Jp markets maximum withdrawal

While in the T/C they mention that bank withdrawals take up to 3 days, the maximum time to allocate a deposit into a trader’s account is 24 hours.

Today forex bonuses

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

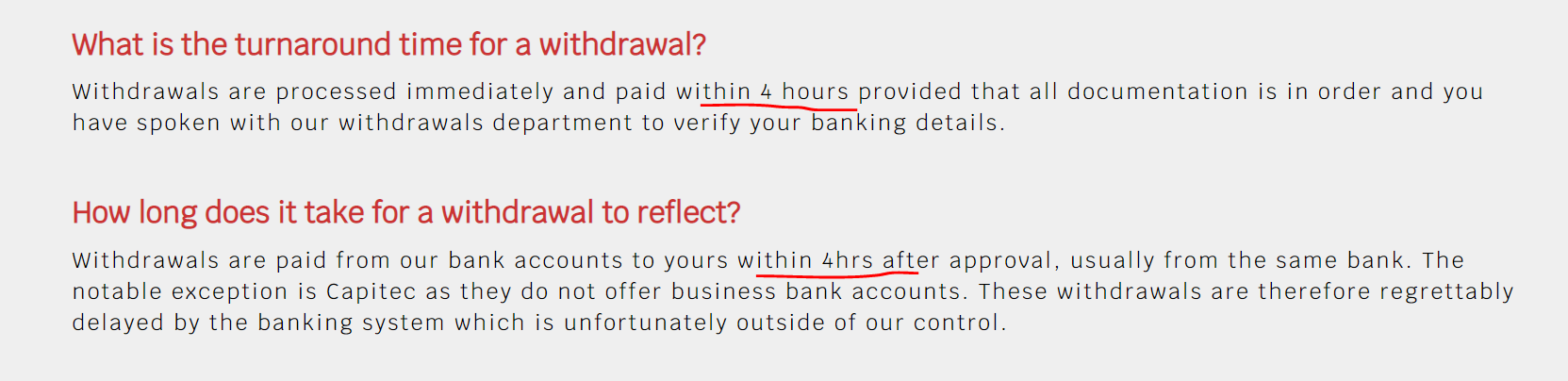

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

Вывод средств

В целях ускорения процесса обработки запросы на вывод средств необходимо подавать через личный кабинет.

Если у вас нет доступа к личному кабинету, воспользуйтесь соответствующей инструкцией.

В случае если вы не выполняли

вывод средств ранее, обратите внимание на следующее:

Вывод на банковские карты* осуществляется без комиссии. Средства зачисляются на банковскую карту в течение 3/5 рабочих дней после обработки запроса на вывод. В некоторых случаях процесс может занять до 10 рабочих дней (в зависимости от банка).

*вывод на банковские карты может быть недоступен в некоторых странах.

Если срок банковской карты, используемой для пополнения счета или вывода средств, истек, необходимо добавить новую карту в личном кабинете. Если номер карты отличается от номера той, срок которой истек, следует прикрепить справку, выданную эмитентом карты, о том, что новая карты выдана взамен старой.

В случае утери, кражи, блокировки или повреждения банковской карты необходимо прикрепить справку, выданную эмитентом карты, о том, что карта более недействительна.

В случае если новая карта ранее не была использована для вывода средств, необходимо активировать ее, пополнив с нее счет на небольшую сумму.

Прежде чем отправить средства на новую карту, компания IC markets вправе затребовать дополнительные документы – например, выписку по старой карте.

Для вывода суммы, превышающей установленную технологиями verified by visa и mastercard secure, следует воспользоваться другим способом вывода средств.

Финансовые операции через систему webmoney выполнятся компанией ingenico epayments (ранее global collect). Компания ingenico epayments не позволяет возвращать средства на счета webmoney, в связи с чем все средства, отправленные на торговый счет через webmoney, выводятся только банковским переводом, что может повлечь за собой дополнительные издержки. При совершении операции через webmoney перевод средств на банковский счет осуществляется в течение 3-5 рабочих дней после обработки запроса.

При внесении средств через fasapay вывод средств происходит банковским переводом, что может повлечь за собой дополнительные издержки. Перевод средств на банковский счет осуществляется в течение 3-5 рабочих дней после обработки запроса.

При внесении средств через poli / bpay вывод осуществляется банковским переводом, не предполагает дополнительных издержек при переводе в местный банк и выполняется в течение 2-3 рабочих дней.

При внесении средств через skrill и bitcoin вывод средств происходит банковским переводом, что может повлечь за собой дополнительные издержки. Перевод средств на банковский счет осуществляется в течение 3-5 рабочих дней после обработки запроса.

При внесении средств через rapidpay вывод средств происходит банковским переводом, что может повлечь за собой дополнительные издержки. Перевод средств на банковский счет осуществляется в течение 3-5 рабочих дней после обработки запроса.

При внесении средств через klarna вывод средств происходит банковским переводом, что может повлечь за собой дополнительные издержки. Перевод средств на банковский счет осуществляется в течение 3-5 рабочих дней после обработки запроса.

При выводе средств, внесенных через интернет-банк в таиланде, на банковский счет в таиланде необходима четка сканированная копия или фотография банковской книги. Перевод средств на банковский счет осуществляется в течение 1 рабочего дня после обработки запроса.

Брокер IC markets не выполняет переводов на счета сторонних лиц. При подаче запроса на вывод средств убедитесь, что целевой банковский или иной счет открыт на ваше имя. Допускается выполнение платежей на совместные счета в том случае, если держатель торгового счета является одним из держателей совместного счета.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018.

JP markets review 2020

JP markets summary

JP markets is a forex broker, that was founded in 2016 and it is currently headquartered in cape town. It aims to create long-lasting trading relationships and trading capability, which will encourage traders from all over the world to reach their trading potential.

- Regulated by the FSCA

- Provides negative balance protection

- Fast deposit process

- No minimum deposit required

- Demo account provided

- Interest on trading account available

- Low non-trading fees

- The trading platform is a very customer-friendly design

- No 24\7 customer support

- Slow withdrawal process

- Inactivity fee required

Safety & regulation

JP markets is a legitimate forex broker that is regulated by the financial services board (FSB) or financial sector conduct authority (FSCA) which is named now, of south africa. This forex trading broker stores client funds in segregated accounts away from corporate funds. JP markets also provides negative balance protection to ensure the protection of the client funds in case your balance in the negatives.

This JP markets review will provide you with the different protective measures that this forex broker takes for clients.

Is JP markets safe?

JP markets is considered a safe forex broker that is registered with the financial services board (FSB) of south africa. JP markets offers negative balance protection to its clients and keeps client funds in segregated accounts.

- Regulated by the financial services board (FSB) of south africa

- Provides negative balance protection

- Stores funds in segregated accounts

- Offersprofessional indemnity insurance

Regulation

JP markets is a legitimate forex broker that is regulated by the financial services board (FSB) of south africa with a license number 46855.

Protection

JP markets is a CFD and forex broker that stores client funds in segregated accounts and provides negative balance protection. In addition, JP markets offers professional indemnity insurance.

Awards

In 2019, JP markets was awarded as the most transparent broker of 2019 by the european and south africa’s best broker of 2019 by the global business outlook magazine.

JP markets fees

JP markets offers low non-trading fees and relatively low trading fees. You will not have to consider being charged with a deposit or withdrawal fee, but the ECN trading account does charge commission.

This JP markets review will inform you of the different trading and non-trading fees you have to consider.

- Low non-trading fees

- No deposit or withdrawal fee

- Tight spreads provided

- Commission charged for ECN trading account

- Inactivity fee required

Trading fees

Trading fees with JP markets are relatively low, but you have to consider that you will be charged with a 10USD commission per lot. In addition, most of the spreads are variable that could start from 0.7 pips. On average, the EUR\USD spread is about 2 pips for the STP trading account, which shows how competitive the spreads are.

Non-trading fees

As for the non-trading fees of JP markets, you will not be charged with a deposit or withdrawal fee. You will be charged with an inactivity fee and an account maintenance fee of 50USD every three months.

Leverage

For regular clients, you will find that the maximum leverage level is up to 1:500. As for professional clients, you will find that the maximum leverage level is up to 1:200.

| Deposit fees and withdrawal fees | ||||

|---|---|---|---|---|

| deposit fees | 0USD | |||

| withdrawal fees | 0USD | |||

| JP markets fees compared to competitors | |||

|---|---|---|---|

| JP markets | hugosway | plus500 | |

| account fee | yes | no | no |

| inactivity fee | yes | no | yes |

| deposit fee | 0USD | 0USD | 0USD |

| withdrawal fee | 0USD | 0USD | 0USD |

Account opening

JP markets offers two different types of trading accounts, depending on the client’s preference. You can choose between the STP trading account and the ECN trading account. Fortunately, you are not required a minimum deposit to open a JP markets account.

This JP markets review will give you a step-by-step guide on how to open a JP markets live account.

- No minimum deposit required

- Flexible leverage levels

- Copy trading account available

- Interest on available balance provided

Minimum deposit

There is no minimum deposit required to trade with JP markets

Account types

JP markets accounts

Both trading accounts of JP markets, the ECN account, and the STP account, are quite similar to one another. The main difference is that the ECN account, or electronic communication network account, trades straight to the market. You will find that you are charged a commission of 10USD with the ECN account while the commission of the STP account is integrated into the spreads provided.

How to open a JP markets trading account

Follow these steps and you will be able to open your very own JP markets live account!

Follow these steps and you will be able to open your very own JP markets live account!

Deposit & withdrawal

The deposits and withdrawals of JP markets are fairly simple. You will not be required to pay a deposit or withdrawal fee. In addition, there are three different forms of payment methods you can fund your trading account with.

This JP markets review will demonstrate the different payment methods offered.

Account base currencies

There is only one account base currency offered by JP markets, which is the USD.

Deposits

With JP markets, you will find that they do not require a deposit fee, which means you will not be charged every time you make a deposit. There are different ways to deposit funds into your trading account, from bank transfers to the electronic wallet. You will find that the deposit process is fast and can be processed up to 24 hours.

- Various methods of deposit

- No deposit fee

- Fast deposit process

- The low minimum withdrawal amount

JP markets deposit options

- Bank transfer

- Credit\debit card

- Electronic payment

Withdrawal

With JP markets, you will not have to pay a withdrawal fee either. You can withdraw funds from your accounts in the same methods of deposits, but the account has to be corresponding to your account information. However, you will find that the withdrawal process can be slow.

- No withdrawal fee

- Various withdrawal options

- The low minimum withdrawal amount

JP markets withdrawal options

- Bank transfer

- Credit\debit card

- Electronic payment

Trading platforms

JP markets provides two types of trading platforms: metatrader4 and an in-house mobile application for JP markets. Metatrader4 is one of the most well-known trading platforms that are used by traders all over the world.

This JP markets review will use metatrader4 as a model to analyze the features available for clients with JP markets.

- Metatrader4

- JP markets mobile application

Web trading platform

The metatrader4 web trading platform that is provided by JP markets is available for use in many languages, and you will find the platform easy to navigate through. There are more than 30 indicators that can be customized to your trading needs, on whatever operating system you own. Additionally, you will have access to five different pending order types, which are: market, limit, stop, good till cancelled (GTC), and good till time (GTT). These order types are considered the order types needed in basic trading. You have the option of viewing your full portfolio and any past transactions that you have made, to keep updated on your performance. On the other hand, the MT4 web trading platform does not provide price alerts or notifications, and you will have to rely on the initial login process since there is no two-step verification process.

- Available in several languages

- Customizable indicators

- Easy to navigate

- Able to view the portfolio and past transactions

- Available on all operating systems

- No price alerts or notifications

- No two-step login process for verification

Desktop trading platform

The metatrader4 desktop trading platform is similar to the web trading platform in many ways. With the desktop platform, you can customize more than 30 indicators any way you choose, in any language you want. You can download the MT4 desktop trading platform on any operating system and you can activate price alerts in the form of push notifications on your desktop. There are five pending order types that you can use to trade, which are: market, limit, stop, good till cancelled (GTC), good till time (GTT). Additionally, you can view your past transactions and your full portfolio, so you can keep track on all your past performances. However, you will find the JP markets MT4 desktop trading platform to be very outdated in design and it does not provide a two-step login process as a form of verification.

- Available in different languages

- Indicators can be customized

- Access to your portfolio and past transactions

- Downloadable on mac and windows

- Price alerts and notifications are available

Mobile trading platform

The JP markets MT4 mobile trading platform is also similar to both the web trading platform and the desktop trading platform. However, this platform is better for users who prefer to trade on the go. You can use the five basic pending order types of market, limit, stop, good till canceled (GTC), and good till time (GTT). As a mobile device user, you can download it on your ios or android device; the mobile application is compatible with both operating systems. There are over 30 indicators that be customized to your liking, and you will find that the design of the trading platform is very user friendly. You can activate price alerts as a push notification on your device, but you cannot use facial recognition or fingerprint recognition as a form of identification for logging in.

- A wide selection of languages available

- Customizable indicators provided

- Price alerts and notifications are available

- Downloadable on ios and android

- User-friendly design

Markets & financial instruments

JP markets offers five different financial markets, including currency pairs and indices. You will be able to trade through five different financial asset classes and more than 50 financial instruments.

This JP markets review will list the different financial markets that you will have access to trade.

| What JP markets offers | ||||

|---|---|---|---|---|

| forex | metals | |||

| indices | shares | |||

| futures | ||||

Markets research & trading tools

Trading tools

JP markets allows two different trading tools that will enable you to improve your trading strategies. You can use the social trading tool that will provide the option of interacting with other traders. Additionally, copy trading is a trading tool to copy trading solutions of other traders and apply it as your own.

This JP markets review will provide you with the different trading tools available with JP markets.

| JP markets tools | ||||

|---|---|---|---|---|

| social trading | copy trading | |||

- Social trading allows interaction with other traders

- Copy-trading enhances the different trading strategies

Cons

Market research

JP markets provides clients with different research materials that will enhance your trading knowledge. You will be able to look through the economic calendar for future and past economic events. In addition, you can use market outlooks and fundamental analysis for more in-depth technical data on the different financial markets.

- Economic calendar updated daily

- Market outlook updated weekly

- Research materials available

- Fundamental analysis provides technical data

Customer service

JP markets provides very helpful customer service methods that have a fast response and relevant answers to your questions. You can reach them via phone, live chat, whatsapp, or email. However, they are not available 24\7 and do not operate during the weekend.

This JP markets review will list the different means of communication that will allow you to reach the customer service team.

- Different types of customer service

- Fast response

- Accurate and relevant answers

- Available in multiple languages

Means of communication

- Phone support

- Live chat

- Email support

Client education

JP markets offers a variety of different educational resources with different educational tools. You will be able to read through how-to documents and online trading courses. Additionally, you will be able to watch video tutorials and look up trading definitions with the trading glossary. If you are more affiliated with a hands-on approach, the demo account is available for you to use without facing any financial exposure.

This JP markets review will demonstrate how to open a demo account through a step-by-step guide.

Client education resources

- Online trading courses

- Research materials

- Video tutorials

- Demo account

- How-to documents

- Glossary

How to open a demo account

You will first need to go into the dashboard of the JP markets website and select the option of “open account”. Once you choose the button of “open a new trading account”, you can select your base currency and type of trading account for the demo account. Finally, enter your login credentials and get started with JP markets.

Conclusion

JP markets is a CFD and forex trading broker that was established in 2016 and it was headquartered in cape town. There are also operations of JP markets in swaziland, kenya, pakistan, and bangladesh. JP markets is currently regulated by the financial services board of south africa.

JP markets is a legitimate forex trading broker that is regulated by the financial services board (FSB) of south africa. This forex trading broker stores client funds in segregated accounts away from corporate funds. JP markets also provides negative balance protection to ensure the protection of the client funds in case of your balance in the negatives.

Overall, JP markets is a safe and regulated forex trading broker that is worth joining.

Hotforex withdrawal

Hotforex is a company with more than six years of experience in the trading business. During these six years, they developed into one of the strongest brands in the forex industry and are now a truly global company. The company’s support team is able to help you in more than 20 different languages, so the chances are you’re well covered when trading here. With more than 350,000 live accounts, they can say that they have a real army of dedicated clients trading with them every single day. The topic of this article, however, will be hotforex withdrawal, probably the most important process of any trading experience. Read on and learn all the details about it in our expert analysis.

Hotforex withdrawal | methods

Let’s first take a look at the methods available for hotforex withdrawal. Of course, you can use wire transfers, and it will take between 2 and 10 days for your money to reach you this way. The same period applies to credit cards, but we have to say that there are quite a few options here – visa, visa electron, mastercard, maestro and even american express can all be used with this broker. Finally, you can also choose to withdraw your money by using online transfer methods, with even more solutions at your disposal. Webmoney, skrill, neteller, sofort, western union, unionpay, trustpay and ideal can all be used. Plenty of ways to perform your hotforex withdrawal, no doubt about that, and all of them are completely safe, as you can read in our is hotforex a scam article. But let’s now see which conditions have to be met to successfully complete the whole process.

Hotforex withdrawal methods

Hotforex withdrawal | requirements

The good news is that you will not have to pay any fees for hotforex withdrawal. This does not apply to banks you use for wire transfers, as they set their own fees and there’s not much the broker can do about that. Minimum withdrawal requirement carries more good news because hotforex withdrawal can be made starting with only $5. The only exceptions to this are wire transfers ($150) and union pay ($50). Keep in mind, however, that you cannot withdraw more than your initial deposit or the sum of all deposits to your credit card. If you want to withdraw more, you will receive the rest via wire transfer. It is also good to know that if you submit your withdrawal request before 10 a.M. Server time, it will be processed the same day, so you can plan ahead. Also, be sure to check which hotforex bonuses can be withdrawn because some of them have special withdrawal conditions.

Hotforex withdrawal page

Hotforex withdrawal | conclusion

As you can see, this broker has invested a lot of effort to make sure you can reach your money anytime you want. Hotforex withdrawal is a quick, safe and simple procedure, just as you would expect from a top-notch company. Therefore, if you want a partner that won’t cause you any problems in managing your money, open an account right here.

JP markets review

Jpmarkets is a forex broker. JP markets offers the metatrader 4 and mobile forex trading top platform. Jpmarkets.Co.Za offers over 25 forex currency pairs, cfds, stocks, gold, silver, oil, bitcoin and other cryptocurrencies for your personal investment and trading options.

2020-06-19: the south african FSCA has privisionally suspended the license of JP markets. This was done because "there is reasonable belief that substantial prejudice to clients or the general public may occur if they continue rendering financial services."

CLICK HERE to verify.

Broker details

Live discussion

Join live discussion of jpmarkets.Co.Za on our forum

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Not able to withdraw

Length of use: 6-12 months

Due to the numerous complaints from clients failing to withdraw their funds, the FSCA (financial sector conduct authority) has provisionally suspended JP market's license pending a full investigation. As from the 19th of june 2020 they are no longer allowed to take any new business or clients. I'm not surprised coz when i used them back in 2016 i couldn't even make a deposit to fund my account. Had to do an EFT and then call their office to let them know so they could check with the bank. Very poor service indeed. Anyway you can read the story of their suspension below:

Length of use: over 1 year

Length of use: over 1 year

This is the worst broker in the world, I made withdrawals amounting to R1.5 million in a he past weeks and they started asking me to submit my fica and bank cards of which I did. Only today they told me I won’t be getting my withdrawals since their system says I used different accounts to fund my account of which I didn’t. I don’t even know the people they talked about.

Stay away from this broker. I just can’t wait for this lock down to be over so I can visit their offices

Length of use: over 1 year

Jp markets should be challenged and charged for market and accounts manipulation. This is wrong and we will expose them.

Our funds and pending orders just disappeared and when we tried to contact someone no one answered.

This broker will not last long with the kind of service it provides.

Frequently asked questions

What is the minimum deposit for JP markets?

JP markets does not have a strict minimum deposit. Traders can invest whatever they are comfortable with. However JP markets recommends starting with around ZAR3,000.

Is JP markets a good broker?

Unbiased traders reviews on forexpeacearmy is the best way to answer if JP markets is a good broker. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we'd recommend to check recent JP markets community discussions: https://www.Forexpeacearmy.Com/community/tags/jpmarkets/

Is JP markets safe?

To define whether a company is safe or not, you'd better get to know about this company, the unbiased traders reviews on forexpeacearmy is the best resources to grant you such knowledge. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

JP markets at least is regulated with south africa financial services board under license 46855. Being regulated gives you a chance to complain to the authority if it comes down to it.

What is JP markets?

JP markets is an online forex retail broker. JP markets offers a number of assets to be traded on metatrader 4 and JP mobile app.

- Forex currency pairs

- Cryptocurrencies

- Stock indices

- Precious metals

- Commodities

Help centre

How can we help you?

Minimum and maximum withdrawals

The minimum and maximum withdrawal amounts vary depending on your chosen deposit method. The table below explains the amounts for each payment option:

| Payment option | limits (£/€) |

| open banking | £/€10 minimum, no max |

| visa debit card | £/€10 minimum, no max |

| solo / maestro card | £/€10 min, limited to deposit amount for some cards |

| mastercard / eurocard | £/€10 min, limited to deposit amount for some cards |

| neteller | £/€10 min, no max |

| skrill | £/€10 min, no max |

| bank transfer | £/€20 min, no max |

| trustly | £/€40 min, no max |

| paypal | £/€10 min, £/€5.5k max |

Closed loop system

Smarkets operates a closed loop system for withdrawing funds. This means if you have deposited by a particular payment source, you will need to withdraw to the same source.

If you have used more than one deposit method, you would need to withdraw to the level of the net deposits on each before being able to withdraw more than you’ve deposited on either.

Each potential withdrawal method will show the maximum you’re allowed to withdraw on the withdrawal page.

Please note: for certain mastercard and maestro payment methods withdrawals are limited to an amount equal to the net deposit from the card, profit will need to be taken by a different method.

Related articles

Still not on smarkets?

Trade sports, politics and current affairs with an industry-low 2% flat commission. All new customers get a £10 welcome bonus.

Jp markets maximum withdrawal

Hear from our college savings expert about how to stay on course to your goals.

View account information

It's never been more important to stay on course toward college

View account information

In times like these, it's important to know you have support.

View account information

Make a college savings plan your new year's resolution

Get started with college planning essentials

View account information

COLLEGE PLANNING:

now more important

than ever before

View account information

Explore our college planning essentials

What’s happening with tuition, scholarships, loans and the job market for college graduates? Find out all of this and more with college planning essentials.

Do you have an account-related question?

If you have any questions, please start by contacting your financial professional. You may also access your account online by clicking the link below. For account related issues, contact our service center at 1-800-774-2108.

Sign up for E-delivery

COVID-19 may impact manual processes and mail delivery timing. For timely transactions and communications, you may access your account and make updates, contributions and withdrawals via our secure online website. Now is also a great time to elect e-delivery of all documents.

On december 20, 2019, the federal further consolidated appropriations act of 2020 (including portions of the setting every community up for retirement enhancement [SECURE] act of 2019) was signed into law. It includes new provisions that allow 529 plan account owners to withdraw assets to pay for certain apprenticeship programs and to pay principal and interest on qualified higher education loans for the beneficiary or any of the beneficiary's siblings. The loan repayment provisions apply to repayments up to $10,000 per individual. These withdrawals will have no federal tax impact.

Under new york state law, these distributions are considered nonqualified withdrawals and will require the recapture of any new york state tax benefits that have accrued on contributions. NY 529 account owners in other states should seek guidance from the state in which they pay taxes. This act is effective for distributions made after december 31, 2018. Account owners are encouraged to consult a qualified tax professional about their personal situations.

Investor service center: 1-800-774-2108

advisor service center: 1-855-JPM-6657 (1-855-576-6657)

effective immediately, shareholder servicing representatives will be available from 8:00 am to 6:00 pm ET. This schedule will be in place until further notice.

For general questions, please email us at ny.529advisor@jpmorgan.Com.

We will respond to you within one business day. For your protection, please do not include your account number, social security number or other sensitive information in your email message.

New york's 529 advisor-guided college savings program

P.O. Box 55498

boston, MA 02205

Overnight mail:

new york's 529 advisor-guided college savings program

95 wells avenue

suite 155

newton, MA 02459

| INVESTMENTS ARE NOT FDIC INSURED, MAY LOSE VALUE AND ARE NOT BANK GUARANTEED. |

Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program.

The comptroller of the state of new york and the new york state higher education services corporation are the program administrators and are responsible for implementing and administering new york’s 529 advisor-guided college savings program (the “advisor-guided plan”). Ascensus broker dealer services, LLC serves as program manager for the advisor-guided plan. Ascensus broker dealer services, LLC and its affiliates have overall responsibility for the day-to-day operations of the advisor-guided plan, including recordkeeping and administrative services. J.P. Morgan investment management inc. Serves as the investment manager. Jpmorgan distribution services, inc. Markets and distributes the advisor-guided plan. Jpmorgan distribution services, inc. Is a member of FINRA.

No guarantee: none of the state of new york, its agencies, the federal deposit insurance corporation, J.P. Morgan investment management inc., ascensus broker dealer services, LLC, jpmorgan distribution services, inc., nor any of their applicable affiliates insures accounts or guarantees the principal deposited therein or any investment returns on any account or investment portfolio.

New york’s 529 college savings program currently includes two separate 529 plans. The advisor-guided plan is sold exclusively through financial advisory firms who have entered into advisor-guided plan selling agreements with jpmorgan distribution services, inc. You may also participate in the direct plan, which is sold directly by the program and offers lower fees. However, the investment options available under the advisor-guided plan are not available under the direct plan. The fees and expenses of the advisor-guided plan include compensation to the financial advisory firm. Be sure to understand the options available before making an investment decision.

For more information about new york’s 529 advisor-guided college savings program, you may contact your financial advisor or obtain an advisor-guided plan disclosure booklet and tuition savings agreement at www.Ny529advisor.Com or by calling 1-800-774-2108. This document includes investment objectives, risks, charges, expenses, and other information. You should read and consider it carefully before investing.

The program administrators, the program manager and jpmorgan distribution services, inc., and their respective affiliates do not provide legal or tax advice. This information is provided for general educational purposes only. This is not to be considered legal or tax advice. Investors should consult with their legal or tax advisors for personalized assistance, including information regarding any specific state law requirements.

Ugift is a registered service mark of ascensus broker dealer service, inc.

If you need additional support in viewing the information on our website, please call our investor service center at 1-800-774-2108 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved.

US cash crisis: withdrawal limits spark bank run fear

The entire world has been focused on the economy as the coronavirus outbreak has devastated global markets. While stocks, commodities, and barrels of oil plunge in value, there’s been considerable demand for cold hard cash in certain countries. According to reports, wall street’s elite has been trying to withdraw $30-50K per person as they flee the hamptons. Moreover, various individuals across the U.S. Are claiming financial institutions like chase and bank of america are restricting cash withdrawal amounts.

US banks impose withdrawal restrictions as customers empty accounts demanding hard cash

Cash is something everyone looks for during times of economic hardship and right now banks are struggling to provide liquidity. During wednesday morning’s trading sessions, global stock markets and futures continue to lose ground. The price of oil has plummeted even further from last week and is at its lowest value per barrel in 17 years. The price of crude oil is hovering around $43 per barrel and goldman sachs predicts the price will drop to $20 per barrel soon. Oil prices have already begun to hurt people within the gas industry as 3,500 halliburton employees from the north belt facility in houston have been laid off due to the price decline. While facing massive layoffs in industries like airlines, tourism, and construction, people are in search of hard cash to help hold them over through the economic storm.

Chase is insolvent. Bank run. Proceeded to lie to me to go around outside the drive thru without my mask and she would give me the 5k promised earlier ($2k rationed per customer). I did so and they refused to give me it. Manager demanded I delete the video. $JPM $XLF pic.Twitter.Com/dof6gq6h6i

— DONT TEST DONT TELL (@enchiridion47) march 17, 2020

News.Bitcoin.Com reported on how in the hamptons, new york’s elite have been going to banks and asking to withdraw large sums of cash. According to reports, banks like chase, jpmorgan and bank of america (boa) have been limiting withdrawals. This is because the rich from new york have been asking for $30-50K withdrawals so banks have created a limit between $3-10K in some areas. During the market massacre on march 12, manhattan bank temporarily ran low on $100 bills after a large rush for cash. A boa spokesperson told the public that there were only issues with large denominations and individuals are able to withdraw $20-50 notes. “we don’t keep large amounts of cash in big bills in the branches because it’s dangerous for our employees and there is low demand,” boa stated.

Bank of america is limiting cash withdrawals to $3,000. Expect that number to drop over the next few days.

— tatiana koffman ⚡️ (@tatianakoffman) march 16, 2020

There are people complaining on social media about the withdrawal limits from certain banks in the U.S over the last few days. “go to the bank today and ask to withdraw your entire balance,” one individual tweeted on march 17. “they are refusing to give out more than $5,000 — even if your account has $20k. Even if your normal withdrawal limit is $10,000 daily.” on march 14, a person from new york tweeted: “food chain is broken. Went to stop & shop [and] shelves are empty. Meats gone. No more eggs — [and] the bank would only permit a $2,500 limit per day withdrawal.” another twitter post shows a man visiting chase bank and recording a video of a manager refusing to give him $5K. Moreover, the branch manager from chase asked the person to delete the video. The man said:

Chase is insolvent — bank run. [the bank] proceeded to lie to me to go around outside the drive-thru without my mask and she would give me the $5K promised earlier ($2K rationed per customer). I did so and they refused to give me it — manager demanded I delete the video.

Starting from today I’ll start to withdraw cash amounts until I reach a buffer of 6 months for living expenses.

Keep in mind that governments:

– will discourage cash withdrawals

– can ban the usage of cash paymentsAll because they’re shit scared of an impending #bankrun

— mr. Backwards ® (@coin_shark) march 14, 2020

European banks shutter, german banks impose withdrawal restrictions, and bank runs from the past

The U.S. Is not the only country that is having cash problems as european banks have shuttered hundreds of branches since the covid-19 spread. For example, the financial institution HVB closed 101 branches across the EU. Reports detail that a few german banks are imposing withdrawal limits and customers can only withdraw 1,000 euros per visit. Ever since last thursday’s stock market crash, people are reminded of the economic disasters in the past like 2008’s financial crisis, ‘black wednesday’ in 1992, and ‘black monday’ in 1987.

Men and women line up in a run on a bank in new york city during the early 1900s. Depictions of bank runs can be seen in classic movies like frank capra’s “it’s a wonderful life.”

However, those crashes didn’t cause massive bank runs; the last time that happened was during the wall street crash in 1929. During the great depression throughout the early 1900s, the 20s and 30s, there was a massive run on savings and loan operations and financial institutions across the U.S. The economic crisis sparked by the coronavirus is causing these fears again.

“bank runs are starting in colorado,” another man from the U.S. Tweeted on march 17. “smaller towns and small cities are not allowing walk-ins [or] anyone, along with limits on cash withdrawals.”

How to prevent A bank run during A manufactured crisis pic.Twitter.Com/k1zmwruk3l

— spiro (@o_rips) march 12, 2020

Bitmex research: ‘bitcoin price may shine in the volatile inflationary aftermath’

In this crazy environment of financial calamity, people are uncertain where cryptocurrencies like BTC will stand. A blog post published on march 17 by bitmex research predicts high inflation from all of these events. Just like many crypto supporters, bitmex researchers think that BTC will shine during the inflationary aftermath. “in such an economic environment, with high inflationary expectations, gold looks set to shine,” bitmex wrote. “but what about bitcoin? Bitcoin has crashed by almost 53% (peak to trough) in the 2020 coronavirus crash, as investors raced to the U.S. Dollar. In many ways this was inevitable. Where the bitcoin price may shine is in the volatile inflationary aftermath of the response to the crash.”

The price of BTC on march 18, 2020, at 10:30 a.M. EST.

At press time, BTC is hovering just above the $5K region but the asset’s value seems to be dragging downwards and flirting with sub-$5K. Even with prices so low, people believe the possibility of bank runs and significant cash liquidity issues will drive more people toward cryptocurrencies. “if you think bitcoin isn’t a safe haven asset, just wait until the bank runs begin,” BTC supporter ‘bitcoin bacon’ tweeted on tuesday. The day prior another individual shared a picture of his stacks of $100 bills on twitter and said: “advice…[I] just cleaned out one of my accounts to get liquid…bank runs will be here by next week.”

What do you think about the economic carnage causing cash shortages and banks adding withdrawal limits? Do you think that cryptocurrencies like bitcoin will benefit from this financial calamity? Let us know what you think about this subject in the comments section below.

Disclaimer: this article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.Com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither bitcoin.Com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Cryptocurrency and global market prices referenced in this article were recorded on march 18, 2020.

Image credits: shutterstock, twitter, and markets.Bitcoin.Com.

Do you want to maximize your bitcoin mining potential? Plug your own hardware into the world’s most profitable bitcoin mining pool or get started without having to own hardware through one of our competitive bitcoin cloud mining contracts.

JP markets - south africa's and africa's biggest forex broker

JP markets is a global forex powerhouse. We set high standards for our services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. We continue to grow everyday thanks to the confidence our clients have in us. We are licensed and regulated by the financial services board, south africa, FSP 46855.

Negative

balance protection

Through the use of an automated transaction monitoring and risk management system, a client’s account will never be allowed to reach negative balance.

Zero fee because

we want you to prosper

We do not charge you any fees for bank deposits or withdrawals made through our payment gateways. We are africa’s best, most reliable & trusted broker.

Quick & sufficient trading platforms

With high performing and innovative technology, our platforms are fast and sufficient for your trading. We do not lag and do not re-quote on orders. What you want you get.

Fast, reliable

deposits & withdrawals

With our almost instant deposit and almost instant funds withdrawal technology. You can enjoy your success almost instantly. No long waiting periods.

State of the art security

for your money

Safety is our top priority. Your monies is always safe with us and are kept in a separate banking account as requested by our regulator. Your money is safe and secure.

Friendly

customer support

Customer support, one of our most prized position – to what makes us different. Call, email or chat with us today. Our consultants are happy to help you with any request.

So, let's see, what was the most valuable thing of this article: JP markets: login, minimum deposit, withdrawal time? RECOMMENDED FOREX BROKERS JP markets is solid, at first glance, as african brokers go, but what is most important is that it is at jp markets maximum withdrawal

Contents of the article

- Today forex bonuses

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Вывод средств

- В случае если вы не выполняливывод средств...

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- JP markets review 2020

- JP markets summary

- Safety & regulation

- JP markets fees

- Account opening

- Deposit & withdrawal

- Trading platforms

- Markets & financial instruments

- Markets research & trading tools

- Customer service

- Client education

- Conclusion

- Hotforex withdrawal

- Hotforex withdrawal | methods

- Hotforex withdrawal | requirements

- Hotforex withdrawal | conclusion

- JP markets review

- Broker details

- Live discussion

- Video

- Traders reviews

- Not able to withdraw

- Frequently asked questions

- What is the minimum deposit for JP markets?

- Is JP markets a good broker?

- Is JP markets safe?

- What is JP markets?

- Help centre

- How can we help you?

- Minimum and maximum withdrawals

- Closed loop system

- Still not on smarkets?

- Jp markets maximum withdrawal

- View account information

- It's never been more important to stay on course...

- View account information

- In times like these, it's important to know you...

- View account information

- Make a college savings plan your new year's...

- View account information

- COLLEGE PLANNING: now more important

- View account information

- Explore our college planning essentials

- Do you have an account-related question?

- Sign up for E-delivery

- US cash crisis: withdrawal limits spark bank run...

- US banks impose withdrawal restrictions as...

- European banks shutter, german banks impose...

- Bitmex research: ‘bitcoin price may shine in the...

- JP markets - south africa's and africa's biggest...

- Negative balance protection

- Zero fee because we want you to prosper

- Quick & sufficient trading platforms

- Fast, reliable deposits & withdrawals

- State of the art security for your money

- Friendly customer support

No comments:

Post a Comment