Ewallet withdrawal

Accept payments from customers in unlimited currencies or cryptocurencies and build markets without the hassle of accepting foreign cards.

Today forex bonuses

Ewallet takes advantage of common design patterns, allowing for a seamless experience for users of all levels.

Ewallet, the smart choice for your business.

Sell using your countries currency and cryptocurrency.

Pay in a snap with the easy and elegant interface which gives you an outstanding experience.

Don't believe us? Take a tour on your on and don't miss a perk.

Better for you and your customers

Customer support.

We’re here to help you and your customers with anything, from setting up your business account to seller protection and queries with transactions.

Quicker and simpler access to funds.

Payments you receive go to your ewallet balance in moments, and you can withdraw funds to your bank account.

Sell on your website. With your currency

Accept payments from customers in unlimited currencies or cryptocurencies and build markets without the hassle of accepting foreign cards.

Ewallet will drive your product forward

Present your product, start up, or portfolio in a beautifully modern way. Turn your visitors in to clients.

Responsive design

Ewallet is universal and will look smashing on any device.

User design

Ewallet takes advantage of common design patterns, allowing for a seamless experience for users of all levels.

Clean and re-usable code

Download and re-use the ewallet open source code for any other project you like.

Main features

The best script for building the modern web fintech application.

- -- bootstrap 4 stable

- -- E-commerce

- -- unlimited ( withdrawal / deposit ) methods

- -- ( send / receive ) money

- -- ( create / load ) vouchers

- -- 6 color skins

- -- currency exchange

- -- unlimited currencies

- -- earn by transaction fees

- -- crossbrowser

- -- user roles

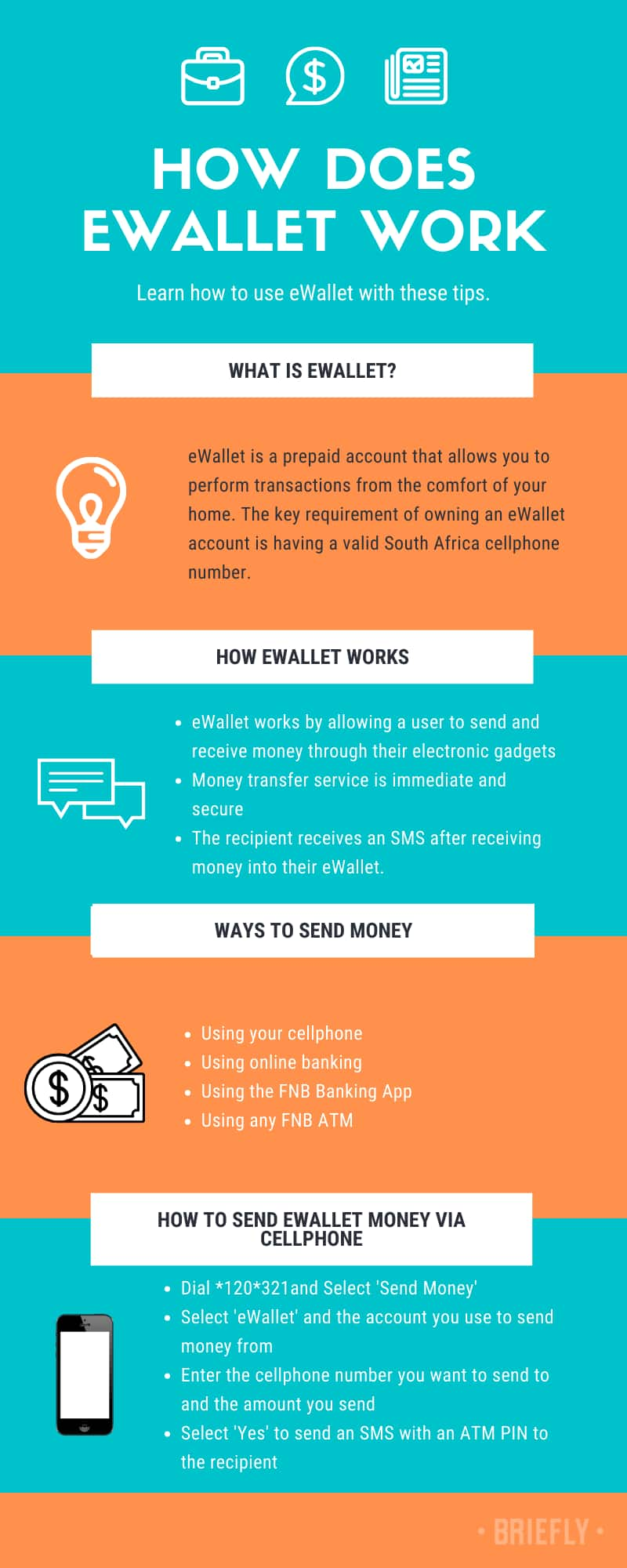

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

Ewallet withdrawal

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How can I withdraw money from my fiat wallet?

Articles in this section

Articles in this section

Our fiat wallet feature allows you to sell cryptocurrencies to your fiat wallet and withdraw money at any time. You can also deposit money to your fiat wallet and have it available at any time to purchase cryptocurrencies. This allows you to react quickly to the market regardless of the processing times of the payment methods.

Available fiat wallets

The following fiat wallets are available at the moment:

- Euro (EUR)

- US dollar (USD)

- Swiss franc (CHF)

- British pound (GBP)

- Turkish lira (TRY)

Withdrawals

To withdraw money from your fiat wallet follow these steps:

- On the dashboard, under fiat wallets , click on the desired fiat wallet

- Click on withdraw

- Select the payout account. If you haven’t done it yet, you will need to create a new payout account for the payment provider you have selected

- Enter the amount you wish to withdraw and click on go to summary

- On the summary page, check if everything is correct and click confirm

- You will receive a confirmation email, click the confirm transaction button in this email

If everything went right, you will be redirected to the success-screen on the bitpanda website.

- Tap the trade button

- Tap on withdraw

- Choose the fiat wallet you wish to withdraw from

- Select the payment provider you wish to use

- If you haven't done it yet, you will need to create a new payout account for the payment provider you have selected

- Enter the amount you wish to withdraw and tap on continue

- On the summary page, check if everything is correct and tap withdraw now

- You will receive a confirmation email, tap the confirm transaction button in this email

If everything went right, you will be redirected to a success-screen in the app.

- Tap the trade button

- Tap on withdraw

- Choose the fiat wallet you wish to withdraw from

- Select the payment provider you wish to use

- If you haven't done it yet, you will need to create a new payout account for the payment provider you have selected

- Enter the amount you wish to withdraw and tap on continue

- On the summary page, check if everything is correct and tap withdraw now

- You will receive a confirmation email, tap the confirm transaction button in this email

If everything went right, you will be redirected to a success-screen in the app.

Ewallets

Payment options

Browse our list of accepted deposit and withdrawal payment options.

- Invoice payments

- Boleto bancário

- Zimpler

- Siru mobile

- Credit cards

- Visa

- Mastercard

- Debit cards

- Dankort

- Ecopayz

- Bank transfer

- Poli

- Giropay

- EPS

- Multibanco

- Euteller

- Fast bank transfer

- Wire transfer

- Sporopay

- Sofort

- Trustpay

- Usemyservices

- INSTADEBIT

- Epay

- Trustly

- Prepaid cards

- Postepay

- Paysafecard

- Lottomaticard

- Neosurf

- Ticket premium

- Ewallets

- Moneta.Ru

- Neteller

- Skrill (moneybookers)

- Paypal

- Webmoney

- Yandex money

- View all

The following list includes all the electronic wallet options which are available for you to deposit funds at playmillion casino and play your favorite games for real money. Pick the one which best suits you and follow our directions to open rapidly and successfully your personal ewallet now.

Yandex money

Webmoney

Paypal

Skrill (moneybookers)

Neteller

Most popular games

Live blackjack

European roulette

Live roulette

Lucky fruity

Caribbean poker

Jacks or better

Cleopatra's secrets

Pirates treasure hunt

Games subject to availability

Casino games

Casino promotions

Company

Avertissement

Afin de respecter la législation en vigueur, le site de playmillion.Com n'est plus disponible aux joueurs résidants en france. Si vous pensez avoir reçu ce message per erreur, cliquez accepter pour continuer.

To comply with regulations playmillion.Com site is not available to players residing in france. If you feel you are receiving this message in error click accept to continue.

Advertencia

Hemos detectado que está intentando acceder a la web desde un país donde no aceptamos jugadores (según nuestros términos y condiciones). Es por ello que no le será posible jugar en nuestra website.

Si está recibiendo este mensaje por error y no está intentando jugar desde un país restringido (según nuestros términos y condiciones) usted puede

To comply with regulations playmillion.Com site is not available to players residing in spain. If you feel you are receiving this message in error click accept to continue.

Advertencia

Észleltük, hogy olyan országból próbál hozzáférni weboldalunkhoz, ahonnan nem fogadunk ügyfeleket (a weboldal használati feltételei szerint), ezért nem játszhat ezen az oldalon.

Ha úgy gondolja, hogy tévesen kapta ezt az üzenetet, és nem olyan országból játszik, ahonnan a weboldalunk tiltja a játekosokat (a weboldal használati feltételei szerint), tovább léphet.

We have detected that you are trying to access our site from a country that we do not accept players from (as per our terms and conditions) and for this reason you cannot play on this website.

If you feel you are receiving this message in error and you are not playing from a country we do not accept players from (as per our terms and conditions) you may continue.

Avertizare

Am detectat că încercați să accesați site-ul nostru dintr-o țară din care nu acceptăm jucători (conform termenilor și condițiilor noastre) și din acest motiv nu puteți juca pe acest site web.

Credeți că primiți acest mesaj dintr-o eroare și nu jucați dintr-o țară din care nu acceptăm jucători (conform termenilor și condițiilor noastre), puteți continua.

We have detected that you are trying to access our site from a country that we do not accept players from (as per our terms and conditions) and for this reason you cannot play on this website.

If you feel you are receiving this message in error and you are not playing from a country we do not accept players from (as per our terms and conditions) you may continue.

Warning

We have detected that you are trying to access our site from a country that we do not accept players from (as per our terms and conditions) and for this reason you cannot play on this website.

If you feel you are receiving this message in error and you are not playing from a country we do not accept players from (as per our terms and conditions) you may continue.

Warning

We have detected that you are trying to access our site from a country that we do not accept players from (as per our terms and conditions) and for this reason you cannot play on this website.

If you feel you are receiving this message in error and you are not playing from a country we do not accept players from (as per our terms and conditions) you may continue.

Warning

We have detected that you are trying to access our site from a country that we do not accept players from (as per our terms and conditions) and for this reason you cannot play on this website.

If you feel you are receiving this message in error and you are not playing from a country we do not accept players from (as per our terms and conditions) you may continue.

Wir haben festgestellt, dass sie unsere internetseite aus dem deutschen bundesland

Schleswig-holstein aufgerufen haben, von wo wir aus gesetzlichen gründen keine spieler

Zulassen können. Wenn sie glauben, dass sie diese nachricht irrtümlicherweise sehen,

Dann kontaktieren sie bitte unseren kundendienst.

Dear customer,

The access of our service is not possible from the territory of the republic of lithuania. For more information please contact gaming control authority of the republic of lithuania https://lpt.Lrv.Lt/

If you feel you are receiving this message by mistake, click ACCEPT to continue.

Gerbiamasis kliente,

Mūsų paslauga neteikiama lietuvos respublikoje esantiems vartotojams. Dėl išsamesnės informacijos, prašome susisiekti su lošimų periežiūros tarnyba prie lietuvos respublikos finansų ministerijos https://lpt.Lrv.Lt/

Jei manote, kad gausite šį pranešimą netinkamai, spustelėkite PRIIMTI, kad tęstumėte.

CAUTION

To comply with the regulations, the playmillion website is not available to players residing in portugal. If you feel you are receiving this message by mistake, click ACCEPT to continue.

Skrill E-wallet — how to deposit and withdraw

There are many options you can choose from when making a deposit or a withdrawal from the platform and skrill e-wallet is one of them. It is a digital wallet that supports a wide variety of currencies and allows you to send and receive money online. Let’s have a closer look at how you can register, top up, verify the wallet and how it is possible to deposit and withdraw from IQ option with it.

Register

To register an account with skrill, follow the link https://account.Skrill.Com/signup

It will redirect you to the sign up page where you need to type in your email address and come up with a password for the e-wallet. Then you will need to fill in the information about your name, surname, country and date of birth.

Once you have set it up, you are ready to use it!

Deposit

Deposit to skrill

If you decide to deposit with skrill, first you will need to top up your e-wallet. In order to do that, log in and go to the deposit tab. Specify your country and the currency that you want to use. Once you do that, you will be able to choose the top-up method among the available ones.

You can deposit with a bank card, wire transfer, other e-wallets (for instance, neteller) or with cryptocurrency. The methods may differ according to your locale.

Once you choose the deposit method, you will need to provide some additional data. You will need to specify your address and date of birth and then you can proceed to the payment.

Note that funds from deposits made with a mastercard bank card cannot be used for gambling transactions. Even though our platform is not a gambling service, you will not be able to deposit that money to your IQ option account, so you need to choose a different payment method. This only applies to mastercard.

Deposit to IQ option

To deposit funds to your IQ option account from skrill, first of all, choose the deposit method on the deposit page — https://iqoption.Com/counting.

Type in the amount of deposit (the minimum is 10 USD) and click proceed to payment. The page will redirect you to the skrill login page, where you need to sign in and complete and confirm the payment. The deposit will be instantly reflected on your IQ option balance.

Withdrawal

Withdraw from IQ option

In order to withdraw from the platform, go to the withdrawal page https://iqoption.Com/en/withdrawal and choose skrill from the list. Specify the amount you would like to withdraw (the minimum is 2 USD) and the email address that your skrill account is registered with.

Make sure that your IQ option account is verified, if not — upload the necessary documents.

Withdraw from skrill

You may withdraw funds to your bank card or bank account by choosing the withdraw tab or you may send your funds to another e-wallet in the send tab.

The time of the processing will depend on the withdrawal method, for a bank card it is up to 3 business days.

Verification

To increase the possible transaction volume in your skrill wallet, you may pass the verification process.

Go to the settings tab, this is where you can also set the security features like 2 factor authentication or find the referrals program. Scroll down and you will see the verification button.

You will be able to pass a simplified verification procedure if you verify the account with facebook.

If not, you will be able to use the skrill mobile app or the website for verification of identity and address.

Verification will also allow you to use a skrill prepaid mastercard which you can issue in the skrill card tab.

Fees

There are no fees for withdrawals and deposits with skrill from our side, which means that you can deposit and withdraw from your IQ option account commission free.

Skrill charges fees for deposits and withdrawals, you may check the up-to-date information on the official skrill website — https://www.Skrill.Com/en/siteinformation/fees/

Now you know everything you need in order to use skrill for transactions without any complications.

NOTE: this article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future.

In accordance with european securities and markets authority’s (ESMA) requirements, binary and digital options trading is only available to clients categorized as professional clients.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

84% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tatyana scherbakova

With respect to what you said about depositing from a mastercard bank card, if I check the ‘non-gambling’ option while depositing, can’t I still deposit?

Hello dear felix, how are you doing? We are so sorry that you had to face such inconvenience.

Can you please contact our support at support@iqoption.Com as we can not check the problem here on social media.

We thank you for your cooperation.

I have non gambling money in my skrill but it cannot be used to topup my IQ option account. What should I do to make it work for me?

You can only choose gambling purpose when depositing your skrill wallet. Please, check the screenshot how you can do it https://prnt.Sc/l9j79u. Payment should go through.

You’re also welcome to choose the alternative payment method here: https://iqcc.Io/en/cabinet/counting

In case you need any assistance regarding your account with us, kindly contact our team at support@iqoption.Com. Thank you!

Does this mean trading on IQ option is equivalent to gambling? Could you give more clarity on this?

If trading in your platform is a non-gambling activity (as you purport to say), what does it mean if we have to mention the purpose of deposit as gambling?

Looks like hypocrisy to me ��

Thank you so much for sharing your concern with us, scott!

Kindly note, that IQ option has no relation to gambling and we have already contacted skrill to resolve this misunderstanding in order to place payments to IQ option under a different category of payments (non-gambling, to be precise).

As I’m sure you understand, gambling is something that you cannot control or analyze much.

However, instruments on our platform implement technical analysis and overall market alertness.

Thank you for taking time to reach out to us. We hope you have no other doubt. Please, keep in mind, that trading involves a high level of risk.

I found no reply button on your message. Hence, replying on my same thread.

Thanks for getting back quickly! I am still not convinced. I feel a good and reputable broking company such as you wouldn’t be having negotiations with a payment partner (who you’ve been closely associating yourself with for the past six years since IQ option’s inception) to request them or contact them regarding changing the category bracket for payments. I expected a better excuse than this.

I do not understand how you are so complacent in this regard. On doing some further inspection, I also found that this is the very same case with neteller as well. Now, I already know both e-wallets are being owned and run by the same parent company. But how on earth can this be just a coincidence?!

Just in case that you have not noticed this until now, here’s the link to your website giving solutions to faqs under which category the same issue has been addressed:

https://iqoption.Com/en/faq/depositing-funds#181

I would like to inform you that it is your reputation that is at stake at the moment. A simple google search with the keywords “iq options skrill gambling” shows it all including your reply to my comment. Even though you clarify that your service is completely legit and of the non-gambling category, your e-wallet partners are already spoiling the image.

When trying to deposit some amount in skrill using a card, the following question pops up:

will you use the money for fantasy sports, online poker, online casino, sports betting, horse wagering or online lottery?

It’s pretty clear that answering yes would translate to “gambling” and no would translate to “non-gambling”. Even then, on selecting the no option, this is what is shown as warning in a special box below:

“selecting NO will prohibit these funds from being used on gaming, casino and betting sites.”

I guess the above condition is enough to assume that all of your activities are being categorized as gambling by the e-wallets. If you would like to repudiate my observations, you’re most welcome to do so.

I’m sorry for the long post. I feel like a lot is being concealed from the innocent traders who invest their hard-earned money on your platform looking to become the next warren buffet (overnight) :P.

Hey dear my country is not among the list provided in platform #uganda

Hi, gabriel!

You are welcome to join us from uganda. In case you need any assistance, kindly get in touch with our support team at support@iqoption.Com. Thank you! ��

I have deposited $30 through skrill and it went successfully but suddenly my balance gies to $0. Without trade.

Its amazing when support team BOT replied to wait. And still nothing.

I need help

Hey hi zabeda! If you have contacted our live support then please wait, they will get back to you. This may take some time however they will definitely get back to you. We thank you for your understanding.

Iwant to help because my balance is zero

Hello rowena, if you do not have funds then you can use the practice account ��

Hi, how’re you? What can we do for you? ��

I wanna information for iq option deposit and withdrawal videos links please.

It will not be possible do deposit to our platform from a non-gambling account. When you make a deposit to skrill from a mastercard, it automatically goes to non-gambling and there is no option for choosing the gambling one. So you need to choose other top-up methods to fill up your skrill, other than mastercard, if you want to deposit to IQ option from it.

Best regards,

tatyana

IQ option team

Y my account yes problem

Hello there!

How are you doing?

We are sorry that you are experiencing some problems, can you please specify what exactly is the issue?

Awaiting your kind response friend ��

That person above got a point. You can explain?

I found no reply button on your message. Hence, replying on my same thread.

Thanks for getting back quickly! I am still not convinced. I feel a good and reputable broking company such as you wouldn’t be having negotiations with a payment partner (who you’ve been closely associating yourself with for the past six years since IQ option’s inception) to request them or contact them regarding changing the category bracket for payments. I expected a better excuse than this.

I do not understand how you are so complacent in this regard. On doing some further inspection, I also found that this is the very same case with neteller as well. Now, I already know both e-wallets are being owned and run by the same parent company. But how on earth can this be just a coincidence?!

Just in case that you have not noticed this until now, here’s the link to your website giving solutions to faqs under which category the same issue has been addressed:

https://iqoption.Com/en/faq/depositing-funds#181

I would like to inform you that it is your reputation that is at stake at the moment. A simple google search with the keywords “iq options skrill gambling” shows it all including your reply to my comment. Even though you clarify that your service is completely legit and of the non-gambling category, your e-wallet partners are already spoiling the image.

When trying to deposit some amount in skrill using a card, the following question pops up:

will you use the money for fantasy sports, online poker, online casino, sports betting, horse wagering or online lottery?

It’s pretty clear that answering yes would translate to “gambling” and no would translate to “non-gambling”. Even then, on selecting the no option, this is what is shown as warning in a special box below:

“selecting NO will prohibit these funds from being used on gaming, casino and betting sites.”

I guess the above condition is enough to assume that all of your activities are being categorized as gambling by the e-wallets. If you would like to repudiate my observations, you’re most welcome to do so.

I’m sorry for the long post. I feel like a lot is being concealed from the innocent traders who invest their hard-earned money on your platform looking to become the next warren buffet (overnight) :P.

Thank you for not being indifferent to our app!

We understand your concern though we do have to negotiate with payment aggregators as it’s their policy to place financial institutions under a certain category of payments.

As soon as we received the comment of scott, the relevant department of ours has contacted skrill representatives one more time.

We received an answer that «binary options trading has always been classified as a type of a “gaming/gambling”. This is a practice adopted by several payment service providers».

Owned by the parent company, skrill and neteller obviously have the same method applied to the categorization of payments.

When a customer uses a card to load his/her skrill account balance, they are always asked what be the purpose of usage of the funds would be. This is a requirement coming from the card schemes. It cannot be skipped. Here is where IQ option is classified as a “gaming/gambling”.

What we did from our side is asked skrill to add high-risk merchants to their classification when asking for a purpose of a deposit in order this question is not raised again.

At the current moment, we are waiting for changes in «the purpose of deposit» section of the above-mentioned website. We will certainly keep you updated on that in the thread to this post.

In case you do not find our actions satisfying enough, you are welcome to join us in live chats/calls. Here is how you may reach us for a detailed consultation in this matter https://iqoption.Com/en/contacts.

IQ option is neither a casino nor a betting site, though trading here presents a risk of losing your capital. Be fully conscious while investing your funds. Thank you for choosing IQ option!

Which means one can use visa card to top-up the skrill non gambling account ?

Ewallet withdrawal

Register as a new user on our system

It only takes a few minutes to set up an ewallet account. Simply follow onscreen instructions.

Billing and additional information

Accept payments on your site using a simple HTML form and IPM notifications

FAQ's and support

Buy goods and pay for services, and if something goes wrong, we will refund money

Learn more about:

Creating an account

♦ note: you must be at least 18 years old to create an ewallet account.

2. Enter your username, email address, first and last name, password, and repeat the password. You have to check: I'm not a robot and to click - register

3. You will receive an email to confirm your new account.

4. After the confirmation, you can log in with your username or email address and your password.

Simple registration, login, password reset

A set of features to support users

Google captcha

The script uses googles API service recaptcha to log in, register and reset the account password. This excludes the brute force of passwords and unauthorized attempts to log into your account.

Two-factor authorization

User can use two-factor authorization when signing in to the account. One-time input tokens can be sent in sms message, email message or accessible through a special mobile application.

Hold balance

The amount of disputed transactions is held on the user's banal and is not available for transactions until the problem is resolved. An administrator can block any transaction

Ticket support system

The ticketing system for customer support will provide the necessary assistance for any user. The user can create a ticket, reply in the ticket and close it if the problem is solved.

Feedback form

A special form for communication for unregistered users allows you to contact the administrator even without an account.

Billing and additional information

Ewallet supports a multicurrency account for money transfer, exchange and payments online and instore

Profile settings

Set your email address, name, family name, language, and password.

Verification

3 levels of verification. The user can enter information about himself and upload documents for receiving funds and making use of deposit methods and withdrawing methods

Billing settings

Set your billing details for easy deposit, transfer, payment online and withdrawal money

No checking

You do not need to enter a token at the time of authorization in your account

Two-factor authentication

You need to enter a token via mobile application at the time of authorization in your account

SMS or email authentification

You need to enter a token via SMS or email message at the time of authorization in your account

Transaction history

User-friendly interface for tracking all your transactions even linking your bank account

Set of tools for receiving payments

Receiving payments in the system ewallet or integration with the user's site

Shop and payment

Users can create stores and digital or physical products that are sold in a special section within the ewallet or web site

Invoices

Invoices between users allow me to pay for goods, services, work

HTML form plugin

Simple integration with third-party sites for receiving payments

Amazing tools to accept payments online and offline

POST notification on server and send user selected receipt

Selling using ewallet cart and orders

Offline stores and service providers can now become a dominating force online " ewallet has built the most amazing future for retail and service providers. An in-sync system by using your everyday ewallet as a selling tool get started today by registering for a merchant account first, after approval by admin, this then allows you to instantly upload and publish your offline products for sale to an online shop within minutes, more impressive is that the items that are sold online or offline are in sync amazing innovation from ewallet all online and offline orders can be tracked in the same wallet you are selling from and getting paid too one wallet does it all

Protect your client's purchases

If the goods are not received or are not as what was described in the sale the user can open a dispute and open an investigation and have the funds returned including crypto this is a FIRST for CRYPTO CURRENCIES "ABILITY TO REFUND " EWALLET PATENT PENDING " please visit resolution center

IPN service

The platform will send POST notification to the user's server with the details of the completed transaction

Low risks

The purchase is paid from the balance account - not directly through a third-party gateway

Popular methods for deposit and withdrawing money

Built-in methods are suitable for most countries

Automatic deposits

Users will instantly receive money to their account balance after the deposit is successful, except for methods of bank transfers and large crypto transactions

Manual withdrawals

Requests for withdrawal of funds are handled by the administrator in manual mode

Operation limits

The administrator can set the minimum and maximum limit for each currency

Verification requirement

Set a minimum level of verification to use the deposit method and withdraw of funds method

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

So, let's see, what was the most valuable thing of this article: ewallet, the smart choice for your business. Sell using your countries currency and cryptocurrency. Pay in a snap with the easy and elegant interface which gives you an outstanding experience. At ewallet withdrawal

Contents of the article

- Today forex bonuses

- Ewallet, the smart choice for your business.

- Sell using your countries currency and...

- Better for you and your customers

- Customer support.

- Quicker and simpler access to funds.

- Sell on your website. With your currency

- Ewallet will drive your product forward

- Main features

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- Ewallet withdrawal

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How can I withdraw money from my fiat wallet?

- Available fiat wallets

- Withdrawals

- Ewallets

- Payment options

- Yandex money

- Webmoney

- Paypal

- Skrill (moneybookers)

- Neteller

- Most popular games

- Live blackjack

- European roulette

- Live roulette

- Lucky fruity

- Caribbean poker

- Jacks or better

- Cleopatra's secrets

- Pirates treasure hunt

- Casino games

- Casino promotions

- Company

- Avertissement

- Advertencia

- Advertencia

- Avertizare

- Warning

- Warning

- Warning

- Dear customer,

- Gerbiamasis kliente,

- CAUTION

- Skrill E-wallet — how to deposit and withdraw

- Register

- Deposit

- Withdrawal

- Verification

- Fees

- Tatyana scherbakova

- Ewallet withdrawal

- Creating an account

- Simple registration, login, password reset

- A set of features to support users

- Google captcha

- Two-factor authorization

- Hold balance

- Ticket support system

- Feedback form

- Billing and additional information

- Ewallet supports a multicurrency account for...

- Profile settings

- Verification

- Billing settings

- No checking

- Two-factor authentication

- SMS or email authentification

- Transaction history

- Set of tools for receiving payments

- Amazing tools to accept payments online and...

- POST notification on server and send user...

- Popular methods for deposit and withdrawing money

- Built-in methods are suitable for most countries

- Automatic deposits

- Manual withdrawals

- Operation limits

- Verification requirement

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

No comments:

Post a Comment