Jp markets account linking

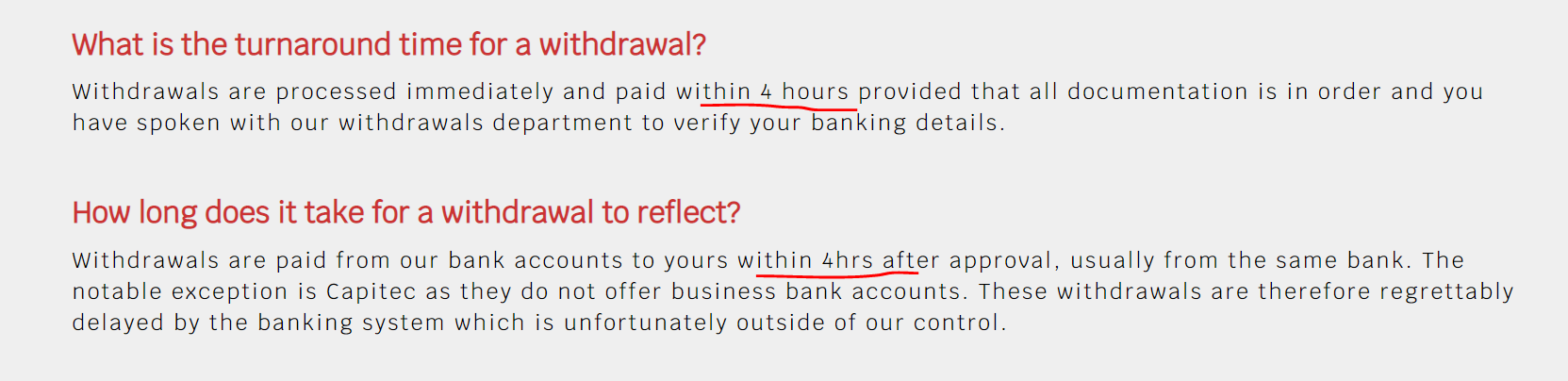

While in the T/C they mention that bank withdrawals take up to 3 days, there is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID.

Today forex bonuses

The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

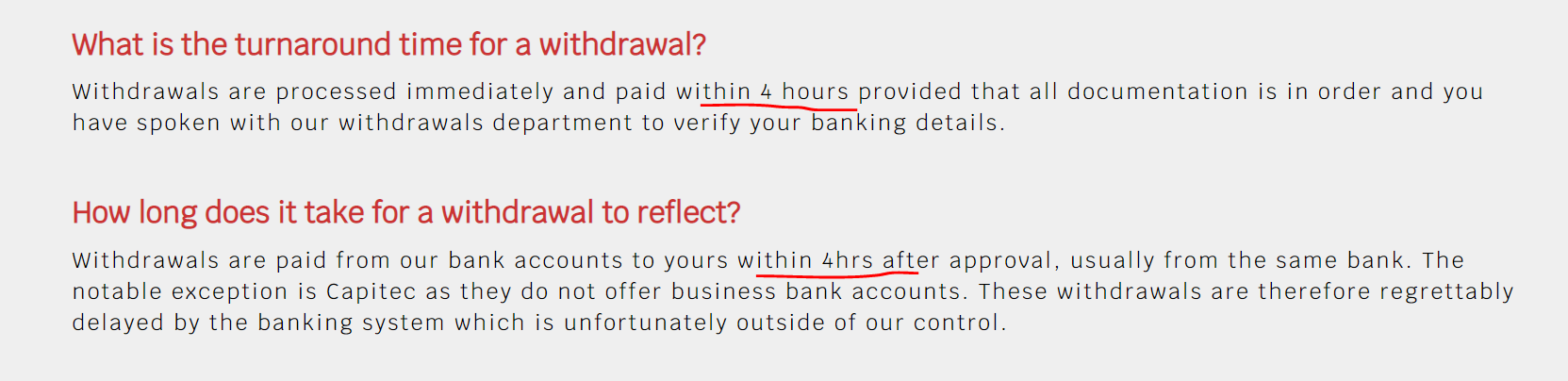

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

Jp markets account linking

Please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. Also, payment allocations can take up to 24 hours from mondays to fridays. For faster allocation please email all proof of payments to finance@jpmarkets.Co.Za.

Account name: JP markets SA (pty) ltd

Account number: 408 902 1536

Account type: current account

Currency type: south african rand account (ZAR)

Bank identifier code (BIC): ABSAZAJJ

Your ref: MT4 number: (e.G. 554472).

Nedbank

Nedbank details:

Account name: JP markets SA (pty) ltd

Account number: 113 6899 766

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Standard bank

Standard bank details:

Account name: JP markets SA (pty) ltd

Account number: 271 294 531

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

First national bank

FNB bank details:

Account name: JP markets SA (pty) ltd

Account number: 62638202432

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Snapscan

Step 1. Snap

Open snapscan and use your phone’s camera to scan the snapcode displayed at the checkout or on your bill.

Step 2. Pay

Enter the amount you want to pay and confirm payment with your 4-digit PIN.

That’s it. You’re done! Make sure the merchant has received proof of payment – email to finance@jpmarkets.Co.Za with the MT4 number in the subject line

Online gateways

We accept payment through several online gateways. This is done through you client portal, the process is quick and easy, with an added benefit of being much faster than a bank deposit.

Please note: when paying with skrill any amount below R200 may result in your deposit not being allocated due to associated fees.

Mpesa

Make use of mpesa to pay in the greater african area. (south africa currently unavailable)

Please follow this link and complete the regular checkout process.

On checkout be sure to choose the i-pay africa option and complete your payment using mpesa.

Please note: that all international payments and other currencies will be converted to the rate that of the SARB (south african reserve bank).

Risk warning: trading on margin products involves a high level of risk.

It is investors’ responsibility to maintain a prudent level of margin, pay their margin and also meet margin call payments on time and in cleared funds. Please keep in mind the possibility of delays in the banking and payments systems. If your payment is not credited by the time you are required to have the necessary margin or meet the margin call, you could lose some, or all of your positions.

JP markets

*** JP markets offers ECN & STP accounts ***

You now have the option to choose the type of account suited to your trading style!

JP markets strives to give traders the best trading conditions to ensure their success and now offer faster liquidity and pricing for clients!

Which type of account suits you?

Open an account today and make your choice to ensure your account suits your trading style and gives you maximum returns!

JP markets is an authorised FSP-46855

JP markets

Official statement

JP markets

Your dreams don’t work unless you do �� ��

JP markets

Always take the road less traveled �� ��

JP markets

JP markets has officially launched whatsapp chat where clients can get their queries resolved by our dedicated support team. This easy to use service will replace instagram and facebook dms. Instead of facebook … ещё or instagram DM's you can log into your whatsapp and message us. The automated system is set up so that you are taken to the relevant department instantly. Your queries are resolved much quicker and the process is more efficient. Please note that as this feature has been enabled ������ �������������� �������� �������� ���� ������������ ���� �������������������� ���� ������ ���� ���������������� ������ ������������������.

Live chat (website), email, telephone and whatsapp chat are the only valid avenues to get a hold of us. ���������������� ��������: +���� ���� ������ ��������

JP markets

Interview with jonathan

Our head of training teboho sat down with jonathan to discuss his journey with JP markets. Jonathan has been a JP markets clients since our inception in 2016 and this is how his journey has been. # clientfeedback # forex # financialfreedom

JP markets

Clients are encouraged to carefully read and familiarise themselves with the new terms and conditions of the 200% bonus on our website, below are a few important changes to expect.

• margin requirements and stop out levels will be adjusted to 30%.

• the full credit amount will be removed from the trading account upon the P/L total being less than your initial deposit.

• it’s the traders responsibility to manage the margin requirements and ensure that a sufficient balance total is available to avoid positions being closed with a stop out order.

We are very excited to introduce this 200% bonus to our traders, we’ll send all clients an update email next week in preparation for the launch.

JP markets

200% bonus

Clients are encouraged to carefully read and familiarise themselves with the new terms and conditions of the 200% bonus on our website, below are a few important changes to expect.

• margin requirements and stop out levels will be adjusted to 30%.

• the full credit amount will be removed from the trading account upon the P/L total being less than your initial deposit.

• it’s the traders responsibility to manage the margin requirements and ensure that a sufficient balance total is available to avoid positions being closed with a stop out order.

We are very excited to introduce this 200% bonus to our traders, we’ll send all clients an update email next week in preparation for the launch.

Connect to an account

To start working with a trading account, you need to connect to it using a login (account number) and password. Two types of account access are available in the trading platform: master and investor. Logging in using the master password gives full rights for working with the account. Investor authorization allows you to see the account status, analyze prices, and work with your own expert advisors, but not trade. The investor access is a convenient tool for demonstrating the trading process on the account.

The trading platform provides the option of extended authentication using SSL certificates.

Click " login to trade account" in the file menu or in the navigator.

Specify the following data in this window:

- Login — the number of the account used for connection.

- Password — the master or investor password for the account.

- Server — server to connect to. Also you can indicate a server manually. Enter its IP address and port number as [server number]:[port number], for example, 192.168.0.1:443.

Enable the "save password" option, and the next time you start the platform, the last used account will be automatically connected to the server. Option "keep personal settings and data at startup" in the platform settings performs the same action.

After specifying all the details, click "OK" to connect.

Forced change of password #

Upon authorization, you may be requested to change the master password of the account. Forced password change can be enabled by the trade server administrator. The mechanism of forced change of the master password, when you first connect or on a regular basis, increases safety.

Enter the new password, and then enter it again to confirm. The password must meet the following requirements:

- It cannot be shorter than the length required in the password change dialog.

- Must contain at least two of three types of characters: lower case, upper case and digits.

- Must not be the same as the previous password.

If the master password is changed forcedly, the investor password of the account is also reset. A new investor password can be set in the platform settings.

Deposit and withdrawal #

The trading platform allows quickly switching to deposit/withdrawal operations on the broker website. You do not need to search for these functions in the trader's room, while fast navigation commands are available directly in terminals: in the accounts menu in navigator and in toolbox:

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

JP markets review

Jpmarkets is a forex broker. JP markets offers the metatrader 4 and mobile forex trading top platform. Jpmarkets.Co.Za offers over 25 forex currency pairs, cfds, stocks, gold, silver, oil, bitcoin and other cryptocurrencies for your personal investment and trading options.

2020-06-19: the south african FSCA has privisionally suspended the license of JP markets. This was done because "there is reasonable belief that substantial prejudice to clients or the general public may occur if they continue rendering financial services."

CLICK HERE to verify.

Broker details

Live discussion

Join live discussion of jpmarkets.Co.Za on our forum

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Not able to withdraw

Length of use: 6-12 months

Due to the numerous complaints from clients failing to withdraw their funds, the FSCA (financial sector conduct authority) has provisionally suspended JP market's license pending a full investigation. As from the 19th of june 2020 they are no longer allowed to take any new business or clients. I'm not surprised coz when i used them back in 2016 i couldn't even make a deposit to fund my account. Had to do an EFT and then call their office to let them know so they could check with the bank. Very poor service indeed. Anyway you can read the story of their suspension below:

Length of use: over 1 year

Length of use: over 1 year

This is the worst broker in the world, I made withdrawals amounting to R1.5 million in a he past weeks and they started asking me to submit my fica and bank cards of which I did. Only today they told me I won’t be getting my withdrawals since their system says I used different accounts to fund my account of which I didn’t. I don’t even know the people they talked about.

Stay away from this broker. I just can’t wait for this lock down to be over so I can visit their offices

Length of use: over 1 year

Jp markets should be challenged and charged for market and accounts manipulation. This is wrong and we will expose them.

Our funds and pending orders just disappeared and when we tried to contact someone no one answered.

This broker will not last long with the kind of service it provides.

Frequently asked questions

What is the minimum deposit for JP markets?

JP markets does not have a strict minimum deposit. Traders can invest whatever they are comfortable with. However JP markets recommends starting with around ZAR3,000.

Is JP markets a good broker?

Unbiased traders reviews on forexpeacearmy is the best way to answer if JP markets is a good broker. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we'd recommend to check recent JP markets community discussions: https://www.Forexpeacearmy.Com/community/tags/jpmarkets/

Is JP markets safe?

To define whether a company is safe or not, you'd better get to know about this company, the unbiased traders reviews on forexpeacearmy is the best resources to grant you such knowledge. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

JP markets at least is regulated with south africa financial services board under license 46855. Being regulated gives you a chance to complain to the authority if it comes down to it.

What is JP markets?

JP markets is an online forex retail broker. JP markets offers a number of assets to be traded on metatrader 4 and JP mobile app.

- Forex currency pairs

- Cryptocurrencies

- Stock indices

- Precious metals

- Commodities

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Connect to an account

To start working with a trading account, you need to connect to it using a login (account number) and password. Two types of account access are available in the trading platform: master and investor. Logging in using the master password gives full rights for working with the account. Investor authorization allows you to see the account status, analyze prices, and work with your own expert advisors, but not trade. The investor access is a convenient tool for demonstrating the trading process on the account.

The trading platform provides the option of extended authentication using SSL certificates.

Click " login to trade account" in the file menu or in the navigator.

Specify the following data in this window:

- Login — the number of the account used for connection.

- Password — the master or investor password for the account.

- Server — server to connect to. Also you can indicate a server manually. Enter its IP address and port number as [server number]:[port number], for example, 192.168.0.1:443.

Enable the "save password" option, and the next time you start the platform, the last used account will be automatically connected to the server. Option "keep personal settings and data at startup" in the platform settings performs the same action.

After specifying all the details, click "OK" to connect.

Forced change of password #

Upon authorization, you may be requested to change the master password of the account. Forced password change can be enabled by the trade server administrator. The mechanism of forced change of the master password, when you first connect or on a regular basis, increases safety.

Enter the new password, and then enter it again to confirm. The password must meet the following requirements:

- It cannot be shorter than the length required in the password change dialog.

- Must contain at least two of three types of characters: lower case, upper case and digits.

- Must not be the same as the previous password.

If the master password is changed forcedly, the investor password of the account is also reset. A new investor password can be set in the platform settings.

Deposit and withdrawal #

The trading platform allows quickly switching to deposit/withdrawal operations on the broker website. You do not need to search for these functions in the trader's room, while fast navigation commands are available directly in terminals: in the accounts menu in navigator and in toolbox:

Take your investing

to the next level

IBKR provides clients from all over the globe with the

ability to invest worldwide at the lowest cost. 1

Lowest costs

Our transparent, low commissions, starting at $0 2 , and low financing rates minimize costs to maximize returns. 3

Global access

Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account.

Premier technology

IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis.

AWARD WINNING PLATFORM + SERVICES

Experience the lowest costs

in the industry 1

low commissions starting at $0 2 access to the IB smartrouting SM system, which provides $0.47 per 100 shares price improvement vs. The industry 4 financing rates up to 50% lower than the industry 5 earn extra income on your lendable shares

learn more

Discover a world of opportunities

Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

Graphic is for illustrative purposes only and should not be relied upon for investment decisions.

Leverage technology built to help you

get ahead

Powerful enough for the professional trader but designed for everyone. Available on desktop, mobile and web.

Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more.

New at interactive brokers

Interactive brokers launches innovative sustainable investing tool

Interactive brokers unveiled an innovative, interactive impact dashboard designed to help clients evaluate and invest in companies that align with their values.

Introducing the mutual funds marketplace

Interactive brokers' mutual funds marketplace offers availability to more than 37,000 mutual funds, including over 33,000 no load and 8,300 no transaction fee funds from more than 380 fund families.

Interactive brokers group donates $5 million to aid coronavirus response

Interactive brokers group, inc. Has donated $5 million to assist efforts to provide food and support for people hurt by the coronavirus in the united states, as well as to advance medical solutions.

IBKR launches interactive brokers ireland limited

IBKR received authorization by the central bank of ireland to launch interactive brokers ireland limited. IBIE was created to support our rapidly growing global client base.

Optimize lot matching to win at tax time

Interactive brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change.

Market commentary delivered to your inbox

IBKR's traders' insight provides daily market commentary, while the IBKR quant blog provides the latest news and sample code for data science and trading. Sign-up for delivery of either to your inbox.

Interactive brokers establishes central european office

IBCE is headquartered in budapest, hungary and was created to serve investors and wealth managers across the european economic area (EEA).

A broker you can trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses.

Excess regulatory capital*

Daily avg revenue trades*

*interactive brokers group and its affiliates. For additional information view our investors relations - earnings release section by clicking here.

Choose the best account type for you

Step 1

Complete the application

It only takes a few minutes

Step 2

Fund your account

Connect your bank or

transfer an account

Step 3

Get started trading

Take your investing to

the next level

FINRA brokercheck reports for interactive brokers and its investment professionals are available at www.Finra.Org/brokercheck

- Rated lowest cost broker by stockbrokers.Com annual online review 2020. Read the full review.

- IBKR lite provides commission-free trades in US exchange-listed stocks and etfs. For complete information, see ibkr.Com/commissions.

- Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

- Average net benefit is calculated using IHS markit® price improvement and IBKR monthly execution statistics. For more information see ibkr.Com/info.

- For complete information, see ibkr.Com/compare.

A message from our CEO regarding COVID-19

Dear clients, business partners, and colleagues of interactive brokers,

IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our clients around the world.

The COVID-19 global pandemic has triggered unprecedented market conditions with equally unprecedented social and community challenges. Like many people, companies and governments around the world, we have focused on how to navigate these uncharted waters.

We are committed to ensuring the highest levels of service to our clients so that they can effectively manage their assets, portfolios, and risks.

We are satisfied that our technical infrastructure has withstood the challenges presented by the extraordinary volatility and increased market volume. We understand that the dramatic increase in service inquiries has led to longer wait times, which has no doubt been frustrating. We encourage our clients to explore the wide range of online information services we provide on our public website and the client portal.

- We traditionally take a conservative stance to risk and we have built risk management systems designed to weather even the current market turmoil. The financial health of the interactive brokers group, and all of its affiliates, remains robust.

- We are a truly global broker, with offices and staff located around the world. We have the ability to run the business from a variety of our locations with minimal risk of disruption. If some offices must temporarily close due to the spread of COVID-19, we can continue to offer our core services from other offices.

- We have been taking steps to protect the well-being of our employees, incorporating health and safety best practices into our strategy as rapidly as possible following published government guidelines. Our employees are an integral part of the IBKR community and are essential to our future.

We appreciate your business and the faith you have placed in us, and most importantly, we wish you safe passage through these uncertain times.

President and CEO, interactive brokers group

Interactive brokers ®, IB SM , interactivebrokers.Com ®, interactive analytics ®, IB options analytics SM , IB smartrouting SM , portfolioanalyst ®, IB trader workstation SM and one world, one account SM are service marks and/or trademarks of interactive brokers LLC. Supporting documentation for any claims and statistical information will be provided upon request. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Options involve risk and are not suitable for all investors. For more information read the characteristics and risks of standardized options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 312-542-6901 or click here. Before trading, clients must read the relevant risk disclosure statements on our warnings and disclosures page. Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, click here. Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, read the security futures risk disclosure statement. For a copy click here. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Before trading, please read the risk warning and disclosure statement.

So, let's see, what was the most valuable thing of this article: JP markets: login, minimum deposit, withdrawal time? RECOMMENDED FOREX BROKERS JP markets is solid, at first glance, as african brokers go, but what is most important is that it is at jp markets account linking

Contents of the article

- Today forex bonuses

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Jp markets account linking

- Facebook

- Official statement

- Interview with jonathan

- 200% bonus

- Connect to an account

- Forced change of password #

- Deposit and withdrawal #

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- JP markets review

- Broker details

- Live discussion

- Video

- Traders reviews

- Not able to withdraw

- Frequently asked questions

- What is the minimum deposit for JP markets?

- Is JP markets a good broker?

- Is JP markets safe?

- What is JP markets?

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- Connect to an account

- Forced change of password #

- Deposit and withdrawal #

- Take your investing to the next level

- Experience the lowest costs in the industry...

- Discover a world of opportunities

- Leverage technology built to help you get...

- New at interactive brokers

- A broker you can trust

- Choose the best account type for you

No comments:

Post a Comment