadines)

- grand capital ltd. 036046 (suite 102 aarti chambers, mont fleuri, victoria, mahe, seychelles)

- this information is intended for investors outside of the united states who are not the US/japanese citizens and residents.

- العربيّة

- Deutsch

- English

- Español

- فارسی

- Français

- Bahasa indonesia

- Bahasa melayu

- Polski

- Português

- Русский

- ภาษาไทย

- Українська

- Tiếng việt

- 简体中文

For LAMM investors

You are a beginner, but want to earn on par with successful traders? Then LAMM is your best choice! The LAMM account is a unique investment service which lets you copy trades of experienced traders. Once you have connected your account to the preferred trader's account and set the ratio, you can sit back and relax. Trades are copied automatically, you do not even have to open the platform. Let experienced traders do all the work for you! With the LAMM service you can invest in forex, stocks, indices and CFD.

Advantages of LAMM accounts in grand capital

Investor's funds are not being transferred to the manager's account and remain on the investor's account the whole time.

An investor can manage risks by setting the copying ratio.

An investor can disconnect from the manager's account or cancel a trade at any time.

The manager can choose the desirable type of reward: fixed fee or a certain percentage from the investor's profit.

The manager uses personal funds for trading.

All transactions are copied automatically.

How it works

Creating a managed account

Manager 1 balance $1 000

expected profit: 30%

commission: 10%

Investor balance: $10 000

Manager 2 balance: $50 (account* micro)

expected profit: 100%

commission: 30%

- The investor copies transactions of manager 1 with replication ratio 1:5 and transactions of manager 2 with replication ratio 1:1.

- Manager’s 1 balance is $1 000, expected profit is 30% and required commission 10%

- Manager’s 2 balance is $50 which is equivalent to $5 000 (the micro account allows calculation in cents), expected profit is 100% and required commission is 30%

At the end of the investment period

Manager 1 profit $1 350

Investor balance: $14 850

Manager 2 profit $3 500

- The manager 1 brought a profit of $1 500 to the investor. The investor paid the commission of 10% therefore, his/her profit from the manager's trading is $1 350.

- The manager 2 brought a profit of $5 000 to the investor. The investor paid the commission of 30% so his/her profit from the manager's trading is $3 500.

- The investor’s final profit brought by the manager 1 and the manager 2 combined is $4 850

How to become an investor

- Register an account with grand capital and receive your access to the private office

- Choose a manager in the rating

- Click "invest in this account" on the manager's page. You will then be offered to connect one of your accounts to the manager's account or create a new one.

- Study the manager’s offer (below the chart)

- Deposit your account with the amount equal to the manager’s balance. Please mind that investor’s balance must match the manager’s balance. For example, the manager’s balance is $1 000. In this case, the investor’s balance should be at least $1 000 or $10 for micro accounts.

- Request to connect to the chosen manager’s account in your private office.

- Both standard and micro accounts are eligible for LAMM.

Become a LAMM investor

| account | profitability for the last 3 months | age | |

| 1 | trade tanzania:4794816 | 675.38% | 39 days |

| 2 | LO 2.0:4752263 | 233.66% | 121 days |

| 3 | shadow2020:4809613 | 175.22% | 48 days |

| 4 | aisha is'haqu mohammed:4428442 | 169.63% | 793 days |

| 5 | blackrock:532377 | 163.96% | 1442 days |

| 6 | alexander smirnov:4749218 | 162.7% | 188 days |

| 7 | money maker:4810394 | 160.62% | 46 days |

| 8 | rafalk:4461092 | 132.82% | 770 days |

- Grand capital ltd.

- Contacts

- Company news

- Trading

- CFD, futures contracts

- Metatrader 4

- Investment

- Managers' rating

- Analytics

- Economic calendar

- Analytic reviews

- Partnership

- Contests

- Agreements

- FAQ

Risk disclosure: before starting to trade on currency exchange markets, please make sure that you understand the risks connected with trading using leverage and that you have sufficient level of training.

Privacy policy describes in which way the company collects, keeps and protects clients' personal data

- grandcapital ltd. 24598 IBC 2018 (suite 305, griffith corporate centre, P.O. Box 1510, beachmont, kingstown, st. Vincent and the grenadines)

- grand capital ltd. 036046 (suite 102 aarti chambers, mont fleuri, victoria, mahe, seychelles)

- this information is intended for investors outside of the united states who are not the US/japanese citizens and residents.

- العربيّة

- Deutsch

- English

- Español

- فارسی

- Français

- Bahasa indonesia

- Bahasa melayu

- Polski

- Português

- Русский

- ภาษาไทย

- Українська

- Tiếng việt

- 简体中文

Forex trading area

About trading, with plenty of forex

A comparison between PAMM and LAMM accounts

In a previous article I’ve talked about the PAMM accounts. Today I’ll talk about LAMM accounts and draw a comparison between the two.

The LAMM (lot allocation money management) have some advantages and is sometimes used by much smaller money managers for their clients. The LAMM allows you to allocate a specific amount of lots that you would like to trade per sub account. For example if your master account consists of 2 sub accounts each with $30,000, but investor 1 wants to be much more aggressive than investor 2 the LAMM will allow the money manager to allocate more lots per trade for investor 1 than for investor 2. With this structure investor 1 can be a lot more aggressive than the other even though they invested the same amount of money into the master account.

That looks like a better option, but in reality creates much more problems due to miscalculation or rounding on the broker side. Especially if there are investors with significantly different amount of money involved.

Let’s systematize the differences:

PAMM: participating interest (from all accounts) with the corresponding interest distribution of profit / loss depending on the success of the manager

LAMM: the transactions of the manager are copied on the accounts of the investors depending on the budget

– how is the trade conducted ?

On PAMM – from a single account

On LAMM – only from a personal account of the manager

PAMM – just at the time of rollover

– distribution of profit / loss

PAMM – in the end of the trading period or at the time of rollover (upon closure of the managed accounts)

LAMM – in the end of the trading interval (see the terms of the offer)

LAMM – depending on the amount of the manager’s capital (usually bigger than in PAMM)

Disadvantages of LAMM

– high minimum deposit (if you have not enough of money on your account for the transaction, the transaction will not be copied on your account)

– you do not have the access to control your account (the manager is not concerned about the calculation of the safe amount of transactions, deposit, etc. He works with his capital only and circulates the money for his own profit)

Disadvantages of PAMM

– instability of the account (if unexpected withdrawal of large amounts of money happens, the manager may have not enough money to hold the position, the transaction will be forcibly closed and the trader, along with the investors will suffer serious losses)

– withdrawal is usually possible only in rollover (once or twice a week, or once in a month, depending on the terms of the offer – though there are few exceptions).

Forex managed accounts: PAMM vs MAM vs LAMM

Forex managed accounts: PAMM vs MAM vs LAMM

A lot of things are possible in the retail forex trading industry. While some people actively trade their accounts by themselves or by copying successful traders, others delegate the trading activity on their accounts to other traders under the ‘power of attorney’. There are different types of managed accounts in forex trading, such as PAMM, MAM, and LAMM. Here we’ll discuss each of them, compare them and take a look at what the regulators do about them.

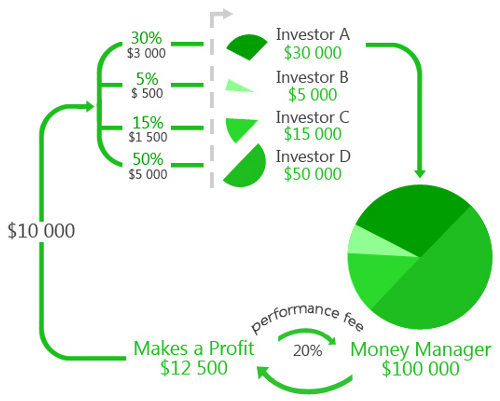

PAMM (profit allocation money management)

The profit allocation money management, PAMM, is a method of managed account in which investors funds are pooled together and traded by an account manager such that profits and losses are shared proportionately among the investors. Like every managed account, this process is facilitated by a forex broker that offers the platform through which the investors and the account manager can relate. Pepperstone is a very good example of a forex broker that offers this service.

Forex managed accounts- PAMM accounts

Being a way of pooling funds together, PAMM is a good way of distributing risk among the investors and helps to weather the storm of short-term volatility so as to enjoy long-term gains. The profit or loss accrued by each investor depends on the proportion of his investment to the entire fund. For example, if a manager has three investors: A, B, and C, who contributed 30, 20, and 50 percents of the entire fund respectively; whatever profit or loss made in each trade, A gets 30 percent, B gets 20 percent and C gets 50 percent of it.

This is a simplistic explanation though, as the account manager takes a certain percent of the profits for his services and, mandatorily, has his own funds invested the fund as well which is entitled to a proportional profit or loss.

Copy trading using your own assigned and trusted broker might be a better approach.

MAM (multi-account manager)

The multi-account manager, MAM, is a method that allows the account manager to trade each investor’s account separately and differently. Thus the manager has the flexibility of assigning higher leverage and other risk management parameters to specific sub-accounts. MAM accounts can give better profit potentials but can also be very dangerous. It is more suitable for investors who understand how the market works and can tolerate higher-risks. An uninformed newbie shouldn’t invest in this type of account.

Forex managed accounts – MAM accounts

In the lot allocation money management, LAMM, each investor’s account is traded separately but in the same way. Whenever the account manager opens a position, the same position is opened in each investor’s account irrespective of the account size. This is a recipe for destruction for the smaller accounts. Expectedly, this method is no longer invoke, because of the issues associated with it.

Comparing the three types of managed accounts — PAMM, MAM, and LAMM

| METHOD | STRUCTURE | DISTRIBUTION OF PROFITS AND LOSS | WITHDRAWAL | MINIMUM DEPOSIT | |

| PAMM | investors’ funds are pooled into a single fund which the account manager trades. | A single account where all funds are pooled. | Distributed proportionally at the end of the agreed trading period, such as monthly, half-yearly or yearly. | At the end of the agreed trading period, such as monthly, half-yearly or yearly. | It depends on the broker and the account manager. |

| MAM | each investor’s account is traded separately and differently making use of different leverage and other risk parameters. | Different account for each investor. | Each investor takes the profit or loss the account has made at the end of the agreed trading period. | At the end of the agreed trading period, such as monthly, half-yearly or yearly. | It depends on the broker and the account manager. However, MAM is suitable for investors that can tolerate higher risks. |

| LAMM | each investor’s account is traded as a separate account but with the same lot size for all accounts. | Separate account for each investor. | Each investor can take the profit or loss the account has made at any time. | At any time. | It depends on the vendor but always larger than PAMM. |

Are these sorts of investment regulated?

Since 2012, financial regulators, such as the FCA in the U.K., the NFA in the U.S., the ASIC in australia, and others, have taken combined action to eradicate the unlicensed financial advisory services and dishonest sales practices of forex brokers. Having identified the pushy sales tactics used to lure novice investors with promise of unrealistic returns, regulators in the major markets — U.K., U.S., europe and australia — have placed serious restrictions on PAMM and similar managed accounts, the amount of leverage that can be employed and the level of knowledge a prospective account manager must have before being allowed to operate.

Conclusion

It is a common knowledge that most of the novice investors resort to investing in managed accounts after failing in trading themselves — being lured by the promise of huge profits. While some managed accounts may be profitable, a lot are not. It is always advisable to be cautious when considering investing in managed accounts. The old adage comes to mind here — if it looks too good to be true, it probably isn’t.

Free netflix accounts & passwords updated 2021 (working)

Free netflix accounts: netflix is a leading video streaming platform that covers all the entertainment stuff including movies, seasons, etc. It provides the best service and also charges less on its subscription compares to its competitors. If you are an avid consumer of video entertainment then you probably aware of the fact that netflix is a one-stop platform for all the exclusive movies and seasons.

With its effective subscription charges & stunning features, it has gathered approx 195 million users from all over the world and continuously growing. And it has also become one of the top streaming companies in the world. Well, netflix requires a monthly or yearly subscription plan if you want to stream its content. For those who can’t afford its subscription plan, we are going to provide free netflix accounts & passwords. Below, we have added fresh unused accounts (email & password), snatch one from the list before someone grabs it.

What are free netflix accounts & passwords?

As you now know that netflix is a video streaming platform, well, in order to access the netflix features, you will need an active netflix account email & password. It will allow you to log in to netflix and access premium content & its features. Netflix has 4 different subscription plans (mobile, basic, standard, premium) that offer different perks at different prices.

The least plan requires 199rs or 3$ per month and with its least subscription, you can stream videos at 720p, watch netflix on your mobile phone & tablet, limited to use on one device at a time, unlimited movies streaming, and also cancel the subscription at any time.

Now, what free netflix accounts & passwords are? Well, they are the same netflix account but have higher plans subscribed and are not limited to use only on a single device. This means the accounts can be used by multiple peoples on multiple devices at the same time without any barrier.

And for your information, we have collected free netflix accounts & passwords from different sources that promise to work. So, now let us show you those accounts & passwords.

Free netflix accounts & passwords updated january 2021 (working)

Free netflix accounts 2021

Below, you will find the list of free working netflix accounts & passwords. The account’s email and password may not work for everybody, in that case, we recommend keep trying the next one until you find the working account from the list.

Working free netflix accounts & passwords

| username | password | plan validity |

|---|---|---|

| netflixgive20@gmail.Com | 2145638 | 10 FEB 2021 |

| porccs43@hotmail.Com | gangsta101 | 29 JAN 2021 |

| iklmickey.Me@yahoo.Com | mickeyme1 | 07 FEB 2021 |

| netflixmania2@mail.Com | trickszylo | 18 MAR 2021 |

| mattsirois20@gmail.Com | worthyaccounts | 25 MAR 2021 |

| mickeemore@yahoo.Com | xx!2vba | 13 MAR 2021 |

| edvinzone@gmail.Com | &kiara | 21 FEB 2021 |

| kelliesharp1974@yahoo.Com | justin14 | 30-days |

| lyonholdings@yahoo.Com | annika1 | 30-days |

| staceydsmith71@yahoo.Com | iloveelvis | 30-days |

| difelicepamela@yahoo.Com | howaboutthat | 30-days |

| wildr4@yahoo.Com | packer31 | 30-days |

| nikkipyatt@gmail.Com | 2greatkids | 30-days |

| nikkimail101@aol.Com | keegan6159 | 30-days |

| porccs43@hotmail.Com | gangsta101 | 30-days |

| prestomajicb@msn.Com | blackcat69 | 30-days |

| rbdeschamp@gmail.Com | desperado1 | 30-days |

| n.Negrin88@gmail.Com | bellatash1 | 30-days |

Free netflix accounts & passwords that still works in 2021

| username | password | validity |

|---|---|---|

| byrne.D.Stephen@gmail.Com | jordam23 | FEB 2021 |

| lil9machete@gmail.Com | billy122 | MAR 2021 |

| jc_alvarez_265@hotmail.Com | jcar26052001 | MAR 2021 |

| khriscarrington@gmail.Com | jk528tf9 | FEB 2021 |

| alexpribb@gmail.Com | notesmen2 | 30-days |

| marvin_buchner@yahoo.De | marvin1207 | 30-days |

| debbeedeb@aol.Com | 1surf1 | 30-days |

| rshabb0@hotmail.Co.Uk | sialkot12 | 30-days |

| dnmir54@yahoo.Com | bucksfan54 | 30-days |

Long-term free working netflix accounts & passwords

We have also found some working free netflix accounts that are newly created. The below free netflix accounts emails & passwords have been taken from another source and have 90 days validity.

| Username | password | validity |

|---|---|---|

| 17netflix@gmail.Com | TQC@373#0 | 90 days |

| netftricks623@gmail.Com | TQC@321#0 | 90 days |

| anujk1@gmail.Com | TQC@321#0 | 90 days |

| nstwi28@gmail.Com | TQC@321#0 | 90 days |

| amank54@gmail.Com | TQC@321#0 | 90 days |

| ramank231@gmail.Com | TQX@321#0 | 90 days |

| netflixg17@gmail.Com | TQ@321#0 | 90 days |

| account1@gmail.Com | TQC@321#0 | 90 days |

Free netflix accounts list updated – 02 january 2021

How to get free netflix accounts in 2021

Get free netflix account

Wanting a free netflix account in the sense one is not ready to actually subscribe to the netflix subscription plan or afford the money without trying its service, for those people, free netflix accounts & passwords have been shared above. You can use the free netflix accounts using the username & password. And that way, you will be able to get a glimpse of its features & content. Other than that, there are some more ways that can help you get free netflix accounts.

Below, we have shared 6 ways through which you can get a free netflix account in 2021. Those will only provide you free netflix account for a few days i.E 14 days, 30 days, 7 days. Now, let me show you those 6 ways to get free netflix accounts.

1. Get free 7-days trial netflix account

Via normal signup on the netflix platform, one can get a 7-days trial account on the first signup for absolutely free. In those 7-days, you will have full access to netflix and you will be able to enjoy all its features & content. To perform normal signup, just visit the official website of netflix and then sign for any subscription you like to have. After 7-days, you can easily cancel the account and netflix will not charge you a penny for that.

(update: jan. 2021) free netflix trial is now not available for all regions. You can check the availability for your region here.

2. Using virtual debit cards

Nowadays, there are many services on the internet that allows creating multiple virtual debit cards that can be used for netflix subscription, online payment, and whatnot. The trick is you can generate multiple VDC and grab trial accounts of netflix with different emails. Once a trial account period gets over, you can signup with another email & enjoy the trial account again and you can follow this process until you become tired of netflix.

3. Sharing of netflix account

If your friends have a netflix account with a premium plan then you can ask them if they can share the account with you. In most cases, if you have good friends, they will not hesitate to share their account with you. In the worst case, you can give them some money and grab the netflix account in partnership. That will definitely work out if you know what I’m talking about here. That will at least save you some money instead of paying for a premium netflix account alone.

4. Use free netflix account with airtel

For india and some other countries, airtel has partnered with netflix to come up with a fantastic offer that provides its user free netflix account with airtel postpaid & prepaid plans. If you are an airtel user then you can take benefit from it & get a free netflix account. For more details, just download & open the my airtel app and signup with your airtel number. In the app, you will find complete details & instructions on how to get a free netflix account by subscribing airtel plan.

5. Netflix MOD

It is a modified version of the netflix stock app that runs without a netflix account. It is made for testing purposes but now it contains all the exclusive features that netflix provides genuinely. And the best part is you can keep using it as long as you want without paying anything. With this, you will also be able to stream movies & seasons, download content to watch offline, etc. Netflix MOD APK is also the best way to get free access to the netflix platform.

6. Netflix cookies

Another fantastic way to access free netflix is by using netflix cookies. Basically, netflix cookies are some files that get created when a subscribed user surfs through netflix via browser. Generally, browser stores cookies to speed up the surfing & overall user experience. We have already talked about netflix cookies and we also have provided working netflix cookies. In this method, you just need an extension called editthiscookies. You can either use it on PC or android. Instructions for both are also described there.

So, these are the basic 6 ways to get a free netflix account other than the free netflix accounts shared above. Now, let me show you the benefits of a free netflix account.

Benefits of a free netflix account

When we get something for free, the benefit really doesn’t matter for most of us but still, some of you may want to know the benefits. For those people, I’m going to share the real benefits of a free netflix account.

Complete access to netflix

Some of you may be doubting that with a free netflix account, you won’t be able to access the full version of netflix. Well, that is false, you will be able to access the full version of netflix with a free netflix account. Yes, you might face some limitations because of the plan that you have got with the provided free netflix account. As per your plan, you will be able to access the possible features that netflix provides to its subscribed users.

Download facility

If you have found something interesting but don’t have a stable internet connection or time to watch then you can download it and watch it whenever you want. That is possible with the download facility that netflix offers to all its users, in all plans. And there are no extra charges for that, this perk is included in all the four plans that netflix currently has. With the download facility, you can choose what video quality you want to download. This option will pop-up once you request downloading by clicking on the download button on netflix while streaming videos.

Stream at 4K/ultra HD

In case, if you have got a standard plan or above with the above provided free netflix accounts then you will be able to stream videos on netflix at 4K/ultra HD. Not all the video streaming platforms have this facility even those who are charging higher than netflix on subscription have only 1080p quality. Well, the best part of netflix is you can stream any video at the finest quality 4k. And that benefit is extremely satisfying for free netflix accounts users.

4-screen

The biggest disadvantage of television right now is only one person can use the TV at a time. Well, the script for online streaming services like netflix is different. However, with netflix’s free account, you can share the screen with 4 other family members or friends. This means, four people will be able to take benefit from a single netflix account at a time. Those four people can choose their favorite movies or seasons to watch separately. That’s the main benefit & feature of netflix.

So, that was the benefits of free netflix accounts which are no different than the actual features of netflix. Well, now we have come so far here, let us answer some frequently asked questions.

Free netflix accounts faqs

If you still have questions about a free netflix account then you can find the answer from here.

How can I get a free netflix account?

To get a free netflix account, you can take netflix’s trial period benefit and try the platform to see if it fits your requirements. Apart from that, you can get a free account from other users who have subscribed to netflix with a standard or higher plan. Or you can also use the free netflix username & password that we have provided here.

Can I get a free netflix account in the philippines?

Yes, anyone can get a free netflix account in the philippines. The free netflix username & password supported in all the regions, the only thing you have to do is to use the free account details i.E username & password, and provide the postal code of your area. That’s it, after that you will be able to access your netflix account from anywhere in the world.

The netflix trial option may not be available in the philippines, make sure you check that from the official site.

Is using the free netflix account is safe?

Yes, it is absolutely safe to use in most of the areas unless you are tricking netflix with ids generated by the free netflix account generator. All the free netflix account that are provided here are genuine accounts hence, you won’t get in trouble after using them.

Should I use free netflix account generated by netflix account generator?

You shouldn’t use it because they use a hack to let the generated ids work on netflix. The video streaming company is also working on to block the fake logins from fake ID’s. Those generated ids may seem to be working for you but that can put you in trouble since it’s purely illegal. Meanwhile, you will be taking some risks while using a free netflix account generated by netflix account generator. We highly recommend ignoring such tools to avoid pointless troubles.

Conclusion

Now, you have reached the bottom line of this article and so far, we have discussed almost everything about the free netflix account. If you are going to use a netflix account provided above then you need to know that it may work for a few days. All the netflix accounts shared above have been taken from other sources and so, some will work & some will not. But we encourage you to try all the listed accounts until you find a working one and then stick with that as long as it works. We just also listed confirmed unused accounts, make sure you check out the long-term netflix accounts section.

We update the free netflix accounts list regularly and try to provide working accounts as much as humanly possible. If you have any personal questions about the free netflix account that hasn’t got answered in the faqs section then you can ask us in the comments below. Also, let us know your thoughts about this article on free netflix accounts and share it if you liked.

Best forex managed accounts 2021

A managed forex account is where a money manager handles the investments and trading of the client’s account on their behalf. They manage the client’s account by seeking trading opportunities, adjusting the risk, implementing their own strategies, or even taking input from the client on what they would like to trade on and how.

The world’s most popular FX platforms, the MT4 and the MT5 both feature the possibility of having a money manager manage accounts through them. This is often called a MAMM account.

The brokers below represent the best forex managed accounts brokers.

82% of retail CFD accounts lose money

82% of retail CFD accounts lose money

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

ECN, market maker, no dealing desk

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

Here’s a list of the best forex managed accounts brokers.

Regulated by: cysec, FCA, FSC

Headquarters : 30 churchill place, london, E14 5EU, UK

82% of retail CFD accounts lose money

FXTM is also known as forextime, and commenced operations in 2011 from its de facto headquarters in limassol, cyprus. Since then, FXTM has achieved rapid global expansion, driven primarily by its desire to serve specific local markets with strong FX demand.

The MT4 and MT5 are the platforms provided by FXTM. These platforms, however, come in various versions built for the web, for desktops and for mobile devices. The FXTM MT5 is an improvement on the MT4 and can be downloaded from the myfxtm members’ area.

Activtrades

Headquarters : 1 thomas more square london E1W 1YN united kingdom

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

Activtrades was founded in 2001 and was recognised by the sunday times fast track 100 as the 90th fastest growing company in the UK for 2017. The company is regulated by the UK financial conduct authority (FCA), as well as the securities commission of the bahamas and offers CFD and spread betting trading accounts with direct execution (non-dealing desk).

FP markets

.png)

Headquarters : level 5, exchange house 10 bridge st sydney NSW 2000, australia

This brokerage offers a massive range of tradable assets through forex, CFD, and share trading accounts. FP markets supports the MT4, MT5, and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spread or commission pricing.

FP markets was founded in 2005 and is headquartered in sydney, australia. It is regulated by the ASIC in australia. Demo accounts are available. While it is suitable for beginners, education resources are limited.

What is a forex managed accounts?

A managed forex account is where a professional trader/money manager manages the trading on the clients’ behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs.

An investor may advise the money manager on strategies and signals to look for while trading on his behalf. An investor may do this to take themselves out of the equation and trade without the psychology and emotions that come with wins and losses. On the other hand, some clients simply choose to let the brokerage/money manager trade the account based on their own systems and strategies.

Forex managed accounts can be compared to traditional investment accounts of equities and bonds, in the way that an investment manager handles the trading logistics. In no instance can a money manager withdraw or add funds to the account, they are granted trade only access to the account, and the investor has full control over their account. Money managers charge a fee or commission for managed accounts, so it is important to research a variety of options, as their prices can vary greatly.

How does a managed forex account work?

For an investor to have a managed trading account, they must first open a trading account at a reputable brokerage firm of their choice. Then allocate the necessary amount of funds for a managed account. The money manager has limited access to the account and operates on a trade only basis. The investor remains in full control of the account and its deposits and withdrawal processes.

Now, if a money manager does not have any control over the investors money, how can they conduct trades? Well, upon setting up a managed account, both the investor and money manager must sign a document called a limited power of attorney agreement (LPOA). This is an agreement for both parties, allowing the trader to trade on an investors account on their behalf, without needing to transfer the investors funds to the traders account. This agreement provides a high level of security, control, and transparency that’s comfortable for the investor.

With the signing of this agreement, the managed account gets placed in what’s called a “master block”, and as stated before, the investor continues to have full control of their account. They can check the balance, deposit or withdraw funds, monitor trade activity, and even revoke the LPOA agreement at any time if they are not happy with the money manager. One thing they can not do is conduct their own trading on the account, unless they revoke the LPOA agreement.

Regarding the money managers aspect of managed forex accounts. They may trade for many investors all from a single master account using PAMM, LAMM, or MAM software and technology. These technical procedures are integrated into most reputable brokerages and various online trading platforms, making it possible for traders to manage investor accounts.

Account types

Investing through a managed account has been around for a long time. In fact, it’s been around for as long as investing. With that in mind, there have generally been 3 types of managed forex accounts that prevail- individual, pooled, and more recently; varieties of PAMM accounts.

Individual account

This type of account is the most simple and standard type of account when you think of a managed account. The account managed is a segregated account where the money manager makes all the trades on your behalf. The traders’ decisions are based solely on your instruction or desire, he/she is trading for you and only you.

Their decisions will be based on your risk level and whether you provide any specific strategy or guidance. Since there are no additional traders’ funds involved in this account, the minimum deposit may be quite high- exceeding $10,000. For this reason, and the fact the manager is trading this account individually for you, you will want to ensure a professional and competent money manager is chosen. A great deal of research and client testimonials will be beneficial when going this route.

Pooled account

This type of account is very similar too mutual funds, in where many investors pool their money together in a separate account and share the profits after fees and expenses. With pooled accounts, there are often a variety of pools to choose from. Each may be offering different risk levels, minimum deposits, investment strategies, currencies traded, and fees and expenses. These types of accounts are managed for a variety of investors, requiring you to choose or be advised on which pool suits your needs.

Unlike individual accounts, the manager is trading for numerous investor desires. To help determine an account for you, each fund will have years of past performance for review. A main benefit of pooled accounts is the lower minimum deposit required to enter, being as low as $2000. Although, there are often minimum participation requirements upon entering a pool fund. These are all factors you need to consider before diving in.

PAMM, LAMM, & MAMM accounts

These types of accounts use sophisticated technology to distribute profits, losses, and fees based on percentages of funds each investor has involved in the master account used for trading. These account methods are relatively new in comparison with the other two listed here, and offer the satisfaction of dealing directly with the broker of your choice in a secure and transparent way.

It’s similar to the mirror and copy trading features some brokers offer, because of the automation and technicality. Although, it still has more similarities to a managed account. All these types of accounts are basically pool accounts, in the sense that numerous investors pool their money together and reap the profits or losses of the money manager.

What should you look for in a managed forex account?

There are numerous things to consider when opening a managed forex account and you must always be careful when selecting a money manager. You need to use due diligence ensuring the money manager is reputable and trustworthy. The forex industry is known to have some notable scammers in the past, so extra precautions must be made to guarantee safe and secure management.

Not only do you need to take precaution when choosing your money manager, but also in the type of account that’s suitable for your needs. Below are some things to look for when choosing a managed forex account.

- The risk level of an account or manager is something to consider. When trading with an individual account, you want to choose a money manager who’s trading style and history is at the level of risk you’re comfortable with. You can advise your money manager on how to trade, but by choosing one that trades with your level of risk already can make all the difference. As well, with trading accounts, you want to choose a pool with your appropriate risk level and trading method.

- Another important factor are the fees, expenses, and minimum deposits involved with a trading account. Many firms will charge performance fees to your account. These fees can vary greatly based on the account type, and risk level of such an account. These rates can range from anywhere between 10%-35% and some cases even higher. These rates are in accordance to a principle called the “high water mark”. This protocol is applied to your account if at the end of each month your net balance is higher than a certain percentage. If this is the case, your account will be deducted the performance fee which is a certain percentage. Some brokerages may also charge an account management fee on top of the other fees for following a specific formula. Also in some cases, there can be a fee for the termination of account in the event of transferring all funds.

- An important factor when choosing a reputable managed forex account is the availability of past performance history. Past performance may not be an indicative factor of future results, but at least the history shows experience of the forex account. There should be published history of at least a few years for a reputable brokerage managed account.

How to open a managed forex account?

Opening a managed forex account is more complicated than you might think. That is why we’ve created a detailed list pertaining to the necessary steps involved. Discover the intricate process in great detail below;

- Before you make the necessary steps to opening an account, you must first determine your risk tolerance. You need to know this so you know who to look for in a money manager, you can view their track record and overall risk score. Another point that goes along with this are your goals. If you want to make higher profits in a short amount of time, high risk managed account might be the option for you.

- Spend time networking and searching for the right forex trader. There are lots of options out there, but not everyone is right for you. Use your due diligence and research, reach out, and network to find the best possible forex brokerage.

- Once you have narrowed down your list of forex traders, you need to go over each contract. Make sure you feel comfortable with everything and understand the max drawdowns, liability coverage, fees and expenses, and so on. Your due diligence is key in obtaining a successfully managed forex account.

- Again, ensure everything is up to spec with the trader your interested in. View past performance reports, client testimonials, reviews, and anything you can dig up on the internet.

- Once you have completed the steps above you are ready to select a forex trader to manage your account. You’ll need to complete and sign the necessary documents, and contracts including the signing of a limited power of attorney agreement (LPOA).

- The next step is to receive your account number and transfer funds into the account. The account number is tied to your name, information, and your segregated trading account. Once everything is in order you can go ahead and transfer the funds, knowing you’re with a trusted and secure forex trader by following the steps above.

- Finally, you wait for the money to be transferred, and it’s complete. It really is a simple process. You can have a managed forex account up and running within a few days. Now, you can analyze your account and even learn from the trades that are being made.

What are LAMM accounts?

Definition:

LAMM or lot allocation management module can be called the predecessor of PAMM. With LAMM account the trader not only does business with his account but his transactions get duplicated in the accounts of the investors. An investor can always check the manager’s real time action. This service benefits both trader and investor. The manager doesn’t have to worry about the number of investors that are connected to the account. Investors can independently specify the amount of funds and monitor every trade being copied. Moreover, investor can diversify funds by allocating with several managers thus reducing risks.

Advantages of LAMM account:

- Investors fund are not transferred to managers account but stay with the investor all the time.

- It is easy to manage risk as the investor can manage the amount of funds to be allocated in LAMM account.

- One of the best features is that the investor enjoys the freedom to cancel the deal or disconnect from the managers account any time he feels like. This makes the movement of the investor very flexible and gives him his space.

- The manager can choose the desirable type of compensation, either fixed or certain percentage of the investor’s profit.

- The manager uses his personal funds for trading.

- All transactions are copied automatically.

Disadvantages of LAMM account:

- The manager does not take any responsibility for the upshot of the trade. It is the investor himself who at his own risk approaches the manager and wants his transactions to be copied.

- There is a high minimum deposit, which means if you don’t have enough money in your account then the transactions will not get copied.

Difference between LAMM and PAMM:

so, let's see, what was the most valuable thing of this article: find what MAM, PAMM and LAMM forex accounts are and how different forex brokers support and handle them. At lamm accounts

Contents of the article

- Today forex bonuses

- Feeling a little confused about brokers with MAM,...

- Three different types of money management systems

- PAMM, LAMM, MAM….Are you confused?

- There are several money-managing systems...

- Suggested articles

- For the LAMM manager

- Advantages of LAMM accounts in grand capital

- How it works

- How to become a manager

- For LAMM investors

- Advantages of LAMM accounts in grand capital

- How it works

- How to become an investor

- Forex trading area

- About trading, with plenty of forex

- A comparison between PAMM and LAMM accounts

- Forex managed accounts: PAMM vs MAM vs LAMM

- Free netflix accounts & passwords updated 2021...

- What are free netflix accounts & passwords?

- Free netflix accounts & passwords updated january...

- Working free netflix accounts & passwords

- Free netflix accounts & passwords that still...

- Long-term free working netflix accounts &...

- How to get free netflix accounts in 2021

- 1. Get free 7-days trial netflix account

- 2. Using virtual debit cards

- 3. Sharing of netflix account

- 4. Use free netflix account with airtel

- 5. Netflix MOD

- 6. Netflix cookies

- Benefits of a free netflix account

- Free netflix accounts faqs

- How can I get a free netflix account?

- Can I get a free netflix account in the...

- Is using the free netflix account is safe?

- Should I use free netflix account generated by...

- Conclusion

- Best forex managed accounts 2021

- Activtrades

- FP markets

- What is a forex managed accounts?

- How does a managed forex account work?

- Account types

- What should you look for in a managed forex...

- How to open a managed forex account?

- What are LAMM accounts?

No comments:

Post a Comment