Forex mill

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Today forex bonuses

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

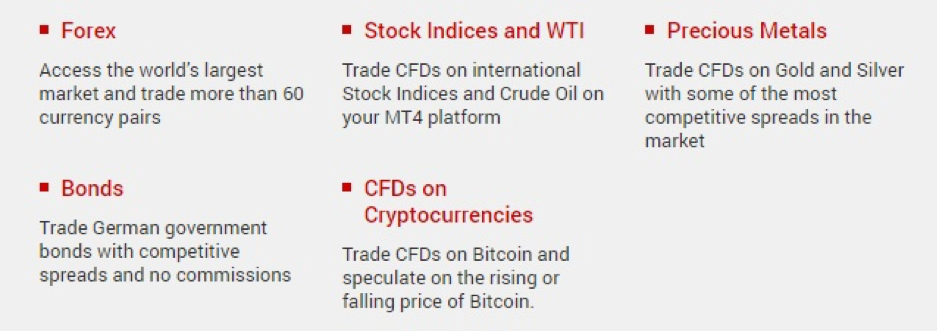

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

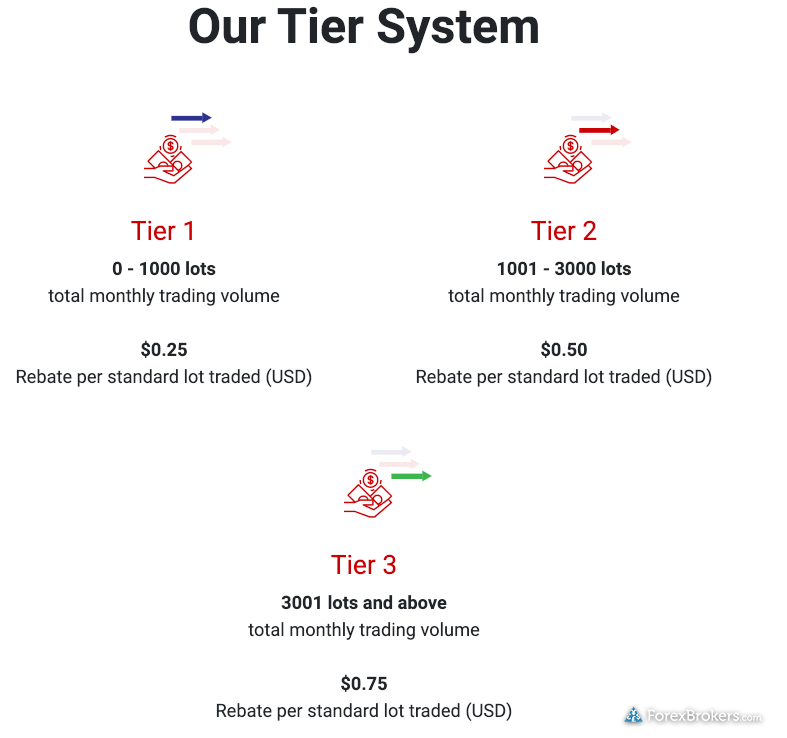

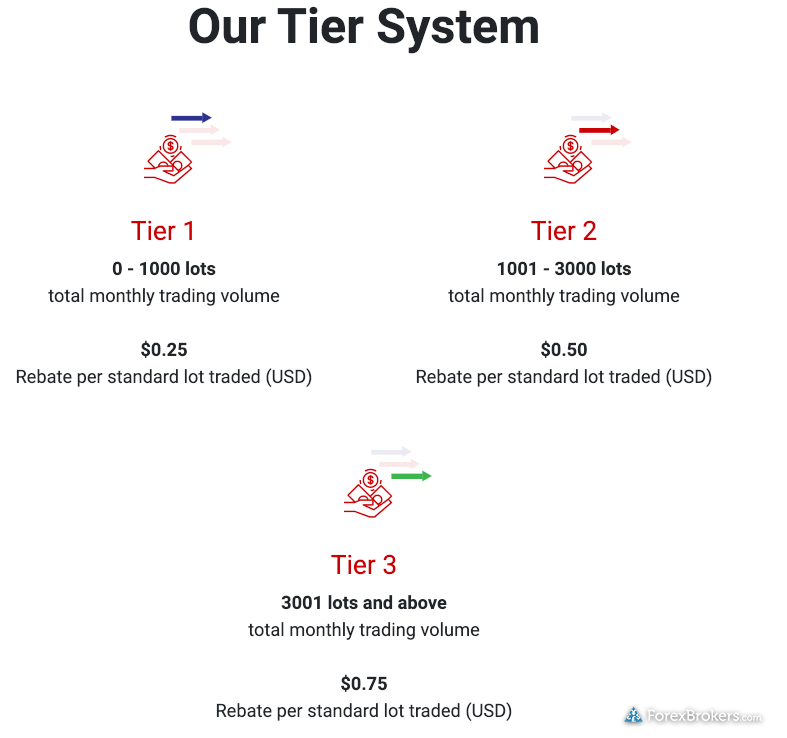

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

Mobile trading

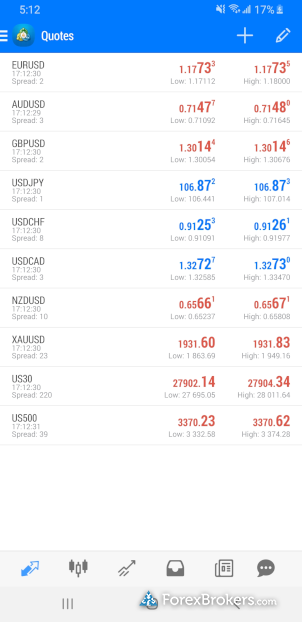

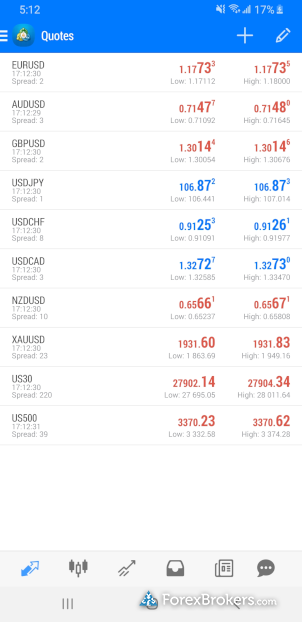

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Currency exchange rate conversion calculator

This currency convertor is up to date with exchange rates from january 31, 2021.

All currencies

- 0x

- Afghan afghani

- Albanian lek

- Algerian dinar

- Angolan kwanza

- Anoncoin

- Ardor

- Argentine peso

- Argentum

- Armenian dram

- Aruban florin

- Augur

- Auroracoin

- Australian dollar

- Azerbaijani manat

- Bahamian dollar

- Bahraini dinar

- Bangladeshi taka

- Barbados dollar

- Belarusian ruble

- Belize dollar

- Bermuda dollar

- Betacoin

- Bhutanese ngultrum

- Binance coin

- Bitbar

- Bitshare

- Bitcoin

- Bitcoin cash

- Bitcoin gold

- Bitmonero

- Blackcoin

- Bolivian boliviano

- Bosnia-herzegovina convertible mark

- Botswana pula

- Brazilian real

- Brunei dollar

- Bulgarian lev

- Burundian franc

- Bytecoin (BCN)

- Cambodian riel

- Canadian dollar

- Cape verde escudo

- Cardano

- Cayman islands dollar

- Central african CFA

- Chilean peso

- Chilean unidad de fomento

- Chinese offshore yuan

- Chinese yuan

- Colombian peso

- Comorian franc

- Costa rican colon

- Counterparty

- Craftcoin

- Croatian kuna

- Cuban convertible peso

- Cypriot pound

- Czech koruna

- Danish krone

- Dash

- Deutsche emark

- Diamondcoins

- Digitalcoin

- Djiboutian franc

- Dogecoin

- Dominican peso

- EOS

- East caribbean dollar

- Egyptian pound

- Electronic gulden

- Eritrean nakfa

- Ethereum

- Ethereum classic

- Ethiopian birr

- Euro

- Falkland islands pound

- Fastcoin

- Feathercoin

- Fiji dollar

- Florincoin

- Fluttercoin

- Franc congolais

- Franko

- Freicoin

- French pacific franc

- Gambian dalasi

- Georgian lari

- Ghanaian cedi

- Gibraltar pound

- Globalcoin

- Goldcoin

- Guatemalan quetzal

- Guinean franc

- Guyanese dollar

- Haitian gourde

- Hobonickel

- Honduran lempira

- Hong kong dollar

- Hungarian forint

- I0coin

- ICON

- IOTA

- Icelandic krona

- Indian rupee

- Indonesian rupiah

- Iranian rial

- Iraqi dinar

- Israeli new shekel

- Ixcoin

- Jamaican dollar

- Japanese yen

- Jersey pound

- Jordanian dinar

- Joulecoin

- Kazakhstani tenge

- Kenyan shilling

- Korean won

- Kuwaiti dinar

- Kyrgyzstani som

- Lao kip

- Lebanese pound

- Lesotho loti

- Liberian dollar

- Libyan dinar

- Lisk

- Litecoin

- Lithuanian litas

- Macau pataca

- Macedonia denar

- Maidsafecoin

- Maker

- Malagasy ariary

- Malawian kwacha

- Malaysian ringgit

- Maldives rufiyaa

- Mauritania ouguiya

- Mauritian rupee

- Maxcoin

- Megacoin

- Mexican peso

- Mexican unidad de inversion

- Mincoin

- Mintcoin

- Moldovan leu

- Mongolian tugrik

- Moroccan dirham

- Myanmar kyat

- NEM

- NEO

- Namecoin

- Namibian dollar

- Nano

- Nas

- Nepalese rupee

- Netcoin

- Netherlands antillean guilder

- New mozambican metical

- New taiwan dollar

- New zealand dollar

- Nicaraguan cordoba oro

- Nigerian naira

- North korean won

- Norwegian krone

- Novacoin

- Nxt

- Omani rial

- Omisego

- Orbitcoin

- Ounces of aluminum

- Ounces of copper

- Ounces of gold

- Ounces of palladium

- Ounces of platinum

- Ounces of silver

- Pakistan rupee

- Panamanian balboa

- Papua new guinea kina

- Paraguay guarani

- Peercoin

- Peruvian nuevo sol

- Pesetacoin

- Philippine peso

- Philosopher stones

- Phoenixcoin

- Polish zloty

- Populous

- Potcoin

- Pound sterling

- Primecoin

- Qatari riyal

- Qtum

- Quarkcoin

- Reddcoin

- Ripple

- Romanian leu

- Russian ruble

- Rwandan franc

- Saint helena pound

- Samoa tala

- Sao tome dobra

- Saudi arabian riyal

- Serbian dinar

- Sexcoin

- Seychelles rupee

- Siacoin

- Sierra leonean leone

- Singapore dollar

- Solarcoin

- Solomon islands dollar

- Somali shilling

- South african rand

- Special drawing right

- Sri lankan rupee

- Status

- Steem

- Stellar

- Stratis

- Sudanese pound

- Suriname dollar

- Swazi lilangeni

- Swedish krona

- Swiss franc

- Syrian pound

- TRON

- Tagcoin

- Tajikistan somoni

- Tanzanian shilling

- Terracoin

- Tether

- Thai baht

- Tickets

- Tigercoin

- Tongan pa'anga

- Trinidad and tobago dollar

- Tunisian dinar

- Turkish lira

- Turkmenistan manat

- Uganda shilling

- Ukrainian hryvnia

- United arab emirates dirham

- United states dollar

- Unobtanium

- Uruguayan peso

- Uzbekistani som

- Vanuatu vatu

- Vechain

- Venezuelan bolivar fuerte

- Verge

- Vericoin

- Veritaseum

- Vertcoin

- Viet nam dong

- Walton

- West african CFA

- Worldcoin

- Yacoin

- Yemeni rial

- Zambian kwacha

- Zcash

- Zeitcoin

- Zetacoin

Text calculator

Enter your calculation below:

Tools

Personal currency calculator

Webmaster options

Coinmill.Com alternatives

Is coinmill.Com not what you were hoping for? Here are some related sites to help you find what you need.

- Dmoz: exchange rates - open directory of exchange rate sites

- Wikipedia: currency - explanation about currency and foreign exchange

- Yahoo finance currency - track currencies including historical graphs

- Oanda - currency trading, forex training, converter, history, and tables

- Bloomberg currency calculator - currency trading with calculator

- Currency trading - fxclub.Com 24 hour online currency trading

- International monetary fund finances - exchange rates, international lending, and world debt management

- XE.Com - universal currency converter

This currency calculator is provided in the hope that it will be useful, but WITHOUT ANY WARRANTY; without even the implied warranty of MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

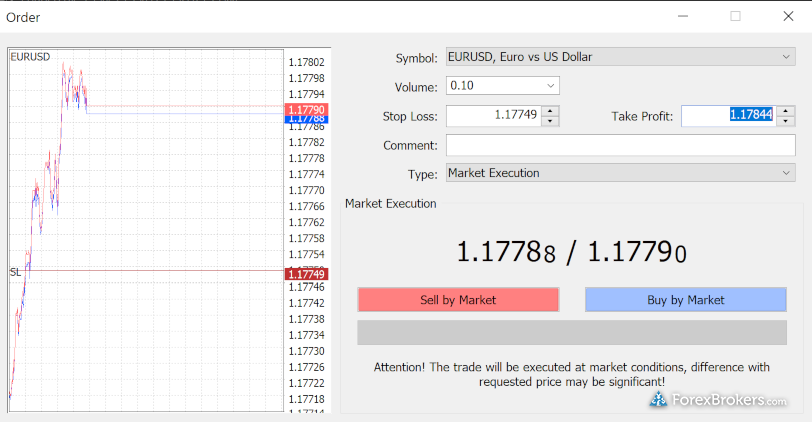

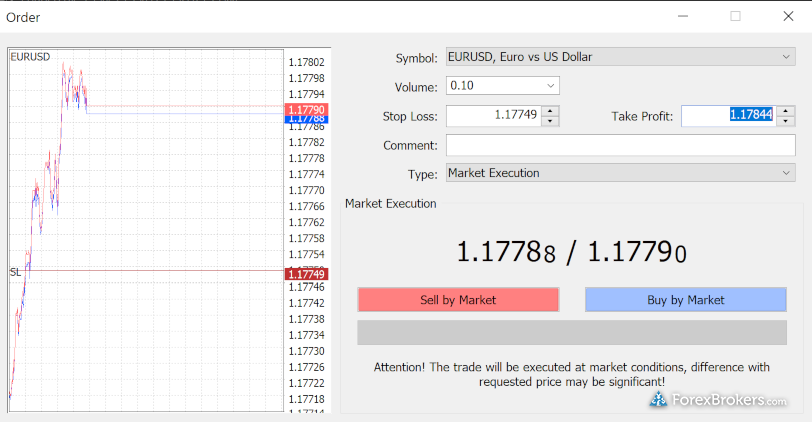

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Currency exchange rate conversion calculator

This currency convertor is up to date with exchange rates from january 31, 2021.

All currencies

- 0x

- Afghan afghani

- Albanian lek

- Algerian dinar

- Angolan kwanza

- Anoncoin

- Ardor

- Argentine peso

- Argentum

- Armenian dram

- Aruban florin

- Augur

- Auroracoin

- Australian dollar

- Azerbaijani manat

- Bahamian dollar

- Bahraini dinar

- Bangladeshi taka

- Barbados dollar

- Belarusian ruble

- Belize dollar

- Bermuda dollar

- Betacoin

- Bhutanese ngultrum

- Binance coin

- Bitbar

- Bitshare

- Bitcoin

- Bitcoin cash

- Bitcoin gold

- Bitmonero

- Blackcoin

- Bolivian boliviano

- Bosnia-herzegovina convertible mark

- Botswana pula

- Brazilian real

- Brunei dollar

- Bulgarian lev

- Burundian franc

- Bytecoin (BCN)

- Cambodian riel

- Canadian dollar

- Cape verde escudo

- Cardano

- Cayman islands dollar

- Central african CFA

- Chilean peso

- Chilean unidad de fomento

- Chinese offshore yuan

- Chinese yuan

- Colombian peso

- Comorian franc

- Costa rican colon

- Counterparty

- Craftcoin

- Croatian kuna

- Cuban convertible peso

- Cypriot pound

- Czech koruna

- Danish krone

- Dash

- Deutsche emark

- Diamondcoins

- Digitalcoin

- Djiboutian franc

- Dogecoin

- Dominican peso

- EOS

- East caribbean dollar

- Egyptian pound

- Electronic gulden

- Eritrean nakfa

- Ethereum

- Ethereum classic

- Ethiopian birr

- Euro

- Falkland islands pound

- Fastcoin

- Feathercoin

- Fiji dollar

- Florincoin

- Fluttercoin

- Franc congolais

- Franko

- Freicoin

- French pacific franc

- Gambian dalasi

- Georgian lari

- Ghanaian cedi

- Gibraltar pound

- Globalcoin

- Goldcoin

- Guatemalan quetzal

- Guinean franc

- Guyanese dollar

- Haitian gourde

- Hobonickel

- Honduran lempira

- Hong kong dollar

- Hungarian forint

- I0coin

- ICON

- IOTA

- Icelandic krona

- Indian rupee

- Indonesian rupiah

- Iranian rial

- Iraqi dinar

- Israeli new shekel

- Ixcoin

- Jamaican dollar

- Japanese yen

- Jersey pound

- Jordanian dinar

- Joulecoin

- Kazakhstani tenge

- Kenyan shilling

- Korean won

- Kuwaiti dinar

- Kyrgyzstani som

- Lao kip

- Lebanese pound

- Lesotho loti

- Liberian dollar

- Libyan dinar

- Lisk

- Litecoin

- Lithuanian litas

- Macau pataca

- Macedonia denar

- Maidsafecoin

- Maker

- Malagasy ariary

- Malawian kwacha

- Malaysian ringgit

- Maldives rufiyaa

- Mauritania ouguiya

- Mauritian rupee

- Maxcoin

- Megacoin

- Mexican peso

- Mexican unidad de inversion

- Mincoin

- Mintcoin

- Moldovan leu

- Mongolian tugrik

- Moroccan dirham

- Myanmar kyat

- NEM

- NEO

- Namecoin

- Namibian dollar

- Nano

- Nas

- Nepalese rupee

- Netcoin

- Netherlands antillean guilder

- New mozambican metical

- New taiwan dollar

- New zealand dollar

- Nicaraguan cordoba oro

- Nigerian naira

- North korean won

- Norwegian krone

- Novacoin

- Nxt

- Omani rial

- Omisego

- Orbitcoin

- Ounces of aluminum

- Ounces of copper

- Ounces of gold

- Ounces of palladium

- Ounces of platinum

- Ounces of silver

- Pakistan rupee

- Panamanian balboa

- Papua new guinea kina

- Paraguay guarani

- Peercoin

- Peruvian nuevo sol

- Pesetacoin

- Philippine peso

- Philosopher stones

- Phoenixcoin

- Polish zloty

- Populous

- Potcoin

- Pound sterling

- Primecoin

- Qatari riyal

- Qtum

- Quarkcoin

- Reddcoin

- Ripple

- Romanian leu

- Russian ruble

- Rwandan franc

- Saint helena pound

- Samoa tala

- Sao tome dobra

- Saudi arabian riyal

- Serbian dinar

- Sexcoin

- Seychelles rupee

- Siacoin

- Sierra leonean leone

- Singapore dollar

- Solarcoin

- Solomon islands dollar

- Somali shilling

- South african rand

- Special drawing right

- Sri lankan rupee

- Status

- Steem

- Stellar

- Stratis

- Sudanese pound

- Suriname dollar

- Swazi lilangeni

- Swedish krona

- Swiss franc

- Syrian pound

- TRON

- Tagcoin

- Tajikistan somoni

- Tanzanian shilling

- Terracoin

- Tether

- Thai baht

- Tickets

- Tigercoin

- Tongan pa'anga

- Trinidad and tobago dollar

- Tunisian dinar

- Turkish lira

- Turkmenistan manat

- Uganda shilling

- Ukrainian hryvnia

- United arab emirates dirham

- United states dollar

- Unobtanium

- Uruguayan peso

- Uzbekistani som

- Vanuatu vatu

- Vechain

- Venezuelan bolivar fuerte

- Verge

- Vericoin

- Veritaseum

- Vertcoin

- Viet nam dong

- Walton

- West african CFA

- Worldcoin

- Yacoin

- Yemeni rial

- Zambian kwacha

- Zcash

- Zeitcoin

- Zetacoin

Text calculator

Enter your calculation below:

Tools

Personal currency calculator

Webmaster options

Coinmill.Com alternatives

Is coinmill.Com not what you were hoping for? Here are some related sites to help you find what you need.

- Dmoz: exchange rates - open directory of exchange rate sites

- Wikipedia: currency - explanation about currency and foreign exchange

- Yahoo finance currency - track currencies including historical graphs

- Oanda - currency trading, forex training, converter, history, and tables

- Bloomberg currency calculator - currency trading with calculator

- Currency trading - fxclub.Com 24 hour online currency trading

- International monetary fund finances - exchange rates, international lending, and world debt management

- XE.Com - universal currency converter

This currency calculator is provided in the hope that it will be useful, but WITHOUT ANY WARRANTY; without even the implied warranty of MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE.

Tickmill – forex broker rating and review 2021

| https://www.Tickmill.Co.Uk/ | |

| status | |

| regulation | FCA UK, cysec, FSA seychelles |

| trading software | metatrader4 |

| headquartered | 1 fore street, EC2Y 9DT, london, united kingdom |

Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the financial conduct authority (FCA) and the FSA of seychelles.

Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data centre.

Tickmill mission

Tickmill is a new way of trading with extremely low market spreads, no requotes, true STP and DMA, absolute transparency and innovative trading technology. Our mission is to provide you with the best possible trading environment so you can focus on trading and become a successful trader.

Tickmill has been built by traders for traders. Our team members have trading experience that goes back to 1994 and have successfully traded on all major financial markets from asia to north america.

Tickmill trading information

Tickmill — latest reviews and comments 2021

Tickmill is scam broker they don't give your money back. Be careful & don't waste your time.

K. Sudesh ranga 16 april, 2020 reply

I chose tickmill through a referal from a forex education centre and it totally disappointed me. The online team is not 24 hours and they can barely do anything when you talk to them. Even after they arrange for a call back, it does not happen on many occasions. On top of them, they do not exercise margin calls like most brokers. My positions got wiped out just like that. And even after they liquidated some of my positions, my margin continues to be negative though my positions are in positive. Till date, this had not been resolved as they are always slow in replies. Recommend all to avoid this broker at all cost!

Vincent lim 15 april, 2020 reply

I chose tickmill accidentally, when I didn't understand anything in forex, but I was lucky that I didn't run into a rogue, but got into a good company, although all the chances were against me. First I opened there a demo account, then a real one, and soon decided to withdraw some money - on trial, would they not deceive you. Brought out. Then I began to quietly trade, and since then two more times I have withdrawn relatively small amounts - two times $ 300 each. There were no obstacles, only at the very first withdrawal it was a little long, scans of documents were required, but the next time they were no longer required.

Malcolm 25 july, 2019 reply

All client trades are executed with no dealing desk* intervention. Most trades are filled in under 10 milliseconds, with up to 2,000 trades executed per second.

I usually do not write reviews, but here the situation is different, tickmill is a relatively young broker. I've been trading here for a month, and managed to withdraw, and I could bargain with the manager, I can confirm that I had a good deal of trying to make my debut. For a couple of weeks you will not make an objective conclusion about the company, but judging by what has already happened, and if there is something that will force me to stop working with the company, then it’s logical that I will not be silent, like everyone here, but as long as the stones do not fly towards the broker, then there are few newcomers here, they usually choose monopolists in the market, and this is a young broker, only those who are looking for it will find it, and the reason why there is not enough negative for you broker to maintain the level of service, after all, they are interesting for now.

Antony 18 july, 2019 reply

I work with three forex brokers companies simultaneously, including tickmill. I use different trading strategies with different brokers, so I can't guarantee 100% comparison accuracy, but it feels more comfortable with tickmill. First of all, I speak about situations when the price is going up and down and does not catch your stop, although the candle crossed it. But it can be a matter of strategy and selected tools, I can't vouch for it. But in principle I can advise with a clear conscience, a good broker, only maybe not for beginners.

I do not like to praise people or companies for nothing. But I am going over the facts on the experience of working with tickmill. This is quite a powerful STP broker from experienced major companies. The interbank market access is an highly important moment for me since there is no conflict of interest with the broker. This is seen immediately both in execution and real spreads that you observe in the terminal. As to spread without additional commissions, it is very adequate for them, the broker does not pull three skins from the client. With this, the spreads in their specifications correspond to those in real trading. They are not moving apart too much, even with extra volatility, as a pound has been observed recently. Just recently, the week on dollar/yena started with a gap and I was standing up for sale. The price opened at 40 points with a gap and immediately closed the deal. I planned to take 50 pips off the taka and took more than 90 off. Fact! I appreciate them for their honesty towards their clients.

Not bad broker, but kridex offers better spread, lower commissions, higher leverage nad faster execution

I love tickimil and they the best broker, but I am not sure why the withdrawals comes in half half. This is a good broker ever

Very good. Problem is leverage. Too small!

I have a serious problem with the bonus you provide us with.You're saying that "we can withdraw any profit we make"but why is it difficult to withdraw our profit.Even the log in details doesn't go through. What's wrong.I need help

Sharl 31 january, 2019 reply

Are serious about what you saying cos I was also asked to do the same but I haven't. Not sure if I should go ahead or just drop everything.

David 28 august, 2019

Tickmill trading bonus is a scum. Made 700usd and after they told mi to fund account so that I can withdraw then I did so nd since that day I'm still waiting to receive my profit so be careful guys

Thabo 12 november, 2018 reply

Tickmill rating

Tickmill reviews rating

Top 10 forex brokers 2021

Latest forex reviews

In an effort to cement our current position as leading international broker of choice, we're proud to announce that we have.

Tickmill is pleased to announce that our educational seminar "forex trading and strategies in depth" was a huge success seminar. A great number of attendees.

As part of our mission to give our global client base access to top-level trading education, we have formed an exclusive partnership with the renowned.

Tickmill exhibited as a silver sponsor at the world of trading expo, germany's leading trading expo which took place on 15-16 november 2019.

In recognition of some of our most loyal clients in asia, tickmill hosted a VIP gala dinner in malaysia's capital city, kuala lumpur. As a broker who always.

Tickmill group once again surpasses previous financial records, posting growth in key financial metrics. The unaudited consolidated net profit for the first.

Join the expert as he as he guides you through the world's largest financial market and get hands-on knowledge on the basics of trading, technical analysis.

As a company, tickmill is always aiming to enhance the experience of our traders through tailoring our services and product portfolio. This time.

Mill trade

Информационно-консультационный центр компании: 115093, 3-й павловский пер., 1, стр. 57, офис 120 БЦ "М-стиль" г. Москва, россия

Официальная информация

Mill trade

Официальное название на русском:

(О) открытый НПФ - это НПФ, в котором может участвовать любой гражданин украины, без ограничений по месту и характеру работы.

(К) корпоративный НПФ - основывается одним или несколькими работодателями для накоплений пенсий для своих работников. Участниками такого НПФ могут быть только те физические лица, которые имеют или имели трудовые отношения участниками или основателями такого фонда.

(П) профессиональный НПФ - может создаваться профсоюзами или отраслевыми организациями, а его вкладчиками могут быть только физические лица с определенной профессией.

Данная колонка показывает характеристики отобранных инвестиционных фондов.

Например: ДОП – диверсифицированный, открытый, паевой.

(Д) диверсифицированные фонды - наименее рискованные фонды с ограниченной структурой активов. Ограничения касаются доли акций, облигаций, депозитов и т.Д. Входящих портфель. Данные ограничения установлены и контролируются государственной комиссией по ценным бумагам и фондовому рынку.

(Н) недиверсифицированные фонды - более рискованные фонды с небольшими ограничениями по структуре активов.

(В) венчурные – фонды с высокой степенью риска и практически не имеющие ограничений по структуре активов.

(О) открытые - это фонды, которые покупают-продают инвестиционные сертификаты (акции) в любой рабочий день.

(И) интервальные - выкуп сертификатов компанией у инвестора осуществляется в определенные дни, указанные в проспекте эмиссии.

(З) закрытые - компания выкупает сертификаты только по окончанию срока действия фонда.

(П) паевые фонды формируются из денег инвестора, без создания юридического лица и владение частью фонда происходит через покупку инвестиционных сертификатов.

(К) корпоративные фонды создаются как юридическое лицо. Инвестиции в данный фонд осуществляются путем покупки акций данного фонда.

Финансовый мир и инструменты инвестиций - о чем этот сайт?

Investfunds.Ua — уникальный информационный портал, освещающий финансовый рынок украины, россии, мира и все возможные инструменты частных инвестиции. В современных рыночных условиях любой желающий может стать инвестором и самостоятельно сформировать свой инвестиционный портфель. На сайте investfunds.Ua ежедневно публикуются новости мира финансов, аналитика и прогнозы ведущих аналитиков, с помощью которых можно легко выбрать желаемую инвестиционную стратегию, а аналитический инструментарий сайта позволяет оценивать ее доходность.

Весь текст

Пути вложения средств можно разделить на коллективные и индивидуальные. Коллективные инвестиции подразумевают участие в инвестиционном фонде под управлением одной из управляющих компаний, которая берет на себя управление инвестиционным портфелем. Такие инвестиции носят долгосрочный характер и контролируемый риск. Если есть желание и азарт, можно попробовать самостоятельное инвестирование на фондовом рынке. В таком случае инвестиционный портфель формируется по своему желанию и интуиции. Вы можете выбрать для торговли на фондовом рынке такие инструменты как акции, облигации, валюты, золото и другие драгоценные металлы, нефть, инструменты срочного рынка (фьючерсы, опционы) и многое другое, главное – оценить риск, ликвидность и возможную доходность.

Инвестиционная стратегия спекулянта более рискованная, но может принести большую доходность инвестиций, вложенных в финансовые инструменты.

На сайте investfunds вы найдете всю необходимую информацию для принятия инвестиционных решений и просто для того чтобы быть в курсе событий в увлекательном мире финансов, бизнеса и инвестиций.

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

Mobile trading

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

So, let's see, what was the most valuable thing of this article: tickmill is a vanilla MT4 broker that offers a small selection of tradeable securities and lacks standout features. For the best rates, agency execution and competitive commission-based pricing can be found with tickmill's VIP and PRO accounts. At forex mill

Contents of the article

- Today forex bonuses

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

- Currency exchange rate conversion calculator

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Currency exchange rate conversion calculator

- Tickmill – forex broker rating and review 2021

- Tickmill trading information

- Tickmill — latest reviews and comments 2021

- Tickmill rating

- Tickmill reviews rating

- Top 10 forex brokers 2021

- Latest forex reviews

- Mill trade

- Официальная информация

- Финансовый мир и инструменты инвестиций - о чем...

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

No comments:

Post a Comment