Trading account

Clients are required to keep all their account related information up-to-date including details like email id, mobile number, address, bank details, demat details, income details etc.

Today forex bonuses

Which will help the client to timely receive any information and to avail the various facilities relating to the trading and demat account. To update the details, client may get in touch with our designated customer service desk or approach the branch for assistance. Congrats, now you know about the requisites for trading – demat and trading accounts. Now, let’s go one step further and understand how to open a trading account. Click here.

Difference between demat account and trading account

WHAT IS A TRADING ACCOUNT?

A trading account is an investment account that holds securities, cash and other holdings like any brokerage account. With a trading account, an investor can buy and sell assets as frequently as they want, that too within the same trading session. Some of the key elements that differentiates a trading account from other investment accounts are – the level of trading activity, the purpose of the activity and the risk involved in the activity. Typically, holders of a trading account are involved in day trading and are often seen exercising long-term buy and hold strategies.

For this reason, you need a special account through which you can conduct transactions. This is called the trading account. Without one, you cannot trade in the stock markets. You register for an online trading account with a stock broker or a firm. Each account comes with a unique trading ID, which is used for conducting transactions.Also, each broker offers different trading account features. Read more about features of trading by kotak securities.

WHAT IS THE DIFFERENCE BETWEEN DEMAT AND TRADING ACCOUNTS?

A trading account is used to place buy or sell orders in the stock market. The demat account is used as a bank where shares bought are deposited in, and where shares sold are taken from. Trading account with kotak securities helps you trade seamlessly in the stock market.

Example ( trading account meaning and procedure)

You have rs.100 in your wallet. You go to a shop and tell the seller that you want a packet of chips, you check the price, and finalize the transaction. Then, you take the money out of your wallet and give it to the seller. In this case, the wallet acts as the demat account, while you act as the trading account.

ONLINE TRADING ACCOUNT OPENING STEPS?

Just like the demat account, a trading account is a must for investing in the stock market. This is because to trade in the stock markets, you need to be registered with the stock exchange. Stock brokers are registered members of the exchanges. They traditionally conduct trades on your behalf.

Most often, stock broking firms have thousands of clients. It is not feasible to take physical orders from every client on time. So, to make this process seamless, it is advisable to open an online trading account. Using this trading account, you can place buy or sell orders either online or phone, which will automatically be directed to the exchange through the stock broker.

HERE’S HOW YOU OPEN A TRADING ACCOUNT:

- First, select the stock broker or firm. Ensure that the broker is good and will take your orders in a timely manner. Remember, time is of utmost importance in the stock market. Even a few minutes can change the market price of the stock. For this reason, ensure that you select a good broker.

- Compare brokerage rates. Every broker charges you a certain fee for processing your orders. Some may charge more, some less.

- Some give discounts on the basis of the amount of trades conducted. Take all this into account before opening an account. However, remember that it is not necessary to choose a broker who charges the lowest fees. Good quality brokerage services provided often may need higher-than-average charges.

- Next, get in touch with the brokerage firm or broker and enquire about the account opening procedure. Often, the firm would send a representative to your house with the account opening form and the know your client (KYC) form

- Fill these two forms up. Submit along with two documents that serve as proof of your identity and address.

- Your application will be verified either through an in-person check or on the phone, where you will be asked to divulge your personal details.

- Once processed, you will be given your trading accounts details. Congrats, you will now be able to conduct trades in the stock market

HOW TO TRADE USING DEMAT ACCOUNT?

Step 1:

Link your trading and demat accounts. This way you won’t have to keep supplying your demat account details for every transaction.

Step 3:

The exchange will process your order. It will verify the details of the transaction, the market price, the availability of the shares in the market, and so on. It will also check the details of your demat account that is linked to your trading account. This is especially so in case of a sell order.

Step 2:

Place an order through your online trading account. This could be a market order, a limit or buy order, or an after-market order. If your brokerage allows you to place orders through the phone, then you will need to supply your trading account details.

Step 4:

Once the order is processed, the shares will be either deposited in or debited from your demat account.

CAN YOU TRANSFER SHARES USING DEMAT ACCOUNT?

Nomination: yes, nomination is possible. You can have a nominee of your choice by filling up the details in the account opening form. This enables the nominee to receive the securities after the death of the holder of the demat account.

Between dps: transfer of shares is possible between demat accounts held with different dps. You need to fill the delivery instruction slip book (DIS) and submit the same to your DP for transferring your shares from another demat account. However, you need to check whether the central depositories are same or not (CDSL or NSDL). If both of them are different, then you need an INTER-depository instruction slip (inter DIS). If they are same, then you need an INTRA depository instruction slip (intra DIS).

Do try to submit that DIS when the market is on. Then, the date of submission of DIS and date of execution of DIS would be the same. Otherwise, there may be a delay. You may also need to pay the broker some charges for the transfer.

What next?

Congrats, now you know about the requisites for trading – demat and trading accounts. Now, let’s go one step further and understand how to open a trading account. Click here.

To open a demat account with kotak securities,click here. You can also open a trading account with us. Just click here.

To open a demat account with kotak securities, click here.

You can also open a trading account with us. Just click here.

| Article pages | ||

|---|---|---|

| best demat account | buy mutual fund without demat account | conclusion of demat account |

| convert physical shares to demat account | demat account opening charges | demat account |

| how to close demat account | informative report on demat account | |

| product pages | ||

|---|---|---|

| brokerage charges | collateral amount in demat account | demat account number |

| documents required for demat account | how to open demat account | use of demat account |

| what is dematerialization account | multiple demat account in india | link your aadhar number with demat account |

| procedure for buying shares through a demat account | difference between dematerialisation vs. Rematerialisation | demat account and its uses |

| what are bonus shares? | Demat account | benefits of dematerialization |

| faqs pages | ||

|---|---|---|

| demat account profile | transfer shares from demat account | demat account security key |

| transfer shares to demat | NRI account | demat account charges |

- Use existing bank account

- Convenience through partnerships

- Kotak securities support

Investment knowledge bank

Trading tools & research reports

Account types & value added services

TIME:

customer service:- mon to fri – 9.00 AM TO 6.00 PM

call and trade:- mon to fri – 8.30 AM TO 5.30 PM

For call & trade, dial 080 4725 3255

write to us at service.Securities@kotak.Com for trading account-related queries and ks.Demat@kotak.Com for demat account-related queries

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account.

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, mutual fund etc.), you need not undergo the same process again when you approach another intermediary. Attention investors prevent unauthorized transactions in your demat / trading account --> update your mobile number/ email id with your stock broker / depository participant. Receive information of your transactions directly from exchanges on your mobile / email at the end of day and alerts on your registered mobile for all debits and other important transactions in your demat account directly from NSDL/ CDSL on the same day." - issued in the interest of investors. Circular no.: NSDL/POLICY/2014/0094, NSE/INSP/27436, BSE - 20140901-21

Kindly note that as per NSE circulars nos: NSE/INVG/36333 dated november 17, 2017, NSE/INVG/37765 dated may 15.2018 and BSE circular nos: 20171117-18 dated november 17, 2017, 20180515-39 dated may 15.2018, trading in securities in which unsolicited messages are being circulated is restricted. The list of such stocks are available on the website of NSE & BSE. In case of any queries, request you to kindly get in touch with customer service on 18002099191/9292

Kotak securities ltd. Having composite licence no.CA0268 is a corporate agent of kotak mahindra life insurance company limited and kotak mahindra general insurance company limited. We have taken reasonable measures to protect security and confidentiality of the customer information.

The stock exchange, mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc., of any of the rules, regulations, bye-laws of the stock exchange, mumbai, SEBI act or any other laws in force from time to time.

The stock exchange, mumbai is not answerable, responsible or liable for any information on this website or for any services rendered by our employees, our servants, and us.

Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. This cautionary note is as per exchange circular dated 15th may, 2020.

Note: NSDL and CDSL have mapped unique client codes (UCC) to demat accounts based on PAN, refer NSDL and CDSL circulars. Format for linking/delinking the UCC: NSDL: link | CDSL: link.

Clients are required to keep all their account related information up-to-date including details like email id, mobile number, address, bank details, demat details, income details etc. Which will help the client to timely receive any information and to avail the various facilities relating to the trading and demat account. To update the details, client may get in touch with our designated customer service desk or approach the branch for assistance.

Investor awareness regarding the revised guidelines on margin collection:-

attention investors :

1. Stock brokers can accept securities as margin from clients only by way of pledge in the depository system w.E.F. September 1, 2020.

2. Update your mobile number & email id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

3. Pay 20% upfront margin of the transaction value to trade in cash market segment.

4. Investors may please refer to the exchange's frequently asked questions (faqs) issued vide circular reference NSE/INSP/45191 dated july 31, 2020, notice no. 20200731-7 dated july 31, 2020 and NSE/INSP/45534 dated august 31, 2020, notice no. 20200831-45 dated august 31, 2020 and other guidelines issued from time to time in this regard.

5. Check your securities /MF/ bonds in the consolidated account statement issued by NSDL/CDSL every month.

. Issued in the interest of investors

Clients are hereby cautioned not to rely on unsolicited stock tips / investment advice circulated through bulk SMS, websites and social media platforms. Kindly exercise appropriate due diligence before dealing in the securities market.

Requirement of obtaining consent through OTP has been waived for off market transfer reason code “implementation of government / regulatory direction / orders” consent through OTP would continue to be required for all other reasons for any off-market transfers. Refer NSDL circular.

Covid-19 impact to clients:-

1. Applicable to clients on whose email id contract notes and other statements get bounced or who have opted for physical contract notes/ other statements or digital and physical contract notes/ other statements :due to the nationwide lockdown, we are unable send physical contract notes and other statements. To view them, log into www.Kotaksecurities.Com

2. Kindly update your email id with us to receive contract notes/various statements electronically to avoid any further inconvenience.

3. We are unable to issue the running account settlement payouts through cheque due to the lockdown. We request you to update your bank account details to facilitate direct transfer to your linked bank account. You may approach our designated customer service desk or your branch to know the bank details updation procedure.

4. Exchange advisory: investors are advised to exercise caution while taking investment decisions in these unpredictable times. Clients are also encouraged to keep track of the underlying physical as well as international commodity markets. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips etc.

Filling complaints on SCORES- easy & quick

a. Register on SCORES portal | b. Mandatory details for filling complaints on SCORES i. Name, PAN, address, mobile number, E-mail ID | c. Benefits: i. Effective communication ii. Speedy redressal of the grievances

Trading account

What is a trading account?

A trading account can be any investment account containing securities, cash or other holdings. Most commonly, trading account refers to a day trader’s primary account. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result. The assets held in a trading account are separated from others that may be part of a long-term buy and hold strategy.

Trading account

Basics of trading account

A trading account can hold securities, cash and other investment vehicles just like any other brokerage account. The term can describe a wide range of accounts, including tax-deferred retirement accounts. In general, however, a trading account is distinguished from other investment accounts by the level of activity, purpose of that activity and the risk it involves. The activity in a trading account typically constitutes day trading. The financial industry regulatory authority (FINRA) defines a day trade as the purchase and sale of a security within the same day in a margin account. FINRA defines pattern day traders as investors who satisfy the following two criteria:

- Traders who make at least four day trades (either buying and selling a stock or selling a stock sort and closing that short position within the same day) over a five-day week.

- Traders whose day-trading activity constitutes more than 6 percent of their total activity during that same week.

Brokerage firms can also identify clients as pattern day traders based on previous business or another reasonable conclusion. These firms will allow clients to open cash or margin accounts, but day traders typically choose margin for the trading accounts. FINRA enforces special margin requirements for investors it considers to be pattern day traders.

Opening a trading account requires certain minimum personal information, including social security number and contact details. Your brokerage firm may have other requirements depending on the jurisdiction and its business details.

FINRA margin requirements for trading accounts

Maintenance requirements for pattern day trading accounts are considerably higher than those of non-pattern trading. The base requirements of all margin investors are outlined by the federal reserve board’s regulation T. FINRA includes additional maintenance requirements for day traders in rule 4210. Day traders must maintain a base equity level of $25,000 or 25 percent of securities values, whichever is higher. The trader is permitted a purchasing power of up to four times any excess over that minimum requirement. Equity held in non-trading accounts is not eligible for this calculation. A trader who fails to meet these requirements will receive a margin call from their broker and trading will be restricted if the call is not covered within five days.

Login

Don't have an account yet?

United kingdom ic_down created with sketch.

- Argentina

- Australia

- Österreich

- België

- България

- Chile

- 中国

- Colombia

- Hrvatska

- Κύπρος

- Česká republika

- Danmark

- Eesti

- Suomi

- France

- Deutschland

- Hellas

- Magyarország

- Ísland

- Éire

- Italia

- 日本

- Latvija

- Liechtenstein

- Lietuva

- Lëtzebuerg

- Malta

- México

- Nederland

- Norge

- Polska

- Portugal

- România

- Россия

- السعودية

- Singapura

- Slovensko

- Slovenija

- South africa

- España

- Sverige

- Schweiz

- الإمارات العربيّة المتّحدة

- United kingdom

- International

Free investing in stocks & etfs. Zero commission, zero fees.

Active trading with leverage and zero commission. Stocks, forex, indices, and more.

Invest tax-free in a zero commission stocks and shares ISA.

Investments can fall and rise. You may get back less than you invested. Past performance is no guarantee of future results. Tax treatment depends on your individual circumstances and may be subject to change.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trading 212 is a trading name of trading 212 UK ltd. And trading 212 ltd.

Trading 212 UK ltd. Is registered in england and wales (register number 8590005), with a registered address 107 cheapside, london EC2V 6DN. Trading 212 UK ltd. Is authorised and regulated by the financial conduct authority (register number 609146).

Trading 212 ltd. Is registered in bulgaria (register number 201659500). Trading 212 ltd. Is authorised and regulated by the financial supervision commission (register number RG-03-0237).

The information on this site is not directed at residents of the united states and canada, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Saxo account

Trade, hedge and invest across 40,000

instruments from our most popular account.

Join saxo today and trade all our asset classes on

industry-leading prices, through award-winning platforms and

with expert personal service.

Why trade with saxo?

Global market access

Trade more than 40,000 instruments across forex, cfds, stocks, options, etfs, commodities, futures, bonds and mutual funds.

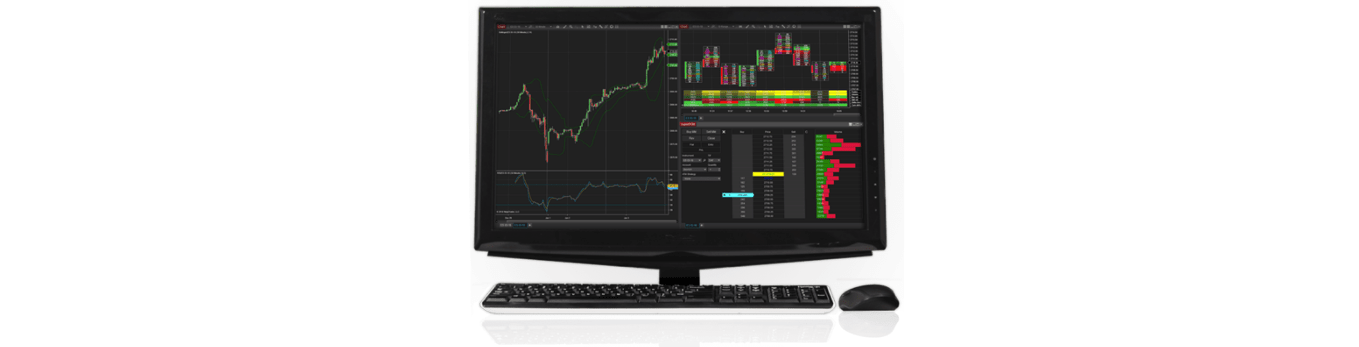

Powerful platforms

Access both our platforms, the award-winning saxotradergo and professional-grade saxotraderpro, from one account.

Industry-leading prices

Benefit from market-leading entry prices and get tighter spreads and lower commissions when you upgrade your trading tier.

Expert support

Receive best-in-class digital support as standard and unlock even better personal service with our premium trading tiers.

Our account tiers

Trade more, pay less and get better service

Minimum funding USD 10,000

Classic

Benefit from industry-leading entry prices

- Tight entry prices

- Best-in-class digital service and support

- 24/5 technical and account support

- Priority local-language customer support

- Direct access to our trading experts, 24/5

- 1:1 saxostrats access

- Exclusive event invitations

Minimum funding USD 200,000

Platinum

Receive even tighter spreads and commissions

- Up to 30% lower prices

- Best-in-class digital service and support

- 24/5 technical and account support

- Priority local-language customer support

- Direct access to our trading experts, 24/5

- 1:1 access to the saxostrats

- Exclusive event invitations

Minimum funding USD 1,000,000

VIP

Get the VIP treatment with our best prices and service

- Our very best prices

- Best-in-class digital service and support

- 24/5 technical and account support

- Local-language personal relationship manager

- Direct access to our trading experts, 24/5

- 1:1 saxostrats access

- Exclusive event invitations

Open a saxo account now

How to move between tiers

How to move between tiers

When you open an account, you are placed into a tier based on your initial funding within 30 days. After your first three months trading, you will automatically be moved to the tier that best reflects your volume - with no additional funding required. To better understand how this works, speak to one of our specialists .

When you open an account, you are placed into a tier based on your initial funding. After your first three months trading, you will automatically be moved to the tier that best reflects your volume - with no additional funding required. To better understand how this works, speak to one of our specialists .

Expert support

Integrated digital support

Find a bank of helpful resources in our self-service support centre or platform-integrated helpdesk.

Personal support

Get expert support for account and technical queries whenever markets are open. Our teams operate from 16 countries, and each team member is a saxo platform specialist and fully immersed in their local market.

In-house analysts

Our team of top-tier strategists – the #saxostrats – provide daily insights, analysis and views across global markets, asset classes and tradable instruments.

Personal relationship managers

Platinum and VIP clients benefit from a personal point of contact to answer account queries and offer exclusive invitations to events and webinars. Your relationship manager can also provide a personal introduction to saxo platforms and educational content, as well as curated market news relevant to your trading and investment interests.

Exclusive VIP services

Become a VIP client to receive priority one-to-one support, market commentary, assistance placing complex orders and a sparring mate to discuss trading strategies. VIP clients can also speak directly with the saxostrats to discuss asset allocation in line with macro developments, their views on all major asset classes, and the implications of central bank policies and other market events.

Frequently asked questions

What documents should I read before applying?

Please read the following documents before applying for a saxo account: general business terms, order execution policy and conflict of interest policy.

What commissions does saxo charge?

For a comprehensive overview of our industry-leading spreads and commissions and details of additional costs, such as inactivity fees, click here.

How is my money protected?

As we’re regulated and authorised by the FSA, when you make a cash deposit into a saxo account, up to EUR 100,000 of your money is guaranteed by the danish guarantee fund.

How do I open an account?

It’s quick and easy to open a saxo account: just fill in our simple online form and verify your ID.

Can I hold multiple currencies in a saxo account?

You can fund and deposit your saxo account with 18 different currencies. Speak to our experts to find out more.

What markets can I access?

Your saxo account will provide access to more than 40,000 instruments, across asset classes, including FX, cfds, etfs, stocks, bonds and more. Find out about our range of tradable markets, here.

How do I transfer stocks to saxo?

You can transfer existing stock portfolios to saxo through our award-winning platforms. Once you’ve opened your account, log into the platform, navigate to ‘my account’, and select ‘asset transfer’.

For more information, please read here.

If you didn’t find what you were after, contact us directly and we’ll be pleased to help.

Open a saxo account now

Open a saxo account now

Simply fill in our application form and submit your documentation.

Our other accounts

Professional account

Find out more about opening an elective professional account.

Corporate account

Give your firm access to the same tools and markets as retail clients.

Democratising trading

and investment for

more than 25 years.

Saxo bank A/S (headquarters)

philip heymans alle 15

2900

hellerup

denmark

Products & pricing

- Forex

- Cfds

- Futures

- Commodities

- Forex options

- Listed options

- Stocks

- Bonds

- Etfs

- Mutual funds

- Investment portfolios

- Trading strategies

- General charges

Platforms

Accounts & service

General

Other

Across

Trade responsibly

all trading carries risk. Read more. To help you understand the risks involved we have put together a series of key information documents (kids) highlighting the risks and rewards related to each product. Read more

This website can be accessed worldwide however the information on the website is related to saxo bank A/S and is not specific to any entity of saxo bank group. All clients will directly engage with saxo bank A/S and all client agreements will be entered into with saxo bank A/S and thus governed by danish law.

Apple and the apple logo are trademarks of apple inc, registered in the US and other countries and regions. App store is a service mark of apple inc. Google play and the google play logo are trademarks of google LLC.

Demo accounts

A free day trading demo account is a fantastic way to gain experience with zero risk. Here, we list the best forex, cfd and spread betting demo accounts. From ‘no registration’ practise accounts, to MT4 simulators that allow you to test strategies, we have reviews for them all. Test out brands and see if day trading could work for you – without risking capital.

Best demo accounts in ukraine 2021

What is a demo account?

A demo account is a kind of trading simulator, or practice account, that allows you to practice day trading with a wide range of financial instruments, from stocks, futures, and options to cfds and cryptocurrency.

How do they work?

Demo accounts are funded with simulated money, allowing you to gain trading experience without risking real capital.

This allows you to craft strategies and build confidence while getting familiar with market conditions.

In addition, it’s an effective way to test drive a potential broker and software.

Capabilities

The best demo accounts allow you to simulate real trading with the only difference being that you use pretend money.

This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds.

- Exploration – testing different financial markets allows you to get a feel for how they behave while finding the right product for you. Trading penny stocks will be different to commodities, for example.

- Gain experience – before you risk real capital, you can practice opening and closing positions, plus applying stops and limits. In addition, you can view margin requirements, as well as track profit and loss.

- Charting – learn how to interpret and utilise charts, from testing technical indicators to identifying patterns.

- Past performance – you can analyse past performance to correct mistakes and hone your strategy before you put real capital on the line.

- Trading tools – learn how to interpret and utilise information from news feeds and market data.

- Watch-lists – demo accounts also allow you to identify and monitor markets of interest.

Benefits

Whether it’s a forex demo account in the UK and australia or CFD and spread betting in the US, all will offer a number of benefits:

Familiarity

- Risk – because demo accounts are funded with simulated money, mistakes won’t cost you any of your hard-earned capital. In addition, they also allow you to practice day trading while you are still saving for that initial account deposit.

- Price action – the best way to understand price action is to experience it. Stock trading demo accounts, for example, will give you practice reacting to volatile markets and capitalising on price fluctuations.

- Broker & platform – finally, online trading with demo accounts is an effective way to test a potential broker and platform. For example, you can check their software has all the charts and tools you need. In addition, do they offer any useful extras, such as trading contests? So, check the overall quality of the broker’s services before you commit real capital.

Strategy

- Calibration – demo brokerage accounts are the ideal place to fine-tune your strategy. You can make mistakes and adjustments until your plan is consistent, without losing real capital. Because overtrading, cutting profits short and direction bias are all common mistakes that can prove costly if you don’t make them in practice accounts first.

- Forward testing – once you have a market and strategy in mind, you can either backtest or forward test your trading plan. While backtesting can prove useful, it lacks the emotional element. Forward testing enables you to put your plan to trade stocks, for example, into action while battling trading pressures in real-time.

- Drawdowns – regardless of how effective your strategy is, there will be days where the market feels against you. However, investing in a demo account allows you to practice sticking to your plan and perhaps adjusting your position size until things turn around.

Overall, signing up for a demo account in binary or stock options, for example, could give you the ideal risk-free platform to develop an effective strategy.

Drawbacks

Before you start looking at demo accounts for trading, these practice accounts do come with certain limitations:

Physical discrepancies

- Execution – demo accounts often provide better execution than live trading. This is because demo accounts usually fill a market order at the price shown on the screen. However, in a live market, there is slippage. This can result in orders not being filled at the expected price. So, meeting previous profit calculations may prove challenging.

- Increased capital – normally, demo software allows you to choose how much capital you would like to trade with. As a result, many individuals opt for far more than they will have when they live trade. Greater capital allows for smaller losses to be more easily recouped. You may also find yourself unable to afford the expensive instruments you explored when using demo accounts.

- Spreads – online forex brokers, for example, often look to impress potential traders with tight spreads in demo accounts. However, in fast-moving markets, in particular, the spread quoted may be far wider.

- Deposits – although using virtual money, there are some brokers who will require an initial deposit to use their demo accounts. So, this is something to check before you sign up.

- Leverage – many traders enjoy the increased leverage some brokers ofter in demo accounts. Whilst this can result in substantial virtual profits, in live-trading it can also lead to significant losses.

- Deal rejection – in demo accounts, trades almost always go through as requested, regardless of certain factors. However, when live trading, price changes between your trade submission and execution can result in rejection. So, be prepared for re-quotes when you upgrade to live trading.

- Trading tools – free charts and packages you get when your trading gold in your demo account may well come at an additional cost when you live trade.

- Market movements – your demo account server may not take into account interest and dividend adjustments, or out of hours price movements.

Psychological discrepancies

- Emotions – demo accounts will not expose you to the fear, hope and greed that you may experience when you live trade. The fear of losing your capital can result in costly mistakes. Whilst greed can lead to holding onto a winning position for too long. Unfortunately, you cannot practice controlling these emotions with demo accounts.

- Complacency – managing risk properly with a practice account is often overlooked. Traders often take more risks than they would if real funds were on the line. This can result in bad habits when you transition to live trading.

- Overtrading – the excitement of trading can cause many with demo accounts to overtrade. After all, why not take that risk when it isn’t real money on the line? This can develop into a habit of overtrading. However, when you move to live trading, you will then need to learn quantity doesn’t always trump quality.

To conclude, a comparison of a demo account vs a real live-trading offering will highlight a number of potential pitfalls to take into account.

Yet that does not necessarily mean you shouldn’t use demo accounts. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital.

Moving from demo to real money

You open a demo account as your first step towards becoming a trader. You want to be successful and make real money. So why stop at the demo stage?

It is a common feeling. That fear of losing real money and the lack of belief that you might actually be a profitable day trader.

The same fears held us back to, but until you take that leap, you will never know. Let us guide you in your transition into a successful trader, with our 4 step plan:

Demo to real action plan

1. Assign some capital to trading

2. Open A real money account

3. Calculate A trade size

4. Start trading!

You already know how to place trades as you have tried it on the demo account. So let us build on each point with some detail;

Assign some capital

You need to set aside some capital. How much is up to you but £250 to £500 is a reasonable minimum, any less limits the number of trades you can make.

Trading is high risk, so you need to be prepared to lose some or all of this money. If the minimum deposit at a broker is less than you have, you dont need to pay it all in – just set it aside.

Open A real money account

You do not have to use the same firm as your demo account, but this will be the easiest transition. Visit the broker page if you want to try someone new for the real account.

Calculate A trade size

How much will you risk on each trade? 1% to 2% is a good conservative number.

If you make 50 to 100 trades, you will be well placed to know if you have what it takes to be profitable trader.

Any less and you will not know if the results were just good or bad luck. 100 trades starts to separate winners from “unprofitable” traders.

Start trading!

Congratulations, you are a trader! Now, are you a winning one?…

Opening a demo account

Most demo accounts are easy to open, whether it’s for cryptocurrency or binary options of 60 seconds. The majority of the time, you will simply have to head over to the broker’s website and fill in a straightforward form.

You will usually be asked for:

- Email address

- Username

- Password

- Location

Often you require no more details than this. Your account login details will then be emailed to you and instructions on next steps will be given.

You can even find some forex demo accounts that require no registration at all.

Reviews

Whether you are looking for the best demo account for share trading on the stock market, commodity trading, futures, forex or binary options, some of the top options have been collated below.

This will allow you to find the right software and offering to compliment your trading style whilst give you exposure to your preferred markets.

Metatrader 4 demo account

The most popular trading platform is metatrader 4 (MT4). However, you can also get metatrader 5 (MT5) demo accounts. These industry standard platforms are now available at most retailers.

Once you have finished your metatrader download, you will be able to analyse markets using a range of technical indicators, without risking any capital.

This allows you to practice analysing price action, chart figures, support and resistance lines, currency correlations, and more.

In addition, demo accounts on MT4 can be opened in a desktop platform, plus in mobile applications.

Both will also allow you to test automated strategies, calling on historical data to optimise your settings.

Once you have your metatrader account password, you can practice all of the above until your demo account expires. However, you will find plenty of brokers offering MT4 demo accounts that don’t expire.

This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want.

You also benefit from diversity. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple.

In fact, because MT4 demo accounts have no time limit, you can try your luck in as many markets as you like, until you find the right product for your trading style. MT4 demo accounts are also available in plenty of countries, from the USA to the UK.

Overall, once you have your MT4 password, you are free to test your strategies for as long as you wish, as most metatrader demo accounts are unlimited.

They provide the ideal risk-free way to identify where your strengths lay and which areas of your trading plan require attention.

IC markets

One of the best forex demo accounts is provided by IC markets. Their forex account is easy to use. It comes with a range of sophisticated charting and trading tools, whilst their website promises a wealth of support and an active user community.

Another major benefit comes in the form of accessibility. You can open a forex demo account from the USA, UK, canada, malaysia, indonesia, and a whole host of other countries.

In terms of technical capabilities, IC markets support a range of platforms.

So, you can select their forex account and get an MT4 download. Alternatively, you can practice on MT5 or ctrader. Also, you can choose between a forex web platform or mobile trading, on both android and ios.

IC markets forex demo account also has no time limit or expiration. So, you don’t have to put real capital on the line until you feel confident.

Overall, if you’re looking for free demo accounts for forex trading, that can be used for an unlimited time, IC markets is a strong contender. They consistently score highly in reviews of forex demo accounts.

Plus500

For demo accounts using cfds only, plus500 is worth considering.

Reviews highlight traders are impressed with the great flexibility, high-quality software, plus competitive spreads when you upgrade to real-time trading.

Another key selling point of plus500 demo accounts is that they do not expire, meaning you can practice indefinitely.

On top of that, you can backtest strategies and get familiar with the nuances of the forex market, all with zero risks.

In addition, head over to the app store and you can get a demo account on your ios or android device. This will allow you to practice on the way to work or at a time convenient for you.

Simply head over to their website and select ‘demo mode’ in the ‘select account mode’ window.

Then follow the on-screen instructions to get set up. Also, you can switch from real money mode to demo by hitting ‘switch to demo mode’. Not to mention, you can reset plus500 demo accounts if you want a fresh start.

So, if you’re looking for a full demo account without needing a deposit, plus500 is a worthwhile choice.

Etoro

If you’re looking for crypto, CFD, or forex demo accounts, etoro is worth exploring.

In fact, once you have registered on their website, a trading account with both real and demo modes is automatically opened.

After you’ve logged in, you simply need to select ‘practice trading login’ on the main screen and enter your etoro login credentials that you registered with.

Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. In addition, demo accounts on etoro can also be reset.

On top of that, you can get their forex demo account in app form, where you can play around with up to €10,000 in virtual funds.

Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface.

A demo account in etoro will also allow you to practice your skills in trading competitions. Furthermore, it’s an ideal choice for those looking for demo accounts without a deposit required.

Summing up

There are plenty of options out there. An MT4 demo account that does not expire could well prepare you for any number of potential markets.

However, remember a forex demo account vs live real-time trading will throw up certain challenges.

So, be wary of those that claim ‘demo account trading is a must in my view’. Instead, consider your needs and look for demo accounts that can replicate real-time trading as accurately as possible, including spreads and trade tools.

NSE demo trading accounts

There are now plenty of options for individuals looking for demo accounts for the NSE (national stock exchange of india). In fact, demo accounts for stock/share trading in india are on the rise.

Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace.

However, it is worth considering whether a minimum deposit is required.

You should also check whether advanced trading tools will come with an additional charge when you upgrade to a live account.

Finally, how long do you have access to their practice offering? Is it unlimited or will you have to look elsewhere after a short while if you’re not ready to upgrade?

It’s also worth noting you can find demo accounts for commodity trading in india. On top of that, there are binary options demo accounts, without needing a deposit.

Furthermore, a number of brokers offer futures demo accounts for an unlimited period. So, it’s worthwhile shopping around before you sign up.

Final word

You do not have to risk your own capital straightaway. You can find plenty of free day trading demo accounts, for binary options and cryptocurrency to forex and stocks.

Location should also not deter you. For example, you can find demo accounts for stock trading in singapore as easily as you can in south africa.

Overall, demo accounts offer a multitude of benefits, from honing a strategy to getting familiar with prospective markets.

However, there are certain limitations, from tackling different emotions to seeing the need for an effective risk management strategy.

But regardless of whether you think using demo accounts is very helpful or not, they remain an effective way to test a potential broker and platform.

11 best online brokers for stock trading of february 2021

Want to trade stocks? You’re going to need an online broker, and that broker should offer a reasonable investment minimum, high-quality trading tools, robust access to customer service and no hidden account fees. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading.

We evaluated brokerage firms and investment companies on the services that matter most to different types of investors. For example, for active traders, we've noted online brokers with low or no commissions and robust mobile trading platforms. For people venturing into investing for the first time, we've included the best online brokers for educational resources (including webinars, video tutorials and in-person seminars) and on-call chat or phone support.

Read on to see our picks for the best brokers, alongside links to our investing experts' in-depth reviews on each.

Want to trade stocks? You’re going to need an online broker, and that broker should offer a reasonable investment minimum, high-quality trading tools, robust access to customer service and no hidden account fees. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading.

We evaluated brokerage firms and investment companies on the services that matter most to different types of investors. For example, for active traders, we've noted online brokers with low or no commissions and robust mobile trading platforms. For people venturing into investing for the first time, we've included the best online brokers for educational resources (including webinars, video tutorials and in-person seminars) and on-call chat or phone support.

Read on to see our picks for the best brokers, alongside links to our investing experts' in-depth reviews on each.

Trading

Upgrade your profit, trade with the best conditions!

Account comparsion

- Floating spread from 1 pip

- Fixed spread from 3 pips

- Floating spread from 0,5 pip

- Fixed spread 0 pip

- Floating spread from -1 pip

- Up to 1:1000

- Up to 1:3000

- Up to 1:3000

- Up to 1:3000

- Up to 1:500

Maximum open positions and pending orders

- From 0,01 to 1 000 cent lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,1 to 500 lots

(with 0,1 step)

- From 0,3 sec, STP

- From 0,3 sec, STP

- From 0,3 sec, STP

- From 0,3 sec, STP

- ECN

Account types, except ECN account, support the following trading instruments: 35 currency pairs, 4 metals, 6 CFD.

Frequently asked questions

What trading account should I choose?

FBS offers various account types designed to meet your needs, including cent , micro , standard , zero spread , and ECN accounts with unique trading conditions. For newbies who have no trading experience, we recommend opening a demo account first, and only after that a micro or cent account. For those who are not the first day in trading, we advise opening a standard account – a classic one. And for real professionals, we suggest a zero spread account or ECN account.

What is a trading account?

To start trading on forex, you must open an account. The primary purpose of trading accounts is to make transactions (open and close orders) with various financial instruments. The trading account is similar to the bank one – you use it to store, deposit, and withdraw money. However, deposits and withdrawals are available only after you verify your account.

What is forex trading?

Forex, also known as the foreign exchange market or FX market, is the world's most traded market, with a $5.1 trillion turnover per day. In simple words, forex trading is the process of converting one country's currency into the currency of another country, aiming to make a profit from the changes in its value.

Why is FBS the best broker for online trading?

FBS is a legitimate forex broker regulated by the international financial services commission, license IFSC/000102/124 , which makes it trustworthy and reliable. We offer our clients the best trading conditions on the market, including different bonuses, convenient trading tools such as CFD trading and stock trading among trading classic currency pairs , regular promotions , the most transparent affiliate commission up to $80 per lot, 24/7 customer support, and more.

How do I start trading?

First, it's really important to remember that becoming a successful trader isn't an overnight process. It takes time to become familiar with the markets, and there's a whole new vocabulary to learn. For this reason, legitimate brokers like FBS offer demo accounts. To open a demo account, you need to register first. After that, download trading software to open and close your first order.

Download trading platform

Metatrader 4

- Download for windows

- Download for ios in appstore

- Download for android in googleplay

- Start trading online

- Download multiterminal

- Download for mac os

Metatrader 5

- Download for windows

- Download for ios in appstore

- Download for android in googleplay

- Start trading online

- Download for mac os

Deposit with your local payment systems

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Your request is accepted

Manager will call your number

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!

Beginner forex book

Beginner forex book will guide you through the world of trading.

Thank you!

We've emailed a special link to your e-mail.

Click the link to confirm your address and get beginner forex book for free.

You are using an older version of your browser.

Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

FOREX trading accounts

Choose an account type that best suits your trading style.

FOREX.Com account

- Advanced trading platforms with customizable interfaces

- Trade forex, equities and more, all on one account

- Fast, reliable trade executions

Metatrader account

- Dedicated FX trading platform

- Exclusive in-platform market news and analysis

- Trades execute at the best available price

DMA account

- Trade on prices as low as 0.1 on all major FX pairs

- Get commission discounts as low as $20/m traded

- Split the spread and place orders within the top of book spreads

What information do I need when opening an account?

We will need you to provide us with your name and address to establish your identity. Typically, we can verify your identity instantly. For more information, see our account document faqs.

What markets does FOREX.Com offer?

You can trade over 80 currency pairs at FOREX.Com. View our full range of markets.

When is forex market open for trading?

You can trade forex at FOREX.Com 24 hours a day, five days a week. For details, read our forex trading times article.

Is there a charge for central clearing?

We provide central counterparty clearing through an omnibus segregated clearing account (OSCA) free of charge as standard to all clients. If you wish to open an individual segregated clearing account (ISCA), fees apply:

- For an individual these charges are: £13,000 account opening fee, plus account maintenance and transaction charges

- For a corporate entity these charges are: £200,000 account opening fee, plus account maintenance and transaction charges

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Open an account

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Related faqs

How do I open a joint or corporate account?

What are the differences between a demo and live account?

How does FOREX.Com make money?

Try a demo account

Your form is being processed.

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

So, let's see, what was the most valuable thing of this article: learn what is trading account, demat account and the difference between demat and trading account. Click here to know more about it on our knowledge bank section. At trading account

Contents of the article

- Today forex bonuses

- Difference between demat account and...

- WHAT IS A TRADING ACCOUNT?

- WHAT IS THE DIFFERENCE BETWEEN DEMAT AND...

- ONLINE TRADING ACCOUNT OPENING...

- HERE’S HOW YOU OPEN A TRADING...

- HOW TO TRADE USING DEMAT ACCOUNT?

- Step 1:

- Step 3:

- Step 2:

- Step 4:

- CAN YOU TRANSFER SHARES USING DEMAT...

- What next?

- Trading account

- What is a trading account?

- Basics of trading account

- FINRA margin requirements for trading accounts

- Login

- Don't have an account yet?

- Saxo account

- Why trade with saxo?

- Global market access

- Powerful platforms

- Industry-leading prices

- Expert support

- Our account tiers

- Classic

- Platinum

- VIP

- How to move between tiers

- How to move between tiers

- Expert support

- Integrated digital support

- Personal support

- In-house analysts

- Personal relationship managers

- Exclusive VIP services

- Frequently asked questions

- What documents should I read before applying?

- What commissions does saxo charge?

- How is my money protected?

- How do I open an account?

- Can I hold multiple currencies in a saxo account?

- What markets can I access?

- How do I transfer stocks to saxo?

- Open a saxo account now

- Open a saxo account now

- Our other accounts

- Professional account

- Corporate account

- Demo accounts

- Best demo accounts in ukraine 2021

- What is a demo account?

- Capabilities

- Benefits

- Drawbacks

- Moving from demo to real money

- Demo to real action plan

- Assign some capital

- Open A real money account

- Calculate A trade size

- Start trading!

- Opening a demo account

- Reviews

- NSE demo trading accounts

- Final word

- 11 best online brokers for stock trading of...

- Trading

- Account comparsion

- Frequently asked questions

- What trading account should I choose?

- What is a trading account?

- What is forex trading?

- Why is FBS the best broker for online trading?

- How do I start trading?

- Download trading platform

- Deposit with your local payment systems

- Data collection notice

- Beginner forex book

- Thank you!

- FOREX trading accounts

- Try a demo account

- Try a demo account

- Open an account

- Active trader program

- Related faqs

- How do I open a joint or corporate account?

- What are the differences between a demo and live...

- How does FOREX.Com make money?

- Try a demo account

- Try a demo account

No comments:

Post a Comment